Executive summary:

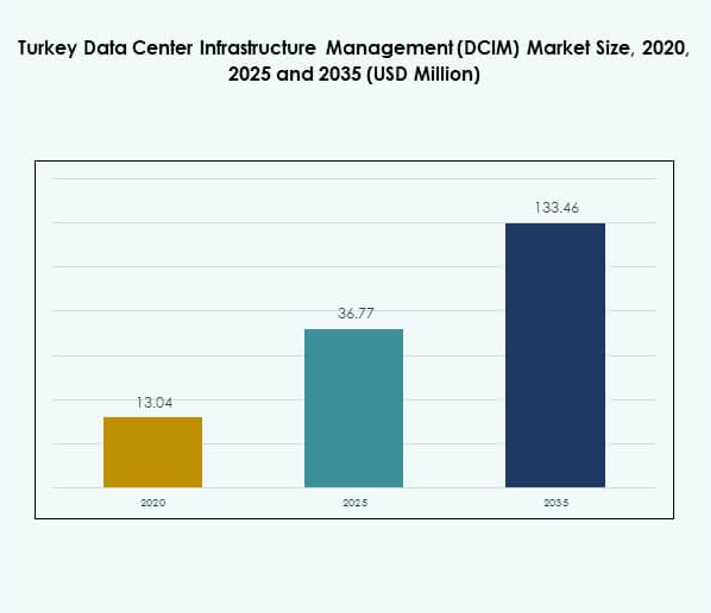

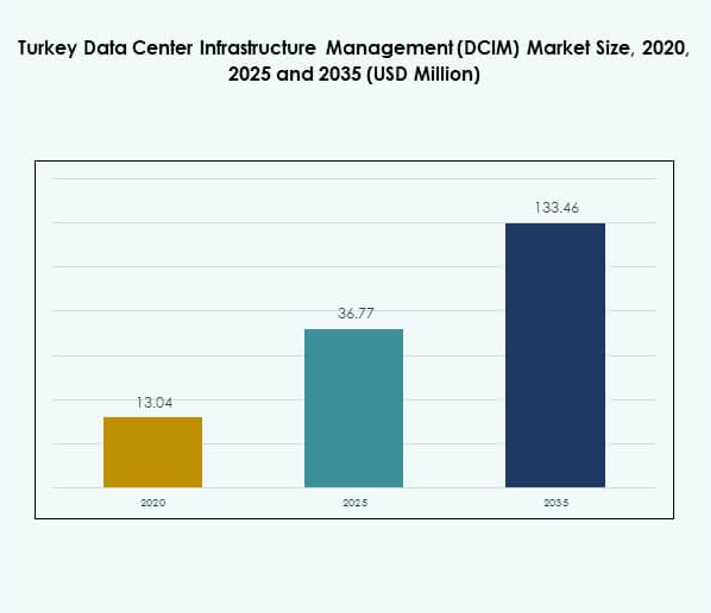

The Turkey Data Center Infrastructure Management (DCIM) Market size was valued at USD 13.04 million in 2020, reached USD 36.77 million in 2025, and is anticipated to reach USD 133.46 million by 2035, at a CAGR of 15.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Turkey Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 36.77 Million |

| Turkey Data Center Infrastructure Management (DCIM) Market, CAGR |

15.53% |

| Turkey Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 133.46 Million |

The market growth is driven by the adoption of AI-powered analytics, IoT-enabled monitoring, and cloud-based DCIM platforms that enhance operational visibility and energy efficiency. Rising demand for automation and sustainability across data centers encourages vendors to offer intelligent, modular, and scalable solutions. For businesses and investors, the market presents strong strategic potential for optimizing resources and improving infrastructure reliability.

Western Turkey dominates due to its advanced data center ecosystem, strong fiber connectivity, and proximity to European markets. Central regions are emerging as key industrial and energy hubs supporting DCIM deployment. Eastern Turkey is gaining traction with new data connectivity routes and government-supported digital infrastructure projects, strengthening its position in the national data center landscape.

Market Drivers

Growing Digital Transformation and Data Center Modernization Across Industries

The Turkey Data Center Infrastructure Management (DCIM) Market is advancing rapidly due to increased digital transformation across industries. Businesses in telecom, BFSI, and manufacturing are expanding data capacity to support automation and AI integration. It benefits from rising investments in smart infrastructure that improve real-time performance monitoring and asset control. Energy efficiency and predictive analytics are major goals for enterprises managing critical operations. The government’s digitalization initiatives promote data localization and improved compliance frameworks. Cloud and edge infrastructure adoption strengthens operational visibility. These transitions drive a steady demand for DCIM platforms.

Rising Adoption of AI-Driven Analytics and IoT-Enabled Infrastructure Optimization

Enterprises in Turkey increasingly adopt AI and IoT-enabled DCIM solutions to enhance predictive maintenance and resource utilization. Smart sensors and automated systems improve power usage effectiveness and equipment lifespan. It enables continuous monitoring of assets, supporting higher uptime levels for mission-critical data centers. AI analytics also simplify complex capacity planning and energy control. The ability to reduce downtime and optimize costs attracts both private and public operators. Integration with IoT ecosystems improves sustainability by cutting unnecessary power use. These advancements highlight the market’s strategic value for long-term operational stability.

- For instance, ABB’s Ability™ Condition Monitoring platform uses AI-driven analytics and IoT sensors to track asset performance and predict equipment issues in real time. It enables proactive maintenance and improves operational efficiency across industrial and data center environments, aligning with the growing adoption of intelligent infrastructure optimization in the Turkey.

Expanding Cloud Computing Ecosystem and Edge Data Center Integration

Turkey’s expanding cloud ecosystem plays a key role in accelerating DCIM adoption. The surge in cloud providers and hyperscale data centers fuels investments in scalable and secure management platforms. It supports hybrid models that balance on-premises and cloud operations efficiently. Edge computing further complements this trend by increasing the need for distributed infrastructure management. DCIM tools help operators achieve visibility across diverse environments and ensure performance continuity. Cloud-linked architectures also strengthen resilience during high workloads. This growth aligns with Turkey’s vision to build a robust digital economy and attract regional investors.

Strategic Emphasis on Energy Efficiency and Green Data Center Operations

The rising focus on sustainability drives new DCIM deployments across Turkish data centers. Operators are adopting renewable energy integration and advanced cooling technologies to reduce carbon footprints. It allows optimization of power and thermal efficiency while meeting international environmental standards. Businesses view DCIM as essential for tracking energy use and achieving ESG targets. Regulatory bodies encourage compliance with energy management standards. Investments in green initiatives also improve brand reputation among global clients. The growing alignment between sustainability and technology efficiency reinforces the market’s long-term growth prospects.

- For instance, Siemens offers an AI-driven White Space Cooling Optimization (WSCO) solution that dynamically adjusts cooling output to match IT load, improving thermal efficiency and reducing energy consumption in data centers. The company also promotes district heating integration, enabling the reuse of waste heat to lower carbon emissions, as outlined in Siemens’ official whitepapers and global sustainability reports.

Market Trends

Integration of AI-Powered Predictive Maintenance in DCIM Platforms

AI-driven predictive maintenance is a defining trend in the Turkey Data Center Infrastructure Management (DCIM) Market. Operators deploy analytics algorithms to anticipate system failures and schedule timely interventions. It improves overall uptime and operational continuity, especially for hyperscale environments. Machine learning integration enhances the precision of power and cooling management. Enterprises rely on automated insights for resource allocation and fault prevention. The trend supports reduced maintenance costs while improving reliability. Predictive DCIM solutions also align with Turkey’s growing focus on automation-led transformation.

Growing Shift Toward Modular and Scalable DCIM Architectures

A shift toward modular architectures is reshaping data center design and management in Turkey. It allows faster deployment, improved flexibility, and simplified maintenance. Enterprises choose modular DCIM systems for their ability to scale with business needs. The approach also enhances cost control and efficiency across distributed environments. Companies benefit from simplified integration with hybrid and cloud models. This trend supports real-time scalability in colocation and edge facilities. The market continues to evolve toward customizable DCIM frameworks that support dynamic workloads.

Emergence of Cloud-Native DCIM Solutions for Distributed Operations

Cloud-native DCIM platforms are transforming how enterprises monitor and manage multi-location data centers. These solutions enable remote access and centralized dashboards, supporting seamless control. The Turkey Data Center Infrastructure Management (DCIM) Market benefits from increased flexibility and integration with third-party applications. It enhances response time and operational transparency across hybrid infrastructure. Cloud-native models also improve cybersecurity compliance and reporting accuracy. Businesses prefer these systems for cost-effectiveness and simplified updates. The trend highlights Turkey’s alignment with global DCIM modernization standards.

Enhanced Focus on Sustainability Reporting and Smart Energy Monitoring

The increasing need for sustainable data center operations drives the adoption of intelligent energy management within DCIM. Smart metering and analytics tools track carbon emissions and energy efficiency. It allows enterprises to comply with local and international sustainability standards. Turkey’s operators integrate DCIM platforms with renewable energy sources to reduce environmental impact. The trend supports transparent energy reporting for investors and regulators. Improved thermal performance and real-time monitoring enhance long-term cost benefits. This direction aligns sustainability with digital transformation priorities across data centers.

Market Challenges

Data Security and Compliance Risks in Hybrid Infrastructure Environments

The Turkey Data Center Infrastructure Management (DCIM) Market faces rising concerns over data privacy and regulatory compliance. Hybrid infrastructure models expose networks to potential cyber threats and integration complexities. It requires strict adherence to local data sovereignty and protection frameworks. Security breaches can disrupt operations and damage brand credibility. Companies often struggle to maintain consistent standards across distributed facilities. The need for continuous monitoring and policy alignment increases management overhead. Adopting secure frameworks and encryption practices remains critical to sustain trust among stakeholders.

Integration Complexity and Limited Technical Expertise in Advanced DCIM Deployment

Implementing advanced DCIM solutions demands technical expertise and cross-platform compatibility, which remain limited in Turkey. Many enterprises face challenges in aligning existing infrastructure with next-generation monitoring tools. It increases deployment time and operational costs for large-scale data centers. The lack of trained personnel slows adoption of AI-based DCIM analytics. Integration between legacy systems and cloud applications often requires custom development. Vendors face difficulties ensuring smooth interoperability across technologies. Addressing this challenge is vital to accelerate market adoption and deliver consistent performance outcomes.

Market Opportunities

Rising Investments in Hyperscale and Edge Data Center Infrastructure Expansion

New hyperscale and edge projects are driving demand for DCIM solutions across Turkey. Investors recognize the role of efficient monitoring and energy control in modern data centers. It creates opportunities for vendors to offer modular, scalable systems tailored to hybrid operations. The expansion of cloud and AI workloads strengthens this opportunity further. Regional operators seek real-time visibility to optimize asset performance. DCIM adoption ensures sustainable growth for both enterprise and colocation providers. The market continues to attract foreign and domestic investments.

Government Initiatives and Smart City Infrastructure Development

Turkey’s government-led digital transformation programs present strong potential for DCIM vendors. Smart city initiatives and national data strategies promote adoption of intelligent infrastructure management. It supports widespread use of analytics-driven decision tools for utilities and energy sectors. Public-private partnerships encourage innovation and technology localization. These initiatives create a favorable regulatory landscape for investors. The growing alignment between policy support and digital modernization drives adoption of DCIM across strategic sectors. Vendors can leverage this environment to expand regional operations.

Market Segmentation

By Component

In the Turkey Data Center Infrastructure Management (DCIM) Market, the solution segment dominates with a significant share due to rising demand for real-time monitoring, automation, and analytics capabilities. It supports integration across power, cooling, and network management layers. Services segment grows steadily, driven by consulting and maintenance needs. Vendors focus on AI and IoT-based modules that enhance scalability.

By Data Center Type

The enterprise data center segment holds the largest share, supported by high investment in digital transformation and asset optimization. The managed and colocation edge data centers show fast growth due to rising connectivity needs. It benefits from adoption of hybrid models and increased AI workloads in cloud facilities.

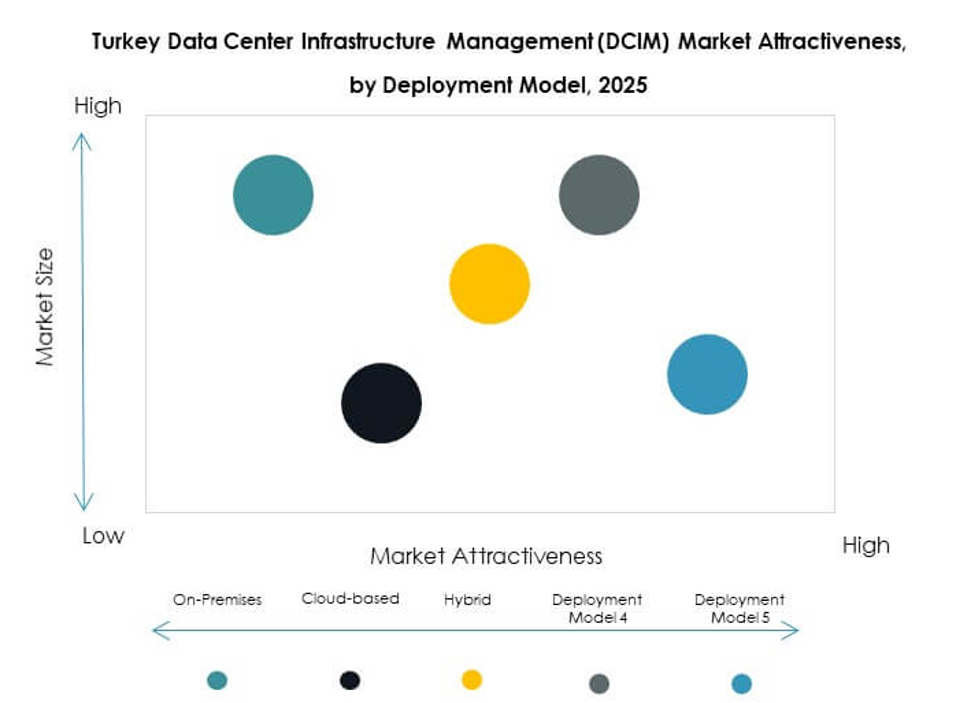

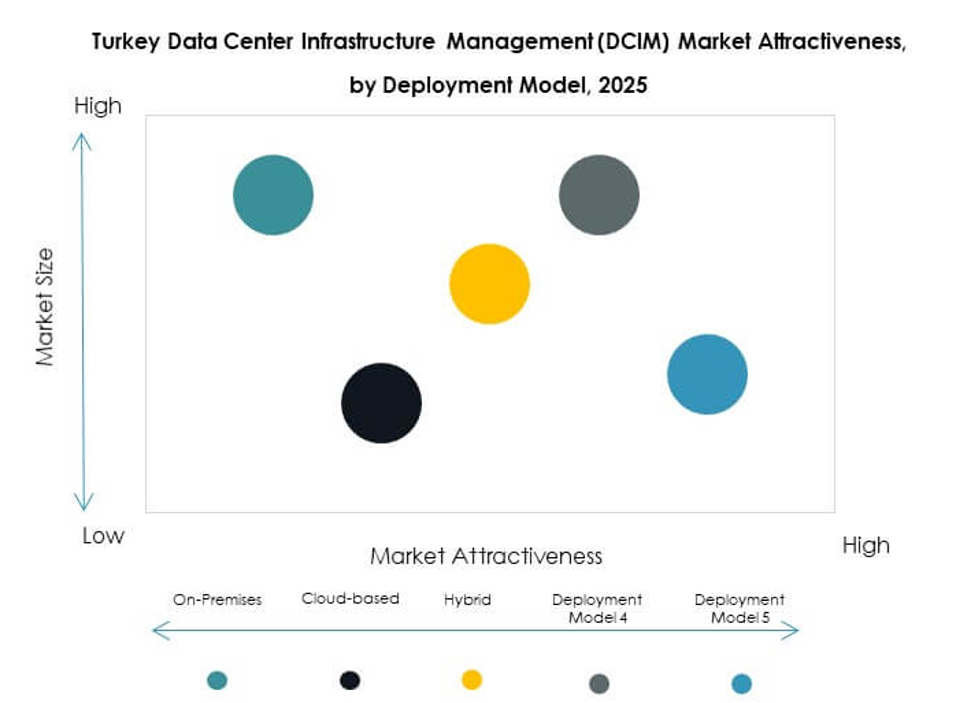

By Deployment Model

Cloud-based deployment leads in the Turkey Data Center Infrastructure Management (DCIM) Market due to flexibility and reduced capital expenditure. On-premises systems remain relevant for organizations requiring full control and data security. Hybrid deployment gains momentum as companies balance performance with compliance.

By Enterprise Size

Large enterprises dominate adoption due to advanced digital infrastructure and strong investment capability. SMEs show growing interest in cost-efficient DCIM solutions to manage distributed assets. It enables smaller businesses to achieve similar transparency and efficiency through scalable platforms.

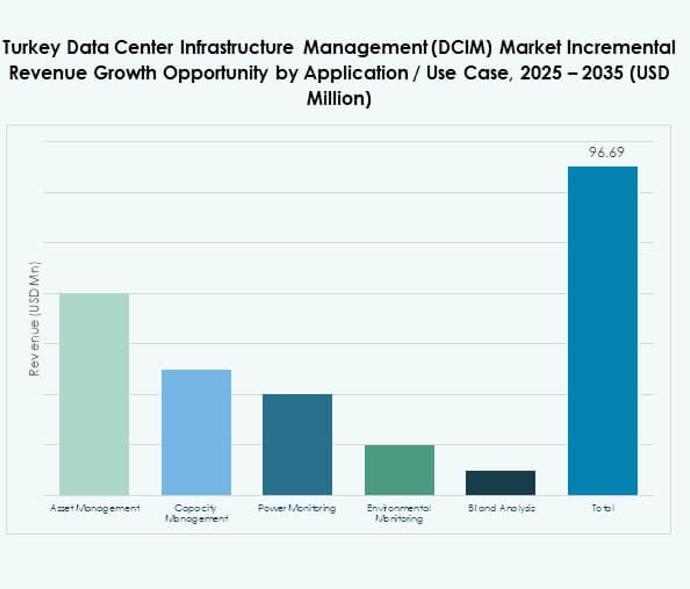

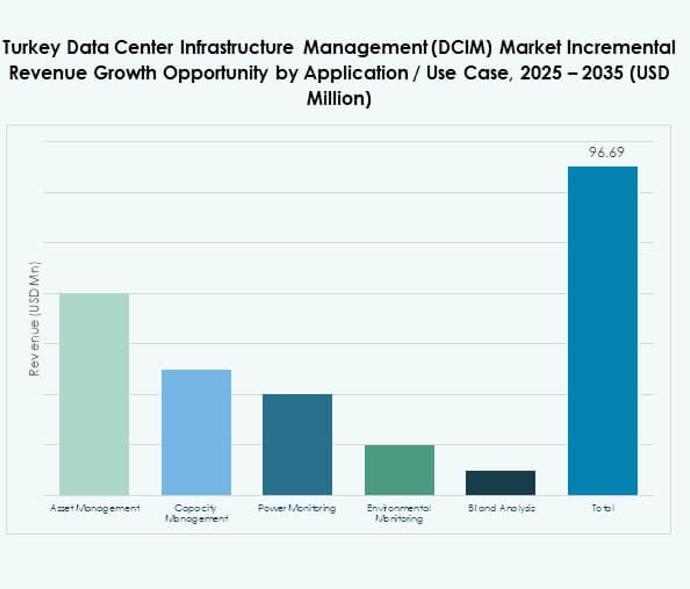

By Application / Use Case

Power monitoring holds the largest market share, reflecting the priority of energy efficiency and sustainability. Capacity management and environmental monitoring follow closely, supporting resource optimization. It ensures seamless operation under high-performance workloads.

By End User Industry

IT and telecommunications lead adoption due to data-heavy operations and continuous service demand. BFSI and healthcare sectors follow, prioritizing uptime and security. It expands toward retail and energy sectors as digital operations grow rapidly across the economy.

Regional Insights

Western Turkey Dominating with 48% Market Share Due to Dense Infrastructure and Cloud Ecosystems

Western Turkey leads the Turkey Data Center Infrastructure Management (DCIM) Market with 48% share. Istanbul and Izmir host major colocation and cloud facilities that serve enterprise clients. It benefits from strong fiber connectivity and proximity to Europe. The region’s expanding hyperscale capacity and regulatory support promote investment. Government-backed technology parks further strengthen infrastructure efficiency. The concentration of data hubs makes western Turkey a digital gateway for the region.

- For instance, Equinix opened its second International Business Exchange (IBX) data center, known as IL4, in Istanbul in October 2024, providing capacity for 1,125 cabinets across 3,045 square meters, and supporting high-density deployments including liquid cooling for AI solutions and advanced workloads.

Central Turkey Emerging with 32% Share Supported by Industrial Expansion and Energy Projects

Central Turkey captures 32% of the market, driven by industrial digitization and energy modernization initiatives. The region’s adoption of smart grids and industrial automation increases demand for DCIM systems. It benefits from growing renewable energy facilities and logistics hubs that require continuous monitoring. Ankara’s technology zones support integration of AI and IoT-driven management solutions. The market gains strength from government incentives promoting local data management capabilities.

- For instance, in February 2024, Türk Telekom and i2i Systems deployed Türkiye’s first domestic industrial 5G Mobile Private Network and Industry 4.0 applications project in the industrial zone OSTİM in Ankara, enabling real-time AI-supported IoT monitoring and increasing efficiency for over 6,500 companies in the OSTİM ecosystem.

Eastern Turkey Showing Rapid Growth with 20% Share Due to Strategic Connectivity Developments

Eastern Turkey records 20% market share, reflecting rapid development in connectivity and digital infrastructure. The expansion of fiber networks and cross-border data routes enhances regional competitiveness. It attracts emerging investments in colocation and cloud-based data centers. Strategic geographic positioning supports data traffic between Asia and Europe. Growth in energy projects and digital infrastructure accelerates the adoption of DCIM platforms. The region’s progress underscores its growing importance within Turkey’s data ecosystem.

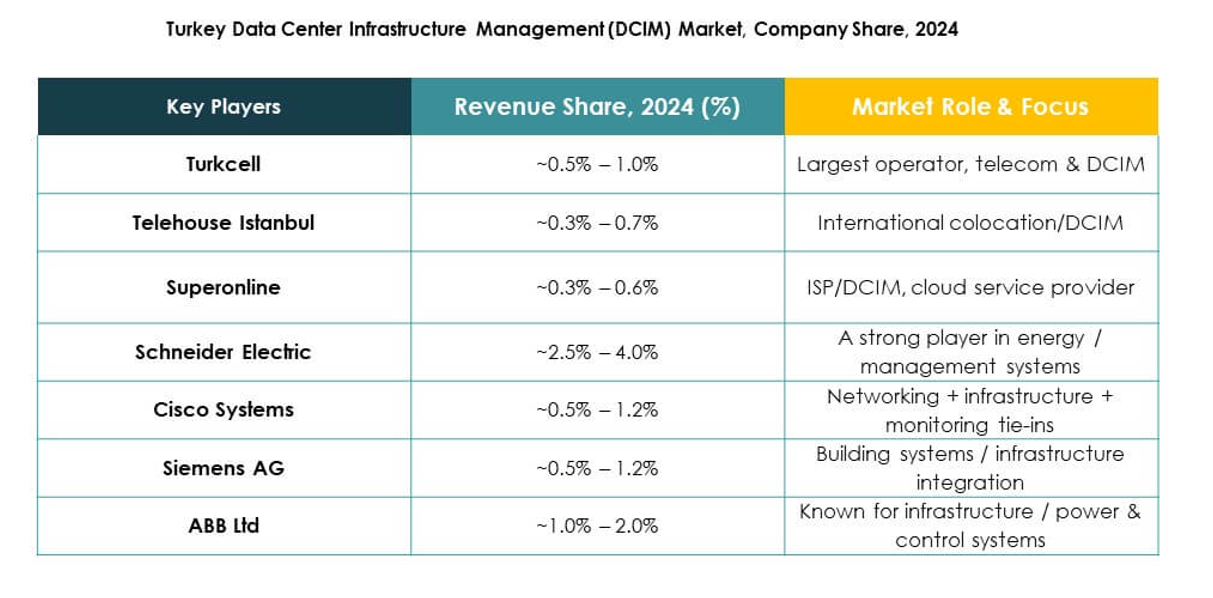

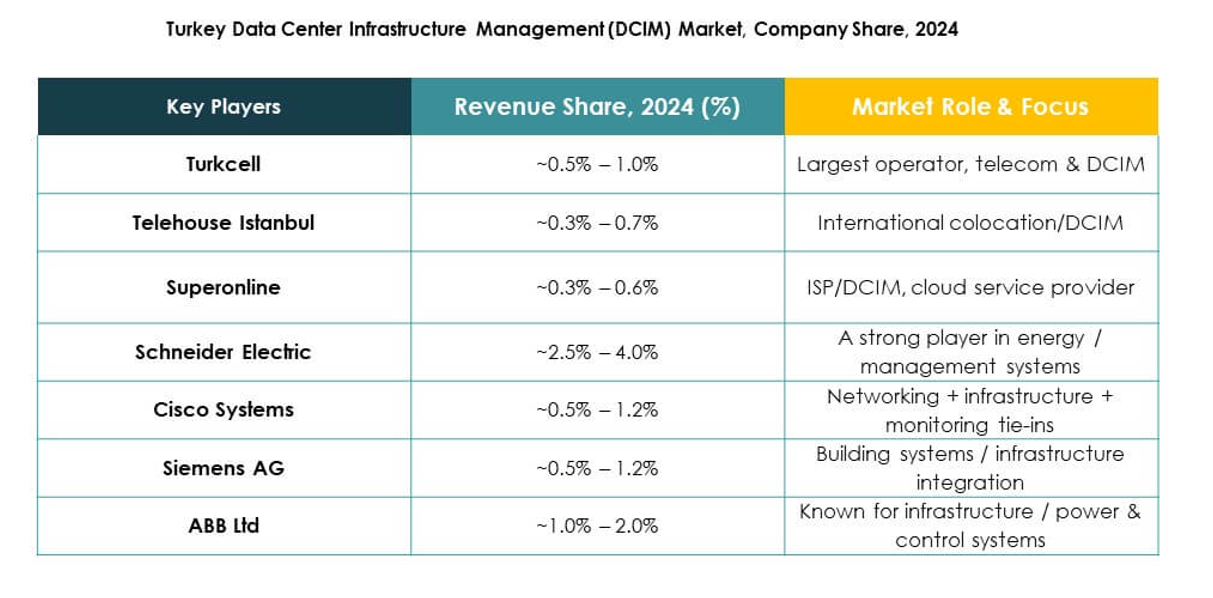

Competitive Insights:

- Turkcell

- Telehouse Istanbul

- Superonline

- Cellcom

- Vodafone TR

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

The Turkey Data Center Infrastructure Management (DCIM) Market is shaped by strong competition between domestic operators and global technology firms. It reflects growing collaboration among telecom providers, colocation data centers, and hardware manufacturers to deliver integrated DCIM solutions. Leading players such as Schneider Electric, Huawei, and Siemens focus on automation, power efficiency, and predictive analytics to strengthen client portfolios. Local providers like Turkcell and Telehouse Istanbul expand regional capacity through sustainable and hybrid infrastructure models. The market emphasizes AI-enabled monitoring, green data management, and modular scalability. Continuous product innovation and service reliability remain key differentiators influencing customer preference and long-term partnerships.

Recent Developments:

- In May 2025, Turkcell’s subsidiary TDC Veri Hizmetleri secured €100 million ($112.5 million) in murabaha financing from Emirates NBD Bank to fund its data center expansion plans in Turkey. Turkcell operates eight core data centers across four markets and aims to add 8.4MW to existing capacity by the end of 2025.

- In February 2024, Edgnex (by DAMAC) and Vodafone Turkey announced a joint project to build a 6 MW data center facility in Izmir, boosting infrastructure ties in the Turkish data space.