Executive summary:

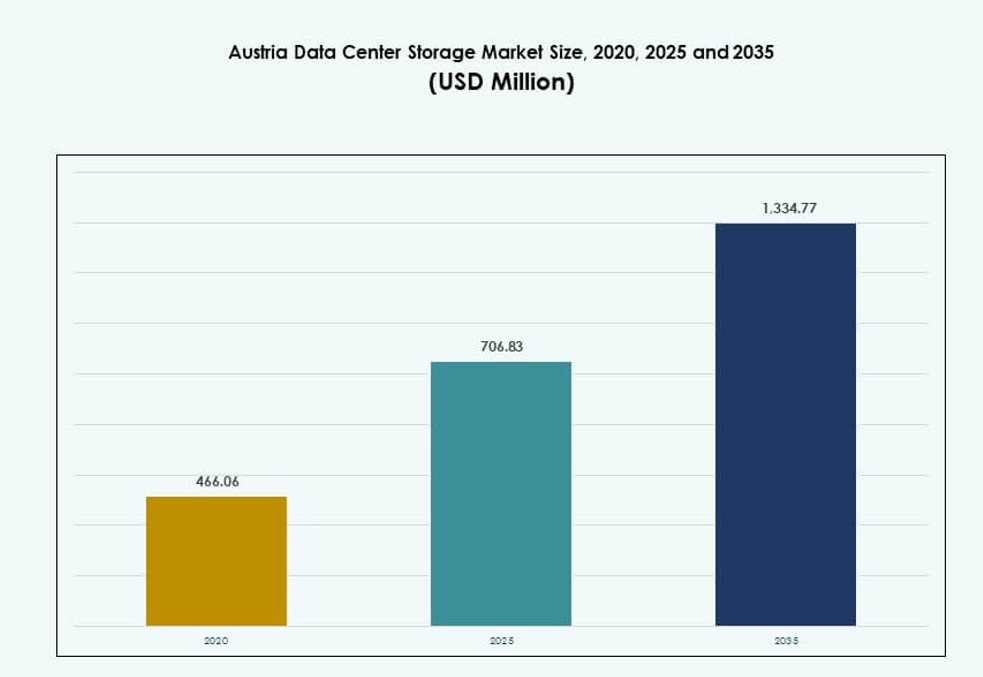

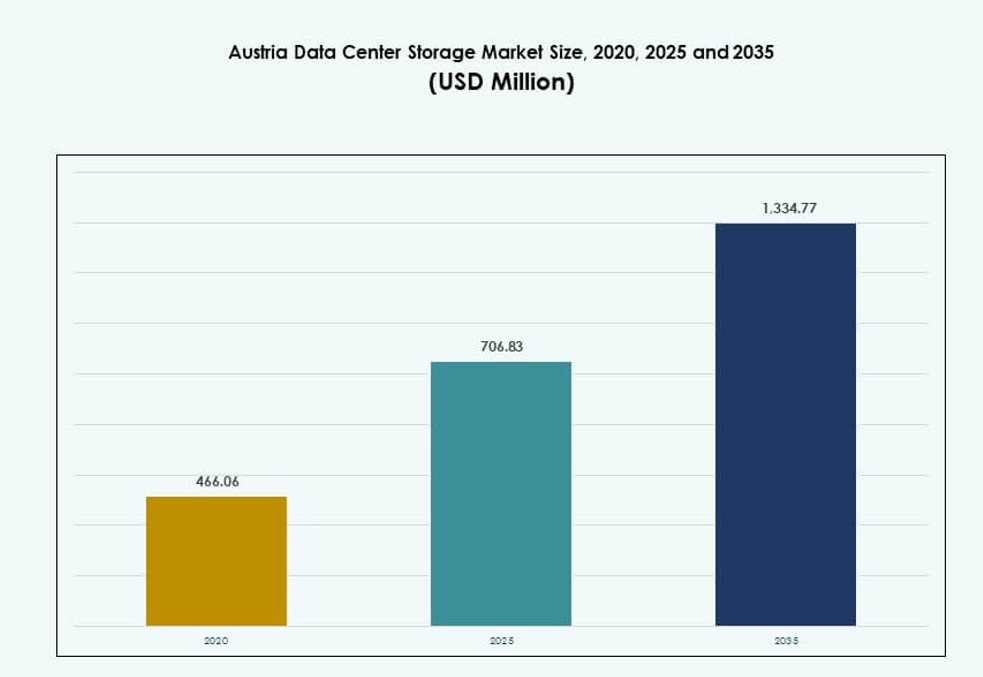

The Austria Data Center Storage Market size was valued at USD 466.06 million in 2020 to USD 706.83 million in 2025 and is anticipated to reach USD 1,334.77 million by 2035, at a CAGR of 6.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Austria Data Center Storage Market Size 2025 |

USD 706.83 Million |

| Austria Data Center Storage Market, CAGR |

6.51% |

| Austria Data Center Storage Market Size 2035 |

USD 1,334.77 Million |

Growing enterprise digitization, smart city infrastructure, and data compliance requirements are key drivers of storage investments in Austria. Businesses across BFSI, telecom, and public sectors are adopting all-flash arrays and software-defined storage to manage growing workloads. Hybrid cloud models are gaining traction, blending agility with local data control. Data protection and AI-driven analytics needs are reshaping procurement decisions. Vendors offering resilient, scalable, and energy-efficient storage see growing demand. Strategic deployments in Vienna and expansion in secondary cities reflect market depth. Enterprises are focusing on secure, regulation-ready infrastructure.

Vienna leads the market with dense enterprise workloads, government infrastructure, and cloud deployments. Graz and Linz are emerging with localized edge deployments and SME demand for modular storage. Western regions such as Tyrol and Salzburg show growing investment from healthcare and public sector institutions. Regional strategies focus on latency reduction and compliance with Austrian and EU data regulations. Data center growth follows business density and government digitalization policies. Demand for sovereign cloud and AI storage infrastructure further boosts activity in key urban zones.

Market Dynamics:

Market Drivers

Rising Demand for Enterprise Digital Transformation Across BFSI and Telecom Sectors

Enterprise digital transformation is accelerating data workloads across Austria’s BFSI and telecom industries. Large firms are replacing legacy systems with scalable storage platforms to support real-time transactions and analytics. Cloud-native solutions and edge storage deployments are gaining traction in line with Austria’s growing fintech and mobile banking user base. The Austria Data Center Storage Market is benefiting from this digital shift, as storage systems need to offer better performance, availability, and security. Financial institutions are moving toward SSD-based storage for faster I/O processing. Telecom companies, in parallel, demand lower-latency SAN and NAS systems to serve growing 5G bandwidth needs. These trends drive demand for flexible storage infrastructure that supports both structured and unstructured data. Austria’s reliable power and telecom infrastructure add to its suitability for data-intensive sectors. Investors and technology providers are prioritizing the market for enterprise-grade storage rollouts.

Adoption of Software-Defined Storage and Hyperconverged Infrastructure in Hybrid Environments

A shift is underway from hardware-centric models toward software-defined storage (SDS) across Austria’s enterprise ecosystem. SDS enables abstraction, automation, and central management of storage across hybrid environments. It supports container-based workloads, which are growing across development and IT teams in Vienna and other tech hubs. Austria Data Center Storage Market players are integrating SDS with hyperconverged infrastructure (HCI) to deliver scalability and agility. This model reduces physical footprint while enhancing workload mobility and disaster recovery. Enterprises see value in lowering operational costs and simplifying management via virtualization layers. Global vendors and local system integrators are collaborating to deliver SDS-driven platforms tailored for Austria’s compliance needs. Cloud-agnostic SDS helps firms scale across on-prem and public cloud setups. These capabilities position SDS and HCI as core pillars of enterprise storage strategy.

- For instance, Exoscale’s public cloud zone in A1’s Vienna data center supports sovereign cloud services with Tier III design and 99.982% availability.

Government-Led Cloud-First Policies and Smart City Programs Accelerating Storage Investments

Austria’s federal and regional governments have launched several cloud-first and e-governance initiatives to modernize services. These programs require highly secure and scalable storage systems to support real-time data exchange and cross-agency collaboration. The Austria Data Center Storage Market is responding with government-grade encryption, disaster recovery systems, and tiered storage models. Smart city initiatives in Vienna, Graz, and Linz involve IoT deployments for traffic, energy, and waste management, driving demand for edge data storage. Public-private partnerships are emerging to deliver dedicated storage infrastructure within government data centers. Compliance with GDPR and Austrian Data Protection Authority guidelines remains critical for these deployments. Strategic investments in sovereign cloud and regional backup facilities are enhancing data localization. Vendors with expertise in secure, public-sector storage systems are gaining preference in tenders and contracts.

AI, IoT, and Analytics Driving Storage Growth Across Medium and Large Enterprises

Austrian businesses are deploying AI and IoT solutions to optimize operations, which creates massive volumes of real-time data. Storage systems must support high throughput and fast retrieval for analytics applications in sectors like healthcare, retail, and manufacturing. The Austria Data Center Storage Market sees demand for low-latency all-flash storage that can process large datasets used in machine learning and automation. Enterprises are also adopting tiered storage that aligns with data frequency and access priority. Edge storage nodes are being installed to reduce data transmission delays in remote industrial and smart logistics settings. NVMe-based SSDs and GPU-optimized storage are emerging as preferred formats in AI-heavy environments. Cloud-based platforms also gain traction, allowing Austrian firms to manage elastic capacity and scale quickly. Strategic focus on data-driven business transformation further accelerates the shift toward next-gen storage technologies.

- For instance, A1 Telekom Austria partners with IBM on managed services in Vienna’s 13,000 m² facility designed for cloud computing and high-reliability IT.

Market Trends

Shift Toward Modular and Scalable Storage Systems in Colocation and Edge Facilities

Colocation providers in Austria are adopting modular storage architectures to match dynamic enterprise demands. These systems allow incremental expansion of capacity while optimizing cooling and energy efficiency. The Austria Data Center Storage Market reflects a clear trend toward scalable units that support mixed workloads. Edge data centers located near manufacturing hubs and logistics corridors require compact, high-density storage. Modular design enables faster deployment and easier integration with existing IT ecosystems. Vendors are offering plug-and-play storage nodes that serve remote enterprise offices with minimal overhead. Austrian businesses prefer solutions that reduce downtime and support 24/7 availability. These modular systems are also aligned with sustainability goals, helping reduce power and space usage. Infrastructure flexibility continues to define new purchase decisions in storage investment.

Integration of Cyber-Resilient Storage With Real-Time Backup and Ransomware Protection

Growing cybersecurity risks have forced Austrian businesses to seek storage systems with built-in resilience. Cyber-resilient storage integrates real-time data replication, backup, and automated rollback capabilities to guard against ransomware. The Austria Data Center Storage Market is seeing traction for immutable backup, isolated recovery zones, and AI-based anomaly detection. Enterprises across BFSI, healthcare, and government sectors are deploying solutions that ensure fast recovery without data loss. Vendors now embed endpoint-to-core encryption and metadata monitoring to harden storage environments. Regulatory pressure under GDPR also compels firms to ensure data integrity and audit trails. Hybrid setups, combining local and cloud backup, are becoming common. Austria’s strong legal framework further encourages businesses to prioritize security in storage procurement.

Demand Surge for Green Storage Solutions Aligned With Carbon Neutrality Goals

Sustainability has become a strategic priority for Austrian enterprises and public sector entities. Data centers are adopting green storage technologies that reduce power usage and environmental footprint. The Austria Data Center Storage Market is influenced by demand for low-power SSDs, intelligent cooling for storage arrays, and smart energy monitoring systems. Vendors are introducing energy-efficient storage with better IOPS per watt metrics. Tiered storage, which moves cold data to low-power environments, supports carbon reduction targets. Companies seek LEED or EN50600-certified storage systems in compliance with European climate frameworks. Renewable-powered colocation centers are being preferred for hosting enterprise storage. Government incentives and corporate ESG goals continue to reinforce the green storage trend.

Rise in Industry-Specific Storage Solutions for Healthcare, Legal, and Public Records

Tailored storage platforms are gaining relevance in Austria’s sector-specific applications. In healthcare, solutions must support imaging archives, electronic health records (EHR), and data retention compliance. The Austria Data Center Storage Market reflects growing interest in vendor-neutral archives (VNAs) and object-based storage for medical workloads. Legal firms and public record institutions require scalable WORM (write-once-read-many) formats for long-term data retention. Blockchain-backed storage solutions are being explored for sensitive land registry and legal records. In education and research, high-throughput storage is used for simulation and modeling datasets. These use cases demand integration with compliance platforms, analytics engines, and domain-specific applications. Providers that offer verticalized storage packages are gaining traction in institutional and regulated sectors.

Market Challenges

High Cost of All-Flash Storage and Advanced Backup Systems Limiting SME Adoption

While demand is growing, high-performance storage systems remain expensive for many small and mid-sized businesses. SSDs, especially NVMe-based units, and enterprise-grade backup systems carry premium pricing. The Austria Data Center Storage Market sees cost as a barrier to widespread deployment of next-gen systems. SMEs still rely on traditional HDD setups, which lack the speed and resilience needed for real-time applications. Licensing models for storage management software also add to total ownership cost. Hybrid models offer some relief but require integration expertise that smaller players often lack. High import costs and VAT implications on IT hardware further constrain investments. Limited access to leasing or storage-as-a-service models affects short-term scalability for SMEs. Without cost-efficient entry points, adoption across Austria’s broader business base remains uneven.

Skills Shortage in Storage Virtualization and Cyber-Resilience Management

Enterprises face difficulty hiring skilled professionals with expertise in software-defined storage, storage virtualization, and data resilience management. The Austria Data Center Storage Market is impacted by the talent gap in integrating multi-cloud storage, handling disaster recovery, and securing workloads. Many IT teams lack hands-on experience with hyperconverged infrastructure or advanced data orchestration tools. Training costs and limited certification programs hinder reskilling efforts in mid-sized firms. Vendor reliance grows as internal capacity weakens, leading to higher consulting costs. This gap affects long-term planning, especially in hybrid cloud environments where orchestration across platforms is key. The shortage may delay implementation timelines and affect ROI on storage modernization projects.

Market Opportunities

Growing Scope for AI-Ready Storage in Research, Manufacturing, and Automation

Austria’s push toward innovation in research and smart manufacturing offers strong opportunities for AI-optimized storage. The Austria Data Center Storage Market is positioned to benefit from AI/ML workloads that demand high-speed, scalable, and tiered storage systems. Universities, R&D centers, and industrial automation firms need platforms that support large unstructured datasets, model training, and real-time inference. Vendors with GPU-integrated or NVMe storage portfolios are expected to gain traction across these verticals.

Expansion of Regional Edge Facilities Unlocking SME and Public Sector Demand

Edge computing nodes in suburban and industrial locations are rising to support faster access to data services. The Austria Data Center Storage Market can tap into SME clusters and local government initiatives through compact, energy-efficient storage solutions. These deployments reduce latency and help public agencies and small firms manage digital operations locally. Vendors offering secure, low-footprint storage appliances gain first-mover advantage in underserved regions.

Market Segmentation

By Storage Type

Traditional storage still holds a sizable share in the Austria Data Center Storage Market due to legacy systems in mid-sized enterprises and public institutions. However, all-flash storage is gaining ground rapidly owing to rising demand for faster throughput and reduced power consumption. Hybrid storage is preferred in organizations undergoing phased digital transformation. Vendors are also offering AI-integrated hybrid models to balance performance and cost.

By Storage Deployment

Storage Area Network (SAN) dominates the Austria Data Center Storage Market, especially in large enterprise environments requiring high-speed block-level access. Network-attached Storage (NAS) is popular in media, education, and SMB setups due to ease of file sharing. Direct-attached Storage (DAS) finds use in edge locations with limited workloads. Adoption of flexible deployment models is increasing with modular growth strategies.

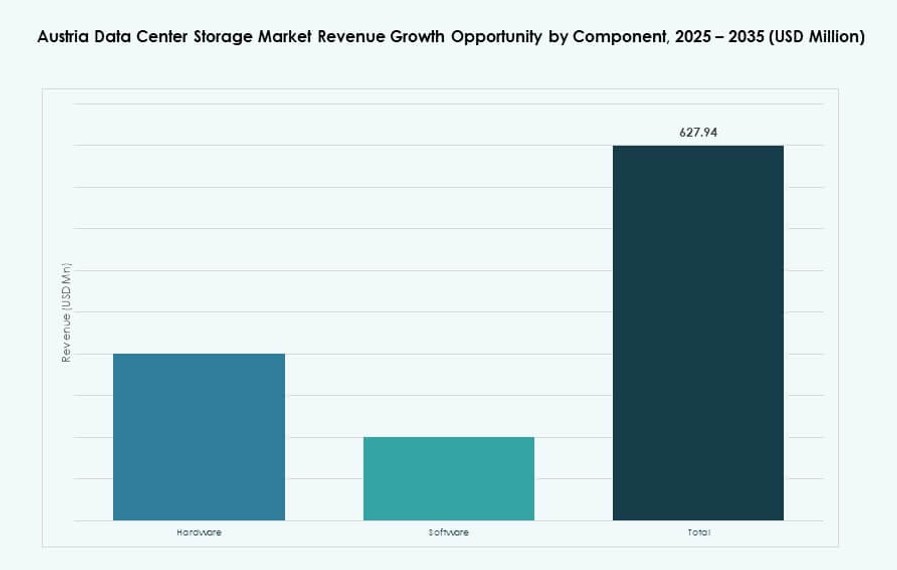

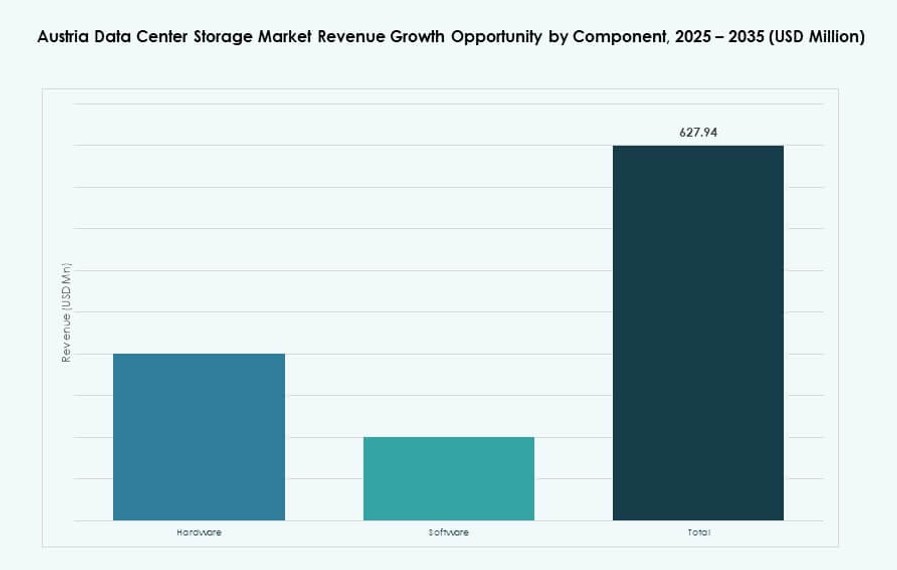

By Component

Hardware holds a dominant share in the Austria Data Center Storage Market, supported by continued investments in SSD arrays, blade enclosures, and server expansion. Software is growing steadily, particularly in software-defined storage, automation, and data management. Companies are investing in orchestration tools to handle hybrid environments and improve workload allocation.

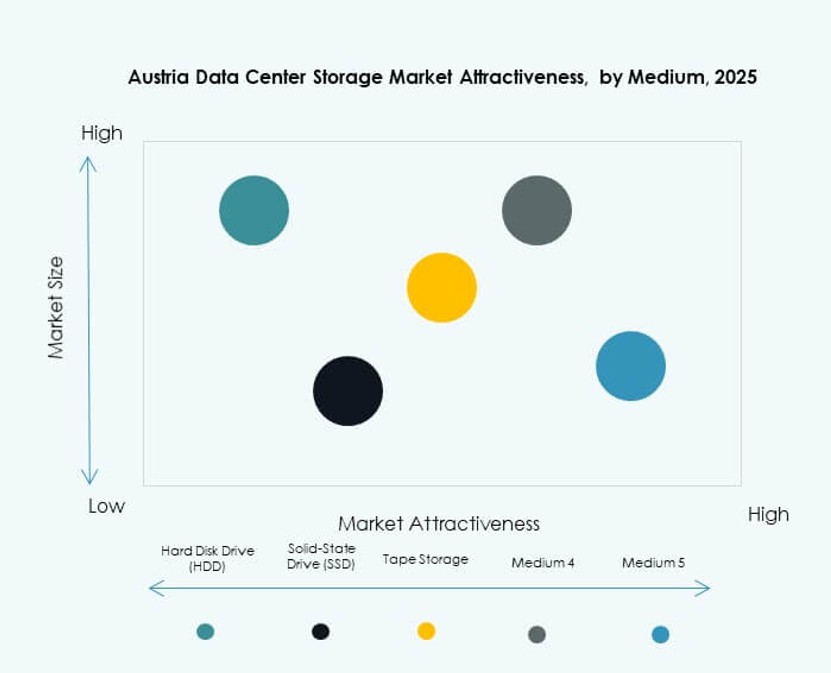

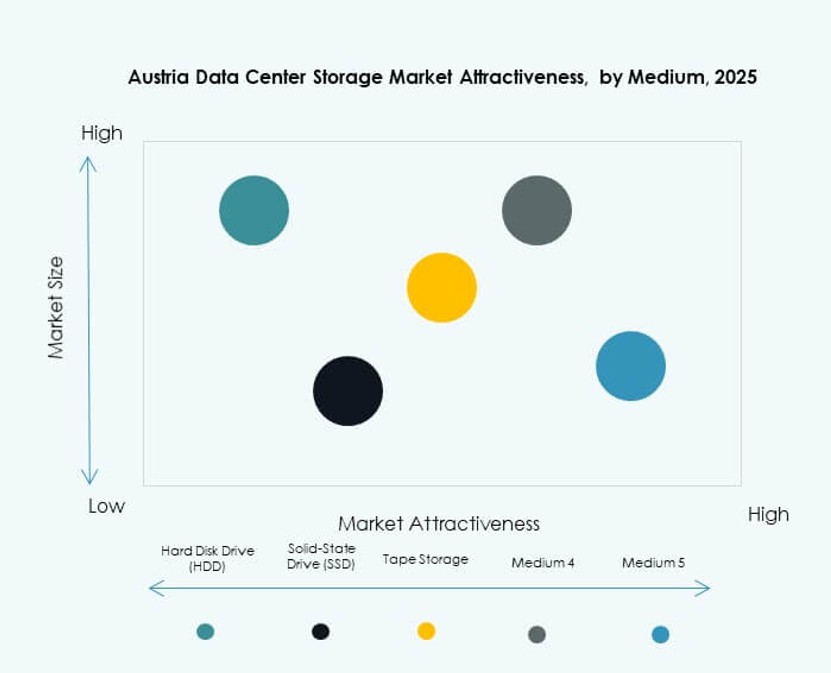

By Medium

Solid-State Drives (SSD) lead the Austria Data Center Storage Market due to speed, reliability, and reduced latency compared to HDDs. HDDs still serve archival and cold storage needs in budget-conscious environments. Tape storage is limited to long-term compliance and niche archival use cases in government or research.

By Deployment Model

Cloud-based deployment is growing fastest in the Austria Data Center Storage Market, favored for scalability and cost flexibility. On-premises storage remains important in sectors with strict data residency and security regulations. Hybrid models are rising across all verticals, combining local control with cloud scalability for mission-critical workloads.

By Application

IT and telecommunications represent the leading application segment, followed by BFSI and healthcare. The Austria Data Center Storage Market also sees strong participation from government and public services. Healthcare is investing in PACS and EHR-ready storage. BFSI focuses on secure, high-availability solutions. Government deployments prioritize data sovereignty and regulation compliance.

Regional Insights

Vienna Metropolitan Area Holds Over 50% Share with Dense Enterprise and Government Workloads

Vienna leads the Austria Data Center Storage Market with over 50% share due to its role as the country’s enterprise and governance hub. It houses national government data centers, major telecom infrastructure, and head offices of financial institutions. Demand is strong for hybrid cloud storage and secure backup infrastructure. The city’s digital innovation hubs also attract AI and research workloads needing high-performance storage systems.

- For instance, A1 Telekom Austria’s Next Generation Data Center in Vienna features 2,550 m² of whitespace across four server rooms and a connected load of 2 x 6.0 MW, supporting hybrid cloud and secure workloads.

Graz and Linz Emerging as Secondary Storage Clusters with Edge Deployments

Graz and Linz are expanding their digital infrastructure, supported by tech startups, academic institutions, and regional data initiatives. These cities represent nearly 25% of the Austria Data Center Storage Market. Edge storage and modular setups are being deployed to support growing local demand. SMEs in logistics, industrial automation, and agri-tech prefer compact, affordable storage systems tailored to regional use cases.

- For instance, Xinon operates a data center facility in Graz at Neufeldweg, providing carrier-neutral colocation services for edge deployments.

Western and Alpine Regions Registering Modest Growth from Government and Research Projects

Regions such as Tyrol, Salzburg, and Vorarlberg collectively contribute around 15–20% of the Austria Data Center Storage Market. These areas benefit from public research projects, regional healthcare digitization, and educational data infrastructure. While large-scale data center footprints are limited, localized deployments continue across universities and public hospitals. Strategic edge node expansion is expected to improve regional access to scalable storage services.

Competitive Insights:

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- NetApp

- Cisco Systems, Inc.

- Seagate Technology

- Veeam Software

- A1 Digital

- CANCOM Austria

- Fujitsu Limited

The Austria Data Center Storage Market is moderately fragmented, with a strong presence of global technology vendors alongside local system integrators. Dell Technologies, HPE, IBM, and NetApp dominate enterprise deployments through integrated hardware and software offerings. These companies cater to demand for all-flash arrays, hybrid cloud storage, and software-defined infrastructure. Local players like A1 Digital and CANCOM Austria support region-specific requirements such as GDPR compliance and data localization. It experiences rising competition in backup, disaster recovery, and cyber-resilient storage, led by vendors like Veeam Software and Cohesity. Enterprises prefer vendors with scalable, hybrid-capable portfolios and end-to-end support. Market positioning depends on technology differentiation, energy efficiency, and data protection capabilities, making innovation and ecosystem integration key to long-term leadership.

Recent Developments:

- In October 2025, Dell Technologies became a strategic partner for the LENDAIDC AI data center project near Salzburg, supplying secure infrastructure tailored for AI workloads. In May 2025, Dell also announced a EUR 45 million expansion of its Austrian service center in Vienna, focused on AI-optimized storage and compliance consulting services for GDPR-driven data center needs.

- In May 2025, ACP Group integrated 56k.Cloud into its international IT platform, expanding its AWS-based cloud and data center services across the DACH region, including Austria, to enhance enterprise digital infrastructure.

- In April 2025, CANCOM Austria, in collaboration with Hewlett Packard Enterprise, launched a federated dataspace service designed for secure AI-enabled data exchange. Built on HPE architecture, the solution supports compliance-driven storage in enterprise and public sector data centers.