Executive summary:

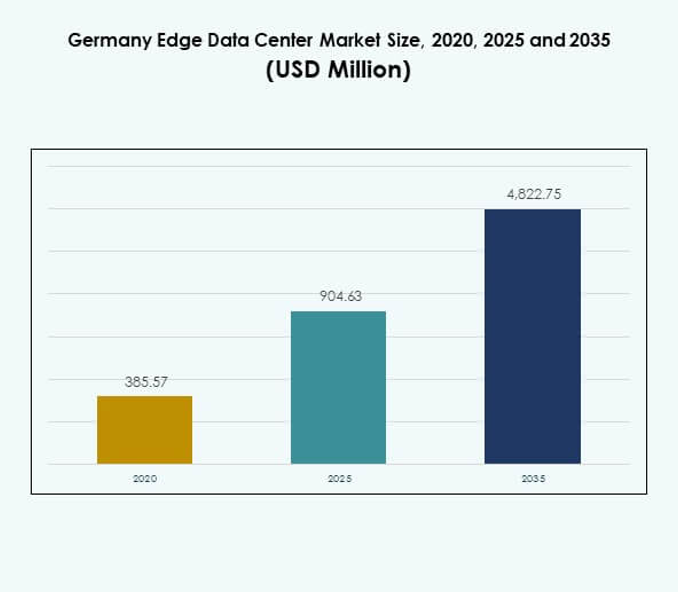

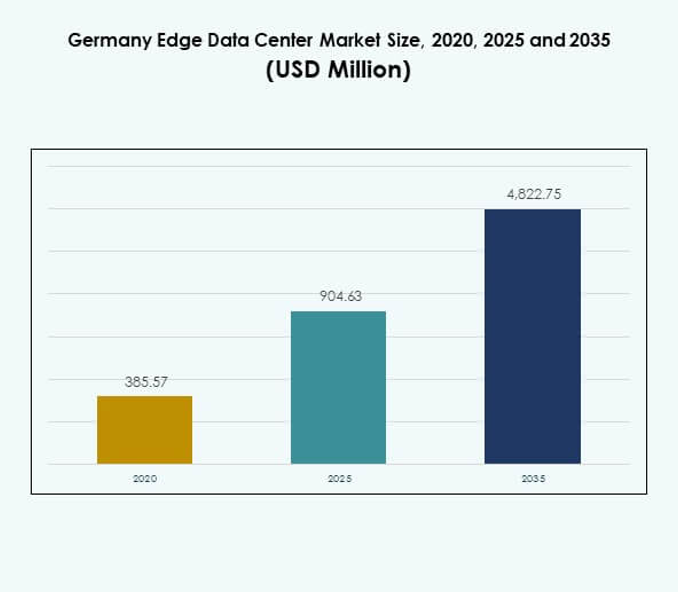

The Germany Edge Data Center Market size was valued at USD 385.57 million in 2020, reached USD 904.63 million in 2025, and is anticipated to reach USD 4,822.75 million by 2035, at a CAGR of 18.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Germany Edge Data Center Market Size 2025 |

USD 904.63 Million |

| Germany Edge Data Center Market, CAGR |

18.05% |

| Germany Edge Data Center Market Size 2035 |

USD 4,822.75 Million |

Growing demand for low-latency computing, AI-driven automation, and digital transformation across industries drives market expansion. The rapid rollout of 5G networks, coupled with Industry 4.0 adoption, accelerates deployment of edge data centers for real-time analytics and smart infrastructure. The market holds strategic importance for enterprises and investors aiming to strengthen connectivity, enhance operational agility, and enable data localization in critical sectors.

Western and Central Germany lead due to their established digital ecosystems, strong industrial base, and robust fiber connectivity. Frankfurt, Munich, and Cologne host key data center hubs supporting enterprise and hyperscale operations. Northern and Eastern Germany are emerging markets, supported by renewable energy projects, government incentives, and growing smart city and manufacturing initiatives that promote distributed edge deployment.

Market Drivers

Rapid Digital Transformation and 5G Infrastructure Development Driving Edge Adoption

The Germany Edge Data Center Market is driven by accelerating digital transformation across industries. Expanding 5G networks are creating strong demand for edge facilities to handle data near the source. It supports ultra-low latency applications in autonomous vehicles, IoT devices, and AR/VR solutions. Telecom operators are investing in localized micro data centers for real-time processing. Cloud providers are deploying edge nodes across German cities to enhance data throughput. The market benefits from Germany’s strong ICT infrastructure and industrial automation. Enterprises prioritize data localization to meet compliance and security needs. Growing reliance on digital ecosystems further strengthens market adoption.

Rising Demand from Industry 4.0 and Smart Manufacturing Ecosystems

The growing Industry 4.0 framework is fueling demand for decentralized computing in manufacturing zones. Edge data centers enable real-time analytics, predictive maintenance, and robotic automation. It improves operational efficiency while minimizing downtime in industrial facilities. German manufacturers integrate AI and IoT systems that require local processing power. Energy-efficient edge facilities align with sustainability mandates in industrial operations. The adoption of hybrid infrastructure strengthens manufacturing agility and competitiveness. Edge computing enhances supply chain transparency and logistics tracking. These advances highlight its strategic value in Germany’s industrial evolution.

- For instance, Siemens’ Electronics Works Amberg integrates edge computing and digital automation to optimize production processes. The facility leverages real-time data from connected machines to enhance efficiency, quality control, and predictive maintenance within its smart manufacturing operations.

Cloud Expansion and IoT Integration Strengthening Edge Deployment Strategies

Cloud adoption and IoT integration are central to market expansion. Major cloud players are investing in regional edge hubs to improve service delivery. It enables localized computing for IoT devices across healthcare, logistics, and retail sectors. Businesses depend on hybrid and multi-cloud frameworks that require distributed data infrastructure. Edge facilities help manage massive IoT data streams with faster decision cycles. Data sovereignty regulations encourage domestic data storage in edge locations. Innovation in AI-driven monitoring tools supports smarter edge ecosystems. These trends boost investment confidence across digital enterprises.

Strategic Investments and Government Initiatives Enhancing Infrastructure Development

Strong policy backing and private investments strengthen infrastructure modernization. The German government supports digital initiatives that promote edge deployments. It enhances connectivity between cloud centers and localized data hubs. Financial institutions, telecom providers, and tech firms are aligning resources for network resilience. Energy-efficient architectures are being prioritized to meet climate goals. Smart city programs rely on edge nodes for real-time data processing. The rise of connected devices is fueling bandwidth optimization requirements. The market presents a strong opportunity for investors seeking digital infrastructure growth.

- For instance, Vodafone Germany activated over 8,000 antennas across 2,800 locations in 2023 using the 700 MHz spectrum to expand nationwide 5G coverage, significantly improving mobile connectivity and network performance, particularly in rural areas.

Market Trends

Expansion of Micro Data Centers and Modular Infrastructure Solutions

The Germany Edge Data Center Market is witnessing the rise of micro and modular facilities. Compact designs enable deployment in urban and remote areas. It supports distributed computing and localized data handling for real-time operations. Modular data centers provide scalability and energy efficiency for enterprises. Their quick installation reduces capital expenditure and deployment time. Organizations are preferring prefabricated modules for flexibility in scaling demand. Telecom operators use micro facilities to support 5G and IoT networks. This modular trend aligns with Germany’s focus on industrial connectivity.

Adoption of AI-Enabled Monitoring and Automation Systems

Artificial intelligence is shaping operational management across edge environments. It improves predictive maintenance, fault detection, and resource utilization. AI algorithms optimize cooling, energy use, and server performance in real-time. It ensures higher uptime and cost efficiency for enterprise users. Integration of automation reduces dependency on manual monitoring. AI-based management platforms allow quick anomaly detection in edge nodes. Businesses use these tools to increase operational reliability. These advancements position AI as a transformative trend in edge development.

Growing Use of Renewable Energy and Sustainable Design Practices

Sustainability initiatives are becoming a defining trend in edge infrastructure. Operators are incorporating renewable energy sources to reduce carbon output. It aligns with Germany’s national goals for clean energy transition. Data centers are using advanced cooling systems and green building materials. Energy reuse and liquid cooling technologies are being widely deployed. Companies are prioritizing low-carbon power supply agreements. Sustainability certifications are influencing investment preferences in the sector. The shift toward green edge infrastructure strengthens environmental compliance and brand value.

Strategic Collaborations and Ecosystem Partnerships Boosting Market Presence

Collaborations between telecom, IT, and energy providers are strengthening edge ecosystems. These partnerships accelerate integration of hardware, software, and network layers. It enables coordinated deployment of distributed infrastructure across key regions. Joint ventures and consortiums are enhancing capacity planning and resource pooling. Edge-to-cloud interoperability frameworks are emerging through open architecture models. Vendors are forming alliances to meet regional connectivity standards. Collaboration promotes innovation and faster implementation cycles. Such partnerships support the long-term scalability of the national digital network.

Market Challenges

High Infrastructure Costs and Complex Deployment Requirements

The Germany Edge Data Center Market faces rising costs in setup and integration. Building distributed networks requires heavy investments in power, cooling, and connectivity. It poses financial constraints for small and mid-sized enterprises entering the market. High electricity prices in Germany add pressure to operating margins. Complex site selection, permitting, and grid access slow project execution. Equipment procurement delays also hinder large-scale deployments. Skill shortages in data engineering further limit operational efficiency. These challenges increase entry barriers for potential new operators.

Data Security, Compliance, and Network Management Concerns

Data protection regulations remain a core challenge in distributed environments. The market must comply with GDPR and local data residency laws. It creates operational complexities for companies handling cross-border data flow. Managing cybersecurity risks across multiple sites requires advanced defense frameworks. Edge nodes remain vulnerable to network intrusions if poorly secured. Maintenance of data integrity and encryption adds to technical demands. It also requires continuous monitoring to meet compliance audits. Firms face pressure to balance scalability with secure data management.

Market Opportunities

Integration with Smart Cities and Advanced Industrial Applications

The Germany Edge Data Center Market offers strong potential in smart city development. Edge networks enhance traffic systems, surveillance, and connected public infrastructure. It enables local processing for critical IoT-based applications. Industrial zones are exploring edge integration for logistics and predictive maintenance. Renewable energy projects also benefit from real-time monitoring through edge setups. Enterprises use localized computing to lower latency and enhance service quality. The push toward urban digitalization widens opportunity across industries.

Rising Demand for Low-Latency Data Services and Cloud Connectivity

Low-latency computing needs are unlocking new investment channels in Germany. Businesses are deploying edge systems to reduce data travel distance. It ensures faster processing for AI-driven analytics and automation. Cloud providers are expanding regional nodes to meet client demand. Hybrid architectures create opportunities for colocation and managed service providers. Enterprises are leveraging edge capabilities for enhanced digital transformation. The trend supports long-term growth across data-driven business operations.

Market Segmentation

By Component

Solutions dominate the Germany Edge Data Center Market due to rapid infrastructure modernization. Edge solutions integrate power, cooling, and management systems that enable efficient operation. Service providers support deployments through maintenance and monitoring contracts. Rising digital workloads push enterprises toward robust edge solutions. Managed service models reduce capital costs for smaller firms. Integration of AI tools enhances real-time data visibility. The solution segment leads market expansion across multiple verticals.

By Data Center Type

Colocation edge data centers hold the largest share, driven by scalability and cost optimization. Businesses prefer colocation due to flexible space and shared infrastructure benefits. It provides faster deployment without heavy initial investment. Enterprise and cloud-based edge centers also show consistent growth. Hybrid configurations enable seamless data transfer across public and private systems. Managed facilities ensure data compliance and operational stability. Strong demand for colocation reflects its role in Germany’s expanding digital infrastructure.

By Deployment Model

Hybrid deployment models dominate market share due to growing demand for flexibility. Enterprises use hybrid setups to balance on-premises control with cloud scalability. It allows workload distribution based on security and latency needs. Cloud-based models expand quickly in service-oriented businesses. On-premises infrastructure remains essential for regulated industries. Hybrid systems offer greater data resilience and cost efficiency. Growing enterprise preference for workload flexibility boosts hybrid adoption rates.

By Enterprise Size

Large enterprises lead market adoption due to higher technology budgets and infrastructure needs. They deploy edge facilities to manage large-scale data processing efficiently. Small and medium enterprises are showing increasing participation in managed edge services. It enables access to high-performance computing without heavy investment. Edge solutions support innovation in retail, logistics, and manufacturing sectors. Large organizations also use edge systems for predictive analytics and AI models. The segment’s dominance reflects strong digital maturity among major corporations.

By Application / Use Case

Power monitoring and environmental monitoring represent major use cases in the market. Enterprises use these systems to manage energy efficiency and optimize uptime. Asset and capacity management tools ensure seamless network performance. It helps reduce downtime and improve operational productivity. BI and analytics use cases gain traction with rising data insights demand. Healthcare, logistics, and retail sectors are key adopters. Strong use-case diversity strengthens the market’s long-term viability.

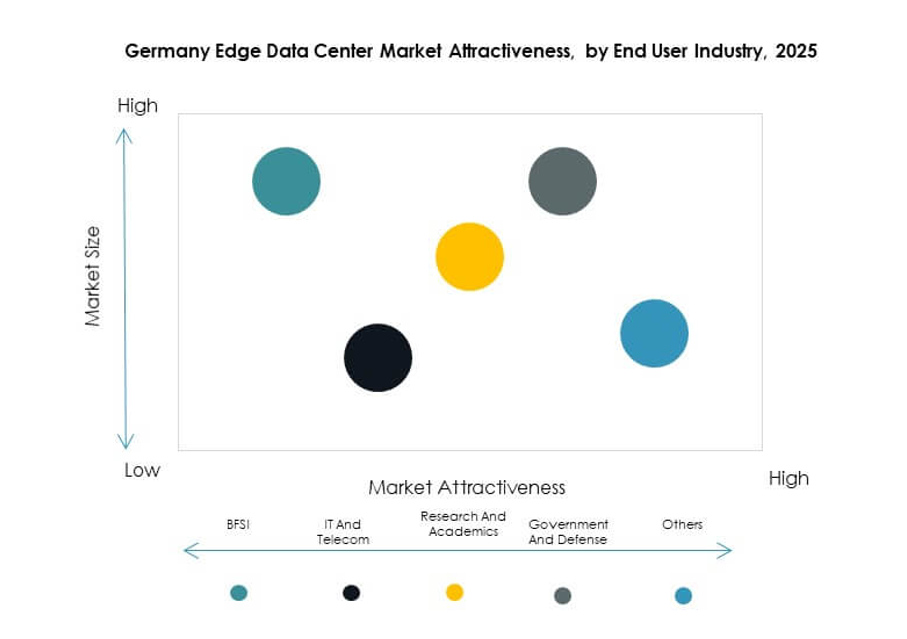

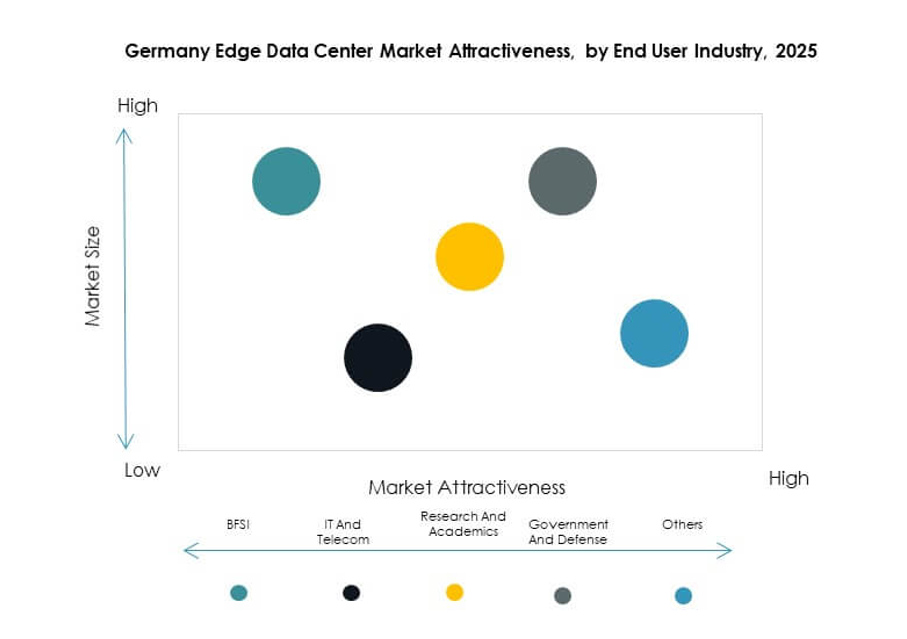

By End User Industry

IT and telecommunications dominate market share with strong infrastructure and 5G rollout. The BFSI and healthcare sectors follow due to growing data localization needs. Retail and e-commerce rely on edge for fast customer response and analytics. Energy and utilities use it for remote monitoring and predictive operations. Aerospace and defense applications focus on real-time data control. The combination of high-speed processing and compliance drives adoption across industries. The segment mix reflects Germany’s diversified digital transformation landscape.

Regional Insights

Western and Central Germany Leading with 46% Market Share

Western and Central regions dominate the Germany Edge Data Center Market due to established connectivity networks. Frankfurt, Munich, and Cologne serve as key hubs for data exchange. It hosts major colocation centers, telecom providers, and hyperscale operators. The region benefits from strong fiber infrastructure and dense enterprise clusters. Government-backed digitalization initiatives attract sustained private investments. Western Germany remains a preferred destination for cross-border data services. Its dominance reinforces Germany’s leadership in Europe’s digital infrastructure.

- For instance, DE-CIX, the world’s leading Internet Exchange based in Frankfurt, hit a new global peak traffic record of 25 terabits per second (Tbps) in April 2025, reflecting a major scale of data exchange capacity through its hubs including Frankfurt, Madrid, and Istanbul. This milestone underscores the region’s critical role in Europe’s digital infrastructure.

Northern Germany Emerging as a Strategic Growth Zone with 32% Share

Northern Germany is gaining traction through renewable energy integration and port-based industries. Hamburg and Bremen are developing new facilities to support maritime and logistics operations. It leverages wind power resources to fuel green data centers. The proximity to Nordic power grids strengthens sustainable energy sourcing. Companies are investing in edge deployments to serve IoT-driven transport and supply chain operations. The region’s focus on sustainability enhances its competitive position.

Eastern and Southern Germany Showing Steady Expansion with 22% Market Share

Eastern and Southern Germany are witnessing steady infrastructure expansion supported by public funding. Berlin, Leipzig, and Stuttgart are emerging as growing hubs for edge deployment. It benefits from tech startups, R&D centers, and university-driven innovation programs. Investments in 5G rollout and smart manufacturing encourage facility expansion. Rising demand from healthcare, automotive, and fintech industries supports regional growth. The region’s balanced development strengthens nationwide network distribution.

- For instance, Colt Data Centre Services announced in April 2025 plans to develop four new data centers across Frankfurt and Berlin, adding 117MW of capacity with hybrid cooling and renewable energy contracts secured, supporting cloud and AI workloads with sustainable design principles.

Competitive Insights:

- Deutsche Telekom (T-Systems)

• Hetzner Online GmbH

• Interxion

• e-shelter (NTT Group)

• EdgeConneX

• Eaton Corporation

• Dell Technologies Inc.

• Fujitsu

• Cisco Systems, Inc.

• Schneider Electric SE

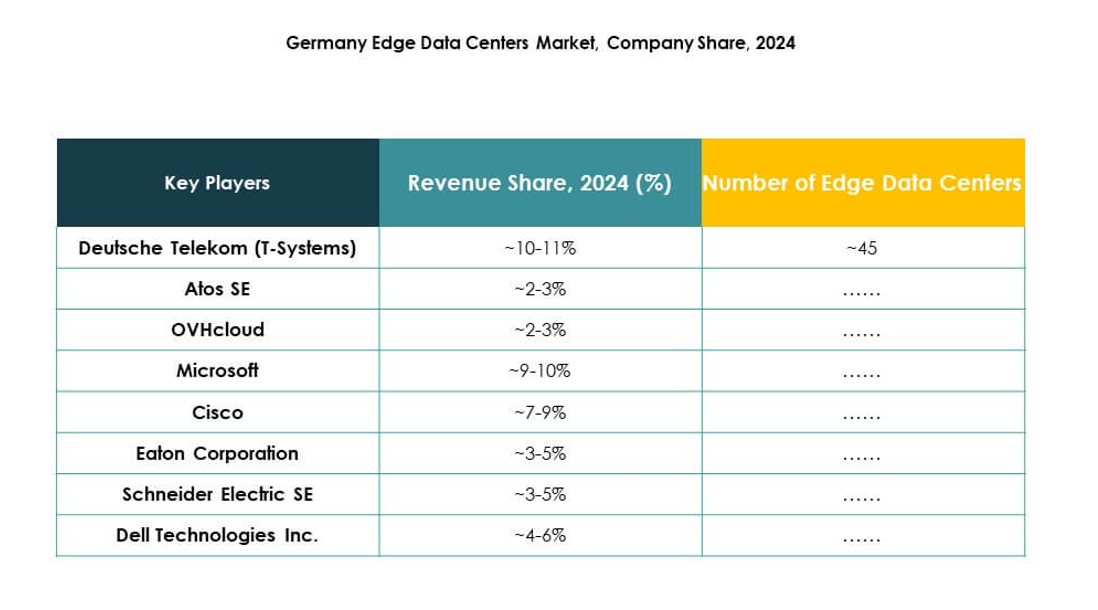

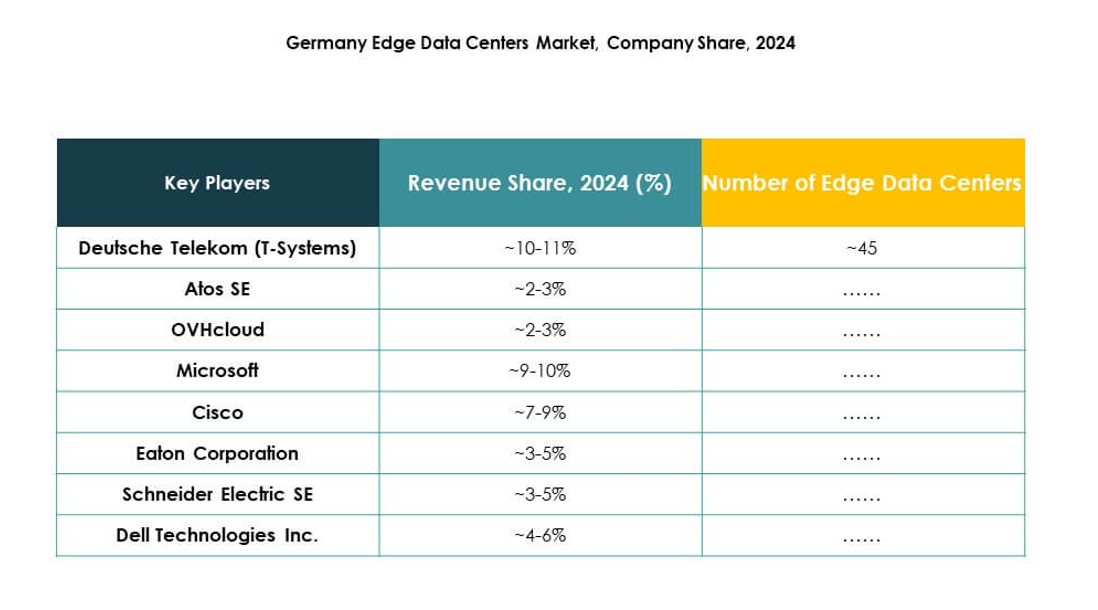

The Germany Edge Data Center Market features strong competition among telecom operators, IT infrastructure providers, and technology innovators. It is defined by continuous investment in edge connectivity, modular designs, and sustainable data center solutions. Deutsche Telekom and Interxion focus on expanding colocation and network edge capacity, while Schneider Electric and Rittal lead in integrated energy-efficient infrastructure. Global technology firms such as Dell Technologies, Cisco, and Microsoft are building hybrid and cloud-edge ecosystems through localized deployments. EdgeConneX and e-shelter accelerate regional coverage through advanced automation and AI-enabled monitoring systems. Continuous innovation and ecosystem partnerships strengthen vendor positioning across the market.

Recent Developments:

- In October 2025, Netmountains launched a new edge data center in Velbert, Germany. The site was retrofitted to feature a liquid cooling hall, positioning Netmountains as a leader in integrating advanced sustainable cooling technologies into Germany’s edge data center landscape.

- In September 2025, Portus announced the groundbreaking of its second data center in Munich, Germany. The site is projected to reach a 7MW capacity by early 2027, marking Portus’ strategic expansion and commitment to meeting rising enterprise demand for edge data capacity in Southern Germany.

- In September 2025, Hochtief, a prominent German construction company, commissioned a new edge data center near Düsseldorf. The facility will occupy 9,000 square meters within the Heilingenhaus Innovation Park, supporting low-latency digital services in the region.

- In July 2025, AtlasEdge highlighted expansion in Germany with the launch of its STR001 data center in Stuttgart. The modular facility offers up to 20MW at full build-out and is fully powered by renewable energy, demonstrating AtlasEdge’s focus on sustainability and compliance with German energy regulations.