Executive summary:

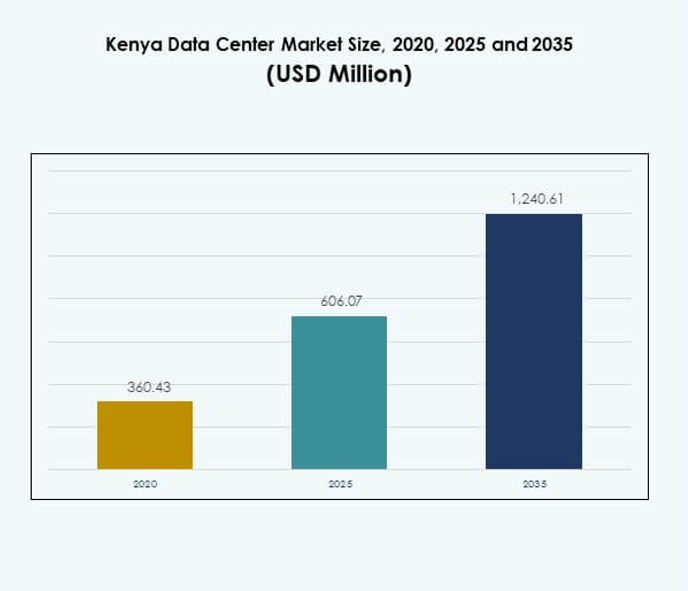

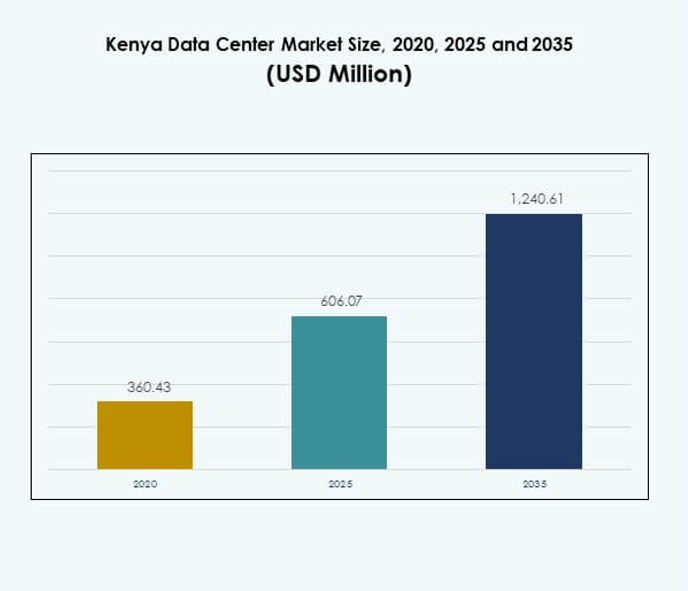

The Kenya Data Center Market size was valued at USD 360.43 million in 2020 to USD 606.07 million in 2025 and is anticipated to reach USD 1,240.61 million by 2035, at a CAGR of 7.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Kenya Data Center Market Size 2025 |

USD 606.07 Million |

| Kenya Data Center Market, CAGR |

7.29% |

| Kenya Data Center Market Size 2035 |

USD 1,240.61 Million |

Growth is supported by rising cloud adoption, fintech expansion, and the digital transformation of enterprises. Organizations are prioritizing secure and scalable data hosting, while providers focus on efficiency through renewable power integration and advanced cooling systems. Innovation in modular and edge deployments improves access to underserved areas. This positions the market as a strategic hub, offering opportunities for both domestic players and global investors seeking to expand digital infrastructure.

Regionally, Kenya leads East Africa due to strong connectivity and its role as a gateway for digital trade. South Africa remains the continental leader, supported by hyperscale capacity and global investment. Nigeria and Morocco emerge as fast-growing markets with regulatory reforms and enterprise demand. Kenya’s position along submarine cable routes makes it a preferred location for international connectivity and regional service delivery.

Market Drivers

Rapid Adoption of Digital Transformation Across Industries

The Kenya Data Center Market is expanding due to enterprises adopting digital-first strategies in finance, healthcare, retail, and government sectors. Cloud platforms, AI-driven applications, and e-commerce platforms demand reliable hosting environments. Data centers provide resilience and support secure storage of sensitive business information. Companies in telecom and fintech lead investments, creating demand for advanced infrastructure. Organizations value flexibility, cost efficiency, and security in their IT operations. Investors recognize that digital transformation requires strong infrastructure. It continues to attract attention for long-term growth potential and strategic investment opportunities.

- For example, Safaricom launched its Tier III-certified Limuru Data Centre in early 2025, offering a designed uptime of 99.982%. The facility supports critical services such as M-PESA and provides enterprise clients with secure, compliant, and high-performance digital infrastructure.

Innovation in Power and Cooling Infrastructure Supporting Efficiency

Energy costs drive demand for innovation in power and cooling technologies across data centers in Kenya. Operators integrate renewable energy such as solar and wind to reduce operational costs. Cooling systems evolve toward liquid and modular solutions, improving efficiency and lowering downtime risks. This focus strengthens sustainability credentials for local and international investors. Hyperscale facilities deploy advanced designs to optimize energy performance. Businesses gain confidence when infrastructure providers adopt green practices. The Kenya Data Center Market benefits from this technological shift. It positions facilities to align with global benchmarks for reliability and sustainability.

- For example, iColo, a Digital Realty company, installed over 650 kW of solar panels in August 2024 across its Nairobi (NBO1) and Mombasa (MBA1) campuses. The project includes 450 kW at Nairobi and nearly 200 kW at Mombasa, supporting plans to supply 25% of facility power through solar generation while leveraging Kenya’s 82% renewable energy grid for sustainability goals.

Government Policy and Connectivity Advancing the Industry

Government policies encourage local data hosting and improve cybersecurity frameworks across Kenya. Expansion of submarine cable connections strengthens global digital integration. This development enhances bandwidth reliability, reducing costs for enterprises and service providers. National digital strategies prioritize local infrastructure over international hosting. It gives businesses confidence to invest in long-term projects. Education, health, and defense agencies are shifting workloads into local centers. The Kenya Data Center Market gains support from such policy reforms. Investors see a clear framework encouraging domestic innovation and sustainable growth.

Strategic Importance for Business Continuity and Investor Confidence

Data security, regulatory compliance, and low-latency connectivity position data centers as vital for enterprises. Businesses require operational continuity during disruptions, making reliable infrastructure essential. Regional service delivery depends on well-connected facilities with redundancy features. Strong investor interest is driven by predictable growth prospects in digital infrastructure. Strategic hubs in Nairobi and Mombasa anchor service delivery across East Africa. Enterprises view data centers as foundations for scaling into new markets. The Kenya Data Center Market represents a secure entry point for international partnerships. It strengthens both business resilience and cross-border digital trade.

Market Trends

Growing Shift Toward Edge and Modular Data Centers

The Kenya Data Center Market experiences rising demand for edge and modular facilities. Enterprises need faster processing for IoT, 5G, and AI-enabled services. Edge facilities reduce latency for applications such as mobile banking and digital health. Modular deployments provide scalability for both SMEs and large enterprises. These centers appeal to investors seeking lower initial capital commitments. Industries benefit from agility when managing dynamic workloads. It reflects a clear trend toward decentralizing capacity. Kenya becomes a key location for deploying adaptable digital infrastructure supporting rapid urban expansion.

Expansion of Hyperscale Investments by Global Providers

Global technology firms are increasingly entering Kenya to establish hyperscale facilities. Hyperscale centers provide high-capacity computing to meet enterprise and cloud provider needs. Such investments strengthen international connectivity and support regional service delivery. It enables local firms to partner with global players in cloud and AI services. Nairobi is emerging as a central hub for hyperscale expansion. New builds prioritize redundancy, renewable energy, and advanced design standards. The Kenya Data Center Market benefits from this international momentum. It reflects growing confidence in Kenya’s role as a digital services leader.

Adoption of AI and Automation Enhancing Data Center Operations

AI-driven tools and automation are transforming facility management and monitoring functions. Predictive analytics improve cooling, energy distribution, and system reliability. Automated systems reduce downtime and support proactive maintenance strategies. Enterprises demand lower operating costs and higher efficiency in hosting services. Data centers deploy robotics for monitoring and energy flow optimization. It enhances service quality and ensures competitive advantage in regional markets. The Kenya Data Center Market integrates these intelligent systems for resilience. It marks a trend toward smarter, more cost-efficient facilities aligned with future needs.

Sustainability Becoming a Priority in Infrastructure Development

Sustainability is a dominant theme shaping Kenya’s data center landscape. Facilities integrate renewable energy and energy-efficient technologies for carbon reduction. Businesses and investors prioritize providers adopting sustainable frameworks. Cooling solutions using advanced liquid systems cut power consumption significantly. International clients demand compliance with global green standards in data hosting. It builds investor trust and long-term customer relationships. The Kenya Data Center Market aligns with sustainable growth goals. It establishes Kenya as an environmentally responsible digital hub within Africa.

Market Challenges

High Energy Costs and Infrastructure Limitations Impacting Growth

The Kenya Data Center Market faces persistent challenges due to high energy costs and limited grid reliability. Operators rely on diesel backup systems, raising operational expenses. Renewable energy adoption improves the situation but requires heavy investment. Power interruptions remain a risk for enterprises relying on continuous uptime. Infrastructure gaps such as limited fiber reach outside Nairobi restrict regional expansion. It reduces the attractiveness of rural deployments. The market continues to face pressure from balancing cost, reliability, and sustainability in operations.

Regulatory Complexity and Talent Shortages Slowing Industry Maturity

Complex regulatory processes hinder smooth entry for international investors. Businesses face unclear policies on cross-border data flows and cybersecurity compliance. Skilled professionals in cloud management, cybersecurity, and AI remain in short supply. Talent shortages raise costs and slow project deployments across facilities. It makes the market heavily reliant on international expertise for advanced operations. Enterprises also demand strict compliance, which strains local capacity. The Kenya Data Center Market needs clear policies and skilled workforce development. It requires alignment of regulations with global standards to attract stronger investments.

Market Opportunities

Rising Demand for Cloud and Colocation Services Across Enterprises

The Kenya Data Center Market offers strong opportunities through increasing cloud and colocation adoption. Enterprises seek scalable solutions that support digital growth while controlling costs. SMEs also move toward colocation to reduce infrastructure burden. Service providers deliver managed hosting, cybersecurity, and business continuity solutions. It strengthens Kenya’s role as a preferred East African hosting hub. The opportunity supports stronger partnerships between enterprises and global cloud leaders.

Expansion Potential Through Regional Connectivity and Digital Trade

Growing cross-border digital services open new opportunities for Kenyan facilities. Submarine cables and regional fiber links enhance access across East and Central Africa. Enterprises expand into regional markets while hosting workloads in Kenya. It attracts investors to build facilities serving multiple economies. Data localization trends also push foreign firms toward local hosting. The Kenya Data Center Market stands to benefit from this regional integration. The opportunity supports Kenya’s role as a digital corridor across Africa.

Market Segmentation

By Component

Hardware dominates the Kenya Data Center Market due to critical demand for servers, storage, and power systems. Cooling and security systems are also key investments as uptime becomes essential. Software solutions including DCIM and monitoring tools are growing with cloud integration. Services such as consulting and managed offerings support enterprises outsourcing IT functions. The hardware segment maintains the largest share, reflecting heavy capital allocation.

By Data Center Type

Colocation centers dominate the Kenya Data Center Market as enterprises seek cost efficiency and flexibility. Hyperscale facilities are expanding due to global providers investing in high-capacity builds. Edge and modular centers gain attention in urban areas with IoT growth. Enterprise data centers remain steady for government and defense use cases. The rise of cloud and internet data centers signals a long-term trend of hosted workloads.

By Deployment Model

Cloud-based deployment holds the leading share in the Kenya Data Center Market. Businesses prefer flexible models supporting AI, big data, and SaaS platforms. Hybrid models grow as firms balance cost efficiency with security needs. On-premises facilities remain relevant for sensitive data in healthcare and defense. Enterprises increasingly view cloud-first strategies as central to transformation.

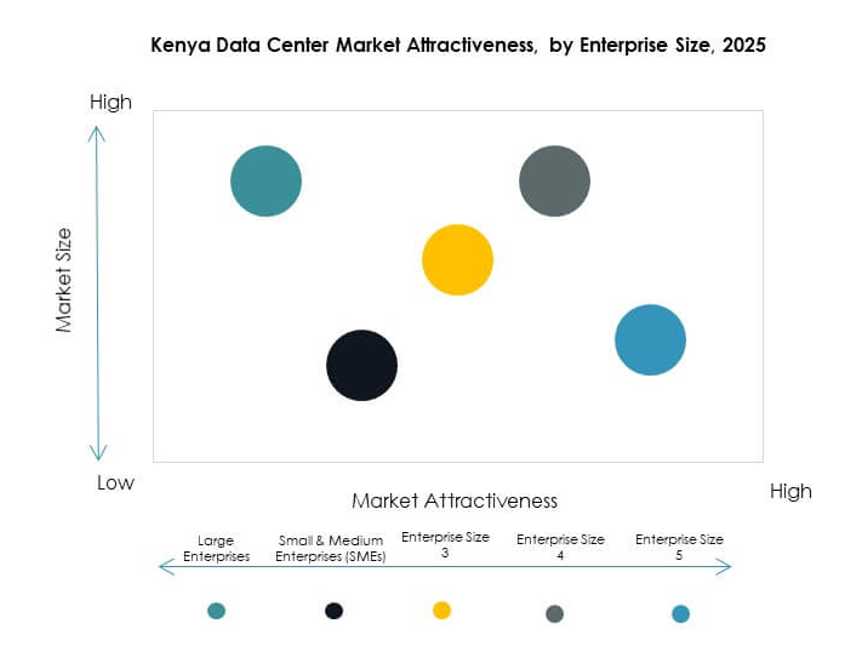

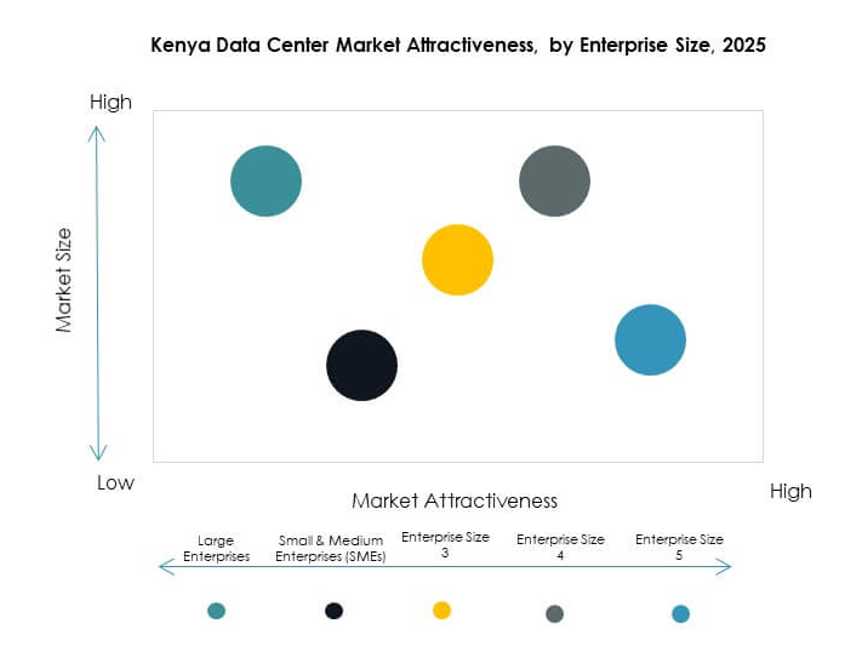

By Enterprise Size

Large enterprises dominate the Kenya Data Center Market due to resource availability and complex IT needs. SMEs increasingly adopt modular colocation and cloud-based services. Cost-efficient solutions make digital adoption easier for smaller firms. Large enterprises drive investments in hyperscale and hybrid deployment, ensuring advanced service delivery. SMEs’ growth represents a promising future segment with rising adoption of cloud solutions.

By Application / Use Case

IT and telecom lead the Kenya Data Center Market as demand grows for connectivity and cloud services. BFSI follows closely due to digital banking expansion across the region. Healthcare, retail, and media sectors show rising demand for secure hosting and analytics. Government and defense applications rely on high-security infrastructure for sensitive workloads. Education and energy sectors add growth from digital learning and utility management.

By End User Industry

Cloud service providers dominate the Kenya Data Center Market due to rising SaaS, IaaS, and PaaS usage. Enterprises follow with digital transformation driving colocation and hybrid adoption. Government agencies represent a growing segment as policies prioritize local hosting. Colocation providers expand capacity to support SMEs and multinationals. Other industries build sector-specific hosting capabilities supporting growth in utilities and education.

Regional Insights

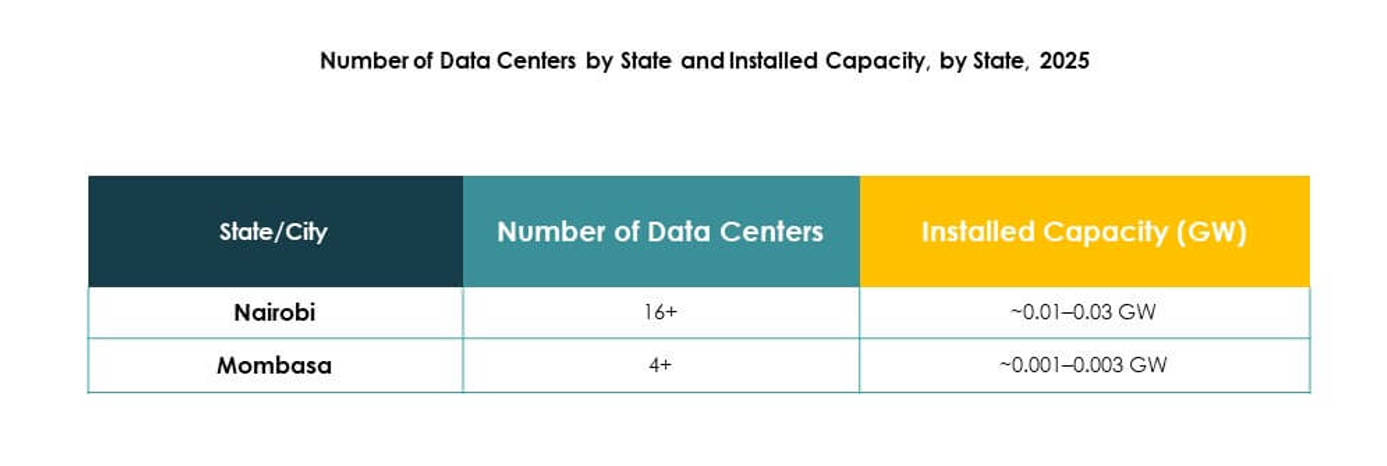

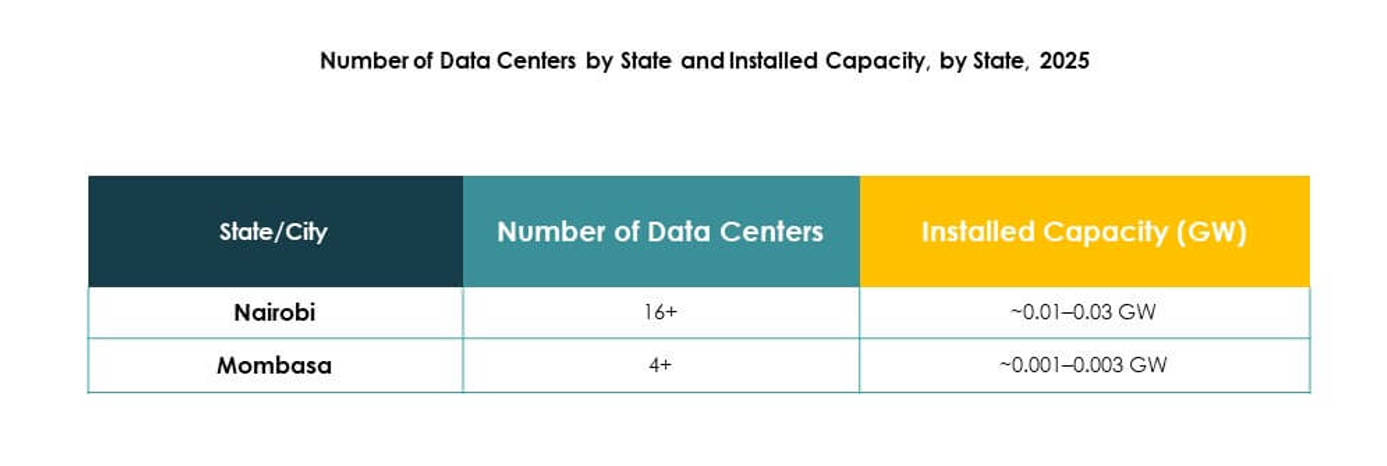

Nairobi and Central Kenya Leading with Largest Share

Nairobi and surrounding central regions account for 48% of the Kenya Data Center Market. Nairobi anchors the industry with hyperscale-ready infrastructure, submarine cable access, and proximity to major enterprises. Limuru has also emerged as a hub, hosting Safaricom’s Tier III data center that supports financial services and cloud adoption. Enterprises in BFSI, telecom, and government rely heavily on facilities in this corridor for reliable hosting. It benefits from established connectivity, concentration of corporate clients, and rapid adoption of cloud services. Nairobi’s dominance ensures Kenya remains the central node for data services delivery across the country.

Coastal Kenya Holding Strong Position

Mombasa contributes 32% of the Kenya Data Center Market, driven by direct access to undersea cables linking Africa to Europe and Asia. Data centers in Mombasa, such as iColo’s MBA1, leverage international connectivity to deliver low-latency services. The port city’s strategic position strengthens Kenya’s role as a gateway for regional internet traffic. It supports colocation services and attracts cloud providers seeking secure landing stations. The strong presence of renewable energy projects further enhances operational sustainability. It remains a vital hub for scaling Kenya’s international and domestic connectivity.

- For instance, SEACOM’s cable landing station in Mombasa provides direct international bandwidth that feeds into local data centers, supporting high-capacity connectivity for financial institutions and cloud operators.

Western and Emerging Regions Expanding Rapidly

Western Kenya and emerging cities like Kisumu hold a growing 20% share of the Kenya Data Center Market. These regions benefit from expanding fiber routes and growing demand for digital services beyond Nairobi and Mombasa. Government initiatives and enterprise investments support local hosting needs, improving service accessibility for inland businesses. It enables SMEs and public institutions to leverage affordable colocation and managed services. The expansion of renewable-powered modular facilities also supports growth in underserved areas. While smaller in scale today, these regions are positioned to accelerate Kenya’s overall digital ecosystem in the coming years.

- For instance, Liquid Intelligent Technologies upgraded its 1,300 km Mombasa–Busia fiber backbone in 2024, enhancing connectivity for Kisumu and strengthening inland data traffic flows into colocation facilities.

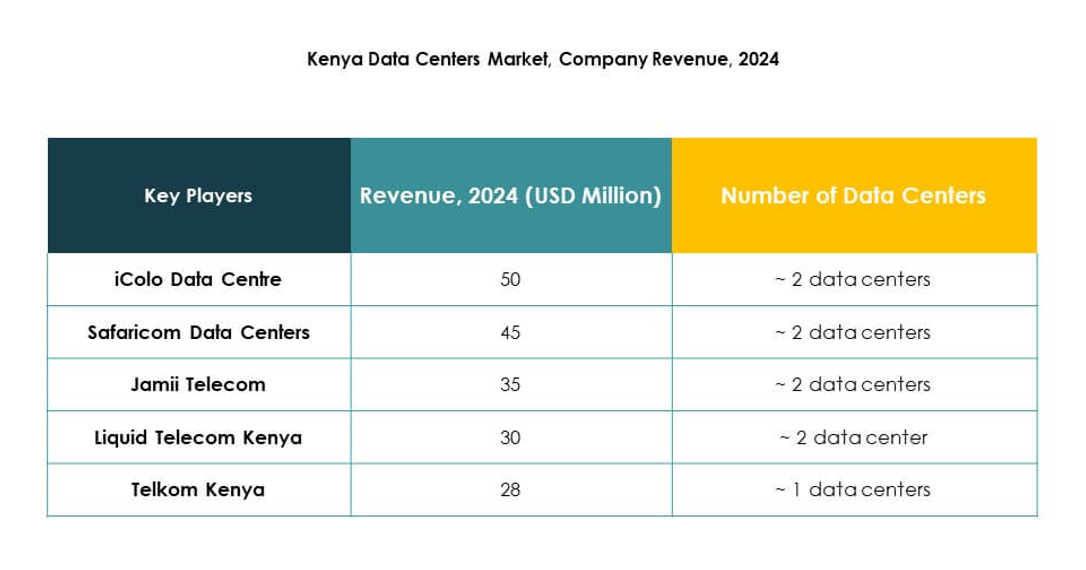

Competitive Insights:

- Maroc Telecom

- Medasys Data Center

- Orange Maroc

- INWI

- Nexans Maroc

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

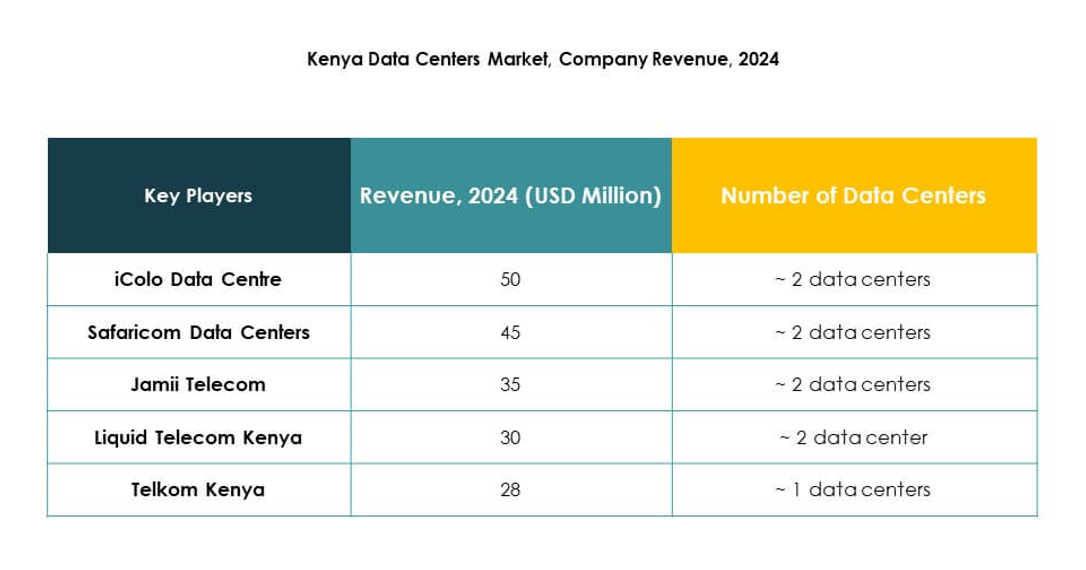

The Kenya Data Center Market features strong competition between regional telecom-backed operators and global technology leaders. Local providers such as Maroc Telecom, Orange Maroc, and INWI focus on expanding colocation and connectivity solutions, while Medasys Data Center strengthens infrastructure capacity for enterprises. Nexans Maroc plays a role in supplying advanced cabling and energy systems that enhance operational reliability. Global leaders including Microsoft, AWS, and Google drive cloud adoption through hyperscale deployments and partnerships with local stakeholders. It creates a balanced ecosystem where regional firms address domestic needs, and global players provide advanced digital services. Competitive strategies emphasize sustainability, energy efficiency, and edge deployment, positioning Kenya as a critical hub in East Africa’s growing digital economy.

Recent Developments:

- In September 2025, Airtel Kenya and Nxtra by Airtel Africa broke ground on East Africa’s largest data centre facility at Tatu City, Nairobi. This new centre will deliver a total power capacity of 44 megawatts, and is slated to be operational by early 2027, featuring advanced security, high-density racks, and energy-efficient operations designed to bolster Kenya’s digital infrastructure and create jobs.

- In September 2025, Digital Parks Africa (DPA) of South Africa formed a strategic partnership with iXAfrica Data Centres, East Africa’s first hyperscale, carrier-neutral, AI-ready data centre operator based in Nairobi. This collaboration will offer seamless data centre services and points of presence to businesses across Southern and Eastern Africa via a single integrated solution, positioning both companies as partners of choice for hyperscalers and government agencies in the region.

- In May 2025, Safaricom, Kenya’s leading telecom, entered into a strategic partnership with iXAfrica Data Centres to jointly offer hyperscale enterprise and cloud services in Kenya, anchored by the new NBOX1 facility in Nairobi. The partnership enables advanced AI-ready infrastructure and dedicated cloud suites for East African enterprises, marking a significant boost in local capacity and services for high-performance workloads.