Executive summary:

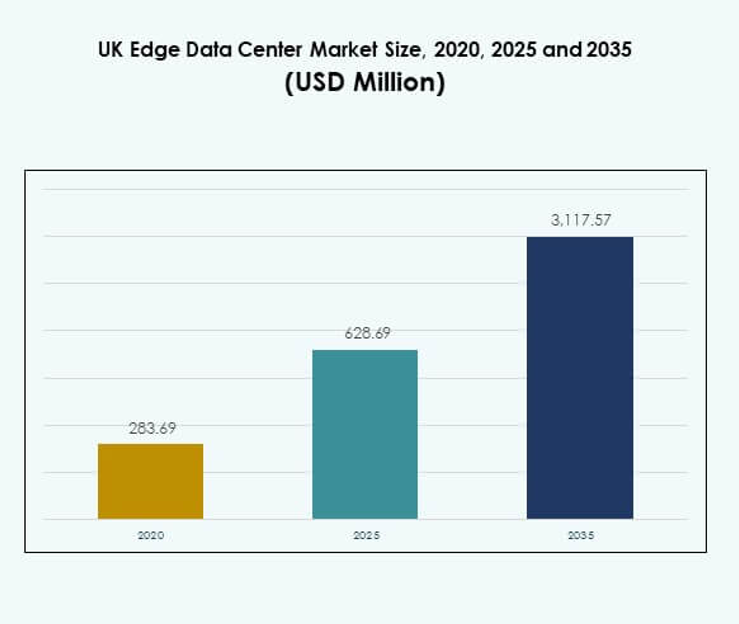

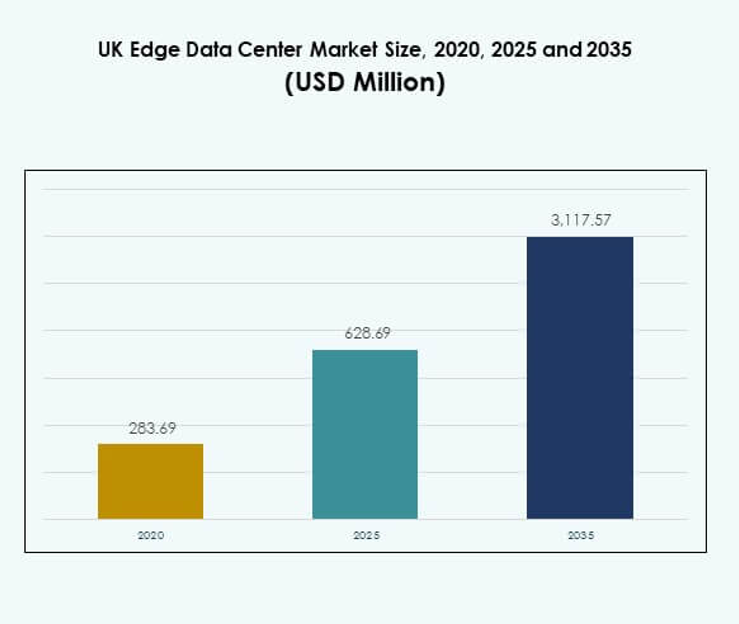

The UK Edge Data Center Market size was valued at USD 283.69 million in 2020, reached USD 628.69 million in 2025, and is anticipated to attain USD 3,117.57 million by 2035, growing at a CAGR of 17.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| UK Edge Data Center Market Size 2025 |

USD 628.69 Million |

| UK Edge Data Center Market, CAGR |

17.22% |

| UK Edge Data Center Market Size 2035 |

USD 3,117.57 Million |

The UK edge data center market is driven by rapid technology adoption, 5G rollout, and growing AI and IoT integration across industries. Businesses are investing in modular, energy-efficient, and low-latency infrastructure to support data-intensive operations. The market holds strategic importance for enterprises and investors seeking enhanced data control, reduced latency, and improved operational agility. Innovation in power management and hybrid cloud models continues to shape its competitive edge.

Regionally, England dominates the market due to London’s strong data infrastructure, financial sector, and high network density. Scotland is emerging as a hub for green data centers powered by renewable energy, attracting sustainability-focused investors. Wales and Northern Ireland are witnessing growth through regional connectivity programs and government-backed digital initiatives supporting industrial edge expansion.

Market Drivers

Rising Adoption of Edge Computing and 5G Integration

The UK Edge Data Center Market is driven by strong demand for edge computing to reduce latency and support real-time data processing. The integration of 5G technology enhances network speed, enabling faster response times for IoT applications. It supports industries like healthcare, automotive, and retail through low-latency communication. Businesses rely on these centers to improve operational efficiency and service delivery. Telecom operators are expanding 5G-enabled infrastructure to meet data-intensive requirements. This shift toward localized data storage strengthens digital ecosystems. The market’s expansion aligns with the UK’s smart infrastructure initiatives.

- For example, in Q1 2025, BT Group made its 5G Standalone network available to 28 million people across 50 major UK towns and cities. The company confirmed plans to expand this coverage to reach 34 million people by August 2025 and achieve nationwide 99% population coverage by 2030, supporting low-latency IoT and real-time enterprise applications.

Growing Cloud-Driven Transformation and Data Volume Expansion

The increasing adoption of cloud services fuels the growth of edge facilities across the UK. Enterprises require local data processing to minimize dependency on central cloud servers. It helps maintain regulatory compliance and supports secure data handling for sensitive sectors. Organizations use edge centers to manage workloads efficiently and reduce bandwidth costs. The growing number of connected devices further drives local data generation. Technology companies are investing in modular and scalable data center solutions. This transition supports digital transformation goals. The market’s cloud synergy makes it crucial for enterprise agility and competitiveness.

Innovation in Energy-Efficient and Modular Infrastructure Designs

Sustainability and innovation remain major growth pillars in the UK Edge Data Center Market. Energy-efficient cooling systems and modular architectures are transforming facility construction. It allows scalability while minimizing carbon emissions. Vendors are investing in renewable power integration and automation tools. These developments align with the UK’s environmental policies and carbon reduction goals. Modular data centers enable quick deployment in remote areas, increasing accessibility. Businesses view green infrastructure as both a cost advantage and a brand value driver. The market benefits from rising investment in eco-friendly digital infrastructure.

- For example, in 2025, STACK Infrastructure secured over USD 6 billion in green financing to expand its sustainable data center portfolio. The funding supports large-scale developments focused on energy-efficient operations and environmental performance, reinforcing STACK’s leadership in sustainable hyperscale infrastructure.

Strategic Investments and National Digital Transformation Policies

Government policies promoting digital economy expansion encourage private investments in edge infrastructure. The UK government’s support for AI, IoT, and cloud innovation strengthens domestic data processing capabilities. It attracts technology firms and investors seeking stable infrastructure for future technologies. Enterprises are localizing data management to ensure compliance with data sovereignty laws. The trend supports the creation of high-performance digital ecosystems. Strategic partnerships between telecom and cloud providers are shaping competitive advantages. Investments in data localization enhance resilience against cross-border data disruptions. This government and corporate synergy ensures long-term industry sustainability.

Market Trends

Expansion of AI and IoT Workloads Across Edge Facilities

AI-driven automation and IoT adoption are reshaping the operational dynamics of the UK Edge Data Center Market. It supports real-time decision-making by processing data near the source. AI applications in predictive maintenance, healthcare diagnostics, and autonomous mobility rely on this infrastructure. Enterprises leverage machine learning to improve energy management within facilities. Demand for GPU-powered edge servers continues to grow. Integration of AI models into industrial and commercial processes is accelerating. The combination of data analytics and edge computing enhances intelligence across connected systems. This trend drives innovation across multiple verticals.

Emergence of Hybrid Edge Models and Distributed Architectures

Organizations are adopting hybrid models that combine cloud and on-premises edge facilities. This structure enhances flexibility and ensures efficient data management. It enables enterprises to handle sensitive data locally while utilizing cloud scalability. Industries with strict data privacy requirements, such as finance and defense, prefer hybrid solutions. The rise of distributed architectures reduces dependency on central networks. Service providers are optimizing workloads between cloud and edge layers. These architectures improve network resilience and operational performance. The trend defines a new phase of infrastructure modernization.

Rising Demand for Edge-as-a-Service and Managed Solutions

Managed service providers are offering Edge-as-a-Service models to support enterprise scalability. It reduces the capital investment required for infrastructure ownership. Businesses adopt this model for faster deployment and predictable costs. Providers handle operations, monitoring, and maintenance, allowing clients to focus on core activities. The model supports SMEs aiming for digital expansion without heavy resource allocation. Integration with automation platforms enhances service quality and uptime. Enterprises seek managed services for AI, analytics, and data hosting. The demand for flexible edge service models is shaping new revenue streams.

Focus on Decentralized Energy and Renewable Power Integration

Sustainability remains a top trend across new edge data center deployments in the UK. Companies invest in renewable power sources to minimize carbon output. It helps maintain regulatory compliance and achieve environmental goals. Solar and wind energy integration enhances long-term cost efficiency. Smart grids support reliable power supply and resilience during demand surges. Green data centers also appeal to investors prioritizing ESG portfolios. This environmental transition aligns with the UK’s commitment to net-zero emissions. It positions the market as a model for sustainable digital infrastructure.

Market Challenges

High Capital Requirements and Infrastructure Modernization Costs

The UK Edge Data Center Market faces high upfront investment costs due to complex infrastructure needs. Building edge facilities demands capital for power systems, cooling, and security solutions. It limits participation of small enterprises and delays large-scale deployment. The requirement for skilled labor and advanced technologies further increases expenditure. Managing distributed data center networks adds operational complexity. Many businesses struggle to balance cost efficiency with performance reliability. It challenges scalability for new market entrants. The high investment threshold slows regional network expansion.

Data Security, Regulatory Compliance, and Connectivity Barriers

Stringent data protection laws and privacy standards increase operational challenges for edge operators. Compliance with GDPR requires precise data localization and encryption mechanisms. It creates pressure on companies to secure multi-location systems. Connectivity issues in rural areas limit widespread edge deployment. Cybersecurity threats also pose major risks to sensitive data handling. The rapid expansion of IoT devices raises potential vulnerabilities. It drives the need for continuous monitoring and threat intelligence solutions. Balancing performance with security remains a major operational hurdle.

Market Opportunities

Expansion of Edge Ecosystem Through AI and IoT Adoption

The UK Edge Data Center Market offers major opportunities in AI-based workload processing and IoT data analysis. It enables industries to leverage localized data intelligence for faster insights. Integration of robotics, smart manufacturing, and autonomous systems creates new demand for low-latency computing. Startups and global players can develop AI-ready edge platforms. Partnerships with telecom operators enhance network efficiency. Growing AI investments open new revenue channels for infrastructure providers. The market’s alignment with future technologies makes it attractive for investors.

Sustainability, Green Infrastructure, and Government Support

Eco-friendly infrastructure creates significant investment opportunities in renewable energy and smart cooling solutions. It encourages companies to align with national decarbonization goals. Government-backed initiatives and public-private partnerships drive funding access. Data center operators can capitalize on green certifications to attract ESG-conscious clients. The trend toward modular, energy-efficient facilities support faster expansion. It enables companies to lower operating costs and achieve sustainable growth. The shift toward low-carbon data processing reinforces the UK’s leadership in digital innovation.

Market Segmentation

By Component

Solutions dominate the UK Edge Data Center Market with a significant share due to rising demand for hardware, cooling, and power systems. It helps enterprises achieve operational efficiency and scalability. Services such as installation and maintenance are expanding rapidly with outsourcing adoption. Managed services providers play a crucial role in system integration. The segment’s growth is supported by strong vendor partnerships and technological advancements. Continuous innovation enhances deployment flexibility and system reliability.

By Data Center Type

Colocation edge data centers hold the largest share due to their cost-effective and scalable nature. They allow enterprises to share infrastructure while maintaining secure environments. Cloud and edge facilities are expanding to meet real-time data demands. Enterprise-owned centers cater to specific workload customization needs. Managed data centers ensure regulatory compliance and optimized performance. It supports industry-specific processing for financial and retail sectors. The segment’s flexibility makes it essential in digital transformation strategies.

By Deployment Model

Hybrid deployment leads the market with strong adoption across industries seeking balance between flexibility and control. It integrates on-premises and cloud-based infrastructure for efficient workload management. On-premises models serve industries with data sovereignty concerns. Cloud-based deployment appeals to enterprises with scalability goals. Hybrid infrastructure supports real-time analytics and low latency. It allows dynamic data transfer between networks for optimized performance. The model’s adaptability ensures long-term infrastructure resilience.

By Enterprise Size

Large enterprises dominate due to their advanced IT budgets and higher workload needs. They invest in multiple edge facilities to enhance regional data distribution. SMEs are rapidly adopting cloud-based and managed solutions for affordability. It supports digital innovation without significant capital commitment. Large firms leverage AI and IoT at scale to improve efficiency. The segment’s diversity ensures competitive service options. This balance strengthens overall industry growth and adoption.

By Application / Use Case

Power monitoring and capacity management applications hold a strong position in the UK Edge Data Center Market. They support energy efficiency, load balancing, and real-time equipment monitoring. Environmental monitoring and BI analytics tools enhance performance insights. Asset management systems ensure uptime and predictive maintenance. These applications allow seamless operations and lower operational costs. The segment benefits from automation adoption across facilities. Its efficiency improvements drive consistent market expansion.

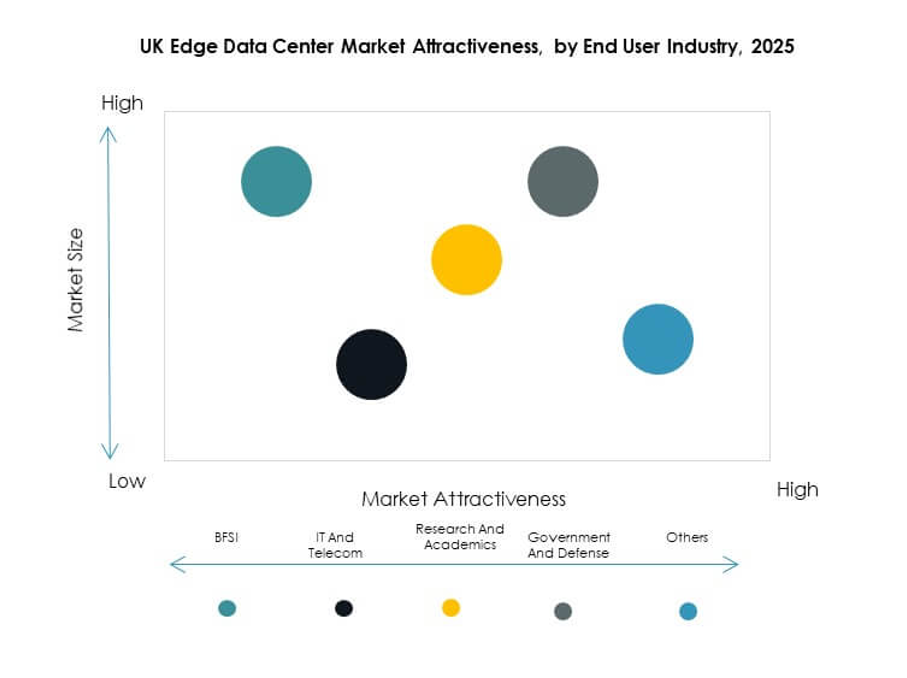

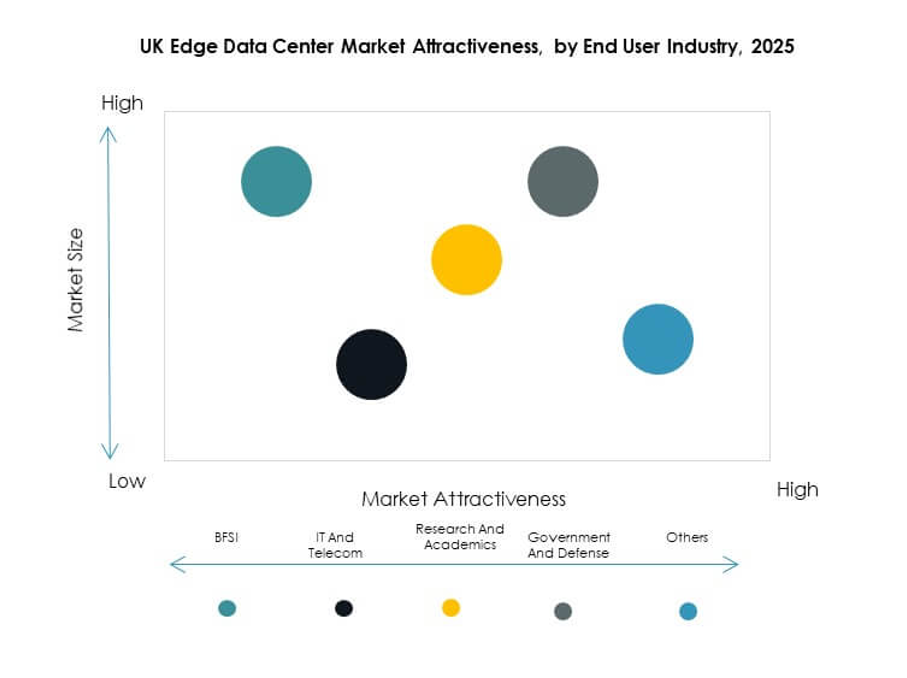

By End User Industry

IT and telecommunications lead the market due to massive data generation and 5G infrastructure rollout. BFSI, retail, and healthcare sectors are fast-growing users due to digital transformation needs. Aerospace and defense industries rely on secure, low-latency networks for mission-critical operations. Energy and utilities adopt edge data centers for predictive maintenance and smart grid management. The diverse adoption across industries highlights the market’s versatility. It strengthens digitalization efforts and operational resilience.

Regional Insights

England: Market Leader with 41% Share

England leads the UK Edge Data Center Market with a 41% share, driven by strong infrastructure and urban connectivity. London serves as the primary hub for colocation and cloud-edge facilities. It supports hyperscale and enterprise-level operations through high-speed network access. The financial and technology sectors contribute heavily to demand. Continuous investment in 5G and fiber infrastructure supports growth. England’s innovation ecosystem ensures rapid technology adoption.

- For example, the Equinix LD7 facility in Slough provides 71,000 sq ft of technical space and supports over 2,600 cabinet equivalents with a minimum power density of 6 kVA per rack. All buildings within the campus are cross-connected, enabling high-density deployments for financial and technology sector clients.

Scotland: Emerging Hub for Sustainable Edge Deployments (32% Share)

Scotland accounts for 32% of the market, supported by renewable energy integration and data center investments. It benefits from cooler climates and availability of green power sources. Edge deployments near industrial and AI research zones are expanding. It attracts enterprises seeking low-carbon operations. The government’s sustainability focus aligns with global green data goals. Scotland’s digital ecosystem is fostering collaboration between universities and tech firms.

- For example, DataVita’s Fortis data centre in Scotland operates on 100% renewable energy and achieves a Power Usage Effectiveness (PUE) of 1.18. The facility is recognized among the most energy-efficient data centres in Scotland, reflecting strong sustainability and operational performance standards.

Wales and Northern Ireland: Growing Regional Connectivity (27% Share)

Wales and Northern Ireland together capture 27% of the UK Edge Data Center Market. They are witnessing increased investment in regional and cross-border connectivity. It supports edge nodes for logistics, retail, and manufacturing sectors. Development of industrial clusters drives local demand for data processing. Rural digitization projects encourage micro-edge deployments. Government support for broadband expansion strengthens competitiveness. These regions are evolving into key growth corridors for edge infrastructure.

Competitive Insights:

- BT Group

- Megacable Holdings

- Telehouse (KDDI Group)

- Endeavor Business Media

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco Systems Inc.

- SixSq

- Microsoft Corporation

- VMware Inc.

- Schneider Electric SE

- Rittal GmbH & Co. KG

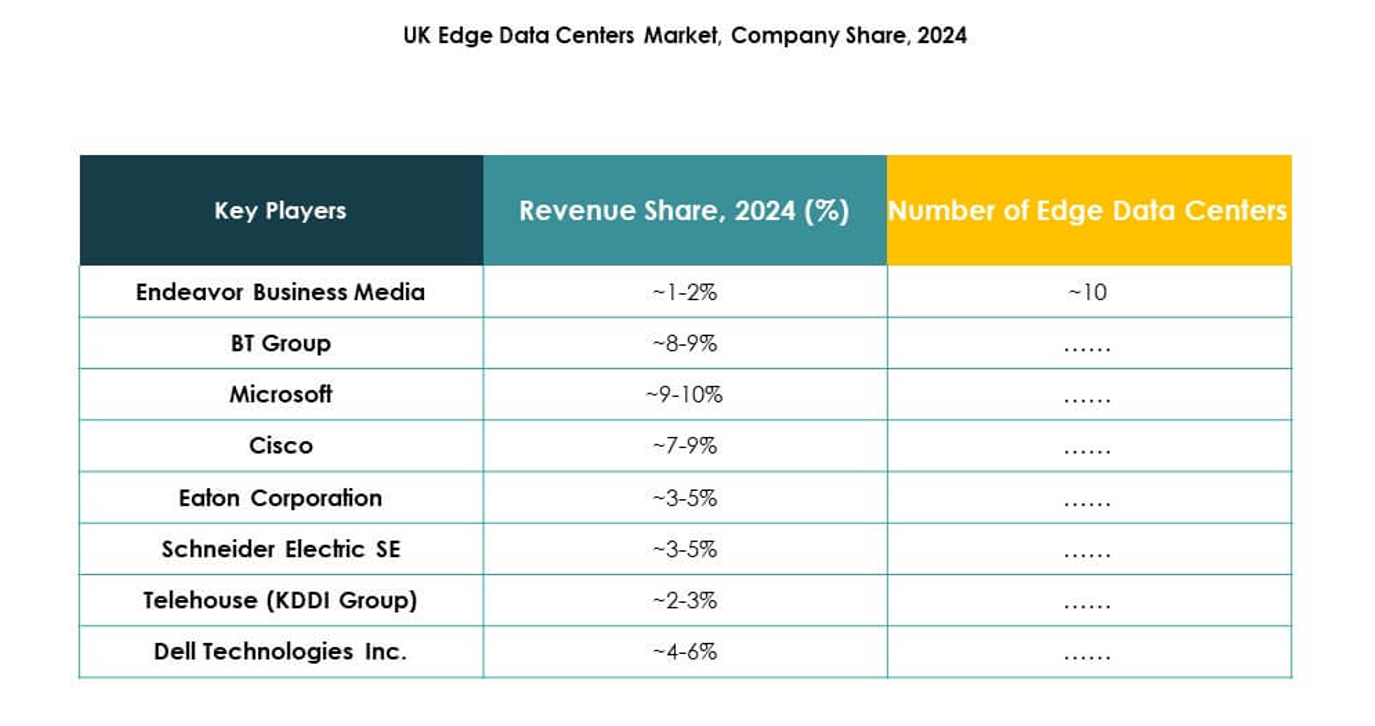

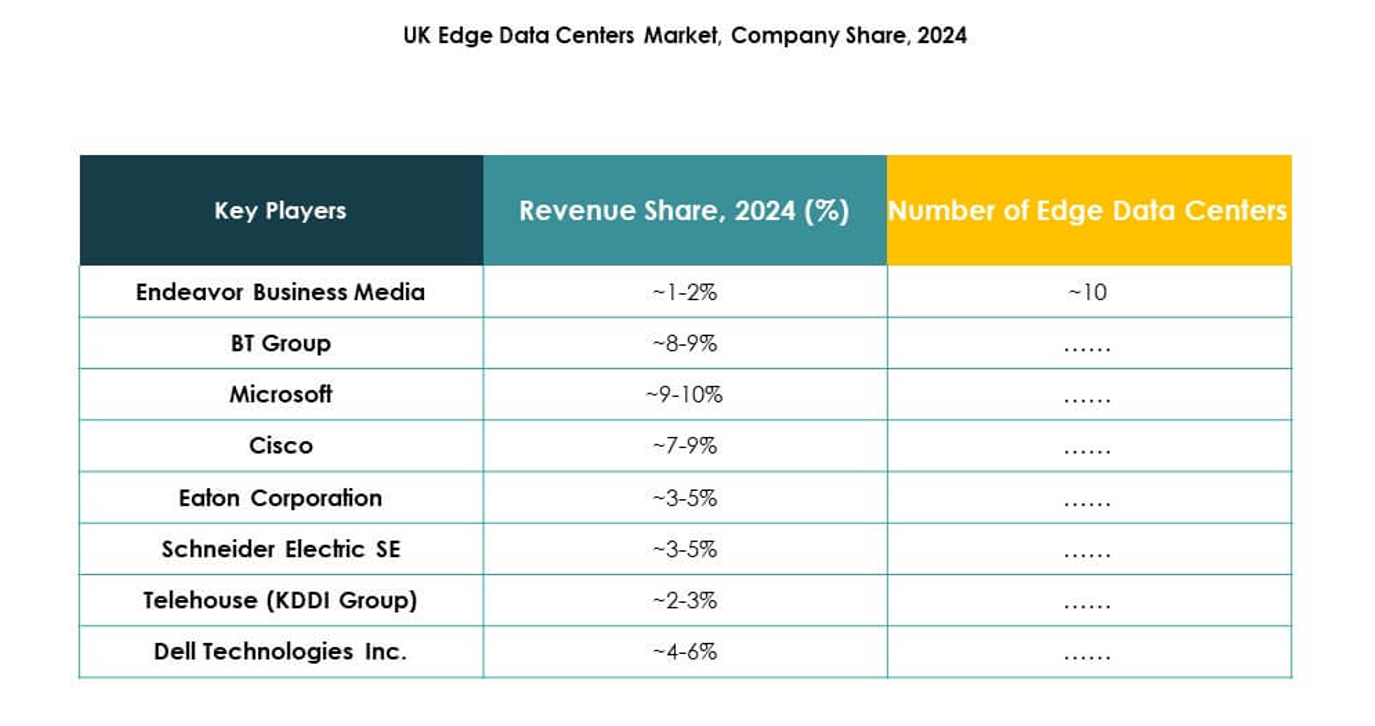

The UK Edge Data Center Market features strong competition among global and domestic players focusing on scalability, sustainability, and edge connectivity. It emphasizes investments in modular infrastructure, renewable power integration, and AI-enabled monitoring systems. Major technology providers such as Dell Technologies, Cisco, and Microsoft expand cloud-edge networks to improve low-latency computing. Hardware specialists like Schneider Electric and Rittal focus on efficient cooling and power systems. Telecom and colocation operators, including BT Group and Telehouse, strengthen service capacity through regional expansion. Partnerships and acquisitions remain central to securing market presence and technological leadership.

Recent Developments:

- In October 2025, Gcore announced the launch of its AI Cloud Stack, a next-generation software platform designed to accelerate the deployment of private AI clouds with hyperscaler-level functionality across edge sites in the UK. This product is tailored to help enterprises and data center operators build high-performance, secure, AI-driven edge infrastructure suitable for advanced applications and low-latency requirements.

- In September 2024, Telehouse, part of KDDI Group, launched an expansion at its Telehouse South facility in London, opening two new floors and adding 5.4MW of IT capacity. This brings the total facility capacity to 7.7MW, with plans for further growth, and underlines Telehouse’s commitment to delivering sustainable, scalable edge infrastructure solutions in the UK.

- In June 2025, Eaton Corporation formed a strategic partnership with Siemens Energy to deliver standardized, modular data center power and onsite generation systems. This initiative targets streamlined construction and integration of grid-independent energy for new data centers, specifically addressing urgent capacity and uptime demands in the UK edge market.

- In May 2025, Dell Technologies debuted new partnerships and expanded offerings as part of its AI Factory initiative at Dell Technologies World 2025. The company introduced fully validated end-to-end AI infrastructure platforms with support for Intel Gaudi 3 accelerators and strengthened its collaboration with AMD, expanding edge AI capabilities for enterprise and data center customers in the UK.

- In January 2024, EdgeConneX—the global edge data center provider—announced a new partnership with EQT Infrastructure VI fund to build and operate high-powered, purpose-built data centers for hyperscale customers, supporting expansion in the UK and globally. This partnership aims to add hundreds of megawatts of new data center capacity, specifically meeting the needs of AI and cloud infrastructure