Executive summary:

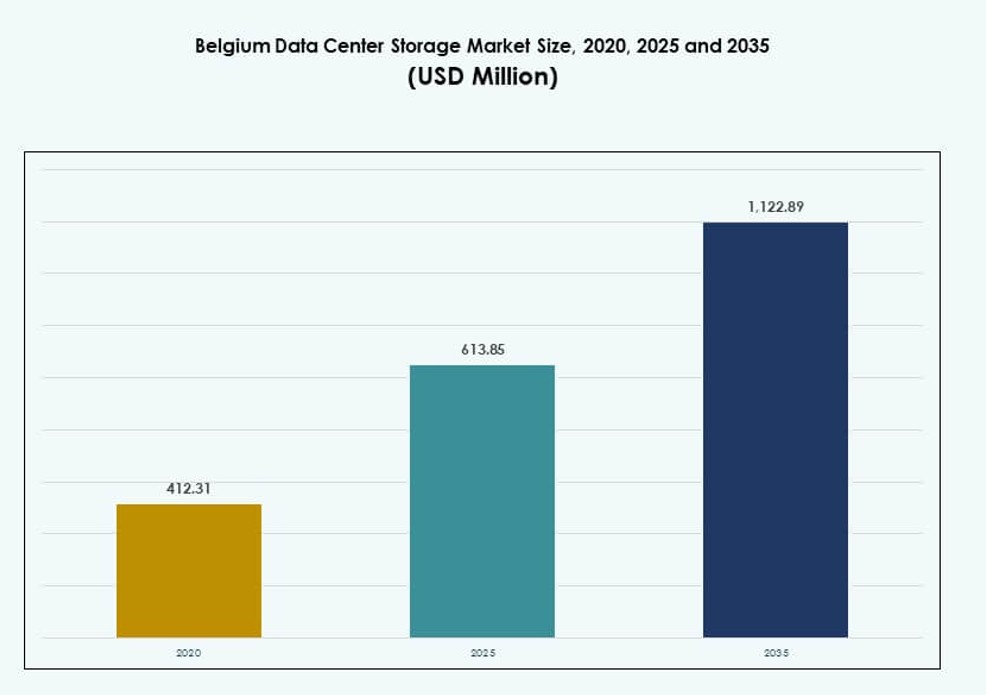

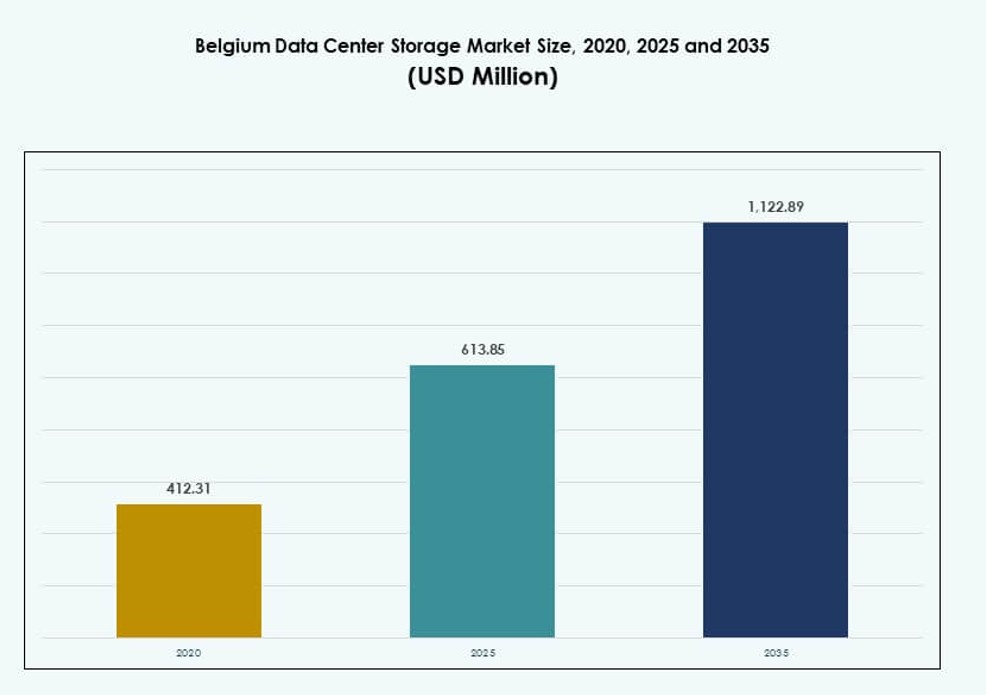

The Belgium Data Center Storage Market size was valued at USD 412.31 million in 2020 to USD 613.85 million in 2025 and is anticipated to reach USD 1,122.89 million by 2035, at a CAGR of 6.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Belgium Data Center Storage Market Size 2025 |

USD 613.85 Million |

| Belgium Data Center Storage Market, CAGR |

6.17% |

| Belgium Data Center Storage Market Size 2035 |

USD 1,122.89 Million |

Enterprises across Belgium are modernizing their IT infrastructure to support growing cloud workloads, AI applications, and regulatory demands. The adoption of hybrid cloud, edge computing, and software-defined storage is reshaping storage deployment models. Businesses seek low-latency, scalable, and secure storage to enable digital transformation. Strategic infrastructure projects and vendor innovation are making storage a key enabler of long-term growth. The Belgium Data Center Storage Market plays a vital role in supporting enterprise agility, resilience, and regulatory alignment.

The Brussels-Capital Region leads the market due to its high-density data center clusters and connectivity. Flanders is emerging as a strong growth area supported by industrial activity and proximity to cross-border digital corridors. Wallonia is gaining traction through secondary city deployments and government-led digital expansion. These geographic trends reflect rising demand for distributed storage and regional redundancy.

Market Dynamics:

Market Drivers

Digital Transformation and Regulatory Push Driving Enterprise Data Storage Investments

Enterprise cloud migration and digital workflows are accelerating across Belgium. Government-led digital mandates and compliance needs like GDPR are pushing organizations to modernize storage systems. This shift favors scalable, secure, and software-defined storage that supports real-time data access. Public and private sector entities increasingly invest in local data centers to maintain data sovereignty. Rising hybrid work models increase demand for low-latency, high-performance storage systems. The Belgium Data Center Storage Market benefits from this ongoing transformation across industries. It gains strategic relevance for stakeholders seeking resilient and compliant IT infrastructure. Market maturity and strong digital readiness also attract foreign investment in storage infrastructure.

Rising AI, IoT, and 5G Deployments Fueling Next-Generation Storage Demand

The spread of AI, 5G, and IoT use cases across Belgium is reshaping storage infrastructure. High-throughput data environments require performance-intensive systems with lower access delays and greater reliability. AI model training and edge analytics need dynamic storage capable of handling unstructured and real-time data. 5G networks push storage closer to the edge for seamless data delivery. Belgium’s smart city plans and industrial IoT adoption strengthen the need for robust data center storage. The Belgium Data Center Storage Market is critical in enabling this data-driven ecosystem. Advanced workloads demand scalable solutions like NVMe arrays and all-flash storage. Enterprises invest in storage platforms that integrate with AI-ready infrastructure.

Increased Adoption of Cloud-Based Storage in Hybrid IT Architectures

Belgian enterprises are expanding hybrid IT environments combining public cloud, private cloud, and on-premises infrastructure. Cloud storage adoption improves operational agility, disaster recovery, and cost optimization. Businesses shift toward software-defined storage for centralized control and dynamic provisioning. Hyperscalers, MSPs, and colocation providers enhance service offerings with flexible cloud-based storage tiers. This hybrid cloud preference fosters demand for object storage, tiered storage, and backup-as-a-service models. The Belgium Data Center Storage Market aligns with this architectural shift. Storage vendors build cloud-native capabilities into infrastructure, enabling rapid deployment across dispersed workloads. Investors gain exposure to recurring revenue models supported by managed storage services.

- For instance, Datacenter United completed the acquisition of four Proximus data centers in March 2025, expanding its footprint to 13 locations across Belgium. The combined group now operates with approximately 13 MW of IT power capacity, enhancing national colocation and hybrid cloud service delivery.

Strategic Role of Data Storage in Belgium’s Emerging Digital Economy

Data storage forms the backbone of Belgium’s evolving knowledge and service economy. The rise in fintech, healthcare IT, and digital manufacturing boosts demand for secure, scalable storage. Businesses rely on real-time insights, requiring high-availability storage with fast retrieval rates. Data retention laws and cybersecurity regulations compel enterprises to invest in storage that ensures compliance and resilience. The Belgium Data Center Storage Market supports national initiatives around digital infrastructure and innovation. It provides the foundation for sectors embracing digital twins, machine learning, and predictive analytics. Reliable storage enables digital competitiveness, attracting tech-focused investments into the region.

- For instance, Proximus entered a long‑term master service and lease agreement for its Evere and Mechelen data centers following their sale to Datacenter United, securing continued high‑availability infrastructure with approximately 11 MW of total capacity to serve internal IT and enterprise clients in the Brussels area.

Market Trends

Edge Computing Integration Increasing Demand for Decentralized Storage Models

Belgium’s enterprises are moving toward edge storage to support latency-sensitive applications. Industrial hubs, hospitals, and logistics centers deploy micro data centers for local data processing. This trend reduces pressure on core storage systems and improves real-time analytics. Edge integration fuels demand for compact, rugged storage units and hyperconverged solutions. Storage platforms must now support seamless data mobility across edge and core locations. The Belgium Data Center Storage Market is adapting to this decentralized storage model. Vendors offer edge-specific products with onboard analytics and security layers. These solutions empower enterprises to handle distributed data ecosystems.

Software-Defined Storage Gaining Ground Across Mid-Sized Enterprises

Software-defined storage (SDS) is being adopted across mid-sized Belgian firms seeking flexibility and cost efficiency. SDS decouples hardware from control software, enabling centralized management and automation. Businesses benefit from lower CAPEX and simplified scalability as workloads grow. SDS solutions are compatible with heterogeneous hardware, increasing vendor neutrality. Belgian IT departments adopt SDS for storage pooling and multi-site replication. The Belgium Data Center Storage Market sees growing traction for these vendor-agnostic platforms. Integration with virtualization environments boosts their appeal for DevOps and testing use cases. SDS also complements hybrid cloud strategies by enabling unified storage orchestration.

Sustainability in Storage Infrastructure Becoming a Procurement Priority

Environmental goals and EU climate regulations are influencing procurement in Belgium’s data center sector. Enterprises seek energy-efficient storage systems with low power consumption and minimal cooling requirements. All-flash storage and SSDs with better thermal performance replace older HDD-based setups. Sustainable packaging and circular economy practices are gaining attention among storage hardware providers. Vendors differentiate on environmental certifications, recyclability, and e-waste reduction. The Belgium Data Center Storage Market reflects this green shift in procurement behavior. Customers favor partners offering transparent lifecycle management and low-carbon logistics. Sustainability adds long-term value in RFPs across public and private tenders.

Growing Use of Container Storage for Kubernetes and DevOps Pipelines

Containerization is reshaping application development and deployment in Belgian organizations. Kubernetes clusters require persistent storage to handle stateful workloads and shared volumes. Container-native storage enables dynamic provisioning and portability across dev, test, and production. DevOps teams use storage APIs to automate CI/CD pipelines and improve deployment cycles. Enterprises favor cloud-native storage architectures with strong compatibility with orchestration tools. The Belgium Data Center Storage Market sees growing investments in these container-ready systems. Vendors optimize storage plugins, CSI drivers, and performance tuning for distributed clusters. Container storage is now vital for agile software delivery and microservices architecture.

Market Challenges

Complexity of Integrating Legacy Storage with Modern Data Center Infrastructure

Belgian enterprises face challenges when modernizing aging storage infrastructure. Legacy systems lack scalability, API compatibility, and real-time access features needed for cloud-native environments. Integration with modern orchestration and security layers creates performance bottlenecks. Transitioning to hybrid storage models requires re-architecting workflows and retraining personnel. Costs of migrating large volumes of mission-critical data further complicate the upgrade cycle. The Belgium Data Center Storage Market must balance innovation with backward compatibility. Vendors are pressured to provide migration tools, interoperability solutions, and legacy support services. These requirements increase project scope and elongate deployment timelines.

Data Sovereignty Rules and Cybersecurity Compliance Driving Operational Complexity

Belgium’s strict data localization and cybersecurity frameworks increase operational burden on storage infrastructure. Enterprises must ensure that data is stored, processed, and backed up within regulated borders. Rising threats from ransomware and phishing attacks push demand for immutable backups and encrypted storage. Compliance with EU directives like GDPR requires fine-grained access control and audit trails. These mandates strain IT budgets and slow down agile deployments. The Belgium Data Center Storage Market operates under intense regulatory scrutiny. Storage providers must embed security by design, support zero-trust models, and maintain high availability. Balancing compliance with flexibility remains a top challenge.

Market Opportunities

Rising Hyperscaler and Colocation Activity Supporting Long-Term Storage Growth

Belgium continues to attract hyperscaler and colocation investments driven by its central European location and strong connectivity. These players build new campuses that demand advanced storage architecture. Opportunities arise for vendors offering scalable systems for AI, HPC, and media-rich workloads. The Belgium Data Center Storage Market benefits from co-deployment with compute and network layers. This drives demand for integrated storage stacks that support tiered performance and distributed data access.

Digitalization of Public Sector and SMEs Opening New Market Segments

Belgium’s public sector agencies and small businesses are undergoing digital transformation. These groups need affordable, secure, and user-friendly storage solutions. Vendors offering tailored storage-as-a-service models can penetrate this expanding segment. The Belgium Data Center Storage Market stands to gain from these decentralizing IT trends. Cloud-first strategies in education, municipal services, and health tech offer scalable entry points.

Market Segmentation

By Storage Type

Traditional storage continues to hold a steady presence in large institutions due to legacy application needs. However, hybrid storage dominates in the Belgium Data Center Storage Market as it balances performance and cost. All-flash storage adoption is growing fast in sectors using analytics, AI, and real-time databases. Flash arrays support higher IOPS, lower latency, and compact footprints, meeting sustainability targets. Hybrid models offer smart tiering, enabling better storage optimization.

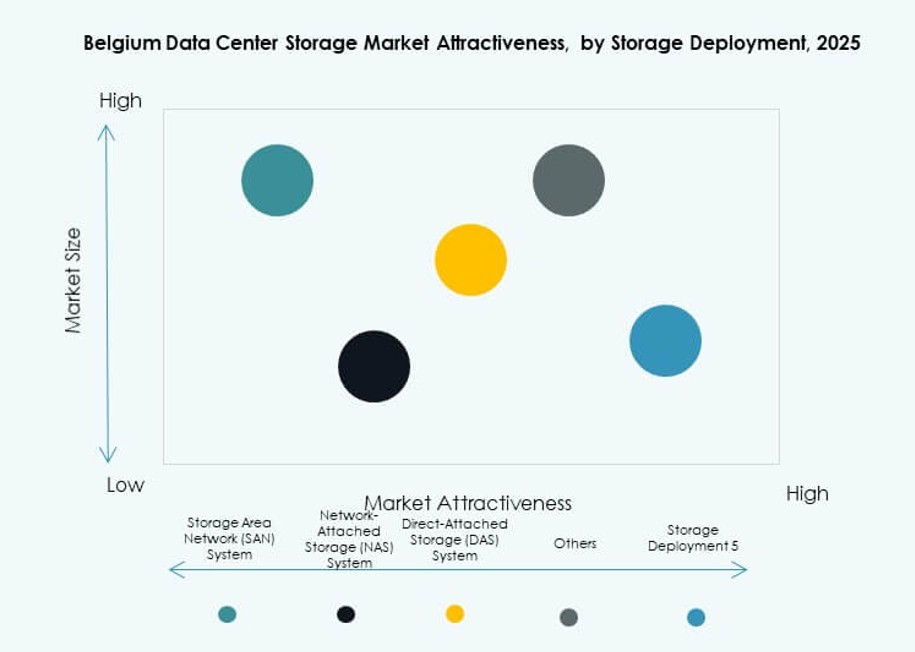

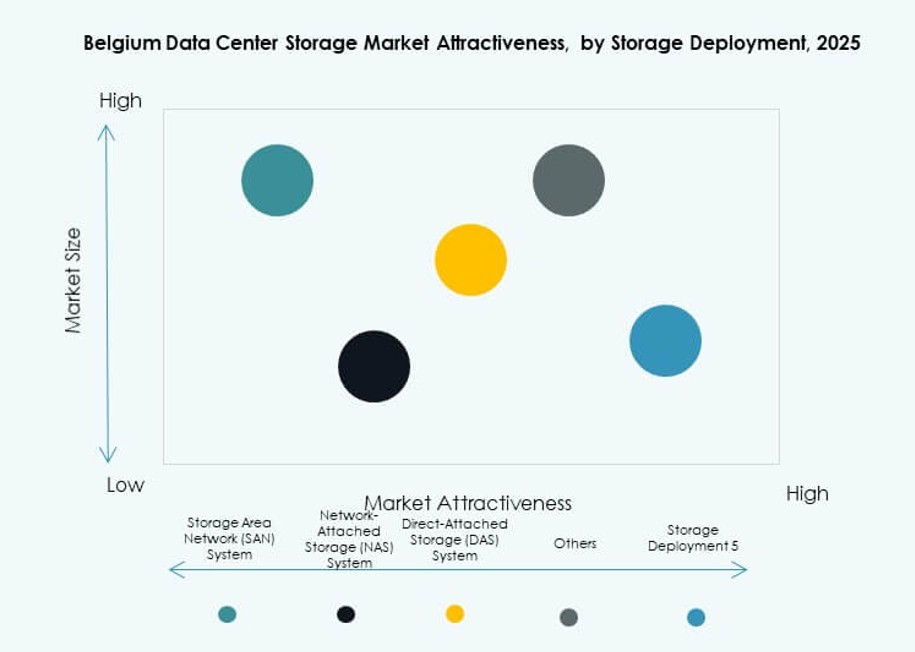

By Storage Deployment

Storage Area Network (SAN) systems lead the market due to their high throughput and reliability. SAN is preferred for virtualized environments and mission-critical applications across telecom and finance. Network-attached Storage (NAS) is popular for file-based sharing in enterprise collaboration. Direct-attached Storage (DAS) serves small-scale use cases with limited scalability. The Belgium Data Center Storage Market is seeing growth in SAN deployments as enterprises expand virtualization and private cloud infrastructure.

By Component

Hardware dominates the Belgium Data Center Storage Market, driven by enterprise investments in scalable arrays and modular storage. Appliances with built-in analytics and automation features are in demand. Software adoption is rising due to the shift toward software-defined storage (SDS). Storage management software enables automation, centralized control, and integration across hybrid environments. Enterprises view software as key for unlocking agility and performance in distributed deployments.

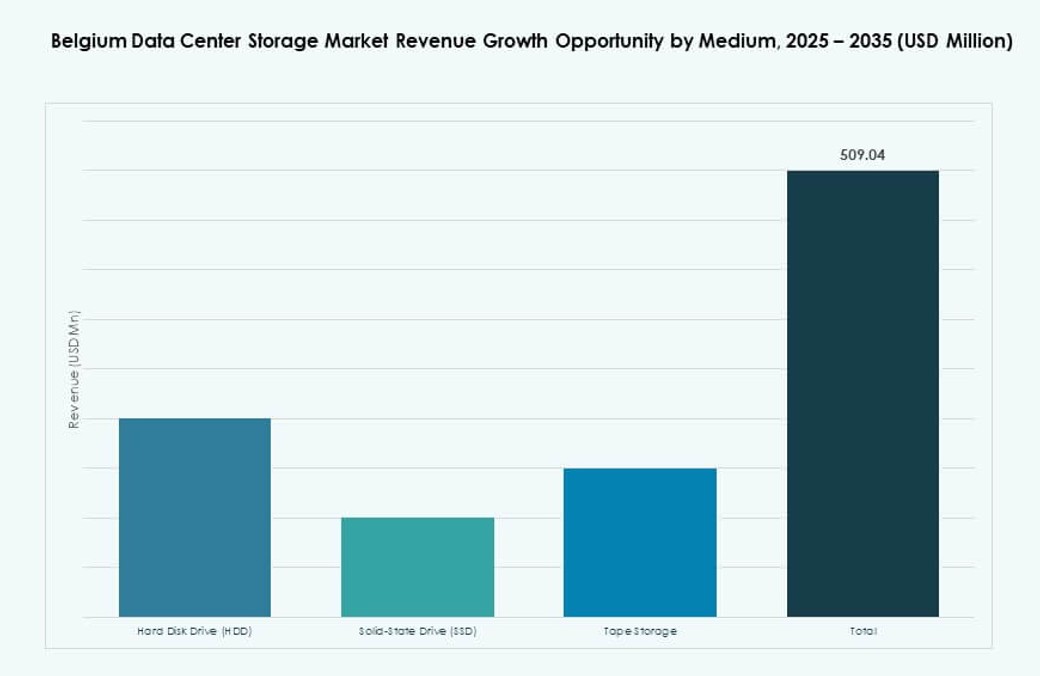

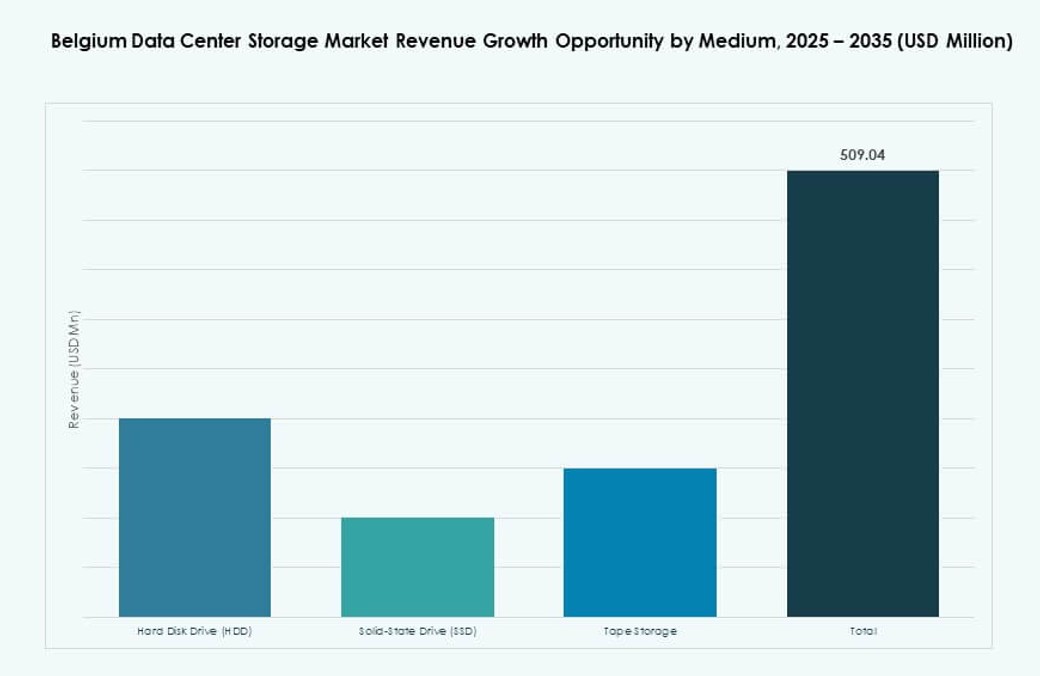

By Medium

Solid-State Drives (SSD) are gaining traction over Hard Disk Drives (HDD) due to faster performance and lower energy usage. SSDs are becoming standard in high-performance and latency-sensitive environments. HDDs remain relevant for cold storage and backup purposes due to cost advantages at scale. Tape storage is niche, mostly in archival workloads for government and research sectors. The Belgium Data Center Storage Market shows clear migration toward SSDs, especially in AI and edge workloads.

By Deployment Model

Hybrid deployment models dominate as Belgian enterprises blend on-premises and cloud-based storage. On-premise models remain vital for compliance and data sovereignty. Cloud-based deployments are increasing in digital-native sectors and SMEs seeking scalability. The Belgium Data Center Storage Market reflects this blended environment. Hybrid models enable workload flexibility, disaster recovery, and cost control. Vendors offer managed storage services that span across physical and virtual environments.

By Application

The IT and telecommunications sector leads storage consumption in Belgium, followed by BFSI and government. Telecom operators and ISPs deploy high-throughput systems for streaming, VoIP, and 5G backhaul. BFSI firms demand secure and redundant storage to meet compliance mandates. Government agencies require localized and resilient storage for sensitive data. Healthcare is growing due to EMR digitization and imaging data. The Belgium Data Center Storage Market aligns its offerings to meet these varied workload demands.

Regional Insights

Brussels-Capital Region Holds Largest Share Due to Dense Data Center Clusters (48%)

The Brussels-Capital Region dominates the Belgium Data Center Storage Market, accounting for 48% of the national share. It hosts dense data center hubs, connectivity exchanges, and enterprise headquarters. Brussels benefits from high fiber density and proximity to EU institutions, driving demand for secure and scalable storage. Its established colocation ecosystem attracts global hyperscalers and managed service providers. The region also houses government and financial workloads requiring Tier III+ infrastructure.

- For instance, Digital Realty’s Interxion BRU4 facility near Brussels offers approximately 6,700 square meters of space and delivers 13.6 MW of IT power capacity, supporting enterprise and colocation workloads across the region.

Flemish Region Emerging with Strong Industrial and Hyperscale Investment Base (36%)

Flanders represents 36% of the market, supported by industrial digitization and smart manufacturing growth. Cities like Antwerp, Ghent, and Leuven offer attractive sites for hyperscale campuses and innovation parks. Flanders supports edge deployments in logistics, chemicals, and energy sectors. Its strategic connectivity to Germany, Netherlands, and France strengthens its position as a cross-border digital hub. Storage demand is driven by AI-based automation and decentralized enterprise IT.

- For instance, LCL operates a carrier-neutral data center in Diegem, offering connectivity to multiple telecom providers. The facility is part of LCL’s national network of five Tier III-certified data centers across Belgium.

Walloon Region Developing as a Cost-Efficient Expansion Area for Tier II Growth (16%)

Wallonia holds 16% of the Belgium Data Center Storage Market share, led by expanding Tier II infrastructure. Lower real estate costs, government incentives, and growing fiber access make it ideal for secondary data center sites. Cities like Charleroi and Liège are attracting public sector and healthcare digitization projects. It acts as a disaster recovery and backup site for enterprises in Brussels and Flanders. Wallonia is positioned to absorb future data storage overflow from the core zones.

Competitive Insights:

- Dell Technologies

- Hewlett Packard Enterprise Development LP (HPE)

- IBM Corporation

- NetApp

- Cisco Systems, Inc.

- Lenovo Group

- Seagate Technology

- Veeam Software

- Nutanix, Inc.

- Proximus

The Belgium Data Center Storage Market is marked by a mix of global technology providers and regional infrastructure players. Dell Technologies, HPE, and IBM lead in enterprise-scale deployments across hybrid, all-flash, and software-defined storage. NetApp and Cisco support cloud-native and virtualized environments, offering modular scalability. Proximus, a key Belgian player, strengthens domestic infrastructure with localized services. Veeam and Nutanix focus on backup, disaster recovery, and hyperconverged systems, gaining traction in mid-market and edge deployments. Lenovo and Seagate support high-density and cost-optimized hardware needs. The market shows growing preference for integrated platforms that combine hardware, orchestration, and analytics. It remains highly competitive, with vendors building strategic alliances to expand vertical-specific use cases across BFSI, telecom, and government sectors.

Recent Developments:

- In March 2025, Datacenter United completed the acquisition of four Proximus data centers in Belgium, expanding its network to 13 locations and strengthening its role in the country’s digital infrastructure market.

- In October 2024, Proximus agreed to sell its datacenter business to Datacenter United, a Belgium-based provider, in a deal valued at €128 million, with completion expected in Q1 2025 to enhance focus on IT integration services.