Executive summary:

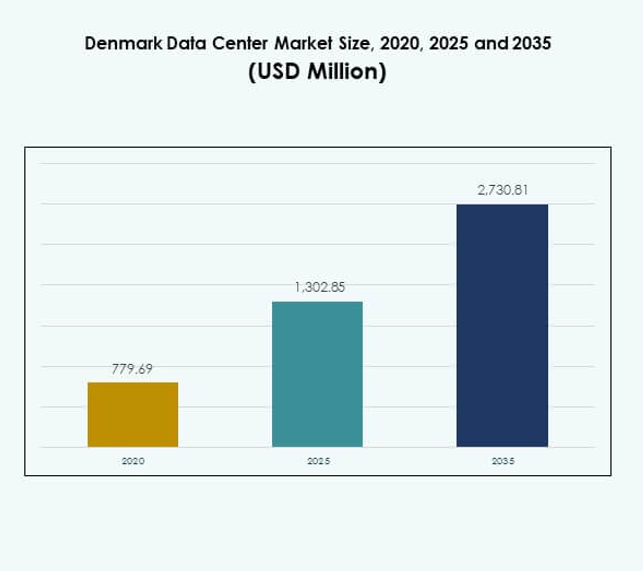

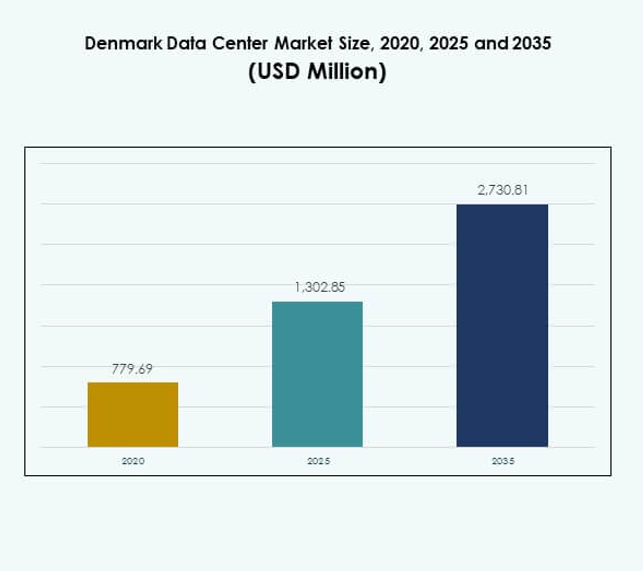

The Denmark Data Center Market size was valued at USD 779.69 million in 2020 to USD 1,302.85 million in 2025 and is anticipated to reach USD 2,730.81 million by 2035, at a CAGR of 7.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Denmark Data Center Market Size 2025 |

USD 1,302.85 Million |

| Denmark Data Center Market, CAGR |

7.64% |

| Denmark Data Center Market Size 2035 |

USD 2,730.81 Million |

Growth in the Denmark Data Center Market is driven by rapid enterprise cloud adoption, integration of renewable energy, and rising demand for hybrid deployment models. Strong digital transformation policies and innovation in sustainable cooling technologies position Denmark as a leading hub for efficient and secure infrastructure. It attracts hyperscale operators and investors seeking reliable, scalable, and green facilities to meet evolving enterprise needs. The market highlights strategic value for global technology providers and domestic players alike.

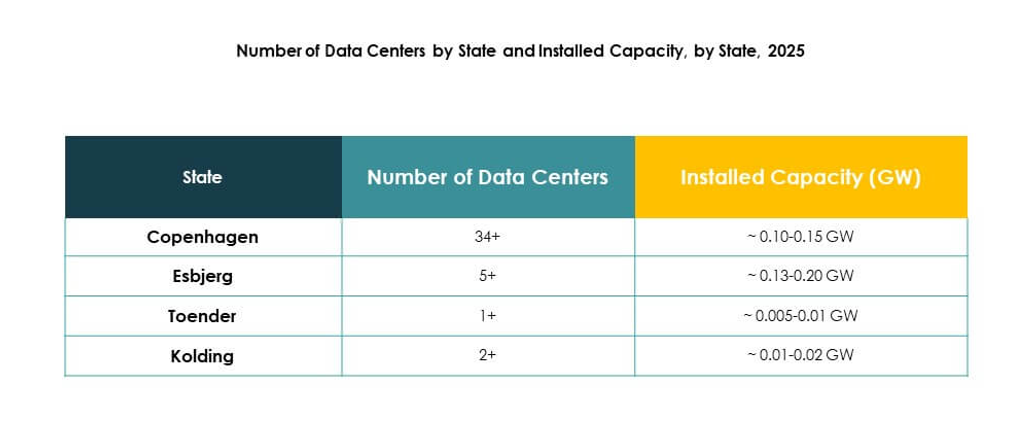

Regionally, Northern Denmark leads with significant activity supported by renewable energy integration and hyperscale developments. Eastern Denmark, particularly Copenhagen, emerges as a strong colocation and connectivity hub, catering to both enterprise and government clients. Western and Southern Denmark show growing potential with modular and edge deployments, driven by SME adoption and industrial demand. This geographic spread reinforces Denmark’s role as a balanced digital infrastructure hub in Northern Europe.

Market Drivers

Rapid Expansion of Digital Transformation and Adoption of Advanced Infrastructure

The Denmark Data Center Market benefits from the country’s leadership in digital transformation. Enterprises are investing in automation, virtualization, and scalable platforms to support rising workloads. Strong government support for a digital-first economy has accelerated adoption of advanced data infrastructure. It reflects Denmark’s ambition to strengthen competitiveness in Northern Europe. The shift from legacy systems toward hybrid and cloud-based platforms highlights a long-term transition. Companies see faster deployment and operational efficiency as a direct outcome. The demand for high-availability services continues to attract hyperscale investors. Businesses and investors recognize the strategic importance of the nation’s ecosystem.

- For instance, Microsoft announced a sustainable datacenter region in Denmark powered by 100% renewable energy, offering Danish customers local data residency and faster access to Microsoft Cloud services. The company also pledged to upskill 200,000 Danes by 2024.

Integration of Renewable Energy with Data Center Operations

Energy efficiency remains a critical driver shaping data center development in Denmark. The market benefits from extensive access to wind power and sustainable energy frameworks. Operators are building facilities aligned with strict carbon neutrality targets. It strengthens the role of the Denmark Data Center Market in promoting environmentally responsible infrastructure. Integration of renewable energy reduces operational costs while attracting global investors. The strong alignment between public policy and private investment accelerates growth opportunities. Multinationals prefer Denmark for building hyperscale sites supported by clean energy. Investors view this combination of low-carbon footprint and reliability as a decisive advantage.

Growing Enterprise Cloud Adoption and Hybrid Deployment Preferences

Enterprise demand for hybrid cloud environments is driving large-scale infrastructure investments. Organizations in financial services, healthcare, and manufacturing seek flexible data management solutions. The Denmark Data Center Market supports these demands by offering robust cloud connectivity. It highlights the growing role of managed services and colocation providers. Hybrid models give enterprises security, compliance, and scalability benefits. Demand for interconnection across regional and global networks has become a defining driver. Investors see long-term growth as enterprises scale digital operations. The preference for hybrid deployments strengthens opportunities for both global and local players.

Innovation in Data Security and Evolving Compliance Requirements

Innovation in cybersecurity and data governance is shaping market strategies. Enterprises prioritize centers with advanced encryption and compliance with EU GDPR regulations. The Denmark Data Center Market has gained prominence by ensuring high standards of data protection. It attracts global firms seeking security-driven hosting environments. Vendors are investing in AI-based monitoring and real-time analytics for enhanced control. Businesses value compliance frameworks that align with regional and international requirements. The integration of AI and predictive security models enhances market trust. Investors consider these advancements critical for protecting digital infrastructure at scale.

- For instance, in 2024, Atea Denmark implemented NIS2-compliant cybersecurity measures to align with EU critical infrastructure regulations, documenting advanced safeguards and reinforcing trust in the country’s digital ecosystem.

Market Trends

Growing Deployment of Modular and Edge Data Center Solutions

Edge and modular data centers are gaining traction in Denmark’s evolving landscape. Enterprises deploy modular facilities to scale capacity quickly and minimize upfront costs. The Denmark Data Center Market reflects demand for localized edge sites supporting latency-sensitive applications. It provides advantages for IoT, gaming, and real-time analytics. Edge expansion reduces pressure on centralized hyperscale facilities. Organizations prioritize modularity for disaster recovery and remote operations. Vendors highlight rapid deployment as a key differentiator. Businesses and investors track these models for sustained growth opportunities.

Rise of AI and Machine Learning Workloads Driving Infrastructure Investments

AI and machine learning workloads are creating new demands on computing power. The Denmark Data Center Market supports enterprises implementing advanced analytics and AI-driven innovation. It strengthens the case for GPU-intensive and high-performance computing systems. Operators upgrade racks and cooling systems to meet these needs. AI deployment encourages larger capital spending in hyperscale facilities. Enterprises see AI as critical to efficiency and customer engagement. Vendors position AI-optimized designs as premium offerings in the market. Investors highlight AI integration as a decisive industry shift.

Expanding Role of Colocation and Interconnection Ecosystems

Colocation providers are reshaping market growth by enabling enterprise scalability. The Denmark Data Center Market demonstrates strong interest in interconnected colocation hubs. It facilitates cross-border traffic flow for cloud providers and enterprises. Growth in interconnection reflects demand for seamless multi-cloud integration. Vendors build ecosystems with high bandwidth and secure connectivity. Enterprises value colocation as a cost-efficient route to modernization. Investors see colocation growth as a stable long-term segment. Providers align strategies with regional connectivity initiatives.

Development of Liquid Cooling and Sustainable Infrastructure Technologies

Liquid cooling systems are increasingly deployed to handle rising rack densities. The Denmark Data Center Market shows rapid adoption of sustainable cooling innovations. It highlights Denmark’s emphasis on energy efficiency and advanced technology integration. Liquid cooling reduces operational costs while increasing system reliability. Facilities integrate advanced power usage effectiveness (PUE) metrics to attract investors. Vendors explore waste heat reuse programs aligned with public sustainability goals. Enterprises support operators deploying advanced green technologies. Investors focus on sustainable infrastructure as a competitive advantage.

Market Challenges

Rising Energy Consumption and Pressure on Sustainable Operations

High energy consumption remains a critical concern for operators. The Denmark Data Center Market faces challenges in balancing growth with sustainability commitments. It depends heavily on renewable energy integration, yet demand often exceeds capacity. Operators face rising operational costs linked to infrastructure scaling. Enterprises require uninterrupted power supply, driving pressure on local grids. Sustainability targets demand ongoing investment in energy-efficient technologies. Vendors find it costly to align with strict carbon-neutral policies. Investors recognize the tension between expansion and sustainable execution.

Regulatory Complexities and Talent Shortages in Specialized Fields

Regulatory requirements in data governance create operational challenges. The Denmark Data Center Market must comply with GDPR and cross-border data flow regulations. It requires continuous updates to meet evolving compliance demands. Operators face a shortage of skilled professionals in AI, cybersecurity, and high-density design. It limits the ability of enterprises to scale complex operations efficiently. Rising competition increases wage pressures for specialized talent. Vendors struggle to align expansion speed with workforce availability. Investors see workforce readiness as a barrier to seamless scalability.

Market Opportunities

Expansion of Hyperscale Facilities Supported by Renewable Energy Infrastructure

Denmark presents strong opportunities for hyperscale data centers backed by renewable energy. The Denmark Data Center Market benefits from sustainable frameworks and abundant wind power. It attracts cloud service providers seeking eco-friendly facilities. Hyperscale operators view Denmark as a regional hub for scalable growth. Vendors highlight low-carbon operations as an incentive for global enterprises. It opens investment pathways for green data ecosystems. Businesses and investors focus on sustainable hyperscale expansion for long-term value.

Growth of Edge Data Centers and Support for Latency-Sensitive Applications

The adoption of edge computing creates strong opportunities for local deployments. The Denmark Data Center Market gains momentum through demand for real-time services. It supports IoT, 5G, and smart city projects across industries. Edge facilities enhance connectivity and reduce data transport delays. Vendors promote edge expansion as critical to digital transformation. Enterprises seek reliability through distributed data infrastructure. It creates new revenue channels for operators specializing in edge solutions.

Market Segmentation

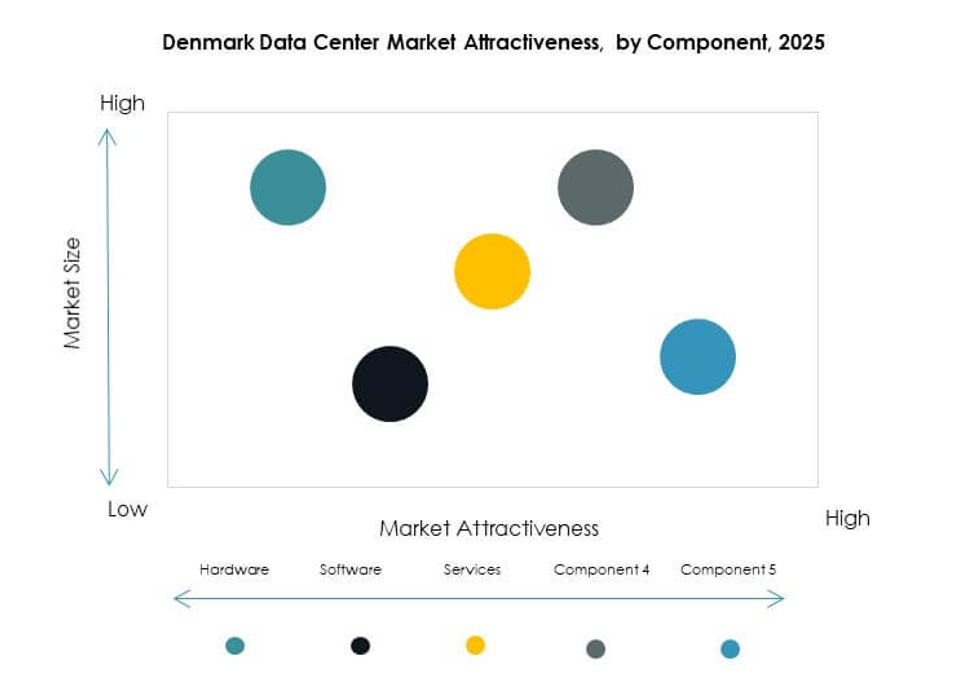

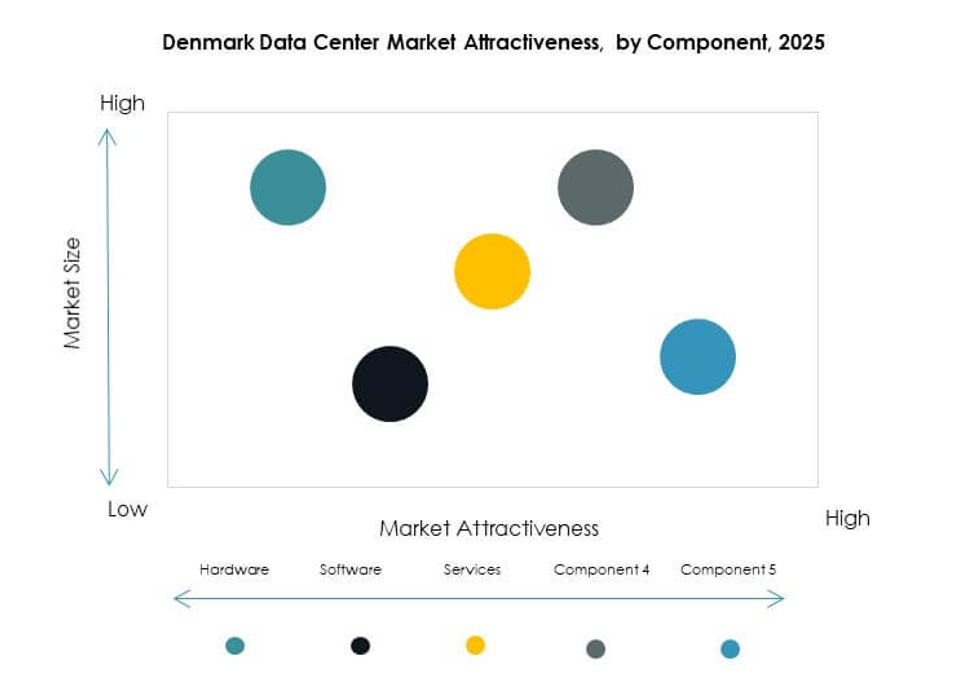

By Component

Hardware dominates the Denmark Data Center Market with servers, networking, and cooling systems leading growth. Strong demand for scalable racks and efficient power solutions strengthens this segment. Software, including DCIM and virtualization tools, grows as enterprises enhance automation. Services such as consulting and integration play a supporting role. Hardware holds the largest share due to continuous upgrades in processing and storage capacity.

By Data Center Type

Hyperscale facilities dominate the Denmark Data Center Market, driven by global cloud providers. Colocation centers are also expanding rapidly with strong enterprise adoption. Edge and modular facilities show growth due to demand for localized computing. Enterprise data centers maintain importance for organizations requiring in-house control. Hyperscale leads due to its scalability and alignment with cloud-first strategies.

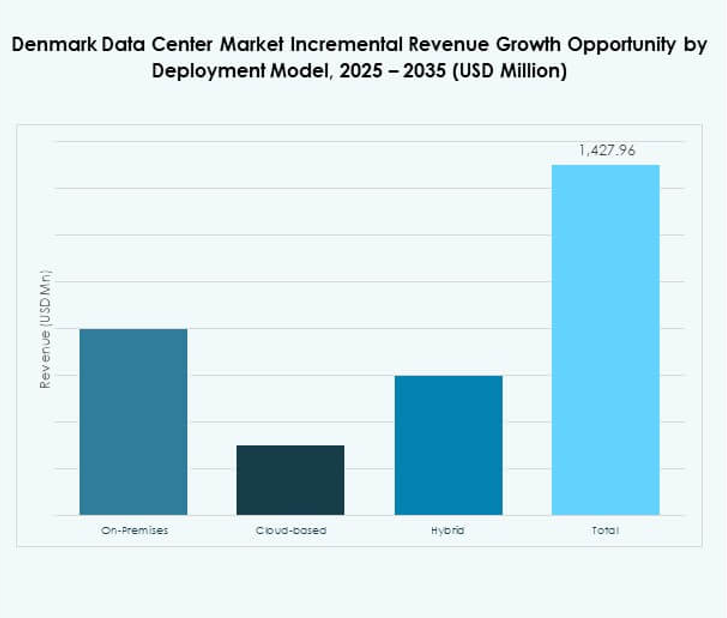

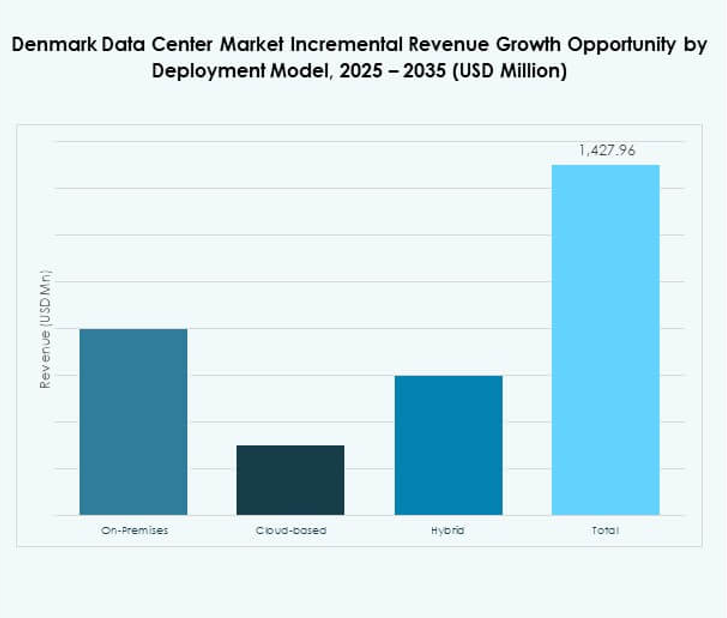

By Deployment Model

Cloud-based deployment holds the largest share in the Denmark Data Center Market. Enterprises rely on hybrid models for compliance and flexibility. On-premises models remain relevant for critical data governance requirements. Vendors promote hybrid adoption as a balanced strategy. Cloud and hybrid models drive growth with high scalability.

By Enterprise Size

Large enterprises dominate the Denmark Data Center Market with significant capital investment. SMEs adopt colocation and managed services to minimize costs. Vendors target SMEs with scalable and flexible packages. Large enterprises maintain leadership through hyperscale and private cloud usage. Growth in SMEs expands market diversity.

By Application / Use Case

IT & Telecom leads the Denmark Data Center Market due to high connectivity demand. BFSI requires secure and compliant storage solutions. Healthcare invests in advanced platforms for digital health records. Retail and e-commerce rely on scalable infrastructure for online growth. Media and entertainment demand low-latency platforms for streaming. Government and defense focus on security-compliant facilities.

By End User Industry

Cloud service providers dominate the Denmark Data Center Market. Enterprises rely on colocation for cost-efficient operations. Government agencies invest in secure infrastructure for data sovereignty. Colocation providers expand with interconnection ecosystems. Cloud players hold the leading position due to high scalability requirements.

Regional Insights

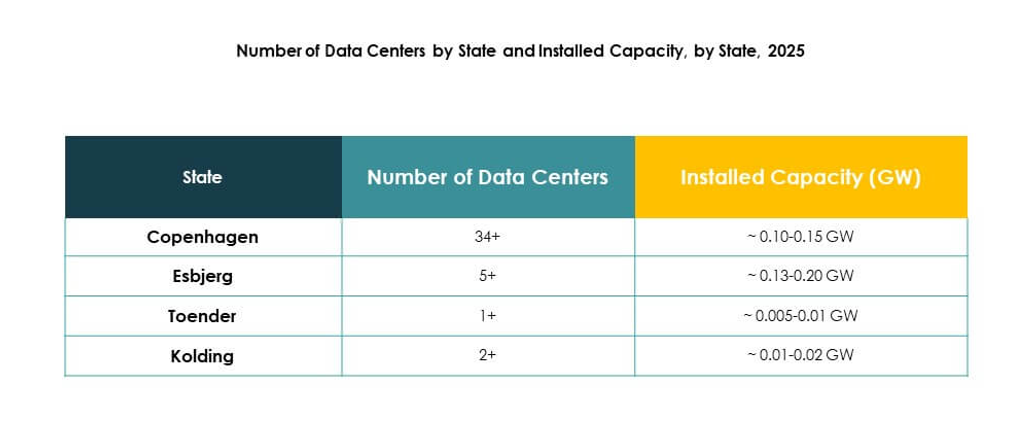

Northern Denmark Leading with Dominant Market Share

Northern Denmark leads the Denmark Data Center Market with a 36% share. It benefits from strong renewable energy projects and hyperscale site availability. Operators favor the region due to robust connectivity and cooling efficiency. Enterprises expand operations in Aalborg and surrounding areas. It highlights Northern Denmark’s role as the country’s digital infrastructure hub. Investors recognize the subregion’s balance of scale and sustainability.

- For instance, Google invested EUR 600 million in its Fredericia data center in Northern Denmark, which supported an average of 2,600 jobs per year between 2018 and 2020, according to a Copenhagen Economics report.

Eastern Denmark Emerging as a Competitive Growth Center

Eastern Denmark holds 32% of the Denmark Data Center Market. Copenhagen drives growth with strong demand for colocation and cloud services. Enterprises see Eastern Denmark as a gateway to broader European connectivity. It benefits from skilled workforce availability and advanced digital infrastructure. Operators prioritize expansions to serve enterprise and government clients. The subregion’s strategic importance supports strong investor interest.

Western and Southern Denmark Expanding with Emerging Market Potential

Western and Southern Denmark collectively account for 32% of the Denmark Data Center Market. Growth is led by regional demand from SMEs and industrial enterprises. Operators invest in modular facilities for distributed workloads. It highlights opportunities in decentralized edge computing. Investors track development potential in energy-backed projects. The subregion supports diversification beyond traditional hubs.

- For instance, Bulk Infrastructure’s DK01 campus in Esbjerg offers 2,300 m² of white space, ensures connectivity through multiple subsea fiber routes, and utilizes offshore wind power to support energy-efficient operations.

Competitive Insights:

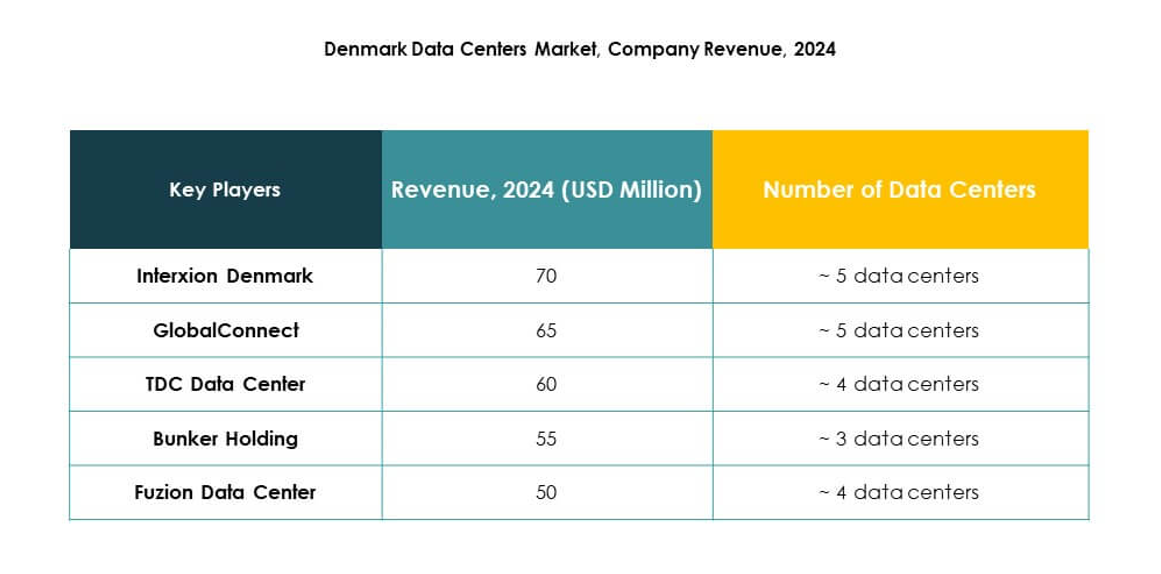

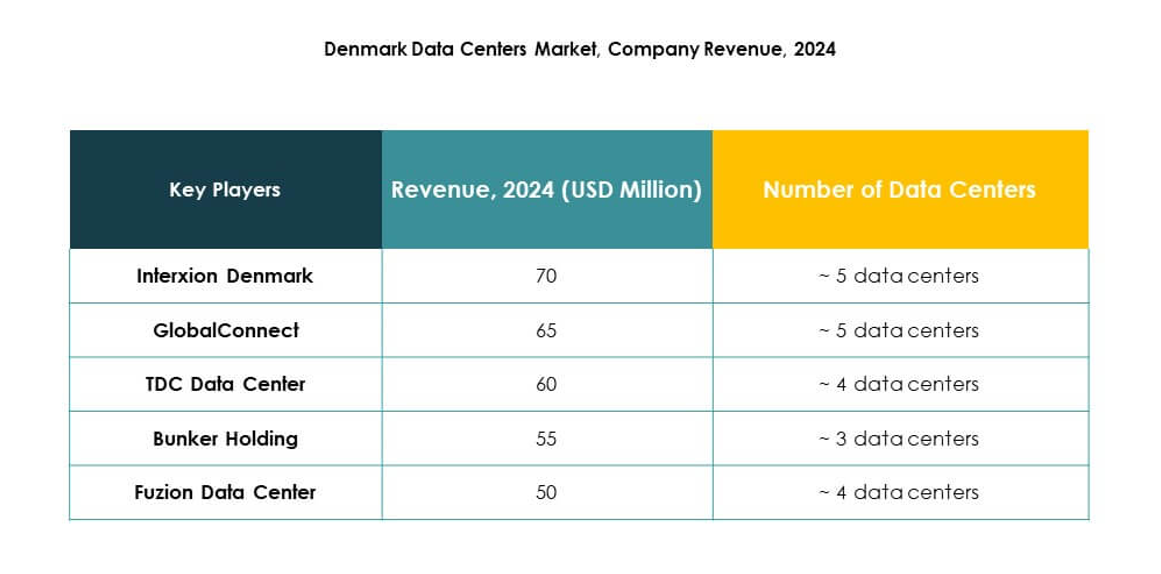

- Interxion Denmark

- GlobalConnect

- TDC Data Center

- Bunker Holding

- Fuzion Data Center

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Denmark Data Center Market features strong competition between regional operators and global hyperscale providers. Interxion, GlobalConnect, and TDC Data Center strengthen their positions through local connectivity and enterprise-focused services, while Fuzion Data Center expands following CapMan Infra’s acquisition. Digital Realty and NTT Communications drive large-scale investments, enhancing global interconnection. Cloud leaders Microsoft, AWS, and Google dominate hyperscale development with renewable energy-backed facilities. It reflects a competitive balance between local specialization and international expansion strategies. Market players focus on green infrastructure, advanced cooling, and hybrid deployment models to capture enterprises demanding sustainable and scalable solutions.

Recent Developments:

- In September 2023, Fuzion Data Center was acquired by CapMan Infra, an investment firm focusing on Nordic telecommunications and energy infrastructure, reinforcing Fuzion’s growth ambitions and expanding its data center presence in Copenhagen.

- In July 2025, Eurowind and Edora announced their partnership to develop a new data center within a renewable energy park in Jutland, Denmark, aiming to use the facility as a proof of concept for future sustainable data center deployments in the region. This collaboration highlights Denmark’s growing focus on integrating data center operations with renewable energy systems for enhanced sustainability and reduced carbon footprint.