Executive summary:

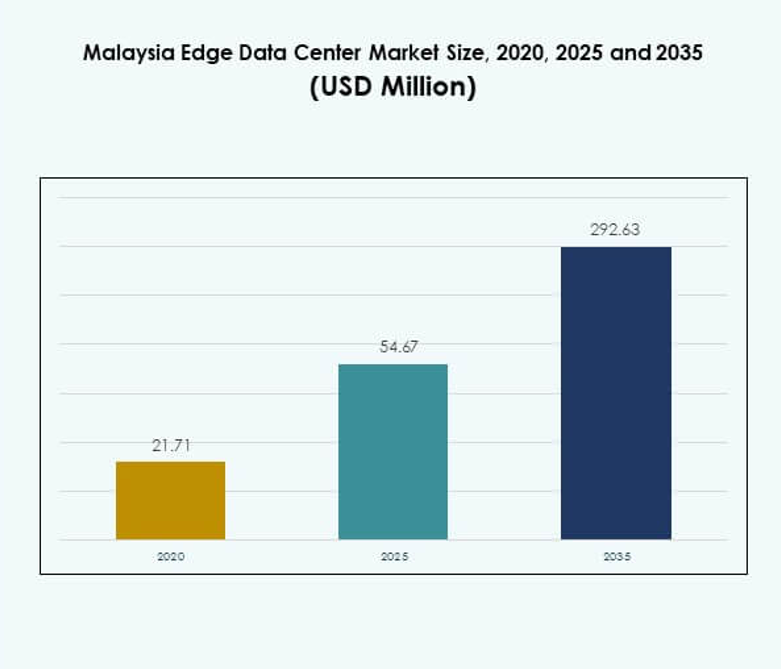

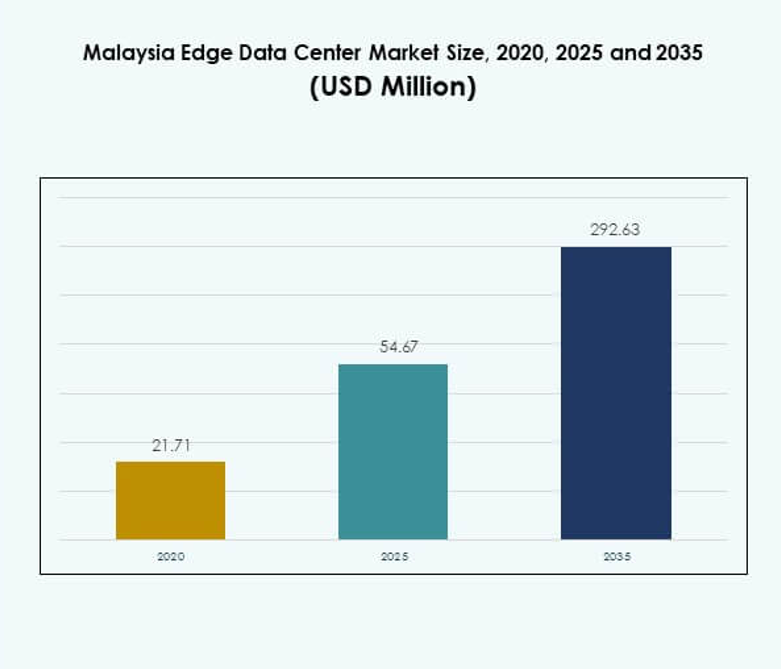

The Malaysia Edge Data Center Market size was valued at USD 21.71 million in 2020, reached USD 54.67 million in 2025, and is anticipated to reach USD 292.63 million by 2035, at a CAGR of 18.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Malaysia Edge Data Center Market Size 2025 |

USD 54.67 Million |

| Malaysia Edge Data Center Market, CAGR |

18.10% |

| Malaysia Edge Data Center Market Size 2035 |

USD 292.63 Million |

The rapid adoption of 5G, IoT, and AI technologies is transforming enterprise infrastructure strategies. Growing demand for low-latency networks is pushing investments in scalable and energy-efficient edge facilities. Innovation in network automation, cloud integration, and data processing is reshaping operational models across industries. The market holds strong strategic importance for businesses and investors seeking growth in digital connectivity and localized data management.

The central region, led by Kuala Lumpur and Selangor, is emerging as the primary hub due to strong connectivity infrastructure and enterprise concentration. The southern region, including Johor, is expanding rapidly, supported by cross-border connectivity advantages. The northern region, with Penang as a growing node, is also gaining traction through new developments that enhance localized digital capacity and regional competitiveness.

Market Drivers

Rapid Integration of Edge Infrastructure with 5G and Cloud Ecosystems

Widespread 5G adoption is transforming network architecture in the Malaysia Edge Data Center Market. Telecom operators and hyperscalers are deploying localized computing assets to reduce latency and support real-time applications. Integration with cloud platforms improves service delivery across industries, from healthcare to e-commerce. The ecosystem is shifting toward distributed architectures that enable efficient data processing closer to the end user. Businesses benefit from lower operational costs and improved service reliability. Investors are finding stable revenue streams in this ecosystem. Strategic collaborations between network operators and data center developers are growing. This transition positions Malaysia as a regional digital infrastructure hub.

Surging Data Traffic Driven by IoT Devices and Digital Transformation

Rapid IoT expansion is increasing the volume of real-time data across industries. The Malaysia Edge Data Center Market is seeing rising demand from logistics, retail, and manufacturing sectors. Businesses depend on edge facilities to manage sensitive and time-critical data efficiently. It enhances operational speed, reduces network congestion, and supports seamless digital operations. Localized data processing is becoming essential to maintain service quality in connected systems. Telecom firms and technology vendors are expanding edge infrastructure across key cities. This shift creates long-term value for investors. It is strengthening Malaysia’s role in Southeast Asia’s digital supply chain.

- For instance, Microsoftannounced the general availability of its Malaysia West cloud region in May 2025, featuring three hyperscale datacenter availability zones in Greater Kuala Lumpur. This new infrastructure provides Malaysian organizations ultra-low latency, in-country data residency, and scalable cloud-AI computing, reinforcing local support for real-time IoT telemetry and analytics. The launch enables thousands of enterprises to operate securely with improved access speeds for cloud applications.

Strong Government Policies Supporting Digital Infrastructure Growth

Government-led initiatives are encouraging strategic investments in modern IT infrastructure. The Malaysia Edge Data Center Market is gaining momentum from policies that promote data sovereignty and cloud-first strategies. These measures attract both foreign and local capital for edge expansion. Regulatory clarity improves investor confidence and accelerates project execution. It aligns national digital transformation with global technological standards. Enterprises benefit from a supportive environment that fosters innovation. Industrial corridors are being developed with enhanced connectivity. The environment is enabling sustainable and scalable edge deployments across the country.

- For instance, under the Malaysia Digital Economy Blueprint (MyDIGITAL), the government is actively enabling AI and cloud infrastructure development. In 2024, Bridge Data Centres (BDC)announced the acquisition of land in Cyberjaya to develop its third datacenter (MY02), expecting to deliver an 87 MW IT load for hyperscale and edge clients in three phases. This expansion directly supports national digital sovereignty, following regulatory clarity and robust policy incentives for data center operators

Strategic Location Enabling Regional Connectivity and Data Routing

Malaysia’s geographic position between major Asian economies is fueling strong network interconnection growth. The Malaysia Edge Data Center Market benefits from access to multiple submarine cables and regional network hubs. It enhances connectivity to Singapore, Indonesia, and global markets. Businesses gain faster data routing and enhanced resilience. This strategic positioning attracts hyperscale and edge developers. It enables enterprises to extend regional service delivery with lower latency. The infrastructure also improves cross-border digital trade potential. Investors are leveraging Malaysia’s location to build scalable, long-term assets.

Market Trends

Growing Adoption of AI-Powered Edge Solutions for Real-Time Processing

The deployment of AI at the edge is gaining momentum across industries. The Malaysia Edge Data Center Market is shifting toward AI-enabled systems that deliver faster and more reliable services. Enterprises use edge AI to optimize operational workflows and automate decision-making. Industries like healthcare, logistics, and energy are embracing these technologies to manage critical workloads. This trend enhances real-time analytics and service responsiveness. It supports high-demand applications like autonomous logistics and predictive maintenance. Companies are building scalable platforms to capitalize on this shift. The market is advancing toward intelligent infrastructure.

Expansion of Colocation Edge Facilities to Enable Cost Efficiency

Cost optimization is driving the growth of colocation-based edge infrastructure. The Malaysia Edge Data Center Market is witnessing increased adoption among enterprises that prefer shared facilities over standalone setups. This model reduces capital expenditure and allows flexible scalability. Businesses can access advanced security, connectivity, and power infrastructure without building new facilities. Colocation hubs are emerging across key urban centers. It improves network resilience and operational uptime for critical industries. This shift is redefining enterprise IT infrastructure strategies. Providers are investing heavily to expand their edge footprint.

Increased Focus on Green Data Center Practices and Energy Efficiency

Sustainability goals are shaping infrastructure investments and operational strategies. The Malaysia Edge Data Center Market is integrating renewable power sources and advanced cooling systems. Operators are adopting modular designs that lower energy use and carbon output. It aligns national digital expansion with global climate targets. Green certification is becoming an important factor for data center operators. This focus attracts ESG-focused investors. Enterprises prefer energy-efficient infrastructure to lower operational costs. The emphasis on sustainability is transforming infrastructure design standards.

Rise of Hybrid Edge Architectures to Enable Multi-Cloud Integration

Hybrid edge models are becoming standard in enterprise IT environments. The Malaysia Edge Data Center Market is seeing rising demand for flexible deployments that connect on-premise systems with multiple cloud platforms. It allows businesses to maintain critical data locally while leveraging cloud computing power. The hybrid structure enhances workload distribution, security, and performance. Enterprises in BFSI and telecom lead this adoption trend. The model helps organizations scale without heavy infrastructure investments. Investors are supporting hybrid solutions to enable multi-cloud innovation. The trend is accelerating regional digital modernization.

Market Challenges

High Capital Expenditure and Long Deployment Timelines

Large investments are required to develop efficient and resilient edge networks. The Malaysia Edge Data Center Market faces delays due to complex planning, permitting, and infrastructure requirements. It often takes years to complete construction and achieve operational readiness. High costs discourage small players from entering the market. Securing financing remains difficult for operators without strong partnerships. Network integration adds further complexity to timelines. Investors are cautious when evaluating long-term returns. The capital-intensive nature of these projects remains a key restraint for rapid scaling.

Talent Shortage and Limited Technical Expertise in Edge Infrastructure

Building and maintaining advanced edge infrastructure requires specialized skills. The Malaysia Edge Data Center Market is impacted by a shortage of skilled engineers, network specialists, and cybersecurity experts. This talent gap affects deployment quality and operational reliability. Companies face difficulties in implementing advanced automation and AI-driven management. Limited local expertise increases reliance on foreign vendors. It also raises operational costs and slows technology adoption. Training and talent development programs are still insufficient. Addressing this gap is essential for sustainable market growth.

Market Opportunities

Strategic Investment Potential in High-Growth Digital Infrastructure Projects

Investors are focusing on scalable and future-ready infrastructure assets. The Malaysia Edge Data Center Market offers opportunities to build edge facilities supporting high-demand applications. Urban centers are witnessing rapid digital expansion across industries. Telecom operators are seeking partners to expand coverage. It allows investors to enter a fast-growing sector with strong fundamentals. Favorable regulations and geographic advantages enhance long-term value creation. This opportunity aligns with rising demand for regional connectivity.

Rising Demand from Emerging Industries and New Digital Services

New-age industries like autonomous mobility, telemedicine, and immersive retail are driving demand for advanced edge infrastructure. The Malaysia Edge Data Center Market can cater to low-latency requirements of these services. It supports application growth across logistics, finance, and e-commerce. Enterprises prefer edge infrastructure to strengthen digital capabilities. The growing technology ecosystem fuels continuous innovation. Early movers stand to secure strong market positions. The expansion of such industries ensures a steady demand pipeline.

Market Segmentation

By Component

Solutions dominate the Malaysia Edge Data Center Market with strong adoption by telecom operators, hyperscalers, and enterprises seeking better control over critical workloads. It holds a major share due to rising investments in software-defined infrastructure, virtualization, and security features. Service providers are expanding offerings to support managed deployments, but solutions lead because of flexibility and scalability advantages.

By Data Center Type

Colocation edge data centers hold the largest share, driven by cost efficiency, scalability, and strong network connectivity. The Malaysia Edge Data Center Market is seeing rapid development of multi-tenant facilities, enabling enterprises to avoid heavy capital investments. Managed and cloud-based centers are also gaining momentum as operators expand hybrid service portfolios across urban hubs.

By Deployment Model

Cloud-based deployments dominate due to faster implementation and easier integration with multi-cloud ecosystems. The Malaysia Edge Data Center Market benefits from strong cloud adoption by telecom, retail, and IT industries. Hybrid models are expanding quickly, offering flexibility for enterprises handling sensitive data, but cloud remains the preferred choice for its agility and cost-effectiveness.

By Enterprise Size

Large enterprises account for the largest market share, leveraging edge infrastructure for latency-sensitive applications. The Malaysia Edge Data Center Market is driven by financial institutions, telecoms, and global hyperscalers seeking to enhance operational efficiency. SMEs are increasing adoption gradually, supported by scalable and cost-effective colocation options.

By Application / Use Case

Power monitoring leads the segment, supported by growing energy optimization efforts. The Malaysia Edge Data Center Market benefits from advanced power tracking and efficiency technologies that ensure uninterrupted operations. Asset and capacity management are expanding segments, reflecting a broader focus on real-time infrastructure control.

By End User Industry

IT and telecommunications hold the largest share, reflecting the sector’s dependence on robust connectivity and edge capabilities. The Malaysia Edge Data Center Market sees growing activity from BFSI and retail industries. Healthcare and energy sectors are also emerging users as low-latency data processing becomes critical for service delivery.

Regional Insights

Central Region – Leading Market with 46% Share

The central region, including Kuala Lumpur and Selangor, leads the Malaysia Edge Data Center Market with a 46% share. It benefits from advanced connectivity infrastructure, proximity to major enterprises, and strong government support. The region hosts multiple submarine cable landing points and hyperscale data hubs. Businesses leverage this strategic location for low-latency operations. Investors target this area for high-value edge deployments. It remains the core growth driver for nationwide infrastructure development.

- For instance, Princeton Digital Group officially delivered Phase One of its 150MW JH1 data center campus in Sedenak Tech Park, Johor, in July 2024. The first phase provides 52MW capacity and is one of the fastest hyperscale launches in Malaysia, completed in just 12 months and directly supported by Malaysia’s investment and digital authorities.

Southern Region – Rapid Expansion with 34% Share

The southern region, particularly Johor, accounts for 34% of the market. It is witnessing rapid infrastructure expansion driven by its proximity to Singapore and favorable logistics networks. Strong cross-border connectivity supports the growth of edge and hyperscale data centers. Developers are investing in new facilities to serve international traffic and enterprise demand. The region is emerging as a major edge hub. Its location enhances its appeal to global investors.

- For instance, YTL Power International and NVIDIA signed a landmark RM10 billion (US$2.36 billion) deal in July 2025 to develop AI-powered data centers in Malaysia. The partnership includes the creation of a sovereign large language model and deployment of NVIDIA’s high-performance GPUs at new green-powered facilities, confirming Johor’s role as a core regional hub for the project.

Northern and Eastern Regions – Emerging Growth Zones with 20% Share

The northern and eastern regions collectively hold a 20% market share. These areas are in earlier stages of infrastructure development. Edge projects here focus on industrial parks, logistics hubs, and public sector digitalization. Government incentives and telecom network expansion are improving market conditions. Businesses are exploring opportunities to decentralize workloads. It is expected to become a significant contributor to future edge capacity expansion. The growth outlook remains strong for these subregions.

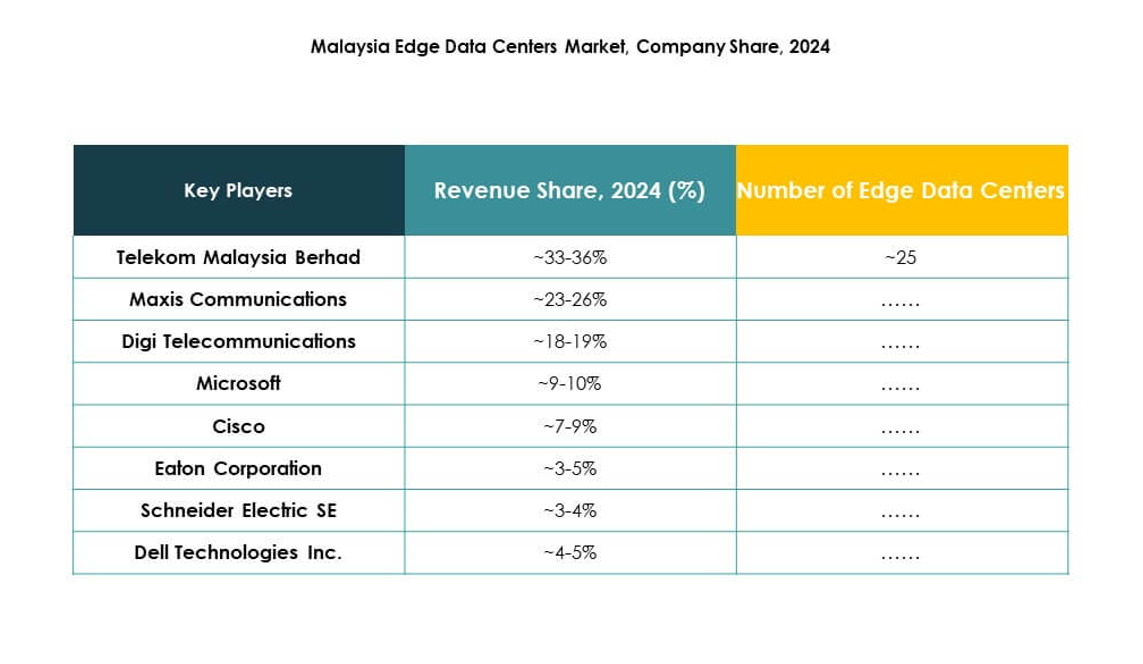

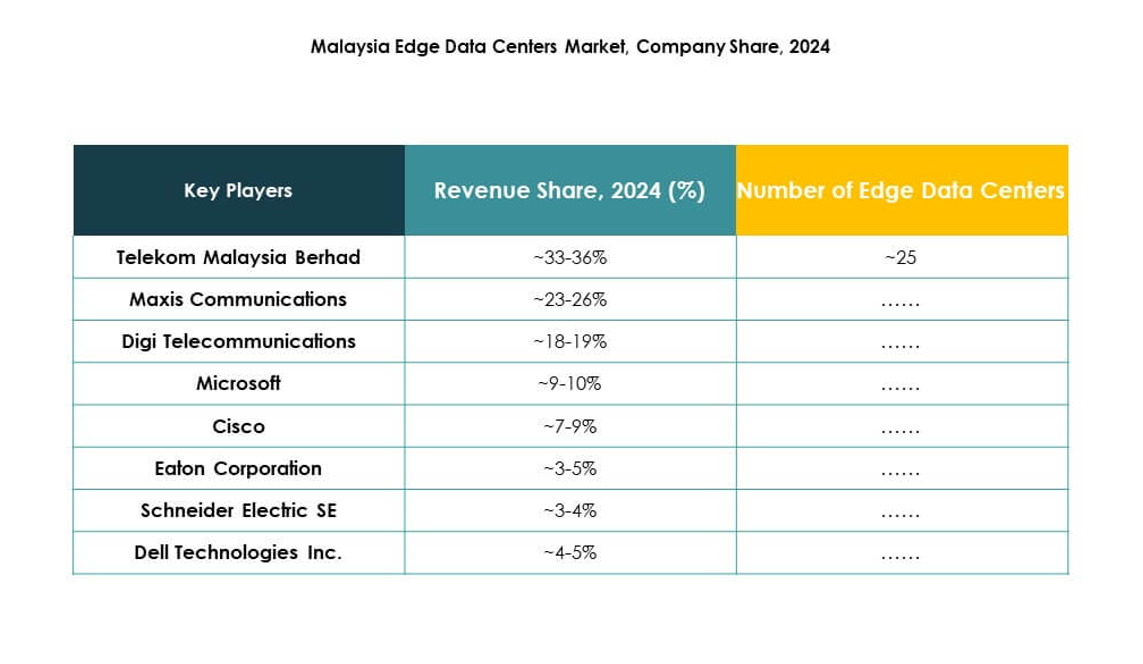

Competitive Insights:

- Telekom Malaysia Berhad

- Maxis Communications

- Digi Telecommunications

- TIME dotCom Berhad

- Redtone Berhad

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

- VMWare

- Schneider Electric SE

- Rittal GmbH & Co. Kg

The competitive landscape of the Malaysia Edge Data Center Market features a mix of domestic telecom operators and global technology leaders. It is driven by aggressive infrastructure expansion, advanced solution integration, and partnerships focused on network modernization. Local firms strengthen national connectivity through edge network rollouts, while international players supply hardware, software, and cloud services. Strategic alliances between these groups enable faster deployment and service innovation. The market is witnessing rising investment in energy-efficient systems, hybrid edge models, and secure connectivity layers. Competitive strategies focus on expanding colocation capacity, enhancing automation capabilities, and building sustainable infrastructure for high-growth digital industries.

Recent Developments:

- In September 2025, Vantage Data Centers revealed plans to acquire a hyperscale data center campus in Johor as part of a significant US$1.6 billion investment to expand its Asia-Pacific presence. The Johor campus, acquired from Yondr Group’s portfolio and supported by major investors like GIC and Abu Dhabi Investment Authority, is expected to deliver more than 300MW of capacity across three centers when fully developed.

- In August 2025, Open DC announced the launch of its new PE2 data center in Penang, Malaysia, establishing it as the largest data center facility on the island according to the company’s claims. This development represents a key milestone in the region’s edge data center landscape and is aimed at meeting the increasing demand for localized digital infrastructure in northern Malaysia.

- In January 2025, Aurora Mobile’s AI platform GPTBots entered into a major partnership with REDtone Digital Berhad to accelerate AI application development and digital transformation initiatives for enterprise customers, aiming to drive intelligent upgrades in Malaysia and across Southeast Asia.

- In Feb 2025, Maxis Communications announced a significant upgrade to its data center infrastructure via a new partnership with Nokia. This includes deploying Nokia’s cutting-edge 7220 Interconnect Router data center switches and event-driven automation technology across multiple Maxis data centers, enhancing network scalability and operational simplicity to support business growth and AI/cloud adoption in Malaysia.

- In June 2024, Telekom Malaysia Berhad (TM) entered into a landmark strategic partnership with Nxera (Singtel’s data center arm) to jointly develop a hyper-connected, AI-ready data center campus in Johor, Malaysia. This venture will see the creation of a state-of-the-art facility aimed at serving hyperscalers and enterprises, leveraging TM’s domestic network and Nxera’s expertise in sustainable and scalable data centers.