Executive summary:

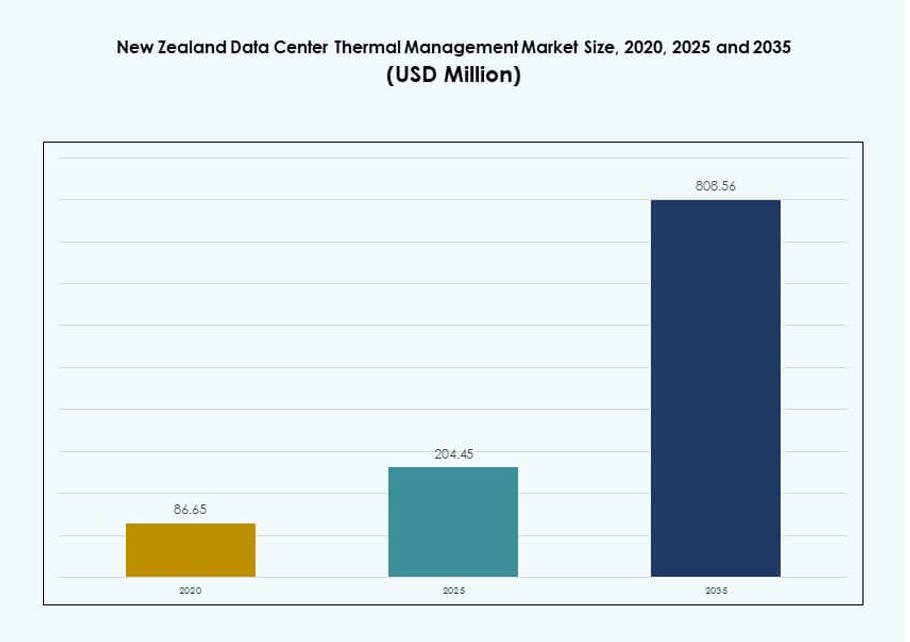

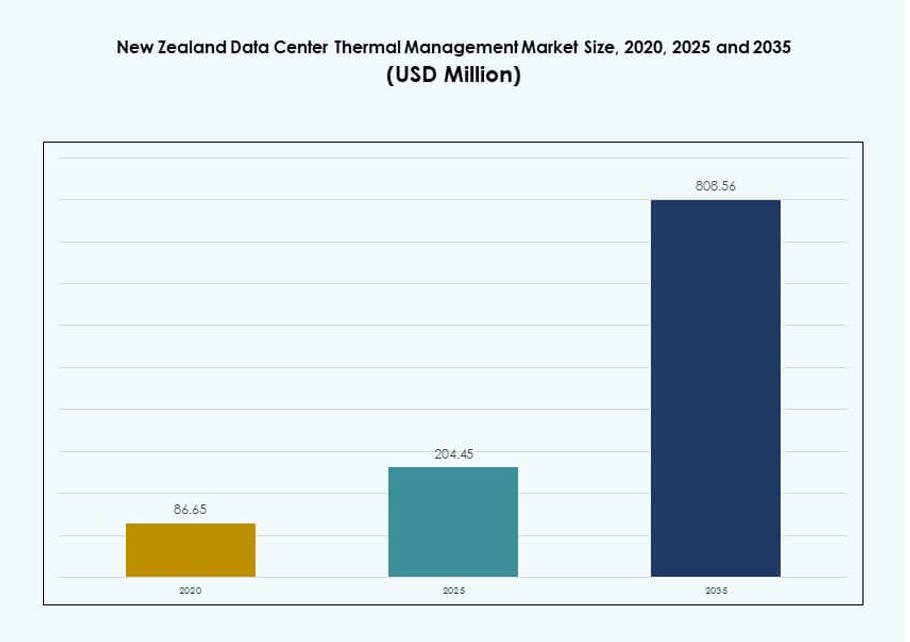

The New Zealand Data Center Thermal Management Market size was valued at USD 86.65 million in 2020 to USD 204.45 million in 2025 and is anticipated to reach USD 808.56 million by 2035, at a CAGR of 14.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| New Zealand Data Center Thermal Management Market Size 2025 |

USD 204.45 Million |

| New Zealand Data Center Thermal Management Market, CAGR |

14.63% |

| New Zealand Data Center Thermal Management Market Size 2035 |

USD 808.56 Million |

Growing investments in AI workloads, hyperscale facilities, and edge computing are driving demand for advanced cooling systems across the country. Operators are adopting hybrid air-liquid systems, predictive thermal software, and free-air cooling to enhance performance and sustainability. Innovations in modular cooling and AI-integrated monitoring platforms help lower energy usage and operating risks. The market holds strategic value for investors due to long-term infrastructure returns, sustainability alignment, and high-density demand from digital transformation.

Auckland leads the regional landscape due to its dense digital infrastructure, proximity to major enterprises, and robust cloud provider activity. Wellington and Christchurch are emerging hubs, supported by government digital initiatives and smart city frameworks. Other regions show growing interest, especially for edge and modular deployments. Market momentum follows connectivity, climate compatibility, and proximity to power infrastructure.

Market Dynamics:

Market Drivers

Rising Hyperscale And Cloud Infrastructure Expansion Across New Zealand

Data center capacity expands to support cloud migration and digital services growth. Enterprises shift workloads to regional facilities for latency control. Hyperscale operators demand higher rack densities and stable thermal control. Power efficiency remains a board-level priority for operators. The New Zealand Data Center Thermal Management Market supports uptime assurance at scale. Cooling systems protect hardware performance under constant load. Investors value predictable returns from infrastructure assets. Reliable thermal design lowers operational risk. This driver sustains long-term capital deployment.

Growing Adoption Of High-Density AI And GPU Workloads

AI workloads increase heat output within compact rack footprints. GPU clusters require precise temperature control across nodes. Operators deploy advanced cooling to avoid performance throttling. Liquid-assisted designs gain interest for dense compute zones. It enables stable operations under continuous processing demand. Hardware vendors align products with higher thermal thresholds. This shift raises demand for modern cooling architectures. Investors track AI-driven infrastructure demand closely. The driver reinforces premium system adoption.

- For instance, DCI builds a 40MW facility in Auckland supporting high-density AI compute with advanced thermal systems. Liquid-assisted designs gain interest for dense compute zones.

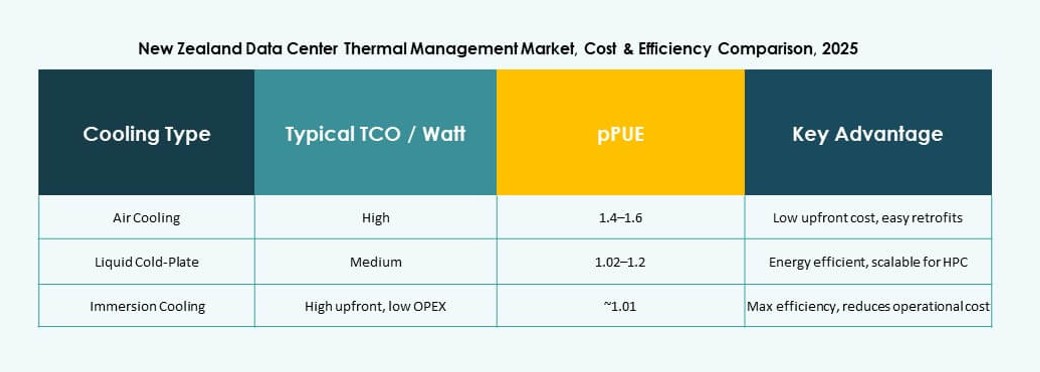

Focus On Energy Efficiency And Carbon Reduction Commitments

Energy efficiency targets shape infrastructure design choices nationwide. Operators pursue lower PUE through optimized airflow management. Free-air cooling aligns with New Zealand’s temperate climate. Sustainability goals influence procurement and facility upgrades. Thermal systems play a direct role in emission reduction. It supports compliance with corporate ESG mandates. Energy savings improve operating margins over time. Green credentials attract global cloud tenants. This driver strengthens long-term market value.

Expansion Of Edge And Regional Data Center Deployments

Edge facilities grow near population and enterprise clusters. Smaller sites still require resilient thermal solutions. Compact designs face airflow and space constraints. Modular cooling supports rapid deployment cycles. It enables service continuity across distributed locations. Telecom and content providers increase regional footprints. Thermal reliability protects service-level agreements. Investors see edge growth as defensive infrastructure play. This driver widens addressable demand.

- For instance, CDC operates 44MW total capacity across Hobsonville and Silverdale sites near Auckland with modular thermal resilience.

Market Trends

Shift Toward Hybrid Cooling Architectures In Mixed Workload Environments

Operators combine air and liquid methods within single facilities. Hybrid setups balance cost control and performance needs. Legacy halls retain air systems for lower density racks. High-density zones receive targeted liquid support. It allows phased infrastructure modernization. Vendors promote flexible system configurations. Operators prefer scalable and adaptable designs. This trend reflects pragmatic investment behavior.

Increasing Use Of AI-Enabled Thermal Monitoring Platforms

Software platforms enhance cooling efficiency through real-time analytics. AI tools predict hotspots before failure events occur. Operators gain granular visibility across racks and aisles. Automated adjustments reduce manual intervention needs. It improves response time during load fluctuations. Data-driven insights support preventive maintenance planning. Vendors integrate analytics into DCIM suites. This trend improves operational confidence.

Retrofit Demand Across Existing Data Center Facilities

Older facilities undergo cooling upgrades to extend lifespan. Retrofits avoid costly greenfield construction delays. Operators replace CRAC units with efficient alternatives. Rear-door exchangers suit space-limited halls. It supports capacity growth without footprint expansion. Service providers see rising retrofit contracts. This trend favors experienced integration firms. Asset optimization drives retrofit momentum.

Preference For Modular And Prefabricated Cooling Systems

Modular cooling shortens deployment timelines significantly. Prefabricated units reduce on-site construction complexity. Operators gain predictable performance and cost control. Modules scale alongside IT load growth. It supports faster market entry for new sites. Vendors standardize designs for regional use. This trend aligns with agile infrastructure strategies.

Market Challenges

High Capital Cost Of Advanced Cooling Infrastructure Deployment

Advanced cooling systems demand substantial upfront investment. Liquid cooling adds cost through specialized components. Smaller operators face budget constraints during upgrades. Return timelines stretch under conservative pricing models. The New Zealand Data Center Thermal Management Market faces adoption gaps in mid-sized facilities. Financing complexity slows decision cycles. Operators weigh efficiency gains against capital exposure. Cost sensitivity remains a structural challenge.

Skill Gaps And Operational Complexity In Managing Modern Cooling Systems

Modern thermal systems require specialized technical expertise. Liquid cooling introduces new maintenance protocols. Operator teams need focused training and certifications. Skill shortages raise operational risk during failures. It increases reliance on external service partners. Complex systems demand precise monitoring and control. Downtime risk concerns conservative operators. Talent availability limits rapid adoption.

Market Opportunities

Rising Demand For Sustainable And Climate-Optimized Cooling Solutions

New Zealand climate supports energy-efficient cooling models. Operators adopt free-air and hybrid solutions widely. Sustainability-focused clients prefer green-certified facilities. The New Zealand Data Center Thermal Management Market aligns with renewable energy usage trends. Cooling vendors tailor solutions for low-carbon goals. Energy efficiency improves long-term asset appeal. This opportunity attracts global cloud investment.

Growth In Managed Thermal Services And Cooling Optimization Contracts

Operators outsource monitoring and maintenance services. Managed services reduce in-house staffing pressure. Providers offer performance-based optimization models. It ensures consistent thermal efficiency levels. Service contracts generate recurring revenue streams. Investors favor service-led margin stability. This opportunity expands value beyond hardware sales.

Market Segmentation

By Data Center Size

Small data centers hold nearly 25% share, driven by edge and enterprise needs. Medium facilities account for about 35% due to regional cloud growth. Large data centers dominate with roughly 40% share, led by hyperscale campuses. The New Zealand Data Center Thermal Management Market benefits from large-scale projects adopting advanced cooling. High rack density drives investment in liquid and hybrid systems. Smaller sites rely on cost-effective air cooling. Medium centers balance scalability and efficiency. Size-based demand shapes vendor strategies.

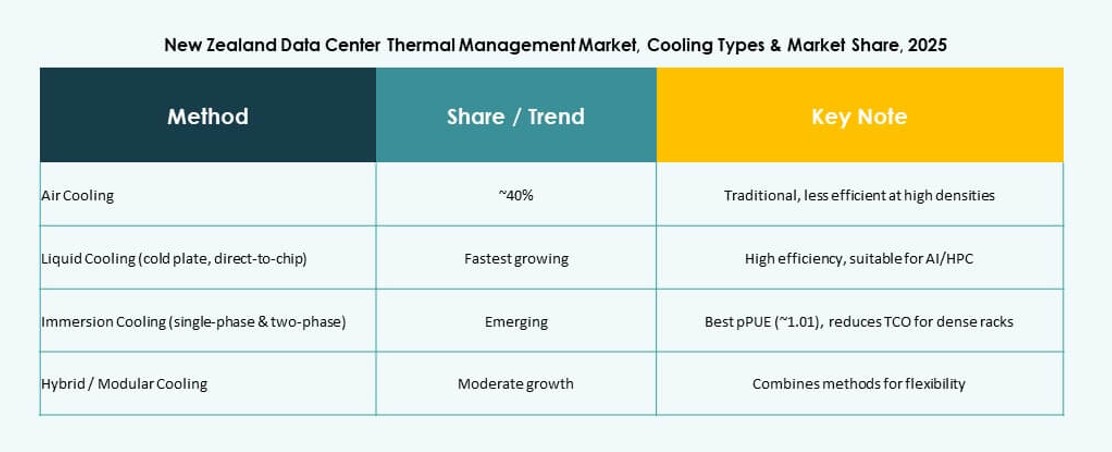

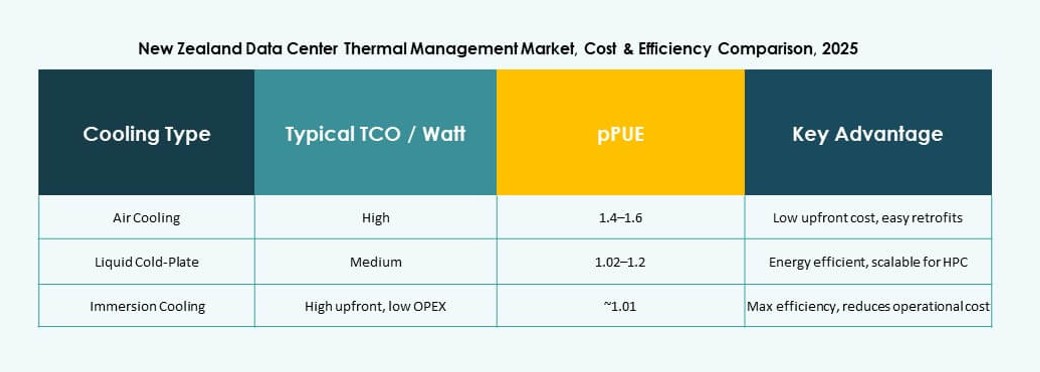

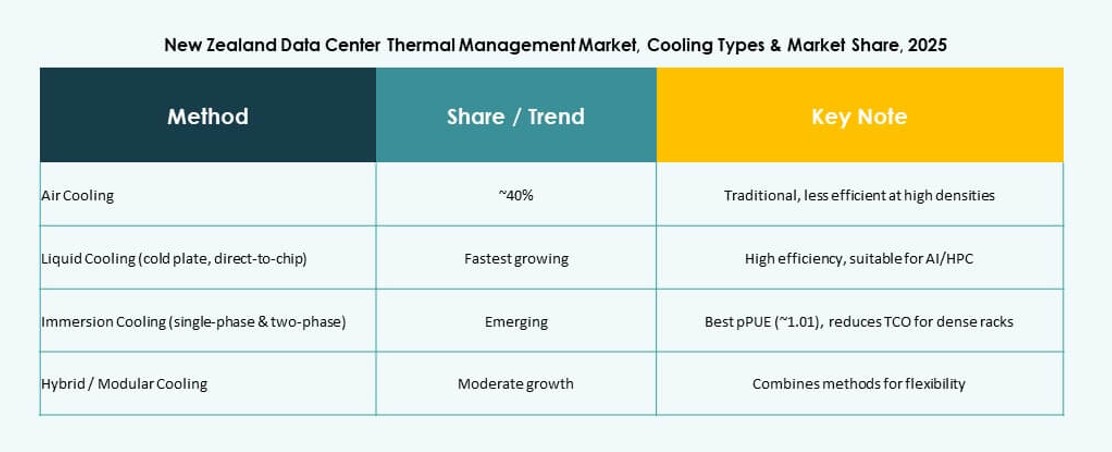

By Cooling Technology

Air-based cooling holds close to 45% share due to cost efficiency. Liquid-based cooling represents around 35% share, driven by AI workloads. Hybrid solutions capture nearly 15% as operators mix systems. The New Zealand Data Center Thermal Management Market sees liquid adoption rise steadily. Direct-to-chip leads liquid deployments. Hot and cold aisle containment remains standard. Hybrid designs support phased upgrades. Technology mix reflects workload diversity.

By Component

Hardware contributes nearly 55% of total spending. Software accounts for about 20% through monitoring platforms. Services hold close to 25% due to retrofits and maintenance. The New Zealand Data Center Thermal Management Market values hardware reliability. Software improves efficiency and visibility. Services ensure system longevity. Component balance supports full lifecycle management. Vendors target bundled offerings.

By Hardware

Cooling units and chillers lead with about 40% share. Fans and airflow devices follow at nearly 25%. Heat exchangers contribute close to 20%. The New Zealand Data Center Thermal Management Market emphasizes efficient airflow control. Piping systems support liquid deployments. Hardware selection impacts energy performance. Modular hardware gains traction. Reliability drives purchasing decisions.

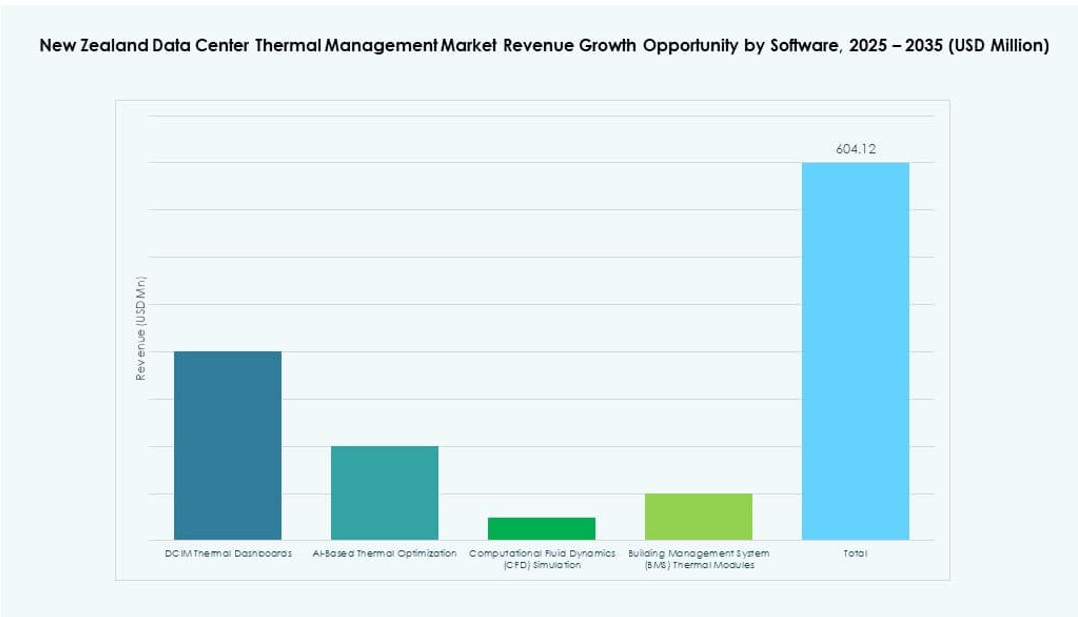

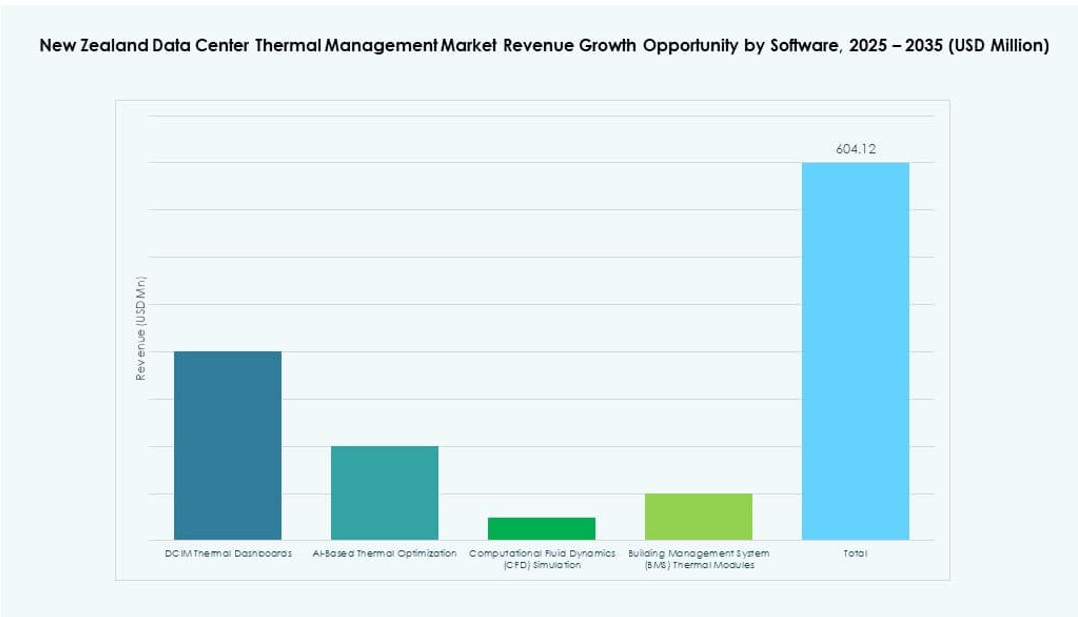

By Software

DCIM dashboards dominate with around 45% share. AI optimization tools hold nearly 30%. CFD simulation accounts for about 15%. The New Zealand Data Center Thermal Management Market adopts analytics for efficiency. BMS modules integrate facility controls. Software reduces operational uncertainty. Predictive insights support uptime goals. Digital layers enhance asset value.

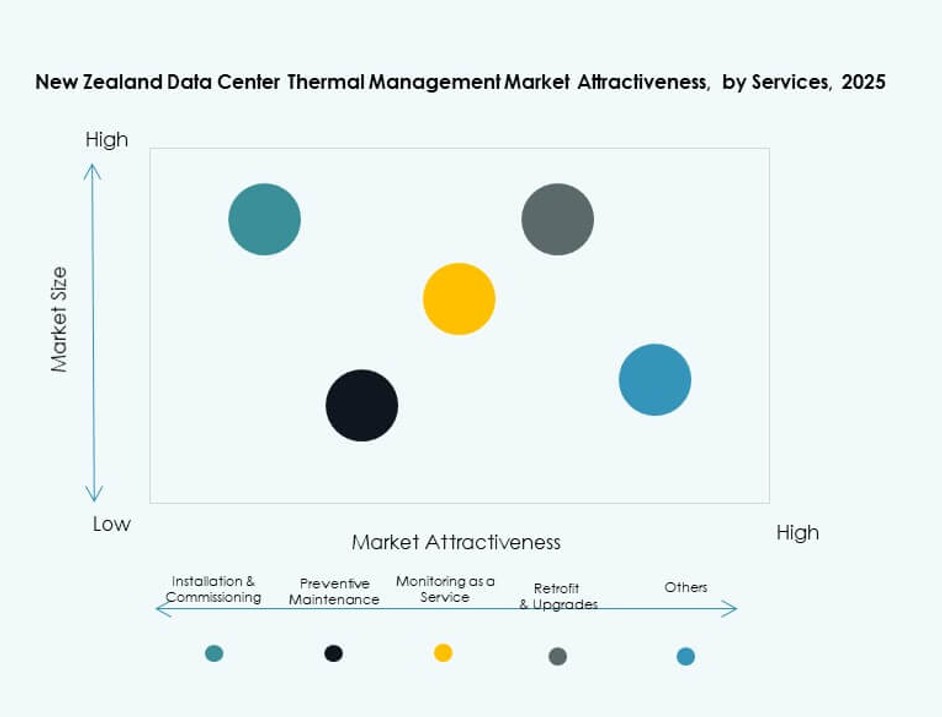

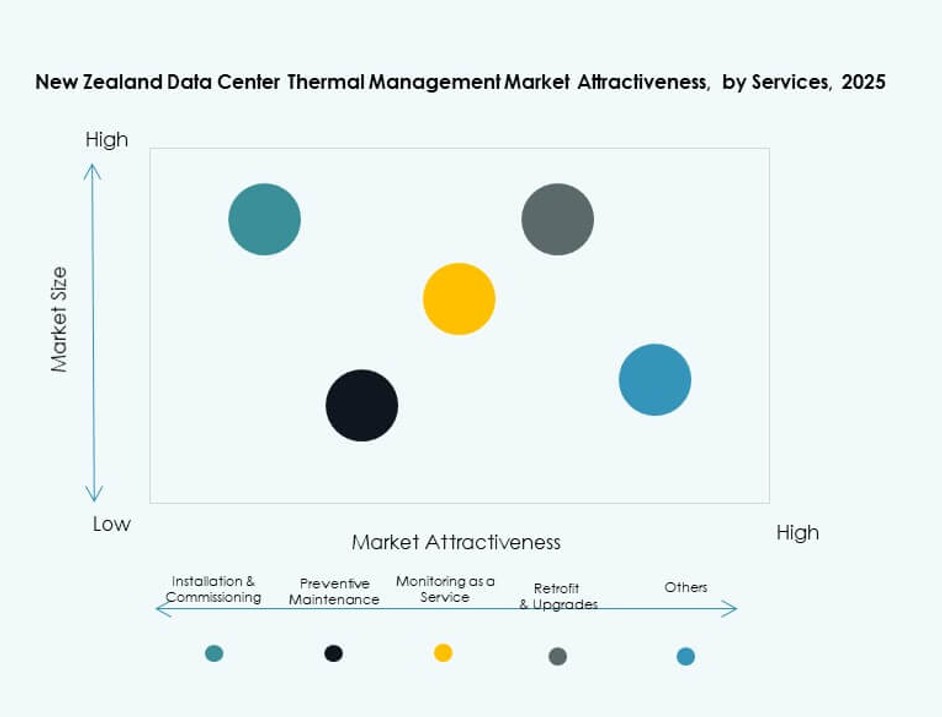

By Services

Installation and commissioning lead with about 35% share. Preventive maintenance holds near 25%. Retrofits and upgrades contribute around 20%. The New Zealand Data Center Thermal Management Market relies on skilled service partners. Monitoring services gain adoption steadily. Services extend system life. Recurring contracts attract investors. Service depth strengthens vendor positioning.

By Data Center Type

Hyperscale dominates with nearly 45% share. Colocation and cloud hold around 30%. Enterprise facilities account for about 15%. The New Zealand Data Center Thermal Management Market follows cloud expansion patterns. Edge data centers grow steadily. Hyperscale sites adopt advanced cooling fastest. Type diversity broadens demand. Investment follows scale.

By Structure

Rack-based systems lead with about 50% share. Row-based solutions follow at nearly 30%. Room-based designs hold around 20%. The New Zealand Data Center Thermal Management Market favors rack-level precision. High-density racks drive this shift. Row-based suits modular halls. Structural choice affects efficiency outcomes. Design flexibility remains key.

Regional Insights

Northern Island Region Including Auckland

Auckland holds nearly 55% market share due to infrastructure concentration. Cloud hubs cluster around metro connectivity zones. Demand rises from enterprise and hyperscale operators. The New Zealand Data Center Thermal Management Market sees strong cooling investment here. Skilled workforce availability supports complex systems. Power and network access favor expansion. Investors prioritize this region.

- For instance, Microsoft’s upcoming Auckland data center region, launched in 2024, is designed for high energy efficiency and targets an average PUE near 1.12 using advanced cooling and optimization systems.

Central And Southern Island Urban Centers

Wellington and Christchurch together hold around 30% share. Government IT systems support steady demand. Regional enterprises prefer localized data hosting. It supports moderate-scale thermal deployments. Cooling upgrades focus on efficiency and resilience. These cities attract edge investments. Balanced growth defines this region.

Emerging Regional And Edge Locations

Other regions account for roughly 15% share. Edge sites support latency-sensitive services. Smaller facilities adopt modular cooling designs. The New Zealand Data Center Thermal Management Market expands gradually here. Climate advantages support free-air cooling. Cost control drives technology choices. Long-term potential remains strong.

- For instance, edge deployments leverage New Zealand’s temperate climate for free-air cooling, reducing water usage aligned with Microsoft’s global WUE average of 0.30 L/kWh across its efficient data center fleet.

Competitive Insights:

- Vertiv Group Corp.

- Schneider Electric

- Stulz GmbH

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Trane Technologies plc

- Johnson Controls International plc

- Airedale International Air Conditioning Ltd.

- Eaton Corporation

- Munters Group AB

The New Zealand Data Center Thermal Management Market features a competitive mix of global and regional players. Vertiv, Schneider Electric, and Stulz lead in precision cooling systems and hybrid solutions tailored for high-density environments. Daikin and Trane offer energy-efficient HVAC systems that align with New Zealand’s sustainability mandates. Delta and Johnson Controls compete in intelligent automation, leveraging DCIM integration and AI-based thermal controls. Companies invest in modular systems to address growing edge deployments and colocation expansion. It sees rising demand for retrofit services, favoring experienced vendors with localized support teams. Partnerships with hyperscale operators and service providers shape strategic positioning. Product innovation, system reliability, and energy efficiency drive market leadership.

Recent Developments:

- In November 2025, LG Electronics partnered with Flex to co-develop modular air and liquid cooling infrastructure for gigawatt-scale AI data centers. The collaboration integrates LG’s cooling tech with Flex’s power solutions for prefabricated, scalable systems.

- In August 2025, Daikin Industries Ltd. announced the acquisition of Dynamic Data Centers Solutions, Inc. (DDC Solutions) to bolster its AI data center cooling capabilities by integrating server cooling technologies with its air conditioning portfolio.

- In May 2025, Delta Electronics, Inc. unveiled comprehensive AI data center solutions emphasizing power and thermal management, including air and liquid cooling for high-density servers. These offerings achieve up to 92% energy efficiency via 800V HVDC architecture and support NVIDIA GB200 deployments.

- In February 26, 2025, Airedale International Air Conditioning Ltd., under Modine, secured $180 million in orders for high-capacity data center cooling systems tailored for AI infrastructure. This deal supports scalable, sustainable cooling with deliveries through 2026.