Executive summary:

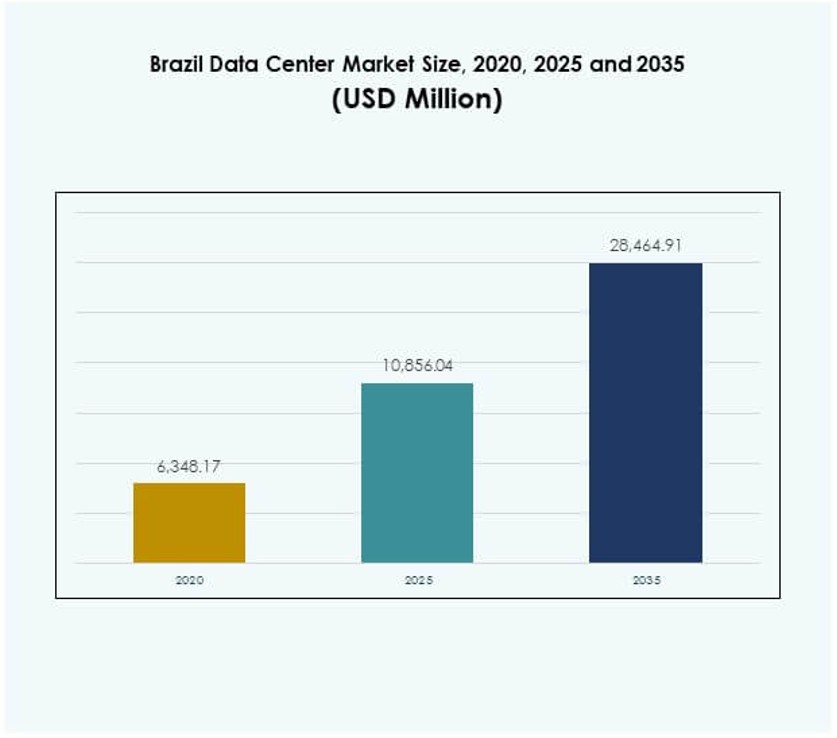

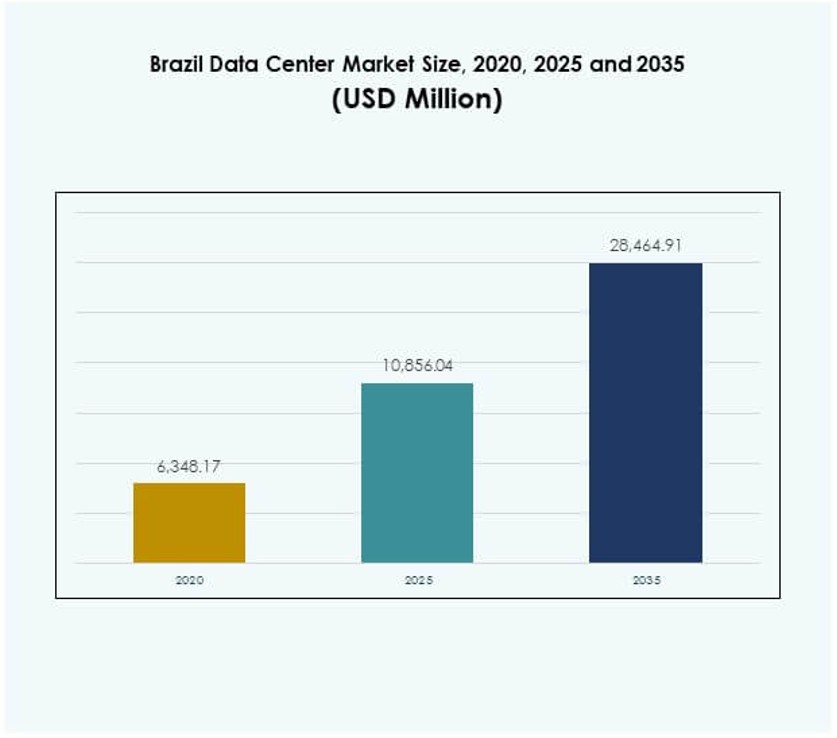

The Brazil Data Center Market size was valued at USD 6,348.17 million in 2020 to USD 10,856.04 million in 2025 and is anticipated to reach USD 28,464.91 million by 2035, at a CAGR of 10.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Brazil Data Center Market Size 2025 |

USD 10,856.04 Million |

| Brazil Data Center Market, CAGR |

10.06% |

| Brazil Data Center Market Size 2035 |

USD 28,464.91 Million |

Growth in the market is driven by rising adoption of cloud computing, digital transformation initiatives, and increasing reliance on data-intensive applications. Enterprises integrate artificial intelligence, big data, and IoT solutions, creating higher demand for secure and scalable infrastructure. Expansion of 5G networks and strong investment in colocation and hyperscale facilities reinforce the sector’s strategic importance. The Brazil Data Center Market provides investors with opportunities to support modernization and strengthen the country’s digital economy.

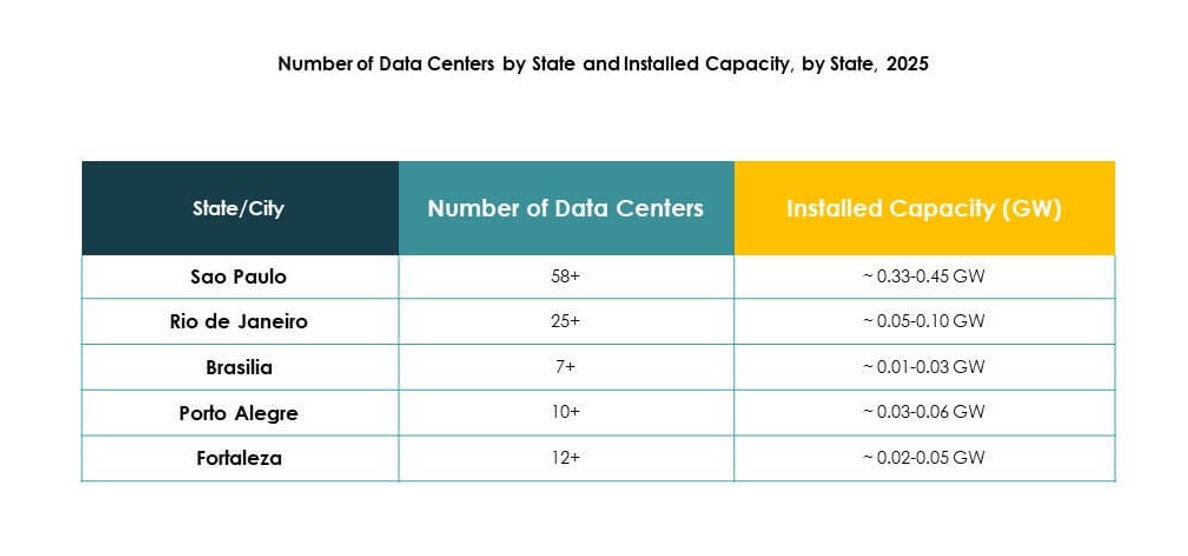

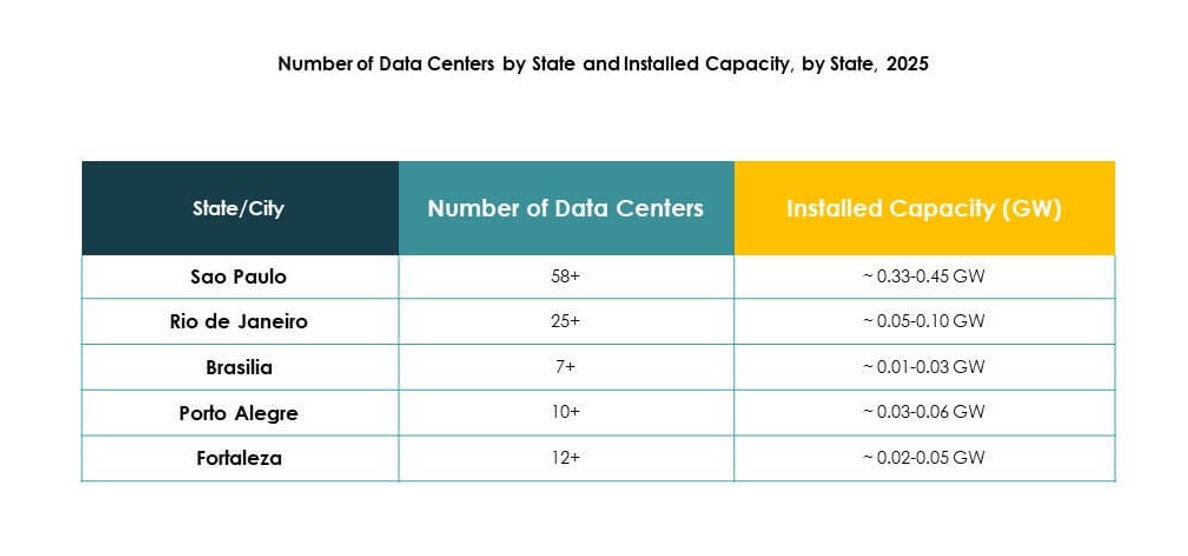

Regionally, Southeast Brazil leads due to São Paulo’s dominance as the country’s primary hub for hyperscale and colocation facilities. The region benefits from robust connectivity, concentration of enterprises, and presence of global cloud providers. Southern and Central-West regions are expanding with enterprise and government adoption, while Northern and Northeastern areas emerge through modular and edge deployments. Thesedevelopments highlight Brazil’s shift toward balanced nationwide digital infrastructure growth.

Market Drivers

Rapid Cloud Adoption and Enterprise Digital Transformation

The Brazil Data Center Market is fueled by strong enterprise adoption of cloud computing and digital services. Local and multinational firms are migrating workloads to cloud platforms to support agility and scale. Organizations invest in modern data centers to enhance efficiency and secure sensitive information. It benefits from government initiatives promoting digital transformation and expanding internet access. Rising adoption of artificial intelligence and big data applications creates demand for advanced infrastructure. Enterprises aim to optimize operations through automation and virtualization. Growing e-commerce and online services further intensify data demand. The sector provides investors with opportunities for consistent growth.

Strong Investment Inflow in Infrastructure and Connectivity Development

The market expands with significant investment in high-capacity data centers, fiber networks, and 5G deployment. Companies invest in greenfield projects and expand existing facilities to handle growing digital traffic. Brazil’s strategic position as South America’s largest economy attracts international cloud providers. Infrastructure investment ensures resilience, security, and scalability for enterprise operations. The Brazil Data Center Market benefits from rising energy-efficient cooling systems and renewable power integration. Enterprises leverage low-latency connectivity to support real-time applications. The ecosystem strengthens through collaboration between global and local operators. It enables businesses to access robust digital platforms and secure reliable service delivery.

- For instance, Scala Data Centers broke ground on a 560 MW dedicated power substation at its Tamboré campus in São Paulo in May 2024, the largest for a data center in Brazil, providing energy reliability and resilience for expanding hyperscale cloud and enterprise clients.

Increasing Role of Colocation and Hyperscale Data Centers

The shift toward colocation and hyperscale data centers strengthens the competitive landscape. Enterprises prefer colocation for cost efficiency, scalability, and compliance support. Hyperscale providers drive large-scale capacity expansion and cloud availability zones. The Brazil Data Center Market grows as global technology leaders build advanced facilities in São Paulo. Rising demand for streaming, gaming, and financial services boosts hyperscale adoption. Colocation providers differentiate through managed services and customized offerings. Enterprises secure flexibility while reducing capital expenditure. It fosters strong demand for energy-efficient infrastructure and modular expansions across the country.

- For example, Equinix has expanded its xScale data center presence in São Paulo, with the SP5x facility dedicated to hyperscale deployments. It provides multinational enterprises and cloud providers with direct, high-capacity connections to major cloud platforms.

Regulatory Environment and Strategic Relevance for Businesses

Government policies promoting data localization and cybersecurity standards enhance market reliability. Companies prioritize compliance with regulations to safeguard customer trust and avoid penalties. The Brazil Data Center Market gains importance as investors align with evolving regulatory frameworks. Demand for disaster recovery and backup solutions strengthens resilience strategies. Businesses recognize the market as vital for enabling digital ecosystems. Local hosting of sensitive data becomes essential across banking, healthcare, and government sectors. Enterprises reduce dependency on foreign infrastructure and improve service quality. It positions Brazil as a digital hub with regional influence and long-term growth potential.

Market Trends

Shift Toward Sustainable and Green Data Center Practices

Operators integrate renewable energy sources and advanced cooling systems into facility design. Companies pursue carbon-neutral strategies to align with global sustainability goals. The Brazil Data Center Market gains momentum as clients demand eco-friendly solutions. Green certifications drive customer confidence and strengthen provider differentiation. Firms adopt modular construction to reduce environmental impact and enhance efficiency. Sustainable energy procurement becomes a priority for hyperscale operators. Enterprises value low operational costs supported by energy-efficient practices. It ensures long-term competitiveness in a market influenced by environmental regulations.

Expansion of Edge and Modular Data Centers for Latency-Sensitive Services

The rise of 5G, IoT, and real-time analytics boosts demand for edge and modular facilities. Edge centers reduce latency and improve performance for streaming, gaming, and financial services. The Brazil Data Center Market evolves as telecom operators and enterprises deploy modular solutions. Modular data centers provide scalability and flexibility at lower investment risk. Businesses adopt edge strategies to improve user experience across diverse regions. It enables expansion into underserved markets with limited traditional infrastructure. Edge growth supports advanced use cases like autonomous systems and telemedicine. Providers expand coverage while maintaining operational resilience and service quality.

Integration of Artificial Intelligence and Automation in Operations

Data centers adopt AI-driven management systems for predictive maintenance and energy optimization. Automation streamlines monitoring, fault detection, and resource allocation. The Brazil Data Center Market advances as providers implement intelligent infrastructure solutions. AI tools optimize workload distribution and support real-time decision-making. Enterprises adopt orchestration platforms for efficient resource utilization. Providers leverage automation to enhance uptime and reduce operational risks. It fosters scalable solutions capable of meeting rapid enterprise demands. AI integration positions the market at the forefront of technological advancement in Latin America.

Rising Importance of Security and Cyber Resilience in Data Center Strategies

Growing cyber threats push providers to adopt advanced security architectures and encryption standards. Enterprises demand compliance with data protection regulations for hosted services. The Brazil Data Center Market emphasizes robust security frameworks across all facility tiers. Providers implement physical, network, and application-level safeguards. Hybrid deployment models require integration of security across cloud and on-premises infrastructure. Businesses prioritize resilience against ransomware and evolving digital risks. It strengthens customer trust and attracts regulated sectors like BFSI and healthcare. Enhanced resilience ensures uninterrupted services in a highly competitive digital economy.

Market Challenges

High Capital Requirements and Infrastructure Complexity

Building advanced facilities requires significant upfront investment in power, cooling, and network systems. Operators face challenges in accessing affordable financing for large-scale projects. The Brazil Data Center Market must balance expansion with cost efficiency to remain attractive. Complex infrastructure design raises operating costs and delays deployment timelines. Rising electricity costs further impact margins, especially for hyperscale providers. Companies also face difficulty in sourcing skilled professionals for operations. It creates barriers for smaller players trying to enter the competitive landscape.

Regulatory, Environmental, and Connectivity Constraints

Strict regulatory requirements increase compliance burdens for international and local providers. Environmental restrictions on energy use and emissions complicate facility development. The Brazil Data Center Market faces uneven connectivity in less developed regions. Limited fiber availability restricts expansion beyond major urban hubs. Geopolitical risks and policy changes create uncertainty for investors. Businesses face challenges in maintaining service continuity during regional power disruptions. It forces operators to invest heavily in redundancy and disaster recovery systems.

Market Opportunities

Growing Demand for Hybrid and Multi-Cloud Strategies

Enterprises seek hybrid and multi-cloud deployments to balance flexibility and security. The Brazil Data Center Market benefits from rising enterprise demand for cloud-native solutions. Providers deliver hybrid platforms to support diverse workloads and compliance needs. Businesses value interoperability between on-premises and cloud infrastructure. It creates opportunities for managed service providers to expand offerings. Enterprises enhance efficiency through integrated hybrid strategies.

Emerging Potential of Underserved Regions and Edge Deployments

Northern and northeastern regions present strong opportunities for new data center investments. The Brazil Data Center Market expands as edge facilities improve digital access in remote areas. Businesses invest in modular centers to reduce deployment costs and risks. It supports telecom operators aiming to extend 5G services across the country. Enterprises leverage edge for real-time applications in manufacturing and healthcare. Regional expansion diversifies revenue sources and increases resilience.

Market Segmentation

By Component

Hardware dominates with servers, storage, and networking equipment accounting for the largest share. The Brazil Data Center Market expands with strong demand for cooling, racks, and security systems. Software segments such as DCIM and orchestration gain traction as enterprises automate operations. Services including consulting, integration, and managed support provide recurring revenue opportunities. Hardware maintains leadership with over 45% share due to capacity expansion and hyperscale adoption.

By Data Center Type

Hyperscale data centers dominate with over 40% share, driven by cloud providers and large enterprises. The Brazil Data Center Market witnesses rapid colocation growth as businesses prefer cost-effective models. Edge and modular centers gain traction in underserved regions. Enterprise and cloud IDCs expand to support growing digital ecosystems. Mega data centers remain limited to metropolitan areas with strong connectivity infrastructure.

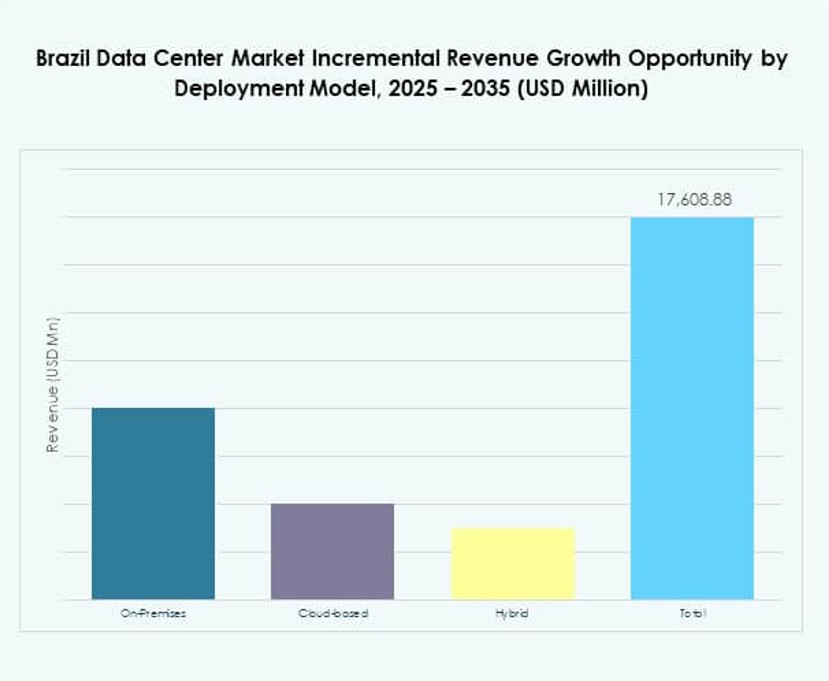

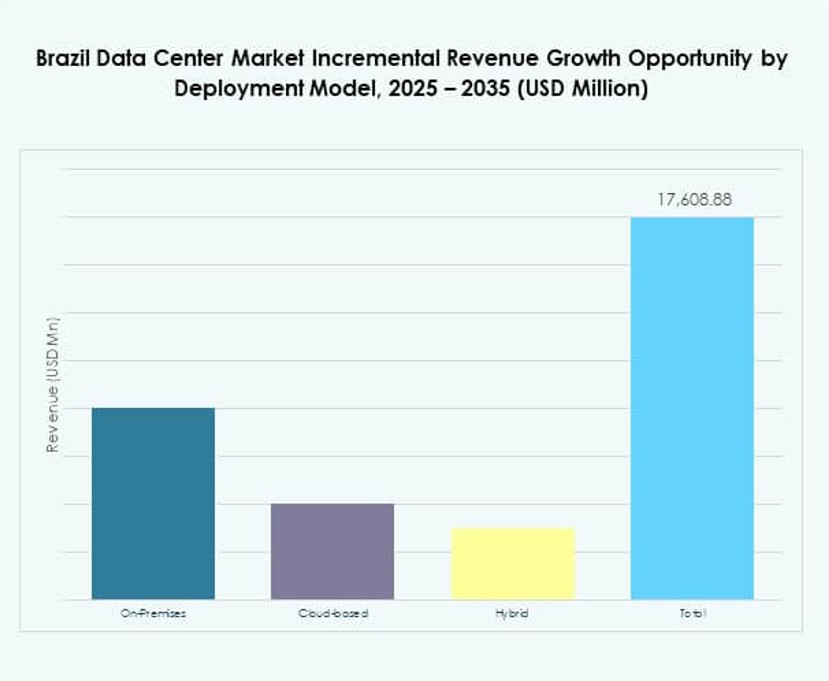

By Deployment Model

Cloud-based models hold the largest share with enterprises adopting flexible and scalable platforms. The Brazil Data Center Market also benefits from hybrid deployment as organizations balance compliance with agility. On-premises remains relevant for regulated industries requiring full data control. Hybrid deployment rises with firms leveraging both on-site infrastructure and cloud resources.

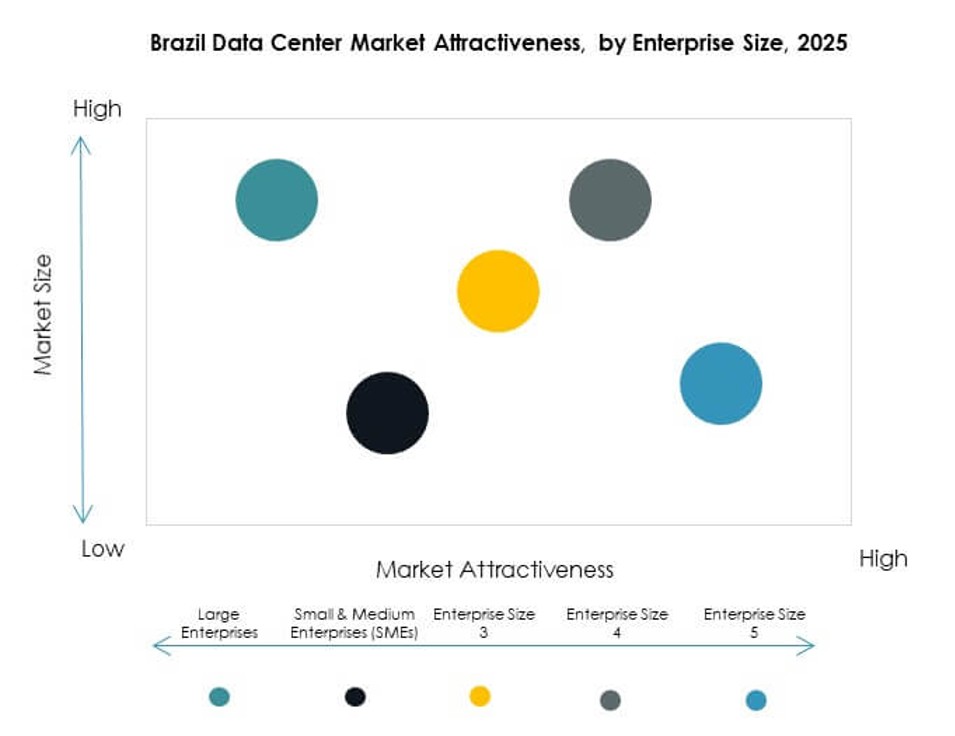

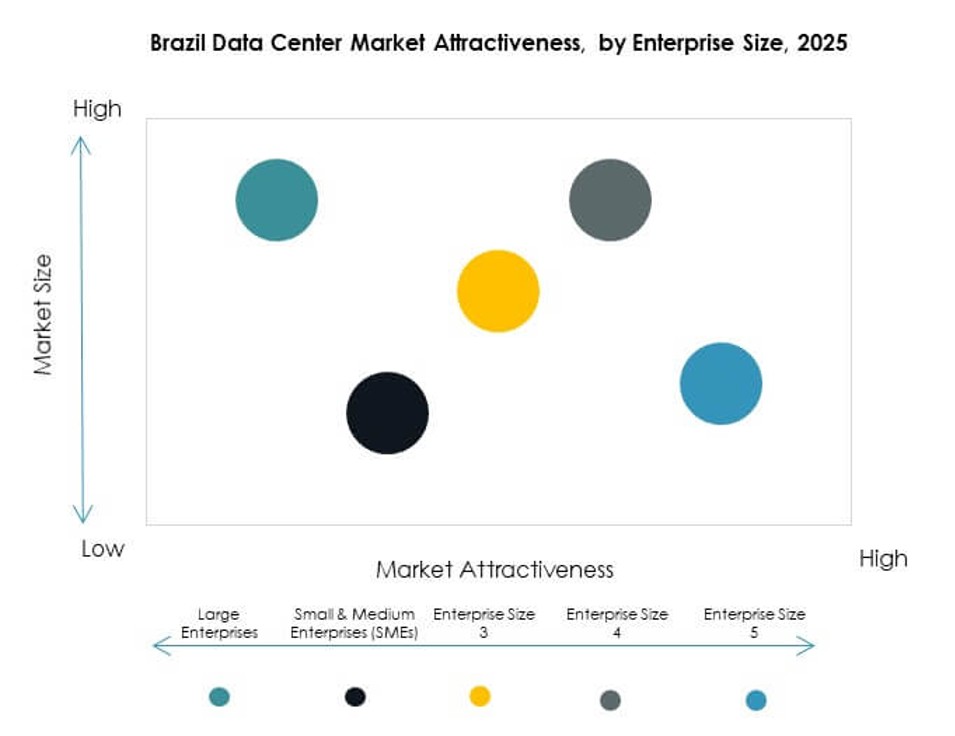

By Enterprise Size

Large enterprises dominate with more than 55% share due to their extensive digital infrastructure needs. The Brazil Data Center Market also sees rising adoption among SMEs supported by affordable colocation services. Cloud adoption enables SMEs to access scalable resources without heavy capital investments. It ensures balanced growth across enterprise size segments.

By Application / Use Case

IT and Telecom lead with over 30% share, driven by rapid digital transformation. The Brazil Data Center Market also benefits from BFSI, healthcare, and government adoption of secure hosting solutions. Retail, e-commerce, and entertainment sectors expand rapidly with digital service demand. Manufacturing and energy applications strengthen demand for edge computing and real-time analytics.

By End User Industry

Cloud service providers dominate with more than 40% market share. The Brazil Data Center Market also grows with enterprise demand for colocation and hybrid services. Government agencies strengthen adoption to secure sensitive information and ensure compliance. Colocation providers offer flexible models for SMEs and mid-sized businesses.

Regional Insights

Southeast Brazil Leading with São Paulo as the Core Hub

Southeast Brazil accounts for 52% share, led by São Paulo as the primary hub. The Brazil Data Center Market benefits from its strong connectivity, business concentration, and skilled workforce. São Paulo attracts global hyperscale providers building advanced facilities. The city offers robust power supply and fiber infrastructure. It secures leadership due to proximity to multinational corporations. Investors prioritize this region for long-term scalability and reliability.

South and Central-West Regions Expanding with Growing Enterprise Adoption

The South holds 18% share, supported by Curitiba and Porto Alegre driving enterprise hosting demand. Central-West contributes 14% share as Brasília strengthens demand from government and defense. The Brazil Data Center Market gains momentum in these regions due to improving infrastructure. Enterprises expand adoption for BFSI, education, and public services. It reflects a balanced mix of colocation and enterprise deployments.

- For example, Ascenty announced in July 2025 a R$ 300 million investment to build SPO05, its fifth data center campus in Greater São Paulo. The facility will span 47 MW and about 40,000 m², targeting cloud, AI, and enterprise-scale clients. The company also launched new units engineered for high availability and low-latency connectivity to meet enterprise and public sector demands.

North and Northeast Emerging with Gradual Edge and Modular Deployments

The North and Northeast together hold 16% share, reflecting emerging opportunities. The Brazil Data Center Market grows as modular and edge facilities expand digital access. Telecom operators extend 5G and broadband services across underserved cities. Enterprises adopt regional facilities to improve latency-sensitive operations. It highlights untapped opportunities for investors seeking early entry advantage. Regional expansion supports inclusive growth in Brazil’s digital economy.

- For example, in August 2024, Grupo ClickIP launched a new data center in Manaus, investing over R$ 20 million in the project. The facility delivers 240 kW of IT capacity and supports up to 49 racks, representing the largest such infrastructure for cloud and broadband connectivity in Brazil’s North region.

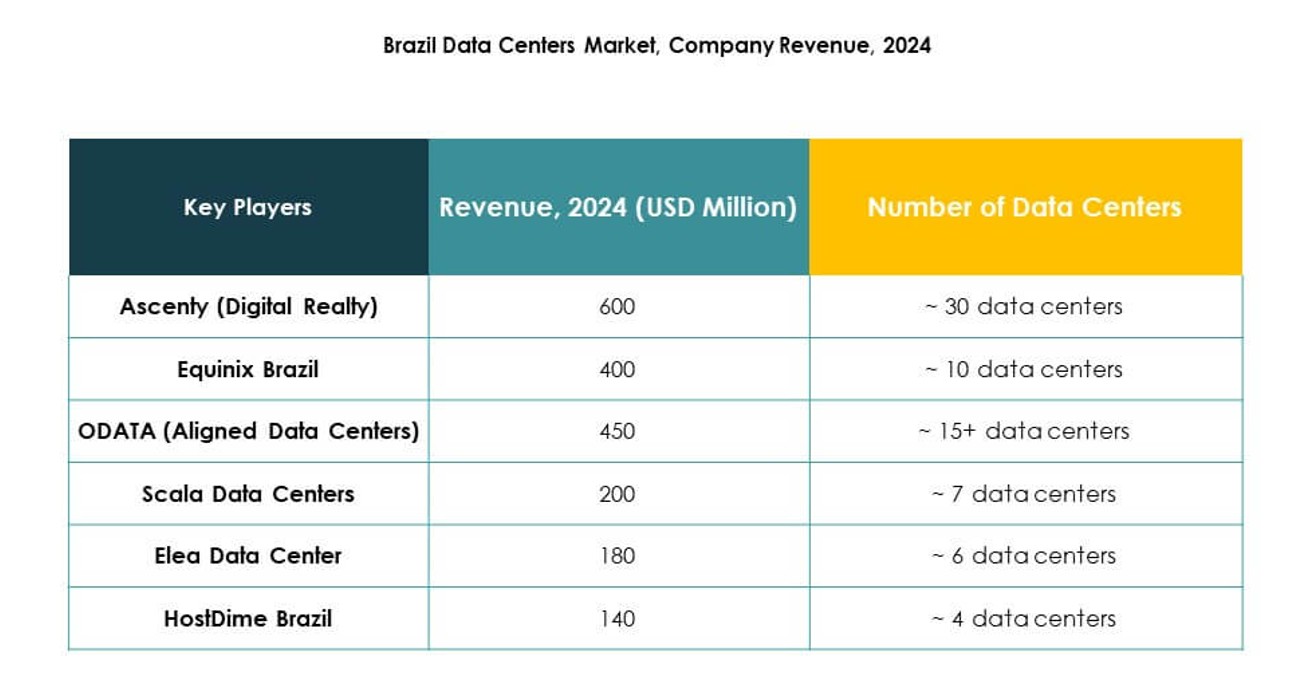

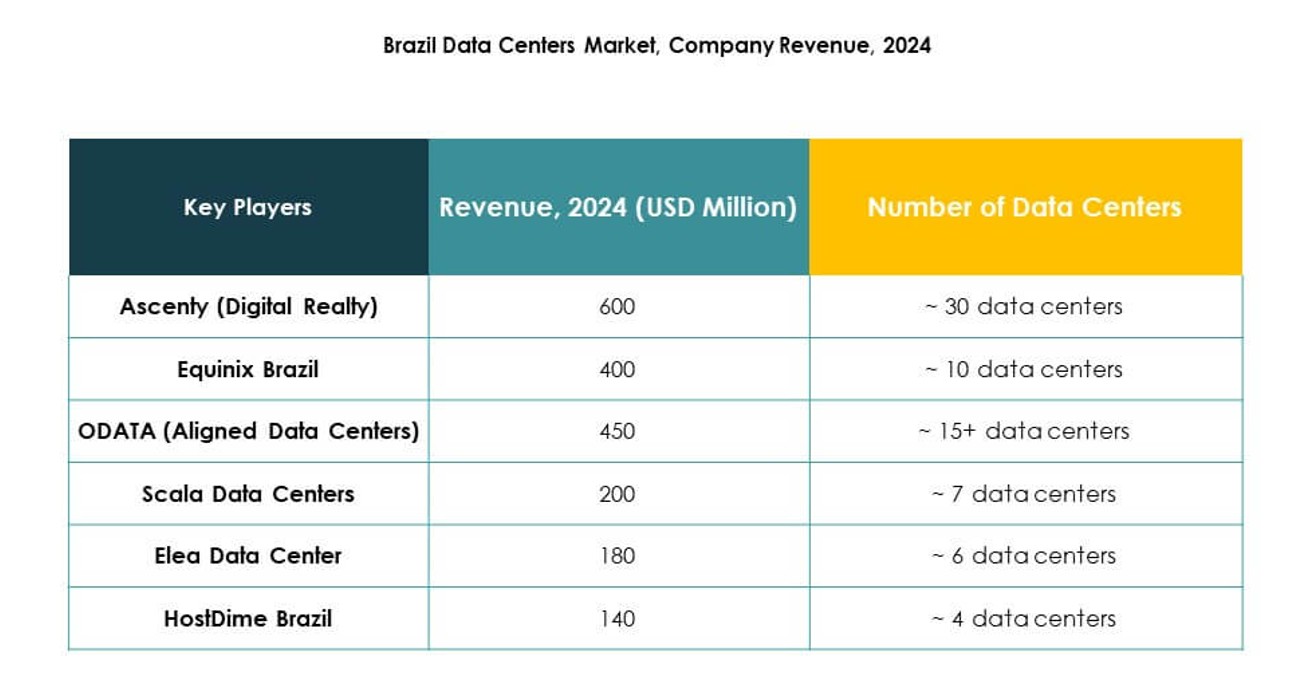

Competitive Insights:

- Ascenty

- Equinix Brazil

- ODATA (Aligned Data Centers)

- Elea Data Center

- Scala Data Centers

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

The Brazil Data Center Market features strong competition between global cloud providers and regional colocation specialists. It benefits from strategic investment in hyperscale facilities by companies like AWS, Microsoft, and Google, while Ascenty and Scala expand regional dominance with large colocation campuses. Equinix Brazil and Digital Realty strengthen global connectivity and enterprise-grade services. NTT leverages global expertise to attract multinational clients, while ODATA focuses on modular expansion and efficiency. Elea Data Center positions itself as a niche player supporting enterprise requirements with flexible solutions. It creates a balanced environment where hyperscale cloud providers, colocation leaders, and regional operators compete by enhancing capacity, sustainability, and service diversity to capture growing enterprise and government demand.

Recent Developments:

- In September 2025, the Brazilian federal government introduced the “Redata” tax incentive program, designed to attract foreign technology companies including those from the United States to build data centers in Brazil by offering exemptions on federal taxes for projects using 100% renewable energy. This move is projected to drive significant investment flow, encourage partnerships, and incentivize new product development in the sector.

- In August 2025, Elea Data Centers launched a major initiative in collaboration with Oracle and the Rio de Janeiro government to develop a new AI-focused data center campus called ‘Rio AI City’. This project aims to deliver 1.5 GW of IT capacity by 2027, with plans to potentially expand to 3.2 GW by 2032, positioning Rio as a regional AI hub.