Executive summary:

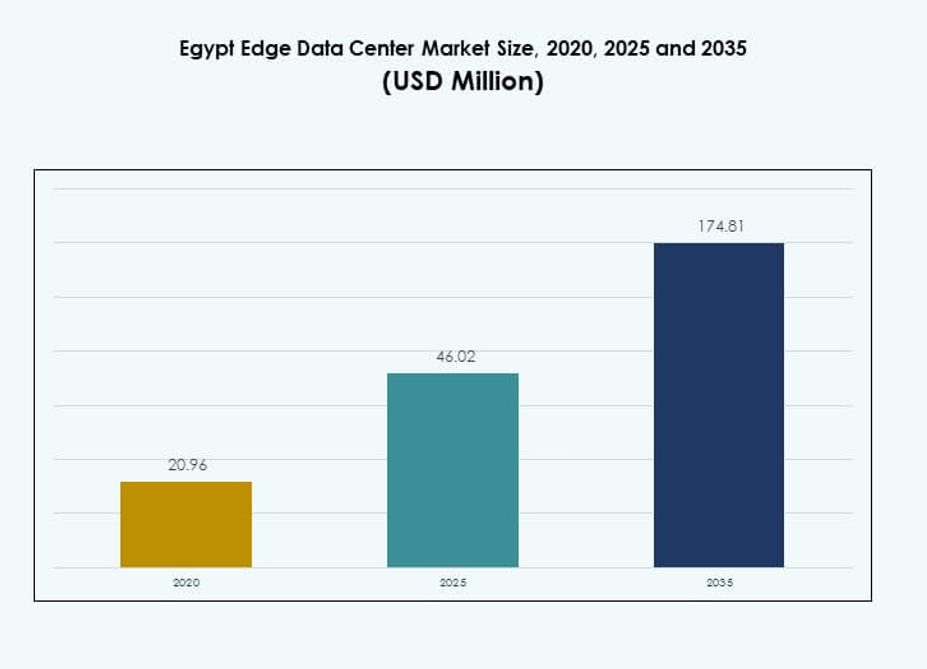

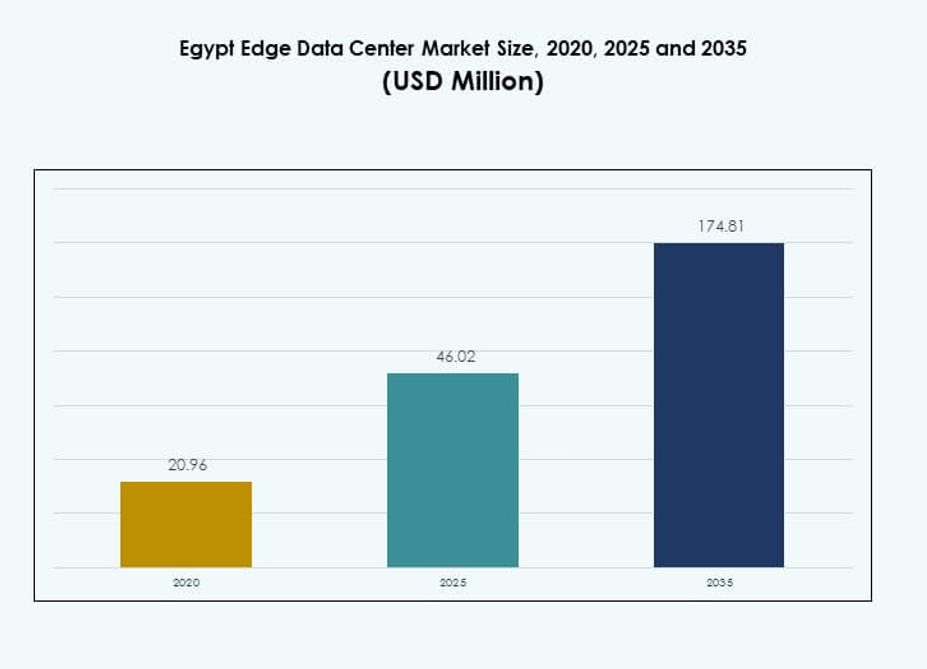

The Egypt Edge Data Center Market size was valued at USD 20.96 million in 2020, grew to USD 46.02 million in 2025, and is anticipated to reach USD 174.81 million by 2035, at a CAGR of 14.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Egypt Edge Data Center Market Size 2025 |

USD 46.02 Million |

| Egypt Edge Data Center Market, CAGR |

14.10% |

| Egypt Edge Data Center Market Size 2035 |

USD 174.81 Million |

Rapid technology adoption, 5G expansion, and rising IoT applications are fueling strong demand for advanced edge infrastructure. Enterprises are shifting workloads closer to end users to improve latency and service delivery. Strategic investments in cloud integration and digital connectivity are reinforcing Egypt’s position as a regional digital hub. The market offers strong opportunities for investors seeking scalable infrastructure and long-term growth potential.

Cairo leads the market due to its robust fiber network and dense enterprise ecosystem. Alexandria is emerging as a key hub supported by port connectivity and rising industrial activity. Suez and other strategic regions are also gaining traction with smart zone projects and connectivity expansion, strengthening national edge infrastructure distribution.

Market Drivers

Rapid Growth of Cloud Computing and Data Localization Policies Enhancing Infrastructure Modernization

Strong adoption of cloud platforms is reshaping digital infrastructure across the country. Enterprises are shifting workloads closer to end users to reduce latency and improve operational reliability. Edge computing supports mission-critical applications that demand real-time processing. Regulatory data localization requirements strengthen domestic investment in distributed facilities. Telecom operators and hyperscale providers are accelerating edge deployments to support these needs. The Egypt Edge Data Center Market benefits from this shift toward high-performance infrastructure. Investors view it as a strategic entry point for future digital services expansion.

Expanding 5G Network Rollouts Driving Edge Capacity and Application Diversification

Extensive 5G expansion is unlocking a new layer of network-driven demand. The technology enables ultra-low latency use cases that rely on proximity computing. Telecom operators deploy edge nodes to support bandwidth-intensive workloads. Industries are adopting AR, VR, and AI services that depend on localized processing. This evolution is driving new service models and operational efficiency. Edge facilities are positioned near major population and industrial hubs to support network densification. It enhances infrastructure resilience and agility. The Egypt Edge Data Center Market benefits from its alignment with national connectivity goals.

Accelerated Digital Transformation Across Industries Supporting Demand for High-Performance Edge Infrastructure

Digital transformation initiatives are scaling across public and private sectors. Financial services, healthcare, and retail are investing in secure, low-latency platforms to improve service delivery. Edge data centers reduce network congestion and improve workload distribution efficiency. Cloud and hybrid solutions are enabling flexible scaling for enterprises of all sizes. Automation and software-defined infrastructure support higher agility in operations. The Egypt Edge Data Center Market gains strong traction from industry digitalization. Investors are focusing on scalable and adaptive edge architectures to capture future growth.

- For example, in December 2024, Africa50 invested USD 15 million in Raya Data Center, with Raya Information Technology contributing an additional USD 10 million. The USD 25 million Tier III facility will begin construction in early 2025 to meet growing demand for data capacity and cloud services in Egypt.

Government-Led Infrastructure Investments and Strategic Partnerships Boosting Edge Deployment

The government is prioritizing ICT infrastructure as a core economic pillar. Public-private partnerships drive investment in new edge clusters and digital corridors. Data center operators collaborate with network providers to expand coverage in underserved regions. This coordinated approach builds a strong ecosystem for future digital services. Incentives and regulatory clarity attract international investors to the domestic market. Strategic investments support national goals for smart cities and digital industries. The Egypt Edge Data Center Market benefits from this aligned policy and investment structure.

- For example, in 2024, Egypt’s telecom regulator awarded 5G licenses to Vodafone, Orange, e& and Telecom Egypt, raising about USD 675 million in spectrum fees. Telecom Egypt secured its 5G license in January 2024 for USD 150 million. Vodafone’s license acquisition was part of the same licensing wave.

Market Trends

Rising Integration of AI-Optimized Edge Infrastructure for Real-Time Workloads

AI and ML adoption is driving new demands on compute and storage infrastructure. Edge nodes are increasingly optimized to handle intensive workloads close to the source. High-density servers, liquid cooling, and GPU clusters are being deployed at scale. This trend supports advanced use cases such as predictive maintenance and real-time analytics. Enterprises see operational benefits from reduced latency and enhanced performance. It creates a new growth pathway for operators and vendors. The Egypt Edge Data Center Market reflects this rising AI integration across industries.

Emergence of Modular and Prefabricated Edge Deployments for Faster Scalability

The market is seeing strong movement toward modular designs that reduce deployment time. Prefabricated edge units allow flexible scaling in urban and rural environments. These solutions offer cost efficiency and operational resilience. Standardized modules enable consistent quality control across multiple sites. Energy-efficient designs improve long-term performance. Operators can rapidly expand capacity based on shifting demand patterns. This flexible structure aligns well with rising enterprise connectivity needs. The Egypt Edge Data Center Market is evolving with modular deployment strategies.

Focus on Green Data Centers and Sustainable Infrastructure Initiatives

Sustainability is becoming central to infrastructure planning. Operators are adopting renewable energy, efficient cooling systems, and intelligent power management solutions. These measures reduce operating costs and support national energy goals. Data centers are integrating circular economy practices and green certifications. Enterprises are aligning IT strategies with environmental compliance. It supports better operational efficiency and investor confidence. The Egypt Edge Data Center Market is witnessing strong movement toward sustainable operations.

Growing Partnerships Between Telecom Operators and Hyperscalers to Expand Edge Reach

Strategic alliances are forming between telecom operators, hyperscalers, and infrastructure providers. These partnerships enable faster network edge expansion with shared investments. It enhances access to advanced connectivity and high-performance computing capacity. Joint ventures support cross-border data exchange and application hosting. Enterprises gain from stable, scalable service delivery. Partnerships accelerate technology integration and market maturity. The Egypt Edge Data Center Market benefits from this growing collaborative ecosystem.

Market Challenges

Limited Power Availability and Infrastructure Constraints Impacting Expansion of Edge Deployments

Energy supply and infrastructure limitations are slowing down capacity growth in key zones. Edge data centers require stable, uninterrupted power sources to maintain performance. Inconsistent grid infrastructure increases operational risks and costs. Many operators rely on diesel generators, which raise environmental and maintenance concerns. Infrastructure bottlenecks affect deployment speed and service quality. This challenge impacts investor confidence and expansion planning. The Egypt Edge Data Center Market faces pressure to align with global power reliability standards. Addressing these gaps is critical for sustainable industry growth.

Regulatory Complexity and Data Sovereignty Issues Affecting Market Scalability

Regulatory frameworks often lack clear definitions for edge operations and data ownership. Complex licensing and compliance structures create entry barriers for foreign investors. Data sovereignty rules limit cross-border data movement, increasing operational complexity. Fragmented policy environments delay large-scale investments. Lack of standardized procedures impacts deployment timelines. Investors seek more transparent and stable regulatory conditions. The Egypt Edge Data Center Market must navigate these issues to unlock broader scalability and innovation.

Market Opportunities

Rising Demand for Low-Latency Applications Creating Strong Investment Potential

Growing adoption of IoT, AR, VR, and smart city solutions drives demand for edge capacity. Enterprises seek low-latency environments to support critical applications. This creates a favorable investment landscape for new operators and partnerships. Edge infrastructure supports scalable and secure services. The Egypt Edge Data Center Market stands to gain from increasing digital workloads across industries. Investors can capitalize on this rising demand for distributed processing.

Strategic Geographic Location Enabling Cross-Border Digital Connectivity

Egypt’s position as a gateway between Africa, Europe, and the Middle East offers a strong advantage. Its fiber optic infrastructure supports international network routes. Edge deployments can enable faster data exchange and lower latency for regional enterprises. Global operators view this as a key expansion hub. The Egypt Edge Data Center Market has a unique opportunity to establish leadership in cross-border edge connectivity.

Market Segmentation

By Component

The solution segment holds a dominant share, supported by growing demand for efficient and scalable infrastructure. Enterprises are investing in edge platforms, networking, and power systems to enhance service delivery. Advanced solutions enable real-time processing and AI-driven analytics. Service offerings are expanding but remain secondary in market share. The Egypt Edge Data Center Market is seeing strong solution-led growth.

By Data Center Type

Colocation edge data centers lead the market due to cost-efficient scalability and shared infrastructure benefits. Enterprises prefer colocation for rapid deployment and flexible capacity. Managed and cloud edge facilities are expanding their footprint to support advanced workloads. Enterprise data centers remain relevant but are more capital intensive. The Egypt Edge Data Center Market is driven by the dominance of colocation facilities.

By Deployment Model

Hybrid models dominate the deployment landscape, offering flexibility and resilience. Enterprises combine on-premises control with cloud scalability to optimize costs and performance. Hybrid environments support dynamic workloads across industries. Cloud-based models are growing rapidly as more businesses modernize IT infrastructure. The Egypt Edge Data Center Market reflects strong demand for hybrid deployment.

By Enterprise Size

Large enterprises hold a major share due to their capacity to invest in advanced edge solutions. They rely on edge computing for AI, analytics, and secure data processing. SMEs are adopting edge services through colocation and managed platforms. This shift is expanding market accessibility. The Egypt Edge Data Center Market benefits from increasing adoption across all enterprise sizes.

By Application / Use Case

Power monitoring dominates the application segment due to operational efficiency benefits. Capacity management and environmental monitoring are also seeing steady growth. Edge solutions enable real-time insights and predictive maintenance. Asset management and BI use cases are rising with increased digitalization. The Egypt Edge Data Center Market is strengthening through diverse application adoption.

By End User Industry

IT and telecommunications lead the market with strong investment in edge infrastructure. BFSI and retail sectors are scaling digital services using low-latency platforms. Healthcare and energy sectors are modernizing critical infrastructure. Aerospace and defense adopt secure edge networks to support mission-critical systems. The Egypt Edge Data Center Market reflects multi-industry engagement driving steady growth.

Regional Insights

Cairo Leading the Market with Strong Network Infrastructure and Investment Activity

Cairo accounts for 45% of the total market share, supported by advanced fiber networks and enterprise clusters. The region hosts major telecom operators and colocation providers. Strong government focus on ICT and smart city initiatives boosts infrastructure expansion. Cairo’s dense business environment makes it the preferred location for new edge deployments. The Egypt Edge Data Center Market benefits from Cairo’s role as the national digital hub.

- For instance, Telecom Egypt achieved 99% fiber-to-the-curb (FTTC) coverage nationwide by February 2025, supporting Egypt’s position as the fastest fixed internet provider in Africa with average broadband speeds increasing from 5.4 Mbps in December 2017 to 84.5 Mbps by February 2025.

Alexandria Emerging as a Secondary Hub Driven by Industrial and Port Connectivity

Alexandria holds 30% of the market share and is rapidly evolving into a strategic edge location. The city’s industrial zones and port connectivity support logistics, manufacturing, and digital trade. Operators are building edge clusters to enhance data routing efficiency. Its strategic location positions it as a vital link in regional digital corridors. The Egypt Edge Data Center Market sees rising investments targeting Alexandria’s infrastructure expansion.

Suez and Other Regions Strengthening Their Role in Edge Expansion Through Strategic Positioning

Suez and other emerging regions collectively account for 25% of the market share. Their location near key trade routes attracts infrastructure investment. The government is supporting these regions through smart zone initiatives and connectivity projects. This diversification reduces dependency on Cairo and builds resilience. The Egypt Edge Data Center Market gains from balanced regional development. Expanding coverage across these regions strengthens national edge capacity.

- For instance, Raya Data Center announced a new Tier III-certified data center project in December 2024 with a total investment of USD 25 million, including USD 15 million from Africa50. Construction is scheduled to begin in early 2025, and the facility will support sectors such as healthcare, real estate, manufacturing, banking, and government operations in Egypt.

Competitive Insights:

- Telecom Egypt

• Orange Egypt

• Vodafone Egypt

• Africa Data Centres

• EdgeConneX

• Eaton Corporation

• Dell Technologies Inc.

• Fujitsu

• Cisco

• SixSq

• Microsoft

• VMware

• Schneider Electric SE

• Rittal GmbH & Co. KG

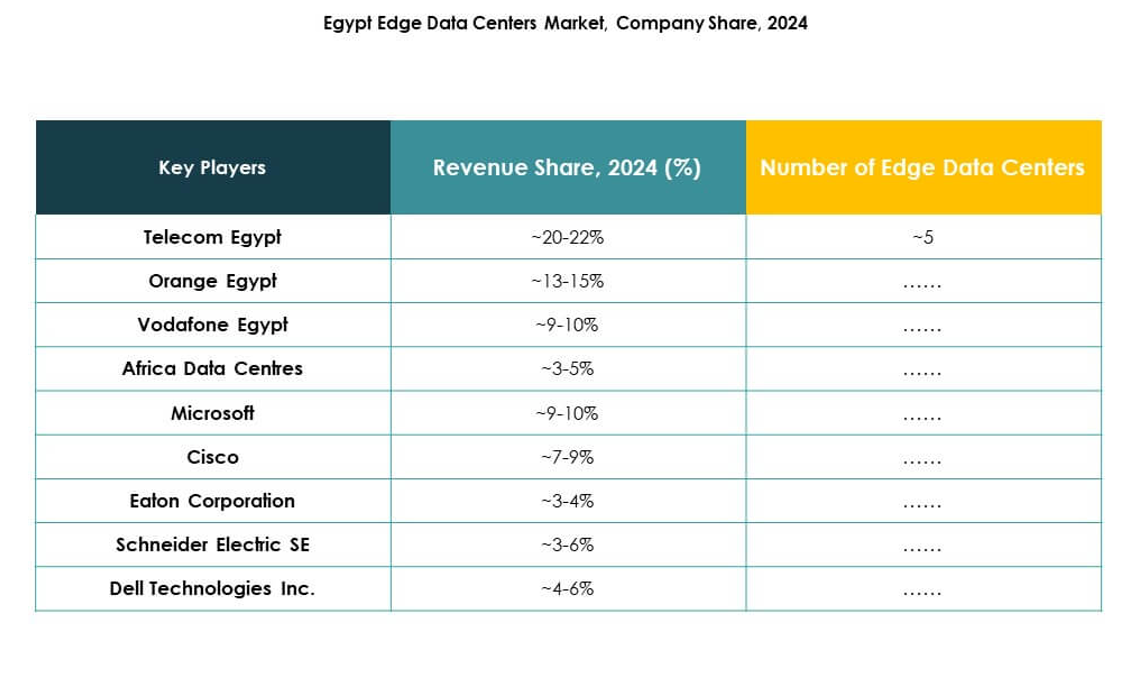

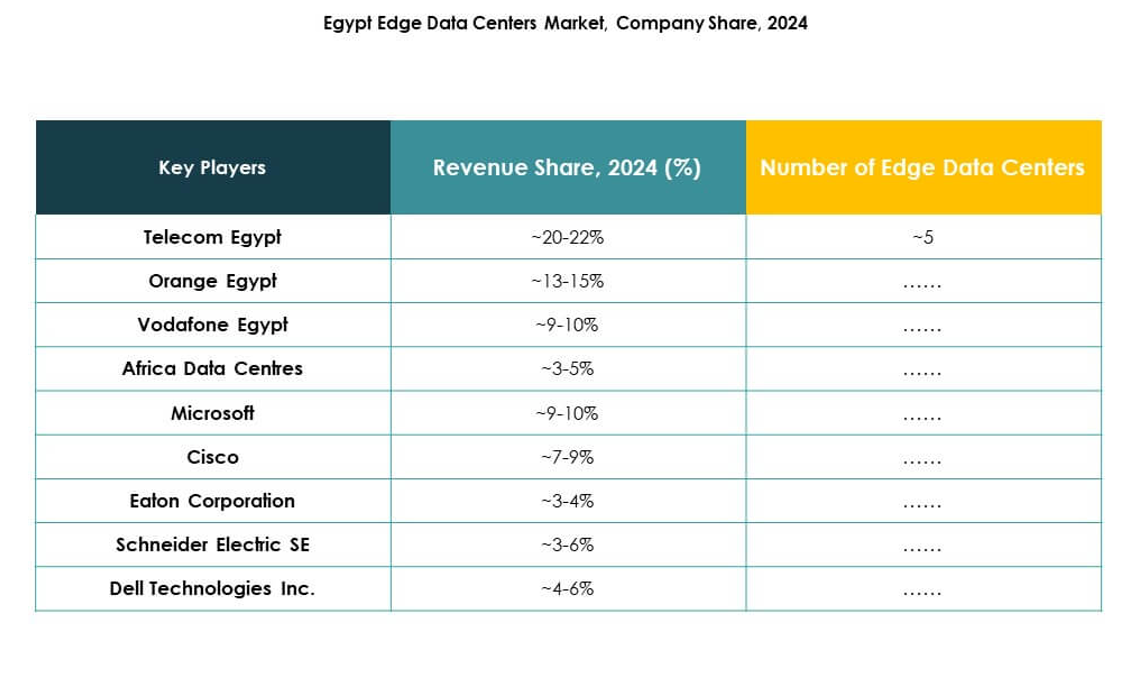

The competitive landscape in the Egypt Edge Data Center Market reflects strong collaboration between domestic telecom operators and global technology providers. Local firms such as Telecom Egypt, Orange Egypt, and Vodafone Egypt dominate connectivity and infrastructure control, leveraging their network reach. International players like Schneider Electric SE, Dell Technologies Inc., and Cisco strengthen their presence through advanced edge solutions and power infrastructure systems. Africa Data Centres and EdgeConneX focus on scalable colocation and modular deployments to expand coverage. Global cloud vendors including Microsoft and VMware enable hybrid and multi-cloud integration. It demonstrates a balanced mix of local leadership and international innovation, creating intense competition centered on technology integration, service quality, and market reach.

Recent Developments:

- In October 2025, Telecom Egypt partnered with Colt Technology Services to launch two new high-speed internet transit nodes in Cairo and Alexandria. These nodes, integrated within Telecom Egypt’s state-of-the-art data centre facilities, aim to boost Egypt’s digital infrastructure and enhance regional connectivity for edge computing, supporting low-latency services and cloud platforms.

- In September 2025, Telecom Egypt announced a major strategic partnership and divestment deal involving its Regional Data Hub (RDH) campus in Cairo. Helios Investment Partners is set to acquire a 75–80% stake in a new Telecom Egypt subsidiary that will hold the RDH assets, valued at approximately $230 million and potentially rising to $260 million, subject to key performance indicators.

- In June 2025, Orange Egypt officially launched 5G services after securing financing for its 5G license. This launch responds to rising demand for edge data center services, enhanced upload/download speeds, and smart city applications in Egypt. Orange’s deployment will prioritize high-traffic zones and incorporate international quality standards, with nationwide expansion following the initial phase.

- In February 2025, Telecom Egypt and Orange Egypt strengthened their business ties through several strategic agreements totaling about $297 million. These agreements encompass enhanced connectivity, the introduction of fibre-to-the-site (FTTS) services, and new service level agreements that will help Orange Egypt prepare for 5G launch and expand its high-speed mobile and internet offerings across Egypt.

- In December 2024, Africa50, an infrastructure investment platform, partnered with Raya Data Center to invest $15 million in a new tier III facility in Egypt. This partnership supports Egypt’s digital transformation goals and the rapid growth of edge data centers needed for real-time applications and improved user experiences in markets such as IoT, autonomous systems, and streaming services.