Executive summary:

The Vietnam Data Center Infrastructure Management (DCIM) Market size was valued at USD 7.70 million in 2020, increased to USD 17.54 million in 2025, and is anticipated to reach USD 76.69 million by 2035, at a CAGR of 17.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Vietnam Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 17.54 Million |

| Vietnam Data Center Infrastructure Management (DCIM) Market, CAGR |

17.67% |

| Vietnam Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 76.69 Million |

The market is expanding rapidly due to rising digital transformation, cloud adoption, and investments in data centers. Businesses are shifting toward automated and AI-enabled management tools to enhance efficiency and reduce downtime. The increasing focus on sustainability, smart monitoring, and real-time analytics strengthens operational control and resource optimization. The market holds strategic value for investors seeking growth in Vietnam’s evolving digital infrastructure ecosystem.

Ho Chi Minh City and Hanoi lead the market due to high connectivity, modern facilities, and enterprise concentration. Emerging regions like Da Nang are gaining traction, supported by government-led digital initiatives and edge data center growth. The country’s location within Southeast Asia strengthens its position as a regional hub for cloud and data services.

Market Drivers

Rising Digital Transformation and Growing Data Center Investments

The Vietnam Data Center Infrastructure Management (DCIM) Market is expanding due to Vietnam’s strong digitalization push and foreign data center investments. Government initiatives such as the National Digital Transformation Program accelerate cloud adoption and demand for automated infrastructure monitoring. Local telecom operators and global hyperscalers deploy advanced DCIM tools to manage large facilities efficiently. Businesses seek operational resilience through predictive analytics and AI-based management. Cloud-native platforms simplify integration across multiple systems. Increasing automation enhances uptime and energy optimization. Investors view the market as a gateway to Southeast Asia’s digital growth.

- For instance, Viettel Group began construction in April 2025 on the Tan Phu Trung Data Center in Ho Chi Minh City, Vietnam’s first hyperscale facility with a planned capacity of 140 MW and around 10,000 racks. The project is designed under Uptime Institute Tier III standards, featuring rack densities averaging 10 kW and peaking at 60 kW to support high-performance and AI-driven workloads.

Adoption of AI, IoT, and Automation in Infrastructure Operations

AI and IoT technologies are transforming Vietnam’s data center management landscape. Real-time monitoring solutions enhance energy efficiency and fault detection. Automation reduces manual intervention and operational costs while ensuring precision in power and cooling management. The Vietnam Data Center Infrastructure Management (DCIM) Market benefits from smart sensors that enable predictive maintenance and asset tracking. Enterprises deploy digital twins to model and optimize operations. Continuous technological upgrades enhance scalability for expanding workloads. It supports enterprise modernization through data-driven decision-making. These innovations improve competitiveness and attract foreign investment.

- For instance, CMC Technology Group signed a strategic partnership with Samsung C&T in August 2025 to build a hyperscale data center in Ho Chi Minh City’s Saigon Hi-Tech Park. The project’s first phase will feature 30 MW capacity with an investment of USD 250 million, aiming to meet global standards for technology, cybersecurity, and green infrastructure.

Growing Demand for Sustainable and Energy-Efficient Data Centers

Sustainability is driving major infrastructure shifts in Vietnam. Data centers focus on energy-efficient architectures, supported by green policies and carbon neutrality goals. The adoption of DCIM solutions helps track and optimize power consumption. The Vietnam Data Center Infrastructure Management (DCIM) Market is witnessing rising demand for renewable integration and intelligent cooling systems. Companies implement DCIM tools for emissions tracking and compliance. Energy audits and AI-driven power monitoring enhance sustainability metrics. Global hyperscalers prefer Vietnam due to lower carbon footprints. It supports environmentally responsible growth and corporate ESG commitments.

Strategic Role in Regional Digital Connectivity and Business Competitiveness

Vietnam’s strategic location strengthens its role in Southeast Asia’s digital ecosystem. The market’s expansion supports cloud service providers and global enterprises seeking regional presence. The Vietnam Data Center Infrastructure Management (DCIM) Market enables resilient infrastructure for telecom, BFSI, and government sectors. It enhances operational transparency and reliability. Cross-border collaborations boost data exchange and innovation. Businesses gain competitive advantages through faster deployment cycles. The government’s investment-friendly policies attract international partnerships. It positions Vietnam as a hub for smart, interconnected, and sustainable infrastructure.

Market Trends

Integration of Edge Computing with Advanced DCIM Platforms

Edge computing adoption is transforming infrastructure management models across Vietnam. The Vietnam Data Center Infrastructure Management (DCIM) Market is adapting to support distributed and low-latency workloads. Edge sites require intelligent monitoring for performance and connectivity. DCIM vendors integrate real-time analytics and remote management tools to ensure service continuity. Decentralized architectures reduce latency and enhance reliability. AI algorithms enable local processing and predictive insights. It supports faster response times for mission-critical applications. This trend promotes hybrid models and broader digital service coverage nationwide.

Shift Toward Cloud-Native and API-Driven Management Architectures

The industry is moving toward modular, cloud-native architectures that simplify DCIM deployment. Cloud-based management allows real-time data access and better integration across multi-vendor environments. The Vietnam Data Center Infrastructure Management (DCIM) Market benefits from API-enabled flexibility supporting scalability. Vendors focus on interoperability for hybrid IT ecosystems. Cloud-native DCIM solutions improve visibility across data assets. It drives efficiency for both enterprises and managed service providers. Continuous updates enhance automation and reduce operational risks. This shift aligns with Vietnam’s rapid digital infrastructure modernization.

Enhanced Cybersecurity and Compliance in Data Center Operations

Data protection and regulatory compliance are becoming top priorities. DCIM platforms now integrate advanced cybersecurity protocols for critical asset management. The Vietnam Data Center Infrastructure Management (DCIM) Market aligns with global standards to ensure resilience. AI-based threat detection prevents unauthorized access and data breaches. Enterprises adopt secure-by-design DCIM frameworks to meet national cybersecurity laws. Multi-factor authentication and encryption strengthen operational integrity. It supports trust among enterprises and investors. Strengthened data sovereignty encourages multinational partnerships.

Adoption of Modular and Scalable Infrastructure Management Systems

Vietnam’s DCIM landscape is evolving toward modular and scalable deployment frameworks. Organizations prefer systems that allow incremental expansion and faster integration. The Vietnam Data Center Infrastructure Management (DCIM) Market supports dynamic capacity planning through flexible configurations. Modular systems reduce downtime during upgrades and expansions. Integration with real-time analytics tools enables smarter infrastructure utilization. It offers faster ROI for enterprises scaling operations. Growing hybrid workloads demand adaptable systems supporting future technologies. This modular trend enhances Vietnam’s position in the digital infrastructure space.

Market Challenges

High Implementation Costs and Limited Technical Expertise

The adoption of advanced DCIM systems faces financial and skill-based barriers. Many local firms find deployment and maintenance costs restrictive. Limited technical expertise in AI, analytics, and automation hinders adoption speed. The Vietnam Data Center Infrastructure Management (DCIM) Market struggles with a shortage of trained engineers to manage complex platforms. Integration challenges across legacy systems increase project timelines. Vendors must offer training and localized support. It restricts rapid scaling across SMEs. Financial constraints among smaller players further slow technological modernization.

Regulatory Uncertainty and Infrastructure Reliability Constraints

Data management and hosting regulations remain complex in Vietnam. Varying interpretations of data localization rules create uncertainty for investors. The Vietnam Data Center Infrastructure Management (DCIM) Market faces challenges from inconsistent power availability and infrastructure reliability. Frequent grid fluctuations affect uptime guarantees. Limited high-capacity fiber networks slow cloud service expansion. It demands stronger collaboration between government and industry to enhance digital infrastructure. Vendor alignment with global compliance standards remains uneven. Long-term policy stability is essential for sustained investor confidence.

Market Opportunities

Expansion of Green Data Centers and Renewable Energy Integration

Vietnam’s increasing commitment to sustainability creates strong opportunities for DCIM adoption. Green data centers rely on intelligent power monitoring and renewable integration. The Vietnam Data Center Infrastructure Management (DCIM) Market benefits from government-backed clean energy initiatives. Companies adopt AI-powered DCIM platforms to track carbon emissions and optimize cooling. It enables transparent ESG reporting and attracts eco-focused investors. Renewable partnerships strengthen national sustainability goals. Rising awareness among enterprises accelerates eco-friendly infrastructure investments.

Rising Demand for Colocation and Cloud-Based Management Solutions

The rapid growth of digital services drives strong demand for colocation facilities and cloud DCIM systems. Enterprises require scalable and secure management platforms for multi-tenant operations. The Vietnam Data Center Infrastructure Management (DCIM) Market experiences rising partnerships with hyperscalers and telecom operators. It offers flexibility to handle dynamic workloads across diverse environments. Cloud-enabled monitoring reduces costs and simplifies maintenance. Regional cloud adoption ensures faster service delivery. This opportunity positions Vietnam as a preferred regional data management hub.

Market Segmentation

By Component

Solutions dominate the Vietnam Data Center Infrastructure Management (DCIM) Market due to their role in automating asset, power, and environmental monitoring. Service segments, including consulting and integration, are expanding rapidly with demand for customized management frameworks. Growing investments in AI-driven DCIM platforms enhance energy efficiency and uptime. It supports enterprises seeking predictive insights. Continuous innovations in modular software improve operational control and sustainability performance.

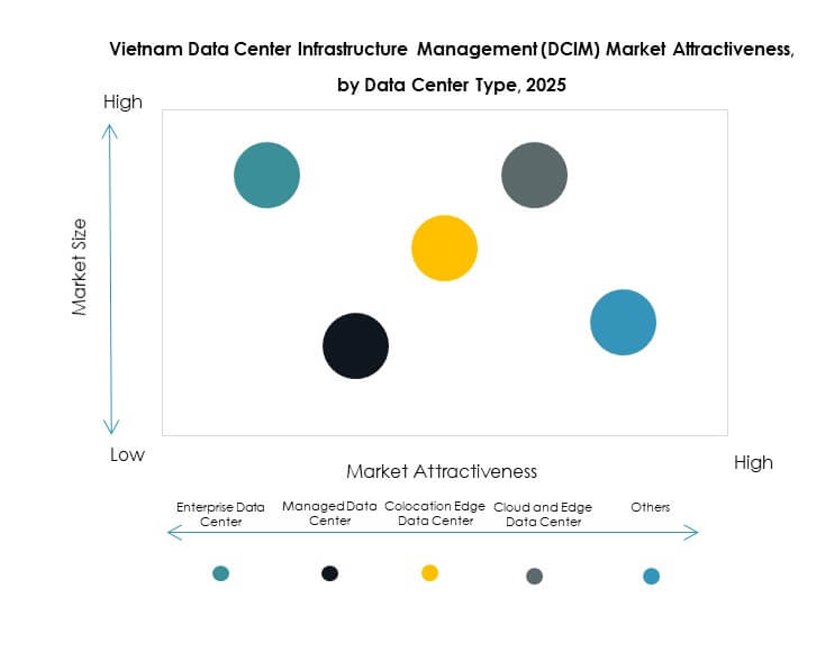

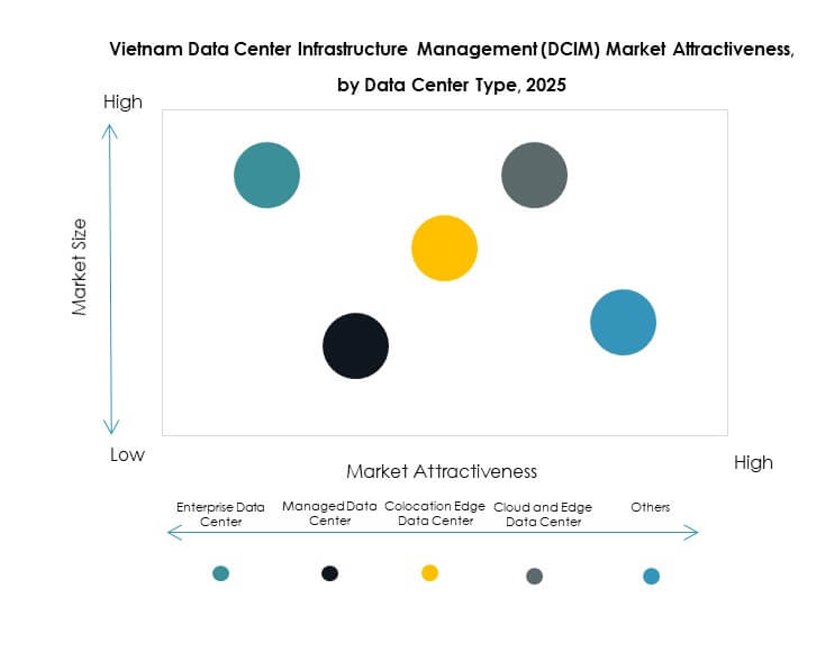

By Data Center Type

Enterprise and cloud-based data centers lead the Vietnam Data Center Infrastructure Management (DCIM) Market, holding the majority share due to large-scale digital adoption. Colocation and edge data centers are emerging rapidly to support distributed workloads and low-latency needs. Managed facilities attract global providers aiming for local market entry. It enhances network resilience and flexibility. The rise of 5G and IoT ecosystems drives further demand across all data center types.

By Deployment Model

Cloud-based deployment dominates Vietnam’s DCIM market owing to flexibility, scalability, and real-time visibility. On-premises models retain importance among regulated industries prioritizing data control. Hybrid models are gaining traction as businesses seek balanced operational and cost advantages. The Vietnam Data Center Infrastructure Management (DCIM) Market benefits from cloud-native capabilities supporting automation and cross-site monitoring. It ensures performance optimization while reducing management complexity for enterprises.

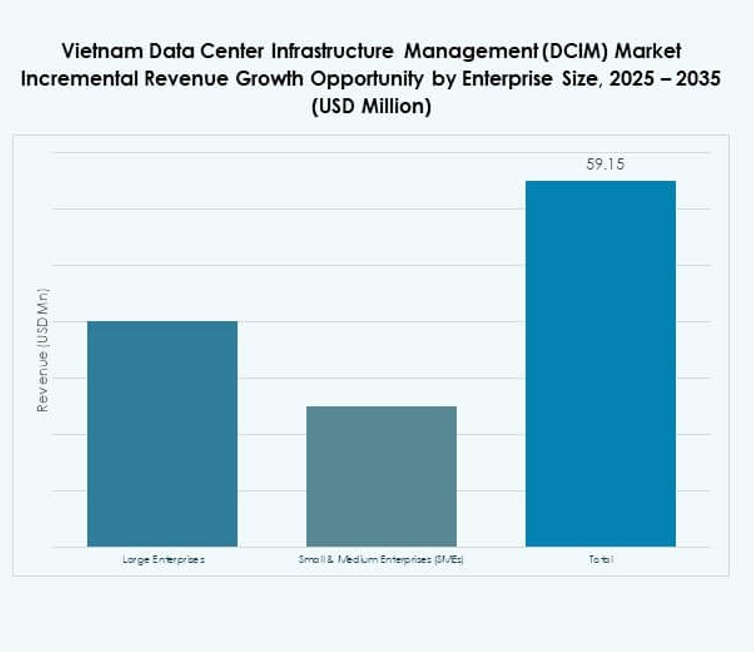

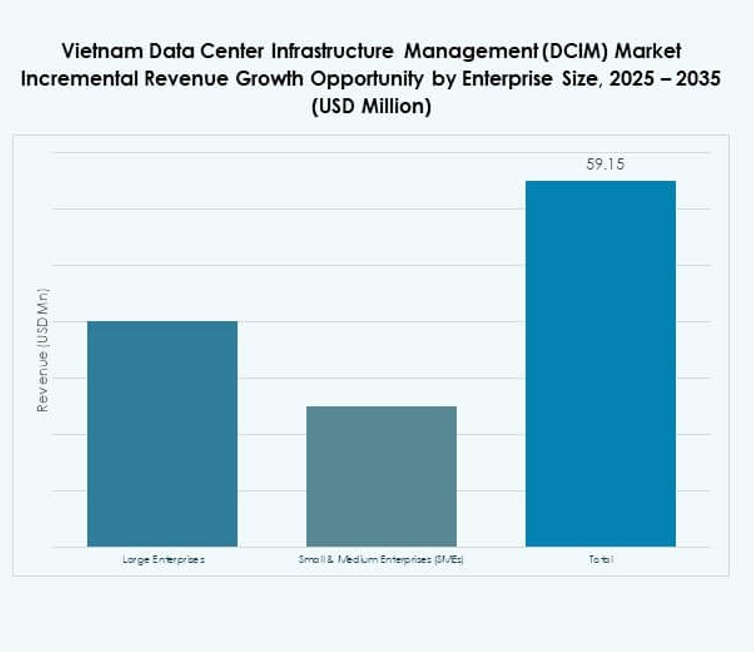

By Enterprise Size

Large enterprises hold the leading share in the Vietnam Data Center Infrastructure Management (DCIM) Market due to their complex infrastructure needs and financial capabilities. SMEs are rapidly adopting DCIM solutions through affordable cloud-based models. This segment benefits from modular systems requiring minimal upfront investment. It enables better power tracking and resource allocation. Enhanced accessibility supports SMEs in achieving enterprise-grade efficiency and compliance.

By Application / Use Case

Power and environmental monitoring applications dominate Vietnam’s DCIM market. These functions enable predictive maintenance and resource optimization. Capacity and asset management tools enhance infrastructure scalability. The Vietnam Data Center Infrastructure Management (DCIM) Market also expands in business intelligence and analytics, improving strategic decision-making. It drives adoption across diverse industries seeking improved visibility and control.

By End User Industry

IT and telecommunications lead the Vietnam Data Center Infrastructure Management (DCIM) Market with the largest share. BFSI and retail sectors are growing fast due to digital transformation and secure transaction management. Healthcare and energy industries are expanding adoption for reliability and compliance needs. It supports high-availability operations across all verticals. DCIM integration improves efficiency and strengthens Vietnam’s digital economy infrastructure.

Regional Insights

Southern Vietnam: Industrial and Hyperscale Data Center Expansion (46%)

Southern Vietnam, led by Ho Chi Minh City, accounts for 46% of the Vietnam Data Center Infrastructure Management (DCIM) Market. The region’s strong industrial base and growing hyperscale investments drive adoption. Major telecom operators and cloud providers deploy DCIM solutions to ensure reliable uptime. It benefits from modern energy grids and network connectivity. Rapid enterprise digitization and foreign investment strengthen the area’s leadership in infrastructure management innovation.

- For instance, FPT’s Tan Thuan Data Center in Ho Chi Minh City spans 10,000 sqm and supports up to 3,600 racks, developed under LEED Certification standards to ensure high efficiency and reliability for enterprise workloads.

Northern Vietnam: Government and Enterprise Digitalization Growth (38%)

Northern Vietnam, anchored by Hanoi, represents 38% of the Vietnam Data Center Infrastructure Management (DCIM) Market. The region hosts major government projects promoting e-governance and smart infrastructure. Local enterprises adopt hybrid DCIM solutions to enhance compliance and monitoring. It benefits from policy support and improving data infrastructure. Rising data sovereignty and national security standards encourage investment in secure management platforms. Continuous upgrades position Hanoi as a digital governance hub.

- For instance, Viettel Group inaugurated the Hoa Lac Data Center in 2024, spanning 21,000 square meters and housing over 2,400 racks and 60,000 servers. The facility maintains a power usage effectiveness (PUE) of 1.4–1.5 and uses renewable energy for 30% of its operations, earning recognition from HSBC for sustainable financing.

Central Vietnam: Emerging Infrastructure and Edge Computing Adoption (16%)

Central Vietnam contributes 16% of the Vietnam Data Center Infrastructure Management (DCIM) Market. Cities like Da Nang are emerging as technology corridors. The area attracts growing investment in edge computing and green energy data centers. It provides lower operational costs and strategic coastal connectivity. The government supports digital ecosystem expansion through infrastructure incentives. These developments position Central Vietnam as an emerging growth frontier for sustainable DCIM deployment.

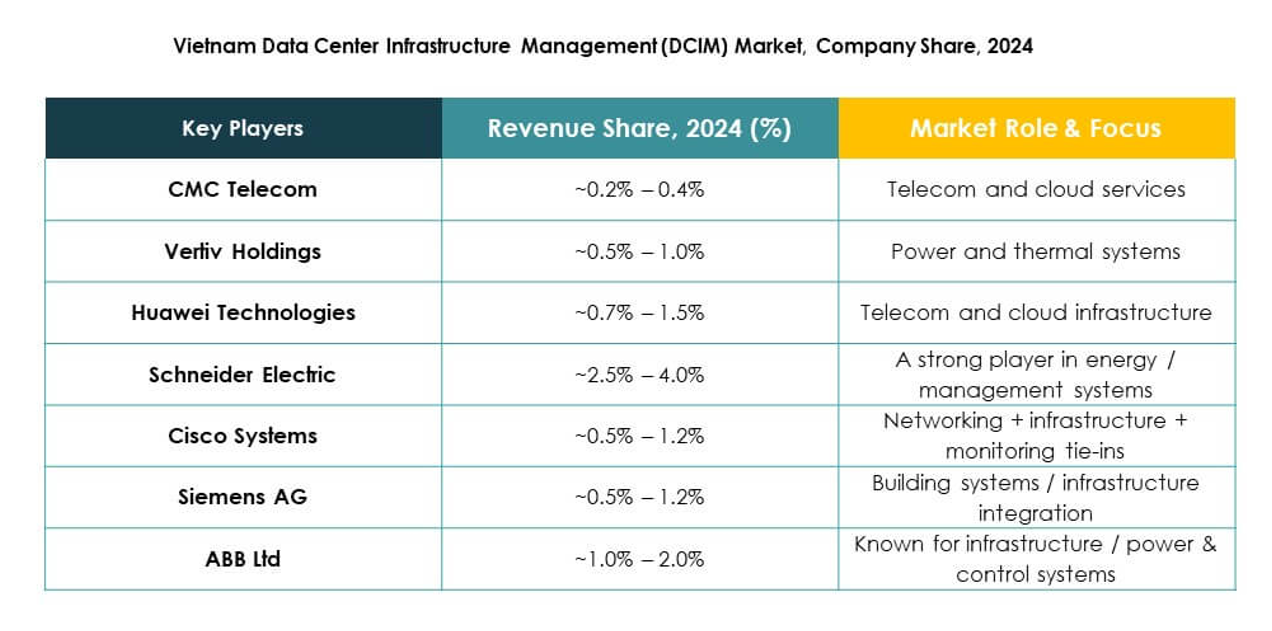

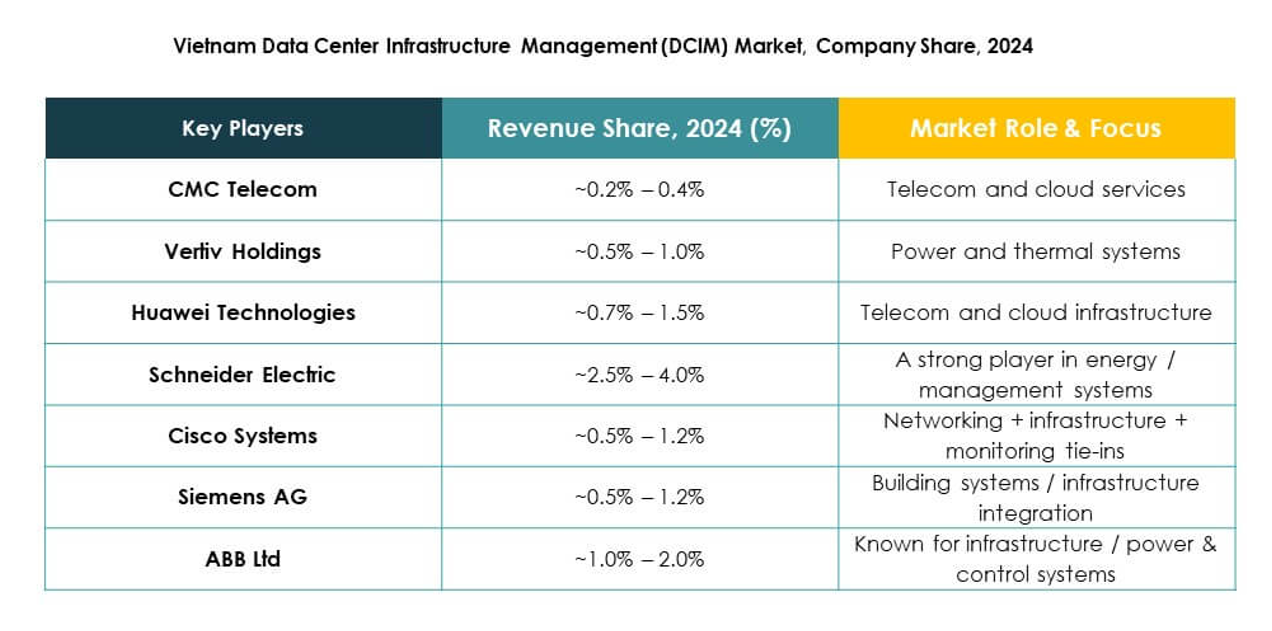

Competitive Insights:

- CMC Telecom

- Vertiv Holdings Co.

- Delta Electronics, Inc.

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation plc

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Others

The Vietnam Data Center Infrastructure Management (DCIM) Market features intense competition among global and regional players focused on innovation, efficiency, and digital transformation. Leading companies invest in AI-driven analytics, automation, and power optimization technologies to strengthen market share. It emphasizes integration of intelligent monitoring platforms to enhance sustainability and reduce energy use. Local firms such as CMC Telecom compete through tailored DCIM services that address Vietnam’s infrastructure needs. Global vendors including Schneider Electric, Huawei, and Vertiv lead in scalable, modular, and hybrid solutions. Strategic alliances, cloud partnerships, and energy-efficient innovations shape long-term competitiveness across enterprise and hyperscale environments.

Recent Developments:

- In September 2025, CMC Telecom and Symphony Communication, a leading infrastructure provider in Thailand, forged a new strategic partnership focused on expanding cross-border connectivity and cloud infrastructure between Vietnam and Thailand. This collaboration is expected to bolster Vietnam’s digital transformation by accelerating the development of data center infrastructure and strengthening ASEAN’s digital capabilities.

- In August 2025, Vertiv Holdings Co. reinforced its commitment to innovation and partnership in Vietnam through the Asia Channel Summit, which gathered more than 250 partners in Da Nang. The event highlighted Vertiv’s latest digital infrastructure offerings for data centers, AI, cloud, and edge deployments, positioning the company and its partners at the forefront of disruptive digital change in the country.

- In April 2025, Viettel commenced construction on a major 140 MW hyperscale data center campus in Ho Chi Minh City. This project is notable as Vietnam’s first data center site exceeding 100 MW with a target Power Usage Effectiveness (PUE) below 1.4, emphasizing high energy efficiency and scalability.

- In April 2024, Viettel launched its green AI-ready data center in Vietnam with a power capacity of around 30MW, marking a significant step toward sustainable data infrastructure in the country. This initiative is part of a growing trend in the Vietnam data center industry emphasizing green and AI-ready facilities.