Executive summary:

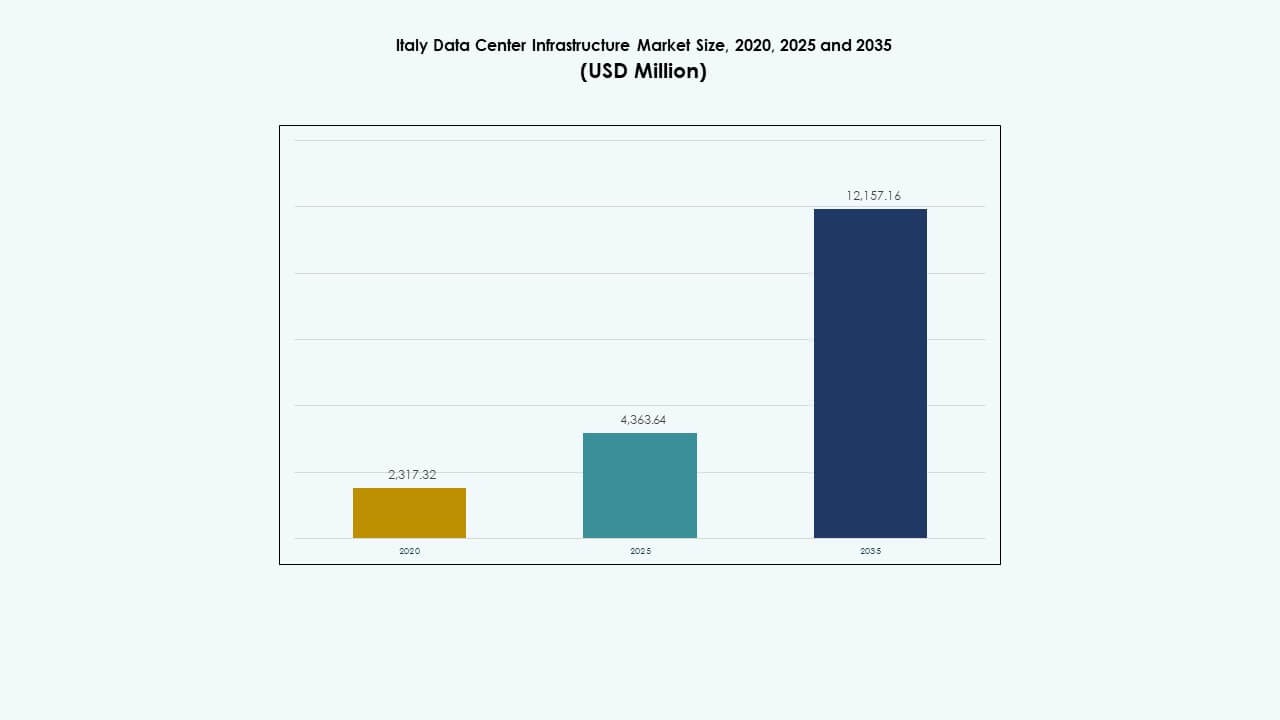

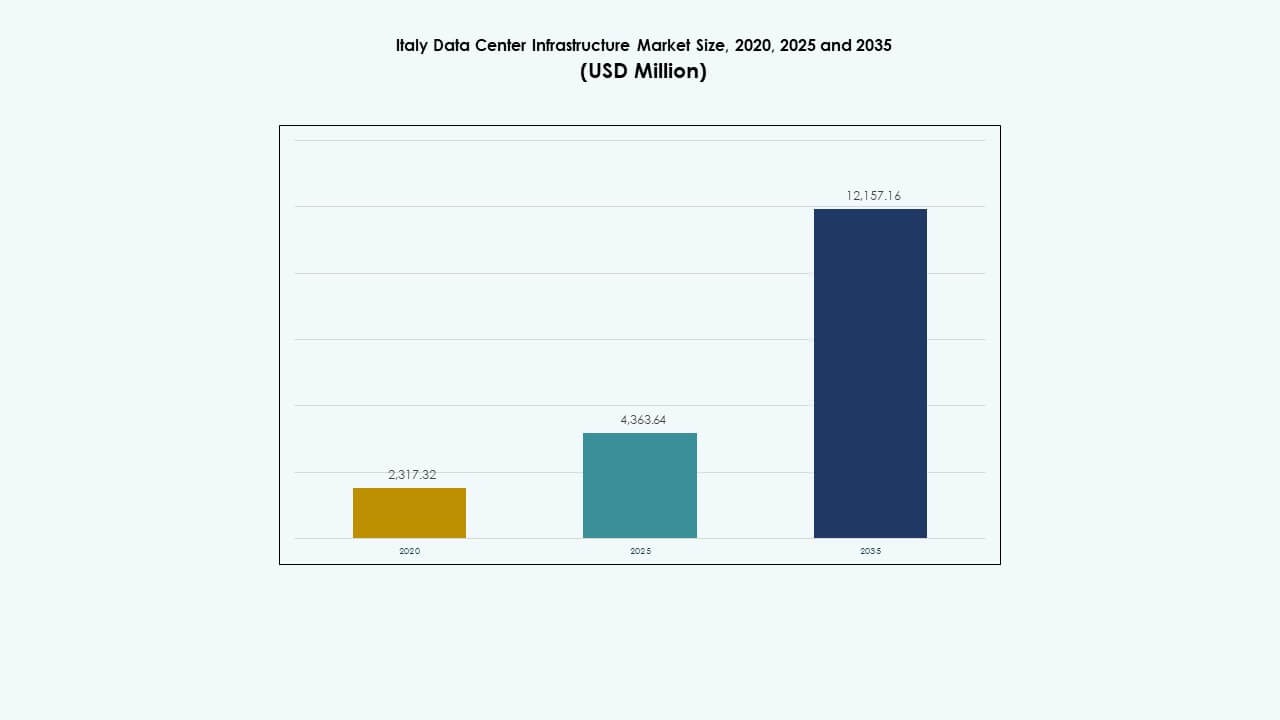

The Italy Data Center Infrastructure Market size was valued at USD 2,317.32 million in 2020 to USD 4,363.64 million in 2025 and is anticipated to reach USD 12,157.16 million by 2035, at a CAGR of 10.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Italy Data Center Infrastructure Market Size 2025 |

USD 4,363.64 Million |

| Italy Data Center Infrastructure Market, CAGR |

10.72% |

| Italy Data Center Infrastructure Market Size 2035 |

USD 12,157.16 Million |

The market expands due to strong cloud adoption, AI integration, and the rapid digitalization of businesses. Enterprises invest in advanced IT, mechanical, and power infrastructure to enhance reliability and efficiency. Innovation in modular and liquid-cooled systems drives sustainable growth. It holds strategic importance for investors seeking long-term returns through high-density and renewable-powered facilities that support Italy’s expanding digital economy and regulatory transformation.

Northern Italy leads in deployments, supported by major hubs in Milan and Turin, where strong connectivity and industrial networks foster large-scale projects. Central regions such as Rome show steady growth due to enterprise modernization. Southern Italy and island regions emerge gradually with renewable energy integration and new submarine cable connectivity improving cross-border data exchange and regional capacity balance.

Market Drivers

Market Drivers

Rising Demand for Cloud Services and Digital Transformation

The Italy Data Center Infrastructure Market grows strongly due to rapid cloud adoption and digital transformation across sectors. Enterprises migrate workloads to hybrid and multi-cloud environments for agility and scalability. Government projects promoting digital innovation further strengthen demand. Businesses across finance, healthcare, and retail integrate AI and IoT applications that require low-latency storage. It supports modernization through scalable architecture and energy-efficient systems. Telecom providers expand fiber connectivity to support next-generation workloads. Investment from global hyperscale operators enhances Italy’s infrastructure competitiveness. This transformation reinforces Italy’s role as a digital hub in Southern Europe.

- For example, Equinix has been significantly expanding its data center presence in Milan, Italy, with the ML5 International Business Exchange (IBX) facility. Opened in early 2021, ML5 initially provided 500 cabinet equivalents and 15,000 square feet of colocation space, with plans to expand to over 1,450 cabinets and 45,000 square feet.

Expansion of Edge Data Centers to Support Localized Computing

Edge data centers gain importance with the rise of latency-sensitive applications. These smaller facilities deliver processing closer to end users, supporting real-time analytics, 5G, and IoT. The Italy Data Center Infrastructure Market benefits from telecom and IT partnerships promoting decentralized networks. It reduces congestion in core facilities and enhances user experience. Automation tools optimize workloads across distributed centers. Localized data processing also improves regulatory compliance by keeping data within national borders. Energy-efficient cooling systems further improve performance in regional facilities. The approach enables smart city development and industrial automation. Investors prioritize these compact centers for quicker deployment cycles.

Sustainability and Renewable Energy Adoption Driving Infrastructure Upgrades

Energy efficiency becomes a critical driver for operators seeking long-term sustainability. The Italy Data Center Infrastructure Market emphasizes renewable energy sourcing to reduce carbon footprints. Operators invest in solar, wind, and hydro-powered data centers. Advanced cooling systems using free air and liquid solutions enhance power usage effectiveness. Data centers adopt ISO 50001 and EN 50600 certifications for energy management. It aligns with European Union Green Deal goals for digital sustainability. Energy-efficient UPS systems and modular infrastructure further minimize environmental impact. Large corporations implement green strategies to attract eco-conscious clients. The trend also helps lower operational costs and enhance reliability.

- For example, Aruba S.p.A., one of Italy’s leading data center operators, has achieved advanced sustainability metrics by powering its facilities predominantly with renewable energy sources such as solar and hydroelectric power. Aruba reports achieving a power usage effectiveness (PUE) ratio of approximately 1.3 across its data centers, thanks to innovative free-air cooling and liquid cooling technologies.

Integration of Artificial Intelligence and Automation in Operations

Automation tools powered by AI reshape the way data centers function. Predictive analytics improve uptime, fault detection, and energy management. The Italy Data Center Infrastructure Market benefits from intelligent monitoring tools that optimize cooling and power efficiency. Operators integrate robotics for hardware maintenance and equipment movement. Machine learning models analyze workload distribution for better capacity planning. It enhances security through automated surveillance and anomaly detection. Companies adopt digital twins to simulate performance under varying loads. These innovations ensure operational stability while reducing human error. AI-driven automation also accelerates scalability for future workloads.

Market Trends

Market Trends

Growth of Hyperscale and Colocation Facilities Across Key Cities

The Italy Data Center Infrastructure Market witnesses strong expansion in hyperscale and colocation facilities. Major operators establish large campuses near Milan and Rome, targeting enterprise and cloud clients. These facilities provide scalable capacity and redundant power systems. Rising enterprise outsourcing drives colocation contracts among SMEs. It supports businesses seeking flexibility without high capital investment. Hyperscale operators collaborate with local construction partners to speed up deployment. The surge reflects global tech firms’ growing trust in Italy’s digital ecosystem. Competitive pricing and advanced fiber routes enhance attractiveness. These centers form the backbone for data-intensive industries.

Emergence of Modular and Prefabricated Data Center Construction

Demand for modular and prefabricated structures accelerates due to shorter deployment timelines. Prefabricated modules enable scalable capacity while maintaining quality standards. The Italy Data Center Infrastructure Market shifts toward factory-built systems that reduce on-site labor dependency. Modular units improve project delivery under strict space or zoning limits. It ensures faster commissioning and better cost predictability. Firms use modular power and cooling blocks to support varying client needs. Adoption of these designs enhances flexibility for future expansion. Industrial parks across northern regions become hotbeds for modular assembly. The approach aligns with sustainable and repeatable construction practices.

Integration of Liquid Cooling and Advanced Thermal Management

Thermal innovation reshapes infrastructure standards across Italian data centers. Operators move toward liquid cooling for high-density workloads like AI and blockchain. The Italy Data Center Infrastructure Market adopts immersion and direct-to-chip systems for better energy efficiency. Free-air and hybrid cooling help reduce power consumption in temperate climates. It drives new designs supporting advanced temperature regulation. Operators implement intelligent cooling controls linked with AI systems. The trend enables stable performance even during peak load conditions. Collaboration with equipment manufacturers brings custom thermal solutions to local markets. This focus strengthens competitiveness in high-performance computing.

Shift Toward Carrier-Neutral and Interconnected Ecosystems

Carrier-neutral ecosystems redefine data exchange in Italy. Facilities provide direct access to multiple cloud and telecom providers. The Italy Data Center Infrastructure Market promotes interconnectivity between enterprise users, ISPs, and content networks. It enables flexible routing and faster latency-sensitive operations. Businesses benefit from diverse connectivity options reducing vendor lock-in. Growing demand for cross-connect services enhances revenue diversity for operators. The trend supports hybrid cloud adoption and multi-site redundancy. Neutral exchange hubs also strengthen international data flow between Mediterranean and central Europe. This interconnected environment improves scalability and network resilience.

Market Challenges

Market Challenges

High Energy Consumption and Strain on Power Infrastructure

Power demand continues to rise across large-scale data facilities. The Italy Data Center Infrastructure Market faces challenges meeting the high electricity requirements of hyperscale and colocation operations. Limited grid capacity in certain regions constrains expansion. Operators encounter delays in obtaining new grid connections. Rising electricity costs reduce operational margins and deter smaller entrants. It creates pressure on national grids already serving manufacturing and residential loads. The push toward renewables demands infrastructure modernization. Grid stability becomes critical during peak usage. Addressing this requires coordinated planning between utilities and developers.

Regulatory Constraints and Construction Delays in Urban Areas

Zoning restrictions and lengthy approval cycles slow new developments. The Italy Data Center Infrastructure Market experiences hurdles related to land use, noise, and energy permits. Local authorities impose strict building codes affecting project timelines. It impacts investment returns and developer confidence. Urban density in Milan and Rome limits large-scale construction. Compliance with EU sustainability and data sovereignty rules adds complexity. Companies invest more in legal and environmental assessments before project execution. Slow permitting also raises project costs. Streamlining policies could unlock higher foreign investment in infrastructure growth.

Market Opportunities

Expansion of AI, IoT, and 5G Infrastructure Driving New Demand

Emerging technologies create strong opportunities across computing ecosystems. The Italy Data Center Infrastructure Market benefits from 5G rollout, IoT adoption, and AI workloads that require real-time processing. Edge computing investments expand near industrial and urban hubs. It enables faster data handling for manufacturing, logistics, and healthcare. Integration with AI supports predictive maintenance and automation. Telecom partnerships accelerate infrastructure readiness. The sector’s alignment with digital innovation policies creates long-term growth momentum.

Strategic Role of Italy as a Southern European Connectivity Hub

Italy’s geographic position strengthens its role in transcontinental data routes. The Italy Data Center Infrastructure Market benefits from undersea cable landings linking Europe, Africa, and the Middle East. Coastal regions host new facilities serving cross-border data traffic. It attracts global hyperscale investors seeking proximity to emerging African and Balkan markets. Improved grid stability and renewable potential support regional competitiveness. Continued infrastructure investments enhance Italy’s strategic standing in European digital connectivity.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates the Italy Data Center Infrastructure Market due to the country’s focus on reliable energy systems. Mechanical systems also show strong demand driven by advanced cooling technologies. Civil and architectural components gain traction with modular and seismic-resistant construction. IT and network infrastructure remain vital for supporting cloud connectivity. The integration of efficient servers and cabling improves overall performance. This segment collectively ensures operational resilience and energy optimization.

By Electrical Infrastructure

Uninterruptible power supply (UPS) and power distribution units (PDUs) lead adoption rates. The Italy Data Center Infrastructure Market values these components for maintaining uptime and stable voltage delivery. Battery energy storage systems (BESS) expand usage for backup capacity. Smart switchgears enhance automation in energy control. Utility service upgrades strengthen grid resilience. Investment in renewable-powered systems continues to grow. These innovations ensure sustainable and uninterrupted operations across major hubs.

By Mechanical Infrastructure

Cooling units and chillers represent the most critical mechanical systems. The Italy Data Center Infrastructure Market adopts efficient air and liquid-based cooling solutions to lower energy consumption. Containment systems optimize airflow management. Pumps and piping upgrades improve overall cooling reliability. Free-air systems dominate in temperate climates, reducing operational costs. Operators emphasize low PUE designs for environmental compliance. Growth stems from rising density workloads and edge deployments. Mechanical innovation remains essential to operational performance.

By Civil / Structural & Architectural

Superstructure and modular systems dominate due to faster assembly and cost benefits. The Italy Data Center Infrastructure Market relies on robust steel and concrete frameworks to meet safety norms. Raised floors and suspended ceilings enhance airflow and cable routing. Building envelopes adopt insulated panels to improve temperature control. Seismic stability influences design standards in sensitive zones. Site preparation aligns with green building initiatives. Prefabricated components shorten project timelines and enhance consistency.

By IT & Network Infrastructure

Networking equipment, servers, and storage lead in demand. The Italy Data Center Infrastructure Market experiences steady upgrades to support high-speed processing and data-heavy applications. Fiber cabling and advanced racks enhance scalability. Server density optimization drives energy-efficient operations. Modern enclosures improve space utilization. Enterprises integrate SDN technologies for dynamic traffic control. IT systems remain the backbone for digital transformation and cloud connectivity across sectors.

By Data Center Type

Colocation data centers dominate due to growing enterprise outsourcing. The Italy Data Center Infrastructure Market sees rapid expansion of hyperscale centers serving cloud providers. Edge data centers support regional computing near user zones. Enterprise facilities maintain presence for security-sensitive operations. Hybrid models emerge combining scalability and control. Each category adapts to industry-specific latency and compliance needs. Demand diversification supports resilient infrastructure investment across Italy.

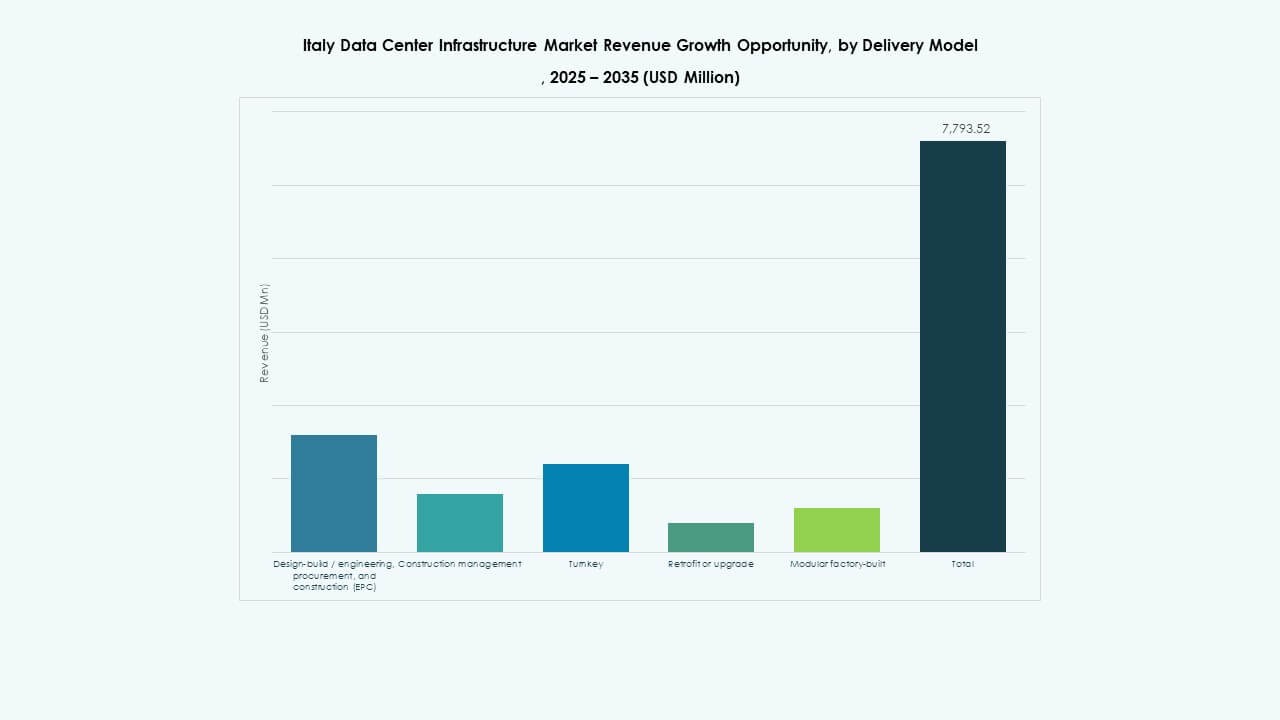

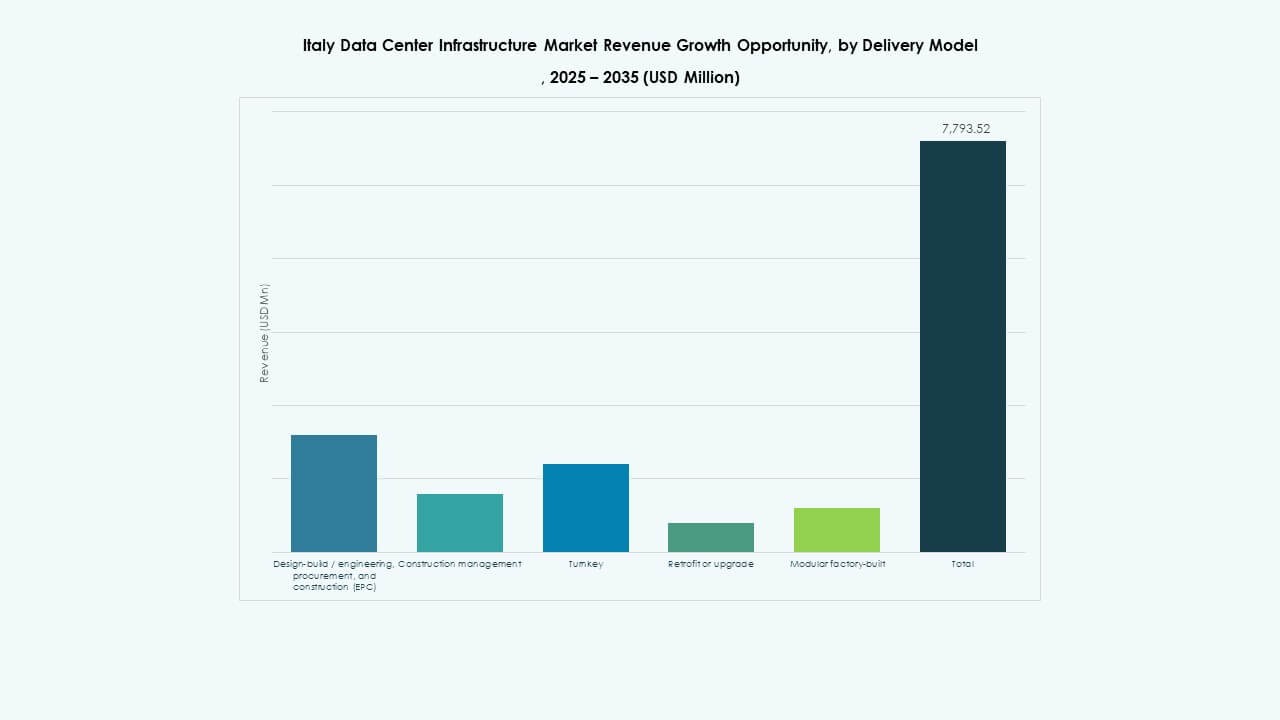

By Delivery Model

Design-build and turnkey models lead due to integrated project management benefits. The Italy Data Center Infrastructure Market prefers turnkey execution for faster delivery and cost control. Retrofit projects rise as older centers modernize power and cooling systems. Modular factory-built solutions gain attention for repeatable construction. EPC firms dominate large-scale development cycles. Construction management remains key for balancing cost, speed, and sustainability.

By Tier Type

Tier 3 data centers dominate installations across Italy for balancing reliability and cost efficiency. Tier 4 facilities emerge in hyperscale projects seeking redundancy and fault tolerance. Tier 1 and 2 structures serve regional and enterprise applications. The Italy Data Center Infrastructure Market benefits from rising compliance with global uptime standards. Demand for high-tier designs grows alongside mission-critical operations. Tier-based classification continues shaping investment and operational strategy.

Regional Insights

Regional Insights

Northern Italy – Leading Market with 52% Share

Northern Italy leads the Italy Data Center Infrastructure Market, hosting key hubs in Milan, Turin, and Bologna. Its strong connectivity, industrial base, and access to renewable energy drive concentration. Milan alone anchors several hyperscale projects and carrier-neutral facilities. Investors favor this region for its advanced fiber network and skilled workforce. Northern Italy’s strategic position enhances cross-border digital exchange. Government policies supporting technology parks strengthen continued dominance.

- For instance, Milan hosts hyperscalers like Equinix and Digital Realty, benefiting from dual 220 kV grid connections and proximity to Swiss hydroelectric power.

Central Italy – Emerging Growth Corridor with 28% Share

Central Italy grows through steady enterprise adoption and regional investments. Rome and Florence anchor data centers serving government, financial, and telecom sectors. The Italy Data Center Infrastructure Market benefits from improving grid reliability in these zones. Modern campuses integrate green energy systems to reduce operational costs. Infrastructure alignment with EU digital strategy fosters expansion. The corridor’s central position ensures balanced latency between north and south regions.

- A major example is Telecom Italia (TIM), which is investing about €130 million in a 25 MW data center near Rome in Pomezia, expected to become operational by late 2026.

Southern Italy and Islands – Expanding Frontiers with 20% Share

Southern Italy gains traction due to renewable energy potential and new cable landings. Palermo and Bari emerge as strategic sites for Mediterranean connectivity. The Italy Data Center Infrastructure Market attracts investment through lower land costs and energy incentives. Local governments encourage tech infrastructure through subsidies. Expansion supports data redundancy and disaster recovery functions. The region strengthens Italy’s overall resilience and international data capacity balance.

Competitive Insights:

- Equinix, Inc.

- Digital Realty

- Schneider Electric

- Vertiv

- ABB

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Huawei Technologies Co., Ltd.

- Fujitsu

The competitive landscape shows a mix of global colocation operators, equipment suppliers, and infrastructure vendors competing for capacity and services. Equinix and Digital Realty dominate with large data-centre footprints and strong interconnection ecosystems across Europe. Power and cooling infrastructure providers such as Schneider Electric, Vertiv and ABB capture significant share by offering UPS, thermal management and modular solutions. IT and networking vendors like Cisco, HPE, Dell and Huawei challenge with integrated server, storage and network stacks. Fujitsu supports customized enterprise-grade infrastructure. Competition remains intense on reliability, energy efficiency, scalability and sustainability metrics. Investors favour firms that offer modular designs, redundant power and inter-carrier neutrality. It drives rapid upgrades and expansion across key metros.

Recent Developments:

- In November 2025, Vertiv announced the acquisition of HVAC services firm PurgeRite for approximately USD 1 billion. The acquisition aims to expand Vertiv’s liquid-cooling and thermal-management capabilities to meet rising demand from high-power, AI-driven data centers. This enhances Vertiv’s mechanical infrastructure offerings in cooling and HVAC services

- In October 2025, Hitachi signed a strategic partnership with OpenAI to expand global AI data-center infrastructure. Under this agreement, the companies will co-develop modular and prefabricated data-center designs, energy-efficient cooling and storage infrastructures, and plan supply-chain strategies for reliable deployment. The deal targets sustainable data-center operations and rapid global expansion of AI infrastructure

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights