Executive summary:

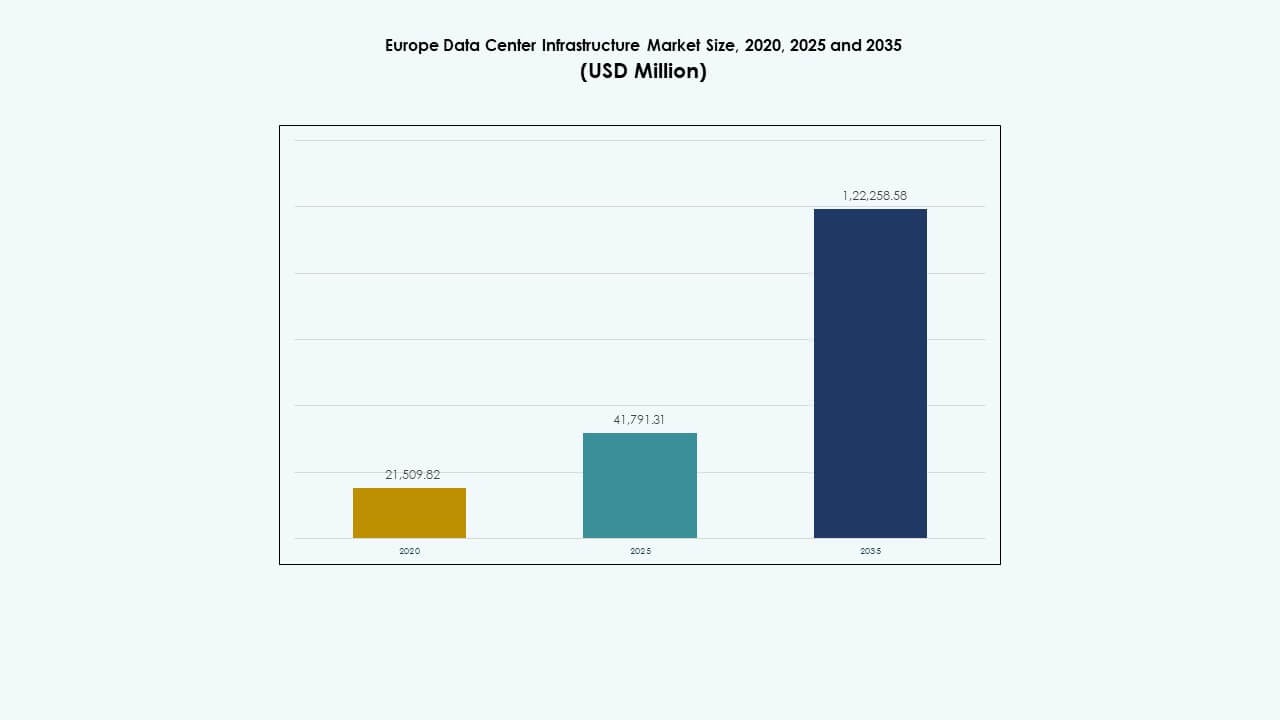

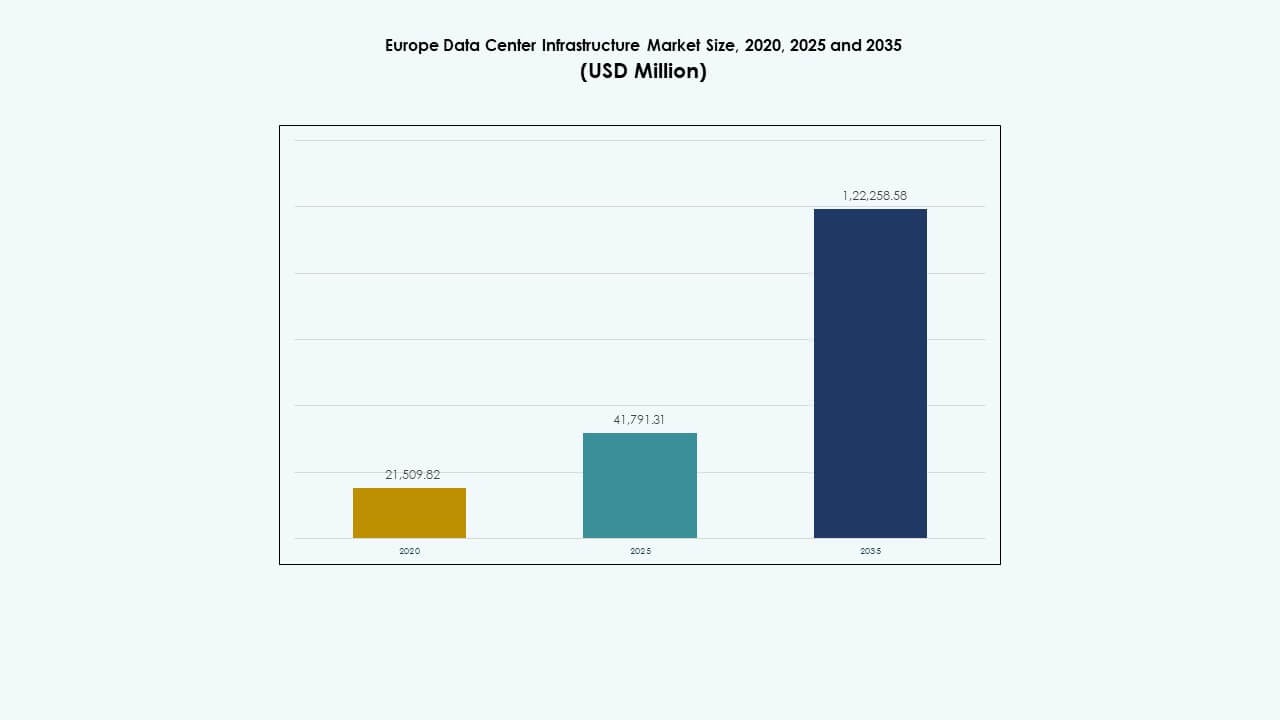

The Europe Data Center Infrastructure Market size was valued at USD 21,509.82 million in 2020, reached USD 41,791.31 million in 2025, and is anticipated to reach USD 122,258.58 million by 2035, at a CAGR of 11.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Europe Data Center Infrastructure Market Size 2025 |

USD 41,791.31 Million |

| Europe Data Center Infrastructure Market, CAGR |

11.25% |

| Europe Data Center Infrastructure Market Size 2035 |

USD 122,258.58 Million |

Rising demand for AI and cloud computing drives rapid infrastructure expansion across the region. Businesses modernize data centers with advanced cooling, power management, and automation solutions to enhance uptime and sustainability. It serves as a strategic investment hub for enterprises and investors focusing on digital transformation, renewable power integration, and operational efficiency in connected ecosystems.

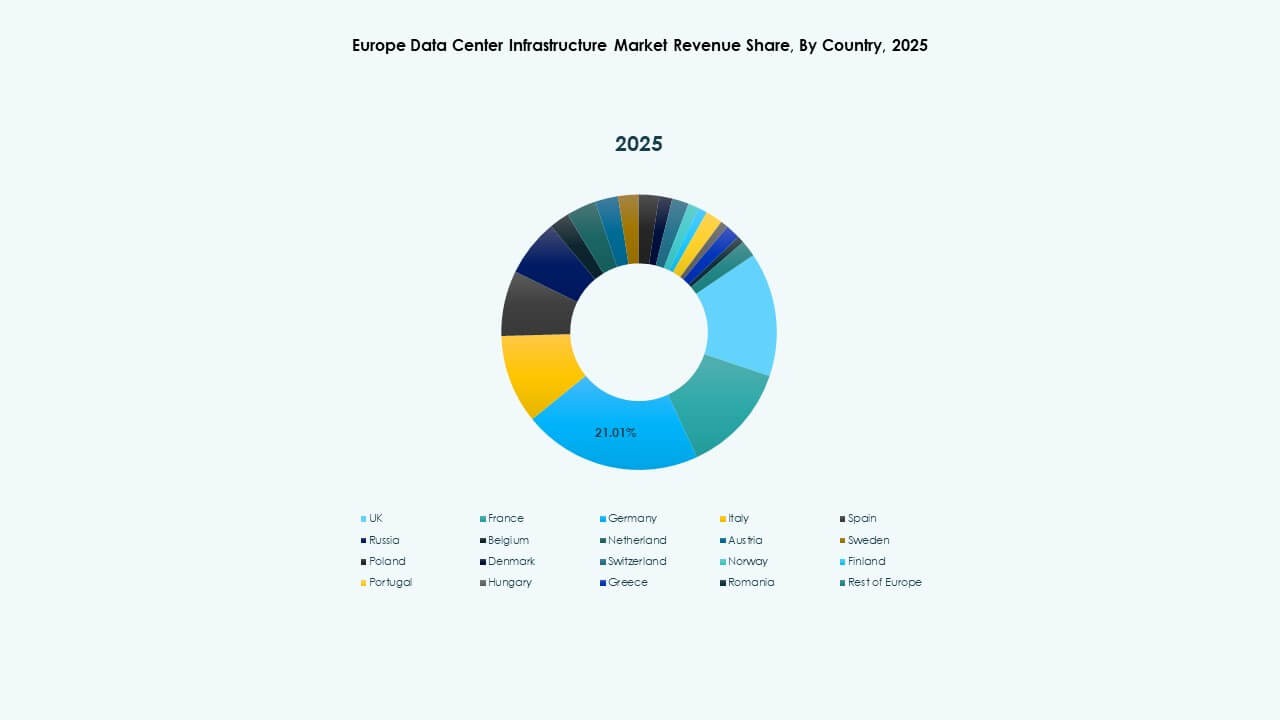

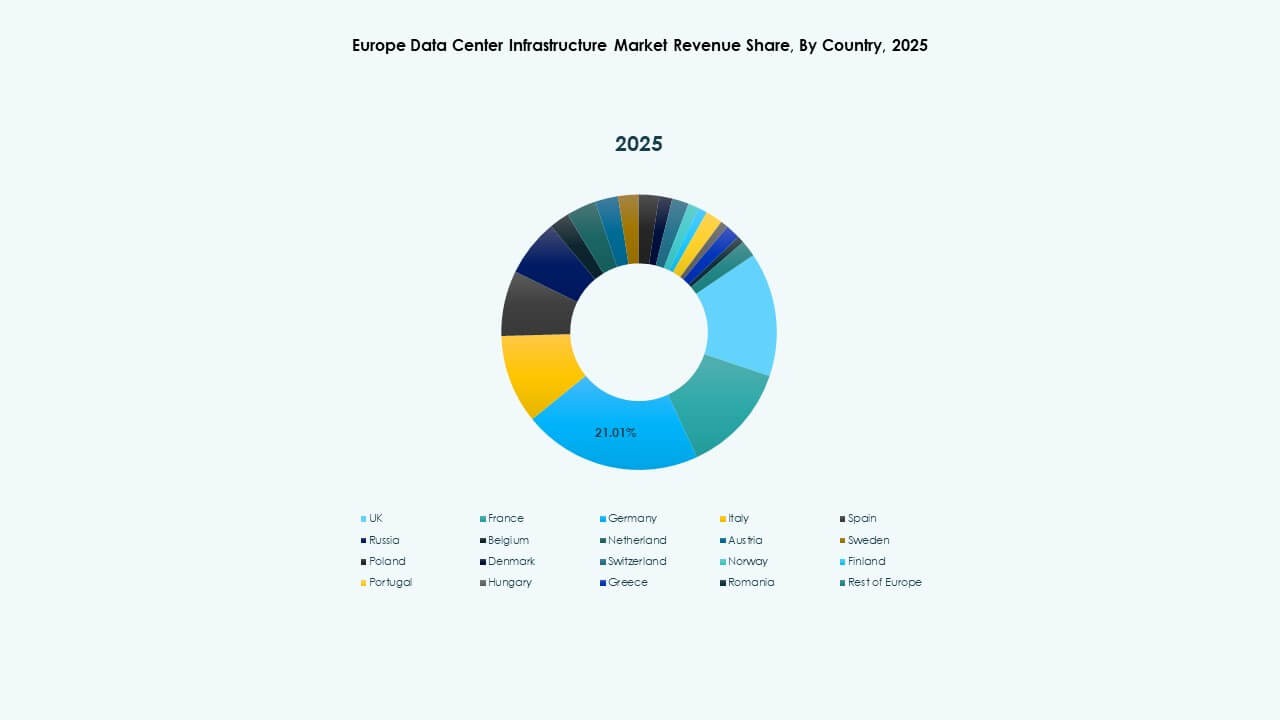

Western Europe remains dominant, led by the UK, Germany, and France due to advanced connectivity and mature digital infrastructure. The Nordic countries gain prominence for renewable power and climate efficiency. Meanwhile, Southern and Eastern European nations, including Spain and Poland, emerge as attractive growth zones driven by policy support, green energy, and expanding edge deployments.

Market Drivers

Market Drivers

Accelerating Cloud and AI Adoption Driving Data Center Expansion

Rapid expansion of cloud and AI workloads fuels strong demand for new data center capacity. Enterprises deploy advanced computing infrastructure to support analytics, automation, and generative AI workloads. Hyperscalers increase investments in scalable and energy-efficient data centers to meet rising regional cloud demand. Hybrid cloud strategies create steady requirements for colocation and edge setups. Many governments promote digital sovereignty, strengthening local infrastructure commitments. Growing adoption of AI-based management tools enhances performance and reduces downtime. The Europe Data Center Infrastructure Market benefits from this growing integration of intelligent technologies across core systems.

Rising Focus on Energy Efficiency and Green Data Infrastructure

Operators prioritize efficient designs to meet sustainability goals and reduce operational costs. Power usage effectiveness targets continue to tighten across the region under EU regulations. Facilities adopt liquid cooling and heat reuse systems to cut emissions. Renewable power sourcing becomes a major investment focus for large operators. Enterprises also demand carbon-neutral IT services that align with ESG targets. Energy-efficient hardware and modular systems reduce waste and simplify scalability. It drives long-term sustainability advantages for operators. Investors view such infrastructure as a cornerstone of Europe’s green digital transition.

- For example, Google maintains an industry-leading average Power Usage Effectiveness (PUE) of about 1.1 across its global data centers. The company uses advanced liquid cooling and heat reuse systems to cut emissions by roughly 40% and operates on 100% renewable energy, aligning with its long-term global and European sustainability goals.

Technological Transformation Through Modular and Prefabricated Infrastructure Models

Adoption of modular construction shortens deployment cycles and improves flexibility across facility designs. Prefabricated modules simplify upgrades and reduce on-site risks for large campuses. Vendors launch standardized building blocks supporting quick scalability. This shift helps operators expand edge and core networks simultaneously. Integrated design-build approaches improve coordination among contractors and suppliers. The approach allows predictable project delivery and cost savings for investors. The Europe Data Center Infrastructure Market experiences faster rollouts through modular scalability. It supports rapid alignment with cloud growth and regional compute demands.

- For example, Equinix has adopted modular architecture to accelerate global and European data center deployments. By 2025, it had deployed over 50 modular facilities worldwide, reducing build time by up to 70% and enabling rapid scalability to meet growing cloud and colocation demand.

Strategic Investments Strengthening Connectivity and Digital Sovereignty

Telecom consolidation and fiber network expansion improve interconnectivity between hubs and edge zones. Governments fund sovereign cloud and data residency programs to safeguard sensitive data. Submarine cables and terrestrial links enhance cross-border network capacity. Colocation providers upgrade facilities to support low-latency financial and AI applications. Strategic investments by hyperscalers deepen Europe’s role in global digital exchange. Investors see stable growth through long-term leasing contracts and strong enterprise demand. It reinforces Europe’s position as a global leader in secure and connected data infrastructure.

Market Trends

Market Trends

Integration of Renewable Energy into Data Center Operations

Operators increasingly link facilities to wind, solar, and hydro power sources to cut emissions. Many adopt direct power purchase agreements to secure long-term renewable supply. Energy storage systems stabilize operations and minimize grid dependency. District heating projects recover waste heat for nearby communities. These initiatives position data centers as sustainable contributors to regional energy ecosystems. The Europe Data Center Infrastructure Market witnesses growing adoption of carbon-free power frameworks. It aligns energy resilience with the continent’s climate-neutral objectives.

Rising Adoption of AI and Automation in Facility Management

AI systems monitor cooling, power, and workloads for predictive maintenance. Automated resource allocation reduces human error and improves uptime efficiency. Vendors deploy AI to optimize airflow, temperature, and energy use. Predictive analytics forecast system strain to prevent unplanned outages. Automation improves service levels across both hyperscale and edge facilities. The trend strengthens operational control across complex networks. It helps data centers achieve higher utilization and lower operational costs within competitive markets.

Growth of Edge Data Centers Supporting 5G and IoT Expansion

Edge sites emerge to reduce latency and support real-time data transfer. Telecom and cloud providers expand micro-facilities near urban zones for faster access. Demand rises for localized processing to enable smart city and autonomous mobility applications. Compact and modular infrastructure supports faster deployment near population hubs. This trend complements hyperscale networks by distributing processing power efficiently. The Europe Data Center Infrastructure Market expands with edge integration improving digital accessibility. It creates balanced data ecosystems across metropolitan and remote regions.

Increased Investments in High-Density and Liquid Cooling Technologies

High-performance computing drives the shift toward higher rack densities. Facilities adopt immersion and direct-to-chip cooling to handle thermal loads. These technologies enhance operational efficiency and system reliability in dense server environments. Operators integrate hybrid cooling systems to support mixed workloads. Vendors focus on compact liquid systems for new AI and GPU clusters. It enhances scalability while maintaining low power usage ratios. The adoption trend marks a vital step in Europe’s transition toward high-density digital infrastructure.

Market Challenges

Market Challenges

High Energy Consumption and Grid Limitations Restricting Expansion

Growing facility demand increases regional electricity load, straining power networks in dense urban zones. Operators face challenges securing sustainable and affordable power sources. Rising utility costs impact project economics and slow construction timelines. Regulatory barriers and grid connection delays extend commissioning cycles. Renewable integration remains uneven across certain regions due to grid limitations. The Europe Data Center Infrastructure Market faces pressure to balance energy use with performance efficiency. It pushes operators to prioritize long-term grid partnerships and on-site generation models.

Complex Regulatory Landscape and Land Availability Constraints

Operators navigate varied regulations covering data privacy, environmental impact, and building codes. Land scarcity near major metros limits large-scale development. Planning approvals take longer, raising capital costs for investors. Compliance with ESG mandates requires significant reporting and certification. Cross-border coordination adds further complexity to network planning. Smaller markets face limited access to skilled workforce and construction resources. It increases project delivery risks and slows the regional expansion momentum.

Market Opportunities

Emerging Edge and Secondary Markets Offering New Investment Potential

Rapid digitalization in Central and Eastern Europe creates fresh growth avenues. Edge facilities near logistics hubs and smart city projects attract new funding. Lower land costs and renewable potential drive investments in Poland, Hungary, and the Baltic states. Regional governments encourage digital infrastructure through incentives and tax reforms. The Europe Data Center Infrastructure Market benefits from this geographic diversification. It widens network coverage and creates balanced load distribution across the continent.

Advances in Modular, AI, and Sustainable Construction Practices

Modular data centers with pre-engineered components enable quick installation and expansion. AI-powered design tools optimize airflow and reduce energy usage during planning. Sustainable construction materials improve carbon efficiency and site longevity. Vendors collaborate with renewable suppliers to build zero-emission campuses. It fosters innovation and aligns infrastructure growth with EU sustainability goals. These advancements build strong investment confidence across future-ready digital campuses.

Market Segmentation

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates due to continuous demand for reliable power delivery. Operators prioritize redundant and efficient systems to sustain 24/7 uptime. Mechanical systems, including cooling units and chillers, gain traction for thermal control. Civil and architectural components secure facility stability and modular adaptability. IT and network infrastructure enhance speed, connectivity, and data throughput. The Europe Data Center Infrastructure Market gains balanced growth across these core categories, reflecting integrated system development.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) leads this segment due to its role in preventing data loss. Power Distribution Units (PDUs) and Switchgears follow closely, supporting continuous power transfer. Battery Energy Storage Systems gain adoption for renewable integration. Utility service connections ensure operational reliability. Operators focus on hybrid power chains combining grid and backup solutions. It strengthens power stability across hyperscale and enterprise facilities.

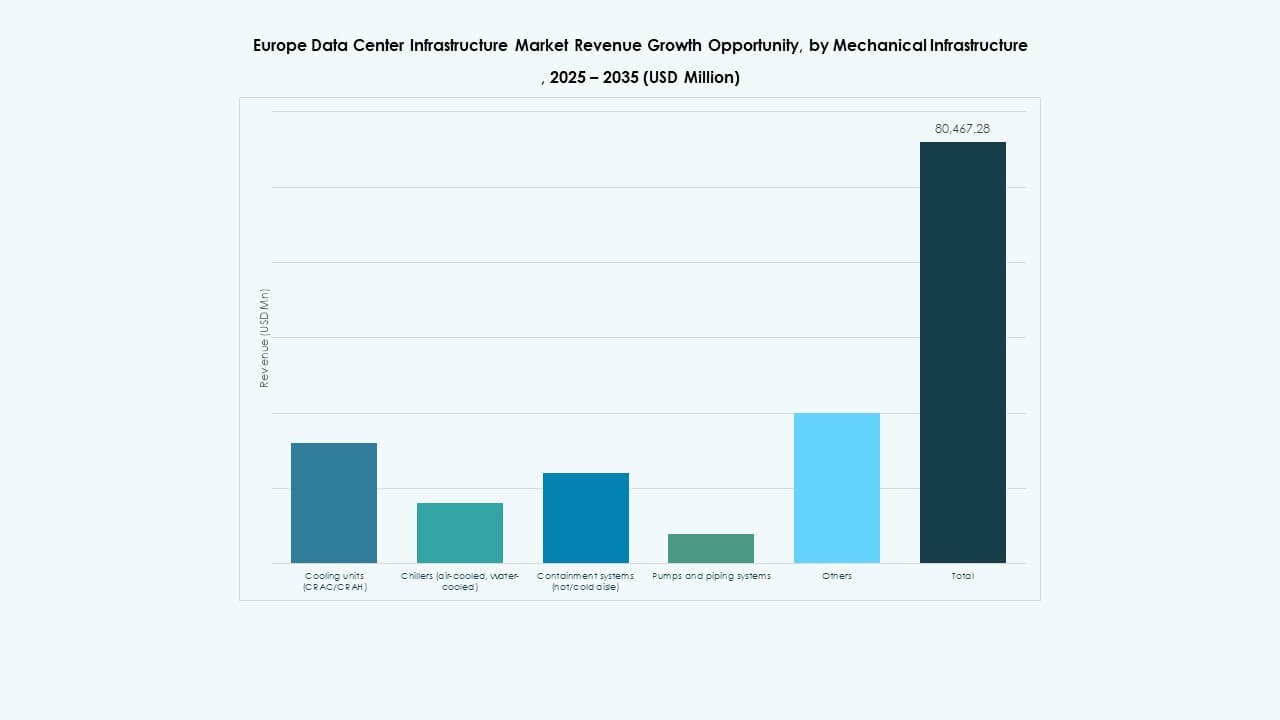

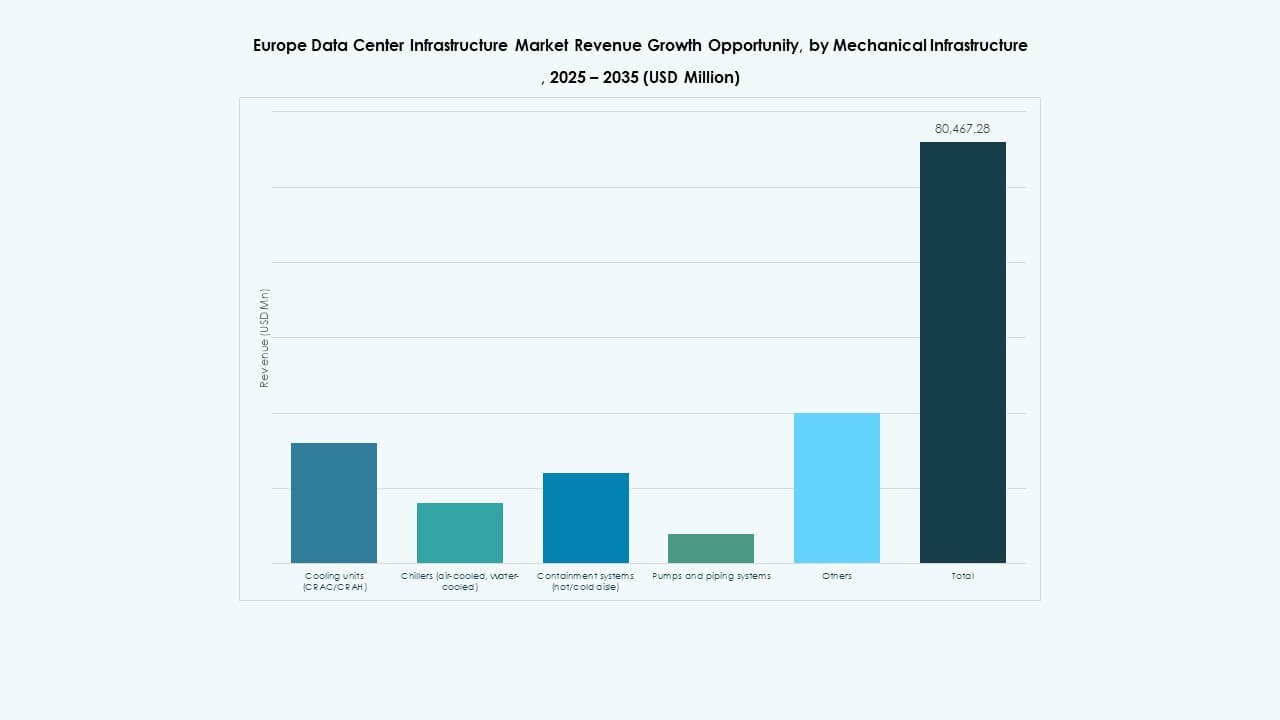

By Mechanical Infrastructure

Cooling units and chillers form the largest share as AI and HPC workloads intensify. Containment systems improve airflow and energy savings. Pumps and piping networks support advanced liquid-based solutions. Hot and cold aisle systems enhance precision cooling. Operators upgrade mechanical designs to achieve optimal thermal efficiency. The segment underpins operational sustainability and hardware longevity across expanding campuses.

By Civil / Structural & Architectural

Superstructure and modular building systems dominate for speed and durability. Raised flooring supports flexible cabling layouts for scalable operations. Building envelope materials improve insulation and environmental control. Prefabricated units reduce on-site construction time and waste. The Europe Data Center Infrastructure Market leverages these elements to streamline project delivery. It enables faster commissioning and greater architectural resilience.

By IT & Network Infrastructure

Servers and storage units hold a major portion due to increased computing needs. Networking equipment ensures high bandwidth and low latency connections. Racks and enclosures standardize layouts for operational efficiency. Optical fiber and structured cabling enhance data transmission reliability. The segment continues to evolve with next-gen connectivity upgrades. It forms the technological backbone of Europe’s digital transformation framework.

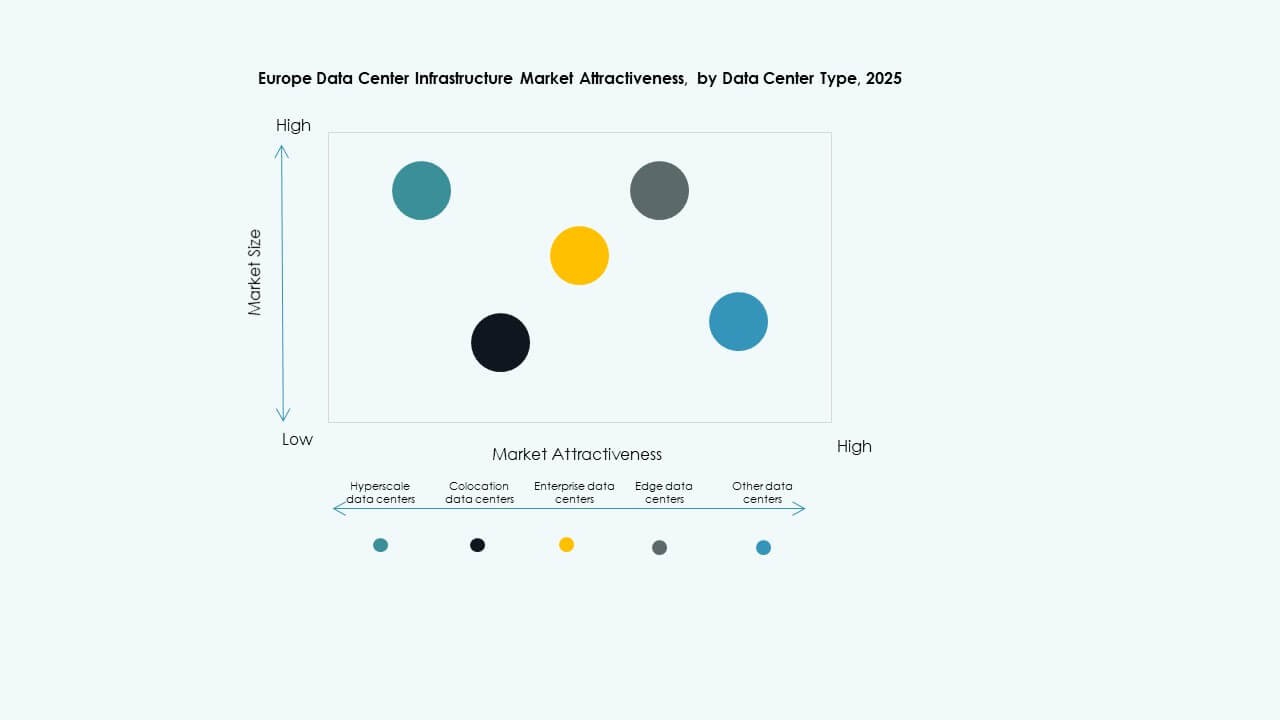

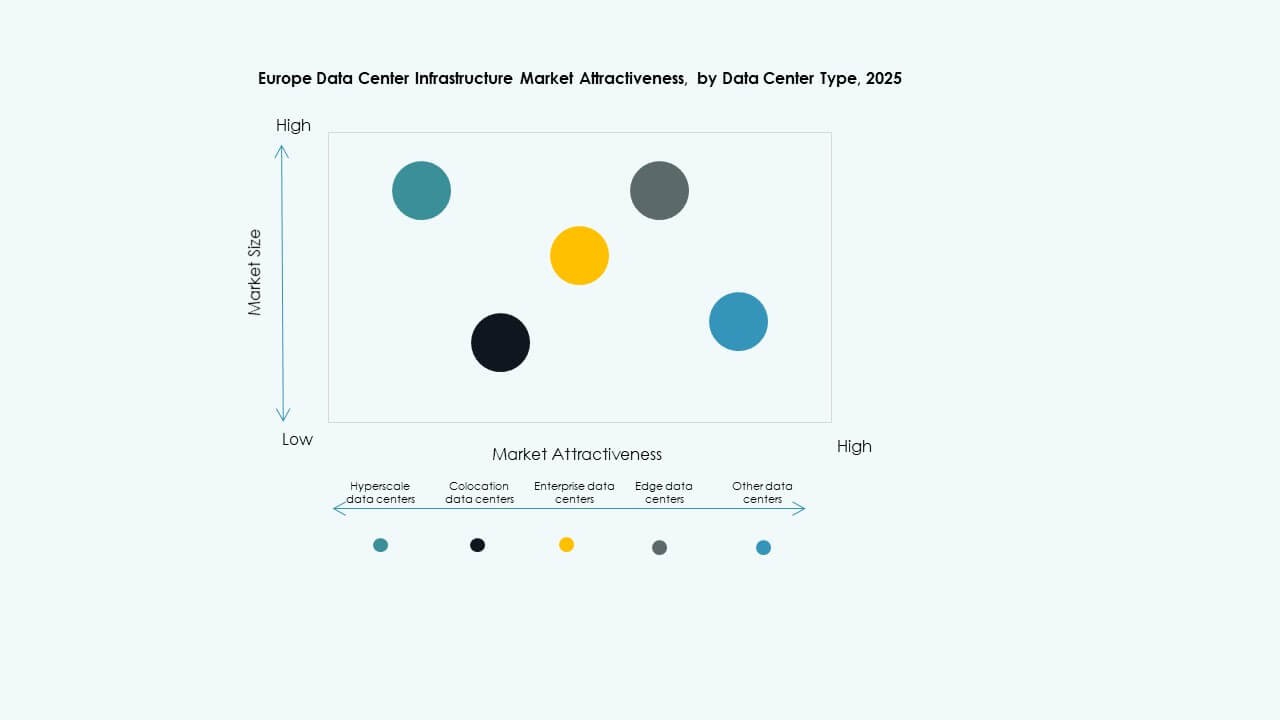

By Data Center Type

Hyperscale data centers dominate due to growing cloud and AI applications. Colocation facilities gain ground with enterprise outsourcing demand. Edge data centers grow rapidly to reduce latency in dense regions. Enterprise sites sustain specific workload control needs. The Europe Data Center Infrastructure Market balances these segments to meet diversified user requirements. It reflects the multi-tier structure of the regional ecosystem.

By Delivery Model

Design-Build/EPC leads with efficient project execution and integrated workflows. Turnkey and modular factory-built solutions attract hyperscale players. Retrofit projects expand as operators modernize legacy sites. Construction management models improve accountability and coordination. It demonstrates the market’s shift toward efficiency-driven delivery frameworks.

By Tier Type

Tier 3 facilities dominate for their redundancy and uptime balance. Tier 4 designs grow with mission-critical workloads needing fault tolerance. Tier 1 and 2 serve smaller enterprises with limited redundancy. Investors focus on higher-tier projects for reliability assurance. It strengthens regional competitiveness and data resilience standards.

Regional Insights

Regional Insights

Western Europe Maintaining Dominance Through Mature Infrastructure

Western Europe holds nearly 55% market share, led by the UK, Germany, and France. Strong connectivity, cloud density, and capital flow sustain its leadership. Established colocation hubs attract enterprise and hyperscale operators alike. High compliance standards ensure operational stability and investor trust. The Europe Data Center Infrastructure Market maintains high concentration here due to advanced grid access and policy support. It remains the epicenter of innovation and network growth.

- For example, Equinix’s FR13 data center in Frankfurt spans approximately 5,295 sqm and delivers 7.75 MW of IT load capacity. Digital Realty inaugurated its FRA18 facility in Frankfurt in 2025, offering 8,200 sqm of space and 16 MW of power capacity, strengthening the city’s role as a key European data-center hub.

Northern and Nordic Regions Emerging as Sustainable Powerhouses

The Nordic region accounts for around 20% market share, supported by renewable energy abundance. Sweden, Norway, and Finland offer low-cost green electricity and stable climates. Data centers in these areas achieve strong energy efficiency metrics. Governments promote investments through green taxation benefits. It fosters large-scale deployments by hyperscalers seeking sustainable operations. The region stands out as Europe’s renewable-driven infrastructure model.

- For example, in the Nordic region, EcoDataCenter operates carbon-positive facilities powered entirely by renewable energy. Google’s Hamina data center in Finland, one of Europe’s largest, achieves a Power Usage Effectiveness (PUE) of about 1.1, demonstrating world-class energy efficiency enabled by the region’s cold climate and green electricity supply.

Southern and Eastern Europe Becoming Next Growth Frontier

Southern and Eastern Europe collectively represent about 25% of the market. Spain, Italy, and Poland lead emerging development due to strategic location and lower costs. Infrastructure projects expand near undersea cable landings and logistics corridors. Governments implement digital policies and regional cloud frameworks to attract investment. The region’s rising power grid reliability supports large-scale construction. It positions these countries as the next cluster of data-driven growth in Europe.

Competitive Insights:

- Schneider Electric SE

- ABB Ltd.

- Vertiv Group Corp.

- Eaton Corporation plc

- Cisco Systems, Inc.

- Fujitsu Ltd.

- Dell Inc.

- Huawei Technologies Co., Ltd.

- Rittal GmbH & Co. KG

- Legrand SA

Major infrastructure vendors compete fiercely across power delivery, cooling, and facility automation. Schneider Electric holds a leading position in power and energy-management solutions for data centers, offering UPS, PDUs, and integrated cooling systems. ABB and Vertiv challenge with modular power and HVAC systems suited for scalable deployments. Cisco, Fujitsu, Dell, Huawei and Rittal provide complementary IT, cabling, and enclosure components. Eaton and Legrand add depth in power-distribution and backup systems, strengthening supply chain robustness. This competitive mix ensures operators can assemble full-stack solutions. The Europe Data Center Infrastructure Market benefits from this vendor diversity, enabling tailored builds and reducing supplier risk. Strong competition drives innovation, cost efficiency, and faster deployment — a clear benefit for investors, operators, and end-users.

Recent Developments:

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

- In May 2025, NTT DATA announced the accelerated expansion of its Global Data Centers division with land acquisitions across North America, Europe, and Asia, supporting nearly a gigawatt of planned data center capacity as part of a $10 billion investment through 2027.

In February 2025, Brookfield Infrastructure Partners and Data4 announced plans to invest over USD 20.7 billion in developing AI-driven data center infrastructure across France over the next five years, aiming to boost operational efficiency and support various industries including financial services and healthcare.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Market Segmentation

Market Segmentation Regional Insights

Regional Insights