Executive summary:

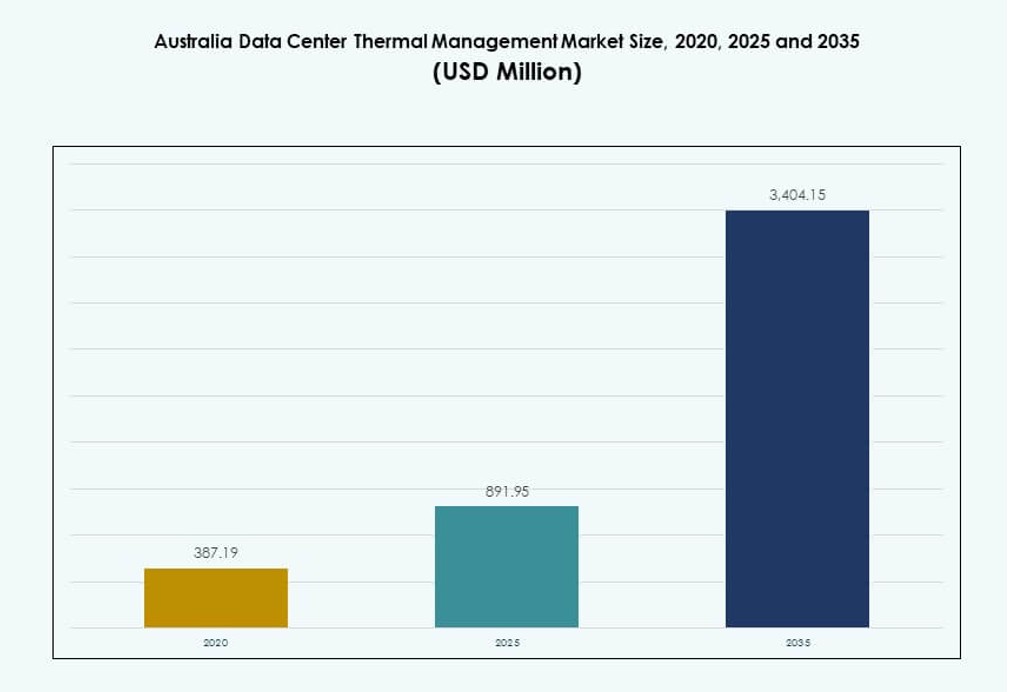

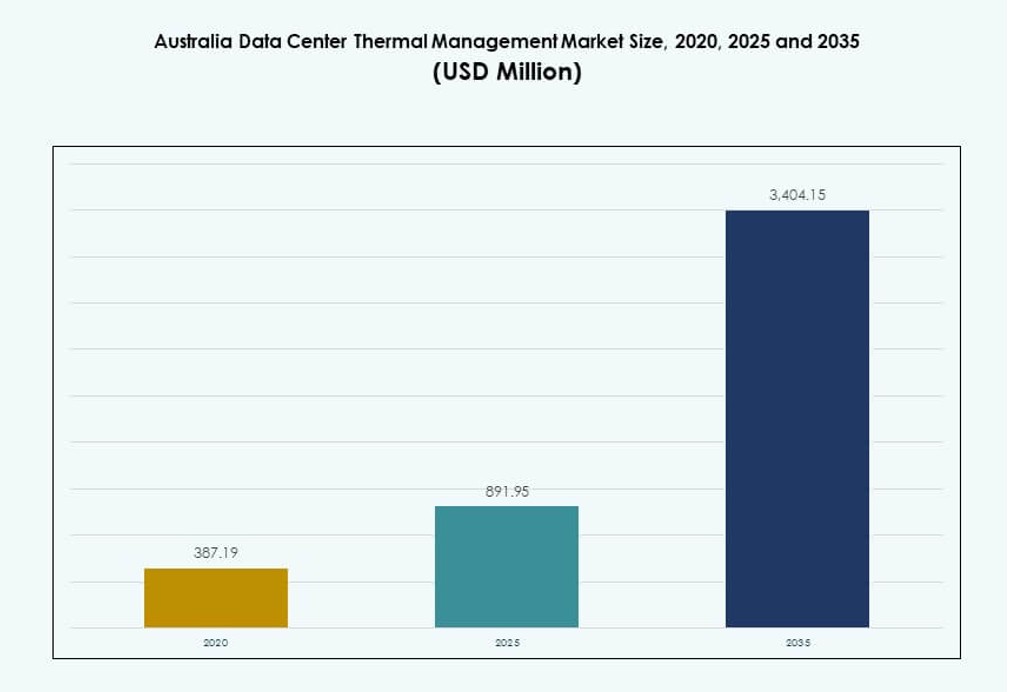

The Australia Data Center Thermal Management Market size was valued at USD 387.19 million in 2020, increased to USD 891.95 million in 2025, and is anticipated to reach USD 3,404.15 million by 2035, at a CAGR of 14.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Australia Data Center Thermal Management Market Size 2025 |

USD 891.95 Million |

| Australia Data Center Thermal Management Market, CAGR |

14.23% |

| Australia Data Center Thermal Management Market Size 2035 |

USD 3,404.15 Million |

The market is driven by the rise of AI workloads, high-density computing, and green infrastructure initiatives. Operators adopt advanced technologies such as direct-to-chip liquid cooling, modular cooling blocks, and predictive software to improve efficiency. Innovations in thermal control systems align with ESG goals, reducing power usage and water consumption. It plays a strategic role for businesses and investors seeking uptime, cost optimization, and long-term sustainability across hyperscale and edge deployments.

New South Wales leads the market due to its dense hyperscale and colocation ecosystem, supported by strong grid access and connectivity. Victoria follows with enterprise and government-led digital infrastructure growth. Emerging opportunities are visible in Queensland and Western Australia, where edge expansion and industry-specific workloads demand scalable cooling. These regions attract new investments due to land availability, climate adaptation needs, and supportive energy infrastructure.

Market Dynamics:

Market Drivers

AI Workloads and High-Density Deployments Reshaping Thermal Management Priorities Across Facilities

Artificial intelligence and machine learning workloads have triggered demand for high-density racks across Australian data centers. These workloads generate more heat, requiring efficient cooling infrastructure to maintain system stability. Operators now prioritize precision cooling systems with zone-specific control to handle thermal variability. Rear door heat exchangers and direct-to-chip cooling support dense compute environments without sacrificing space. Liquid cooling adoption is growing, especially in hyperscale and AI-driven facilities. The Australia Data Center Thermal Management Market benefits from investments targeting improved energy efficiency and uptime. IT load consolidation increases thermal demands, raising the importance of adaptive thermal systems. Businesses and investors view thermal management as essential to infrastructure reliability and operational cost control.

- For instance, NEXTDC’s S3 Sydney supports up to 80MW IT capacity across 10,800 racks with rear door heat exchangers and high-density cooling.

Sustainability Mandates Driving Innovation in Cooling Technology and Energy-Efficient Systems

Australia’s net-zero carbon goals push operators to adopt sustainable thermal practices. Renewable energy integration is common, but thermal systems still contribute significantly to data center energy usage. Advanced air and liquid systems, including economizer modes and free cooling, reduce overall consumption. Heat reuse initiatives are gaining attention across urban colocation sites. Software platforms like DCIM and AI-based optimization allow dynamic thermal load balancing. The Australia Data Center Thermal Management Market evolves to align with ESG reporting standards. This shift attracts green investments and supports eco-centric infrastructure development. Sustainable cooling drives long-term cost advantages and ensures regulatory compliance.

Digital Economy Expansion and Cloud Migration Fuel Infrastructure Modernization Needs

Enterprises across Australia continue migrating workloads to the cloud, increasing demand for large-scale and edge data centers. Expansion of public cloud regions by global hyperscalers accelerates deployment of thermal control infrastructure. The Australia Data Center Thermal Management Market supports this transition by ensuring system uptime and energy efficiency across diverse infrastructure setups. Thermal management solutions are critical in preventing outages, reducing PUE, and enhancing equipment life. As companies scale digital services, colocation providers invest in scalable, modular cooling. Edge locations require compact, self-regulating systems that ensure consistent thermal performance. Investors monitor thermal innovation to assess ROI and reliability.

- For instance, AWS Asia Pacific (Sydney) region operates across three Availability Zones with redundant and isolated cooling systems that support its 99.99% uptime SLA. Backed by a AU$20 billion investment through 2029, AWS is scaling its thermal infrastructure in both Sydney and Melbourne to support sovereign cloud and AI workloads.

Government Policies, Power Constraints, and Regulatory Pressure Influence Strategic Thermal Decisions

Australia faces energy grid limitations, particularly in urban clusters where data centers concentrate. Government energy standards push operators to implement thermal systems that limit peak demand. Regulatory agencies emphasize water-efficient cooling amid drought concerns, prompting zero-water and closed-loop solutions. Heatwave events test infrastructure resilience, highlighting the importance of thermal redundancy. The Australia Data Center Thermal Management Market responds by integrating predictive monitoring and automation tools. Facilities increasingly design around thermal risk rather than static load assumptions. Strategic investors value operators with advanced cooling design, especially under regional climate pressure and power scarcity challenges.

Market Trends

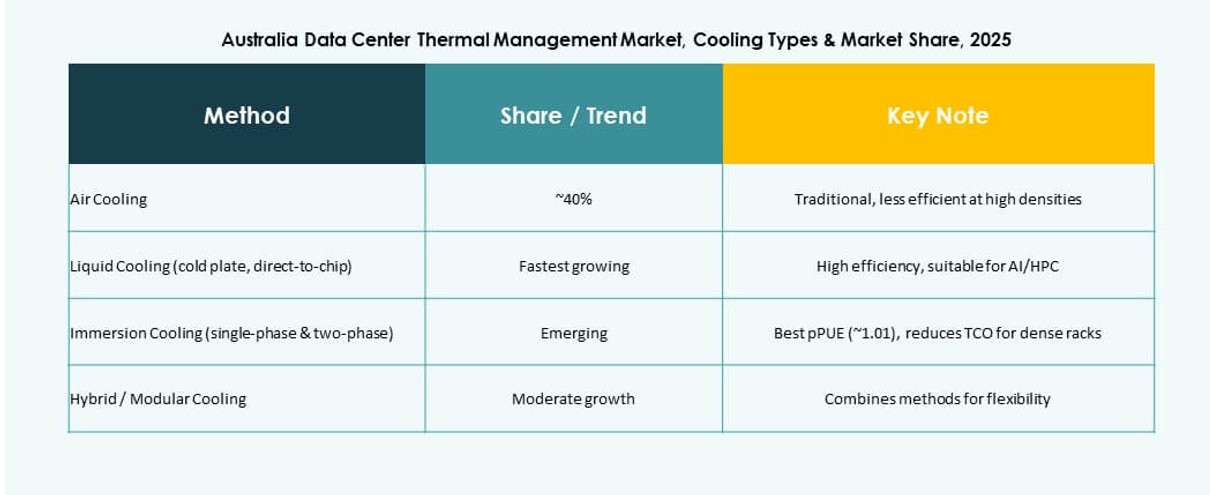

Rising Adoption of Direct-to-Chip and Immersion Cooling in High-Performance Computing Environments

Direct-to-chip and immersion cooling are becoming key components of thermal design in Australia. These methods directly target processor heat, reducing reliance on large mechanical cooling systems. The Australia Data Center Thermal Management Market sees strong adoption in AI clusters and HPC environments. Liquid systems offer higher efficiency for 50 kW+ racks now common in AI training. OEMs and operators collaborate to enable compatibility across GPU-dense systems. Deployment remains concentrated among hyperscalers and research institutions. New designs allow modular integration of direct liquid cooling into retrofitted spaces. Liquid innovation continues to outpace traditional airflow solutions.

Increased Integration of AI and Machine Learning for Predictive and Autonomous Thermal Management

AI tools increasingly manage thermal operations in Australian data centers, enabling predictive cooling strategies. These systems analyze real-time thermal and power data to optimize fan speeds, fluid flow, and chiller operations. The Australia Data Center Thermal Management Market benefits from reduced human intervention and enhanced system efficiency. Vendors integrate AI into Building Management Systems and DCIM platforms. Self-adjusting thermal algorithms adapt quickly to load spikes and reduce waste. Autonomous cooling helps maintain target PUE levels under fluctuating demand. Operators gain more visibility and control through AI-powered dashboards. It improves uptime while cutting operational costs.

Growing Use of CFD Simulations and Digital Twins in Thermal Infrastructure Planning and Design

Computational Fluid Dynamics (CFD) simulations are now standard in designing Australia’s advanced thermal systems. They model airflow, temperature, and pressure across facilities before deployment begins. The Australia Data Center Thermal Management Market uses these tools to optimize layout and cooling architecture. Digital twins help operators visualize real-time performance and predict future scenarios. These platforms detect inefficiencies, allowing pre-emptive corrective action. Real-time updates ensure system performance stays aligned with facility growth. It enhances planning accuracy and supports operational scalability. Thermal simulation tools reduce costly retrofits and shorten time-to-market.

Emergence of Heat Reuse and District Heating Partnerships in Urban Data Centers

Operators in Melbourne and Sydney explore partnerships to reuse waste heat from data centers for surrounding buildings. These district heating concepts improve thermal efficiency and reduce carbon footprints. The Australia Data Center Thermal Management Market now includes heat recovery integration as a competitive differentiator. Operators design systems with heat exchangers that transfer waste heat to external infrastructure. This shift reflects broader city planning goals tied to energy circularity. It creates opportunities for policy-backed collaboration between utilities and colocation providers. Although early-stage, projects indicate growing interest in low-waste energy ecosystems.

Market Challenges

Power Constraints and Grid Limitations Restrict Cooling Scalability in Urban Clusters

Urban areas like Sydney face increasing difficulty securing grid capacity for expanding data centers. Power supply limits hinder large-scale cooling deployments requiring high initial loads. This restricts thermal design flexibility, especially for facilities running AI or HPC workloads. Operators must invest in highly efficient, low-footprint cooling technologies to operate within power budgets. The Australia Data Center Thermal Management Market struggles with balancing cooling capacity and energy constraints. Delays in utility approvals impact thermal system upgrades. Backup systems need to handle peak summer loads while ensuring compliance with local regulations. Redundancy requirements further stretch design options.

Water Scarcity and Regulatory Pressure Undermine Viability of Conventional Cooling Systems

Australia’s water scarcity issues challenge the use of evaporative cooling systems traditionally preferred for their efficiency. Regulatory agencies impose stricter water-use guidelines for commercial infrastructure. This forces operators to explore closed-loop and air-cooled systems that are often costlier or less efficient. The Australia Data Center Thermal Management Market must pivot toward solutions that ensure performance while reducing water consumption. Technology transitions involve high capital expenditure and risk. Water-based systems now require adaptation to meet sustainability targets. Developers must future-proof thermal infrastructure against evolving climate and policy risks.

Market Opportunities

Edge Data Center Growth and Remote Deployment Drive Demand for Compact Cooling Systems

The rise of edge computing across Australia’s regional and remote zones presents new thermal opportunities. These sites demand compact, energy-efficient cooling systems that operate with minimal maintenance. The Australia Data Center Thermal Management Market benefits from modular and containerized solutions tailored to low-density deployments. Telecom operators and enterprise IoT networks fuel this expansion. Prefabricated cooling modules enable rapid deployment and localized control.

Sustainable Infrastructure Investments Unlock Potential for Smart and Green Cooling Technologies

Australia’s focus on sustainability opens investment channels for thermal innovation. Smart cooling integrated with renewable energy sources positions data centers as environmentally responsible assets. The Australia Data Center Thermal Management Market attracts green funds by aligning with ESG frameworks. Emerging solutions in heat reuse, AI optimization, and zero-water systems enhance investor appeal. This transition supports long-term infrastructure resilience.

Market Segmentation

By Data Center Size

Large data centers dominate the Australia Data Center Thermal Management Market, driven by hyperscale and government cloud deployments. These facilities demand sophisticated cooling systems to handle 30–60 kW per rack loads. Medium-sized data centers follow in share, particularly from banking and education sectors. Small data centers serve localized or edge requirements with compact thermal systems. Large centers lead market growth due to strong hyperscaler expansion.

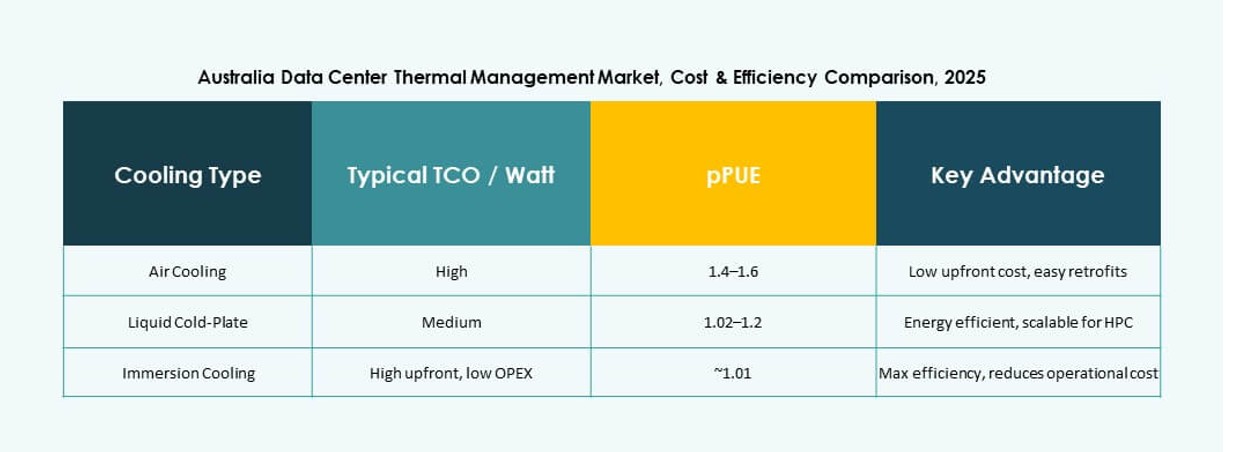

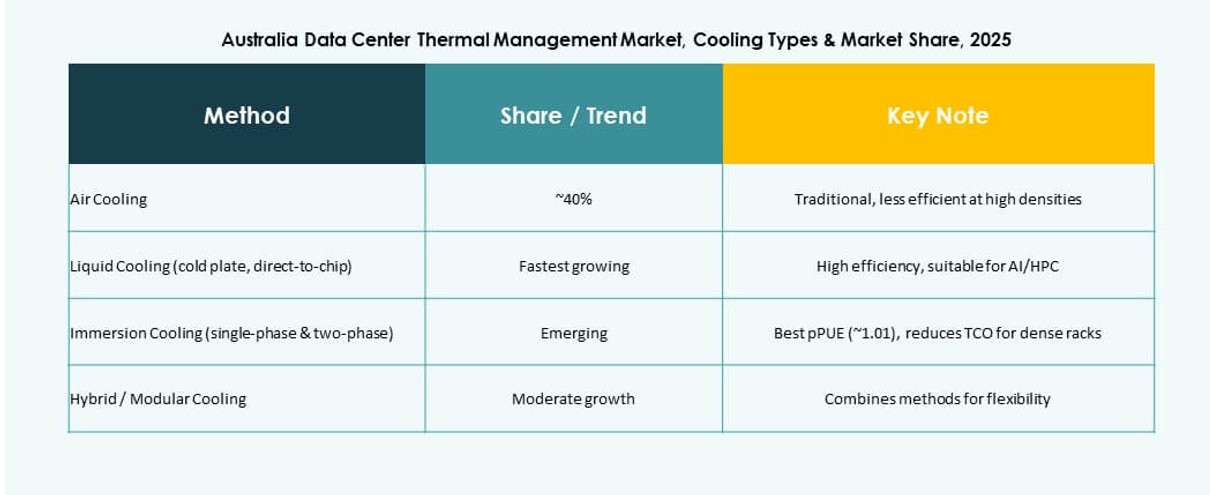

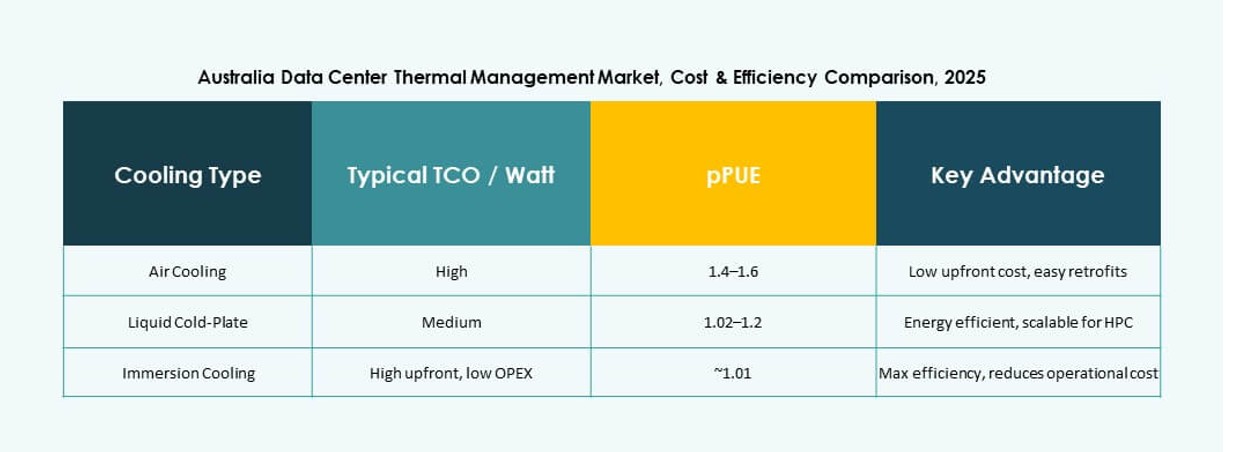

By Cooling Technology

Air-based cooling remains widely used, especially direct air and hot/cold aisle containment. Liquid-based cooling, including direct-to-chip and immersion, is gaining fast traction in high-density AI environments. Hybrid and thermoelectric methods support edge and modular facilities. The Australia Data Center Thermal Management Market sees hybrid systems bridge legacy infrastructure and modern cooling. Liquid-based cooling records the fastest growth rate.

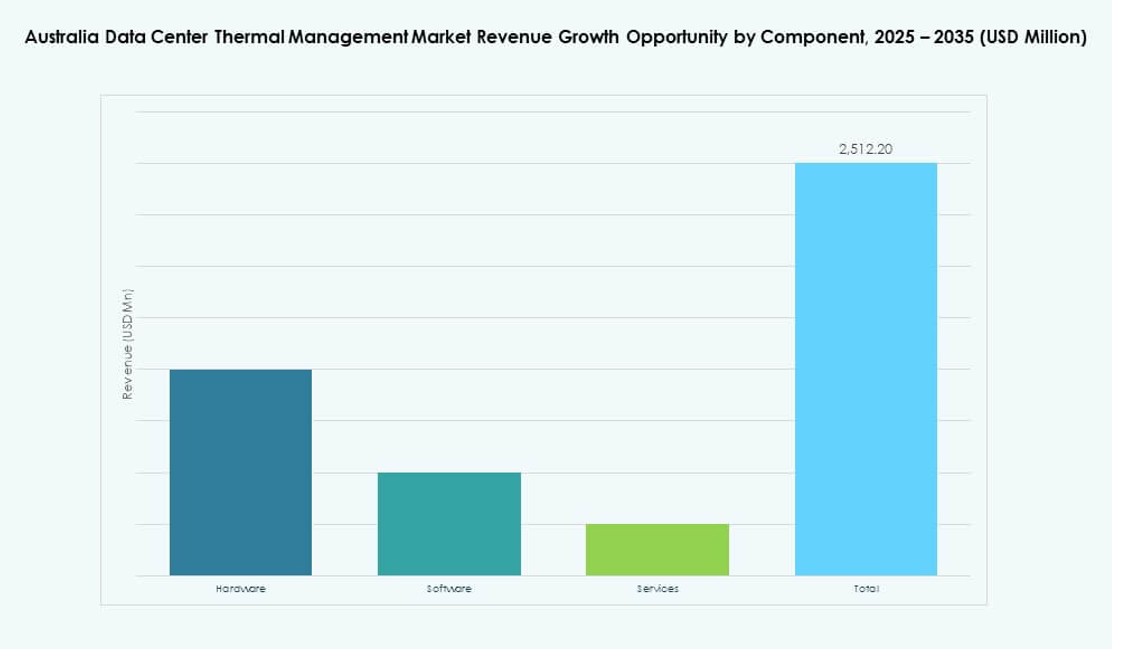

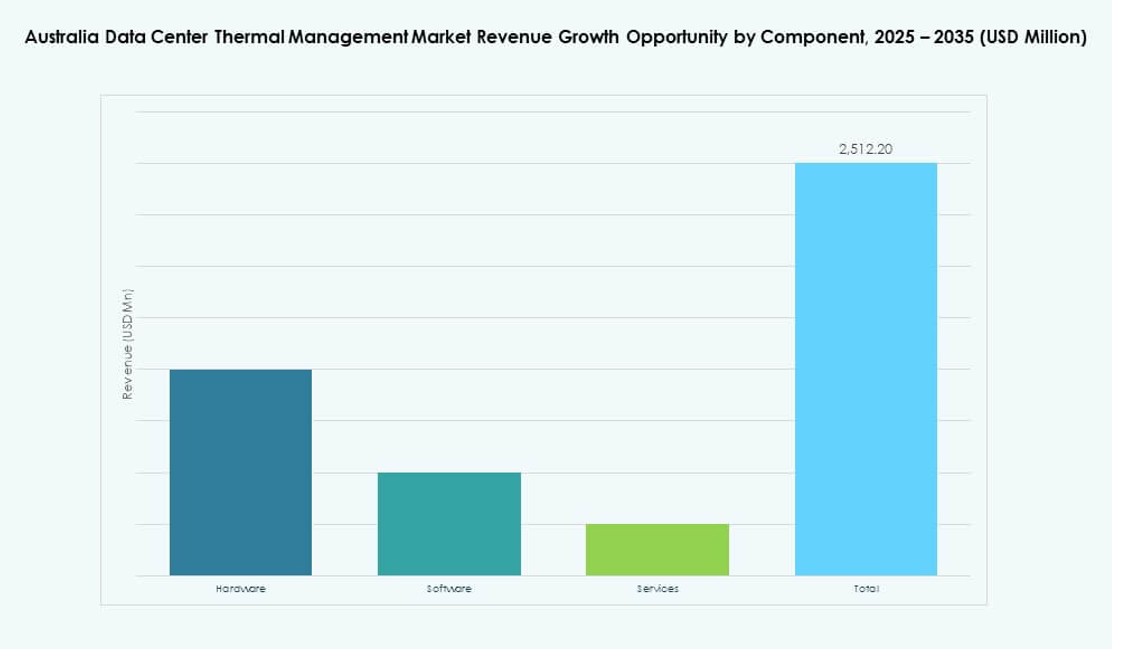

By Component

Hardware dominates the market, accounting for the bulk of infrastructure investment. Chillers, distribution systems, and airflow devices make up significant cost centers. Software plays a growing role in efficiency optimization. Services such as retrofits, upgrades, and monitoring are essential for lifecycle management. The Australia Data Center Thermal Management Market relies on coordinated component deployment to ensure performance.

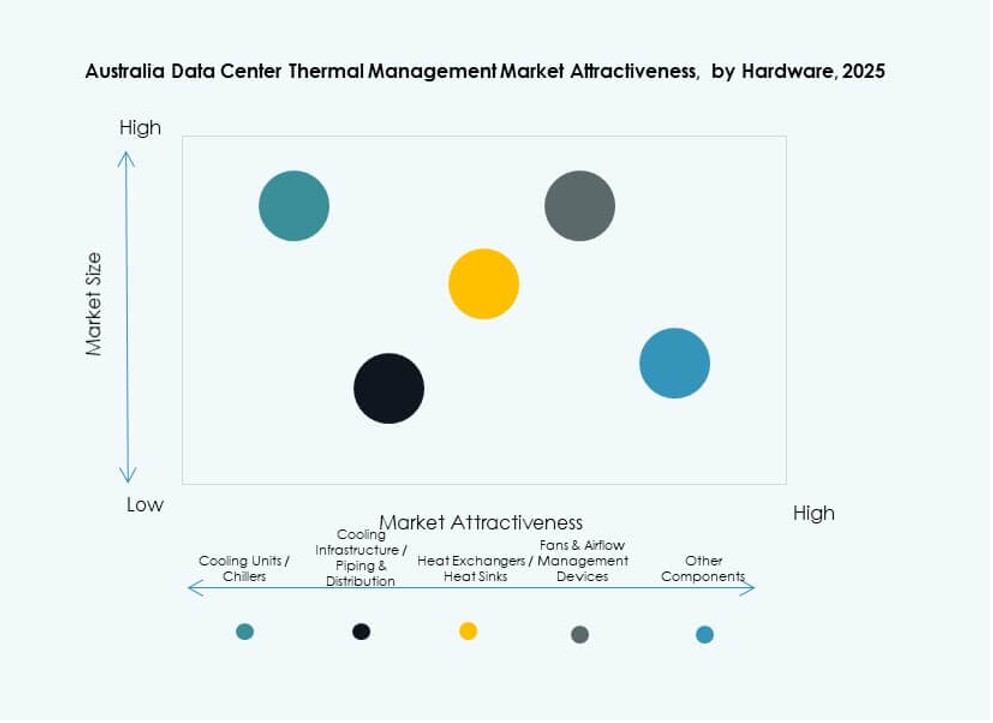

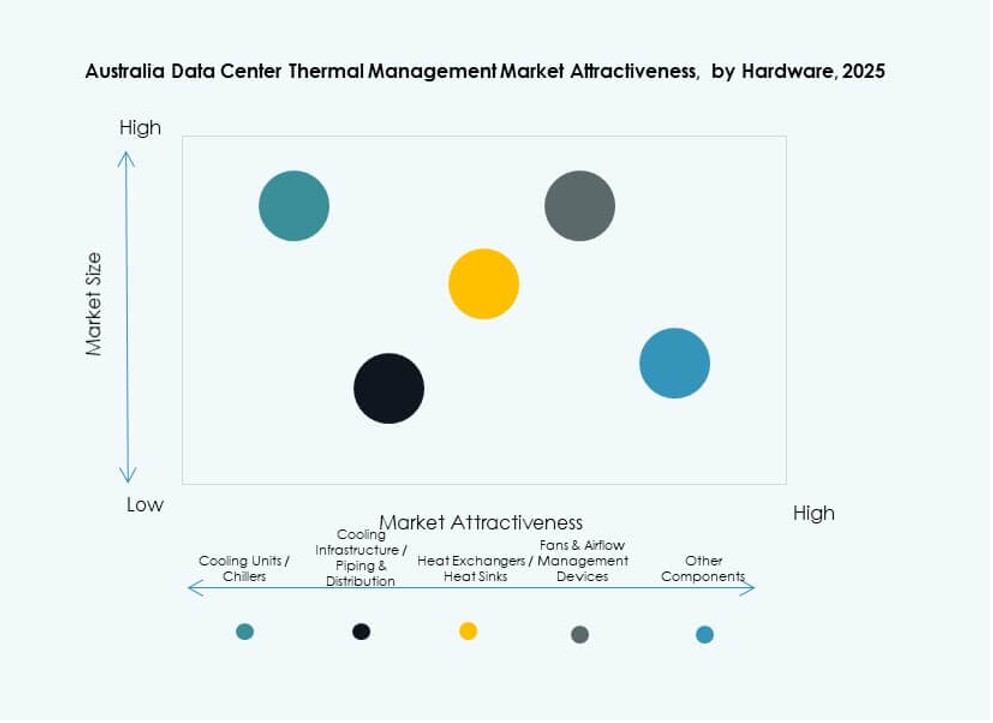

By Hardware

Cooling units and chillers form the backbone of facility-wide thermal systems. Piping, heat sinks, and airflow devices support precise temperature regulation. Heat exchangers gain importance in liquid and heat reuse systems. Hardware selection is critical to uptime and energy efficiency. The Australia Data Center Thermal Management Market emphasizes reliability and modularity in hardware adoption.

By Software

DCIM dashboards remain the most widely adopted software type, aiding real-time monitoring. AI-driven optimization software is on the rise, especially for hyperscale operations. CFD simulation software supports both design and operations, improving layout and airflow strategies. BMS modules integrate facility-wide systems under a unified control panel. Software adoption enhances predictive and automated cooling.

By Services

Installation and commissioning services dominate due to ongoing new builds and expansions. Preventive maintenance and retrofits ensure thermal performance longevity. Monitoring-as-a-service supports remote oversight of edge facilities. Upgrades focus on sustainability improvements and liquid cooling integration. The Australia Data Center Thermal Management Market relies on robust service delivery for seamless operations.

By Data Center Type

Hyperscale facilities lead demand, driven by AWS, Microsoft, and Google expansion. Enterprise and colocation segments follow, supported by financial services and public cloud migration. Edge and micro data centers show strong future potential in remote regions. The Australia Data Center Thermal Management Market evolves with workload diversity across all types. Hyperscale and edge segments grow at the fastest pace.

By Structure

Room-based cooling remains dominant in legacy setups and enterprise environments. Row-based systems gain traction for modular deployments and retrofits. Rack-based cooling supports high-density environments, particularly in AI training clusters. The Australia Data Center Thermal Management Market moves toward structure-specific optimization. Each structure aligns with density, power, and footprint needs.

Regional Insights

New South Wales Leads the Market with Over 43% Share Due to High Data Center Density

New South Wales holds the largest share of the Australia Data Center Thermal Management Market at over 43%. Sydney’s status as a major digital hub, cloud availability zone, and connectivity center drives infrastructure concentration. The region hosts hyperscale facilities by AWS, Microsoft, and Google. Cooling demand rises with AI and cloud adoption across urban campuses. Thermal systems are designed to handle heatwaves and grid volatility. New South Wales remains the anchor for innovation and investment.

- For instance, AWS’s Asia Pacific (Sydney) region has expanded significantly over the past decade through multiple mature data center developments, supporting sovereign cloud and AI workloads across three availability zones with highly redundant cooling infrastructure.

Victoria Accounts for Approximately 31% Market Share with a Focus on Government and Finance Workloads

Victoria captures about 31% of the Australia Data Center Thermal Management Market, supported by strong enterprise and public sector demand. Melbourne sees continued development in colocation and hybrid cloud deployments. The state promotes green infrastructure and encourages sustainable cooling practices. Government incentives support upgrades in thermal energy efficiency. Cooling technologies integrate with energy storage and microgrid systems. Victoria’s focus on regulatory alignment boosts operator confidence.

- For instance, Melbourne has emerged as Australia’s secondary data center hub, with consistent double-digit growth in IT capacity driven by hyperscale and government cloud expansion. Leading providers like NEXTDC and AirTrunk continue to scale thermal infrastructure to support AI, public sector, and enterprise workloads.

Queensland and Western Australia Emerge as Growth Markets with Edge and Regional Expansion

Queensland and Western Australia jointly account for around 18% of the market, showing high potential for future growth. Regional expansion of edge data centers in Brisbane and Perth drives demand for compact thermal systems. Mining, logistics, and agritech sectors increase digital infrastructure needs in these areas. Power availability and land costs attract new developments. The Australia Data Center Thermal Management Market grows in these regions through prefabricated, scalable deployments. These states see rising activity from domestic operators and international firms.

Competitive Insights:

- NEXTDC

- AirTrunk

- Schneider Electric

- Vertiv Group Corp.

- Mitsubishi Electric

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Airedale International Air Conditioning Ltd.

- Johnson Controls International plc

- Munters Group AB

The competitive landscape in the Australia Data Center Thermal Management Market reflects strong participation from both global technology leaders and specialized cooling providers. Firms like Schneider Electric, Vertiv, and Mitsubishi Electric hold significant share through broad product portfolios and deep service networks. Hyperscale operators such as NEXTDC and AirTrunk drive demand for high-efficiency systems and custom solutions. Mid‑tier vendors focus on niche thermal technologies that improve energy outcomes and lower costs. Collaboration between hardware suppliers and software innovators enhances predictive thermal controls and remote management tools. Competition centers on energy efficiency, modular design, and rapid deployment. Buyers evaluate vendors based on reliability, regional support, and total cost of ownership. Market pressure pushes firms to refine product roadmaps and pursue partnerships that strengthen their position.

Recent Developments:

- In November 2025, LG Electronics and Flexofficially announced a strategic global partnership to co-develop integrated, modular data center cooling solutions.

- In April 2025, NTT Facilities opened the “Products Engineering Hub for Data Center Cooling” testbed in Tokyo, partnering with GF for pre-insulated piping to test chiller-less systems like direct liquid cooling.