Executive summary:

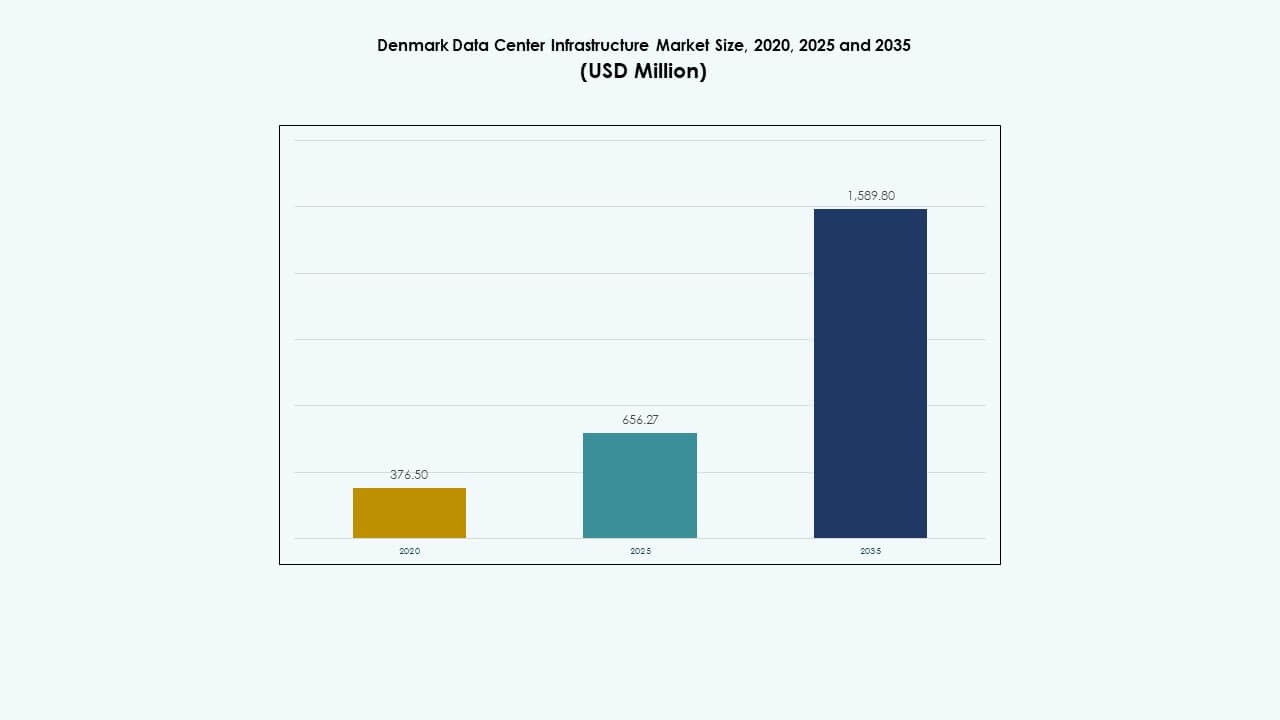

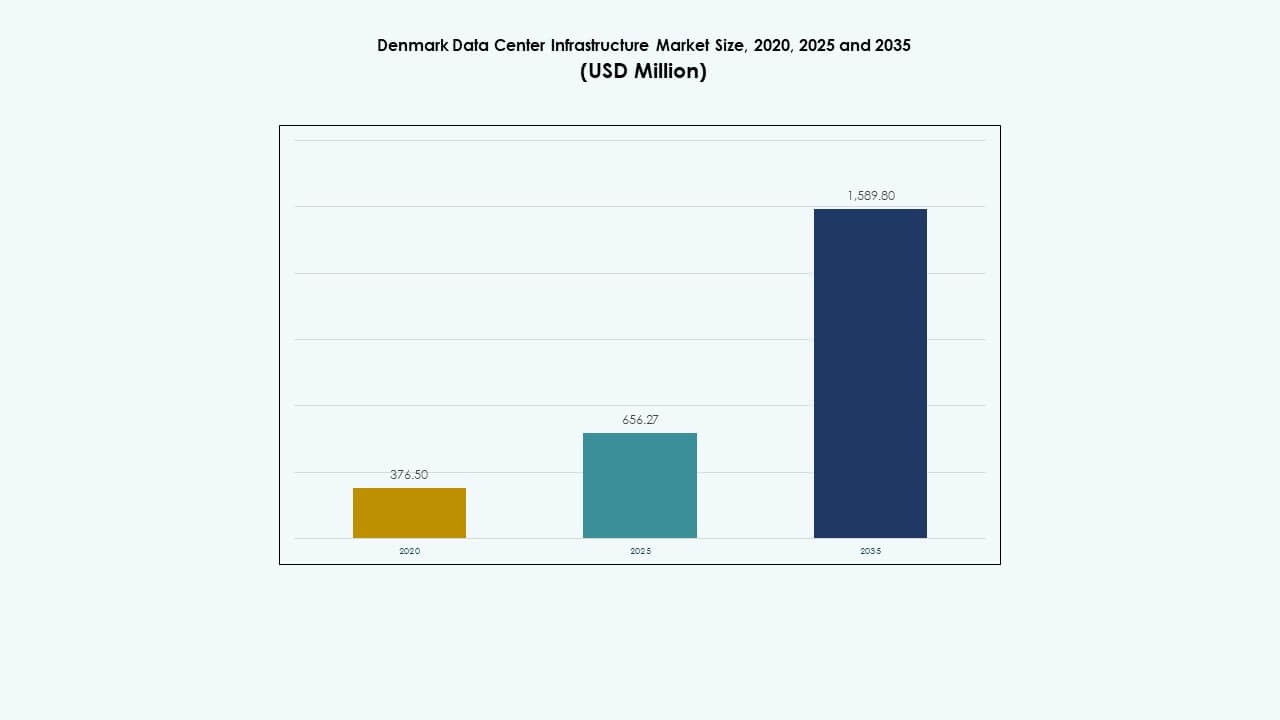

The Denmark Data Center Infrastructure Market size was valued at USD 376.50 million in 2020 to USD 656.27 million in 2025 and is anticipated to reach USD 1,589.80 million by 2035, at a CAGR of 9.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Denmark Data Center Infrastructure Market Size 2025 |

USD 656.27 Million |

| Denmark Data Center Infrastructure Market, CAGR |

9.18% |

| Denmark Data Center Infrastructure Market Size 2035 |

USD 1,589.80 Million |

A surge in cloud adoption and AI workloads drives rapid infrastructure upgrades. Companies adopt modular designs, efficient power distribution, and advanced cooling systems to handle higher compute demand. Growing need for low-latency connectivity and data sovereignty spurs local developments. Sustainability goals prompt integration of renewable energy and energy-efficient cooling, making data centers eco-friendlier. Investors prefer this stable growth path and fund expansions to meet increasing enterprise requirements.

Major demand centers cluster in the Copenhagen metropolitan area. Strong grid infrastructure and fiber links support hyperscale and colocation builds there. Western Denmark shows growing interest in green-energy powered facilities thanks to wind and biomass availability. Nordic neighbours such as Sweden and Norway monitor Danish capacity trends for cross-border latency benefits. Eastern European players show initial interest, but uptake remains early. Moves outside urban hubs appeal to investors seeking low-cost land and stable renewable power.

Market Drivers

Market Drivers

Growing Investments in Renewable Energy-Powered Data Centers Strengthening Infrastructure Efficiency

The Denmark Data Center Infrastructure Market gains traction through heavy investment in renewable power integration. Operators adopt 100% green energy strategies to align with national sustainability targets. It benefits from the country’s advanced wind and hydroelectric capacities that reduce operational carbon footprints. The shift toward cleaner grids encourage hyperscalers to expand capacity locally. Businesses rely on energy security and stable power supply to ensure uptime. Infrastructure developers prioritize power-efficient equipment to optimize performance. This approach boosts long-term profitability for operators. Investors find Denmark’s energy stability a major advantage in expanding digital infrastructure.

- For instance, Eurowind Energy partnered with Edora to develop a data center within a renewable energy park in Jutland, Denmark. The site integrates 3.6 MW wind turbines, an 8 MW solar facility, and a 10.8 MW / 43.2 MWh battery system to power data operations sustainably and eliminate diesel backup use.

Rapid Adoption of Cloud, Edge, and AI Workloads Accelerating Facility Modernization

Cloud and AI workloads drive modernization across the Denmark Data Center Infrastructure Market. Enterprises transition from legacy IT setups to advanced colocation and edge solutions. It reflects growing digital transformation among financial, retail, and public sectors. Providers deploy modular builds to meet flexible compute demands and reduce deployment time. AI integration pushes higher rack densities and thermal optimization needs. This dynamic fosters continuous hardware and cooling innovation. Vendors introduce scalable systems to support hybrid and multi-cloud adoption. Investors view the trend as a key growth enabler in Denmark’s expanding digital ecosystem.

Expansion of Hyperscale Data Centers Strengthening Denmark’s Role in the Nordic Digital Hub

Hyperscale expansion solidifies Denmark’s role as a core European data exchange zone. The Denmark Data Center Infrastructure Market benefits from strategic proximity to major submarine cables. It links Northern Europe to global network corridors through low-latency routes. Hyperscalers like Google and Meta choose Denmark for its policy stability and energy availability. These projects trigger new power grid and substation developments. Infrastructure suppliers experience rising demand for electrical and mechanical components. The country’s digital infrastructure maturity supports higher regional traffic. This connectivity advantage strengthens Denmark’s strategic digital relevance in Europe.

- For instance, Google’s data center in Fredericia incorporates advanced power-efficient infrastructure and low-latency network connectivity aligned with Denmark’s green energy policies, driving demands for new power grid expansions and electrical components to support increased regional traffic.

Focus on Green Building Standards and Circular Design Enhancing Operational Sustainability

Operators follow green construction codes to reduce lifecycle emissions and improve sustainability. The Denmark Data Center Infrastructure Market adopts circular design in building materials and waste reuse. Firms emphasize advanced HVAC and liquid cooling for better energy-to-output ratios. Certification under ISO 50001 and LEED standards attracts foreign investment. The government promotes environmental incentives supporting zero-emission construction. Businesses align digital operations with EU’s environmental goals. Energy-efficient lighting, automation, and predictive maintenance cut power overheads. These sustainable models redefine Denmark’s market leadership in responsible digital infrastructure expansion.

Market Trends

Market Trends

Rising Integration of Liquid Cooling and Immersion Technologies Enhancing Data Center Efficiency

Liquid cooling and immersion systems gain traction across Denmark’s data facilities. The Denmark Data Center Infrastructure Market witnesses higher adoption of these technologies to manage AI-intensive workloads. Operators replace air-cooling with advanced liquid-based alternatives to achieve low PUE levels. Immersion cooling extends hardware lifespan while reducing maintenance. The technology improves power efficiency per rack, cutting operational costs. Data-driven automation optimizes thermal balancing in dense clusters. Vendors test hybrid cooling combining free-air and liquid systems. It marks Denmark as an innovation leader in sustainable thermal management across Europe.

Increased Demand for Modular and Prefabricated Data Center Construction Models

Developers in the Denmark Data Center Infrastructure Market prefer modular builds for scalability and speed. Prefabricated components allow faster commissioning and lower installation risks. Modular setups support remote site expansion without lengthy construction phases. Vendors introduce containerized power and cooling units to serve edge computing nodes. Prefabrication enhances quality control and standardization in design. It ensures repeatable, efficient builds suited for multi-site rollouts. Construction firms invest in hybrid models integrating factory-built structures. The shift supports Denmark’s digital readiness while maintaining sustainable construction frameworks.

Growing Role of Artificial Intelligence and Automation in Data Center Management

AI automation transforms operations across the Denmark Data Center Infrastructure Market. Smart monitoring platforms analyze energy consumption and predict faults in real time. AI-driven resource scheduling improves power and cooling balance. Automation reduces manual dependency, improving reliability and uptime. Vendors deploy intelligent PDUs and DCIM systems for precision control. Predictive algorithms forecast component aging, extending asset life. Robotics aid in material handling and maintenance tasks. It enhances workforce safety while minimizing downtime risks. AI-led optimization defines Denmark’s new phase of operational intelligence.

Strengthening Focus on Edge Computing Expansion and Distributed Network Ecosystems

Edge deployments rise as enterprises demand low-latency computing closer to users. The Denmark Data Center Infrastructure Market expands with micro data centers in urban zones. These compact facilities process data locally, reducing network congestion. Telecom firms collaborate with edge developers to support 5G rollouts. Enterprises deploy edge capacity to power IoT, AR, and real-time analytics. The distributed infrastructure ensures seamless digital experiences. Manufacturers and logistics firms rely on edge integration for faster decision cycles. This evolution complements hyperscale and colocation growth across Denmark’s data landscape.

Market Challenges

Market Challenges

Escalating Power Demand and Grid Pressure Constraining Data Center Scalability

The Denmark Data Center Infrastructure Market faces challenges linked to rising power needs. The growing concentration of hyperscale and AI workloads strains grid stability. Energy authorities must balance industrial demand and residential supply. Long lead times in substation expansion delay project execution. High dependency on renewable inputs increases intermittency risks. Operators require advanced energy storage for continuity. Power redundancy remains costly, affecting smaller data center economics. Investors must account for long-term energy inflation and grid integration complexities.

Complex Environmental and Planning Regulations Slowing New Project Approvals

Stringent environmental laws delay new facility approvals across the Denmark Data Center Infrastructure Market. The government enforces strict emission and land-use compliance standards. Projects undergo extended environmental impact assessments. This slows construction timelines and inflates capital expenditure. Urban areas face zoning restrictions limiting expansion. Developers must coordinate with multiple agencies for water and energy usage permits. The compliance load deters smaller firms from entering. It demands strong regulatory navigation to sustain long-term development.

Market Opportunities

Rising AI and High-Performance Computing Investments Creating Demand for Advanced Infrastructure

AI and HPC workloads present new growth opportunities for the Denmark Data Center Infrastructure Market. Enterprises require higher density and GPU-optimized facilities to support training and inference. Operators plan retrofits for advanced chip cooling systems. It creates space for innovation in liquid-cooled racks and modular GPU pods. Strong R&D ecosystems and skilled labor attract foreign investment. AI integration enhances competitiveness and pushes new design standards across the nation.

Growing Export Potential for Sustainable Data Center Design and Engineering Expertise

Denmark’s green design leadership opens global business opportunities. The Denmark Data Center Infrastructure Market produces technology models that inspire sustainable builds abroad. Local firms export modular, low-carbon construction and energy management systems. It strengthens Denmark’s global brand as a sustainability innovator. Cross-border partnerships promote technology transfer in cooling and efficiency. The expertise creates high-value contracts in emerging digital economies seeking sustainable infrastructure.

Market Segmentation

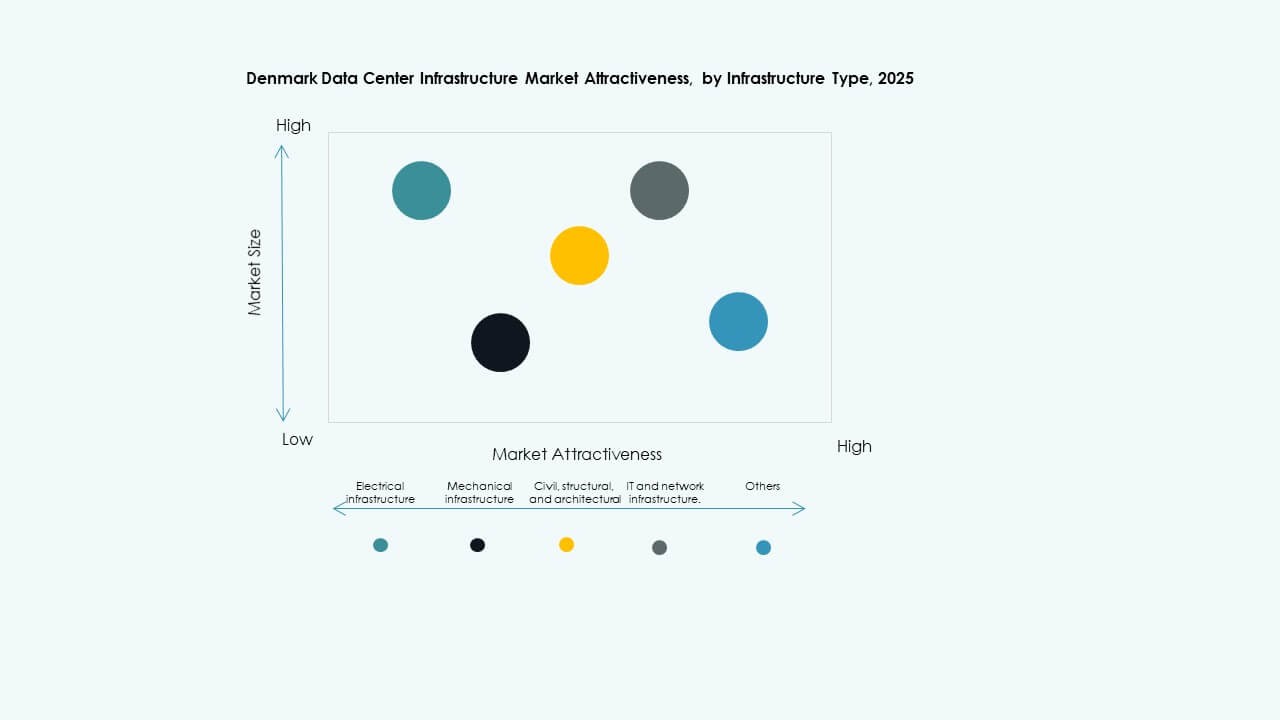

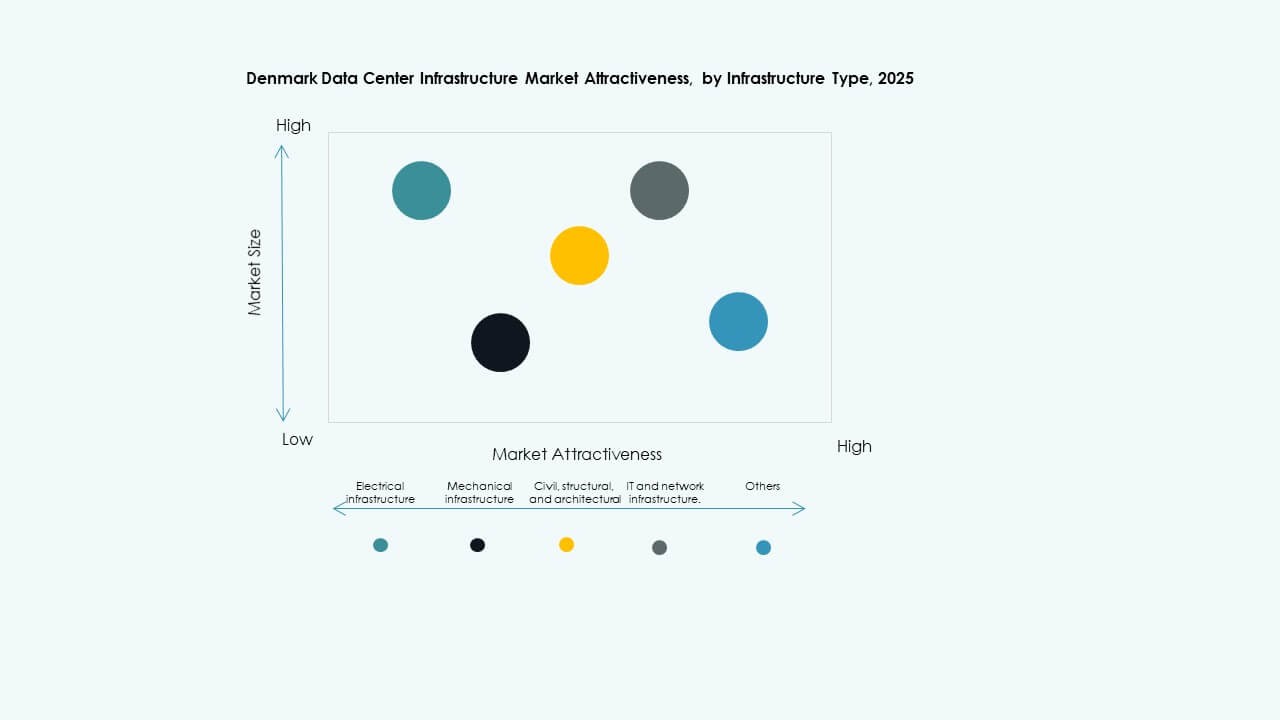

By Infrastructure Type

Electrical infrastructure dominates the Denmark Data Center Infrastructure Market due to energy-intensive workloads. Mechanical systems grow with cooling innovation, while civil and IT infrastructure expand steadily. Strong investment in electrical upgrades ensures operational reliability. Mechanical and IT subsystems support AI integration. Civil frameworks improve resilience and modular design. The segment balance supports comprehensive facility development across the country.

By Electrical Infrastructure

The UPS and power distribution units lead the electrical segment of the Denmark Data Center Infrastructure Market. Reliable grid connections and backup power define this dominance. Battery energy storage systems gain importance for renewable integration. Switchgears and PDUs enhance system protection and flexibility. Demand for stable power flow drives innovation in energy automation. These upgrades ensure constant uptime and cost efficiency for operators.

By Mechanical Infrastructure

Cooling systems dominate the mechanical segment in the Denmark Data Center Infrastructure Market. Facilities prefer advanced CRAC/CRAH and air-cooled chillers for dense AI workloads. Containment solutions improve airflow and reduce energy waste. Pumps and piping systems support scalable liquid-cooling infrastructure. Mechanical reliability remains central to operational performance. New heat recovery solutions emerge to reduce thermal losses.

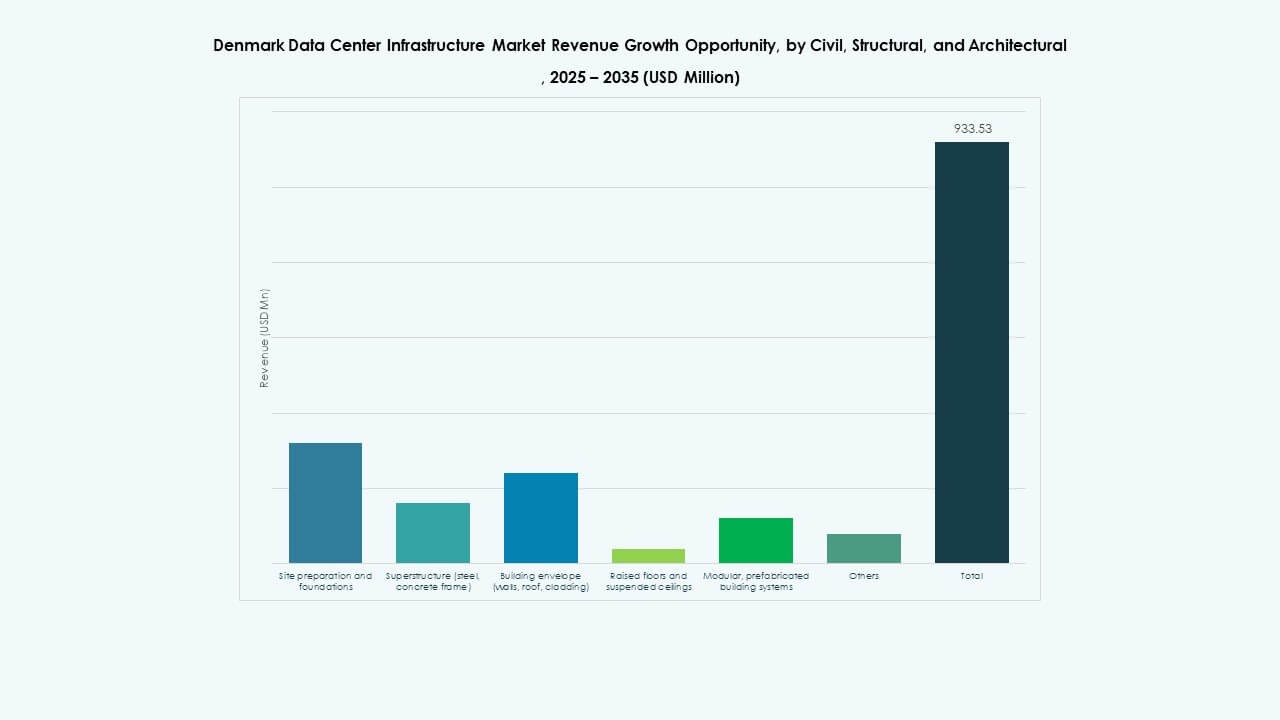

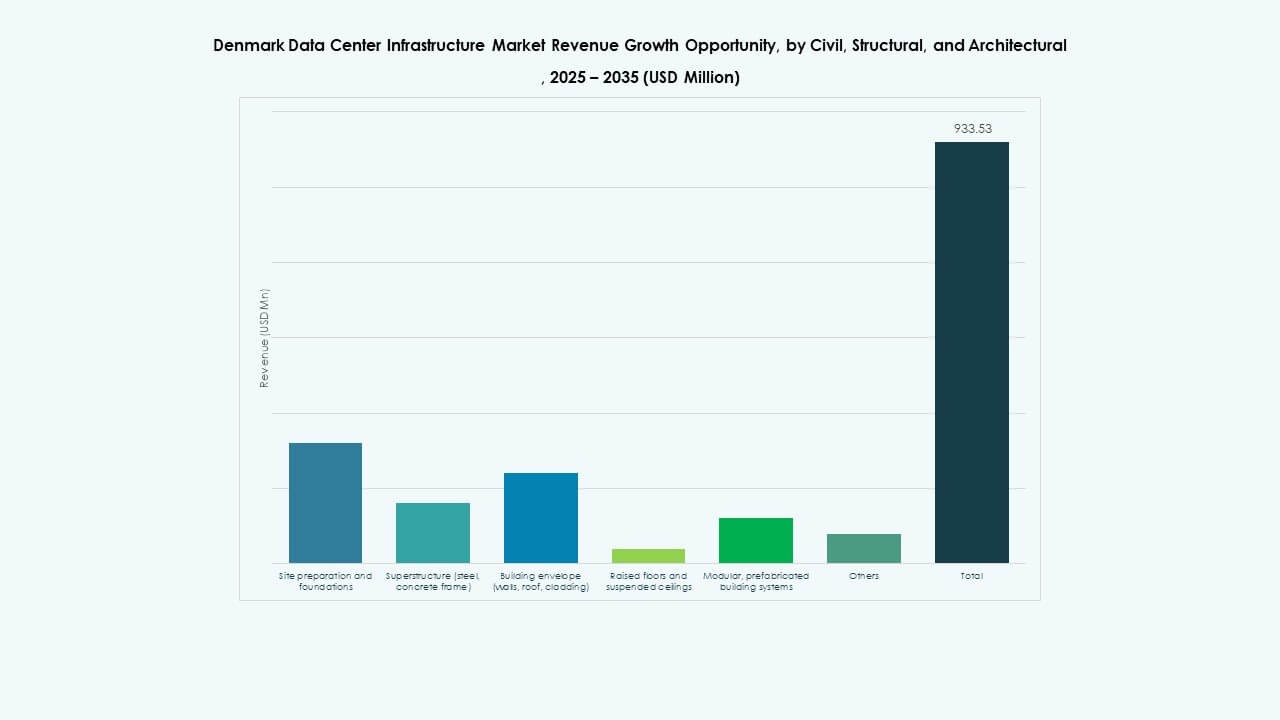

By Civil / Structural & Architectural

The civil and structural segment of the Denmark Data Center Infrastructure Market emphasizes modular and prefabricated designs. Developers adopt flexible steel and concrete frames for faster deployment. Raised floors and suspended ceilings improve airflow management. High-quality cladding enhances thermal insulation. Building envelopes ensure resilience against harsh weather. These improvements raise long-term sustainability in Denmark’s infrastructure ecosystem.

By IT & Network Infrastructure

Networking equipment and servers dominate the IT segment of the Denmark Data Center Infrastructure Market. Storage and fiber cabling gain traction for faster data exchange. Racks and enclosures evolve to manage high-density configurations. It highlights strong focus on cloud connectivity and AI computing. Upgrades in IT infrastructure drive better workload optimization across enterprises.

By Data Center Type

Hyperscale centers hold the largest share in the Denmark Data Center Infrastructure Market. Colocation and enterprise data centers also record strong growth. Edge deployments rise with distributed computing. These combined models ensure flexibility in hosting and scalability. The diversification supports national digital resilience and attracts new entrants.

By Delivery Model

Design-build and turnkey delivery models dominate the Denmark Data Center Infrastructure Market. Construction management gains preference for large, multi-phase builds. Retrofit projects address older facility modernization. Modular factory-built solutions enhance scalability and sustainability. This mix provides cost-efficient and reliable infrastructure expansion.

By Tier Type

Tier 3 facilities hold the major share of the Denmark Data Center Infrastructure Market. These centers offer optimal uptime balance with cost efficiency. Tier 4 builds grow with hyperscale and AI demands. Lower tiers support edge and small enterprise deployments. The tier distribution underlines a balanced infrastructure ecosystem across Denmark.

Regional Insights

Regional Insights

Copenhagen Metropolitan Zone Leading with More Than 55% Market Share

Copenhagen leads the Denmark Data Center Infrastructure Market with over 55% share. The region hosts major hyperscale campuses and interconnection hubs. Strong grid connectivity and fiber access drive sustained investment. Proximity to financial and telecom clusters ensures high network demand. The city attracts international developers due to policy transparency and low-latency advantages.

- For instance, Digital Realty hosts the Gefion AI supercomputer in Denmark, built with 1,528 NVIDIA H100 GPUs connected through Quantum-2 InfiniBand. The system supports national AI research and advanced computing initiatives, marking Denmark’s growing role in sovereign AI infrastructure.

Western Denmark Emerging as a Strategic Green Energy and Industrial Hub

Western Denmark contributes around 30% share of the Denmark Data Center Infrastructure Market. It benefits from vast renewable resources and land availability. The region’s industrial base supports hybrid power projects. Data centers leverage wind energy and district heating systems. Local municipalities promote green construction, drawing large-scale colocation projects.

- For instance, Penta Infra acquired a second data-center site in Copenhagen in September 2024, planning a new 20 MW facility spanning more than 20,000 m².

Northern and Southern Regions Supporting Edge and Distributed Facility Growth

Northern and southern zones collectively hold about 15% share of the Denmark Data Center Infrastructure Market. These regions expand edge data centers to serve logistics and manufacturing clusters. Smaller cities deploy modular and prefabricated facilities to manage regional data loads. Strong cross-border connectivity with Norway and Germany enhances integration. The growing regional diversity reinforces Denmark’s balanced data ecosystem.

Competitive Insights:

- Digital Realty

- Equinix, Inc.

- Schneider Electric

- ABB

- Vertiv Group Corp.

- Cisco Systems, Inc.

- Dell Inc.

- Huawei Technologies Co., Ltd.

- IBM

- Lenovo

The Denmark Data Center Infrastructure Market features strong competition between global hyperscale operators, equipment manufacturers, and infrastructure solution providers. It remains shaped by innovation in power, cooling, and modular system design. Players such as Digital Realty and Equinix dominate colocation and interconnection services through scalable, energy-efficient campuses. Equipment providers including ABB, Schneider Electric, and Vertiv lead electrical and mechanical system integration. IT vendors like Cisco, Dell, and Huawei support advanced network and compute requirements. Local expansion strategies focus on renewable power use and AI-ready infrastructure. The competitive balance favors companies with strong sustainability credentials, deep technical partnerships, and regional deployment capabilities.

Recent Developments:

- In May 2025, Thylander unveiled plans to open Denmark’s first fully Danish hyperscale data center, in collaboration with Copenhagen Infrastructure Partners. The center, expected to launch in 2026, will initially have a capacity of 10-20 megawatts and aims to challenge foreign ownership in Denmark’s data center market by focusing on local energy optimization and security expertise.

- In February 2025, Aeven announced a collaboration with Microsoft Denmark to connect traditional on-premises data centers to the Microsoft Azure cloud platform. This partnership aims to streamline the management of hybrid environments, enhancing cloud integration capabilities across Denmark.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights