Executive summary:

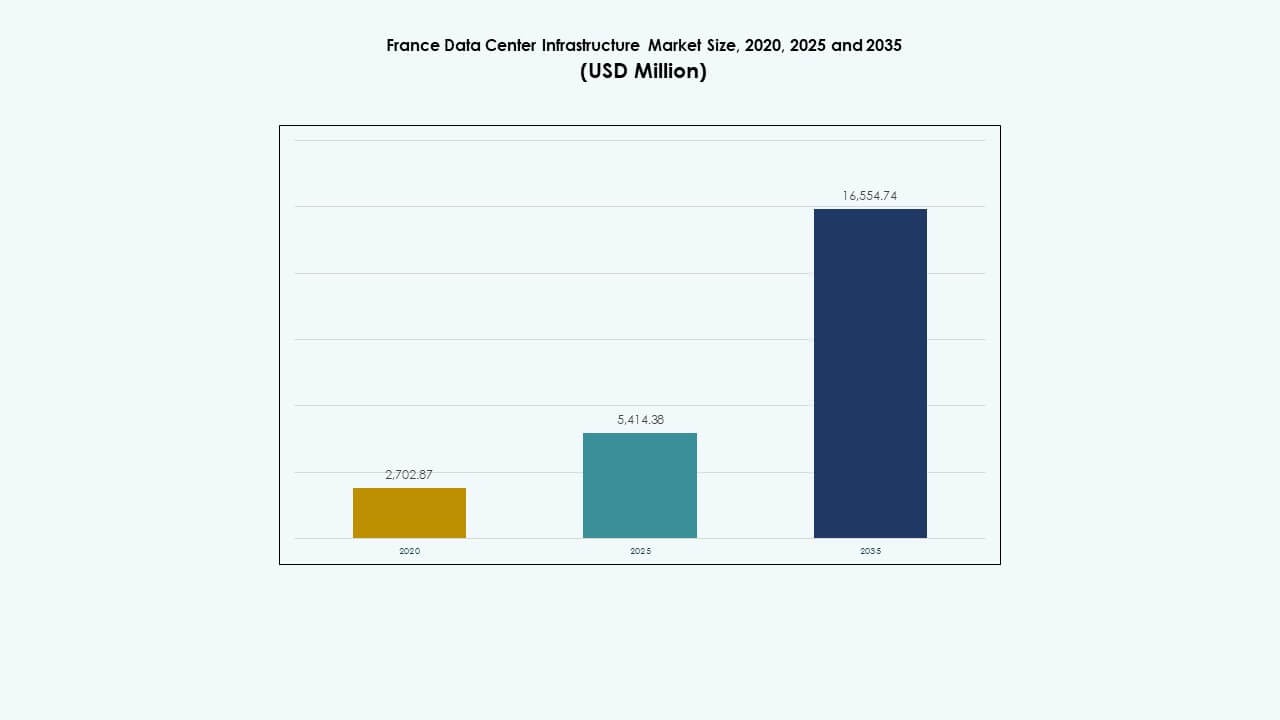

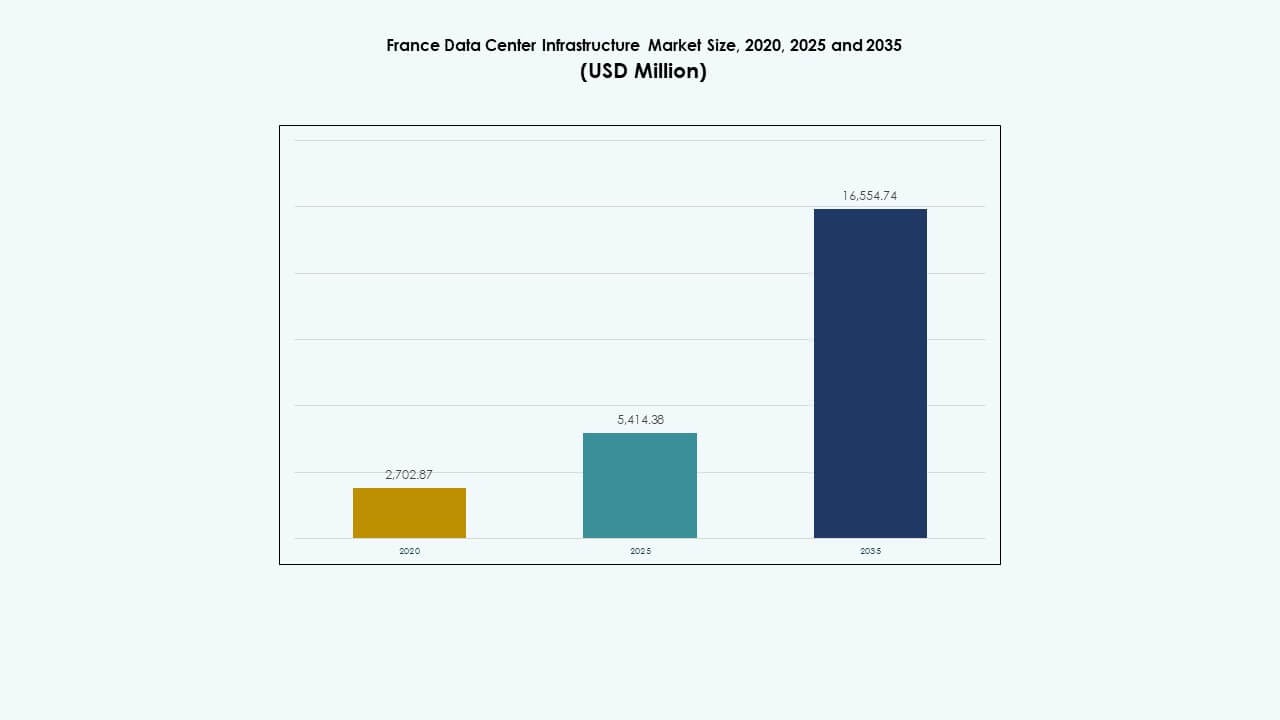

The France Data Center Infrastructure Market size was valued at USD 2,702.87 million in 2020, reached USD 5,414.38 million in 2025, and is anticipated to reach USD 16,554.74 million by 2035, at a CAGR of 11.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| France Data Center Infrastructure Market Size 2025 |

USD 5,414.38 Million |

| France Data Center Infrastructure Market, CAGR |

11.74% |

| France Data Center Infrastructure Market Size 2035 |

USD 16,554.74 Million |

The market growth is driven by strong adoption of cloud computing, AI workloads, and colocation facilities. Rapid innovation in power management, cooling, and modular data center design enhances energy efficiency and scalability. Enterprises and hyperscale providers expand investments to meet rising digital demands, while sustainability goals shape infrastructure planning. This sector holds strategic importance for investors seeking long-term growth in France’s digital transformation landscape.

Northern and Western France lead due to robust power grids, connectivity, and renewable integration supporting hyperscale expansion. Paris remains the central hub for large colocation facilities, while southern cities such as Marseille and Lyon emerge as secondary clusters. These regions attract developers through favorable climate, submarine cable access, and lower construction costs, strengthening nationwide data infrastructure diversification.

Market Drivers

Market Drivers

Rapid Expansion of Cloud and Colocation Facilities

The France Data Center Infrastructure Market grows due to a surge in cloud adoption and colocation investments. It benefits from rising enterprise data volumes and government digital initiatives. Businesses migrate workloads to secure and energy-efficient environments. Strong demand from telecom, BFSI, and public sectors drives large-scale deployments. Colocation operators expand footprint near Paris and Marseille to serve hyperscale clients. Firms prioritize sustainability and low-latency infrastructure. Green energy sourcing shapes investment strategies. Data localization laws further accelerate infrastructure expansion across key metro zones.

- For instance, Equinix launched its PA13x data center in Meudon, Paris in 2025 with an investment of about €350 million. The facility offers roughly 78,910 sq ft of colocation space and 28.8 MW of IT capacity. The site features 12 data halls and integrates photovoltaic panels covering approximately 350 m².

Innovation in Power and Cooling Efficiency

Continuous innovation in energy and cooling systems strengthens the France Data Center Infrastructure Market. It advances through high-efficiency UPS systems, liquid cooling, and heat-recovery technologies. Operators deploy smart monitoring to minimize downtime and power loss. The sector shifts toward modular designs that allow rapid deployment and scalability. Improved air-handling units and containment systems enhance thermal performance. Efficiency upgrades reduce operational costs and emissions. These changes attract investors focused on sustainable portfolios. Strategic alignment with France’s carbon neutrality targets further boosts long-term confidence.

Digital Transformation and AI-Driven Workloads

AI, analytics, and IoT applications increase computing demands within the France Data Center Infrastructure Market. It gains momentum as enterprises modernize IT ecosystems. Rising AI workloads require high-density racks and GPU clusters. Companies integrate automation tools to optimize resource utilization. Demand for smart infrastructure drives adoption of predictive maintenance systems. Edge deployments support latency-sensitive operations across logistics and manufacturing. Enhanced connectivity through 5G networks strengthens distributed computing. Firms invest in resilient data hubs to ensure service continuity under high loads.

- For example, the joint AI-ready data center campus development spearheaded by Bpifrance, MGX, Mistral AI, and NVIDIA, planned to deliver about 1,400 MW of high-density computing power. This initiative targets growing AI and GPU cluster workloads, emphasizing edge deployments and supporting latency-sensitive applications across sectors like logistics and manufacturing.

Strategic Investments and Policy Support

Government incentives and favorable policies encourage infrastructure development across the France Data Center Infrastructure Market. It benefits from data sovereignty rules that require local hosting of sensitive information. Tax benefits and streamlined approvals foster investor confidence. Private players partner with utilities to access renewable energy and stable power supply. Infrastructure projects align with national digitization goals and EU Green Deal mandates. Collaborative projects among telecom operators expand fiber backbones. Increased focus on regional hubs diversifies capacity beyond Paris. This ecosystem ensures balanced growth and long-term market resilience.

Market Trends

Market Trends

Shift Toward Sustainable and Carbon-Neutral Data Centers

Sustainability emerges as a defining trend in the France Data Center Infrastructure Market. Operators focus on carbon-neutral operations through renewable energy sourcing. Facilities adopt hydrogen fuel cells and advanced cooling technologies to reduce emissions. Circular energy usage models reuse heat for community networks. Certifications under ISO 50001 and LEED boost competitiveness. Energy transparency becomes essential for investors evaluating ESG performance. Green procurement policies drive suppliers toward low-impact materials. Environmental compliance acts as a market differentiator for international clients seeking sustainable partners.

Rise of Modular and Prefabricated Infrastructure Models

The modular construction approach dominates new developments in the France Data Center Infrastructure Market. It enables faster deployment, lower construction costs, and design flexibility. Prefabricated components improve scalability across hyperscale and enterprise facilities. Operators use plug-and-play modules to handle growing compute demand. This trend supports shorter delivery timelines for clients seeking immediate capacity. Modular designs reduce onsite labor and improve quality control. Data center developers leverage 3D modeling for precision planning. Prefabrication also enhances sustainability by minimizing construction waste and energy use.

Growing Importance of Edge and Micro Data Centers

Edge computing transforms the structure of the France Data Center Infrastructure Market. It supports decentralized data processing near end users for real-time applications. Telecom firms expand edge nodes for 5G and IoT services. Micro data centers address urban connectivity and latency-sensitive workloads. These installations enhance business continuity and local resilience. Enterprises deploy compact edge units to serve AI-driven automation systems. The trend increases demand for high-density power and efficient cooling. It broadens infrastructure needs across retail, transport, and healthcare verticals.

Integration of AI and Automation in Facility Operations

Automation tools redefine operational management in the France Data Center Infrastructure Market. AI enhances fault detection, capacity planning, and predictive maintenance. Smart sensors improve airflow management and power allocation. Real-time data analytics optimize system uptime and efficiency. Operators rely on digital twins for performance simulation and asset tracking. Automated reporting supports compliance with European sustainability regulations. Robotics and drones streamline physical inspections and inventory checks. The rise of autonomous systems ensures higher reliability and reduced operational costs.

Market Challenges

Market Challenges

High Energy Demand and Grid Pressure

The France Data Center Infrastructure Market faces rising energy consumption that strains local grids. It requires stable power delivery to support high-density computing loads. Grid congestion risks escalate during peak hours, affecting operational reliability. Energy pricing volatility adds uncertainty for long-term planning. Operators invest heavily in on-site renewable generation and battery systems. Regulatory frameworks emphasize efficiency targets that increase compliance costs. Balancing expansion with sustainability goals becomes a persistent challenge. Limited renewable integration in some regions delays decarbonization progress.

Land Availability and Environmental Compliance Constraints

Finding suitable land for large facilities poses major hurdles for the France Data Center Infrastructure Market. Urban expansion limits access to affordable, well-connected plots. Environmental regulations require strict adherence to noise, water, and emission standards. Lengthy permit procedures delay project execution and increase overhead. Developers navigate local zoning restrictions that vary by municipality. Community resistance to industrial expansion near residential zones adds complexity. Maintaining ecological balance while expanding infrastructure demands innovative site design. These constraints slow project timelines and raise development costs.

Market Opportunities

Rising Demand for AI, HPC, and Cloud Expansion

Growing AI and high-performance computing workloads create new opportunities in the France Data Center Infrastructure Market. It attracts hyperscale cloud providers expanding regional capacity. Enterprises upgrade to hybrid models combining private and public cloud systems. AI training facilities demand specialized infrastructure with high energy density. Investment in next-generation processors and interconnects fuels modernization. Start-ups offering AI-optimized data center services gain investor attention. Partnerships between tech firms and utilities improve long-term operational efficiency.

Expansion into Secondary Cities and Renewable Integration

Regional diversification opens fresh prospects for the France Data Center Infrastructure Market. Emerging zones such as Lyon, Marseille, and Toulouse witness increasing development interest. These areas offer lower costs, land availability, and strong fiber links. Operators target renewable-powered regions to meet sustainability mandates. Solar and wind integration enhances resilience against grid fluctuations. Regional incentives attract construction and logistics investment. This spatial expansion balances national capacity while supporting localized digital transformation.

Market Segmentation

By Infrastructure Type

Electrical infrastructure leads the France Data Center Infrastructure Market due to rising demand for stable power systems. Mechanical systems follow closely, driven by advanced cooling innovations. Civil and IT infrastructure segments support large-scale deployments in metro hubs. Growth in modular and prefabricated architecture enhances design flexibility. Investments in scalable electrical networks remain crucial for hyperscale development.

By Electrical Infrastructure

UPS systems dominate the electrical segment, ensuring uninterrupted power delivery. Battery Energy Storage Systems gain traction for load balancing and sustainability. PDUs and switchgears expand in high-density data halls. Transfer switches enhance redundancy and fault protection. The focus remains on reliability, efficiency, and renewable energy compatibility.

By Mechanical Infrastructure

Cooling units and chillers hold major share due to rising rack densities. Containment and piping systems optimize thermal management. Operators explore liquid and free-air cooling to reduce energy use. Mechanical innovations reduce operational costs and carbon impact. Vendors focus on low-GWP refrigerants to align with EU regulations.

By Civil / Structural & Architectural

Superstructure and modular systems drive growth in civil infrastructure. Raised floors and efficient envelope designs support airflow optimization. Prefabricated modules accelerate delivery and standardize builds. Developers emphasize seismic stability and durability. Energy-efficient materials gain importance for sustainability certification.

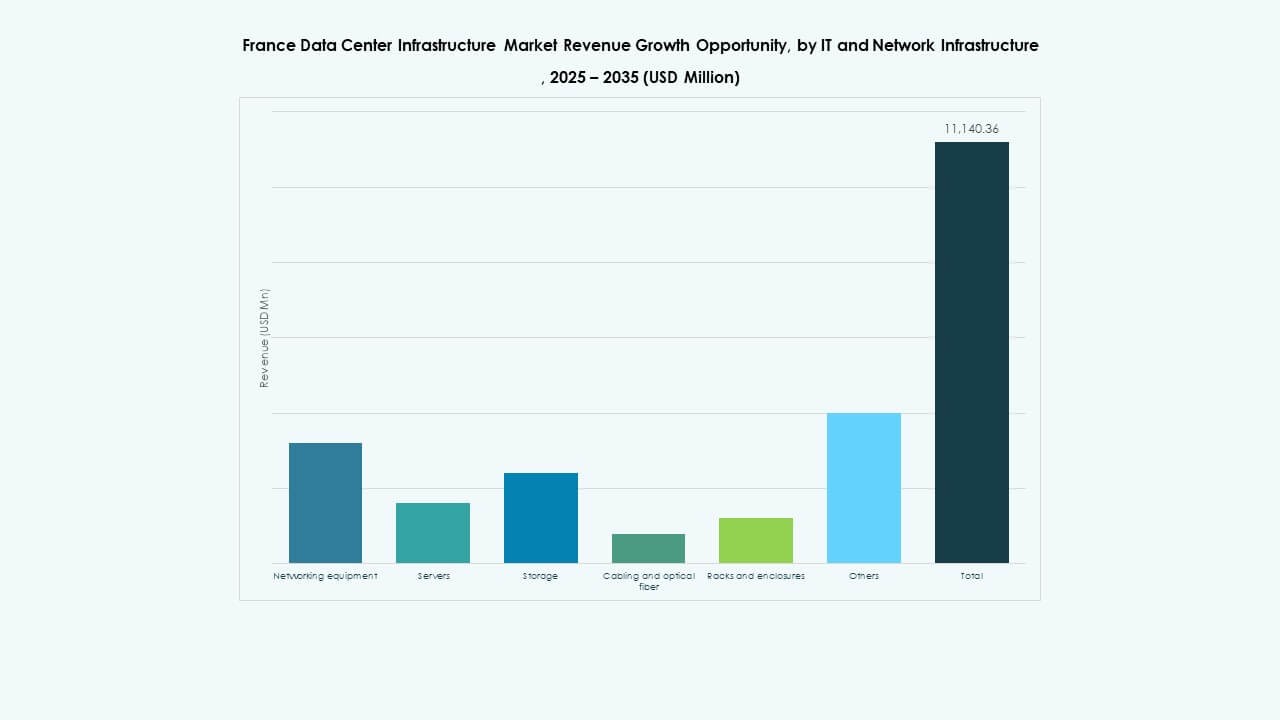

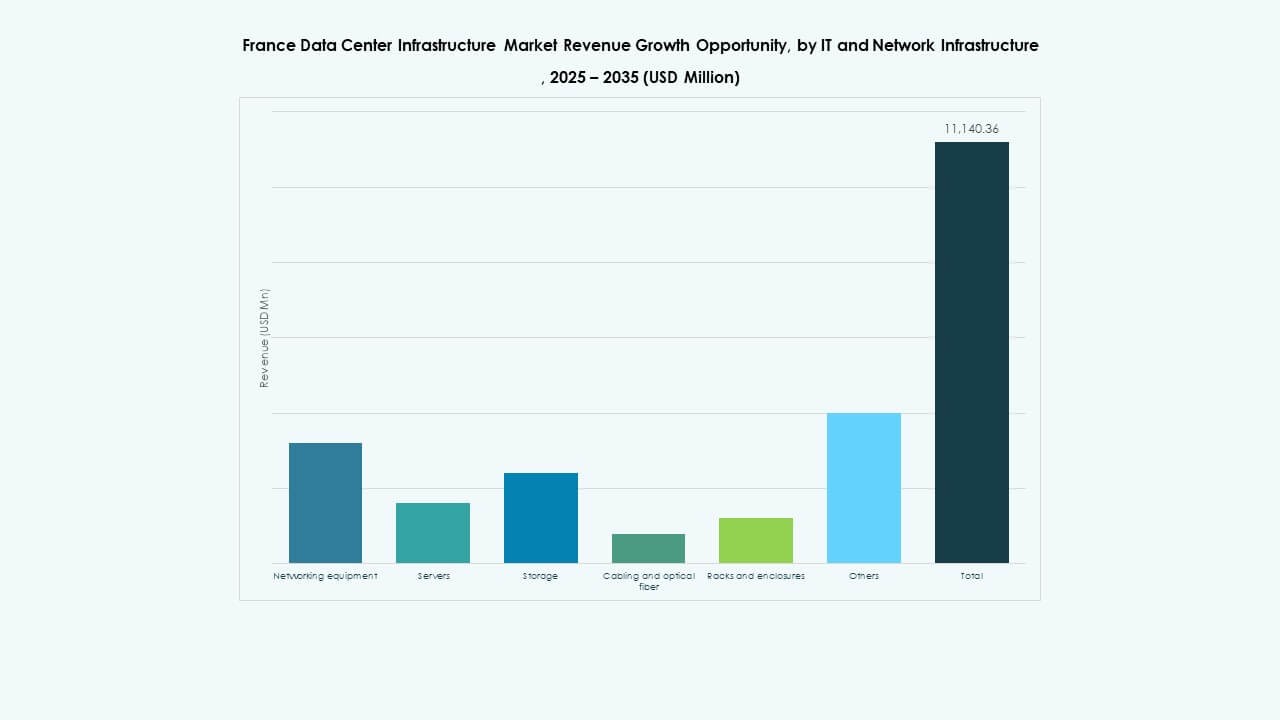

By IT & Network Infrastructure

Networking equipment and servers remain core of IT infrastructure. Storage expansion supports growing enterprise workloads. Fiber cabling enhances data speed and reliability. Racks and enclosures evolve to support dense configurations. Integration of AI-ready hardware strengthens digital performance.

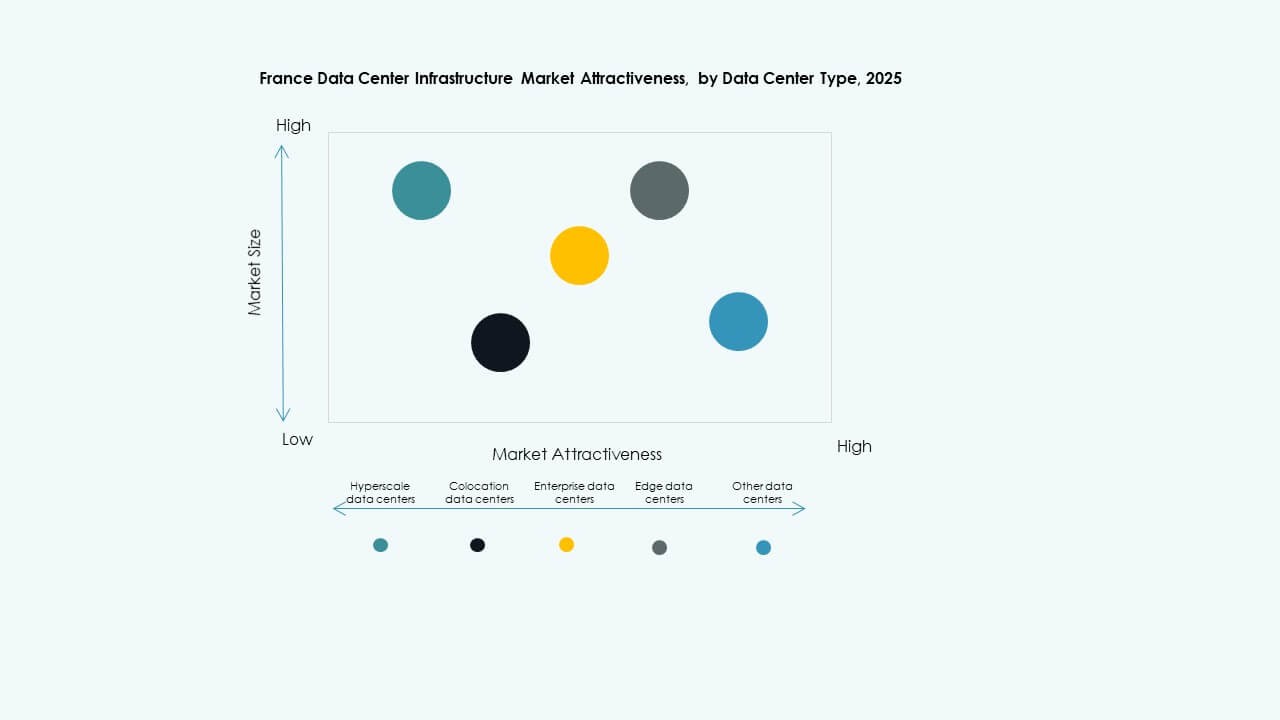

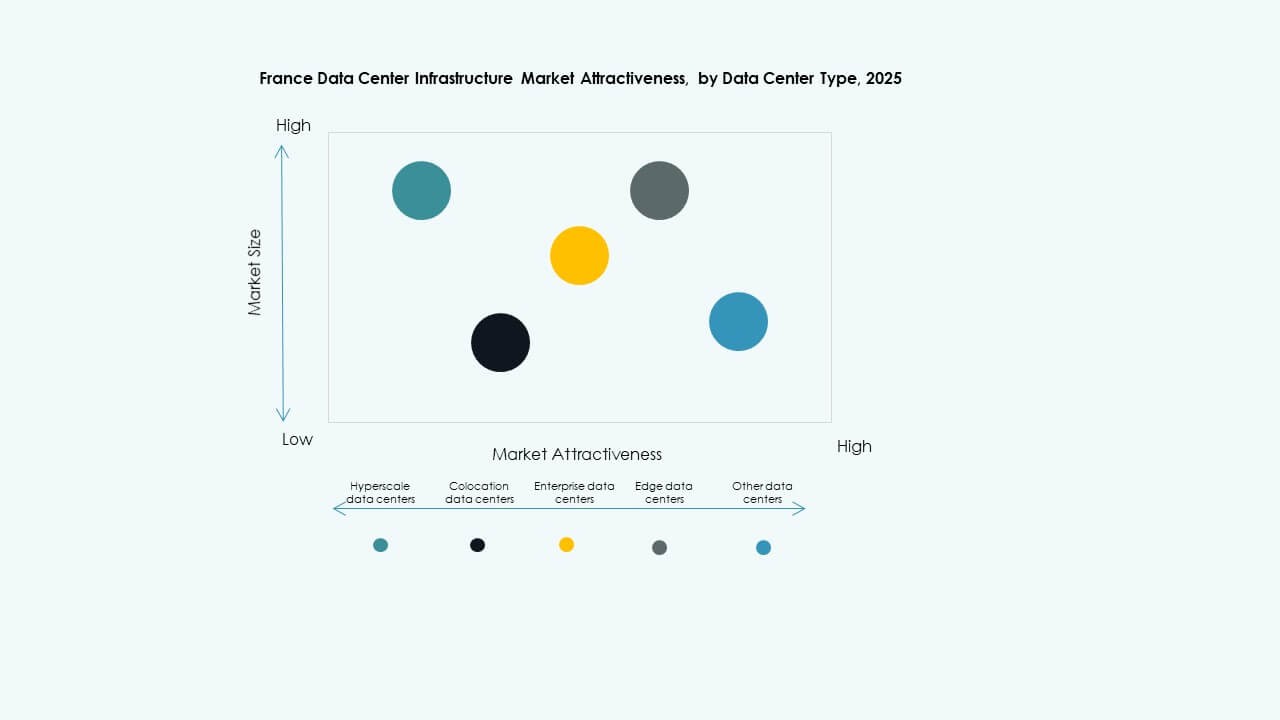

By Data Center Type

Hyperscale centers dominate, driven by global cloud providers. Colocation centers expand to serve enterprise outsourcing demand. Edge facilities rise with 5G adoption and local processing. Enterprise and government centers retain importance for confidential data hosting. Each segment complements national digital transformation goals.

By Delivery Model

Turnkey and design-build models lead due to efficiency and cost control. Modular factory-built solutions gain traction for speed and repeatability. Construction management approaches offer flexibility for phased projects. Retrofit and upgrade work sustain legacy facilities. EPC players focus on integrated project execution to reduce timelines.

By Tier Type

Tier 3 centers command the highest market share, offering balanced redundancy and cost efficiency. Tier 4 adoption increases among mission-critical industries. Tier 1 and Tier 2 serve smaller enterprises and edge sites. Growing demand for uptime assurance drives multi-tier investments. Advanced cooling and dual-power feeds become standard across high-tier projects.

Regional Insights

Regional Insights

Northern and Western France: Dominant Hubs for Hyperscale Expansion (Market Share: 47%)

Northern and Western France lead the France Data Center Infrastructure Market due to strong connectivity and access to renewable energy. Paris remains a key hub for hyperscale and colocation projects. Government-backed initiatives enhance grid capacity to support expansion. The presence of major cloud providers strengthens the regional ecosystem. Investors prefer these regions for reliable infrastructure and skilled workforce availability. Consistent renewable sourcing supports carbon-neutral commitments.

- For example, CloudHQ’s CDG Campus in Lisses, Grand Paris Sud, is a confirmed hyperscale data center site featuring two buildings with a combined IT load capacity of around 150 MW. Each facility spans approximately 53,000 square meters, reinforcing the region’s status as a major hub for large-scale digital infrastructure in France.

Southern and Central France: Emerging Growth Corridors (Market Share: 33%)

Southern and Central France gain traction through investments in Marseille and Lyon corridors. These areas benefit from submarine cable access and favorable climate conditions. Strong fiber networks connect to Mediterranean digital routes. Developers target energy-efficient designs suited for warm climates. Industrial clusters in these zones drive enterprise-led facility expansion. Supportive local policies and affordable land make them attractive for new entrants.

- For example, Interxion, a Digital Realty company, operates several major data centers in Marseille, strategically positioned to leverage Mediterranean submarine cable connectivity. The Marseille campus includes multiple facilities such as MRS1, MRS2, and MRS3, featuring advanced cooling systems and serving as a key colocation hub connecting Europe, Africa, and the Middle East.

Eastern France and Outlying Regions: Strategic Expansion Frontiers (Market Share: 20%)

Eastern France and peripheral regions represent the next wave of infrastructure diversification. Data centers near Strasbourg and Lille serve cross-border connectivity with Germany and Benelux. These zones offer cost-effective power and transport links. Growing industrial digitization boosts local data demand. Governments promote regional inclusion to balance digital capacity across France. The trend enhances resilience and reduces overreliance on metropolitan hubs.

Competitive Insights:

- Equinix, Inc.

- Digital Realty

- DATA4

- Schneider Electric

- Vertiv Group Corp.

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM

- Dell Inc.

The France Data Center Infrastructure Market remains highly competitive, with global and regional leaders investing heavily in capacity expansion and energy-efficient solutions. It benefits from strong participation by technology providers and colocation specialists focused on modular, scalable systems. Companies emphasize green data center designs to align with national sustainability targets. Equinix and Digital Realty dominate through extensive colocation portfolios, while Schneider Electric and Vertiv lead in power and cooling systems. Cisco, HPE, and Huawei strengthen IT networking and server integration capabilities. Continuous partnerships between vendors, construction firms, and energy suppliers sustain innovation and operational excellence across new and upgraded facilities.

Recent Developments:

- In November 2025, EDF and OpCore announced a joint development plan for a €4 billion data center project in France, with the first phase expected to be operational by 2027. This initiative aligns with France’s fast-track grid connection scheme and represents a significant investment in the country’s digital infrastructure.

- In July 2025, Vesper Infrastructure acquired French data center operator Thésée DataCenter from French state-owned investment group Caisse des Dépôts et Consignations/Banque des Territoires and Groupe IDEC Invest.

- In May 2025, Prologis announced a development plan for four data center sites in Paris, set to provide more than 580 MW of capacity around the French capital, highlighting the growing trend of large-scale data center projects in the region.

- In February 2025, Equinix, Inc. inaugurated its 11th data center in France, named PA13x, located in Meudon near Paris, with an investment of around €350 million. This new facility strengthens Equinix’s presence in the Île-de-France region and underlines its commitment to providing sustainable digital infrastructure for businesses and cloud players, including partnerships with Engie Solutions to utilize excess heat for local energy networks.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights