Executive summary:

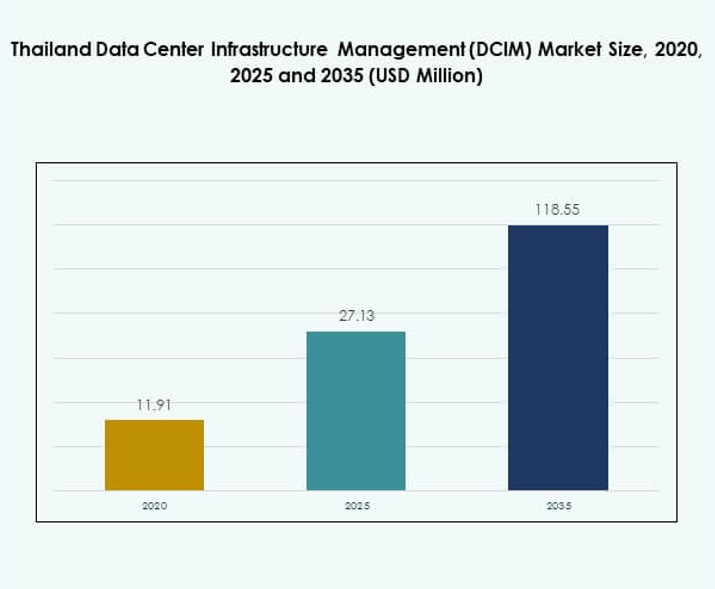

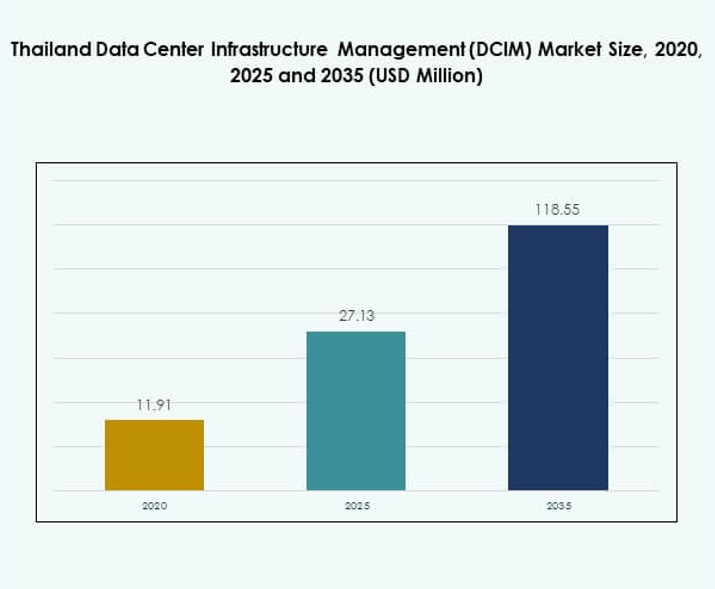

The Thailand Data Center Infrastructure Management (DCIM) Market size was valued at USD 11.91 million in 2020, increased to USD 27.13 million in 2025, and is anticipated to reach USD 118.55 million by 2035, growing at a CAGR of 17.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Thailand Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 27.13 Million |

| Thailand Data Center Infrastructure Management (DCIM) Market, CAGR |

17.67% |

| Thailand Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 118.55 Million |

The market growth is driven by rising cloud adoption, energy-efficient technologies, and integration of AI and IoT into data center operations. Businesses seek advanced DCIM platforms for predictive maintenance, automation, and real-time performance visibility. It holds strategic importance for enterprises aiming to improve operational efficiency, reduce energy costs, and enhance infrastructure scalability, making it a key investment area in Thailand’s evolving digital ecosystem. Central Thailand leads the market due to its strong enterprise concentration and expanding hyperscale data centers in Bangkok. The Eastern Economic Corridor is emerging as a key growth zone driven by industrial expansion and international investments in green data centers. Northern and Southern Thailand show growing adoption of edge facilities, improving connectivity and supporting Thailand’s goal of building a balanced, nationwide digital infrastructure.

Market Drivers

Rapid Digital Transformation and Integration of Advanced DCIM Technologies

The Thailand Data Center Infrastructure Management (DCIM) Market is witnessing strong growth driven by rapid digital transformation across industries. Businesses are adopting AI-driven analytics and IoT-enabled monitoring to improve operational visibility and energy efficiency. The integration of automation tools enables predictive maintenance and faster incident response. Cloud computing and 5G expansion have increased data volumes, creating demand for advanced DCIM platforms. Enterprises seek centralized management systems to streamline performance across facilities. IT modernization initiatives by both private and public sectors support smart data center development. The market’s evolution highlights Thailand’s focus on scalable, sustainable, and digitally connected infrastructure.

Rising Demand for Energy Efficiency and Sustainable Data Center Operations

Energy optimization remains a critical driver for DCIM adoption in Thailand. The focus on reducing carbon emissions has prompted operators to invest in real-time monitoring tools and renewable-powered infrastructure. Intelligent power management solutions minimize energy waste and lower operational costs. Green data center certifications are becoming key investment criteria for global enterprises entering Thailand. Smart cooling and load-balancing solutions are improving power usage effectiveness across facilities. Businesses benefit from significant cost savings and enhanced system reliability. The push for sustainability aligns with Thailand’s climate commitments and digital economy roadmap.

- For example, True IDC partnered with Altervim in November 2023 to install solar panels with a 1 MWp capacity at its Bangkok data centers. The project generates approximately 1.4 million kWh of electricity annually, reducing greenhouse gas emissions and supporting Thailand’s green energy targets.

Expansion of Cloud Ecosystems and Colocation Infrastructure

Thailand’s expanding cloud ecosystem has accelerated the deployment of scalable DCIM platforms. Global hyperscalers and local providers are investing in modular and hybrid data centers. These developments require precise asset tracking and automated infrastructure management. DCIM solutions enable real-time visibility into distributed environments, reducing downtime risks. The hybrid model supports seamless integration between private and public cloud resources. Enterprises and government agencies prefer DCIM tools for enhanced control, security, and compliance. The growing colocation sector further strengthens Thailand’s position as a Southeast Asian data hub.

Government Initiatives Supporting Smart Infrastructure and Digital Economy Growth

The government’s Thailand 4.0 strategy emphasizes digital innovation and infrastructure efficiency. DCIM platforms play a vital role in achieving these goals through smart data operations. Strategic policies encourage private investments in high-capacity and energy-efficient data centers. Collaboration between public agencies and technology firms fosters knowledge exchange and digital skills. DCIM adoption also supports cybersecurity and disaster recovery readiness across industries. Thailand’s strategic location attracts foreign investors seeking regional connectivity. The market’s momentum underscores its role in powering the nation’s digital future and enhancing data sovereignty.

- For example, the Royal Thai Government signed a memorandum of understanding (MoU) with Microsoft in 2023 to establish new AI-powered cloud infrastructure, including a new data center region in Thailand. This partnership aims to provide AI training to over 100,000 individuals and enhance e-government services with improved cybersecurity and disaster recovery capabilities, underpinning Thailand’s digital economy and Thailand 4.0 strategy.

Market Trends

Adoption of AI-Driven Predictive Analytics for Intelligent Infrastructure Management

AI-based predictive analytics has become a defining trend in the Thailand Data Center Infrastructure Management (DCIM) Market. Operators use machine learning to anticipate faults, optimize load distribution, and forecast capacity needs. Predictive maintenance minimizes downtime and enhances system reliability. Intelligent automation also helps reduce human error in large-scale data environments. The ability to visualize performance in real time supports faster decision-making. Businesses gain a competitive advantage through data-driven insights. AI integration continues to reshape operational strategies, promoting self-healing and autonomous data center operations.

Growth of Modular and Edge Data Centers to Support Latency-Sensitive Applications

The shift toward modular and edge architectures reflects Thailand’s growing digital economy. DCIM tools are central to managing distributed systems across multiple locations. Edge data centers support emerging applications in IoT, AI, and streaming services. Modular designs allow flexible capacity expansion without major infrastructure overhauls. DCIM platforms facilitate consistent control over power, cooling, and asset management in decentralized networks. This approach ensures faster response times and higher operational agility. It reinforces Thailand’s role as a regional hub for real-time digital services.

Integration of Cloud-Native DCIM Solutions for Scalable Management Efficiency

The cloud-native DCIM trend is reshaping operational management frameworks in Thailand. Organizations favor software-defined solutions for flexibility and cost efficiency. Cloud-based DCIM supports centralized monitoring across hybrid environments. It simplifies updates, enhances data access, and improves collaboration among IT teams. The demand for remote visibility has increased since the rise of hybrid work models. These platforms also integrate easily with enterprise applications and APIs. Businesses adopt cloud-native DCIM for greater scalability and reduced capital expenditure, fueling steady market expansion.

Rising Focus on Cybersecurity and Compliance in Data Infrastructure Management

Cybersecurity has become integral to DCIM deployment strategies in Thailand. Enterprises prioritize platforms offering integrated threat detection and access control. Regulatory compliance with international standards like ISO/IEC 27001 drives innovation in secure infrastructure monitoring. DCIM solutions provide encrypted communication and real-time alerts for anomaly detection. Businesses adopt zero-trust frameworks to safeguard sensitive data assets. The growing number of cyber incidents reinforces the demand for secure management ecosystems. Strong compliance frameworks strengthen investor confidence and operational continuity across Thailand’s data infrastructure.

Market Challenges

High Implementation Costs and Integration Complexities Across Legacy Systems

The Thailand Data Center Infrastructure Management (DCIM) Market faces financial and technical barriers in adoption. High initial setup costs deter smaller enterprises from deploying advanced solutions. Integration with existing legacy systems often causes compatibility issues and extended deployment timelines. Limited technical expertise also affects successful implementation. Many firms struggle with data migration between hybrid environments. Inconsistent vendor standards complicate interoperability among multi-vendor ecosystems. Budget constraints delay modernization projects for several mid-sized operators. These challenges slow the transition to unified infrastructure management and digital resilience.

Skill Shortage and Limited Awareness of Advanced DCIM Capabilities

A significant challenge lies in the shortage of skilled professionals capable of managing sophisticated DCIM systems. The Thailand market lacks enough technicians trained in automation, AI analytics, and hybrid infrastructure. This shortage reduces operational efficiency and response times during technical incidents. Many enterprises remain unaware of the strategic benefits offered by next-generation DCIM tools. Insufficient training programs further restrict adoption in regional markets. Organizations must focus on capacity-building initiatives to strengthen talent pipelines. Collaboration with universities and tech institutes can help fill this gap. Without addressing this shortage, Thailand risks lagging in operational optimization and innovation.

Market Opportunities

Growing Investments in Green Data Centers and Renewable Infrastructure Expansion

The Thailand Data Center Infrastructure Management (DCIM) Market presents opportunities through sustainable operations. Businesses are investing in energy-efficient technologies aligned with environmental goals. DCIM tools optimize cooling systems and power distribution, enabling measurable carbon reduction. Government incentives promote renewable integration in new facilities. Enterprises view sustainability as a competitive differentiator in global partnerships. These developments position Thailand as a regional leader in green digital infrastructure. Long-term investment prospects remain favorable for eco-focused technology providers.

Expansion of Cloud and AI Ecosystems Supporting Digital Transformation

Thailand’s expanding digital infrastructure ecosystem creates opportunities for cloud-based DCIM platforms. AI integration enhances capacity planning and real-time control. Cloud scalability supports regional data exchange and hybrid enterprise workloads. The demand from telecom, finance, and e-commerce sectors continues to rise. Government digital initiatives also encourage innovation partnerships. DCIM providers offering integrated analytics, automation, and compliance tools gain strong traction. These advancements enhance the market’s role in driving intelligent and sustainable data management.

Market Segmentation

By Component

In the Thailand Data Center Infrastructure Management (DCIM) Market, the solution segment dominates with advanced monitoring and analytics tools. These systems manage energy, assets, and environmental factors efficiently. The service segment grows as enterprises seek managed operations and technical support. Demand for software solutions increases due to scalability and automation benefits. Integration with AI and IoT technologies drives higher adoption rates. Vendors emphasize customizable platforms to fit enterprise needs.

By Data Center Type

The enterprise data center segment holds the largest share due to heavy corporate digitization. Managed and colocation centers show strong growth with rising outsourcing demand. Cloud and edge data centers gain attention for supporting latency-sensitive workloads. The Thailand Data Center Infrastructure Management (DCIM) Market benefits from the rise of modular deployments. Hybrid ecosystems strengthen Thailand’s position in Southeast Asia’s data economy.

By Deployment Model

Cloud-based DCIM leads adoption in Thailand due to flexibility and lower upfront costs. It enables centralized control and faster deployment across facilities. Hybrid models attract enterprises balancing data privacy and scalability. On-premises solutions remain relevant for high-security sectors such as finance. The Thailand Data Center Infrastructure Management (DCIM) Market continues shifting toward SaaS platforms.

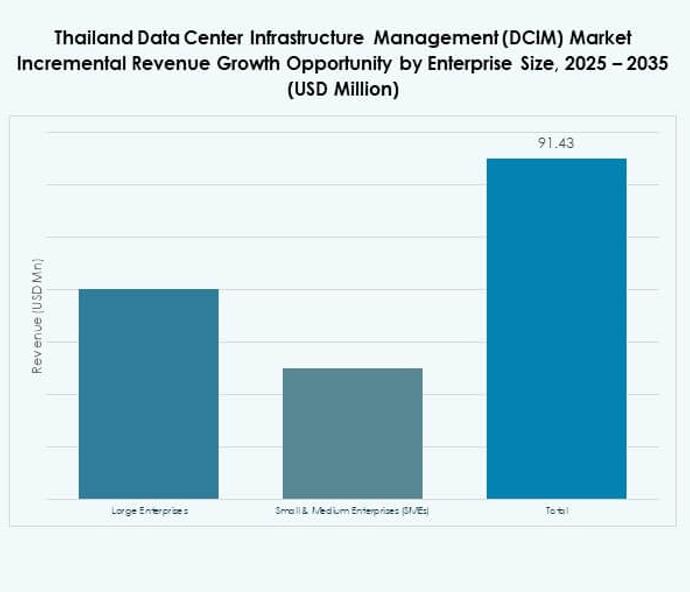

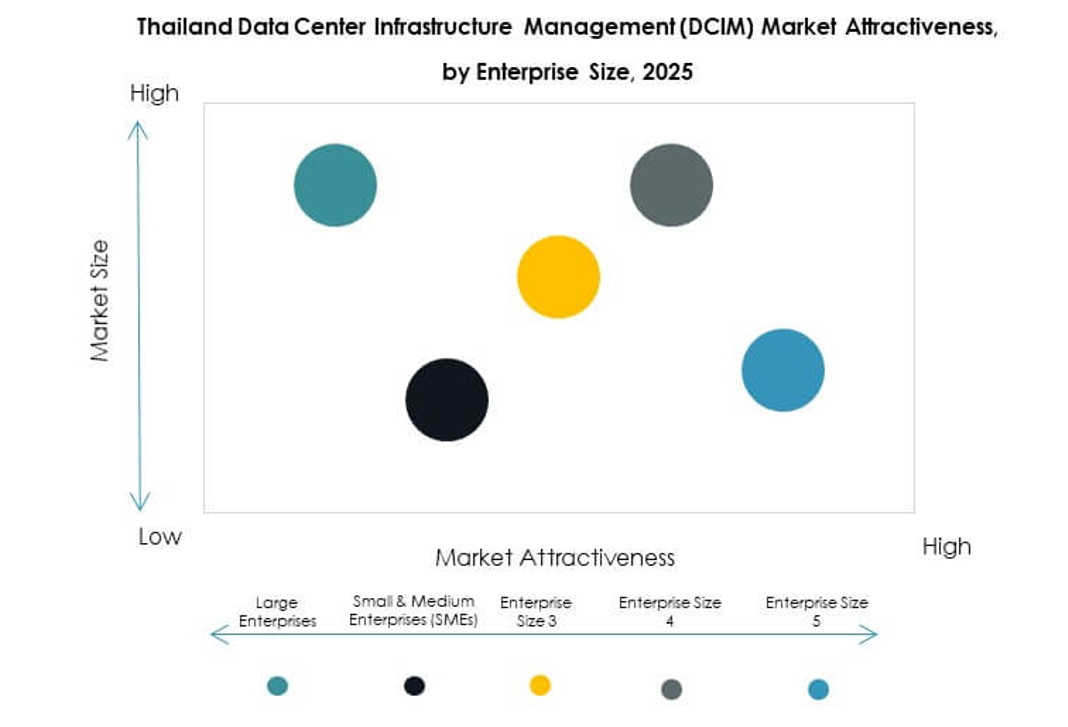

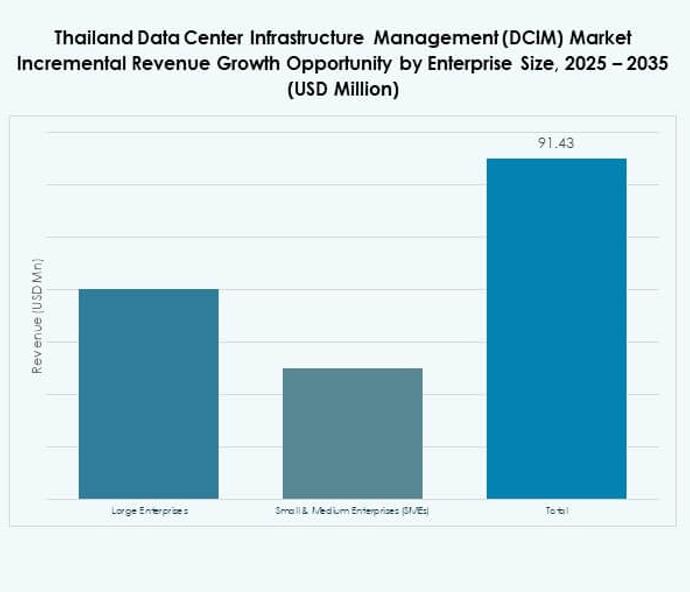

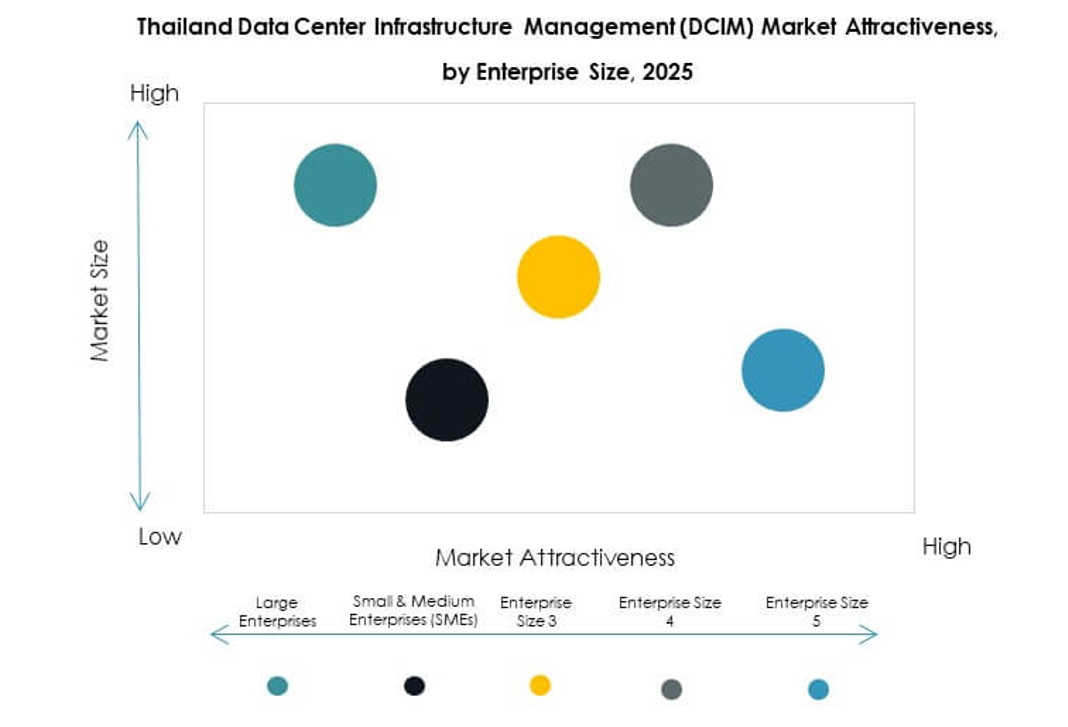

By Enterprise Size

Large enterprises dominate the market with extensive IT infrastructure investments. SMEs show increasing adoption to improve resource efficiency. Affordable cloud-based DCIM solutions make digital transformation accessible to smaller firms. The Thailand Data Center Infrastructure Management (DCIM) Market benefits from SME digitization programs. Vendors target scalable platforms suitable for multi-tier organizations.

By Application / Use Case

Power and environmental monitoring remain key applications driving adoption. Asset management and capacity planning optimize energy and equipment usage. BI and analytics tools enhance predictive capabilities across facilities. The Thailand Data Center Infrastructure Management (DCIM) Market evolves toward integrated monitoring frameworks.

By End User Industry

The IT and telecommunications sector leads with extensive infrastructure modernization. BFSI and healthcare sectors adopt DCIM for compliance and operational reliability. Retail and e-commerce gain from automation and real-time insights. Energy and utilities apply DCIM for efficiency and safety improvements. Aerospace and defense focus on security and data control.

Regional Insights

Central Thailand Dominating Market Share Through Concentrated Data Center Hubs (46%)

Central Thailand dominates the Thailand Data Center Infrastructure Management (DCIM) Market with 46% share. Bangkok serves as the core hub for hyperscale data centers and multinational operators. The concentration of enterprise headquarters drives continuous infrastructure investment. DCIM adoption supports efficiency and uptime in mission-critical operations. Strong fiber connectivity and government-backed smart city projects reinforce the region’s leadership.

- For instance, in 2021, ST Telemedia Global Data Centres (Thailand) officially opened STT Bangkok 1 in Hua Mak, a carrier-neutral data center with an IT load of 22 MW, holding ISO 27001, Uptime Tier III, and LEED Gold certifications. The seven-story facility supports high-density computing and aligns with global sustainability and operational standards.

Eastern Economic Corridor (EEC) Expanding as Emerging Digital Infrastructure Zone (34%)

The Eastern Economic Corridor accounts for 34% of the national share, driven by industrial and logistics growth. Chonburi and Rayong attract global investors for green and modular data centers. The region’s strategic proximity to ports enhances international connectivity. DCIM adoption accelerates with sustainability-focused developments and 5G-enabled networks. It strengthens Thailand’s role as a key regional digital gateway.

- For instance, SUPERNAP (Thailand) operates a Tier IV-designed colocation data center in Chonburi, supporting up to 33 kW per cabinet with expansion potential toward 60 MW. The facility features a target PUE of 1.35–1.45, 24/7 network operations, and a modular design that ensures high efficiency and scalability.

Northern and Southern Regions Witnessing Gradual Expansion Through Edge Deployments (20%)

Northern and Southern Thailand collectively hold 20% market share with rising edge installations. Chiang Mai and Songkhla see increasing investments from regional ISPs and cloud providers. Edge facilities bring data processing closer to users, reducing latency. DCIM systems enhance performance visibility in these decentralized setups. Infrastructure expansion supports national goals for balanced digital inclusion.

Competitive Insights:

- True IDC

- IBM

- Delta Electronics

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Others

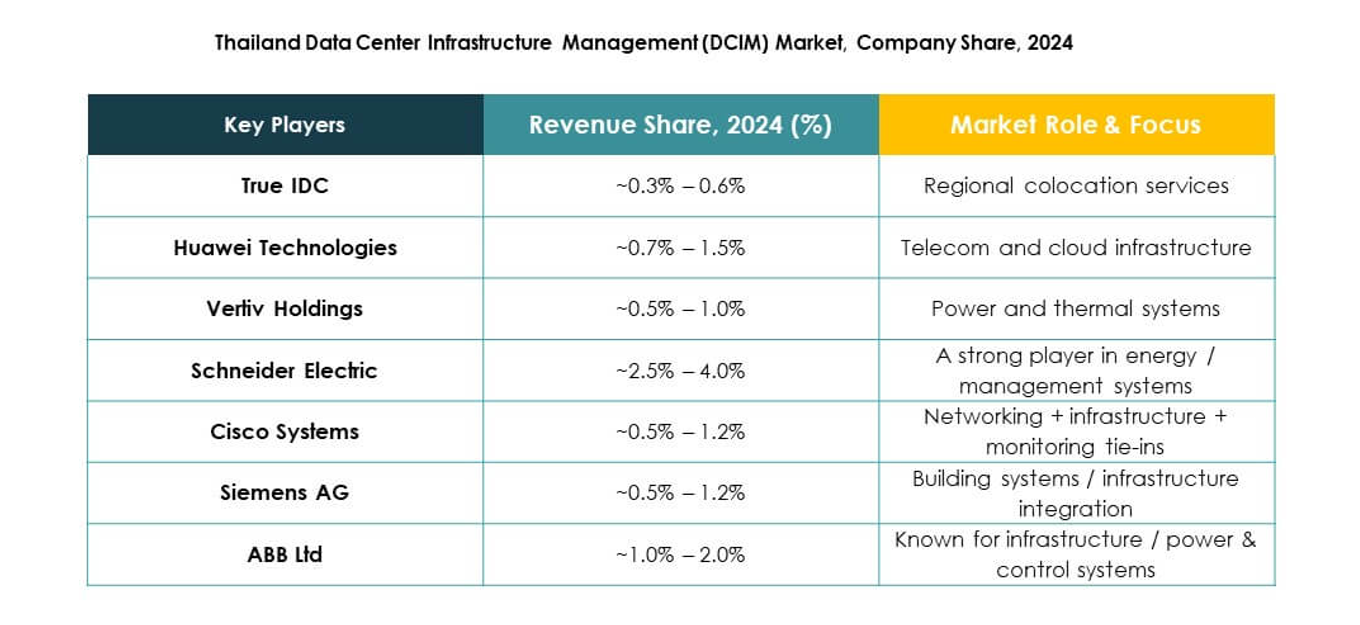

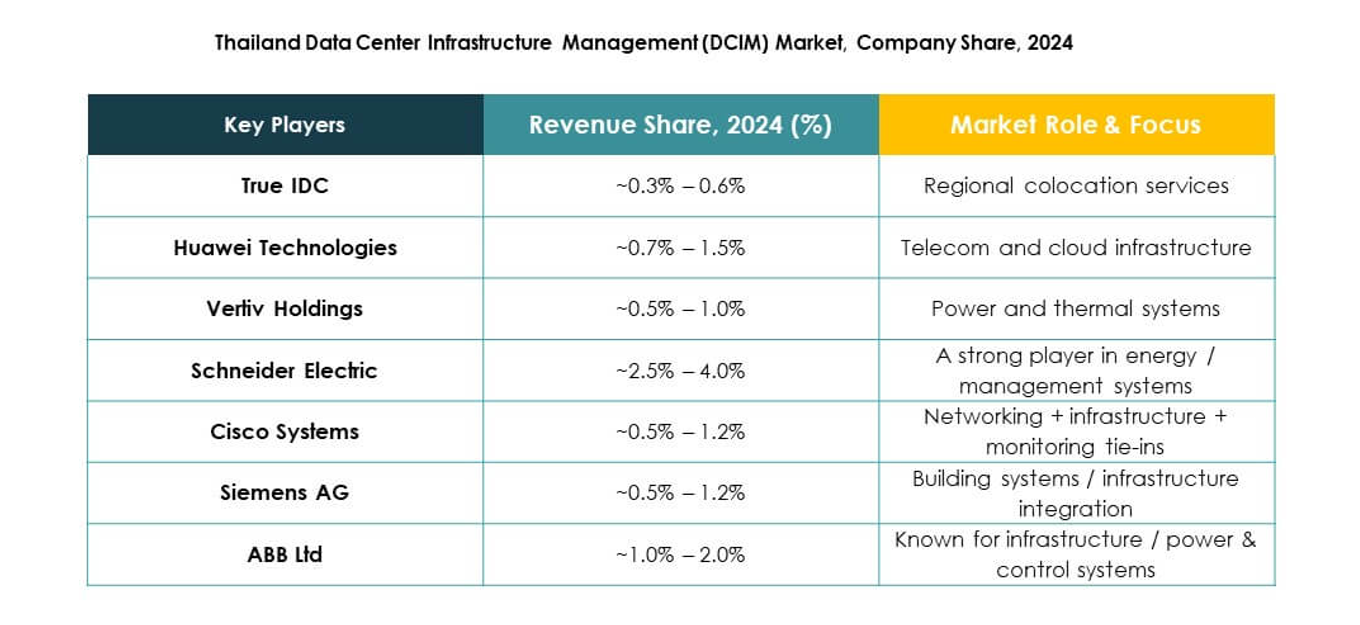

The Thailand Data Center Infrastructure Management (DCIM) Market features strong competition among global and domestic technology providers. True IDC leads through localized infrastructure solutions and strong service integration. IBM, Schneider Electric, and Huawei focus on intelligent automation and AI-enabled DCIM platforms. Delta Electronics and Eaton emphasize energy-efficient systems for sustainable data center operations. Cisco and Siemens advance network and software-defined management capabilities. ABB strengthens its market position with power optimization and modular designs. It continues to evolve with strategic partnerships, R&D investments, and smart infrastructure projects supporting national digitalization. Competitive intensity remains high, driven by rapid innovation, demand for hybrid infrastructure, and Thailand’s emergence as a key digital hub in Southeast Asia.

Recent Developments:

- In September 2025, Delta Electronics (Thailand) Public Company Limited entered a strategic partnership with VST ECS (Thailand) Co., Ltd., one of the country’s leading IT distributors, to promote Delta’s UPS systems and data center infrastructure solutions nationwide. This collaboration aims to deliver integrated, high-efficiency solutions, supporting enterprise and public sector clients as Thailand continues its rapid digital transformation driven by AI and advanced data workloads.

- In September 2025, Delta Electronics (Thailand) also participated in the ITD Southeast Asia Forum 2025 in Bangkok, engaging with international leaders and highlighting its commitment to supporting Thailand’s digital future and growing data center market through innovative technologies and sustainable solutions.

- In July 2025, True IDC, the leading data center and cloud services provider under Charoen Pokphand Group, expanded its collaboration with Alibaba Cloud by being appointed as the Authorized Distributor and sole Managed Services Provider (MSP) of Alibaba Cloud in Thailand. This strategic partnership seeks to strengthen Thailand’s digital infrastructure and empower local organizations in their transition to AI and cloud-powered digital operations, providing end-to-end cloud services and supporting the country’s digital economy.