Executive summary:

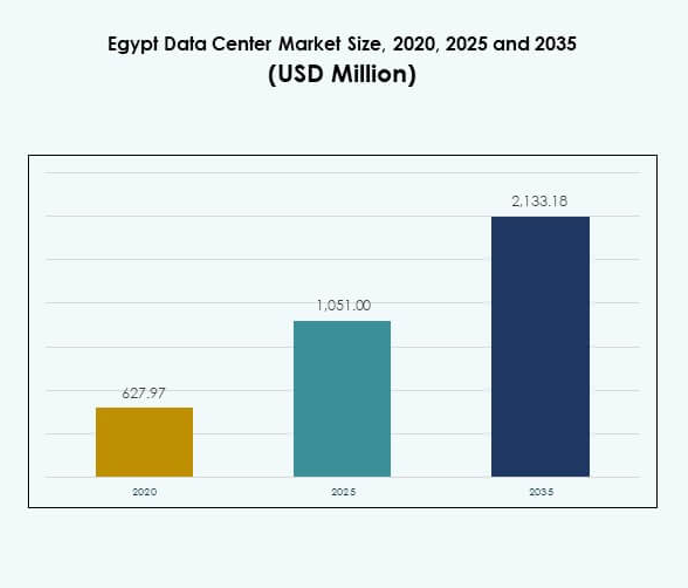

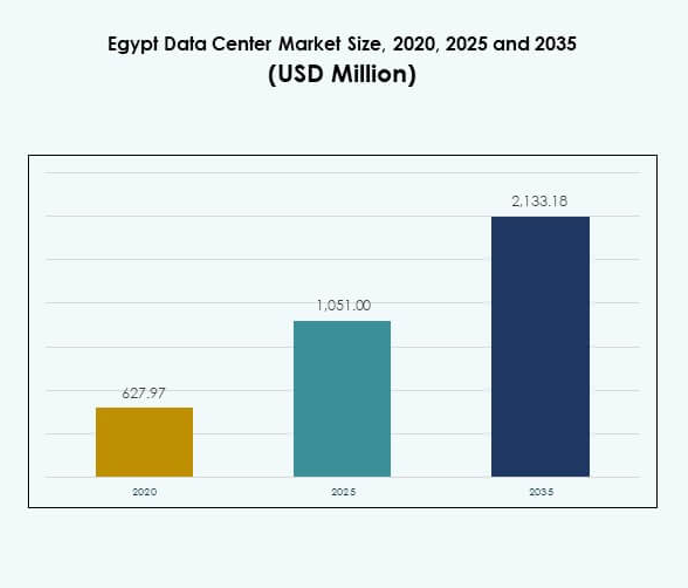

The Egypt Data Center Market size was valued at USD 627.97 million in 2020 to USD 1,051.00 million in 2025 and is anticipated to reach USD 2,133.18 million by 2035, at a CAGR of 7.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Egypt Data Center Market Size 2025 |

USD 1,051.00 Million |

| Egypt Data Center Market, CAGR |

7.24% |

| Egypt Data Center Market Size 2035 |

USD 2,133.18 Million |

The market is advancing through strong cloud adoption, digital transformation, and AI integration across industries. Enterprises are deploying hybrid and modular facilities to meet growing demand for efficiency, resilience, and scalability. Green initiatives, renewable-powered facilities, and smart automation are driving innovation in operations. Government support for ICT development strengthens Egypt’s role as a digital hub. For investors, the market holds strategic importance due to its capacity to connect Africa, Europe, and the Middle East.

North Africa leads the market with Egypt’s infrastructure positioning it as a digital gateway to multiple regions. Strong undersea cable connectivity and advanced ICT adoption give Egypt a competitive edge. The Middle East shows rising integration with Egypt through enterprise and telecom collaborations. Sub-Saharan Africa is emerging as a growth frontier, with rising digital adoption supported by regional partnerships. This mix of leadership and emerging potential reinforces Egypt’s importance in the wider data center landscape.

Market Drivers

Market Drivers

Rising Demand for Cloud Services and Accelerated Digital Transformation

The Egypt Data Center Market is expanding rapidly due to the widespread adoption of cloud services. Enterprises across banking, retail, and telecom sectors are deploying scalable infrastructure to manage increasing workloads. Government-led initiatives for digital transformation are creating a favorable investment environment. Businesses view Egypt as a key hub linking Africa, Europe, and the Middle East. The push for automation, e-governance, and AI solutions is fueling infrastructure upgrades. Cloud-native platforms are driving enterprise modernization. Multinational providers are strengthening partnerships with local players. Investors see Egypt’s data economy as an emerging powerhouse.

Growing Investments in Colocation, Edge Computing, and Modular Infrastructure

Colocation is gaining momentum due to the need for flexible and cost-effective hosting. Enterprises rely on colocation providers to reduce capital expenditure while ensuring security. The Egypt Data Center Market is seeing higher adoption of modular and edge designs for agility. Demand from media, fintech, and healthcare sectors supports this trend. Modular centers reduce deployment time and improve energy efficiency. Investors target edge deployments to bring services closer to end-users. Telecom companies are driving edge adoption through 5G networks. It positions Egypt as a regional hub for low-latency services.

- For instance, Egypt inaugurated its first government data and cloud computing center in April 2024, spanning 23,500 sqm, with space for more than 10,000 sqm of technical infrastructure, supported by contributions from 15 local and international companies, and housing advanced AI and disaster recovery operations for ministries.

Innovation in Green Data Centers and Energy-Efficient Technologies

Sustainability is a major driver influencing investment decisions. Operators are introducing renewable energy integration and advanced cooling methods. The Egypt Data Center Market is adopting liquid cooling, free-air systems, and energy storage technologies. Enterprises prefer facilities with lower PUE metrics to cut operational costs. Green certifications attract global players seeking sustainable expansion. Solar energy projects are linked with new data center builds. Partnerships with utilities strengthen the ecosystem for renewable-driven facilities. Investors are aligning with global ESG frameworks while entering the Egyptian market.

- For instance, Egypt is preparing to establish a green data center project fueled by around 200 megawatts of solar and wind power, part of its official plan to scale renewable capacity for data center infrastructure and reduce its carbon footprint.

Strategic Importance of Egypt as a Regional Digital Gateway

Egypt’s geographic position at the intersection of major submarine cables enhances its appeal. Global cloud providers recognize its role in enabling international connectivity. The Egypt Data Center Market benefits from its role as a bridge to Africa and Europe. Businesses utilize Egypt as a hub to expand regional reach. The government’s vision for a digital economy reinforces investor confidence. Enterprises focus on hybrid and multicloud strategies to achieve resilience. ICT infrastructure development is positioning Egypt as a top-tier digital hub. Long-term prospects rely on strategic partnerships and government backing.

Market Trends

Expansion of Artificial Intelligence and High-Performance Computing Applications

The integration of AI workloads is reshaping the Egypt Data Center Market. Enterprises invest in GPU-accelerated computing to handle advanced analytics. AI adoption in healthcare, fintech, and government services demands higher processing power. High-performance computing supports critical workloads including simulations and predictive analytics. Operators are adapting infrastructure for high-density deployments. Liquid cooling and AI-ready facilities are becoming standard investments. This trend accelerates Egypt’s positioning as a technology-driven hub. Investors see strong potential in supporting AI ecosystems across industries.

Integration of Smart Automation and Data Center Infrastructure Management Tools

Automation is driving operational excellence across Egyptian facilities. The Egypt Data Center Market is incorporating DCIM, orchestration, and monitoring solutions to optimize performance. Enterprises demand visibility into capacity, power, and security. AI-based automation ensures predictive maintenance and reduces downtime risks. Smart systems are also being used for workload distribution. Operators invest in monitoring platforms for sustainability compliance. This reduces operational costs and enhances efficiency. The shift toward software-driven management makes Egypt’s centers globally competitive.

Rising Role of Hybrid and Multicloud Deployments Among Enterprises

Hybrid strategies dominate enterprise IT roadmaps. The Egypt Data Center Market reflects this shift as organizations deploy multicloud environments. Hybrid models provide flexibility and security while meeting compliance demands. Enterprises balance on-premise, cloud, and colocation resources. Demand for data sovereignty drives adoption of private cloud solutions. Multinational providers are expanding cloud availability zones in Egypt. Enterprises prefer hybrid models to ensure workload resilience. The growing need for cost optimization reinforces multicloud preference. Hybrid adoption is set to remain a defining trend in the future.

Development of Carrier-Neutral and Interconnected Ecosystems

Carrier-neutral data centers are gaining importance in Egypt. The Egypt Data Center Market is moving toward interconnected ecosystems that host multiple service providers. Enterprises benefit from cost-effective connectivity and reduced vendor lock-in. Neutral hubs support cloud on-ramps, fintech services, and content delivery networks. Telecom providers are entering into partnerships with colocation players. This strengthens interconnection points across Africa, Europe, and Asia. Enhanced network density improves latency-sensitive applications. Carrier-neutral ecosystems foster collaboration and drive Egypt’s digital growth.

Market Challenges

High Energy Consumption and Pressure to Ensure Sustainable Operations

Energy demand remains a key challenge in the Egypt Data Center Market. Operators face rising electricity costs while trying to maintain efficiency. Power-intensive cooling and AI workloads add further complexity. Meeting global sustainability standards requires significant capital investment. Renewable energy integration is progressing but remains limited in scale. Grid stability also raises concerns for large-scale deployments. Enterprises face difficulties aligning ESG goals with operational realities. It creates financial and operational risks for both local and global players.

Regulatory Barriers and Data Sovereignty Concerns Affecting Investments

Compliance challenges hinder seamless growth in the Egypt Data Center Market. Enterprises face restrictions tied to data residency and cybersecurity regulations. These rules increase the complexity of cross-border operations. Global investors seek clarity on evolving policy frameworks. Fragmented regulations slow the pace of multicloud adoption. Security certification requirements add to operational costs. Concerns about data sovereignty also influence enterprise cloud strategies. Investors remain cautious while evaluating long-term commitments. It highlights the need for consistent policies to attract greater capital flow.

Market Opportunities

Growing Potential for AI, Cloud, and Digital Services Across Enterprises

The Egypt Data Center Market is unlocking new opportunities in AI and digital transformation. Enterprises are deploying AI workloads for healthcare diagnostics and financial services. Cloud adoption among SMEs is fueling demand for scalable infrastructure. E-commerce growth supports higher storage and processing needs. Telecom providers seek to enhance 5G-enabled digital ecosystems. Global vendors are investing in regional AI clusters. It positions Egypt as a hub for enterprise-grade services. Opportunities continue to expand across multiple verticals.

Expansion of Renewable-Powered and Modular Data Center Deployments

Sustainability-driven projects are creating attractive opportunities in the Egypt Data Center Market. Investors explore solar and hybrid energy models to power large facilities. Modular deployments reduce setup time and support regional scalability. Government support for renewable integration strengthens these opportunities. Enterprises prefer sustainable providers with lower operational costs. Renewable-powered centers meet international ESG expectations. This draws global firms seeking green partnerships. It ensures Egypt remains competitive in future digital ecosystems.

Market Segmentation

By Component

Hardware dominates the Egypt Data Center Market due to heavy reliance on servers, networking, and power systems. Cooling and security infrastructure form essential parts of investments. Software segments such as DCIM and orchestration tools are gaining traction. Services including consulting and managed solutions are growing with enterprise demand. Rising automation drives the software segment further. Hardware maintains the largest revenue share due to capital-intensive deployments. Services enable long-term operational support. Software adoption strengthens performance and efficiency.

By Data Center Type

Hyperscale centers lead the Egypt Data Center Market as global cloud providers expand. Colocation facilities remain critical for enterprises seeking flexibility. Enterprise data centers cater to specific sectoral needs such as BFSI and healthcare. Edge deployments grow due to 5G and latency-sensitive applications. Modular designs enable faster scalability. Mega data centers are emerging but still limited. Internet data centers drive digital content growth. Hyperscale and colocation remain the most dominant categories.

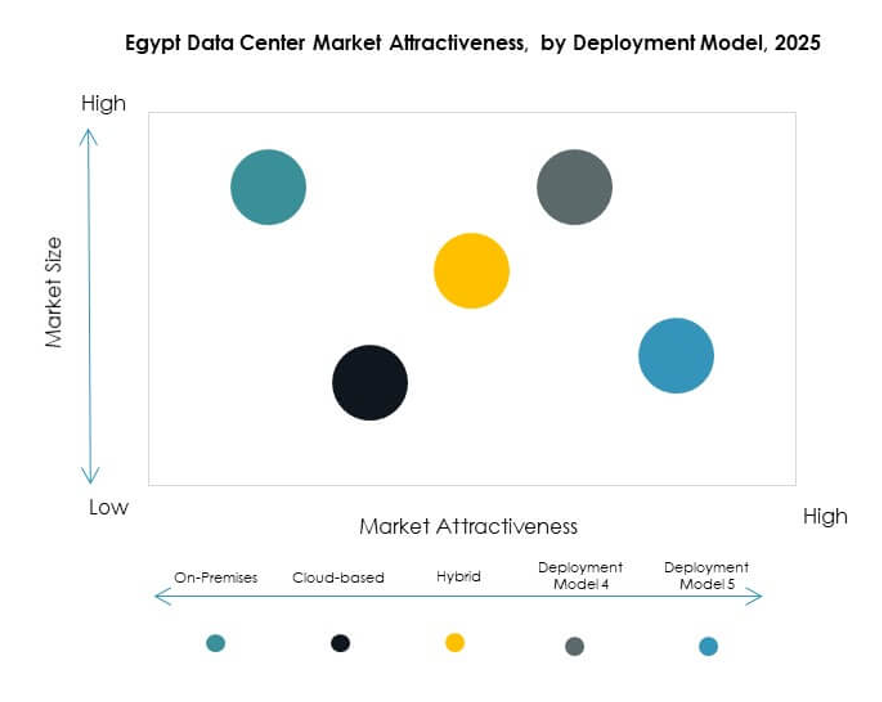

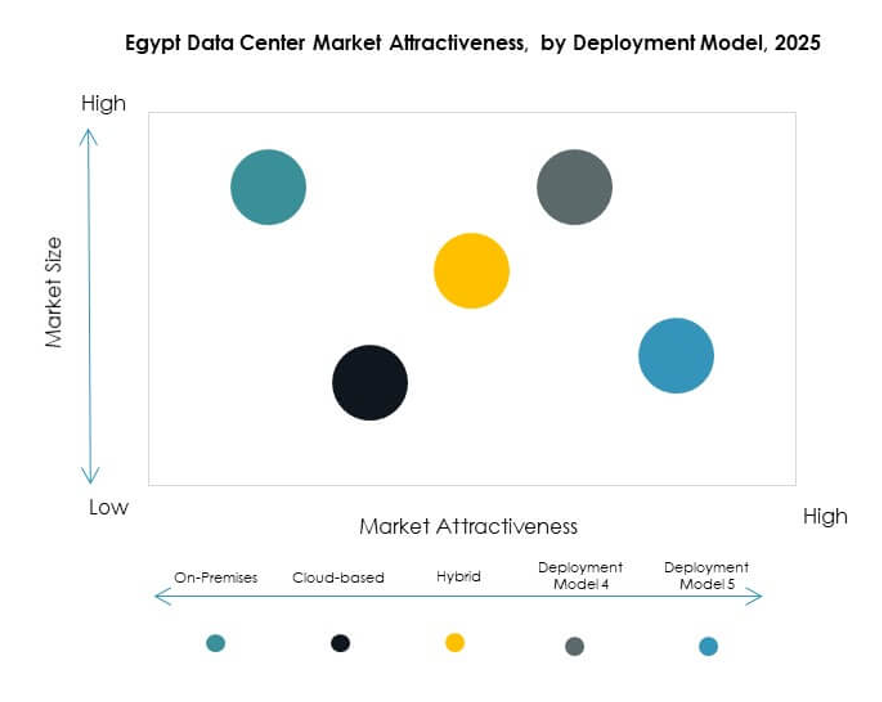

By Deployment Model

Hybrid deployment models dominate the Egypt Data Center Market due to enterprise demand for resilience. On-premises deployments are preferred by regulated sectors such as government and defense. Cloud-based models gain traction among SMEs and startups. Hybrid strategies allow workload flexibility while maintaining compliance. Enterprises rely on hybrid approaches to ensure business continuity. Global players enhance cloud offerings in the country. Cloud-native adoption grows steadily among small firms. Hybrid adoption secures leadership across the deployment spectrum.

By Enterprise Size

Large enterprises hold the largest share in the Egypt Data Center Market. They require high-capacity infrastructure for AI, cloud, and analytics. SMEs are increasingly adopting managed and hybrid services. Demand from SMEs is supported by cost-effective colocation solutions. Large enterprises focus on multicloud strategies. SMEs are becoming significant contributors to market growth. High investment capacity keeps large enterprises ahead. Both segments contribute to sustained industry momentum.

By Application / Use Case

IT and telecom dominate the Egypt Data Center Market due to connectivity and cloud expansion. BFSI ranks high due to strict data compliance needs. Healthcare demand is rising with digital health services. Retail and e-commerce are emerging strongly due to online growth. Media and entertainment add demand for storage and streaming capacity. Manufacturing focuses on automation and analytics. Education and utilities remain growing contributors. IT and telecom maintain the leading position.

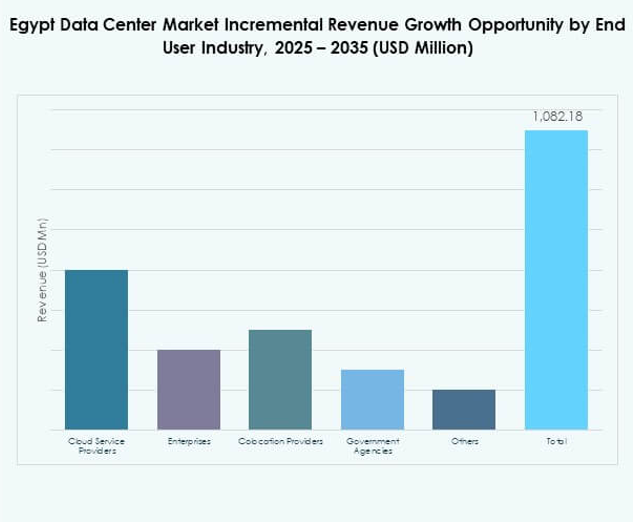

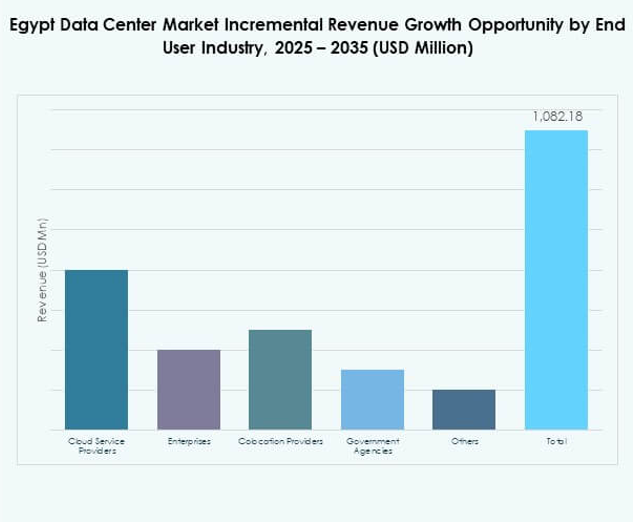

By End User Industry

Cloud service providers dominate the Egypt Data Center Market as hyperscale demand increases. Enterprises contribute significantly through hybrid adoption. Colocation providers are gaining attention for cost-effective models. Government agencies demand secure, compliant infrastructure. Other segments such as fintech and energy diversify demand further. Cloud providers remain the primary force shaping the ecosystem. Enterprises align with them for scalability. Colocation and government end-users continue to expand their roles.

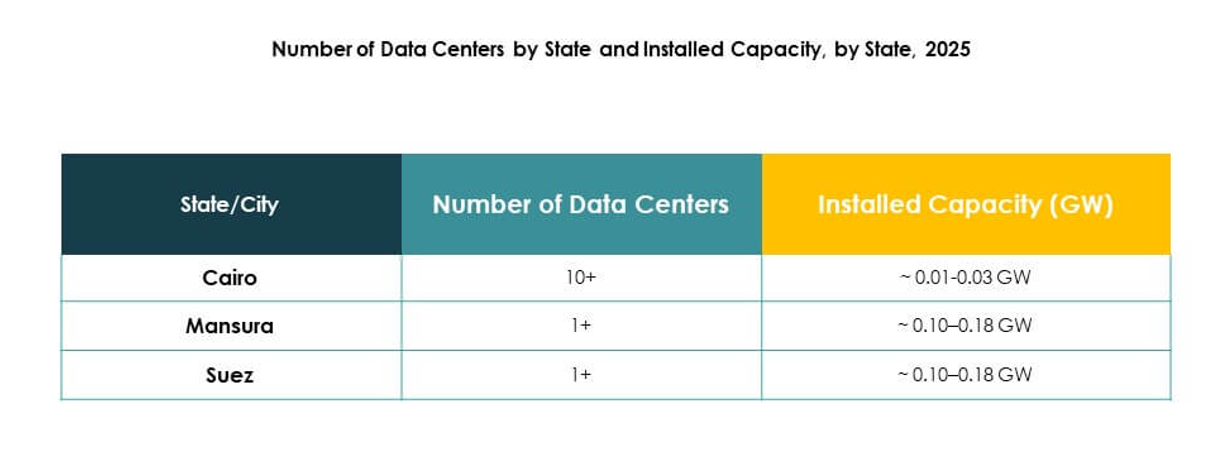

Regional Insights

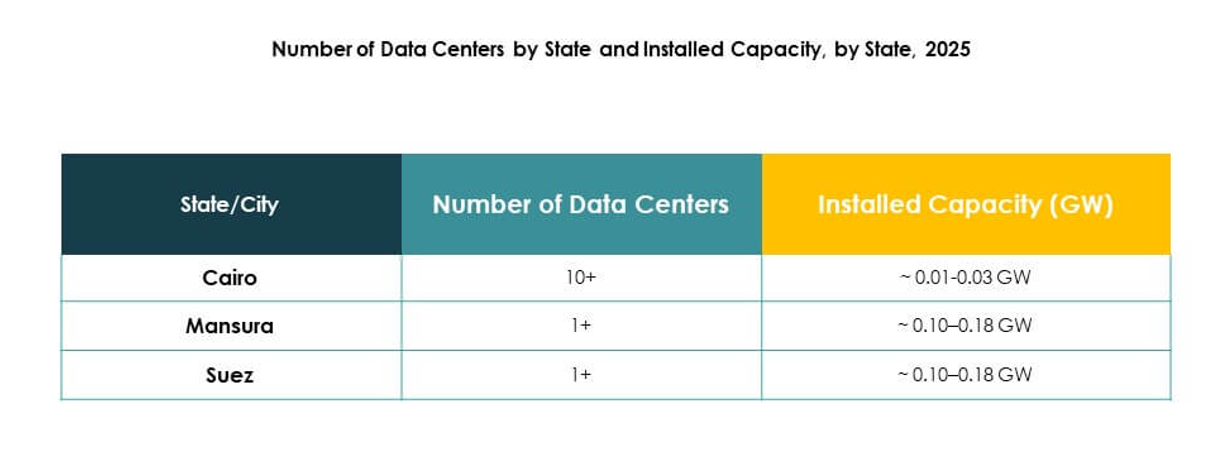

North Africa’s Strategic Leadership in Market Expansion

North Africa holds a 42% share of the Egypt Data Center Market. Its leadership is driven by Egypt’s geographic advantage as a regional hub. Submarine cable landings strengthen its connectivity with Europe and Asia. Government-backed digitalization projects support the dominance. Enterprises in Cairo and Alexandria lead demand. ICT infrastructure attracts both local and global providers. It establishes North Africa as the most critical subregion for growth.

- For instance, in July 2025, Telecom Egypt completed the landings for the SEA-ME-WE 6 subsea cable system at Port Said and Ras Ghareb, increasing the country’s international connectivity. The 21,700 km cable project involves major global players such as Microsoft, Orange, and Bharti Airtel, and provides additional routes between Asia, Africa, and Europe, thereby reinforcing Egypt’s role as a regional interconnection hub.

Middle East Connectivity Enhancing Regional Integration

The Middle East holds a 36% share of the Egypt Data Center Market. Proximity to Gulf countries boosts cross-border collaborations. Telecom investments connect Egypt to key Middle Eastern digital hubs. Enterprises benefit from trade and regional partnerships. Demand is rising for colocation and hybrid services. Cairo’s role as a digital gateway strengthens regional positioning. It enhances Egypt’s integration into Middle Eastern markets.

Sub-Saharan Africa Emerging With Growing Demand Potential

Sub-Saharan Africa accounts for 22% of the Egypt Data Center Market. It remains in the early stages of adoption compared to other subregions. Enterprises explore colocation and cloud-based models. Governments invest in digital transformation to strengthen economies. Infrastructure gaps still limit growth. Egypt’s providers see opportunities to expand southward. It highlights Sub-Saharan Africa as an emerging contributor to long-term market expansion.

- For instance, in January 2025, Africa50, a pan-African infrastructure investor, officially took a stake in Raya Data Center (RDC), supporting the construction of a major new Tier III data center in Egypt. This project directly targets growing data demand and digital transformation in Sub-Saharan Africa by providing scalable, certified infrastructure attractive to both regional and international enterprises.

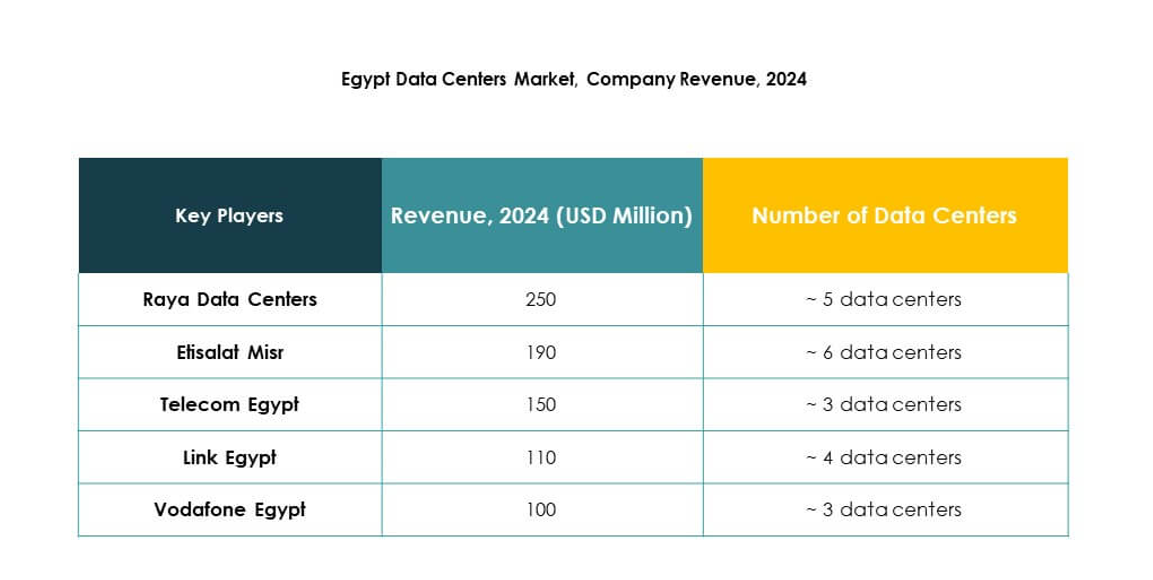

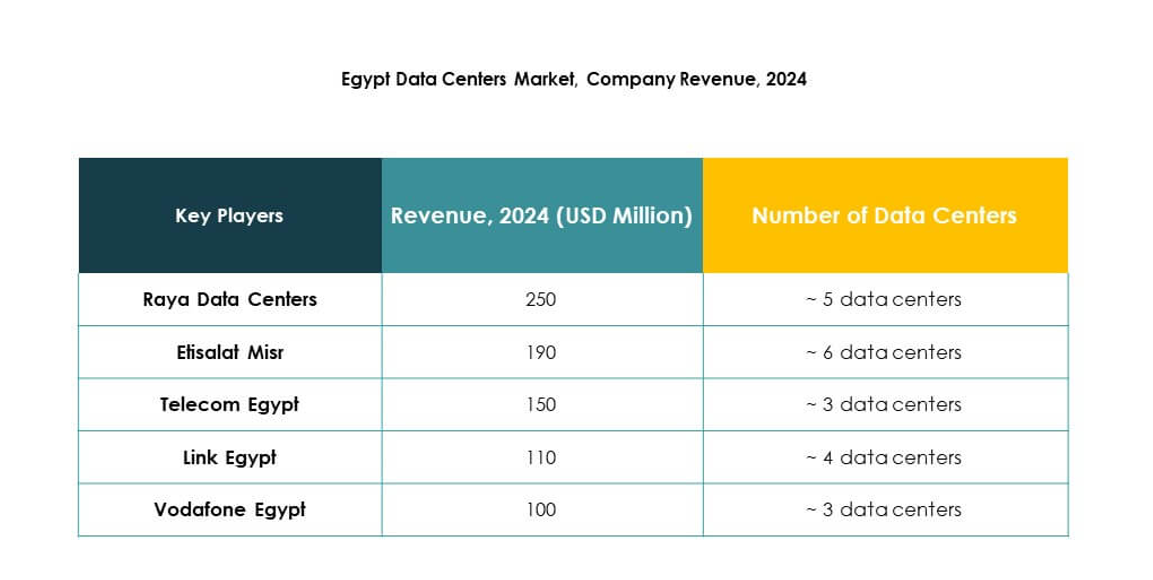

Competitive Insights:

- Raya Data Centers

- Etisalat Misr

- Telecom Egypt

- Vodafone Egypt

- IBM Egypt

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Egypt Data Center Market is characterized by strong competition between domestic providers and global technology leaders. Local operators such as Telecom Egypt, Raya Data Centers, and Etisalat Misr focus on expanding colocation and connectivity services. Global firms including AWS, Microsoft, and Google invest in cloud infrastructure to strengthen enterprise adoption and regional reach. NTT and IBM bring managed services and hybrid solutions into the ecosystem. Vodafone Egypt leverages telecom networks to enhance enterprise-grade hosting. It is witnessing strategic alliances, capacity expansions, and innovation in green infrastructure, creating an environment where providers compete through scalability, advanced technologies, and regional integration.

Recent Developments:

- In September 2025, Telecom Egypt gave preliminary board approval to British private equity firm Helios Investment Partners for a binding offer to acquire a 75-80% stake in Telecom Egypt’s Regional Data Hub data center. The deal values the RDH facility at up to $260 million and is designed to expand Helios’ data infrastructure portfolio while supporting Telecom Egypt’s multi-phase campus in Cairo, which reached full utilization and attained multiple Tier III certifications.

- In September 2025, NEOIX PLC disclosed a new strategic partnership with Baukontor Niederrhein GmbH to accelerate data center development projects in Egypt. This alliance aims to support the expansion of hyperscale data center infrastructure by leveraging both companies’ expertise and resources, reinforcing Egypt’s growing role as a digital hub in Africa and the Middle East.

- In December 2024, Raya Data Center secured a strategic partnership and $15 million investment from Africa50, complemented by a further $10 million from Raya Information Technology, to build a new Tier III data center in Egypt. Construction for this advanced facility is set to begin in early 2025 and aims to enhance Egypt’s digital infrastructure and cloud computing capabilities while promoting green, energy-efficient practices throughout its operation.

Market Drivers

Market Drivers