Executive summary:

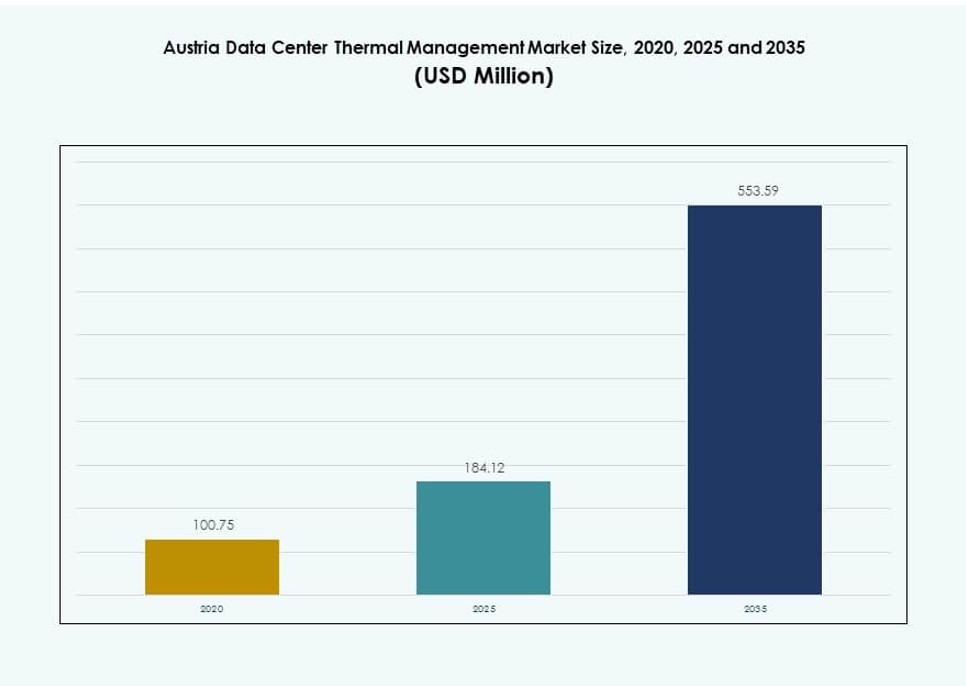

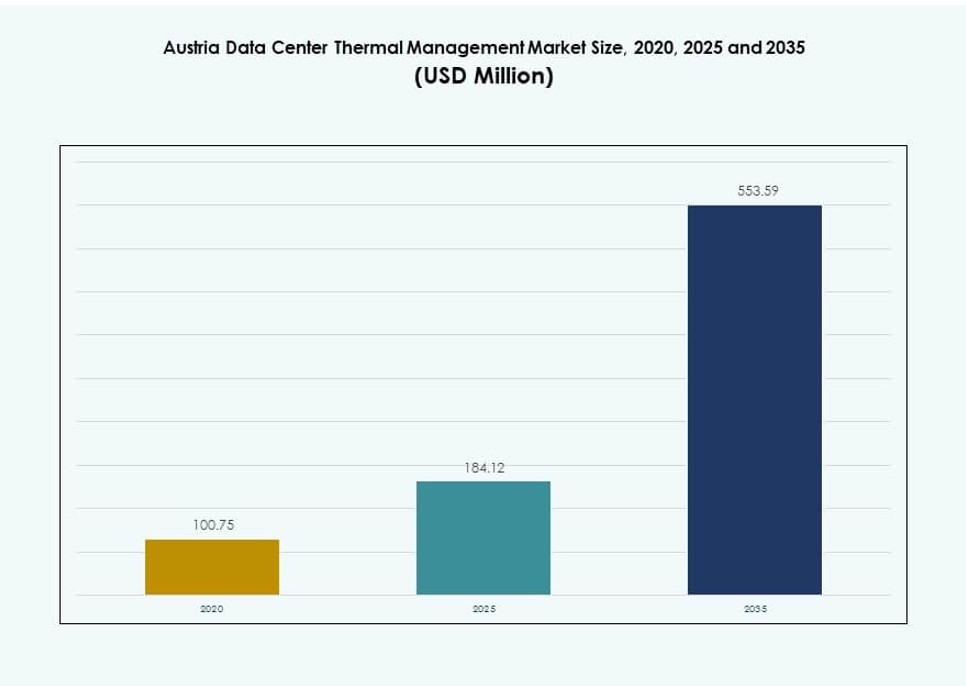

The Austria Data Center Thermal Management Market size was valued at USD 100.75 million in 2020, growing to USD 184.12 million in 2025, and is anticipated to reach USD 553.59 million by 2035, at a CAGR of 11.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Austria Data Center Thermal Management Market Size 2025 |

USD 184.12 Million |

| Austria Data Center Thermal Management Market, CAGR |

11.58% |

| Austria Data Center Thermal Management Market Size 2035 |

USD 553.59 Million |

The market is driven by the rise in high-density workloads, AI integration, and stricter energy efficiency mandates. Data centers are transitioning to liquid cooling, direct-to-chip systems, and AI-based thermal optimization to support rack densities exceeding 30 kW. Enterprises and hyperscale operators aim to meet sustainability targets and reduce PUE while ensuring thermal resilience. These shifts make thermal management a strategic focus area for reducing operational costs and ensuring infrastructure scalability. This attracts investors looking to back future-ready, energy-efficient digital infrastructure.

Vienna leads the market due to its high data center concentration, strong energy infrastructure, and connectivity advantages. The region supports both colocation and enterprise-grade facilities with increasing adoption of smart cooling. Styria and Upper Austria are emerging, offering land availability and grid access for expansion. Western Austria gains traction due to its cross-border links with Switzerland and Germany. Each subregion contributes uniquely to the market’s growth through urban demand, renewable integration, or international alignment.

Market Dynamics:

Market Drivers:

Increasing Demand for High-Density and AI-Driven Workloads Necessitating Advanced Thermal Solutions

Rising AI and high-performance computing demand is reshaping cooling requirements across Austrian data centers. Dense rack deployments now exceed 20–30 kW per rack, straining traditional air-based systems. The Austria Data Center Thermal Management Market is responding with rapid adoption of liquid cooling technologies. Direct-to-chip and immersion cooling offer better thermal efficiency in compact environments. Operators aim to reduce energy costs while supporting next-gen workloads. Investments in thermal redesign are critical for sustainability targets. High-density IT needs resilient, scalable thermal frameworks to ensure uptime. This market shift opens opportunities for tech providers offering low-latency, precision cooling systems.

- For instance, Vertiv has expanded its liquid cooling portfolio for AI and high‑density data centers, including high‑capacity Coolant Distribution Units and dedicated liquid cooling services. The company states these solutions support advanced AI and HPC workloads and enable more efficient heat removal than traditional air‑based cooling systems.

Growing Focus on Sustainability and Power Usage Effectiveness (PUE) Reduction Across Data Center Operators

Operators are under pressure to meet national energy efficiency mandates and environmental targets. Achieving a low PUE, often under 1.3, has become a key operational metric. The Austria Data Center Thermal Management Market sees rising investment in cooling systems that support waste heat reuse. Vienna and other metro zones incentivize energy-efficient facilities through green certifications. Smart cooling systems with predictive analytics reduce unnecessary thermal load. Operators adopt temperature-aware workload balancing to minimize energy waste. Sustainability goals now drive thermal innovation across all data center formats. It accelerates the shift from legacy air-cooling to hybrid and liquid-based models.

Widespread Adoption of Smart Infrastructure and AI-Powered Thermal Optimization Solutions

Data centers are moving toward intelligent infrastructure that autonomously manages thermal performance. AI-powered DCIM and CFD tools allow real-time airflow and heat predictions. These tools optimize fan speeds, chiller loads, and coolant flow to match dynamic IT loads. The Austria Data Center Thermal Management Market benefits from integration of machine learning in operations. Operators can cut cooling energy by over 20% through predictive controls. Automated fault detection systems also lower downtime risks. Smart sensors enhance granularity, helping operators balance cooling zones precisely. AI tools also support long-term planning by simulating cooling performance under different load scenarios.

- For instance, Schneider Electric’s EcoStruxure IT platform provides AI-driven monitoring and analytics to improve data center thermal performance. It helps operators detect thermal anomalies, optimize cooling setpoints, and support efficient energy use across high-density and AI-intensive environments.

Expanding Colocation and Hyperscale Investments Supporting Infrastructure Modernization Initiatives

Hyperscale and colocation demand is rising, particularly in urban hubs like Vienna. These facilities need modular and scalable thermal setups to meet fast-changing requirements. The Austria Data Center Thermal Management Market gains traction through greenfield builds and retrofits for AI-ready deployments. New projects include liquid-cooled racks and centralized chiller plants. Edge deployments are also expanding, requiring compact but powerful thermal systems. Global cloud providers seek compliance with EU energy efficiency directives. Modernization initiatives now prioritize adaptive thermal designs that scale with hardware changes. It encourages continuous innovation across thermal hardware and software vendors in the market.

Market Trends:

Integration of Liquid Cooling Technologies in AI and HPC Infrastructure for Efficiency and Density Gains

Liquid cooling is moving from niche to mainstream due to its performance benefits in dense environments. Immersion and direct-to-chip cooling allow operators to cool CPUs and GPUs efficiently. The Austria Data Center Thermal Management Market is witnessing high adoption among AI-driven workloads. Cooling capacity per rack now surpasses 50 kW in some hyperscale projects. Liquid-based methods improve thermal transfer and reduce airflow constraints. These systems also minimize noise and floor space needs. Liquid cooling supports sustainability by allowing higher inlet temperatures. Vendors invest in coolant-safe hardware design and leak-proof architectures.

Deployment of Digital Twin Simulations for Real-Time Thermal Performance Optimization

Operators now simulate entire thermal environments before deployment using CFD and digital twin platforms. These models test airflow, humidity, and heat dissipation across different layout configurations. The Austria Data Center Thermal Management Market benefits from this virtual-first approach to reduce overcooling risks. Digital twins help optimize cooling unit placement and duct configurations. Real-time simulations enable proactive design adjustments without physical trial and error. Operators use AI to feed live sensor data into these models for continual refinement. Thermal design validation helps align energy performance with SLA compliance. The trend supports better capital allocation and faster commissioning cycles.

Adoption of Modular Thermal Units and Row-Based Cooling for Scalability and Rapid Deployment

Prefabricated and modular thermal systems are gaining traction across edge and hyperscale deployments. Row-based cooling units with localized airflow controls offer high scalability. The Austria Data Center Thermal Management Market is experiencing demand for quick-to-deploy cooling units. Modular systems allow phased capacity expansion without major infrastructure revamps. Operators choose these for brownfield sites with limited physical space. Row-based units deliver targeted cooling to hotspot zones, improving thermal efficiency. The flexibility of modular designs supports faster ROI. Manufacturers now offer integrated monitoring tools embedded into these modules for real-time control.

Growing Use of Renewable Cooling Methods and Heat Reuse to Align with Energy Policy Goals

Austria promotes circular energy use and carbon neutrality, pushing operators to reuse waste heat. District heating integration allows facilities to export excess thermal energy to nearby residential grids. The Austria Data Center Thermal Management Market aligns with national goals through free air cooling and heat pump integration. Cooling systems now leverage outdoor temperatures to reduce chiller loads. Operators deploy water-side economizers and thermal energy storage to reduce grid dependency. Heat reuse enhances ESG profiles and attracts sustainability-focused investors. Renewable integration has become a standard feature in new build specifications. These methods strengthen long-term operational efficiency and compliance.

Market Challenges:

High Initial Investment and Retrofitting Costs Limit Adoption of Advanced Cooling Technologies

Operators face significant upfront costs when upgrading from legacy cooling systems to advanced setups. Retrofitting for liquid cooling requires changes to rack design, flooring, and electrical layouts. The Austria Data Center Thermal Management Market must overcome financial constraints in older facilities. SMEs often delay upgrades due to tight capital budgets. ROI calculations may not favor newer systems without long-term usage assurance. Thermal retrofits also involve potential operational disruption. Coordinating shutdowns for infrastructure changes is difficult in 24/7 facilities. These cost barriers slow down market transformation and technology standardization.

Limited Local Expertise and Infrastructure for Large-Scale Liquid and Hybrid Cooling Deployments

Austria faces a shortage of specialized contractors and engineers for liquid cooling infrastructure. Most providers rely on imported expertise or cross-border partnerships. The Austria Data Center Thermal Management Market needs stronger training pipelines and domestic skill development. Installation errors can cause system inefficiencies or risks of leakage. Limited supplier diversity also affects component availability and support timelines. Edge deployments face logistical delays due to this lack of expertise. Vendors must establish local service centers and training hubs. Standardization across liquid cooling architectures remains low, creating compatibility issues across equipment.

Market Opportunities:

Rising Demand for Edge Data Centers Driving Compact, Efficient, and Modular Thermal Solutions

Edge computing expands across Austria, especially in smart city and IoT-based deployments. These edge sites require compact, low-maintenance thermal systems. The Austria Data Center Thermal Management Market has strong opportunities in rack and row-based cooling systems. Vendors offering noise-free, energy-efficient, and remotely managed cooling units will gain market share. Plug-and-play solutions appeal to decentralized deployments in underserved areas. Edge growth supports tailored offerings for telecom, healthcare, and transport sectors.

Government Sustainability Incentives Encouraging Investment in Renewable and Heat Reuse-Based Cooling

Austria offers incentives for green infrastructure, including tax benefits and carbon credit access. These policies boost demand for heat recovery and energy-efficient thermal units. The Austria Data Center Thermal Management Market benefits from subsidies on clean energy integration. Operators using district heating, solar-cooled chillers, or thermal energy storage can offset costs. This support framework helps vendors scale eco-friendly cooling portfolios across enterprise and hyperscale segments.

Market Segmentation:

By Data Center Size

Large data centers dominate the Austria Data Center Thermal Management Market, driven by colocation and hyperscale deployments. These facilities demand high-capacity cooling units, often exceeding 1 MW. Medium-sized data centers show steady adoption of modular cooling. Small data centers remain limited to traditional air-based methods. The large segment benefits from AI workload support and automation. Strategic partnerships with cloud providers continue to drive growth in this category.

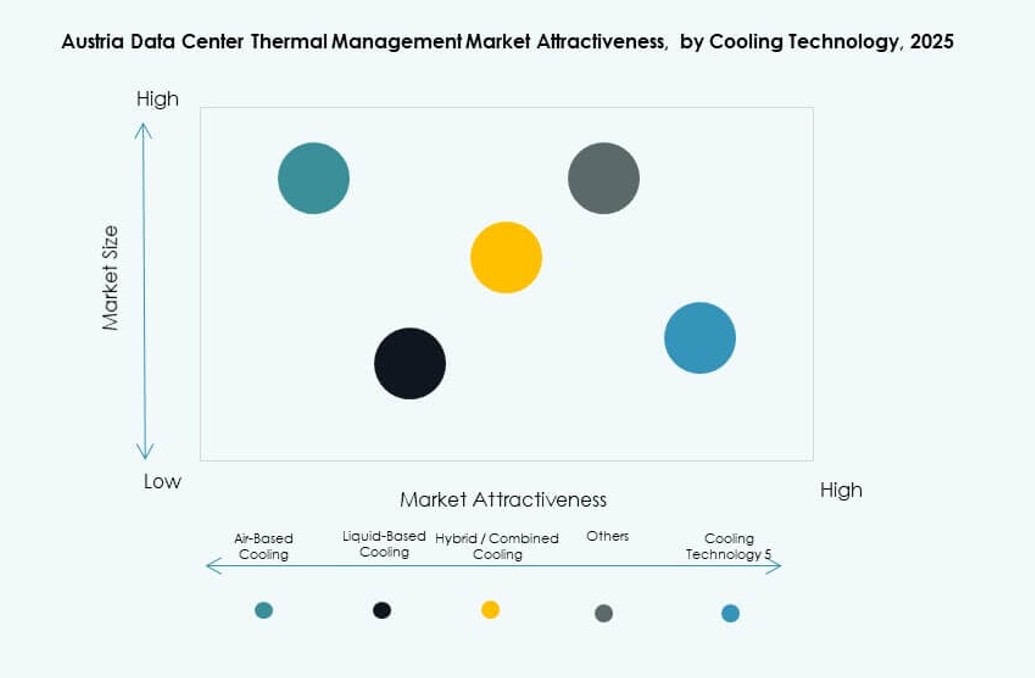

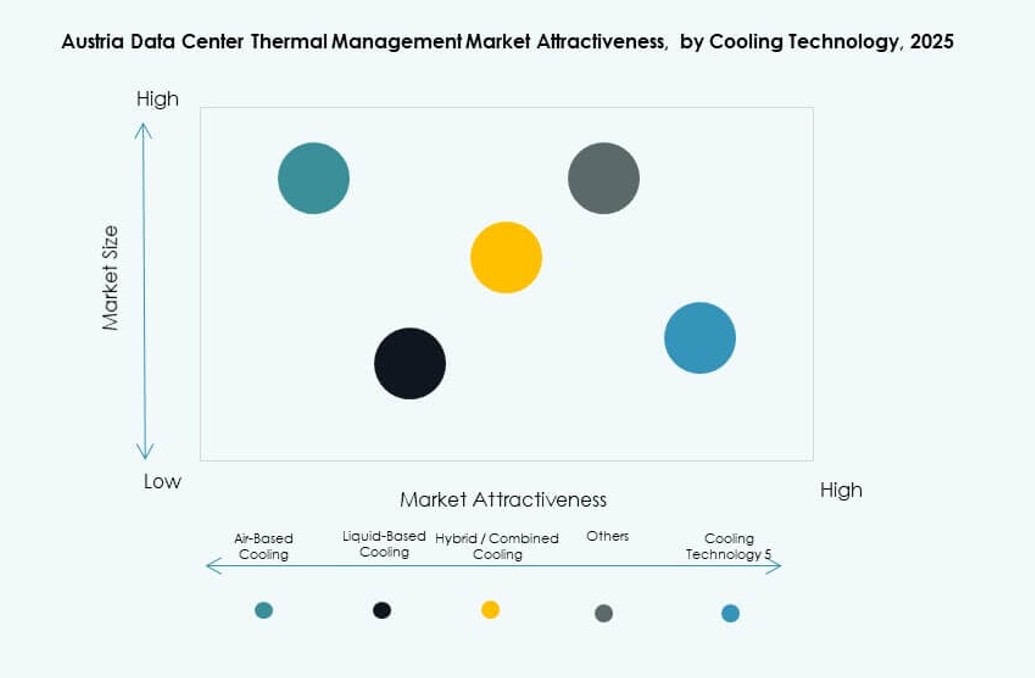

By Cooling Technology

Air-based cooling remains widely used, especially hot/cold aisle and rear-door exchangers in enterprise setups. However, liquid-based cooling is the fastest-growing segment, driven by AI applications and high-density racks. Direct-to-chip and immersion cooling systems support over 50 kW per rack. Hybrid cooling offers flexibility, combining air and liquid methods. The Austria Data Center Thermal Management Market is also seeing interest in thermoelectric and phase-change solutions for niche needs.

By Component

Hardware dominates the market due to the capital-intensive nature of chillers, fans, and piping systems. Software plays a growing role in managing energy use and predicting thermal loads. Services such as maintenance and retrofits are crucial for uptime and compliance. The Austria Data Center Thermal Management Market is shifting toward integrated solutions that blend all three components for performance optimization and lifecycle cost control.

By Hardware

Cooling units and chillers lead the hardware segment, followed by fans and airflow devices. Heat exchangers and distribution systems gain relevance in liquid cooling scenarios. The Austria Data Center Thermal Management Market also sees rising demand for precision piping systems for immersion cooling. Hardware innovations target modularity, energy savings, and reduced footprint. Players differentiate through performance efficiency and smart integration.

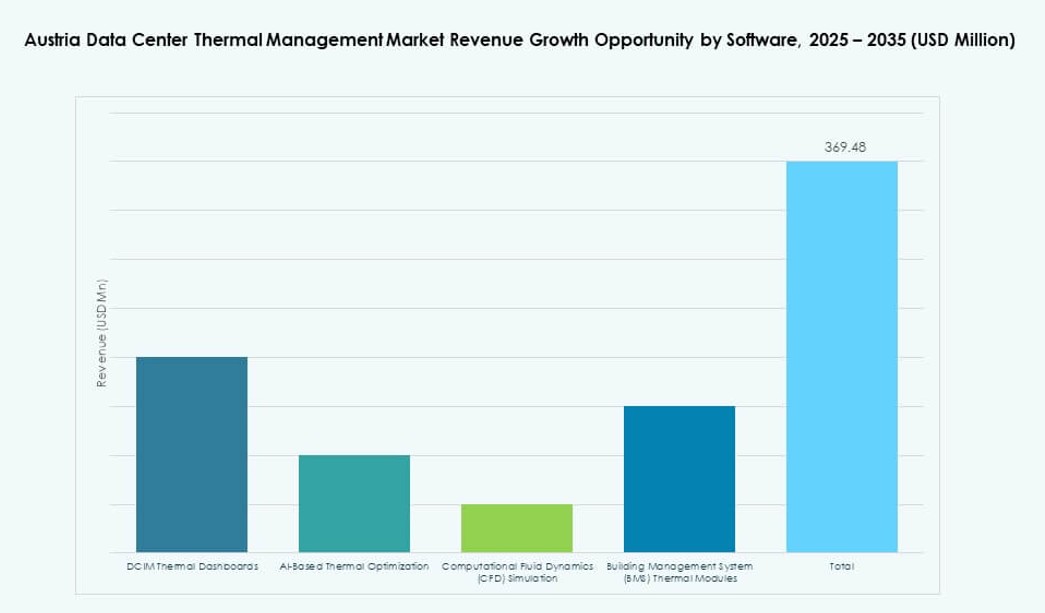

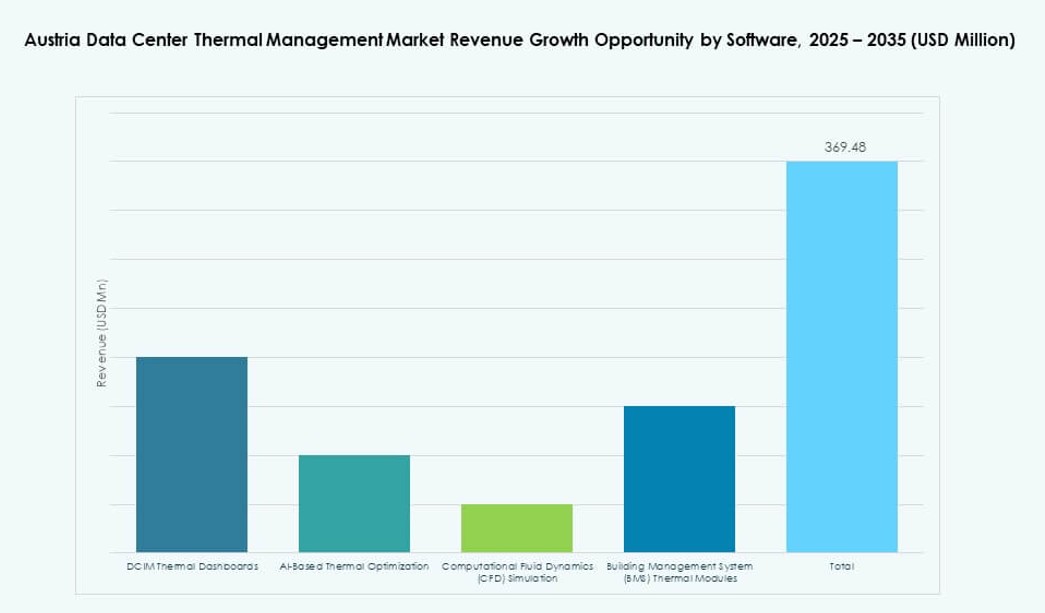

By Software

DCIM dashboards are the most adopted tools, helping operators visualize real-time thermal metrics. AI-powered platforms for workload-based cooling optimization are expanding rapidly. CFD simulation tools assist in thermal design and airflow mapping. BMS modules offer facility-wide coordination with HVAC systems. The Austria Data Center Thermal Management Market shows growing preference for cloud-based and vendor-neutral software platforms.

By Services

Installation and commissioning lead the services segment, driven by new builds. Preventive maintenance and retrofits gain traction in older facilities. Monitoring-as-a-service supports small and edge deployments lacking in-house teams. Retrofit projects include upgrading airflow systems and integrating sensors. The Austria Data Center Thermal Management Market increasingly values full-lifecycle service providers with local support capabilities.

By Data Center Type

Colocation and cloud data centers hold the largest share due to Austria’s connectivity infrastructure and digital transformation efforts. Hyperscale facilities are expanding through foreign investment. Enterprise data centers lag in cooling upgrades but still form a significant base. Edge data centers are emerging in telecom and smart city nodes. Each type requires tailored thermal solutions based on density, redundancy, and power availability.

By Structure

Room-based cooling dominates legacy installations, while row-based and rack-based structures gain popularity in modern builds. Row-based cooling suits modular and containerized data centers. Rack-based systems are ideal for AI workloads and edge deployments. The Austria Data Center Thermal Management Market reflects a gradual shift toward decentralized cooling architectures. Structural flexibility allows adaptation to rising thermal density demands.

Regional Insights:

Vienna Metropolitan Zone Leading with Over 40% Market Share Due to High Data Center Density

Vienna remains the core hub for digital infrastructure in Austria. It hosts the largest share of colocation and hyperscale data centers. The Austria Data Center Thermal Management Market sees the most deployments of advanced cooling systems in this region. Vienna’s grid stability and data sovereignty laws attract international investments. The city’s climate supports energy-efficient air cooling and district heating. Most greenfield and brownfield modernization projects originate from this region.

- For instance, Digital Realty’s (formerly Interxion) Floridsdorf data center in Vienna uses a heat pump system with Wien Energie to deliver waste heat via a 150-meter pipe to Klinik Floridsdorf Hospital, covering 50-70% of the hospital’s heating demand and saving up to 4,000 tons of CO2 annually.

Upper Austria and Styria Emerging as Strategic Sites Driven by Renewable Integration and Land Availability

Styria and Upper Austria together account for around 30% of the market. These regions benefit from land availability and proximity to renewable energy sources. Operators favor them for expansion beyond Vienna’s saturated market. Regional governments promote investment through economic development zones. The Austria Data Center Thermal Management Market finds strong potential in these areas for modular, green cooling systems. Local energy utilities support infrastructure development.

- For instance, VERBUND supplies large amounts of renewable hydropower across Upper Austria, helping industrial users, including data centers, source green energy. This renewable supply supports energy‑efficient cooling and aligns with sustainability goals in regional thermal management practices.

Western Austria and Border Areas Hold Around 20% Share with Growth from Cross-Border Hyperscale Deployments

Western Austria, including Salzburg and Tyrol, contributes approximately 20% to the market. It gains traction through proximity to Switzerland and Germany. Cross-border demand supports hyperscale investments in these areas. The Austria Data Center Thermal Management Market benefits from free-air cooling enabled by alpine climates. Regional operators tap into low-temperature zones for cost-effective thermal management. The area holds long-term strategic value for edge and disaster recovery sites.

Competitive Insights:

- Vertiv Group Corp.

- Siemens Austria

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Airedale International Air Conditioning Ltd.

- Johnson Controls International plc

- Mitsubishi Electric Corporation

- Asetek, Inc.

- Eaton Corporation

- Black Box Corporation

The competitive landscape in the Austria Data Center Thermal Management Market shows established global players and strong regional specialists driving innovation. Companies compete on efficiency, reliability, and energy savings tailored to high‑density workloads. Vertiv and Siemens leverage broad portfolios and local service networks to secure major hyperscale and enterprise deals. Daikin and Mitsubishi focus on advanced HVAC and liquid cooling solutions that reduce operational costs. Delta’s power‑thermal integration gives it an edge in modular systems. Airedale and Asetek push niche cooling technologies for high‑performance environments. Johnson Controls and Eaton offer holistic infrastructure management tied to building systems. Black Box strengthens connectivity and integrated facility controls. Strategic partnerships and localized support remain key differentiators in this market.

Recent Developments:

- In October 2025, Vertiv launched new rack, power, and cooling solutions aligned with Open Compute Project (OCP) standards, specifically designed for data centers, enhancing thermal management efficiency in markets like Austria.

- In April 2025, Daikin expanded its data center cooling portfolio with the launch of the new Pro-C computer room air handler (CRAH) from Vienna, targeting advanced thermal solutions for regional facilities.