Executive summary:

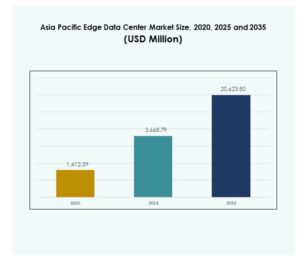

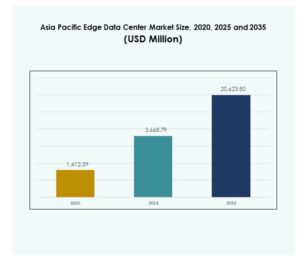

The Asia Pacific Edge Data Center Market size was valued at USD 1,412.39 million in 2020 to USD 3,668.79 million in 2025 and is anticipated to reach USD 20,623.80 million by 2035, at a CAGR of 18.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Asia Pacific Edge Data Center Market Size 2025 |

USD 3,668.79 Million |

| Asia Pacific Edge Data Center Market, CAGR |

18.67% |

| Asia Pacific Edge Data Center Market Size 2035 |

USD 20,623.80 Million |

Rapid advances in IoT, cloud, and 5G technologies have driven robust innovation and increased adoption of edge computing across multiple industries. Enterprises invest in decentralized data infrastructure to enable real-time analytics, enhance security, and optimize operational efficiency. The market’s strategic significance is amplified by its ability to support next-generation applications and unlock new avenues for business agility and investor returns.

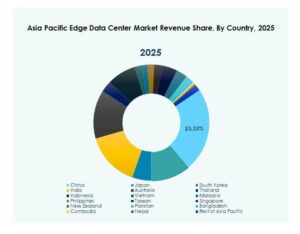

Countries such as China, Japan, and South Korea lead the region due to their robust digital ecosystems and aggressive technology investments, while India, Indonesia, and Vietnam emerge as fast-growing markets supported by expanding digital economies and government incentives. This diverse landscape positions the Asia Pacific Edge Data Center Market as a dynamic hub for regional connectivity and digital transformation.

Market Drivers

Rapid Adoption of IoT and 5G Driving Edge Infrastructure Expansion

The Asia Pacific Edge Data Center Market is propelled by large-scale adoption of IoT devices and the acceleration of 5G network deployments. Enterprises seek low-latency infrastructure to manage expanding volumes of real-time data from connected ecosystems. It supports mission-critical applications in industries such as telecom, manufacturing, and transportation. The integration of 5G with edge computing enhances service performance and data routing efficiency. Increased demand for near-source data processing boosts capacity investments across regional hubs. Telecom operators and hyperscalers focus on edge nodes to improve data proximity and bandwidth management. The convergence of IoT and 5G fosters decentralized architecture adoption. This driver establishes edge facilities as a fundamental pillar of next-generation digital infrastructure.

Growing Demand for Real-Time Analytics and Cloud Optimization

Real-time analytics creates significant growth opportunities for the Asia Pacific Edge Data Center Market across enterprise networks. Organizations aim to process data locally to reduce backhaul costs and improve response times. It enables businesses to derive instant insights for predictive maintenance, automation, and customer engagement strategies. Enterprises leverage hybrid cloud frameworks that integrate localized processing with centralized cloud systems. Corporate digital strategies now prioritize distributed computing environments over traditional centralized models. This shift supports scalable, resilient, and adaptive infrastructure for dynamic workloads. Vendors focus on modular edge designs to maximize operational flexibility. The integration of edge analytics transforms industrial performance benchmarks across sectors.

- For example, Hitachi Rail integrated NVIDIA’s IGX platform into its digital asset management system to enable real-time AI analysis across 2,000 trains and 8,000 rail cars. The solution has helped reduce maintenance costs by up to 15% and service delays by up to 20%, improving operational efficiency and reliability.

Innovation in Artificial Intelligence and Autonomous Systems

Artificial intelligence and automation continue redefining value creation in data infrastructure. AI-driven workloads rely on local data processing to maintain efficiency and privacy compliance. The Asia Pacific Edge Data Center Market captures this momentum through infrastructure tailored for AI inference, robotics, and autonomous operations. It attracts enterprise investments focused on balancing performance with energy sustainability. Continuous innovation in edge-ready processors, GPUs, and intelligent power management systems supports scalability. Data centers integrate machine learning frameworks to refine resource allocation and workload distribution. Enterprises exploit AI-enabled predictive analytics to minimize downtime and optimize asset utilization. Edge environments evolve into intelligent nodes instead of passive storage systems.

- For instance, SK Telecom showcased autonomous robots powered by Telco Edge AI in August 2024, demonstrating how edge intelligence and computer vision enabled real-time navigation and operational autonomy for logistics robots deployed in South Korean telecom network operations.

Strategic Importance for Enterprises and Investors

The Asia Pacific Edge Data Center Market represents a core growth avenue for enterprises modernizing their IT ecosystems. It strengthens competitive positioning through efficient data handling, faster connectivity, and enhanced security. Decentralized computing unlocks enterprise agility across supply chains, telecom, and retail networks. Investors view edge infrastructure as a resilient asset class within digital transformation portfolios. The region’s strong technology adoption and supportive policies attract institutional funding and venture capital. Governments recognize its role in enabling smart cities, e-governance, and AI-led innovation. Industry collaboration between telecom carriers, hyperscalers, and infrastructure firms drives integrated service ecosystems. Strategic investments in edge facilities position the region as a global innovation hub.

Market Trends

Emergence of Modular and Scalable Edge Architectures

Evolving design models highlight a trend toward modular edge data centers across the Asia Pacific Edge Data Center Market. These architectures help enterprises deploy capacity in distributed formats with faster installation times. It supports incremental expansion based on application demands and workload intensities. Dynamic scalability ensures resource utilization matches evolving connectivity patterns. Vendors emphasize prefabricated construction to streamline deployment in remote areas. The design trend enhances energy efficiency while reducing capital expenditure risk. Regional projects increasingly integrate prefabricated edge units within telecom towers and urban clusters. This modularization supports adaptive network growth aligned with digital infrastructure initiatives.

Sustainability and Energy Efficiency Becoming Central Priorities

Sustainability has shifted from a compliance requirement to a strategic objective within the Asia Pacific Edge Data Center Market. Operators focus on energy-efficient cooling, renewable energy sourcing, and reduced carbon footprints. It encourages technology partnerships to deploy green technologies like liquid cooling and AI-based thermal management. Enterprises prefer data center providers adopting carbon-neutral practices supporting corporate ESG mandates. Energy optimization becomes vital with the steep rise in localized facilities. Vendors invest in renewable microgrids and on-site solar power integration. Regulatory authorities push for transparent sustainability reporting among infrastructure operators. This trend establishes eco-resilience as a competitive differentiator across regional markets.

Rising Edge Deployment Across Industrial and Urban Ecosystems

Edge infrastructure is being deployed extensively to support industrial automation and smart city ecosystems. The Asia Pacific Edge Data Center Market witnesses increasing adoption across manufacturing zones, transport hubs, and urban management systems. It plays a pivotal role in managing real-time communication between connected devices and operational networks. Smart factories deploy edge environments to enhance process automation accuracy. Governments encourage deployment near population-dense areas for seamless connectivity. Infrastructure providers collaborate with local municipalities for site integration and data security protocols. New investment patterns favor edge co-location within dense network corridors. The accelerating edge footprint strengthens operational reliability and responsiveness at scale.

Integration of AIoT and Analytics in Edge Environments

Artificial intelligence and the Internet of Things (AIoT) form a defining trend in next-generation edge ecosystems. The Asia Pacific Edge Data Center Market integrates intelligent automation for predictive and prescriptive analytics. It improves decision-making efficiency where real-time data flow is critical for adaptive applications. AIoT integration supports healthcare, automotive, and logistics through smart monitoring and control systems. Businesses deploy inference engines close to data sources to achieve rapid operational feedback. Dynamic data processing improves efficiency while reducing dependency on centralized resources. Enterprises experiment with lightweight AI frameworks to optimize computing boundaries. This fusion of AI and IoT sets the transformative trajectory for localized data environments.

Market Challenges

High Capital Requirements and Complex Deployment Ecosystem

The Asia Pacific Edge Data Center Market faces high capital intensity driven by infrastructure, power, and network integration costs. It requires sophisticated planning to align site selection, cooling design, and interconnectivity standards. Many enterprises hesitate due to the fragmented nature of infrastructure ownership and regional regulations. Uncoordinated licensing frameworks slow site approvals and construction timelines. Power distribution challenges persist across developing economies with limited grid reliability. Investors navigate operational risk due to longer payback cycles in remote deployments. Vendors focus on strategic partnerships to share cost structures and mitigate financial exposure. Balancing technical sophistication with commercial feasibility remains a critical hurdle for large-scale adoption.

Cybersecurity, Data Governance, and Operational Complexity

Rising data decentralization introduces complex security vulnerabilities across multi-edge nodes. The Asia Pacific Edge Data Center Market contends with inconsistent cybersecurity frameworks among operators and end-users. It demands uniform standards for encryption, identity management, and policy enforcement. Governments impose stricter data localization laws that complicate international network configurations. Businesses struggle to manage fragmented monitoring systems across distributed nodes. Vendor accountability and interoperability emerge as recurring concerns among enterprise clients. Sustaining uptime while enforcing compliance adds to management intricacies. Continuous monitoring, advanced firewalls, and AI-driven threat detection remain necessary but resource-intensive countermeasures.

Market Opportunities

Expansion into Underpenetrated and Secondary Urban Hubs

The Asia Pacific Edge Data Center Market presents high-potential opportunities across emerging urban clusters and secondary cities. It benefits from rising mobile connectivity, government-led digital programs, and expanding enterprise adoption of distributed computing. Local and international investors explore edge expansion beyond capital cities to address latency-sensitive applications. It aligns with decentralized cloud strategies and regional data processing requirements. New entrants develop joint ventures to create scalable campus models in peripheral regions. Telecom operators leverage fiber expansions for improved last-mile connectivity. Municipal smart projects accelerate edge integration within urban infrastructure. Early deployment offers substantial first-mover advantages in competitive regional segments.

Collaboration in AI-Optimized Edge Ecosystems and Managed Services

Growing collaboration between hyperscalers, telecom carriers, and managed service providers defines the market’s opportunity landscape. The Asia Pacific Edge Data Center Market benefits from co-development of AI-integrated edge ecosystems supporting diverse industrial applications. It stimulates service innovation in real-time analytics, robotics, and connectivity management. Enterprises seek managed edge offerings with simplified scalability and reduced operational overhead. Vendors prioritize open architecture solutions enabling cross-platform compatibility. Government programs focused on digital industrialization further strengthen partnership models. Service diversification across sectors from logistics to healthcare expands addressable market potential. These alliances accelerate ecosystem maturity across regional technology corridors.

Market Segmentation

By Component

The Asia Pacific Edge Data Center Market is segmented into solutions and services, with the solutions segment currently leading due to its foundational role in enabling the deployment and operation of edge infrastructure. Solutions comprise hardware, networking equipment, and management platforms, dominating overall revenue share as enterprises prioritize scalable and robust architectures. The services segment, including managed and professional services, registers the fastest growth, benefiting from increasing demand for operational support, maintenance, and consulting as businesses seek to optimize and expand edge deployments.

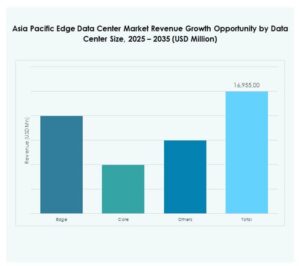

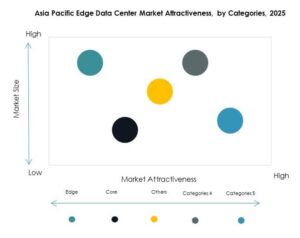

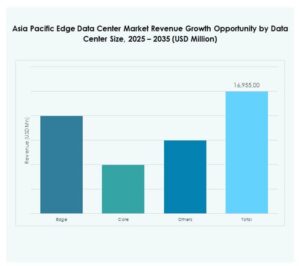

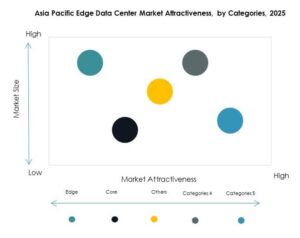

By Data Center Type

Key data center types in this market include enterprise, managed, colocation, cloud and edge, and other specialized facilities. Colocation edge data centers account for the largest market share, attracting enterprises seeking cost-efficient, scalable, and low-latency options without the burden of full ownership. Cloud and edge data centers experience rapid growth, integrating hybrid architectures that blend local processing with cloud resources. Demand for managed solutions grows, driven by SMEs desiring turnkey deployment and reduced complexity in rapidly changing IT environments.

By Deployment Model

Deployment models span on-premises, cloud-based, and hybrid solutions. Hybrid deployment dominates because it balances the need for control and security with scalability and remote management. Enterprises adopt hybrid models to seamlessly connect on-premises infrastructure with distributed edge and cloud resources, facilitating agile workload management. Cloud-based deployments gain traction thanks to increasing digital transformation, while on-premises models remain significant in sectors requiring stringent data localization and compliance.

By Enterprise Size

Both large enterprises and SMEs utilize edge data centers, but large enterprises represent the dominant segment by market share. These organizations lead adoption due to vast network footprints, higher resource requirements, and a need for real-time analytics across geographically dispersed assets. However, SMEs display rising interest, leveraging edge as a cost-effective, accessible means to gain digital capabilities previously reserved for larger competitors, thus driving continued growth in this category.

By Application / Use Case

The Asia Pacific Edge Data Center Market supports diverse applications, with asset management, capacity management, power monitoring, environmental monitoring, and BI and analysis as core segments. Power monitoring and capacity management are primary drivers, helping enterprises optimize uptime and resource use while maintaining reliability. Environmental monitoring gains importance as sustainability drives new regulations. BI and analytics facilitate faster business insights, transforming how companies analyze and act on real-time data across operational environments.

By End User Industry

Key end-user industries are IT and telecommunications, BFSI, healthcare, retail and e-commerce, aerospace & defense, energy & utilities, and others. IT and telecommunications claim the highest market share, reflecting urgency for low-latency networks and high data traffic in the region’s digital landscape. Healthcare and BFSI show rapid expansion, driven by telemedicine, data security, and regulatory demands. Retail, e-commerce, and energy sectors harness edge solutions for seamless customer engagement and grid monitoring, supporting broad sectoral adoption.

Regional Insights

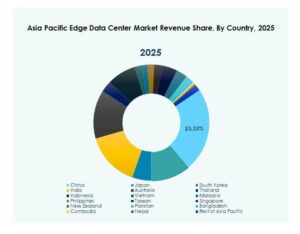

East Asia: Market Leadership and Maturity

East Asia leads the Asia Pacific Edge Data Center Market, capturing approximately 40% of the regional market share. China, Japan, and South Korea drive this leadership with substantial investments in 5G rollouts, robust IT infrastructure, and policy support for digital transformation. The high concentration of technology giants and telecom providers enables advanced edge deployments to support smart cities, autonomous systems, and real-time industrial automation. These nations benefit from an established cloud ecosystem, strong regulatory oversight, and cross-industry partnerships that hasten innovation and large-scale edge integration.

- For example, at the Global Data Center Facility Summit 2025 in Dubai, Huawei introduced its PowerPOD modular data center solution, offering 2.4 MW per container, expandable to 3.2 MW. The system is designed to support AI training clusters, intelligent computing, and edge inference, developed in collaboration with ten ecosystem partners.

South Asia and Southeast Asia: Rapid Growth and Emerging Hubs

South Asia and Southeast Asia account for nearly 35% of the regional market, representing vibrant, high-growth zones in the Asia Pacific Edge Data Center Market. India and Singapore act as primary regional hubs, owing to government-backed digitalization initiatives, data localization regulations, and surging cloud use among enterprises. Indonesia, Vietnam, and Malaysia are fast emerging, buoyed by their youthful demographics, rapid urbanization, and expanding digital economies. These regions encounter strong demand for edge infrastructure in manufacturing, e-commerce, and fintech, driving substantial and sustained investment inflows.

Oceania and Rest of APAC: Niche Expansion and Infrastructure Modernization

Oceania and the rest of APAC make up about 25% of the market, with Australia playing a commanding regional role due to advanced connectivity, mature cloud service markets, and well-resourced enterprises demanding high-reliability edge services. New Zealand, Thailand, and Philippines also exhibit steady niche growth as investments target upgrading legacy systems and expanding edge applications into rural and remote localities. These economies focus on modernizing public sector and utility services and improving last-mile connectivity to meet rising consumer and enterprise digital expectations.

- For example, NEXTDC’s Perth data centers (P1 and P2) hold NVIDIA DGX-Ready certification for AI infrastructure and liquid-cooled GPU workloads. The company reported an average PUE of 1.39 in FY23, outperforming the typical industry average of 1.7, with the P2 site designed to achieve a PUE as low as 1.15.

Competitive Insights:

- China Mobile

- Nippon Telegraph & Telephone (NTT)

- Eaton Corporation

- Dell Technologies Inc.

- Compass Datacenters

- Fujitsu

- American Tower

- Cisco

- SixSq

- Microsoft

The Asia Pacific Edge Data Center Market features a highly competitive landscape with a blend of telecom giants, technology leaders, and infrastructure specialists vying for market share. Companies like Dell Technologies Inc. and Cisco leverage strong technology portfolios in networking and edge solutions, whereas NTT and China Mobile utilize vast telecom infrastructure to provide scale and reliability. Eaton Corporation, Schneider Electric SE, and Rittal GmbH & Co. Kg differentiate through energy efficiency and advanced modular designs. The market witnesses intensive collaboration, strategic partnerships, and M&A activity as players expand regional coverage and deliver novel services. It sees hyperscalers and local specialists investing in scalable, sustainable, and low-latency infrastructures to address surging demand for AI, IoT, and 5G applications.

Recent Developments:

- In October 2025, Digital Edge further accelerated its expansion in the Asia Pacific edge data center market by securing an IDR 5.5 trillion (USD 325 million) corporate facility from PT Bank Central Asia Tbk (BCA) to support continued data center development in Indonesia. The funding will enable the completion of the final phase of the EDGE2 facility in South Jakarta and advance the company’s vision for state-of-the-art, energy-efficient infrastructure in the fast-growing Indonesian edge market.

- In May 2025, Nippon Telegraph & Telephone (NTT) announced a major $16.4 billion buyout of its IT services arm, NTT Data, along with a global data center expansion plan that includes land acquisitions for nearly a gigawatt of new data center capacity across seven strategic markets, including Tochigi, Japan in the Asia Pacific region. This expansion supports growing demand for AI and cloud infrastructure.

- In June 2024, China Mobile launched a new computing center in Beijing equipped with 4,000 AI accelerator cards, claiming a total AI computing performance of over 1,000 petaflops, with 33% of the AI chips domestically developed. The facility spans 57,000 square meters and is part of China Mobile’s network of 12 intelligent computing centers across China,