Executive summary:

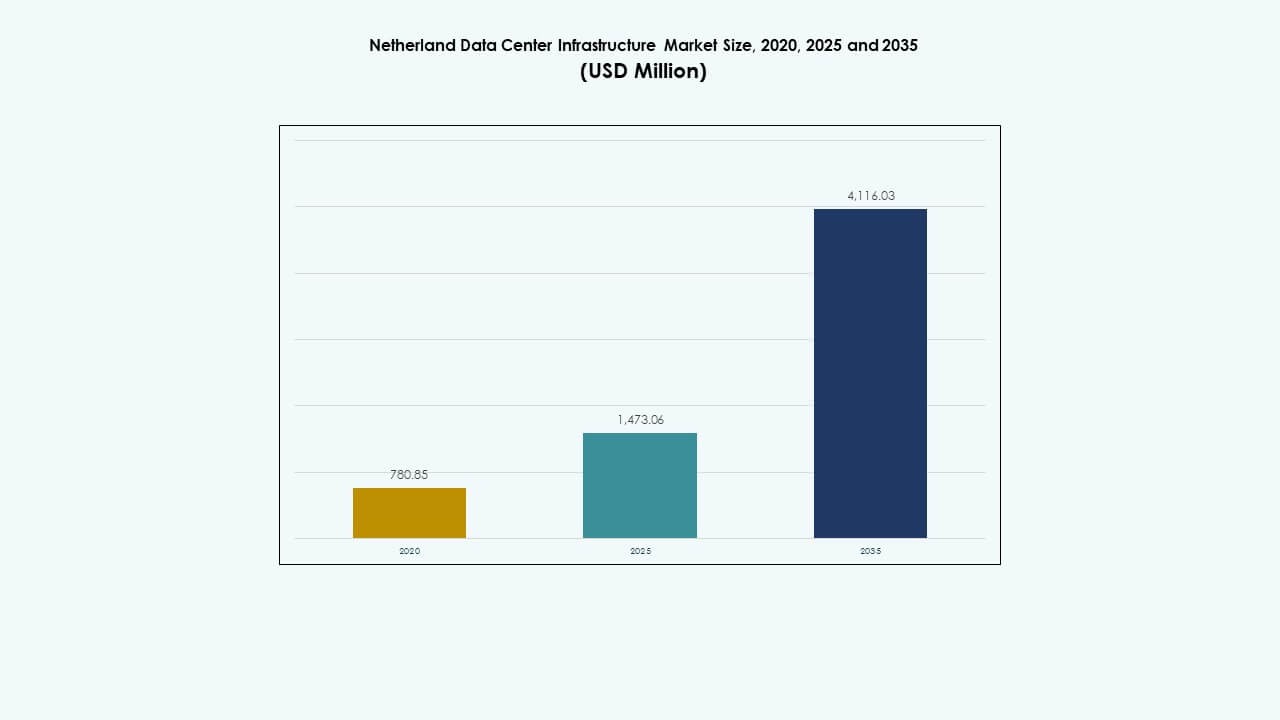

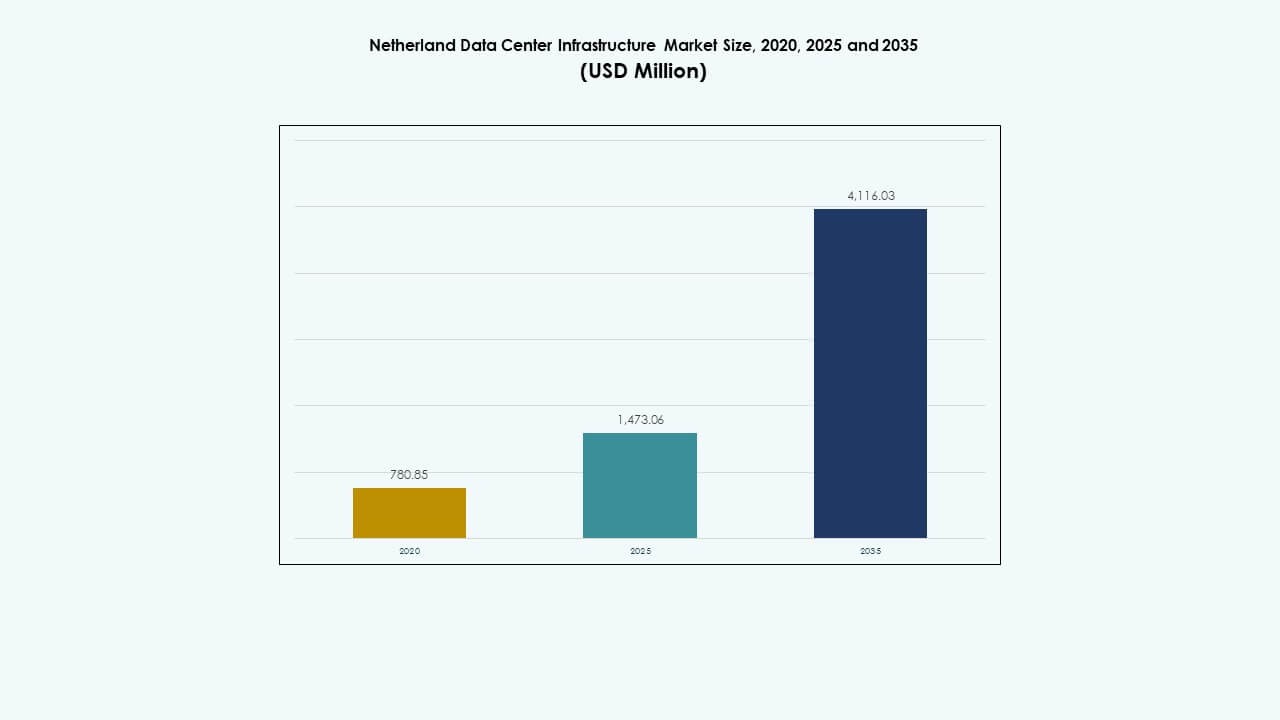

The Netherland Data Center Infrastructure Market size was valued at USD 780.85 million in 2020 to USD 1,473.06 million in 2025 and is anticipated to reach USD 4,116.03 million by 2035, at a CAGR of 10.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Netherland Data Center Infrastructure Market Size 2025 |

USD 1,473.06 Million |

| Netherland Data Center Infrastructure Market, CAGR |

10.75% |

| Netherland Data Center Infrastructure Market Size 2035 |

USD 4,116.03 Million |

Strong demand for cloud computing, AI-ready infrastructure, and colocation services fuels expansion across the Netherland Data Center Infrastructure Market. Companies invest in sustainable facilities with advanced cooling, modular construction, and automation systems. Government policies supporting renewable power and digital connectivity enhance investor confidence. The nation’s strategic role as a European data hub attracts major technology players building scalable and energy-efficient campuses.

Western Netherlands dominates the Netherland Data Center Infrastructure Market due to dense connectivity and renewable energy access in cities like Amsterdam and Rotterdam. Northern provinces such as Groningen emerge as secondary growth zones driven by available land and renewable integration. Southern regions strengthen industrial data capacity and edge deployments. This geographic balance sustains nationwide digital infrastructure development.

Market Drivers

Market Drivers

Growing Investments in Digital Infrastructure Modernization and Green Data Center Expansion

The Netherland Data Center Infrastructure Market benefits from rapid modernization across its data ecosystems. Rising demand for high-performance computing drives large-scale upgrades in power, cooling, and IT systems. Businesses adopt advanced energy-efficient technologies to meet strict sustainability standards. Government initiatives promote renewable power integration, encouraging greener operations. Cloud providers expand hyperscale facilities to support AI, 5G, and IoT applications. Local colocation centers attract enterprise clients seeking scalable and secure infrastructure. Continuous fiber network development enhances connectivity and data flow reliability. Investors view the Netherlands as a strategic gateway to European digital trade. It positions itself as a core hub linking transatlantic and continental data flows.

- For instance, Amsterdam’s data-center capacity rose from about 298 MW in 2016 to around 565 MW by 2023, reflecting significant expansion in colocation and hyperscale facilities.

Rapid Technological Integration Across Edge and Hyperscale Deployments

The Netherland Data Center Infrastructure Market advances through active deployment of AI-driven cooling, automation, and monitoring tools. Operators focus on integrating hybrid and multi-cloud systems to meet complex enterprise workloads. The nation’s strong telecom infrastructure supports low-latency applications and edge computing nodes. It achieves balanced power distribution with intelligent grid systems and UPS innovation. New hyperscale projects feature modular buildouts for faster delivery. AI, blockchain, and HPC workloads enhance facility design flexibility. Companies pursue ISO-certified efficiency targets for long-term operational excellence. The market strengthens its leadership through consistent digital infrastructure upgrades. It continues to evolve with an emphasis on resilience and smart integration.

Surging Cloud and Colocation Adoption by Enterprises and Startups

The Netherland Data Center Infrastructure Market gains momentum through increasing enterprise reliance on hybrid cloud models. Startups leverage colocation services for agility and scalability. Strong data protection laws strengthen trust in hosted solutions. Organizations prioritize redundant networks and disaster recovery frameworks. Demand grows for software-defined power and cooling management tools. Telecom operators partner with hyperscalers to expand regional availability zones. Renewable energy commitments align with enterprise sustainability goals. Enhanced interconnection enables high-speed collaboration among digital service providers. It drives a stable ecosystem where local innovation meets global demand.

Government Support and Regulatory Clarity Boosting Strategic Investments

The Netherland Data Center Infrastructure Market benefits from supportive public policies that streamline construction and energy approval processes. Authorities encourage renewable integration through carbon-neutral energy sourcing. Simplified zoning regulations accelerate facility development timelines. Tax incentives attract multinational data firms seeking regional presence. National cybersecurity programs promote infrastructure reliability and data sovereignty. The Netherlands’ digital economy agenda ensures ongoing technology alignment. Proximity to European trading centers enhances commercial appeal for foreign investors. The market maintains stable growth through transparency and institutional trust. It positions itself as a model for sustainable digital infrastructure policy.

- For instance, Google opened a new data center in Winschoten, Netherlands with a €600 million investment, operating on renewable energy. The facility supports waste-heat reuse and uses rooftop solar and efficient cooling systems strengthening local infrastructure and aligning with EU sustainability directives.

Market Trends

Market Trends

Shift Toward Liquid Cooling and Immersion-Based Efficiency Systems

The Netherland Data Center Infrastructure Market sees strong adoption of liquid and immersion cooling for high-density racks. Operators replace legacy air-based systems to reduce power usage effectiveness (PUE). These methods improve thermal control while reducing operational noise and maintenance costs. Major data centers deploy adaptive control units for precise environmental regulation. AI-enabled monitoring adjusts fluid flow dynamically to manage thermal loads. Sustainable refrigerants and biodegradable fluids gain industry preference. Modular designs simplify integration into existing facilities. This transition aligns with global carbon-neutral commitments and EU Green Deal policies. It continues to redefine energy efficiency benchmarks.

Expansion of AI and HPC-Driven Facility Designs for Next-Generation Computing

The Netherland Data Center Infrastructure Market aligns with rising demand for AI and high-performance computing workloads. Facility layouts integrate GPU-optimized clusters to handle training-intensive models. Dynamic workload orchestration tools balance computing loads across multi-tenant environments. Operators deploy advanced microgrid systems to manage fluctuating power needs. AI-ready architectures enable continuous machine learning applications for predictive maintenance. Cloud and research institutions partner to develop AI supernodes within national networks. Infrastructure upgrades focus on high throughput and low latency designs. Strong fiber backbones ensure consistent data exchange speeds across Europe. It strengthens its technological depth through adaptive AI integration.

Growth in Modular and Prefabricated Construction Models

The Netherland Data Center Infrastructure Market embraces modular construction for faster deployment and lower capital intensity. Prefabricated modules allow precise scalability without disrupting live operations. EPC contractors deliver standardized designs optimized for sustainability certifications. Pre-engineered cooling and power units enhance build predictability. Modular campuses support hybrid configurations suited for enterprise and hyperscale clients. Supply chain reliability improves through local fabrication hubs. Construction timelines shrink significantly, cutting commissioning time. Investors value this predictability for return-on-investment planning. It evolves toward a flexible, rapid-deployment infrastructure model suitable for global cloud expansion.

Increased Focus on Renewable Power and Circular Infrastructure Practices

The Netherland Data Center Infrastructure Market leads in renewable adoption through on-site solar, wind, and hydro integration. Operators purchase power directly from local renewable producers via PPA agreements. Facilities deploy battery energy storage systems to stabilize grid supply. Heat reuse projects channel excess energy to district networks, supporting community sustainability goals. Circular construction practices promote recyclable materials and low-carbon concrete. Operators implement water-free cooling and smart lighting to reduce waste. Government-backed clean energy targets guide long-term investment behavior. The market strengthens its reputation for eco-efficient design and performance. It defines future standards for sustainable digital growth in Europe.

Market Challenges

Market Challenges

Energy Consumption Constraints and Pressure for Carbon-Neutral Operations

The Netherland Data Center Infrastructure Market faces high scrutiny over energy usage and carbon output. Power constraints in metropolitan regions limit new project approvals. Growing data traffic amplifies grid dependency, challenging sustainability goals. Operators must balance performance with stringent emission caps. Green energy sourcing remains competitive amid limited renewable supply. Infrastructure upgrades require capital-intensive transitions to hydrogen-ready or battery-supported systems. Energy audits and compliance reporting raise operating complexity. National regulators demand transparency on lifecycle efficiency metrics. It confronts an evolving landscape where power optimization defines competitiveness.

Rising Land and Construction Costs Limiting Urban Data Center Expansion

The Netherland Data Center Infrastructure Market experiences limited land availability in key metros such as Amsterdam. High real estate prices raise barriers for new entrants and expansions. Environmental zoning policies restrict large-scale development in urban corridors. Construction material inflation impacts total cost of ownership projections. Supply chain delays affect critical infrastructure components, especially cooling and UPS systems. Stakeholders must optimize footprints through vertical builds and compact designs. Permit processing timelines vary by municipality, slowing deployment schedules. These constraints push development toward suburban and regional sites. It must innovate spatially to sustain long-term scalability.

Market Opportunities

Emergence of Edge Data Centers to Support 5G and IoT Ecosystems

The Netherland Data Center Infrastructure Market presents strong growth potential through edge deployments. Telecom and cloud providers invest in micro facilities near population hubs. These centers reduce latency for autonomous systems, connected vehicles, and smart cities. Demand grows from real-time applications like AR, VR, and healthcare monitoring. Edge models complement hyperscale networks by handling localized data. Operators explore hybrid partnerships for distributed compute infrastructure. It becomes a strategic enabler for next-generation digital services. The expansion of 5G networks reinforces edge capacity demand.

Sustainability and Innovation Driving Next-Generation Investment Pipelines

The Netherland Data Center Infrastructure Market gains opportunity through the rise of sustainable and modular construction. Investors prioritize ESG-aligned assets with net-zero potential. Operators adopt AI-driven management for predictive cooling and power optimization. Circular economy frameworks attract funding from impact-driven portfolios. Innovation clusters in Amsterdam and Rotterdam accelerate technology trials. Water-free cooling and smart power systems reduce operational costs. The market appeals to global hyperscalers seeking low-carbon hosting zones. It evolves as a blueprint for environmentally responsible data infrastructure in Europe.

Market Segmentation

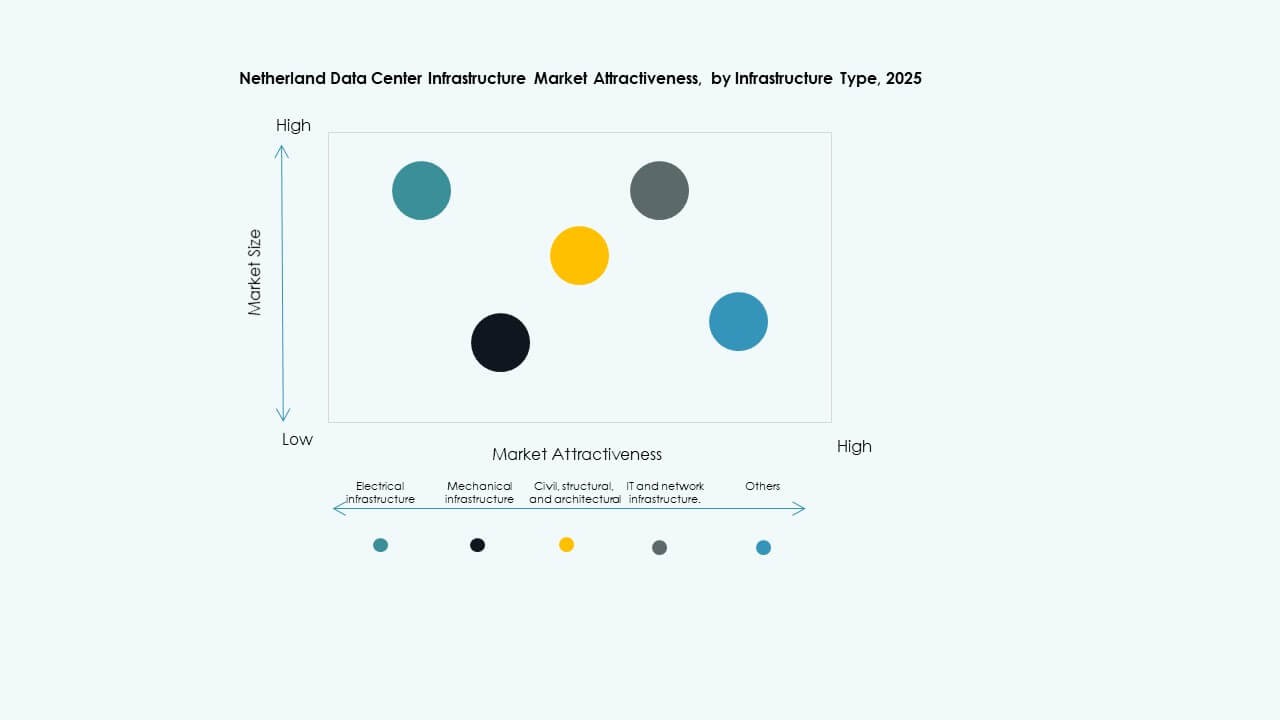

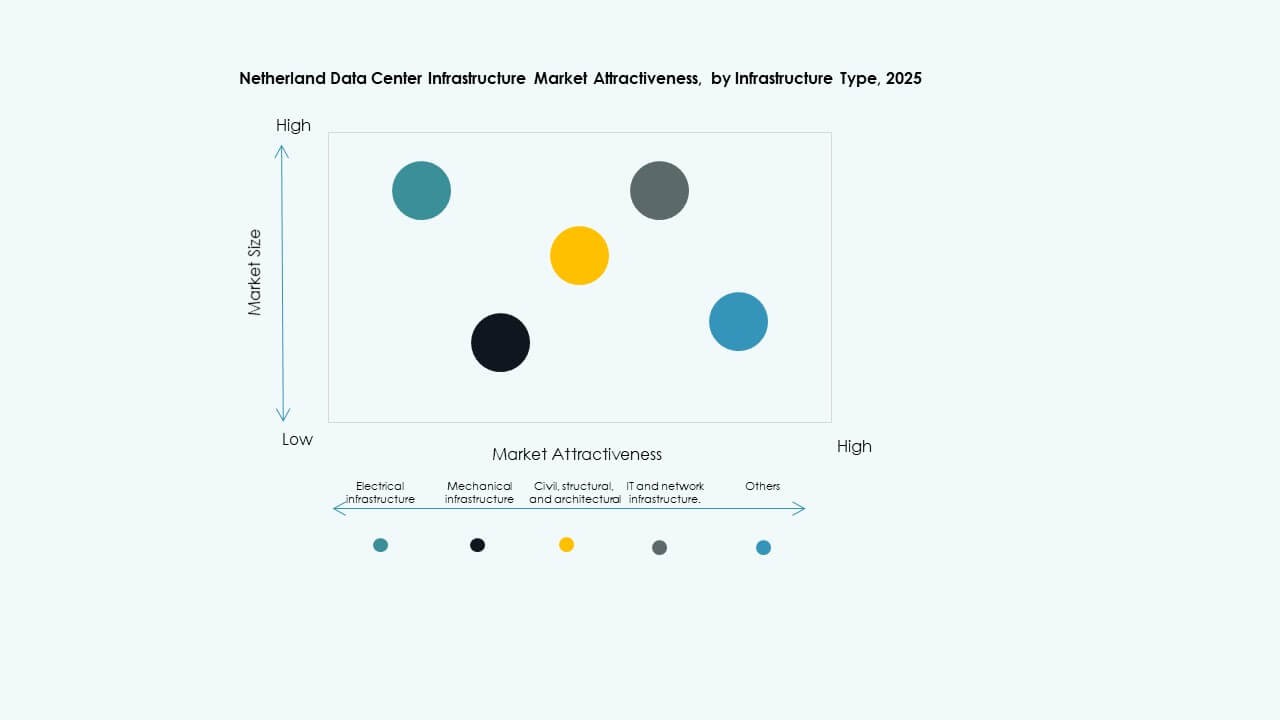

By Infrastructure Type

The Netherland Data Center Infrastructure Market is led by IT and Network Infrastructure, accounting for the highest share due to strong enterprise digitization. Electrical and mechanical infrastructure follow, driven by efficiency and resilience improvements. Demand for civil and architectural systems increases with green building designs. IT and network equipment upgrades dominate capital allocation, supporting 5G, AI, and cloud computing workloads. Growing modularity across all types enhances flexibility and lifecycle value.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems lead the electrical segment, driven by continuous uptime needs. Battery Energy Storage Systems (BESS) gain prominence as grid stabilizers. PDUs and transfer switches enhance load distribution efficiency. Power monitoring integration ensures compliance with energy standards. Utility connections improve reliability across hyperscale facilities. UPS innovation with lithium-ion batteries supports higher density racks. It ensures consistent energy delivery within expanding hybrid cloud networks.

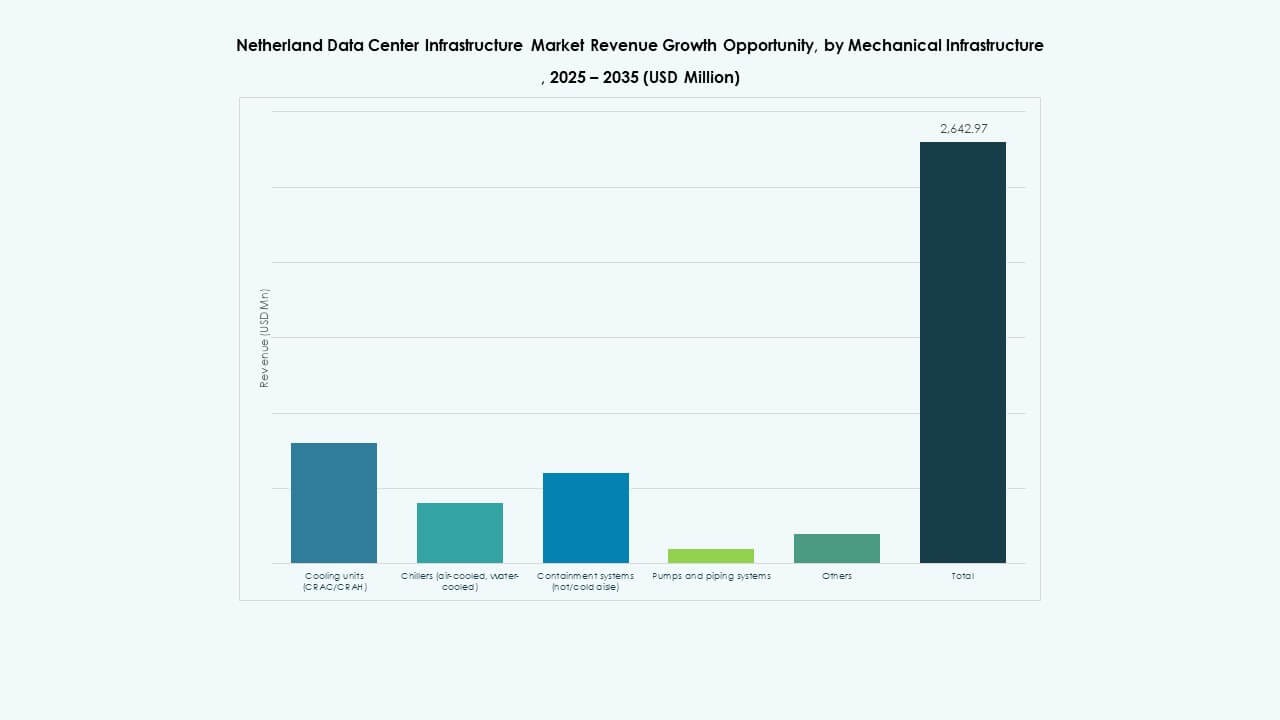

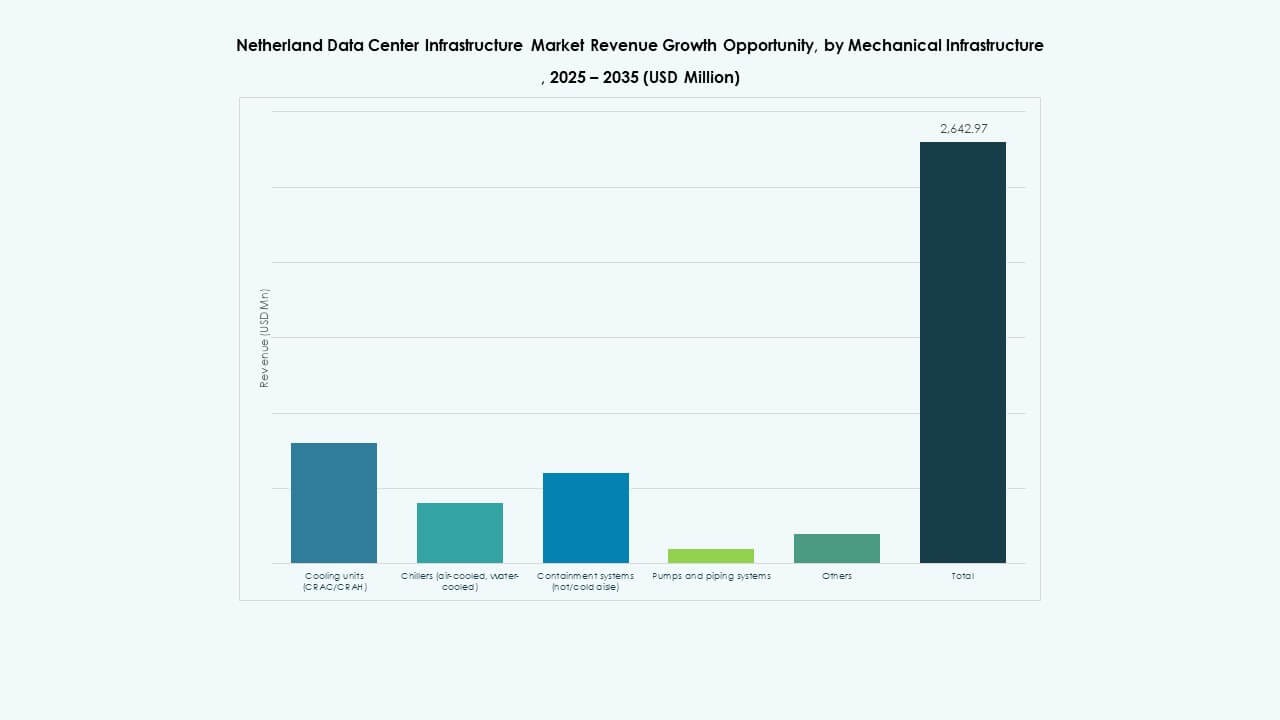

By Mechanical Infrastructure

Cooling units such as CRAC and CRAH dominate the segment due to thermal management demands. Chillers using air-cooled and water-cooled technologies expand across urban facilities. Containment systems improve energy efficiency through controlled airflow zones. Pumps and piping systems enhance cooling redundancy and performance. Operators shift toward liquid cooling for high-performance clusters. Mechanical innovation focuses on minimizing water use and power waste. It strengthens long-term environmental sustainability goals.

By Civil / Structural & Architectural

Superstructure and building envelope solutions lead the segment, reflecting focus on durability and energy conservation. Modular and prefabricated systems accelerate project timelines. Foundations and site preparation integrate smart drainage and insulation materials. Raised flooring systems support dynamic rack layouts and air circulation. Builders adopt reflective roofing to lower thermal absorption. Local construction codes promote sustainable materials and structural resilience. It delivers flexible and future-proof data center shells.

By IT & Network Infrastructure

Servers and networking equipment dominate this category, driven by AI, HPC, and enterprise cloud adoption. Storage systems evolve with NVMe and SSD technologies for faster throughput. Optical cabling supports high-bandwidth connections between edge and hyperscale nodes. Rack densities increase for compact deployments in urban zones. Network virtualization enhances resource allocation efficiency. IT infrastructure remains the technological backbone of the sector. It enables scalable, intelligent, and data-driven operations across Europe.

By Data Center Type

Colocation data centers dominate the segment due to enterprise preference for scalable outsourcing. Hyperscale data centers expand rapidly to support global cloud providers. Edge data centers emerge as key components for 5G and IoT ecosystems. Enterprise facilities modernize through hybrid cloud migration. Other types, including government and research centers, adopt green and modular designs. It reflects balanced diversification across facility scales and functions.

By Delivery Model

Design-Build and EPC models lead due to large-scale projects requiring integrated delivery. Modular factory-built solutions gain traction for cost-efficient rollouts. Retrofit and upgrade projects grow in older industrial zones. Turnkey models remain popular for hyperscale expansions needing rapid completion. Construction management ensures quality across multi-stakeholder developments. Project optimization technologies reduce construction lead times. It sustains development efficiency while maintaining operational excellence.

By Tier Type

Tier 3 data centers hold the majority share, balancing uptime, redundancy, and cost efficiency. Tier 4 facilities expand to meet hyperscale reliability demands. Tier 2 and Tier 1 serve smaller regional or edge deployments. Businesses prioritize certifications to meet SLA and compliance targets. Growing emphasis on 99.999% uptime drives design upgrades. The tier framework guides investment alignment with operational criticality. It supports market credibility and global hosting standards.

Regional Insights

Regional Insights

Western Netherlands – Amsterdam and Rotterdam Holding Dominant Market Share (~62%)

The Netherland Data Center Infrastructure Market is concentrated in Amsterdam and Rotterdam, driven by global interconnection hubs and submarine cable access. Strong connectivity and renewable integration make these cities core data exchange centers. Hyperscalers and colocation providers cluster in this region due to access to skilled labor and sustainable energy sources. Urban zoning reforms accommodate dense multi-tenant campuses. Power grid resilience ensures continuous uptime across major facilities. It remains the commercial and technological backbone of national infrastructure.

- For instance, Equinix operates multiple data centers across the Amsterdam metro area, offering connections to hundreds of international networks and cloud providers through its Platform Equinix ecosystem. The facilities run on 100% renewable energy, reinforcing Amsterdam’s role as a leading European data exchange hub.

Northern Netherlands – Groningen and Friesland Emerging Growth Corridors (~23%)

Northern provinces such as Groningen attract large-scale hyperscale developments supported by available land and renewable capacity. Wind and solar farms contribute to green power stability. Local governments promote balanced growth through digital economy incentives. The region’s cooler climate enhances natural cooling efficiency. Data parks support regional industries, education, and logistics networks. It evolves into a strategic alternative for load distribution away from saturated urban zones.

- For instance, Google’s Eemshaven data center has matched 100% of its electricity use with renewable energy since 2017, supported by a 30 MW solar power purchase agreement from Sunport Delfzijl. The facility relies on nearby wind and solar farms to ensure continuous green energy supply and grid stability.

Southern and Eastern Netherlands – Industrial and Edge Development Zones (~15%)

Southern cities like Eindhoven and Nijmegen witness strong growth in edge and industrial data centers. Proximity to manufacturing and research clusters supports localized compute requirements. Infrastructure investments improve connectivity to Belgium and Germany. Industrial automation drives need for low-latency and private cloud facilities. Smaller cities offer cost-effective expansion options for national networks. It supports decentralization and diversified growth of the national data infrastructure landscape.

Competitive Insights:

- NorthC

- Switch Datacenters

- EvoSwitch

- Digital Realty

- Equinix, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Schneider Electric

- ABB

- Vertiv Group Corp.

The competitive landscape of the Netherland Data Center Infrastructure Market features a strong mix of local and global players competing on scale, reliability, and technological strength. Global firms push advanced cooling and power distribution solutions to attract hyperscale clients. Local providers leverage deep knowledge of regional energy regulations and renewable power access to deliver cost-efficient solutions for enterprises. Infrastructure vendors supply modular and scalable systems that reduce deployment time and boost resilience. Clients demand high uptime, energy efficiency, and compliance, which strengthens competition around service quality and sustainability credentials. Companies differentiate through integrated solutions, rapid deployment, and robust maintenance support. The market rewards providers with flexible delivery models and proven operational track records.

Recent Developments:

- In November 2025, Antin Infrastructure Partners and EQT entered a competitive bidding process for control of NorthC, with the potential sale of the Dutch data center operator valued at around $2 billion, signaling strong investor interest in Netherlands infrastructure assets.

- In September 2025, NorthC completed the acquisition of the six data centers from Colt Technology Services, assuming operational control effective September 1 for facilities in the Amsterdam metropolitan area and Germany, enhancing its Benelux presence with expanded capacity, sustainability upgrades, and integration into its digital services platform.

- In September 2025, Microsoft acquired 50 hectares of land in the Netherlands for a significant data center expansion, responding to customer demand for more storage and cloud services in the region

- In June 2025, SPIE acquired Rovitech, a Dutch technical services provider specializing in ICT, telecom, and electrical installations for data centers. This acquisition strengthens SPIE’s expertise in data centers and expands its nationwide footprint in the Netherlands, enhancing its local service offering and support for sustainable data center solutions.

- In April 2025, NorthC signed an agreement to acquire six data centers from Colt Technology Services, including sites in Amsterdam, Netherlands, along with locations in Germany, adding over 25 MW of power capacity and establishing a long-term partnership where Colt remains a key customer.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights