Executive summary:

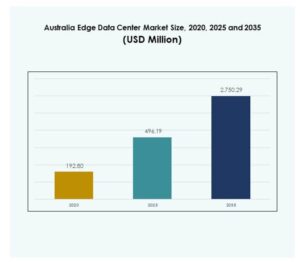

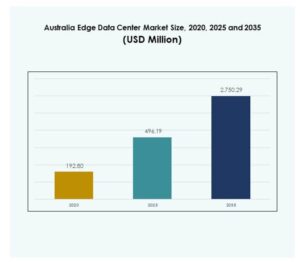

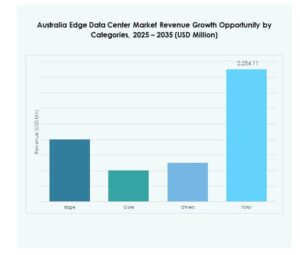

The Australia Edge Data Center Market size was valued at USD 192.80 million in 2020, reached USD 496.19 million in 2025, and is anticipated to reach USD 2,750.29 million by 2035, at a CAGR of 18.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Edge Data Center Market Size 2025 |

USD 496.19 Million |

| Australia Edge Data Center Market, CAGR |

18.51% |

| Australia Edge Data Center Market Size 2035 |

USD 2,750.29 Million |

The market is witnessing rapid expansion driven by widespread 5G deployment, IoT integration, and AI-powered applications. Enterprises are adopting edge infrastructure to improve data processing speed, reduce latency, and enhance user experience. It supports key industries such as telecom, finance, and healthcare by enabling real-time analytics and localized cloud solutions. The Australia Edge Data Center Market is becoming a strategic hub for investors aiming to capitalize on digital transformation and energy-efficient technologies.

New South Wales and Victoria lead the market due to advanced connectivity infrastructure and strong enterprise presence. Western Australia and Queensland are emerging as regional growth centers supported by renewable-powered facilities and smart industrial projects. Rising investment in data networks and sustainability-driven operations is strengthening nationwide infrastructure. The geographic spread of edge deployments is establishing Australia as a leading digital and cloud-ready economy in the Asia-Pacific region.

Market Drivers

Expansion of 5G Infrastructure and Data Localization Initiatives

The rollout of 5G networks in Australia is accelerating the demand for low-latency computing. Telecom providers and cloud operators are expanding distributed edge nodes to enhance connectivity for IoT, AR/VR, and AI applications. The Australia Edge Data Center Market benefits from government-backed digital transformation programs and rising enterprise focus on data sovereignty. It supports critical operations in industries such as finance, healthcare, and logistics. Edge facilities enable data processing closer to the source, improving response time and network reliability. Businesses are using localized data storage to meet compliance and performance needs. Investors are focusing on high-speed connectivity zones for growth. The expansion of 5G ecosystems will continue to fuel market scalability.

- For example, Telstra, Australia’s largest telecom provider, announced its strategy to extend 5G coverage to 95% of the population by the end of 2025 as part of its T25 initiative. By mid-2025, Telstra led with the highest number of 5G base stations 2,695 sites across the country far ahead of other providers, underpinning low-latency applications for enterprises and enabling localized data solutions for compliance and performance in finance, healthcare, and logistics.

Growing Integration of Artificial Intelligence and IoT Technologies

Artificial intelligence and IoT adoption across industries are driving the demand for decentralized processing capabilities. Edge centers now host advanced workloads that support real-time analytics, robotics, and autonomous systems. The Australia Edge Data Center Market provides the infrastructure for smart city frameworks and connected industrial ecosystems. It enables enterprises to manage and analyze data at scale with reduced bandwidth costs. AI-driven automation also enhances facility management, cooling efficiency, and power optimization. Companies are embedding sensors for predictive maintenance and workload balancing. Cloud-to-edge coordination strengthens data management capabilities. The growing AI-IoT synergy is reshaping how businesses deploy and manage digital assets.

- For example, NEXTDC secured NVIDIA DGX-Ready Data Center certification in 2024, confirming its readiness to support advanced AI workloads. The company’s upcoming M4 campus in Melbourne is planned with a capacity of up to 150 MW, designed for high-density racks exceeding 1 MW, positioning it as a key hub for Australia’s next-generation AI and data infrastructure.

Shift Toward Renewable and Sustainable Edge Operations

Sustainability initiatives are transforming how data centers operate across Australia. Edge operators are focusing on integrating renewable power sources such as solar and wind. The Australia Edge Data Center Market is evolving to support green operations through efficient cooling, modular design, and waste heat recovery. It aligns with national climate goals and energy efficiency standards. Businesses are adopting eco-friendly facilities to meet ESG commitments and reduce carbon emissions. Operators are also forming partnerships with utilities for sustainable energy supply. New designs include liquid cooling and battery-based backup systems. This focus on sustainability creates long-term investment confidence and operational stability.

Rising Need for Cloud-Edge Synergy and Digital Resilience

Enterprises are transitioning from centralized cloud models to hybrid edge infrastructures. This shift enhances agility, resilience, and continuity for mission-critical workloads. The Australia Edge Data Center Market supports hybrid cloud environments with localized compute and data security. It allows faster content delivery, seamless scalability, and enhanced uptime for applications. Organizations in sectors like e-commerce and healthcare are deploying edge nodes to maintain business continuity during outages. Strategic collaborations between hyperscalers and telecoms are reshaping Australia’s digital backbone. Data decentralization ensures performance consistency across dispersed geographies. The growing edge-cloud fusion reinforces national competitiveness in digital services.

Market Trends

Emergence of Modular and Micro Data Center Architectures

Organizations are increasingly adopting compact, modular designs to meet localized computing needs. Micro data centers enable flexible and rapid deployment near end-users or industrial facilities. The Australia Edge Data Center Market is witnessing rising adoption of containerized and prefabricated modules. These models minimize construction time and improve scalability for distributed networks. Modular structures reduce operating costs and simplify maintenance. Vendors are standardizing configurations to serve diverse workloads efficiently. It supports industries requiring rapid digital transformation. The trend strengthens regional data processing capacity and operational responsiveness.

Growth in AI-Driven Automation and Predictive Management Systems

Edge facilities are becoming more intelligent through AI-enabled management systems. Automation ensures optimized energy usage, real-time monitoring, and fault prediction. The Australia Edge Data Center Market leverages machine learning to enhance operational control and uptime. AI tools analyze performance data, helping operators predict and prevent failures. Automated systems streamline workload allocation and temperature regulation. Predictive analytics supports resource optimization and capacity planning. The integration of smart algorithms minimizes human error. Intelligent automation is setting new standards for efficiency and reliability across Australian facilities.

Strategic Collaborations Between Telecom and Cloud Service Providers

Telecommunication companies and hyperscale cloud providers are forming partnerships to expand edge infrastructure. These alliances accelerate nationwide connectivity and digital inclusion. The Australia Edge Data Center Market benefits from investments in 5G, fiber optics, and hybrid networks. Strategic cooperation enhances interoperability between platforms and applications. Cloud-edge integration improves enterprise computing flexibility and performance. Telecom-backed edge nodes are emerging in urban and remote zones. Collaborative models also foster innovation in data management and cybersecurity. Partnerships are reinforcing Australia’s position as a regional data connectivity hub.

Increasing Demand from Content Delivery and Streaming Services

The rise in OTT and digital media consumption is driving edge computing adoption. Data centers now host latency-sensitive applications such as live streaming and gaming. The Australia Edge Data Center Market supports content providers seeking faster load times and smoother experiences. Edge networks reduce congestion by caching content closer to viewers. Video platforms benefit from real-time data transfer and localized traffic handling. This trend enhances end-user experience and supports market expansion. Media and entertainment firms are investing in edge deployments nationwide. The momentum underscores growing digital lifestyle demands across Australia.

Market Challenges

High Capital Expenditure and Complex Infrastructure Deployment

Building edge data centers requires significant investment in power systems, cooling, and network infrastructure. The Australia Edge Data Center Market faces challenges in balancing rapid deployment with cost efficiency. Land acquisition and regulatory approvals further increase project complexity. Many operators struggle to achieve return on investment due to high initial setup costs. Integrating edge facilities within existing urban areas involves zoning and construction limitations. Supply chain disruptions for specialized hardware delay scalability. Smaller enterprises face funding constraints when entering the market. These financial and logistical barriers may slow infrastructure expansion in some regions.

Shortage of Skilled Workforce and Energy Reliability Issues

The industry requires advanced technical expertise in edge networking, cybersecurity, and facility management. The Australia Edge Data Center Market experiences workforce gaps that affect system performance and innovation pace. Limited availability of trained engineers increases operational risk for complex deployments. Energy reliability also poses a challenge in remote and regional locations. Power fluctuations impact uptime and can disrupt mission-critical applications. Operators must invest in backup and renewable solutions to maintain stability. The combination of skill shortages and power reliability issues creates operational bottlenecks. Addressing these gaps is essential for achieving sustainable industry growth.

Market Opportunities

Expansion of AI, IoT, and Cloud-Integrated Edge Ecosystems

The growing convergence of AI, IoT, and cloud computing offers strong growth potential. The Australia Edge Data Center Market supports industries requiring real-time analytics and automation. Sectors like manufacturing, transport, and retail are deploying edge solutions for digital optimization. Investments in AI-driven edge nodes enhance network responsiveness. It also improves predictive maintenance and analytics-driven decision-making. Integration with public and private clouds creates new service opportunities. Enterprises are seeking low-latency infrastructure to enhance competitiveness. Expanding industrial automation drives greater need for hybrid edge solutions.

Rising Demand for Green, Modular, and Regional Data Facilities

Investors are increasingly favoring sustainable and modular designs for distributed computing. The Australia Edge Data Center Market benefits from renewable energy integration and localized deployments. Solar and wind-powered centers are gaining preference across suburban and rural areas. It aligns with national sustainability goals and reduces operational costs. Modular construction enables faster setup and scalability. Regional facilities help extend connectivity beyond metropolitan areas. Businesses are leveraging these edge nodes for efficiency and resilience. The trend strengthens Australia’s position as a green digital infrastructure leader.

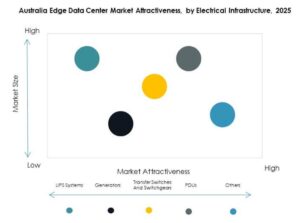

Market Segmentation

By Component

Solutions dominate the Australia Edge Data Center Market due to high demand for integrated power, cooling, and networking infrastructure. These components ensure reliable performance for AI and IoT workloads. Service providers focus on offering management and maintenance services for enhanced uptime. The solution segment holds the largest share owing to its role in infrastructure modernization and digital continuity.

By Data Center Type

Colocation edge data centers hold the largest market share due to cost-effective scalability and shared resource models. These centers cater to SMEs and cloud providers requiring localized access. The Australia Edge Data Center Market benefits from increasing demand for flexible space and hybrid connectivity. Managed and cloud-edge centers are gaining traction for data security and operational control.

By Deployment Model

Hybrid deployment dominates due to its balance between on-premises control and cloud scalability. It enables data processing flexibility and improves resilience. The Australia Edge Data Center Market sees rising hybrid adoption across industries managing sensitive and distributed workloads. On-premises setups serve regulated sectors, while cloud-based models expand digital accessibility and agility.

By Enterprise Size

Large enterprises lead the market with higher IT budgets and advanced digital strategies. They deploy edge facilities to improve latency and security across operations. The Australia Edge Data Center Market also witnesses increasing adoption among SMEs due to growing cloud migration. Competitive pricing and managed services make edge solutions more accessible to smaller firms.

By Application / Use Case

Power monitoring is the dominant application due to rising emphasis on energy efficiency and sustainability. The Australia Edge Data Center Market supports automated power optimization and predictive control. Environmental monitoring and BI analytics are expanding segments driven by IoT integration. Data-driven visibility enhances facility operations and cost management.

By End User Industry

IT and telecommunications lead the market, accounting for the largest share. They drive infrastructure growth through 5G and network modernization projects. The Australia Edge Data Center Market also serves BFSI, healthcare, and retail sectors demanding secure, low-latency computing. Energy and utilities are emerging as strong adopters of edge-based predictive analytics.

Regional Insights

New South Wales and Victoria: Core Digital Infrastructure Hubs (48% Market Share)

New South Wales and Victoria dominate the Australia Edge Data Center Market due to strong urban connectivity and enterprise concentration. Sydney and Melbourne host major hyperscale and colocation centers. These states benefit from robust fiber networks and proximity to corporate headquarters. Continuous investments in 5G and green data centers sustain their leadership. It supports the expansion of fintech, telecom, and content delivery sectors. Government incentives and favorable policies attract global investors to these hubs.

- For example, NEXTDC’s S3 Sydney campus delivered 24 MW of built capacity in FY25, with 20 MW under construction and 8 MW in planning. The facility holds Uptime Institute Tier IV Gold certification and features advanced biometric security systems, reinforcing its role as one of Australia’s most resilient and high-performance data centers.

Western Australia and Queensland: Emerging Green and Industrial Edge Zones (32% Market Share)

Western Australia and Queensland are gaining traction with renewable-powered data centers and industrial automation. The Australia Edge Data Center Market sees rising deployment in mining and resource sectors. Facilities integrate solar and wind energy to improve sustainability and cost control. Perth and Brisbane are witnessing new projects from telecoms and energy operators. It supports real-time industrial analytics and remote operations. Strong regional demand for connectivity fuels infrastructure expansion across these states.

- For example, DC Two’s Bibra Lake facility in Perth operates in Stage 1 configuration with 3 MW design-accredited capacity and is pursuing Tier III accreditation. The Collie project is designed to support up to 4 MW power, host about 256 IT racks at up to 30 kW per rack, and be powered using renewable energy.

South Australia, Tasmania, and Northern Territory: Developing Connectivity Corridors (20% Market Share)

These regions are developing smaller-scale edge deployments to bridge digital gaps. The Australia Edge Data Center Market is expanding through modular and mobile facilities. Investments target education, defense, and public administration sectors. Renewable energy potential in Tasmania strengthens data sustainability. Strategic geographic positioning supports regional redundancy and resilience. It helps distribute data load evenly across the national network. Government-led digital inclusion programs are accelerating these regional initiatives.

Competitive Insights:

- Telstra Corporation

• Optus (Singtel)

• TPG Telecom

• Equinix

• Digital Realty

• EdgeConneX

• Fujitsu

• Cisco

• Eaton Corporation

• Microsoft

The Australia Edge Data Center Market features strong competition among telecom operators, global cloud providers, and infrastructure specialists. It is driven by rising demand for low-latency services and localized data hosting. Telstra, Optus, and TPG Telecom focus on expanding edge connectivity through 5G integration and regional data zones. Global firms such as Equinix, Digital Realty, and EdgeConneX lead in scalable colocation and hybrid cloud solutions. Fujitsu and Cisco emphasize intelligent automation and AI-based management tools, while Eaton and Microsoft focus on energy efficiency and cloud-edge collaboration. The competitive environment encourages innovation in modular design, renewable energy use, and cross-industry partnerships to strengthen Australia’s digital infrastructure resilience.

Recent Developments:

- In August 2025, Telstra announced a major strategic joint venture with Infosys, accelerating AI-powered cloud and digital transformation for Australian enterprises. Infosys is acquiring a 75 percent stake in Versent Group, a cloud and digital transformation subsidiary of Telstra, while Telstra will retain a 25 percent minority interest. This collaboration aims to leverage Infosys’ advanced AI, cloud, and cybersecurity capabilities to boost Versent’s strengths in delivering digital solutions across large Australian organizations.

- In July 2025, TPG Telecom completed the sale of its Enterprise, Government, and Wholesale (EGW) fixed-line business and associated fibre network to Vocus Group in a landmark AU$5.25 billion transaction. This move expands Vocus’ fibre footprint across Australia to over 50,000km, brings new international cable capacity, and positions the combined platform to directly challenge incumbent providers in enterprise and government connectivity.

- In March 2025, Optus (Singtel) partnered with a consortium including Microsoft, Tech Mahindra, and Databricks to launch a Unified Data Platform (UDP) using Microsoft Azure—replacing legacy on-premise data warehouses with a modern, cloud-native lakehouse architecture. This collaboration marked the first Asia-Pacific deployment of this kind, yielding operational efficiency improvements and laying the foundation for advanced AI and edge computing capabilities in the Australian market.

- In July 2025, Carrier Connect Data Solutions Inc. entered into a share purchase agreement to acquire all outstanding shares of Nexion W1 DC Pty Ltd., which operates a 2 MW Tier II/III data center in Perth, Australia, serving the Asia Pacific region. Under the terms of the acquisition, Carrier Connect will pay AUD $2.5 million, with a payment structure that includes upfront and long-term amortized payments.