Executive summary:

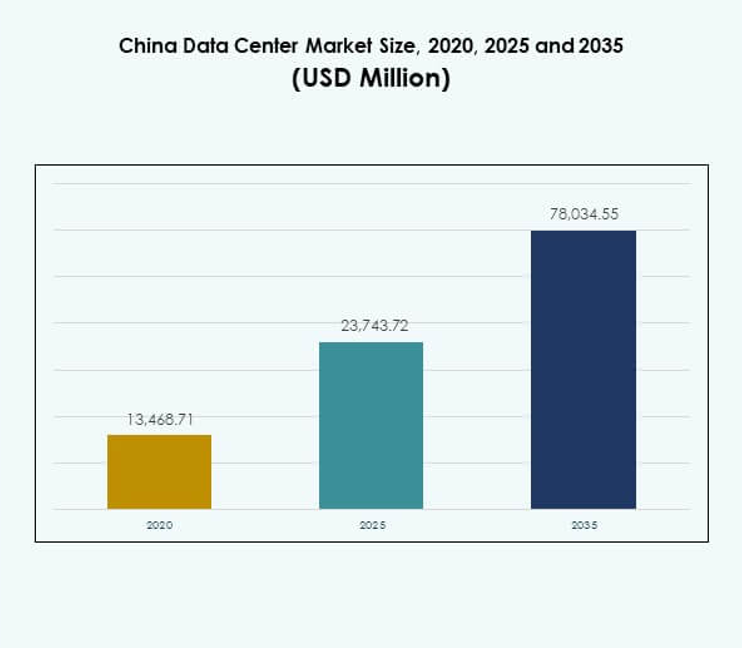

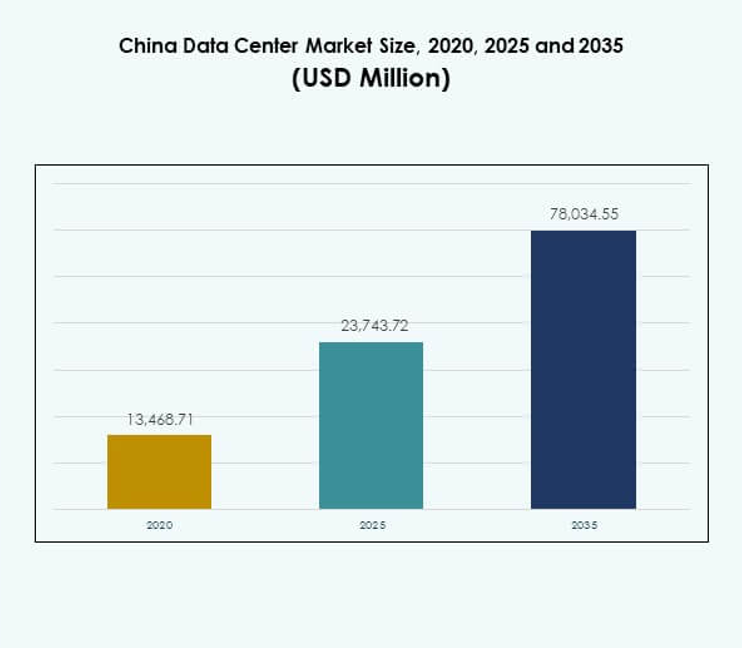

The China Data Center Market size was valued at USD 13,468.71 million in 2020 to USD 23,743.72 million in 2025 and is anticipated to reach USD 78,034.55 million by 2035, at a CAGR of 12.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| China Data Center Market Size 2025 |

USD 23,743.72 Million |

| China Data Center Market, CAGR |

12.48% |

| China Data Center Market Size 2035 |

USD 78,034.55 Million |

The market expansion is driven by digital transformation, cloud adoption, and the growing use of AI and big data. Enterprises prioritize hybrid infrastructure to balance scalability and security while government initiatives promote modernization and energy efficiency. It holds strategic significance for investors as enterprises and service providers accelerate innovation, expand capacity, and strengthen digital resilience to meet the rising demands of various industries.

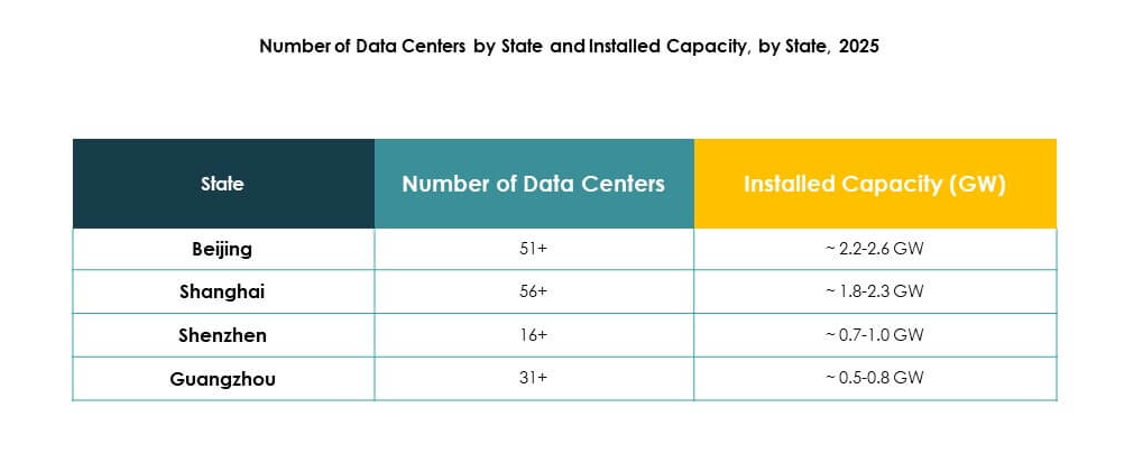

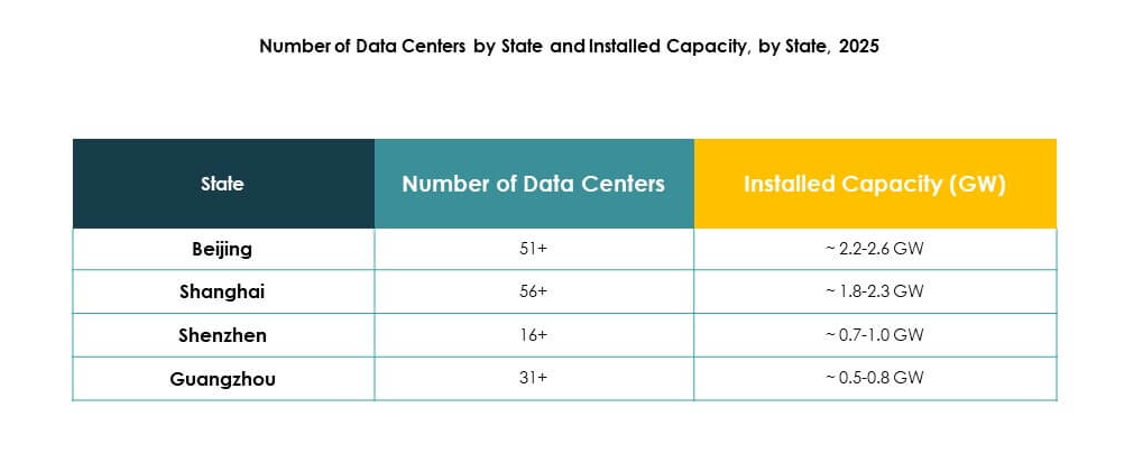

Eastern China leads with strong connectivity and enterprise clusters, supported by Shanghai and Jiangsu as key hubs. Northern China follows with Beijing’s influence in technology and government-backed projects, creating a stable growth path. Western and central regions are emerging due to lower land costs, renewable energy projects, and government incentives, which make them attractive for future infrastructure development and balanced nationwide expansion.

Market Drivers

Accelerating Digital Transformation and Widespread Adoption of Cloud Computing Platforms

The China Data Center Market experiences strong momentum from enterprises shifting to digital-first strategies. Cloud computing platforms offer efficiency, scalability, and secure data management for industries of all sizes. Demand rises from IT, finance, healthcare, and retail seeking advanced digital infrastructure. Cloud adoption allows enterprises to handle increasing workloads while meeting compliance requirements. It drives investment in hyperscale and modular facilities nationwide. Enterprises prioritize low-latency operations for faster customer services and real-time decision-making. Digitalization fuels long-term commitments from multinational firms. Investors consider the segment vital for supporting business resilience and competitiveness.

- For instance, PSBC (Postal Savings Bank of China) uses Huawei’s GaussDB to process over 2 billion transactions per day and up to 67,000 transactions per second during peak hours across its 40,000+ branches and more than 650 million customers.

Rapid Expansion of Artificial Intelligence, Big Data, and High-Performance Computing Applications

Artificial intelligence and big data technologies intensify demand for advanced infrastructure in the China Data Center Market. AI workloads require high-density computing environments, fueling rapid investment in servers and storage solutions. Big data analytics strengthens the need for enhanced connectivity and faster processing speed. High-performance computing accelerates research in healthcare, finance, and manufacturing. It drives the development of specialized data halls with advanced cooling technologies. Industry stakeholders emphasize efficient energy usage for sustainable operations. Partnerships between enterprises and technology providers expand innovation ecosystems. These advancements create opportunities for continued growth and profitability.

Government Policies Supporting Digital Economy and Infrastructure Modernization Efforts

Supportive government policies contribute to growth in the China Data Center Market. National strategies promote modernization, energy efficiency, and technology-led competitiveness. Regulations ensure compliance with strict cybersecurity and data localization rules. It aligns digital infrastructure with long-term economic priorities. Incentives encourage private and public collaboration in building advanced facilities. Investments strengthen green and renewable-powered data centers across provinces. Enterprises gain confidence with regulatory clarity and stable operational environments. Government initiatives enhance investor trust and increase international collaboration. Favorable policy frameworks accelerate the pace of digital transformation and technological progress.

- For instance, China Telecom’s Inner Mongolia Information Park spans over 7 million square feet and draws about 150 MW of power. The facility plans to host over 100,000 racks and accommodate more than 1 million servers under full build-out.

Growing Enterprise Demand for Hybrid Models and Industry-Specific Digital Solutions

Hybrid cloud models gain traction within the China Data Center Market. Enterprises demand a balance between cost optimization, flexibility, and control over critical data. Industry-specific solutions cater to verticals such as BFSI, healthcare, and e-commerce. Hybrid adoption reduces reliance on single infrastructure providers and increases resilience. It supports seamless integration of private and public resources. Enterprises benefit from operational agility while maintaining compliance with local requirements. It positions hybrid deployments as a strategic advantage. Growth in this model reshapes competitive dynamics and attracts continued investment. Hybrid frameworks underpin enterprise innovation and long-term scalability.

Market Trends

Rise of Green Data Centers Powered by Renewable and Energy-Efficient Technologies

The China Data Center Market observes a steady transition toward sustainable energy use. Operators adopt renewable sources such as solar and hydropower to reduce emissions. Green cooling systems like liquid cooling and free-air designs gain prominence. It ensures compliance with national energy efficiency targets. Investors prioritize facilities with clear sustainability commitments. Demand for environmentally responsible data centers rises across enterprises. Regulatory incentives further accelerate adoption of green technologies. Sustainability strengthens the nation’s role in climate-conscious digital infrastructure.

Increased Focus on Edge and Micro Data Center Deployments in Emerging Cities

Edge and micro facilities expand rapidly in the China Data Center Market. Smaller centers serve demand in Tier 2 and Tier 3 cities. Localized infrastructure ensures low latency and efficient data processing. It supports applications in IoT, smart cities, and connected devices. Enterprises deploy edge facilities to meet customer needs closer to end-users. Government-led digital city projects create new opportunities for providers. Telecom operators partner with hyperscale firms to extend regional networks. Edge deployments become a defining trend in extending national digital coverage.

Growing Investment in Data Center Automation and Orchestration Platforms

Automation solutions reshape operational efficiency in the China Data Center Market. Platforms optimize workloads, resource allocation, and predictive maintenance. It reduces downtime while cutting operational costs significantly. Virtualization and orchestration technologies improve scalability across large facilities. AI-driven monitoring ensures secure and adaptive operations. Enterprises adopt automation to manage complex digital workloads. Investment in software solutions rises as competition intensifies. Automation strengthens operational resilience and enables smoother hybrid infrastructure integration.

Expansion of Cross-Border Connectivity and International Cloud Integration Networks

International integration strengthens the global positioning of the China Data Center Market. Connectivity agreements expand direct access to global cloud service providers. It enhances multinational enterprises’ ability to operate seamlessly across regions. Subsea cable projects increase bandwidth and cross-border data traffic. Colocation hubs attract international companies seeking access to Chinese customers. Partnerships between domestic and foreign players boost competitiveness. The trend underlines the nation’s role in global data trade. International integration supports innovation ecosystems and drives stronger market expansion.

Market Challenges

Rising Concerns Over Energy Consumption and Environmental Sustainability in Large-Scale Operations

The China Data Center Market faces mounting concerns regarding energy intensity. Large-scale data centers consume significant power, raising questions of environmental sustainability. Pressure increases to adopt renewable energy and high-efficiency cooling systems. It remains challenging to balance performance with energy efficiency. Providers face scrutiny over carbon footprints and regulatory compliance. Rapid expansion amplifies the strain on regional power grids. Meeting sustainability targets requires heavy investment in clean energy. Industry stakeholders must address these issues to maintain competitiveness.

Complex Regulatory Environment and Heightened Cybersecurity Risks Impacting Growth Prospects

The China Data Center Market operates under a highly regulated environment. Data localization requirements impose strict compliance on global operators. It raises costs for multinational firms adapting to national rules. Cybersecurity threats also challenge operators handling sensitive information. Enterprises demand higher safeguards against data breaches and hacking. Ensuring compliance and security drives up operational complexity. Cross-border restrictions add another layer of complication. The sector faces long-term challenges in aligning innovation with security obligations.

Market Opportunities

Expansion of Smart City Projects and IoT Ecosystems Creating Strong Demand for Edge Facilities

The China Data Center Market benefits from national smart city initiatives. IoT ecosystems drive demand for edge and micro facilities across urban centers. It supports critical services like traffic management, healthcare monitoring, and industrial automation. Enterprises explore partnerships to scale infrastructure quickly. Local governments provide incentives for edge deployments. Low-latency requirements make smaller facilities essential. Providers capture new opportunities in decentralized urban ecosystems. Growth aligns with broader smart infrastructure goals nationwide.

Rising Demand for AI, Cloud Gaming, and Digital Entertainment Infrastructure Solutions

The China Data Center Market gains from digital entertainment expansion. AI-powered cloud gaming and streaming platforms require low-latency infrastructure. It supports immersive experiences for millions of users. Enterprises expand facilities dedicated to entertainment and AI processing. Investment flows into high-performance storage and GPU servers. E-commerce platforms also demand advanced digital infrastructure. The entertainment boom enhances long-term opportunities for investors. Rapidly growing user bases ensure sustained infrastructure growth.

Market Segmentation

By Component

Hardware dominates the China Data Center Market, driven by demand for servers, storage, and networking equipment. Growth in AI, cloud, and big data workloads strengthens hardware investment. Software solutions like orchestration and DCIM also expand steadily. Services such as managed and consulting offerings provide strong value for enterprises. Providers combine hardware with software and services for holistic solutions. Hardware continues to lead due to performance needs. Long-term growth prospects remain centered around hardware-driven infrastructure.

By Data Center Type

Hyperscale facilities lead the China Data Center Market, capturing the largest share of deployments. Colocation and enterprise facilities continue to grow as businesses seek scalable solutions. Cloud and internet data centers expand with surging digital service demand. Edge and micro data centers rise in importance due to IoT growth. Mega facilities attract large investments from global and domestic players. Each type fulfills unique industry needs. Hyperscale dominates due to its ability to serve multiple industries efficiently.

By Deployment Model

Hybrid deployment dominates the China Data Center Market, combining flexibility with cost optimization. Enterprises leverage cloud-based resources for scalability while maintaining on-premises security. On-premises models continue serving sensitive sectors like defense and banking. Cloud adoption accelerates for enterprises needing fast deployment. Hybrid models meet compliance needs while offering efficiency. Providers design tailored solutions to balance workload distribution. Hybrid frameworks remain attractive due to their adaptability. They continue to drive long-term strategic importance.

By Enterprise Size

Large enterprises dominate the China Data Center Market with major investments in scalable infrastructure. Small and medium enterprises grow steadily through cloud adoption and colocation services. SMEs leverage digitalization to access advanced computing resources. Large organizations continue driving hyperscale expansion. SMEs remain critical for market diversification. It positions both segments as important in digital infrastructure growth. Investment focus remains stronger in large enterprise projects. Large organizations set the pace for industry adoption.

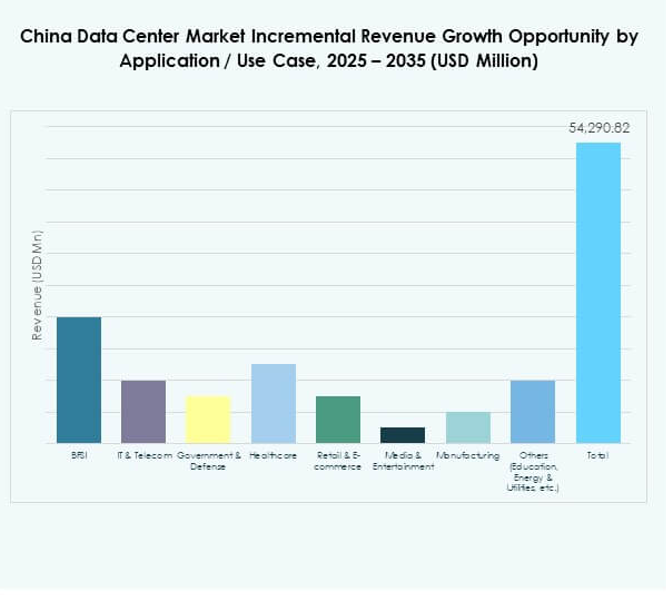

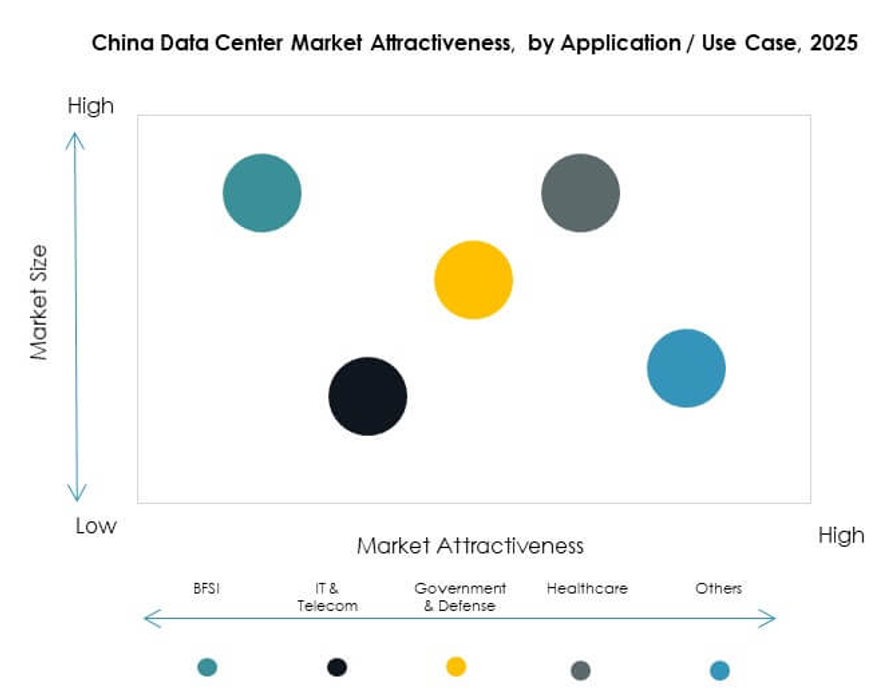

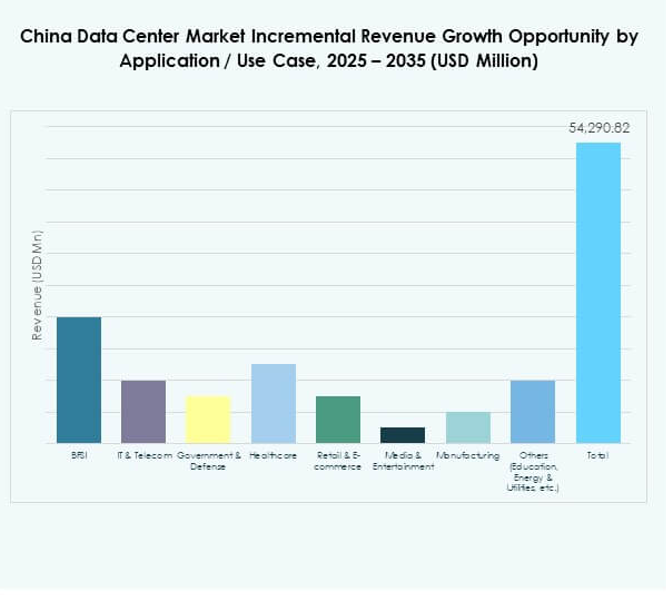

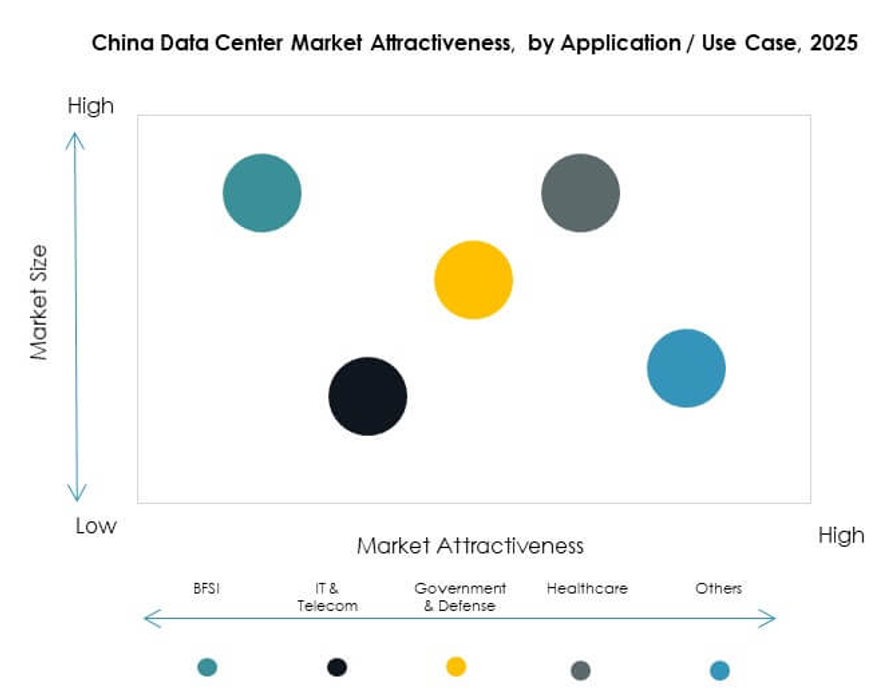

By Application / Use Case

IT and telecom dominate the China Data Center Market with the largest share. BFSI and e-commerce also drive significant demand for secure and scalable solutions. Healthcare adopts infrastructure for digital records and telemedicine. Media and entertainment rise with cloud gaming and streaming. Government and defense sectors expand secure facilities. Manufacturing drives smart industry transformation. Each application adds unique demand characteristics. IT and telecom maintain leadership due to data-heavy operations.

By End User Industry

Cloud service providers dominate the China Data Center Market as major drivers of expansion. Enterprises invest heavily in colocation and hybrid solutions. Government agencies strengthen secure national infrastructure. Colocation providers capture opportunities from SMEs and mid-tier enterprises. Other industries, including education and energy, add steady demand. It strengthens diversity in end-user adoption. Cloud service providers maintain leadership due to scale. They remain the most influential force shaping the market.

Regional Insights

Eastern China Leading With 42% Market Share Driven by Coastal Economic Strength

Eastern China leads the China Data Center Market with 42% share. Strong economic hubs such as Shanghai and Jiangsu drive digital infrastructure demand. Coastal connectivity enhances international data flows and global partnerships. It attracts hyperscale and colocation providers investing in large-scale facilities. Renewable energy adoption supports sustainability efforts. Eastern China continues as a strategic digital gateway. Its dominance reflects urban density and enterprise concentration.

Northern China Holding 31% Share With Beijing as the Core Technology Hub

Northern China accounts for 31% share in the China Data Center Market. Beijing anchors growth with strong government presence and technology clusters. Enterprises expand rapidly due to favorable policy frameworks. It serves as a hub for AI, cloud computing, and big data projects. Strong academic institutions add research-driven innovation. Northern China maintains stability with high regulatory compliance. Its influence extends across enterprise and government sectors.

- For instance, GDS operates a hyperscale data center campus in Beijing optimized for AI workloads, delivering high-density compute and low latency connectivity to major cloud providers. The site uses real-time, AI-driven cooling controls to optimize energy usage and supports scalable model training for enterprise clients.

Western and Central China Emerging With 27% Share Backed by Low-Cost and Green Energy

Western and Central China capture 27% share of the China Data Center Market. Lower land and energy costs attract new deployments. Provinces such as Sichuan and Inner Mongolia lead renewable-powered facilities. It provides balance to high-density eastern and northern hubs. Government incentives encourage investment in green projects. Edge and modular facilities expand in urbanizing cities. Western and central regions strengthen resilience and nationwide coverage.

- For instance, in 2025, China Unicom opened a data center in Xining, Qinghai, that currently delivers 3,579 petaflops of computing capacity using nearly 23,000 domestically produced AI chips, indicating China’s push toward self-sufficient, renewable-driven high-performance infrastructure.

Competitive Insights:

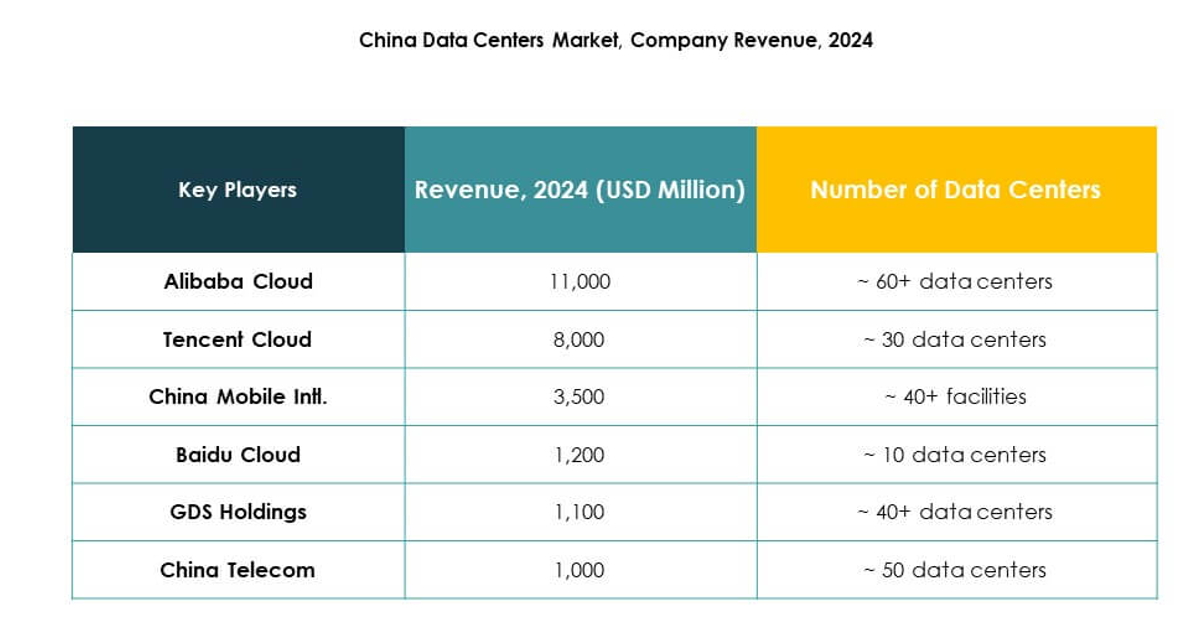

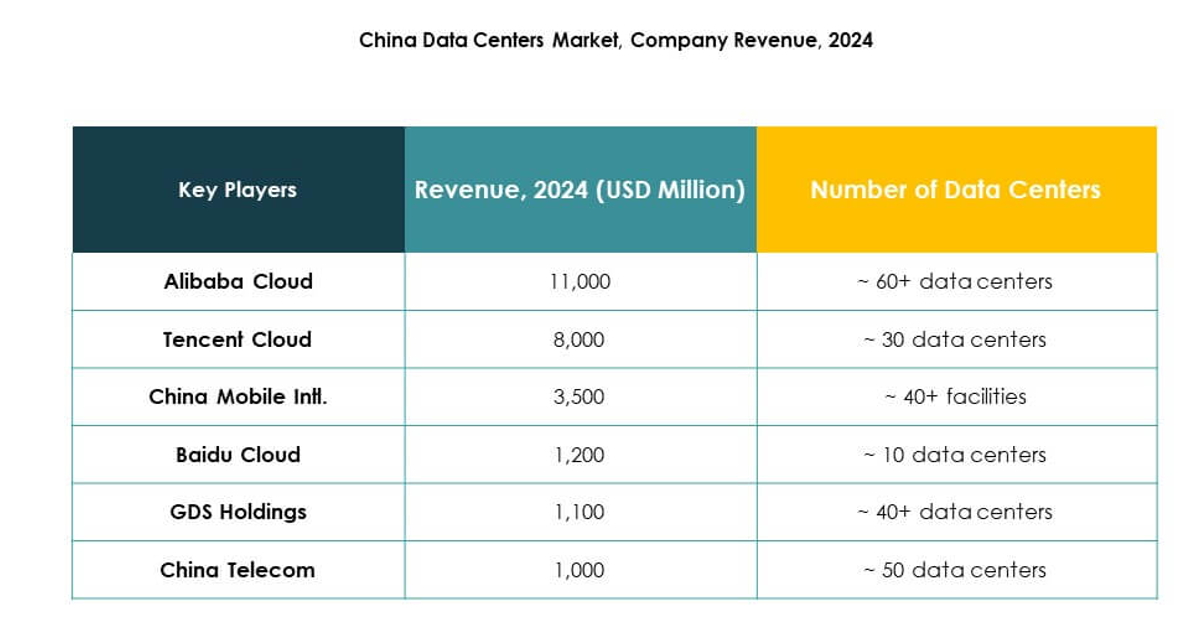

- Alibaba Cloud

- Tencent Cloud

- China Mobile Intl.

- Baidu Cloud

- GDS Holdings

- China Telecom

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC (Alphabet Inc.)

- Others

The China Data Center Market features a highly competitive environment shaped by domestic leaders and global entrants. Alibaba Cloud, Tencent Cloud, and Baidu Cloud dominate through extensive cloud platforms and large-scale deployments. Telecom giants such as China Mobile Intl. and China Telecom leverage nationwide networks to expand their infrastructure base. GDS Holdings plays a central role in colocation, while international firms like Digital Realty and NTT strengthen hybrid service offerings. Global hyperscale providers including Microsoft, Amazon Web Services, and Google extend their presence through strategic partnerships and sustainable investments. It maintains rapid growth with companies focusing on high-density computing, renewable energy adoption, and edge expansion strategies to secure long-term competitiveness across the digital economy.

Recent Developments:

- In September 2025, Alibaba Cloud announced an expansion in global data center operations along with a strategic partnership with Nvidia to accelerate AI and cloud advancements. The company introduced new artificial intelligence products and shared plans to launch data centers in multiple countries, including enhancements in infrastructure to meet the rising demand for AI-supported cloud services in China.

- In September 2025, Tencent Cloud entered a strategic partnership with TVU Networks to launch an integrated cloud-based media production solution. This collaboration leverages Tencent Cloud’s infrastructure and TVU’s microservices platform to enhance efficiency and scalability for global media organizations, supporting AI-driven production workflows and addressing the evolving needs of China’s digital media sector.

- In September 2025, Bain Capital completed a landmark transaction that saw the sale of its China-based data center business, operated through WinTriX DC Group (formerly Chindata), to a consortium led by Shenzhen Dongyangguang Industry Co., Ltd (HEC) along with institutional investors and local government funds. This deal, valued at approximately $4 billion, marks the largest merger and acquisition in the history of the Chinese data center industry, underscoring both investor demand and Chindata’s influential role in the region’s digital infrastructure transformation.

- In September 2025, China Unicom unveiled a major new data center project in Xining, Qinghai Province. This $390 million facility is powered predominantly by domestically produced AI chips, with Alibaba’s T-Head division providing about 72% of the nearly 23,000 processors used so far. The center currently boasts 3,579 petaflops of computing capacity, with plans to reach 20,000 petaflops upon completion, representing a strategic push for greater national technological independence in the face of international trade tensions