Executive summary:

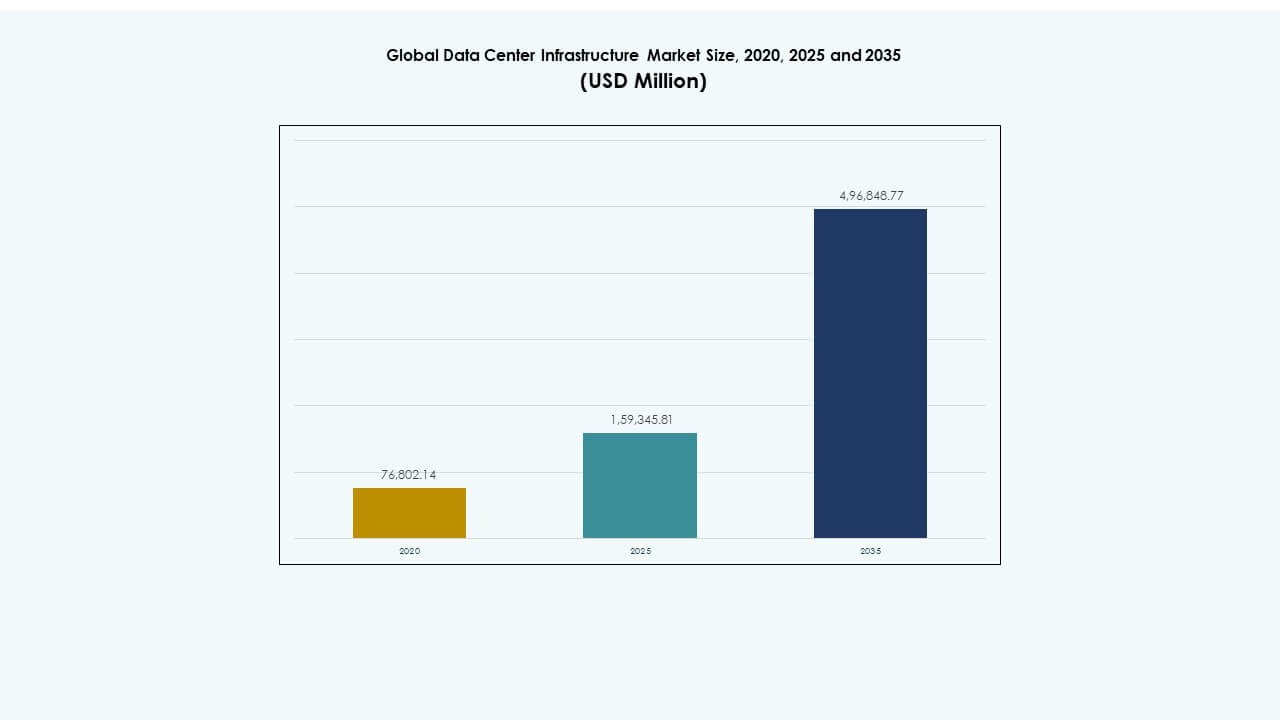

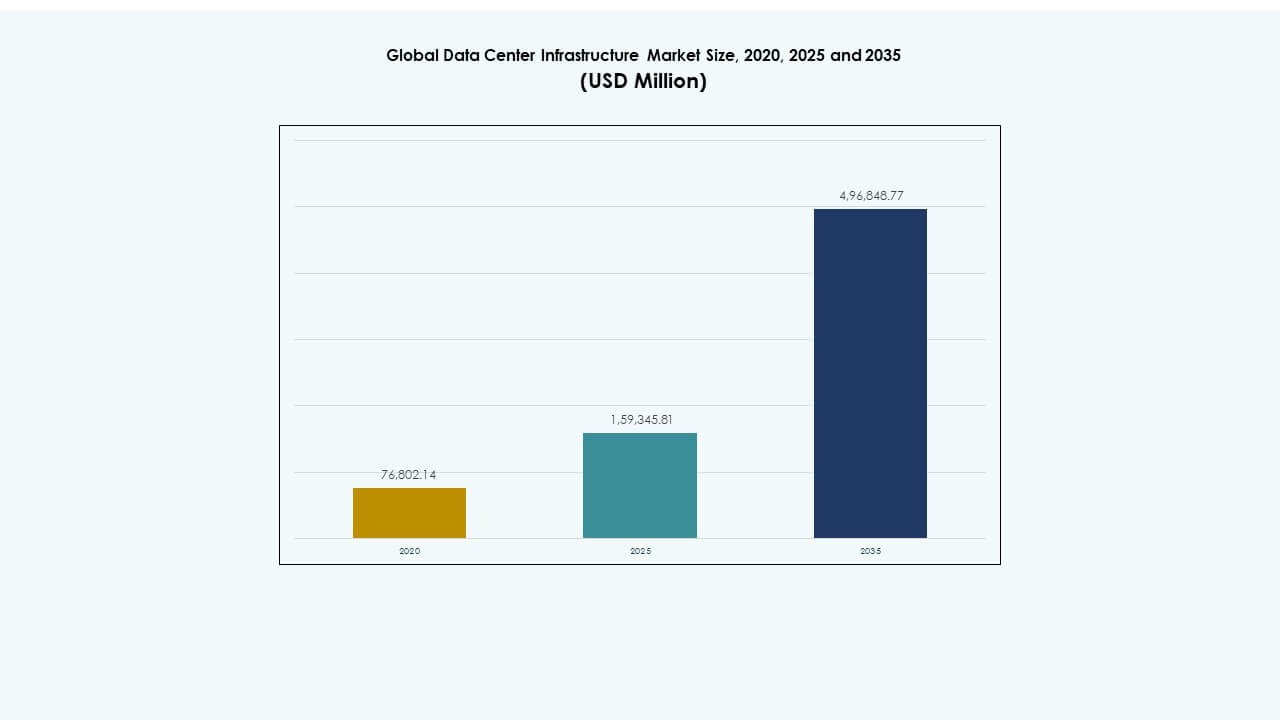

The Global Data Center Infrastructure Market size was valued at USD 76,802.14 million in 2020 to USD 159,345.81 million in 2025 and is anticipated to reach USD 496,848.77 million by 2035, at a CAGR of 11.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Infrastructure Market Size 2025 |

USD 159,345.81 Million |

| Data Center Infrastructure Market, CAGR |

11.96% |

| Data Center Infrastructure Market Size 2035 |

USD 496,848.77 Million |

Rising demand for cloud computing, AI processing, and data analytics drives infrastructure upgrades worldwide. Enterprises invest heavily in modular, scalable, and energy-efficient systems to handle exponential data growth. Advancements in cooling technologies, power systems, and automation improve operational resilience and reduce total cost of ownership. The Global Data Center Infrastructure Market plays a strategic role in enabling digital transformation, making it a priority for hyperscale operators, investors, and governments pursuing sustainable technology ecosystems.

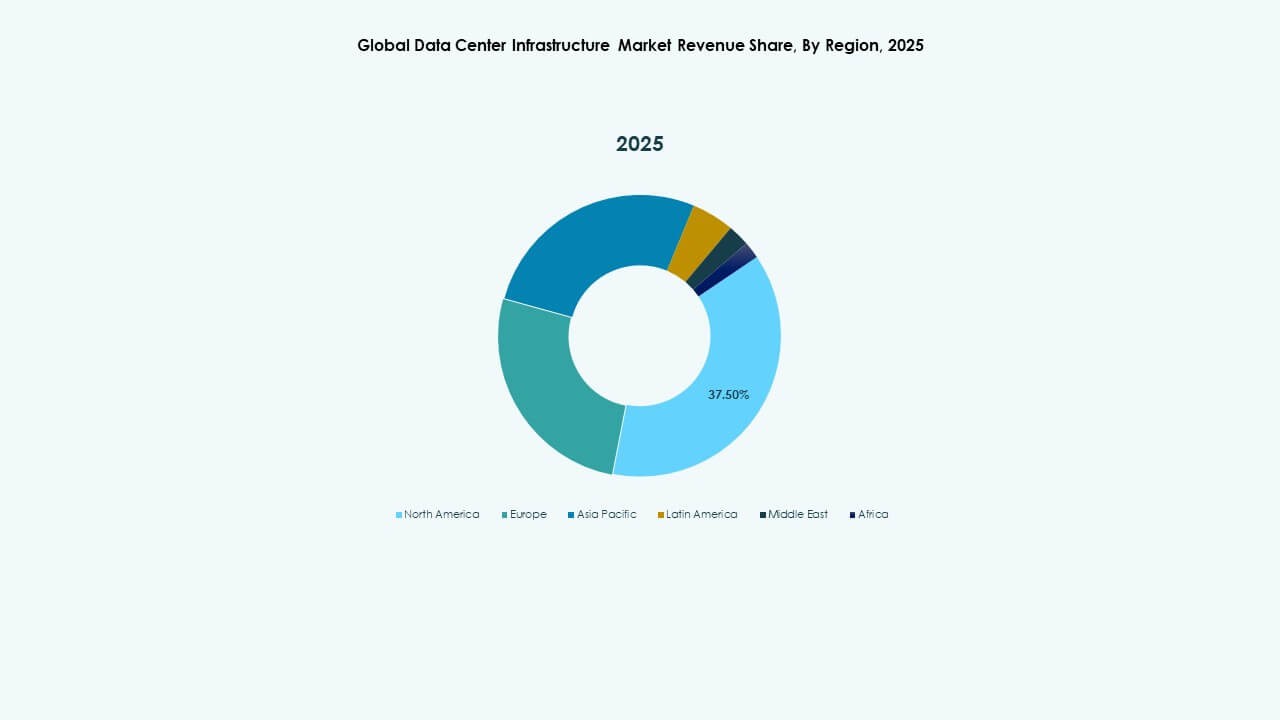

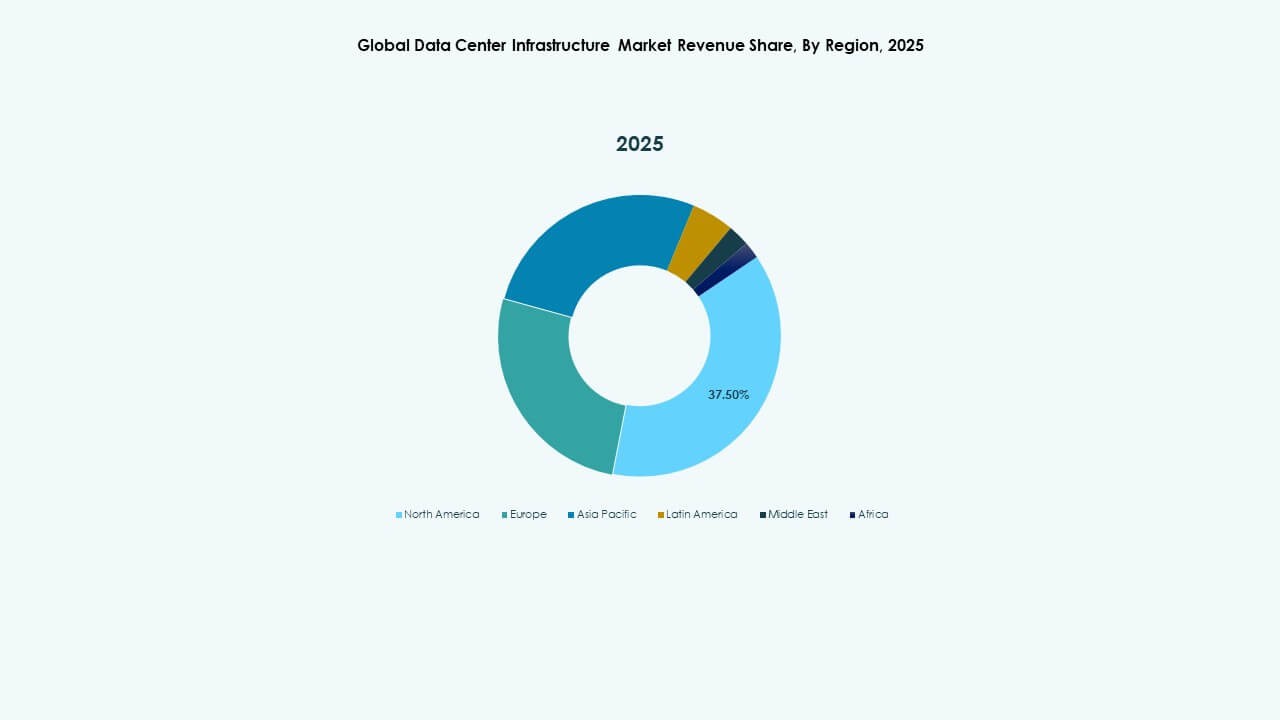

North America leads the market due to a strong hyperscale presence and rapid AI-driven workload expansion. Europe follows with strict energy efficiency standards and large colocation developments. Asia-Pacific emerges as the fastest-growing region supported by increasing digitalization across China, India, and Southeast Asia. Latin America, the Middle East, and Africa show rising potential driven by cloud adoption, data localization, and infrastructure modernization.

Market Drivers

Market Drivers

Expansion of High-Density Data Processing and Enterprise Virtualization

The Global Data Center Infrastructure Market grows through rising demand for dense computing environments. Enterprises shift workloads toward cloud and edge infrastructure to achieve faster analytics and lower latency. Virtualization enables better hardware utilization and resource optimization. IT teams deploy scalable architectures to meet surging data volumes from AI and IoT applications. Hardware modernization aligns with corporate sustainability goals by lowering power use. Data centers increasingly combine advanced cooling and automation to maintain uptime. Enterprises see infrastructure upgrades as essential for digital transformation success. It delivers stronger operational resilience and long-term scalability.

- For example, Equinix demonstrated strong growth in hybrid cloud and AI infrastructure in 2025, evidenced by closing 4,100 deals and adding 6,200 net interconnections, totaling over 492,000 interconnections globally.

Adoption of Energy-Efficient Infrastructure and Cooling Systems

Enterprises pursue greener data center operations to control power costs and meet sustainability mandates. Modern infrastructure integrates liquid cooling, AI-driven monitoring, and energy reuse systems. Operators design low-PUE facilities to minimize energy waste. The Global Data Center Infrastructure Market benefits from advanced cooling materials and smart airflow management. Demand grows for renewable-powered centers with efficient energy routing. Investors prioritize low-carbon footprints as part of risk mitigation strategies. Infrastructure vendors develop modular solutions to optimize cooling across hybrid environments. It strengthens global progress toward climate-resilient and efficient data management ecosystems.

Shift Toward Edge Data Centers and Distributed Computing Models

Edge deployment transforms infrastructure design across telecom and enterprise segments. Businesses seek smaller, localized nodes to support 5G, real-time analytics, and latency-sensitive workloads. Modular edge sites expand processing capacity beyond traditional hubs. The Global Data Center Infrastructure Market evolves with decentralized architectures that connect remote operations to core networks. Manufacturers introduce compact and pre-engineered units that shorten deployment timelines. Energy optimization supports stable performance in constrained spaces. It provides businesses with agility and service continuity in distributed environments. Faster response times enhance the user experience across digital platforms.

Integration of Automation, AI, and Predictive Management Tools

Automation redefines how data centers handle maintenance, performance, and security. Operators integrate AI-driven systems that predict failures before downtime occurs. Software-defined infrastructure enables adaptive resource allocation. The Global Data Center Infrastructure Market benefits from platforms combining real-time analytics with automated workflows. Predictive management minimizes costs while improving availability. Enterprises reduce manual oversight and enhance infrastructure transparency. Automation platforms now extend across networking, storage, and power domains. It promotes long-term reliability and operational excellence within complex, multi-tenant environments.

- For example, in 2025, Cisco launched its AI-ready Data Center Infrastructure solutions, including the Cisco Data Fabric architecture designed to enhance operational resilience and automate analytics. These innovations support predictive management, improved resource optimization, and stronger reliability across hyperscale and enterprise data centers.

Market Trends

Market Trends

Rising Investments in Hyperscale and Cloud-Native Infrastructure Expansion

Hyperscale operators dominate investment plans as digital workloads accelerate. Cloud-native deployments require vast physical infrastructure to support AI training and global connectivity. The Global Data Center Infrastructure Market witnesses rapid hyperscale buildouts across leading tech regions. Multi-billion-dollar projects expand rack densities and storage throughput. Providers build interlinked facilities to support hybrid cloud models. Expansion across tiered facilities enables flexible capacity scaling. Enterprises align with hyperscale ecosystems for performance and redundancy. It drives innovation cycles across power systems, cabling, and automation technologies.

Adoption of Modular and Prefabricated Infrastructure Solutions

Operators increasingly choose modular infrastructure for faster deployment and cost control. Prefabricated data halls and containerized modules reduce construction timelines significantly. The Global Data Center Infrastructure Market experiences strong momentum for plug-and-play scalability. These setups lower upfront investment risks while improving flexibility. Vendors optimize module configurations to fit regional power standards and space limitations. Enterprises value consistent design and simplified maintenance. Modularization allows operators to scale capacity with market demand. It ensures reliability without extended project delays or high integration costs.

Growing Focus on Security Integration and Resilient Design Models

Data centers adopt advanced physical and cybersecurity integration to safeguard assets. Multi-layered systems combine biometric authentication, AI-based surveillance, and predictive monitoring. The Global Data Center Infrastructure Market aligns facility security with regulatory compliance frameworks. Operators embed disaster recovery mechanisms into physical design to ensure resilience. Security investments address both physical intrusion and cyber sabotage risks. Governments enforce data protection laws shaping facility designs globally. Resilient design enables continuous operation during grid failures. It enhances trust among clients managing critical digital infrastructure.

Widespread Adoption of AI-Based Infrastructure Management Platforms

AI-based management platforms are transforming infrastructure oversight and performance control. These systems enable real-time decision-making across power, cooling, and network systems. The Global Data Center Infrastructure Market grows as AI automates fault detection and resource distribution. Intelligent dashboards provide predictive analytics that guide maintenance planning. Software-defined models deliver transparency and reduce unplanned downtime. Enterprises improve service reliability through autonomous infrastructure control. AI integration ensures adaptive capacity scaling based on workload intensity. It reinforces proactive operations across globally connected data environments.

Market Challenges

High Capital Expenditure and Operational Complexity Across Facilities

Establishing large-scale centers requires significant capital investment and advanced engineering. Complex integration of power, cooling, and IT components raises project costs. The Global Data Center Infrastructure Market faces hurdles from lengthy approval processes and land scarcity. Supply chain disruptions delay critical hardware deployment. Skilled labor shortages add pressure on timelines and costs. Managing multiple vendor systems introduces technical inconsistencies. Compliance with regional data laws raises additional expenditure. It challenges profitability across expanding multinational operations.

Sustainability Pressures and Energy Supply Constraints

Energy consumption remains a major constraint across expanding data centers. Operators face rising scrutiny over power usage and carbon emissions. The Global Data Center Infrastructure Market must balance efficiency with reliability under grid limitations. Regions with unstable energy infrastructure encounter performance risks. Renewable energy integration remains limited in developing markets. Heat dissipation challenges strain traditional cooling methods. Governments impose stricter energy regulations affecting expansion strategies. It compels firms to innovate sustainable designs to ensure long-term viability.

Market Opportunities

Market Opportunities

Expansion in Emerging Economies with Growing Digital Infrastructure

Emerging markets offer strong opportunities for greenfield projects and capacity buildout. Rapid internet adoption fuels investment in localized facilities. The Global Data Center Infrastructure Market gains traction across Asia, Africa, and Latin America. Governments launch initiatives to attract hyperscale and colocation providers. Affordable land and incentives strengthen regional competitiveness. Local cloud adoption drives need for compliant, scalable infrastructure. It allows investors to capture growth from underserved digital economies.

Rising Demand for Green and Renewable-Powered Data Centers

Sustainability trends create strong potential for renewable-powered infrastructure models. Operators prioritize solar, wind, and hydro integration into existing grids. The Global Data Center Infrastructure Market benefits from demand for low-emission facilities. Vendors introduce eco-certified components and waste heat recovery systems. Enterprises seek partners meeting ESG targets for long-term collaboration. Efficient technologies enhance brand reputation and investor confidence. It positions operators as leaders in responsible infrastructure modernization.

Market Segmentation:

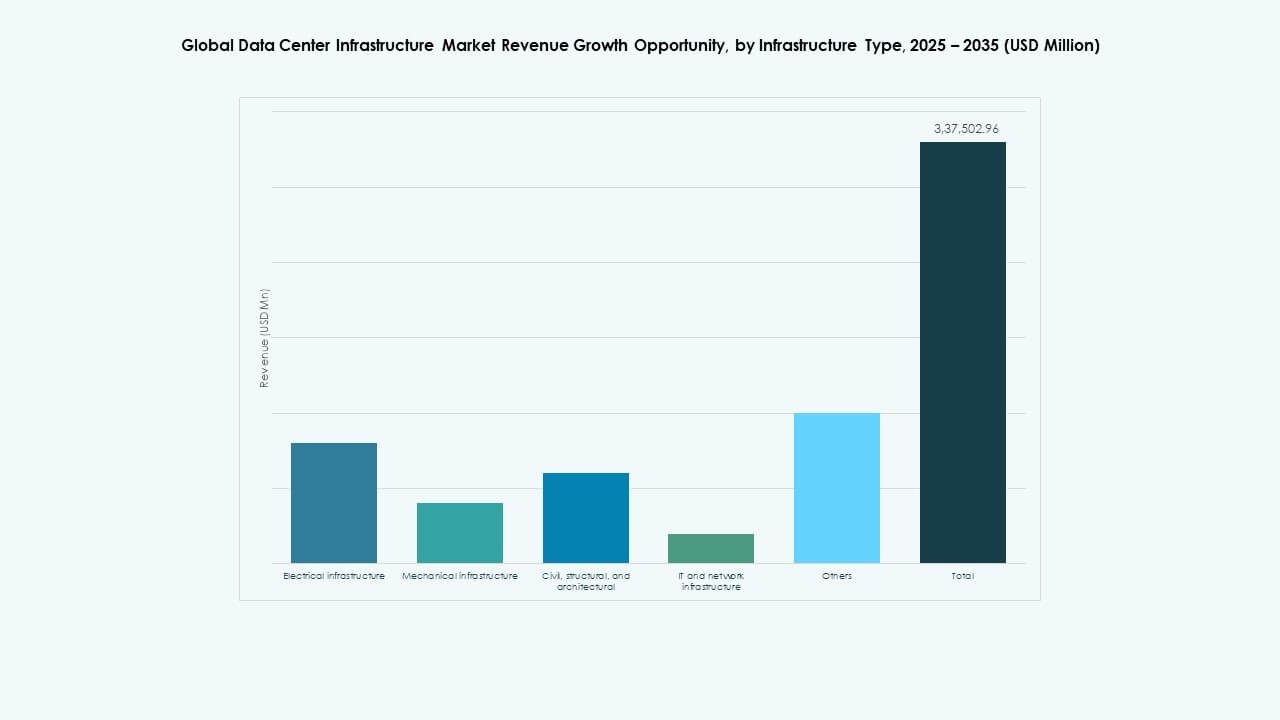

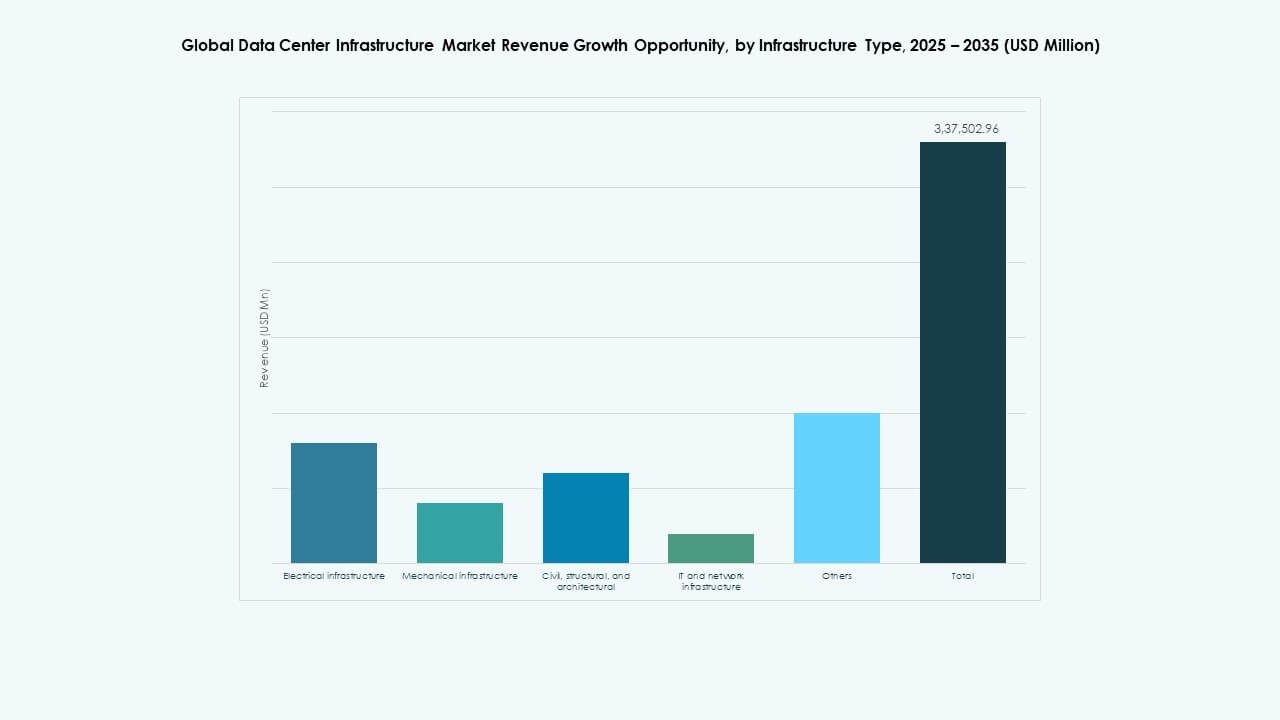

By Infrastructure Type

Electrical infrastructure dominates the Global Data Center Infrastructure Market due to its critical role in ensuring continuous power supply and operational reliability. UPS systems, PDUs, and switchgears form the backbone of facility uptime. Mechanical and IT network infrastructures also contribute significantly, driven by increased cooling needs and high-performance computing. Civil and architectural components support modular and prefabricated design trends. Demand for integrated, scalable, and energy-efficient setups remains strong across hyperscale and enterprise facilities.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems lead the segment due to their essential role in maintaining uptime during grid failures. Battery Energy Storage Systems (BESS) gain momentum through renewable integration and peak-load optimization. PDUs and switchgears enhance efficiency in high-density environments. The Global Data Center Infrastructure Market benefits from investments in advanced grid connections and power redundancy. Rising power demand pushes innovation in lithium-ion storage, dynamic voltage regulation, and smart distribution frameworks.

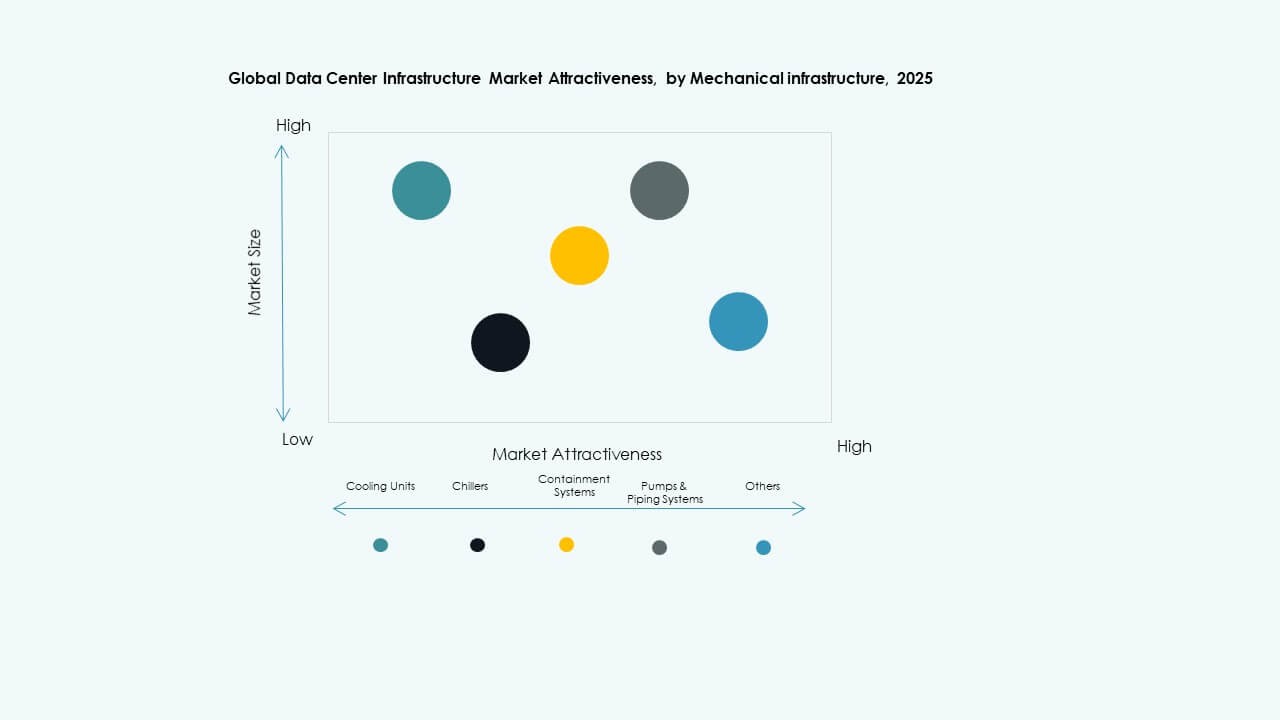

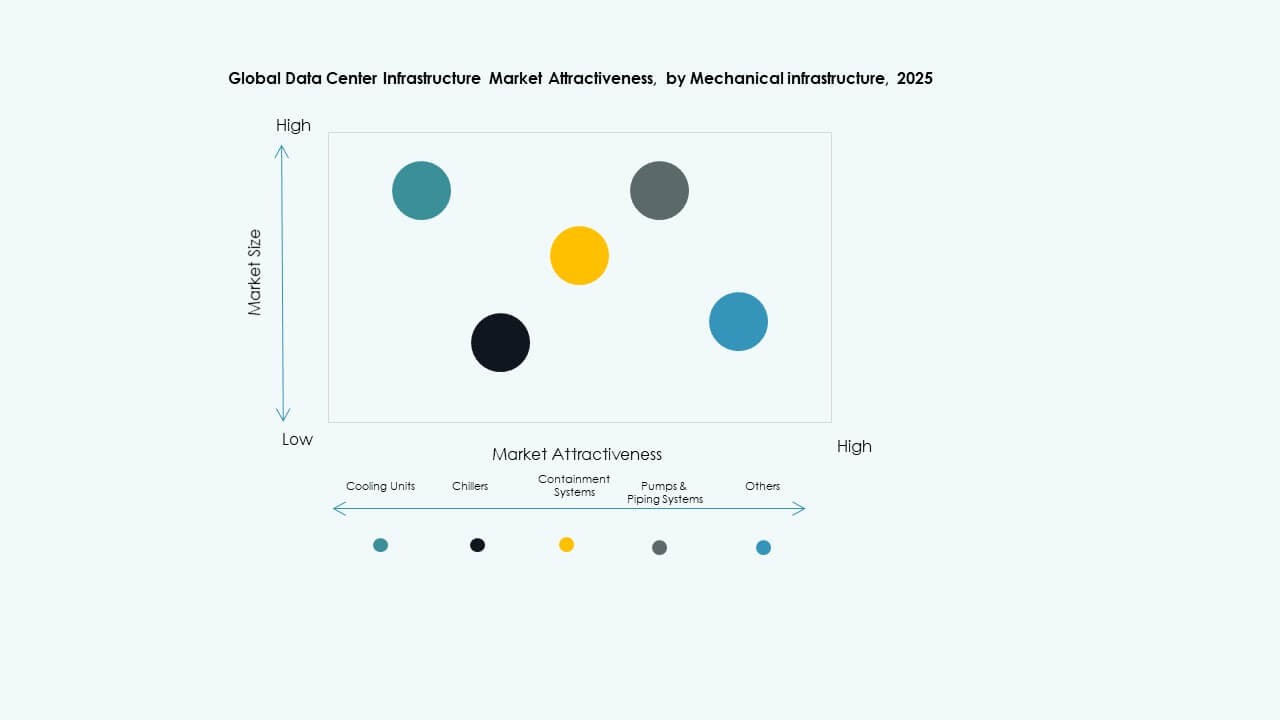

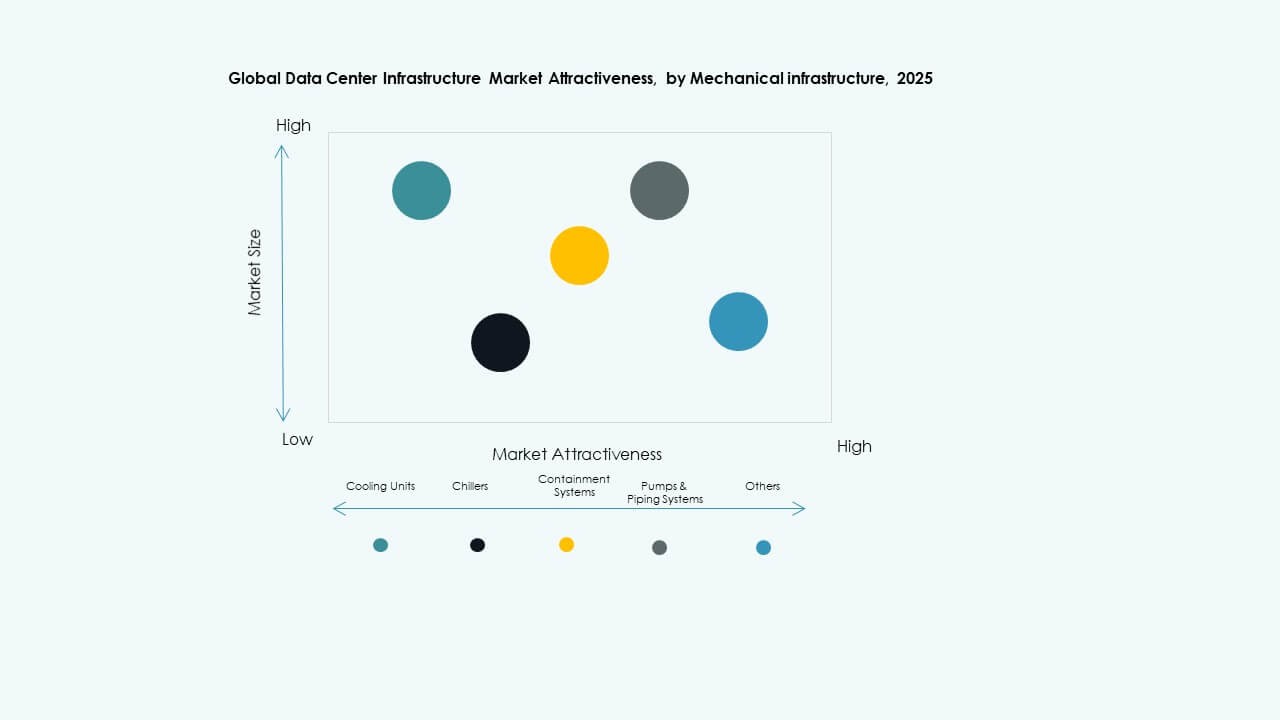

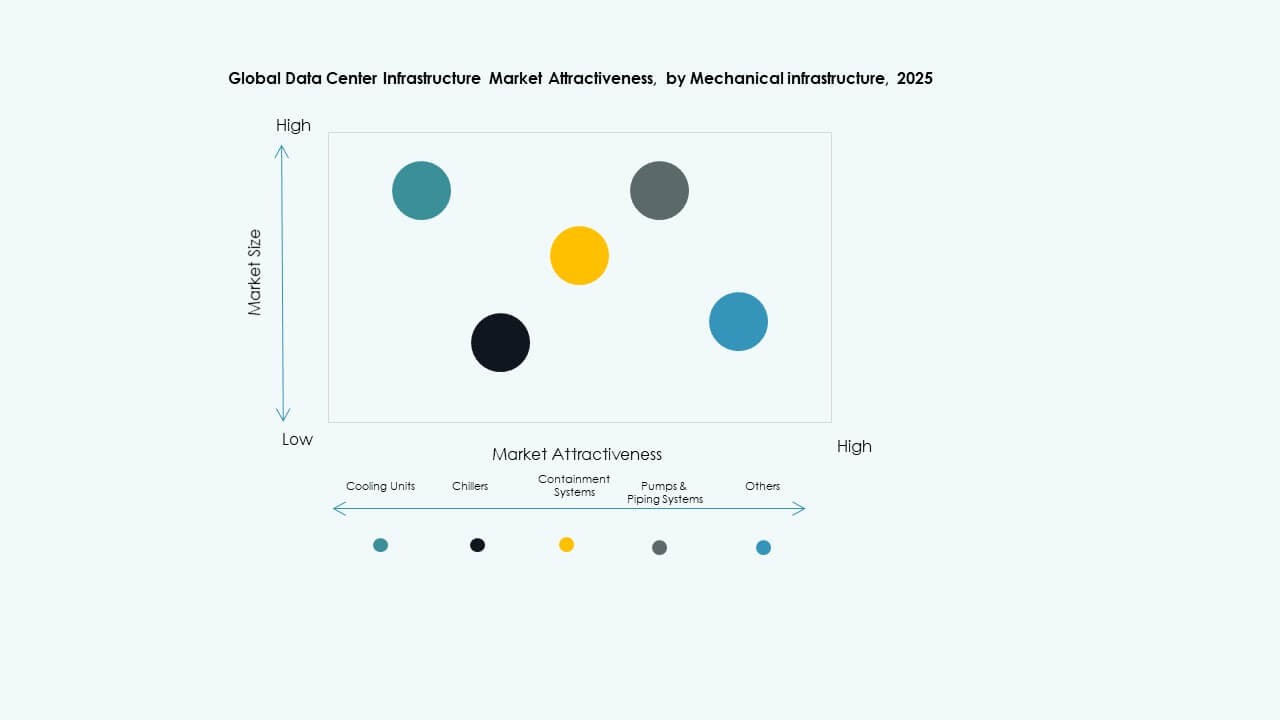

By Mechanical Infrastructure

Cooling units, particularly CRAC and CRAH systems, dominate mechanical infrastructure due to their vital function in thermal management. Chillers and containment systems expand rapidly with the shift to high-density racks and liquid cooling solutions. Modular and AI-optimized cooling designs improve energy efficiency. The Global Data Center Infrastructure Market experiences growth from sustainability goals and PUE optimization. Pumps and piping upgrades strengthen reliability and adapt to varying climatic conditions.

By Civil / Structural & Architectural

Modular and prefabricated building systems account for major growth within civil infrastructure. These approaches shorten construction timelines and reduce on-site labor needs. Superstructure designs now emphasize flexibility, seismic resistance, and airflow optimization. The Global Data Center Infrastructure Market benefits from investments in sustainable construction materials and design-build contracts. Raised floors and envelope improvements enhance thermal performance. Cost efficiency and adaptability remain key purchasing drivers.

By IT & Network Infrastructure

Servers and networking equipment dominate IT infrastructure spending as demand for AI and cloud workloads surges. Storage expansion follows with increasing adoption of high-speed SSD and NVMe systems. The Global Data Center Infrastructure Market grows with rapid deployment of optical fiber cabling and 400G networks. Racks and enclosures evolve toward higher density and airflow efficiency. Vendors focus on scalable and automated platforms supporting real-time data flow and analytics.

By Data Center Type

Hyperscale data centers lead in market share due to continuous investment by cloud giants. Colocation centers grow steadily, driven by enterprises seeking shared, secure, and compliant environments. Edge data centers show rising adoption across telecom and IoT use cases. The Global Data Center Infrastructure Market expands as enterprise data centers modernize legacy systems. Scalability, interconnectivity, and regional latency reduction fuel segment evolution globally.

By Delivery Model

Design-build and EPC models dominate project execution due to their integrated planning and cost-control benefits. Turnkey solutions gain traction among hyperscale operators seeking fast deployment. Modular factory-built models see rapid growth for scalability and sustainability. The Global Data Center Infrastructure Market supports diverse contracting frameworks to meet regional compliance and timeline demands. Retrofit and upgrade services rise with modernization of legacy facilities.

By Tier Type

Tier 3 data centers hold the largest share for their balance of redundancy, efficiency, and operational resilience. Tier 4 facilities expand in regulated sectors requiring fault tolerance and 100% uptime. Tier 1 and 2 centers serve smaller enterprises and regional applications. The Global Data Center Infrastructure Market trends toward hybrid tier adoption to meet mixed workloads. Energy efficiency and SLA compliance guide new tier design preferences.

Regional Insights:

Regional Insights:

North America

The North America Global Data Center Infrastructure Market size was valued at USD 29,607.99 million in 2020 to USD 59,756.27 million in 2025 and is anticipated to reach USD 185,205.35 million by 2035, at a CAGR of 11.89% during the forecast period. North America holds approximately 37% of the global share. The region leads due to high cloud adoption, strong internet infrastructure, and presence of hyperscale operators. The U.S. dominates investments, followed by Canada, driven by colocation and enterprise upgrades. Power efficiency and modular data center deployments support market momentum. It benefits from mature digital ecosystems and rising AI-driven workloads. Government and private funding accelerate construction across tier 3 and tier 4 facilities. Sustainable energy integration remains a key focus across major operators.

- For example, in H1 2025, Northern Virginia, the largest U.S. data center hub, recorded an 80% rise in under-construction capacity to 2,078.2 megawatts, with 538.6 megawatts of net absorption. This surge highlights the region’s continued leadership in large-scale data center development and infrastructure expansion.

Europe

The Europe Global Data Center Infrastructure Market size was valued at USD 21,509.82 million in 2020 to USD 41,791.31 million in 2025 and is anticipated to reach USD 122,258.58 million by 2035, at a CAGR of 11.25% during the forecast period. Europe accounts for about 24% of the global market share. Growth is driven by GDPR compliance, data localization policies, and green infrastructure mandates. Major hubs such as the UK, Germany, and the Netherlands attract continuous hyperscale expansion. Energy-efficient cooling and renewable-powered campuses shape regional strategy. The Global Data Center Infrastructure Market in Europe emphasizes modular and sustainable builds. Regional operators adopt hybrid models to balance cost and capacity. It remains a critical region for digital resilience and sovereign data operations.

Asia Pacific

The Asia Pacific Global Data Center Infrastructure Market size was valued at USD 18,327.99 million in 2020 to USD 42,965.84 million in 2025 and is anticipated to reach USD 149,844.12 million by 2035, at a CAGR of 13.20% during the forecast period. The region commands nearly 30% of global share, showing the fastest growth trajectory. China, India, Japan, and Australia are major contributors supported by rapid digitalization. Strong demand from hyperscale and cloud service providers boosts facility expansion. Infrastructure modernization aligns with 5G rollout and edge deployments. The Global Data Center Infrastructure Market benefits from local manufacturing and government-backed investments. Colocation and AI-ready data centers gain popularity. It positions Asia Pacific as the next global powerhouse in digital infrastructure.

- For example, in 2025, China’s cloud and AI-focused firms announced major capital expenditure increases aiming to expand data-center capacity to support rising AI demand. Analysts expect electricity capacity for data centers in China to grow significantly this year to meet the surge.

Latin America

The Latin America Global Data Center Infrastructure Market size was valued at USD 3,812.06 million in 2020 to USD 7,781.61 million in 2025 and is anticipated to reach USD 22,027.67 million by 2035, at a CAGR of 10.89% during the forecast period. Latin America captures nearly 4% of total market share. Brazil leads regional expansion with ongoing hyperscale and telecom infrastructure projects. Chile, Colombia, and Mexico follow with improved connectivity and renewable energy use. The Global Data Center Infrastructure Market grows through increased enterprise cloud adoption. Power reliability and regional interconnectivity drive demand for modular centers. Governments support digital transformation through tax incentives. It establishes Latin America as a key emerging zone for scalable data infrastructure.

Middle East

The Middle East Global Data Center Infrastructure Market size was valued at USD 2,004.54 million in 2020 to USD 3,967.71 million in 2025 and is anticipated to reach USD 10,359.30 million by 2035, at a CAGR of 10.00% during the forecast period. The region holds about 3% of global share. The UAE and Saudi Arabia lead large-scale data center investments aligned with national digital agendas. Expansion of hyperscale zones and government cloud initiatives accelerate growth. The Global Data Center Infrastructure Market benefits from adoption of AI, IoT, and smart city applications. High temperatures drive innovation in advanced cooling systems. Colocation and telecom-backed data centers expand across major urban clusters. It enhances regional data sovereignty and cross-border connectivity.

Africa

The Africa Global Data Center Infrastructure Market size was valued at USD 1,539.75 million in 2020 to USD 3,083.06 million in 2025 and is anticipated to reach USD 7,153.75 million by 2035, at a CAGR of 8.69% during the forecast period. Africa accounts for roughly 2% of global share. South Africa dominates the market, followed by Nigeria and Egypt, driven by telecom-led digital initiatives. Growing cloud adoption and international submarine connectivity stimulate investment. The Global Data Center Infrastructure Market gains traction through regional innovation hubs. Infrastructure deficits and energy shortages limit scalability in some zones. Modular and solar-powered centers emerge as efficient alternatives. It represents a strong long-term opportunity for digital ecosystem growth.

Competitive Insights:

Competitive Insights:

- Schneider Electric

- ABB

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- Eaton Corporation plc

- Vertiv Group Corp.

- Huawei Technologies Co., Ltd.

- IBM

- Fujitsu

Industry leaders deploy wide-ranging solutions across power, cooling, network, and IT infrastructure. Schneider Electric and ABB maintain strength in power distribution and energy management, making them go-to providers for mission-critical facilities. Dell, HPE, Cisco, Huawei, and IBM lead in servers, networking, storage, and full-stack IT infrastructure. Eaton and Vertiv supply backup power, cooling, and rack solutions that support high-density deployments. Market competition encourages firms to bundle electrical, mechanical, and IT infrastructure to offer integrated solutions. The Global Data Center Infrastructure Market rewards suppliers who deliver reliability, scalability, and energy efficiency. Firms with modular and prefabricated offerings tend to win contracts for new builds and upgrades. This competitive environment pushes innovation and favours companies with broad portfolios and global reach.

Recent Developments:

Recent Developments:

- In November 2025, Vertiv announced the acquisition of HVAC services firm PurgeRite for approximately USD 1 billion. The acquisition aims to expand Vertiv’s liquid-cooling and thermal-management capabilities to meet rising demand from high-power, AI-driven data centers. This enhances Vertiv’s mechanical infrastructure offerings in cooling and HVAC services

- In November 2025, Schneider Electric secured roughly USD 2.3 billion in new U.S. data-center contracts. The deals include major supply agreements with a hyperscale operator and a leading colocation provider to supply power modules, cooling systems, UPS units and switchgear over 2025–2026.

- In October 2025, Hitachi signed a strategic partnership with OpenAI to expand global AI data-center infrastructure. Under this agreement, the companies will co-develop modular and prefabricated data-center designs, energy-efficient cooling and storage infrastructures, and plan supply-chain strategies for reliable deployment. The deal targets sustainable data-center operations and rapid global expansion of AI infrastructure

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

- In May 2025, NTT DATA announced the accelerated expansion of its Global Data Centers division with land acquisitions across North America, Europe, and Asia, supporting nearly a gigawatt of planned data center capacity as part of a $10 billion investment through 2027.

Market Drivers

Market Drivers Market Trends

Market Trends Market Opportunities

Market Opportunities Regional Insights:

Regional Insights: Competitive Insights:

Competitive Insights: Recent Developments:

Recent Developments: