Executive summary:

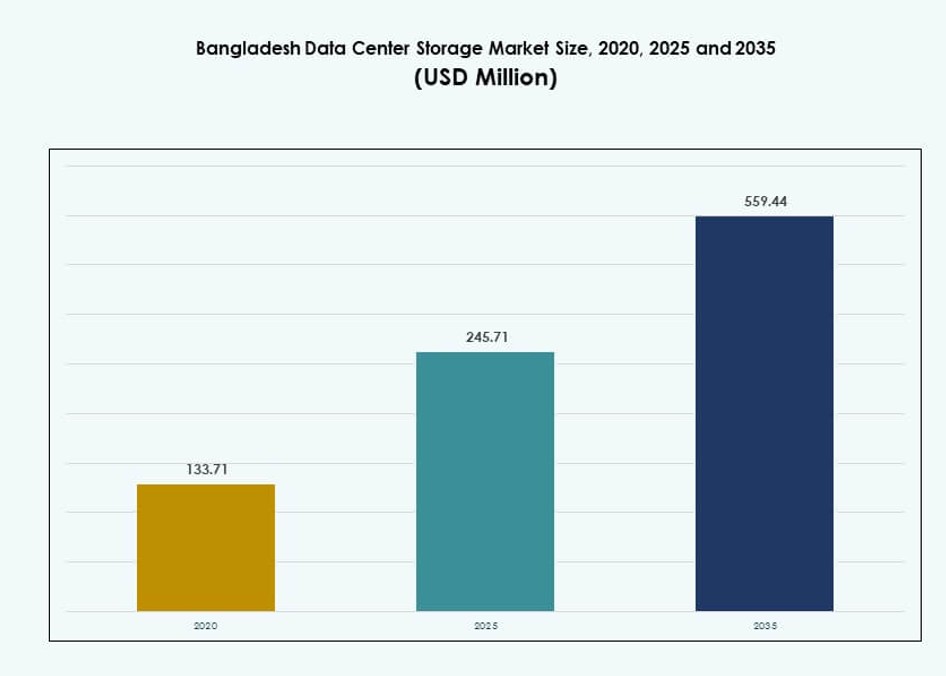

The Bangladesh Data Center Storage Market size was valued at USD 133.71 million in 2020 to USD 245.71 million in 2025 and is anticipated to reach USD 559.44 million by 2035, at a CAGR of 8.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Bangladesh Data Center Storage Market Size 2025 |

USD 245.71 Million |

| Bangladesh Data Center Storage Market, CAGR |

8.49% |

| Bangladesh Data Center Storage Market Size 2035 |

USD 559.44 Million |

The market is driven by the country’s expanding digital economy, government-backed cloud initiatives, and rising demand for local data hosting. Enterprises are shifting from legacy systems to software-defined and hybrid storage to meet growing data volumes. Growth in sectors like BFSI, telecom, and e-commerce is creating continuous demand for high-performance, compliant infrastructure. Storage modernization supports national data sovereignty, disaster recovery, and AI-driven services. This transformation improves operational resilience and digital service delivery across both public and private sectors.

Dhaka leads the market with the highest concentration of data centers, enterprise demand, and fiber connectivity. Chattogram is emerging due to its role in logistics, port activity, and regional industry digitization. Secondary regions such as Sylhet and Khulna are gradually adopting modular and edge storage systems. These locations benefit from increased 4G/5G rollout, cloud penetration, and smart city projects. The regional landscape is evolving in response to decentralized data demands.

Market Dynamics:

Market Drivers

Government Digitization Programs and Public Cloud Mandates Fuel Storage Demand Growth

Government-led digital transformation is a key force behind the Bangladesh Data Center Storage Market. The “Digital Bangladesh” vision continues to accelerate e-governance, national ID systems, and secure data platforms. These initiatives require storage with high redundancy, uptime, and data sovereignty. Public cloud mandates are also gaining ground across ministries and education. Investments in smart city platforms and e-health systems add data-intensive workloads. It is enabling increased data center utilization through state-backed hosting platforms. Agencies seek private-cloud and hybrid storage to manage sensitive citizen records. Businesses are aligning with these policies for compliance. The market benefits from this steady stream of institutional demand.

- For instance, the National ID system under Election Commission’s NIDW manages a database covering over 155 million citizens with a full rack Oracle Server as Data Centre and 514 regional server stations nationwide.

Fintech, Mobile Banking, and E-Commerce Ecosystems Driving Enterprise Storage Transformation

The rapid evolution of fintech and e-commerce in Bangladesh is reshaping enterprise storage requirements. Mobile financial services, real-time payments, and digital wallets generate massive volumes of transaction data. Fintech firms and banks require scalable storage with low-latency access and disaster recovery. The Bangladesh Data Center Storage Market is responding through flash storage, backup appliances, and hybrid cloud systems. Edge storage is also rising with merchant onboarding in tier-2 and tier-3 cities. Retailers are adopting cloud-native storage for loyalty platforms and CRM analytics. Data-driven services push enterprises to modernize traditional infrastructure. Investors see long-term value in enabling data-resilient commerce ecosystems.

- For instance, bKash supports widespread mobile financial services integrated with NID verification for secure transactions across millions of users.

Surge in Domestic Cloud Infrastructure and Software-Defined Storage Platforms

The market is witnessing rising deployment of domestic cloud infrastructure for storage. Telecom providers and IT service firms are launching sovereign cloud zones across Dhaka and Chattogram. These are powered by virtualized SAN, NAS, and scale-out object storage. The Bangladesh Data Center Storage Market is seeing stronger preference for software-defined solutions due to lower hardware dependence. AI-based storage orchestration is improving operational efficiency. Vendors are integrating analytics, deduplication, and auto-tiering capabilities. This shift enables better performance, energy efficiency, and workload portability. It also supports varied data formats and latency profiles across enterprises. The transition is deepening digital maturity among storage buyers.

Telecom Operators and Tower Cos Enabling Edge Storage Expansion Beyond Metro Cities

Nationwide 4G coverage and fiber deployments are opening new frontiers for edge data center storage. Telecom players are investing in edge nodes and content caching near consumption centers. The Bangladesh Data Center Storage Market benefits from telecom-tied edge platforms that serve local businesses. Rural financial services, school networks, and regional healthcare chains are early adopters. Edge systems are often configured with hybrid storage for compliance and uptime. It is enabling faster onboarding for microenterprises and public service access in remote areas. Local ISPs and tower companies also offer modular colocation with bundled storage. These developments support inclusive data infrastructure across the country.

Market Trends

Rise of Flash-Based and NVMe Storage in High-Performance Computing Workloads

The transition to flash and NVMe-based architecture is growing in sectors requiring high IOPS and low latency. BFSI, OTT media platforms, and logistics providers are replacing aging disk arrays with all-flash systems. The Bangladesh Data Center Storage Market is seeing active adoption of NVMe-enabled SAN arrays for AI and analytics. Vendors report rising demand for performance-centric storage for ML training and fraud detection. Flash arrays offer smaller form factor, lower power, and high throughput. IT teams use tiering strategies to manage cost and performance. This trend reflects a broader shift toward performance optimization in data center environments.

Data Residency, Compliance, and Sovereignty Creating Tailwinds for Localized Storage

Enterprises in finance, healthcare, and telecom must meet national data residency rules. The Bangladesh Data Center Storage Market is shaped by compliance-driven demand for in-country storage infrastructure. Companies are moving mission-critical workloads from offshore clouds to domestic facilities. Localized backup, DRaaS, and archival storage options are expanding. It is creating growth for modular storage systems with local data governance controls. Sovereign cloud initiatives further boost on-premises and hybrid deployment. Demand for security-hardened, access-controlled storage appliances is also growing. This trend helps foster a trusted digital ecosystem while supporting national digital sovereignty goals.

Surging AI Adoption Across Sectors Driving Need for Scalable and Flexible Storage Platforms

AI and ML workloads in sectors like manufacturing, finance, and public health are generating complex datasets. These require high-capacity, high-throughput storage backends. The Bangladesh Data Center Storage Market is responding with object storage, GPU-optimized systems, and parallel file systems. It supports real-time model training and inference workflows. Cloud-native platforms with dynamic provisioning and auto-scaling are being adopted. AI-focused data centers prefer flexible storage that handles unstructured and semi-structured data. AI-driven operations management also helps automate storage lifecycle tasks. This trend is strengthening the synergy between storage architecture and intelligent compute.

Growing Preference for Managed Storage-as-a-Service Among SMEs and Mid-Sized Enterprises

SMEs and mid-sized businesses in Bangladesh are moving away from CAPEX-heavy storage investments. Managed storage offerings are gaining popularity with bundled support, backup, and upgrades. The Bangladesh Data Center Storage Market is seeing IaaS providers launch pay-as-you-go storage tiers. Multi-tenancy and API access are key features sought by businesses. These services reduce operational burdens and enhance cybersecurity posture. Hybrid offerings are allowing seamless scale between on-prem and cloud. IT partners are integrating vertical-specific storage templates for ease of deployment. Managed storage is becoming a growth channel for data center operators.

Market Challenges

Limited Domestic Hardware Manufacturing and Import Dependency Affecting Storage Cost and Availability

Bangladesh’s reliance on imported data center hardware impacts cost stability and availability. The country lacks local assembly or manufacturing for storage arrays, SSDs, or controllers. The Bangladesh Data Center Storage Market faces lead time issues for scaling infrastructure during demand spikes. Import duties and forex fluctuations add financial pressure. Supply constraints affect custom configurations and replacements. Procurement cycles are longer, hindering rapid upgrades. Limited availability of certified resellers and service partners further complicates deployment. It also impacts after-sales support and firmware compatibility. Strategic supply diversification remains a key gap to address.

Energy Reliability, Cooling Infrastructure, and Site Constraints in Non-Metro Locations

Many regions beyond Dhaka lack reliable power and efficient cooling systems. This limits large-scale storage deployments in edge or tier-2 locations. The Bangladesh Data Center Storage Market must balance performance with heat output and uptime requirements. High ambient temperatures demand better thermal management for HDD and flash systems. Sites with poor grid connectivity must rely on diesel generators, raising OPEX. Urban congestion restricts data center space and floor load capacity. It becomes harder to implement high-density storage racks without specialized infrastructure. These issues create uneven geographic access to storage capabilities.

Market Opportunities

Strong Pipeline of Sovereign Cloud, National Data Center, and E-Government Initiatives

Bangladesh’s push for sovereign digital infrastructure presents clear opportunities for storage vendors. National data centers and secure government clouds require high-capacity, compliant storage. The Bangladesh Data Center Storage Market will benefit from programs enabling identity services, land records, and social safety net delivery. Storage providers can partner with system integrators to build modular and scalable systems.

Rising Demand for Green Data Centers and Energy-Efficient Storage Technologies

Sustainability priorities are driving interest in green-certified storage infrastructure. Operators are adopting low-power SSDs, intelligent cooling, and power-efficient controllers. The Bangladesh Data Center Storage Market is expected to attract investment in eco-friendly, energy-rated equipment. Vendors offering reduced carbon footprint and TCO will be well-positioned in RFPs tied to public and private procurement.

Market Segmentation

By Storage Type

Traditional storage remains the dominant category, but all-flash storage is rapidly gaining share in performance-sensitive applications. Hybrid storage is emerging as a preferred option among BFSI and public sector workloads seeking a balance of speed and cost. In the Bangladesh Data Center Storage Market, hybrid and all-flash solutions are expanding faster due to increased demand for analytics and AI applications across industries.

By Storage Deployment

Network-attached storage (NAS) leads the segment due to widespread adoption in SMEs, content platforms, and education networks. Storage Area Network (SAN) systems dominate in large enterprises and telecoms requiring block-level access and performance. Direct-attached storage (DAS) is still used for backup and isolated environments. In the Bangladesh Data Center Storage Market, SAN systems see rising interest due to virtualization and database growth.

By Component

Hardware dominates the market, driven by demand for high-density enclosures, controllers, and disk arrays. Software components are growing as enterprises adopt storage virtualization, orchestration, and automated tiering. The Bangladesh Data Center Storage Market is increasingly leaning toward integrated platforms that combine hardware with intelligent software-defined management layers for improved scalability and control.

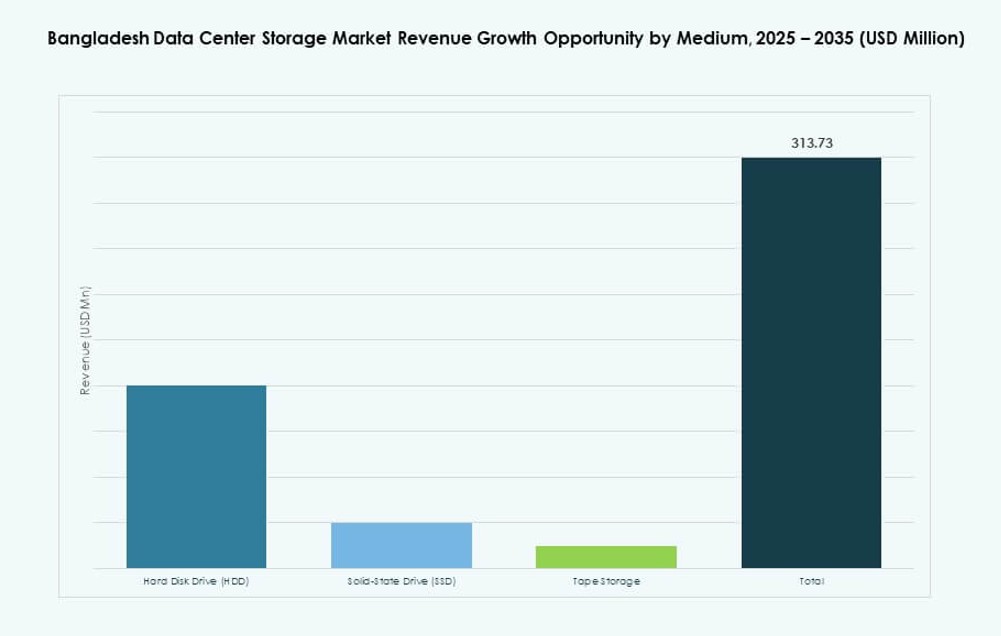

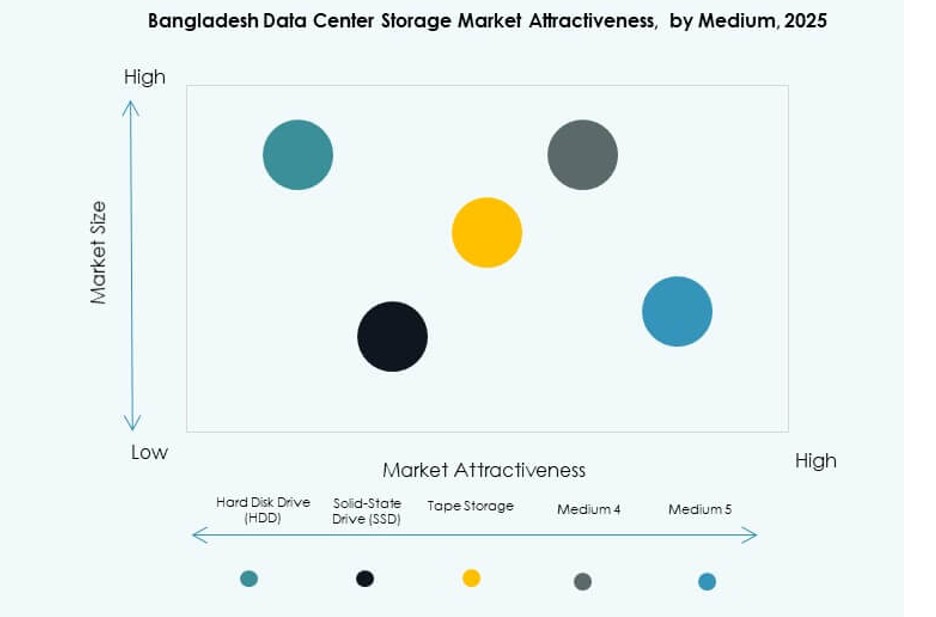

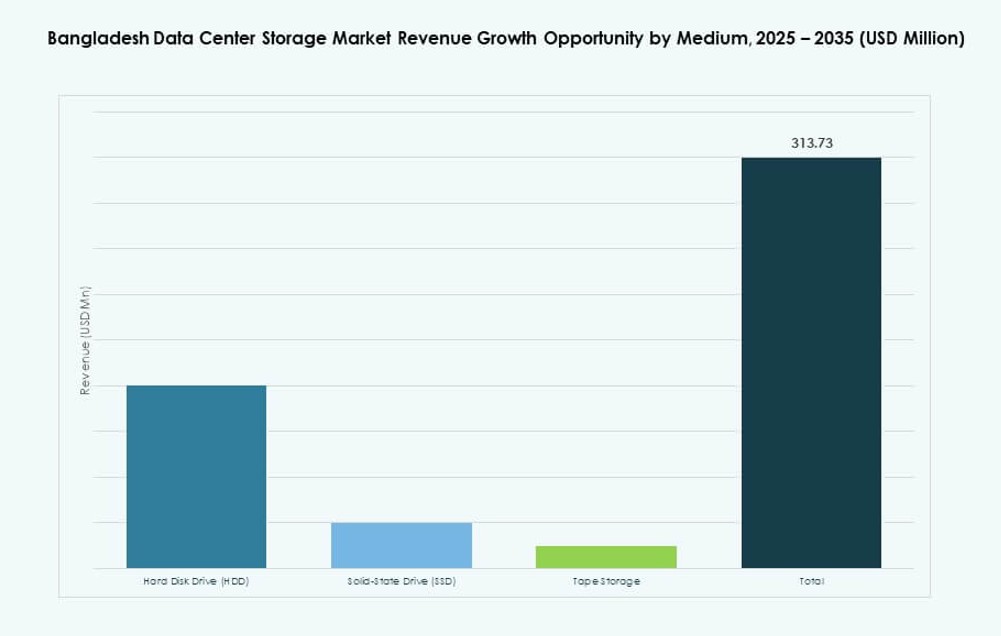

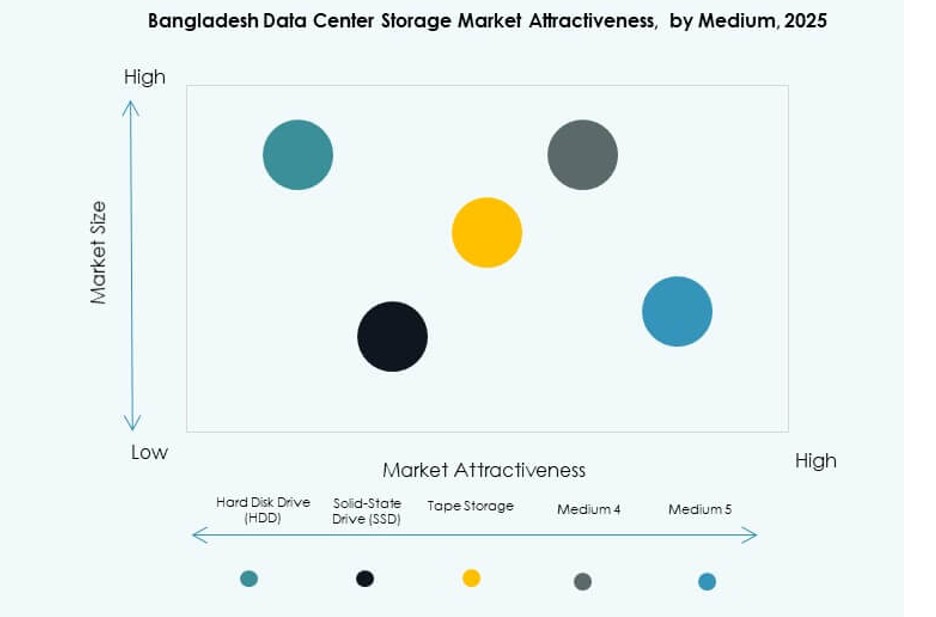

By Medium

Hard Disk Drives (HDDs) continue to lead due to cost advantage and availability in large capacities. However, Solid-State Drives (SSDs) are gaining fast with enterprises prioritizing speed, IOPS, and reliability. Tape storage holds relevance for archival and regulatory use cases. The Bangladesh Data Center Storage Market is seeing increased SSD deployment in sectors handling real-time analytics and mission-critical applications.

By Deployment Model

Cloud-based deployment is seeing rapid growth as businesses scale without infrastructure overhead. On-premises models continue to dominate among regulated sectors and large enterprises. Hybrid models are gaining ground, blending local control with cloud flexibility. In the Bangladesh Data Center Storage Market, hybrid deployment is expected to be the fastest-growing model due to compliance and agility needs.

By Application

IT and Telecommunications hold the largest share, driven by network infrastructure, subscriber data, and edge service demands. BFSI is a key segment with high data protection, uptime, and latency requirements. Government usage is expanding due to digitization of records and citizen services. Healthcare is emerging with electronic medical records and diagnostic imaging. The Bangladesh Data Center Storage Market sees a sharp rise in multi-sectoral demand with growing digitization.

Regional Insights

Dhaka Region Holds Over 60% Market Share Led by Government and Enterprise Data Demand

Dhaka leads the Bangladesh Data Center Storage Market, holding more than 60% share. The city hosts major telecom firms, banks, government IT hubs, and public cloud zones. Most colocation and enterprise data centers are concentrated here. Power availability, skilled workforce, and fiber connectivity support dense infrastructure deployment. The region continues to attract new hyperscale and sovereign cloud investments.

Chattogram Contributes Around 20% with Growth in Port-Linked Industrial and Logistics Data

Chattogram contributes about 20% share, fueled by storage needs in logistics, shipping, and regional commerce. The port city is a growing secondary data center hub. SMEs and manufacturers in the region seek hybrid storage for operational data. Connectivity with Dhaka ensures failover and DR capacity. The area benefits from SEZ-linked investments and public infrastructure digitization efforts.

- For instance, Banglalink expanded its regional network infrastructure in Chattogram with VEON-backed investments for 5G backhaul tied to port digitization efforts.

Sylhet, Khulna, and Rajshahi Emerging with Edge Storage and Modular Infrastructure Rollouts

These regions collectively hold close to 20% share and are witnessing increased edge deployments. Telecoms and local ISPs are deploying modular storage nodes to serve financial services, education, and health networks. The Bangladesh Data Center Storage Market in these areas is backed by government digital outreach and smart city pilots. Growing fiber backbone and improved grid supply enable stable growth in non-metro markets.

- For instance, Grameenphone launched its Super Core Data Center in Sylhet in 2024, a Tier III facility with 4MW IT capacity serving as the largest MNO-owned site for regional digital services.

Competitive Insights:

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- NetApp

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Hitachi Vantara

- Cisco Systems, Inc.

- Cohesity, Inc.

- Lenovo Group

- Summit Communications

The Bangladesh Data Center Storage Market features a mix of global OEMs and local infrastructure enablers. Dell, HPE, NetApp, and Huawei dominate with high-performance storage arrays, hybrid cloud offerings, and enterprise service ecosystems. IBM and Hitachi Vantara support core BFSI and telecom workloads with software-defined and tape-integrated solutions. Local players like Summit Communications support fiber and colocation storage demand across metros. The market favors vendors offering flexibility in hybrid deployment, localized service support, and regulatory compliance. It remains fragmented by deployment model and workload type, with growing preference for managed services and sustainable storage infrastructure.

Recent Developments:

- In December 2025, Summit Communications entered into a five-year space and power lease agreement with EDOTCO Bangladesh to enhance telecom tower infrastructure, supporting expanded network coverage and 4G/5G rollout across Bangladesh, which bolsters data center-related connectivity demands.

- In February 2024, GenNext Technologies and Bangladesh Data Center Company Ltd (BDCCL) launched the Meghna Cloud data center in Kaliakoir Hi‑Tech City. This project represents the first large‑scale cloud data center in Bangladesh offering integrated compute, storage, and networking services under one roof.