Executive summary:

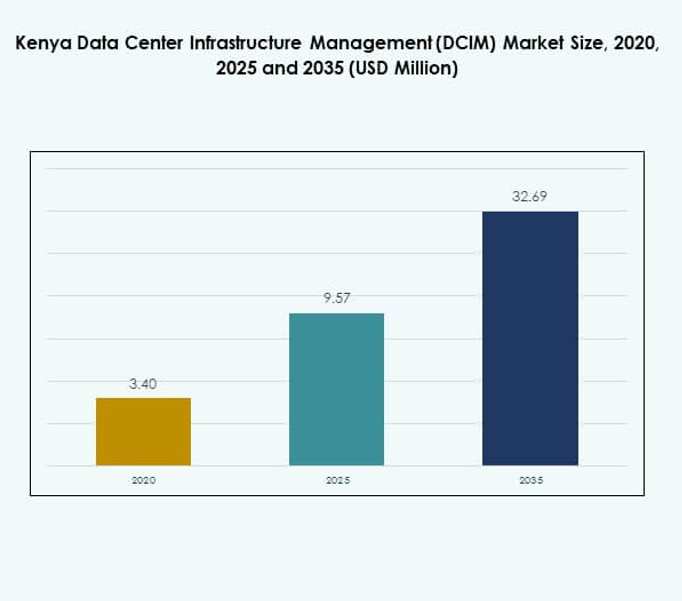

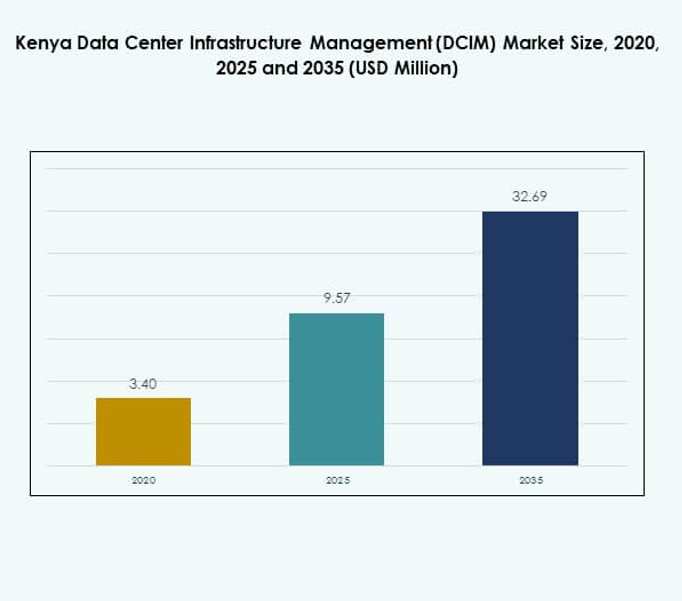

The Kenya Data Center Infrastructure Management (DCIM) Market size was valued at USD 3.40 million in 2020, increased to USD 9.57 million in 2025, and is anticipated to reach USD 32.69 million by 2035, at a CAGR of 14.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Kenya Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 9.57 Million |

| Kenya Data Center Infrastructure Management (DCIM) Market, CAGR |

14.76% |

| Kenya Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 32.69 Million |

The Kenya DCIM market growth is driven by the rapid adoption of cloud computing, automation, and smart infrastructure technologies. Businesses are investing in DCIM platforms to optimize energy use, improve system reliability, and ensure real-time visibility across hybrid and edge environments. It plays a vital role in Kenya’s digital economy by enhancing operational efficiency, sustainability, and scalability, making it a key focus area for both enterprises and investors.

Regionally, Nairobi leads Kenya’s DCIM landscape due to its strong connectivity infrastructure and concentration of large enterprises. The coastal regions, supported by international cable landings, are emerging as vital hubs for colocation and cloud expansion. Western Kenya is gaining attention for localized data processing, driven by government digitalization initiatives and growing enterprise IT adoption.

Market Drivers

Rising Demand for Data-Driven Operations and Digital Transformation

The Kenya Data Center Infrastructure Management (DCIM) Market benefits from rising adoption of digital services across banking, telecom, and government sectors. Companies in Kenya prioritize efficient IT operations to manage increasing data volumes from e-commerce and cloud applications. The growing use of DCIM tools supports power, cooling, and asset optimization. Businesses seek real-time control and monitoring for energy-efficient operations. Government initiatives promoting ICT expansion further accelerate demand. The digital economy’s growth creates consistent infrastructure requirements. It drives higher adoption of automation and AI in data center monitoring. Investors recognize strong revenue potential from this long-term digital shift.

- For instance, in July 2024, iXAfrica launched East Africa’s first AI-ready hyperscale data center in Nairobi in partnership with Schneider Electric, leveraging Schneider’s EcoStruxure management solutions throughout the facility to deliver 99.999% uptime and a design Power Usage Effectiveness (PUE) of 1.25 across the campus, supporting critical digital transformation for Kenyan enterprises.

Technological Advancements in Automation and Energy Efficiency

Automation in DCIM platforms drives faster and smarter decision-making. Advanced analytics and AI integration improve performance, predict equipment failures, and reduce downtime. The focus on sustainability promotes adoption of energy-efficient power management systems. The Kenya DCIM ecosystem is expanding through smart sensors, modular equipment, and IoT integration. Businesses use these innovations to meet environmental compliance and cost-efficiency goals. Edge computing and remote operations require accurate real-time insights. It encourages hybrid and cloud-based DCIM implementations. Global vendors and local firms are forming partnerships to enhance infrastructure capabilities.

Growing Cloud Adoption and Expansion of Colocation Facilities

The surge in cloud computing adoption across Kenya enhances the relevance of DCIM systems. Cloud-based solutions allow scalability, ease of deployment, and remote visibility. Telecom operators and colocation service providers rely on DCIM for managing distributed networks efficiently. Rising data storage and backup requirements strengthen adoption among large enterprises. The growth in mobile connectivity and fintech drives further infrastructure expansion. It creates favorable conditions for cloud-focused DCIM adoption. Local innovation in infrastructure management strengthens Kenya’s digital competitiveness. Businesses integrating multi-cloud frameworks invest heavily in secure, flexible management platforms.

Strategic Investments in Smart Infrastructure and Data Resilience

Strategic capital inflows from global technology investors reinforce Kenya’s role as an East African data hub. Companies prioritize smart infrastructure that ensures operational continuity and reduced risk of failure. The DCIM solutions improve business resilience by monitoring system health in real time. It enhances resource allocation and aligns with enterprise automation goals. Increasing partnerships between public and private sectors support this growth. Data-driven policies and regional integration initiatives foster demand for digital infrastructure. Investors view the market as an essential growth enabler for digital transformation. Kenya’s data infrastructure maturity supports its long-term ICT competitiveness.

- For instance, Africa Data Centres operates the NBO1 Nairobi facility, an Uptime Institute Tier III certified data center with 7.5MW site capacity and advanced security and monitoring systems. It provides resilient, scalable colocation services connected to pan-African networks, underpinning East Africa’s digital infrastructure growth.

Market Trends

Integration of AI and Machine Learning in Infrastructure Management

AI and machine learning are transforming DCIM platforms in Kenya. These technologies allow predictive maintenance, reducing downtime and energy waste. The Kenya Data Center Infrastructure Management (DCIM) Market benefits from advanced analytics for capacity forecasting. Intelligent algorithms analyze operational data to optimize cooling and power systems. Businesses achieve higher reliability and efficiency through automated decision-making. It leads to improved asset lifespan and reduced operating expenses. AI-driven control systems are rapidly becoming industry standards. Local data centers are adopting these technologies to strengthen operational transparency.

Emergence of Edge Data Centers to Support Real-Time Applications

Edge data centers are gaining traction in Kenya due to expanding IoT and 5G networks. These facilities reduce latency and support faster data processing near end-users. Enterprises demand compact, energy-efficient solutions for local operations. The Kenya DCIM market leverages edge monitoring systems to manage dispersed infrastructure. This approach enhances reliability for applications such as telemedicine and fintech services. It reduces network congestion and improves end-user experience. Edge DCIM platforms also enable simplified maintenance through centralized dashboards. Kenya’s telecom growth accelerates investment in these regional mini data hubs.

Adoption of Cloud-Native DCIM Solutions for Remote Operations

The shift toward cloud-native DCIM solutions enhances operational flexibility and accessibility. Cloud-based management platforms support real-time monitoring from any location. The Kenya Data Center Infrastructure Management (DCIM) Market benefits from remote infrastructure oversight, vital during distributed workforce operations. Enterprises embrace SaaS-based DCIM for cost efficiency and scalability. The integration of APIs improves interoperability between cloud services. It allows seamless data synchronization across hybrid environments. Growing preference for subscription models strengthens vendor-customer relationships. Local and regional service providers are upgrading to multi-tenant cloud management tools.

Increased Focus on Sustainability and Renewable Energy Integration

Sustainability plays a key role in shaping Kenya’s DCIM strategies. Operators integrate renewable energy sources to power data centers efficiently. The Kenya DCIM market aligns with national sustainability policies promoting low-carbon infrastructure. Businesses implement green energy monitoring tools to optimize consumption. It strengthens corporate responsibility and meets international standards. Energy-efficient cooling systems and waste-heat recovery gain traction. Vendors innovate sustainable DCIM modules to attract eco-conscious clients. Kenya’s renewable energy capacity enhances its position as a sustainable data hub.

Market Challenges

High Implementation Costs and Limited Technical Expertise

The Kenya Data Center Infrastructure Management (DCIM) Market faces challenges related to high initial investment costs. Many small and medium enterprises struggle to adopt advanced management tools. Implementation and integration of DCIM require significant capital and skilled professionals. Limited technical expertise in automation and analytics slows adoption. It restricts optimization and real-time monitoring capabilities. Local businesses depend heavily on imported systems, increasing operational costs. Lack of specialized training programs weakens technical readiness. These barriers limit full-scale digital transformation within smaller organizations.

Inconsistent Power Supply and Infrastructure Reliability Issues

Kenya experiences infrastructure limitations that affect continuous DCIM operations. Unstable power supply and limited fiber connectivity remain major obstacles. The Kenya DCIM market contends with downtime risks and high maintenance costs. Power disruptions impact system reliability and increase backup requirements. It limits scalability for data-intensive industries. Rural areas face greater connectivity gaps, hindering distributed operations. Dependence on diesel generators increases costs and environmental impact. Strengthening national energy and network reliability is critical to address these challenges.

Market Opportunities

Expansion of Smart Cities and Government-Led Digitalization Programs

Kenya’s growing smart city projects create opportunities for DCIM solution providers. The Kenya Data Center Infrastructure Management (DCIM) Market gains momentum through government-backed initiatives promoting ICT integration. Digital government services and public cloud adoption increase infrastructure needs. It encourages investment in modular data centers supporting urban digital ecosystems. Vendors introducing scalable, AI-powered DCIM tools will benefit from this policy-driven expansion. The public sector’s focus on e-governance enhances DCIM demand for monitoring and efficiency.

Rising Investment by Global and Regional Colocation Providers

Kenya is attracting global colocation providers investing in large-scale infrastructure. International partnerships strengthen the DCIM ecosystem through technology transfer and capacity building. The Kenya DCIM market benefits from expansion projects that increase operational standards and reliability. It supports cross-border data flows and digital commerce. Increased foreign participation boosts competition and innovation. New investors aim to develop energy-efficient, secure data facilities catering to regional clients.

Market Segmentation

By Component

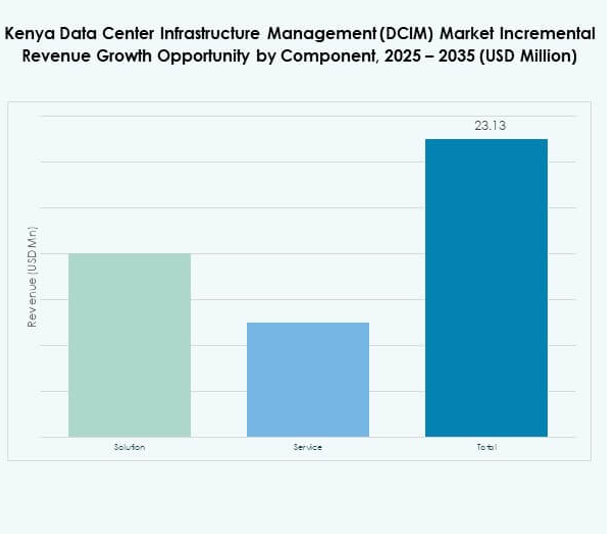

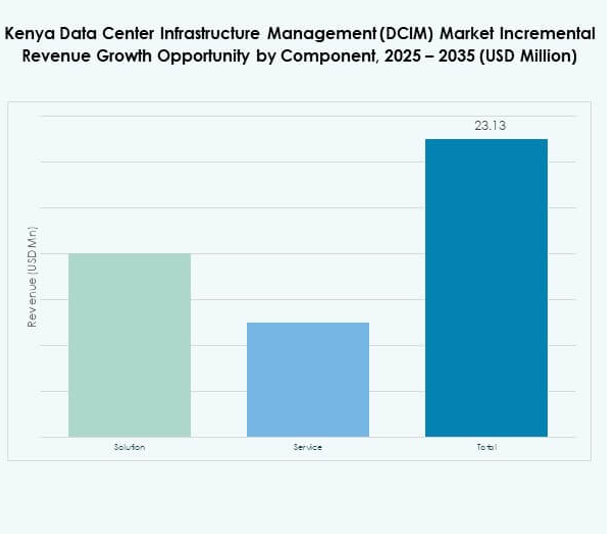

The solution segment dominates the Kenya Data Center Infrastructure Management (DCIM) Market due to the rising need for integrated monitoring systems. Software-based DCIM tools offer better visibility into power, cooling, and IT assets. Businesses prefer customizable solutions that streamline workflows and cut costs. Services such as consulting and maintenance complement this demand. It strengthens system uptime and energy optimization. The increasing adoption of real-time analytics drives higher market share for solution providers.

By Data Center Type

Enterprise data centers lead the Kenya DCIM market owing to growing digitization across large corporations. These facilities demand advanced asset and capacity management for high availability. Colocation and cloud data centers also show strong growth with expanding telecom and e-commerce sectors. It supports hybrid infrastructure adoption for scalable operations. Managed service providers invest in automated monitoring for better reliability. The rise of edge data centers further diversifies deployment models across Kenya.

By Deployment Model

The cloud-based segment holds a significant share of the Kenya Data Center Infrastructure Management (DCIM) Market. Cloud platforms enable cost-effective scalability and accessibility. Enterprises adopt hybrid models to balance security and flexibility. On-premises systems remain vital for sectors prioritizing data control. The hybrid segment is expanding due to growing remote work and multi-cloud integration. It improves data handling efficiency and business continuity. Vendors providing adaptive deployment architectures see increased customer interest.

By Enterprise Size

Large enterprises dominate the Kenya DCIM market with higher investments in IT modernization. These organizations require centralized control and energy-efficient systems. SMEs are gradually adopting cloud-based and modular DCIM tools for cost benefits. It enhances their competitiveness and operational performance. The affordability of subscription-based models supports SME growth. Integration of automation tools further expands accessibility. Rising demand for scalable solutions fuels strong market expansion across enterprise categories.

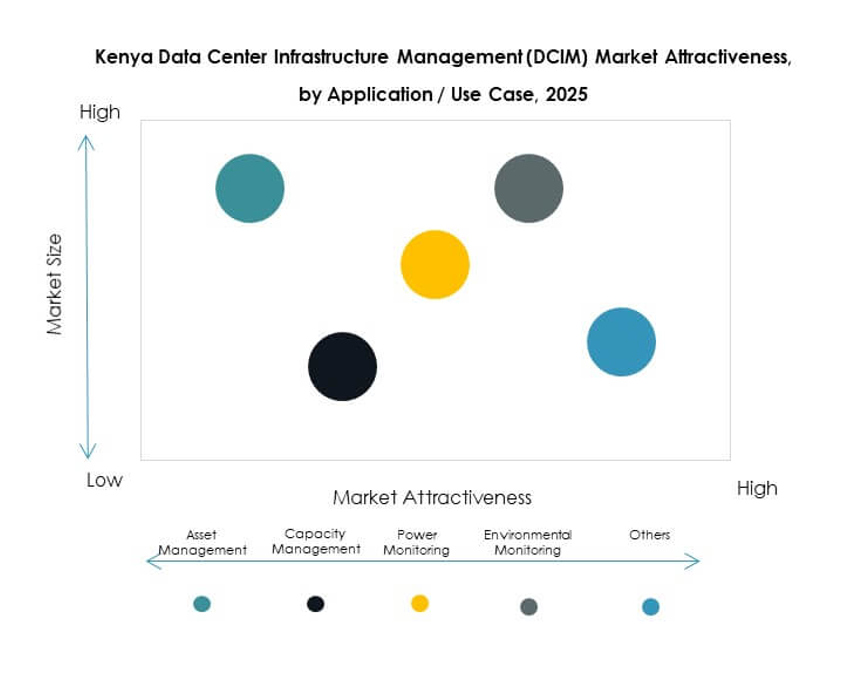

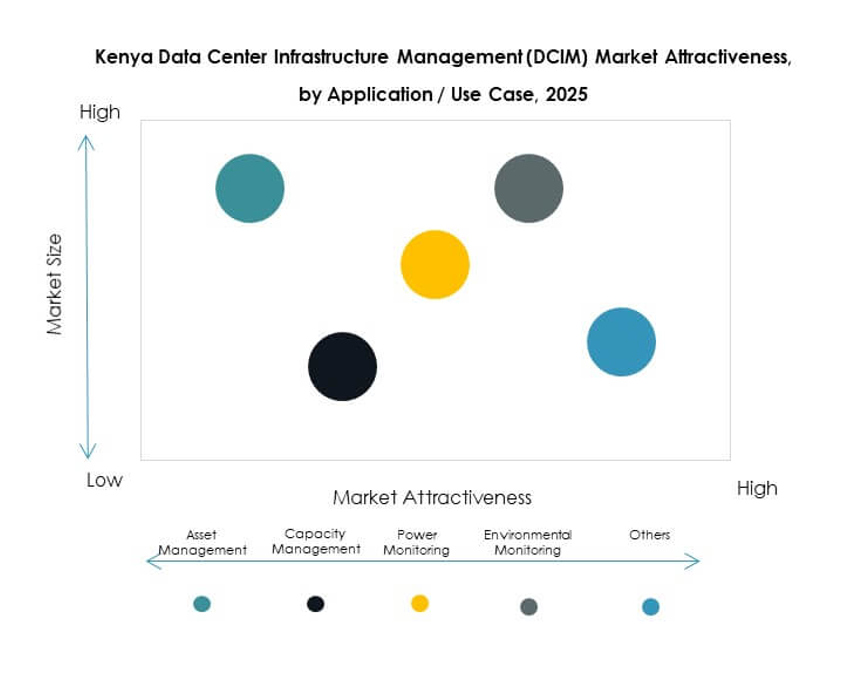

By Application / Use Case

Power monitoring holds the largest share in the Kenya Data Center Infrastructure Management (DCIM) Market. Efficient energy use is essential for cost control and sustainability compliance. Capacity management and asset tracking are also key growth areas. Environmental monitoring supports performance optimization and regulatory adherence. It allows data centers to achieve higher uptime and operational reliability. BI and analytics functions are gaining momentum for data-driven decision-making. The combination of these applications enhances infrastructure intelligence.

By End User Industry

The IT and telecommunications sector leads the Kenya DCIM market, driven by continuous digital service expansion. The BFSI and retail sectors adopt DCIM for network uptime and data protection. Healthcare providers use DCIM for compliance and secure storage of patient data. Energy and utilities invest in DCIM to manage distributed systems efficiently. It ensures reliability in critical infrastructure operations. Growing digitalization across industries increases demand for real-time management and automation tools.

Regional Insights

Nairobi and Central Kenya – Regional Technology and Infrastructure Hub (38% Share)

Nairobi dominates the Kenya Data Center Infrastructure Management (DCIM) Market with a 38% share. It serves as the nation’s technology and business nucleus. Major telecom operators and cloud providers establish their primary facilities in this region. Nairobi’s robust connectivity infrastructure and skilled workforce attract global partnerships. It supports enterprise cloud adoption and colocation services. The government’s Smart Nairobi initiative promotes sustainable and efficient data operations. Continued investment strengthens the region’s leadership in digital infrastructure.

Coastal Kenya – Growing Hub for Colocation and Connectivity Expansion (34% Share)

Coastal Kenya, including Mombasa, accounts for 34% of the market, driven by undersea cable connectivity and new colocation facilities. The region acts as Kenya’s gateway for global internet traffic. Data centers benefit from lower latency and better network access. It supports logistics, trade, and international communications sectors. Coastal cities are witnessing increased deployment of green data infrastructure. This progress aligns with Kenya’s energy diversification and sustainability goals. The growth encourages private investments and technology-driven expansions.

- For instance, iColo, a Digital Realty company, installed over 650 kW of new solar panels across its Kenyan campuses, including almost 200 kW at its expanding Miritini campus in Mombasa as of September 2024, making the facility a regional leader in green power adoption for data centers. iColo’s Mombasa location is also an interconnection hub, supporting more than 85 network providers and providing sustainable power for colocation services.

Western and Northern Kenya – Emerging Digital and Industrial Clusters (28% Share)

Western and Northern Kenya collectively hold 28% of the Kenya Data Center Infrastructure Management (DCIM) Market. These areas are emerging due to increased industrialization and regional development projects. The expansion of fiber optic networks and renewable energy facilities boosts growth potential. It creates opportunities for local data management and analytics operations. Educational institutions and healthcare centers adopt DCIM for operational efficiency. Regional initiatives aimed at digital inclusivity enhance market penetration. The development of secondary cities supports balanced digital infrastructure distribution.

- For instance, in 2025, the Kenyan government expanded the national fiber optic network to 13,590 kilometers, up from 8,900 kilometers in 2022, with a goal to connect underserved counties and rural populations and accelerate digital inclusion. The country’s official National Energy Compact (2025–2030) confirms investment in stand-alone system expansion for rural access, promoting productive use of energy and supporting widespread connectivity in Western and Northern Kenya.

Competitive Insights:

- Teraco Data Environments

- Safaricom

- iColo Data Centre

- Liquid Telecom

- Cisco Systems, Inc.

- Equinix

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Others

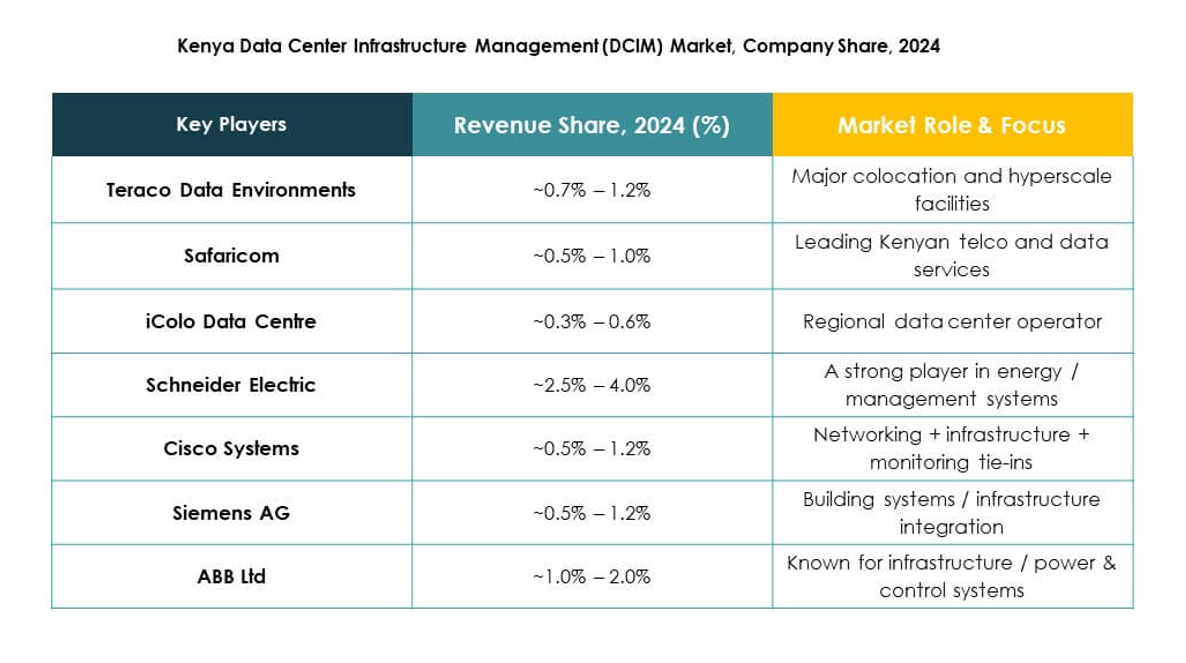

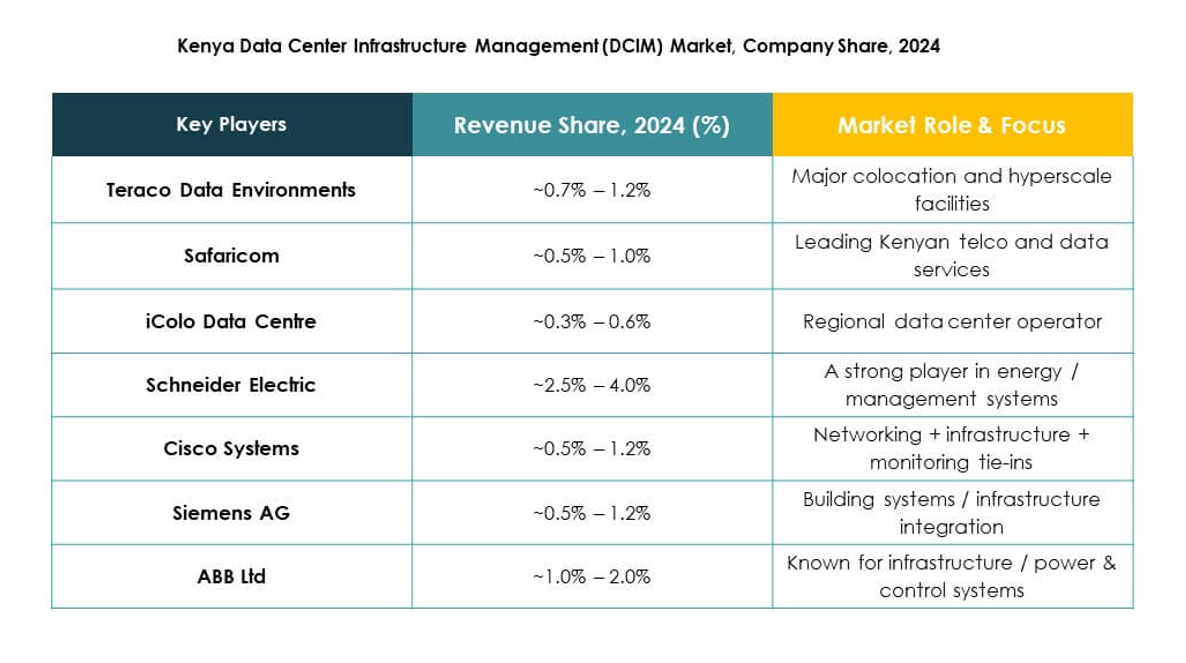

The Kenya Data Center Infrastructure Management (DCIM) Market features a competitive mix of global and regional players focused on infrastructure modernization and digital growth. It is driven by innovations in automation, cloud integration, and energy-efficient designs. Companies such as Schneider Electric, Huawei, and Siemens lead in intelligent DCIM platforms combining analytics and sustainability. Local operators like iColo and Safaricom strengthen their footprint through colocation services and cloud expansion. Equinix and Teraco focus on high-capacity, interconnected facilities supporting enterprise scalability. Eaton and Cisco emphasize hardware and software integration for operational efficiency. The market competition encourages partnerships, technology transfer, and investments in hybrid DCIM models.

Recent Developments:

- In June 2025, SISCOM Tech launched its newest data center cluster, hosted within IX Africa’s Tier III-designed, 4.5 MW facility along Mombasa Road in Nairobi, marking a partnership with IX Africa to support scalable, AI-ready colocation and gaining Data Controller status under Kenya’s Data Protection Act.

- In May 2025, Safaricom entered into a strategic partnership with iXAfrica Data Centres to deliver enterprise and cloud solutions at the newly launched NBOX1 hyperscale data centre in Nairobi, enabling AI-driven workloads and integrated infrastructure for clients across East Africa.

- In May 2025, Safaricom announced a strategic partnership with iXAfrica (an iColo company) to construct East Africa’s first AI-ready data center in Kenya, a facility designed to provide advanced computing resources for enterprises and AI applications, marking a major step in the region’s digital infrastructure.