Executive summary:

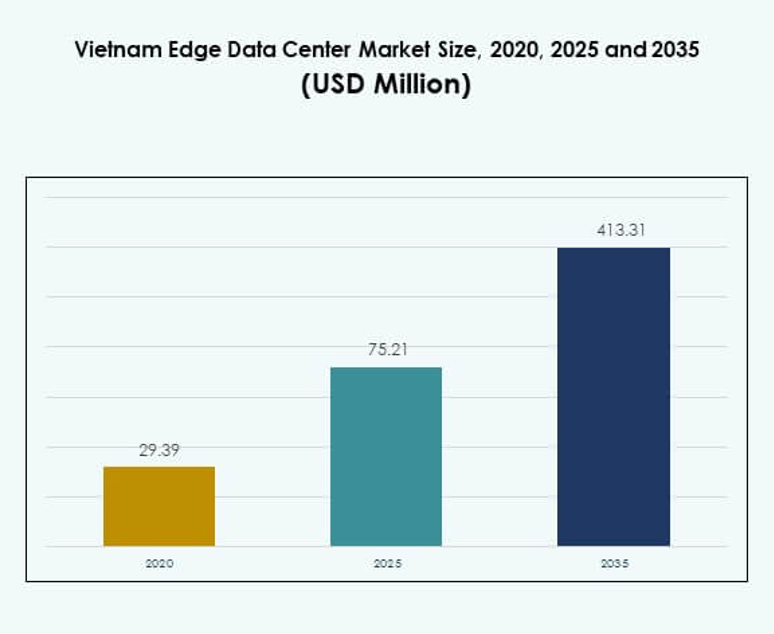

The Vietnam Edge Data Center Market size was valued at USD 29.39 million in 2020, USD 75.21 million in 2025, and is anticipated to reach USD 413.31 million by 2035, at a CAGR of 18.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Vietnam Edge Data Center Market Size 2025 |

USD 75.21 Million |

| Vietnam Edge Data Center Market, CAGR |

18.40% |

| Vietnam Edge Data Center Market Size 2035 |

USD 413.31 Million |

Edge computing is expanding rapidly across Vietnam, driven by 5G rollout, AI adoption, and increasing data localization. Businesses view edge facilities as critical for enhancing operational speed and service reliability. The market is strategically important for investors seeking early entry into high-growth digital infrastructure. Strong demand from telecom, BFSI, and manufacturing sectors is fueling sustained expansion. Ongoing innovation in edge architecture and modular designs is reshaping the country’s digital landscape.

The North region is leading due to its developed connectivity infrastructure and concentration of large-scale data centers. The South region is emerging as a major hub with strong enterprise demand and urban digital transformation. The Central region is gaining traction through new investments and smart city programs. This regional balance strengthens Vietnam’s position as a strategic location for edge infrastructure development in Southeast Asia.

Market Drivers

Rapid Expansion of 5G Infrastructure and Data Localization Requirements

Widespread deployment of 5G networks across the country is reshaping digital infrastructure. Telecom operators and cloud providers are investing in high-speed, low-latency systems to support advanced services. Edge data centers enable efficient processing near users, improving response times and network reliability. Growing data localization policies are increasing the need for localized computing hubs. Businesses are viewing edge infrastructure as a strategic asset for scaling operations. Investors recognize its role in powering new digital services. It drives broader digital transformation across key industries. Vietnam Edge Data Center Market benefits from this rapid infrastructure modernization.

- For example, Viettel plans to deploy over 2,000 5G Open RAN stations nationwide in 2025, using Qualcomm chipset platforms, making Vietnam one of six countries able to manufacture 5G network equipment. This deployment supports ultra-low latency performance and strengthens Vietnam’s 5G digital infrastructure.

Rising Digital Transformation Across Enterprises and Public Sectors

Enterprises in banking, healthcare, retail, and telecom are accelerating digital transformation plans. They rely on real-time analytics, AI workloads, and smart applications to enhance services. Edge computing enables faster decision-making by reducing dependence on distant data centers. Government digitalization programs are further boosting edge adoption. Companies are using edge infrastructure to improve operational efficiency and user experience. This demand is drawing strong interest from both local and global investors. It creates stable opportunities for long-term returns. Vietnam Edge Data Center Market gains strategic significance through this digital shift.

Increased Demand for Low Latency and High Computing Capacity Applications

The growing popularity of smart devices, IoT systems, and connected platforms requires ultra-low latency networks. Enterprises are moving workloads closer to end users to meet strict performance requirements. Edge facilities reduce traffic on backbone networks while improving security and reliability. The technology supports new business models in manufacturing, logistics, and financial services. Tech firms are building advanced nodes to strengthen competitive positioning. Investors see this demand as a driver for scalable deployments. It sets the foundation for future digital ecosystems. Vietnam Edge Data Center Market aligns with these performance-focused strategies.

- For example, CMC Corporation received approval in mid-2025 for a USD 250 million hyperscale data center in Ho Chi Minh City. The facility will launch with a 30 MW capacity, expandable to 120 MW, and will integrate advanced networking technologies to support large-scale AI and IoT workloads. This project marks a major step in strengthening Vietnam’s digital infrastructure.

Accelerated Innovation Through Strategic Partnerships and Cloud Ecosystem Growth

Global and local technology firms are forming partnerships to expand edge capacity. These alliances focus on integrating AI, IoT, and automation tools into next-generation data centers. Cloud service providers are also extending their footprint to support hybrid and distributed architectures. Enterprises are leveraging these models to optimize cost and improve operational agility. The strategic relevance of these developments attracts large capital inflows. This innovation accelerates infrastructure maturity and industry competitiveness. It enhances market visibility for long-term players. Vietnam Edge Data Center Market benefits from ecosystem synergy and technology evolution.

Market Trends

Integration of Artificial Intelligence and Automation Within Edge Infrastructure

Edge facilities are increasingly integrating AI-driven solutions for predictive maintenance and resource optimization. Automation tools are enhancing energy efficiency, cooling systems, and operational control. Enterprises are adopting AI at the edge to support real-time applications like autonomous vehicles and telemedicine. This shift creates new service delivery models and operational flexibility. Tech providers are deploying advanced management software to reduce manual intervention. It strengthens operational reliability and performance consistency. Global and local players are investing heavily in AI integration. Vietnam Edge Data Center Market is evolving with smarter operational capabilities.

Emergence of Green Data Centers with Strong Sustainability Targets

Growing environmental concerns are driving the shift toward sustainable edge infrastructure. Operators are deploying energy-efficient cooling systems and renewable power solutions. Green certifications are becoming a key competitive factor in securing enterprise contracts. Companies are adopting modular designs to minimize resource usage and optimize performance. Governments and enterprises are aligning infrastructure with ESG goals. It builds investor confidence in the long-term viability of assets. Partnerships with renewable energy suppliers are rising. Vietnam Edge Data Center Market reflects this strategic sustainability transition.

Wider Adoption of Modular and Prefabricated Data Center Designs

Modular architectures are gaining preference due to fast deployment timelines and flexibility. Prefabricated edge units allow operators to scale infrastructure rapidly across multiple regions. Enterprises view modular models as cost-efficient and less disruptive to operations. Vendors are delivering containerized solutions with advanced power and cooling integrations. This trend enables dynamic network expansion strategies. It reduces deployment risks and enhances adaptability. Cloud service providers are increasingly adopting modular models for expansion. Vietnam Edge Data Center Market is aligning with scalable and agile infrastructure designs.

Rising Investment in Rural and Tier-2 City Edge Deployments

The demand for reliable connectivity is growing beyond major urban centers. Enterprises and service providers are targeting rural and tier-2 cities for new deployments. Edge nodes in smaller cities improve service delivery and network reach. These expansions support e-commerce growth, smart agriculture, and local manufacturing. Government digitalization programs are fueling these regional deployments. It diversifies network infrastructure across the country. Investors see these emerging areas as high-potential growth zones. Vietnam Edge Data Center Market expands its footprint through rural edge infrastructure.

Market Challenges

High Infrastructure Costs and Complex Network Integration Issues

Building edge facilities requires significant capital investment and technical expertise. Operators must integrate advanced power, cooling, and network systems into distributed environments. The cost of establishing resilient infrastructure is often higher than traditional models. Many firms face challenges aligning edge deployments with legacy systems. Limited skilled labor also slows development in several regions. These hurdles create financial and operational barriers for new entrants. It puts pressure on businesses to secure strategic partnerships and funding. Vietnam Edge Data Center Market faces structural obstacles due to these cost complexities.

Regulatory Framework Gaps and Data Security Concerns

Lack of a unified regulatory framework creates uncertainty for operators and investors. Data localization requirements demand strict compliance but vary across sectors. Companies must address cybersecurity threats linked to distributed architectures. Securing multiple edge nodes is more complex than centralized facilities. Unclear legal guidelines often delay deployment approvals. These issues limit infrastructure growth in critical areas. It increases operational risks for service providers and enterprises. Vietnam Edge Data Center Market must navigate evolving regulatory and security landscapes.

Market Opportunities

Growing Demand from Emerging Digital Ecosystems and Enterprise Expansion

New industries like fintech, e-commerce, and telehealth are driving demand for edge solutions. These ecosystems depend on real-time analytics and reliable connectivity. Enterprises are expanding into underserved regions to reach new customers. Government incentives encourage technology investments and foreign partnerships. It creates strong opportunities for infrastructure developers and investors. Rising cross-industry collaborations enhance market reach. Vietnam Edge Data Center Market stands to gain strategic momentum from this expansion.

Integration of Renewable Energy and AI to Strengthen Competitive Edge

The integration of renewable power solutions is attracting green investors and ESG funds. AI-driven automation allows operators to optimize energy use and cost efficiency. Companies that deploy sustainable edge nodes gain strong brand positioning. Governments are supporting clean energy transitions in infrastructure projects. It encourages large-scale investment from global technology firms. Competitive advantages emerge through cost reduction and environmental compliance. Vietnam Edge Data Center Market is well placed to capitalize on these sustainable growth opportunities.

Market Segmentation

By Component

Solution dominates the segment due to rising demand for integrated infrastructure platforms. Enterprises prioritize scalable and secure solutions to support mission-critical workloads. Advanced cooling, power, and AI-driven management systems enhance operational efficiency. Service offerings, including managed maintenance and monitoring, are growing steadily. It ensures long-term stability and cost control for operators. Vietnam Edge Data Center Market benefits from strong demand for comprehensive solutions that reduce operational complexity.

By Data Center Type

Colocation edge data centers hold the largest market share due to flexibility and cost benefits. Enterprises use these facilities to deploy edge computing without high upfront investments. Managed and cloud edge centers are also expanding, driven by digital transformation. Providers offer high security, strong connectivity, and optimized energy performance. It allows businesses to scale infrastructure with minimal complexity. Vietnam Edge Data Center Market reflects this strong colocation-led growth trend.

By Deployment Model

Hybrid deployment model leads due to its balance of control, security, and flexibility. Enterprises combine on-premises infrastructure with cloud systems to optimize workload distribution. Hybrid solutions improve business continuity and support real-time applications. On-premises models remain relevant in regulated industries, while cloud-based models support scalability. It enables cost-effective and reliable service delivery. Vietnam Edge Data Center Market grows with rising hybrid deployments across multiple verticals.

By Enterprise Size

Large enterprises dominate this segment due to their capacity to invest in advanced infrastructure. These companies focus on low latency, high computing power, and strong network security. SMEs are steadily increasing adoption with flexible and cost-effective solutions. Service providers are offering modular deployment options to target smaller businesses. It expands the market base and encourages infrastructure innovation. Vietnam Edge Data Center Market shows strong growth potential across both enterprise groups.

By Application / Use Case

Power monitoring applications lead this segment due to their critical role in operational stability. Edge facilities rely on precise energy tracking to reduce costs and optimize performance. Capacity and environmental monitoring are gaining momentum with AI-based solutions. BI and analytics use cases support smart manufacturing and digital commerce. It ensures efficient resource use and reliable service delivery. Vietnam Edge Data Center Market benefits from strong adoption of energy and data intelligence tools.

By End User Industry

IT and telecommunications sector holds the dominant share due to its early adoption of edge computing. BFSI and retail sectors are rapidly expanding their deployments to enhance real-time operations. Healthcare is leveraging edge infrastructure for telemedicine and secure patient data. Energy and utilities are deploying edge systems for grid management and monitoring. It creates a diverse ecosystem supporting multiple industries. Vietnam Edge Data Center Market strengthens its position through broad industry adoption.

Regional Insights

North Region: High Market Penetration Driven by Infrastructure Expansion

The North region leads with a 42% market share supported by advanced telecom infrastructure. Hanoi acts as a central hub for digital innovation and data localization projects. Enterprises benefit from strong connectivity and high investment inflows. Major service providers are expanding colocation and hybrid edge facilities in this region. It attracts both local and international investors targeting digital services. Vietnam Edge Data Center Market sees strong growth momentum in this strategic hub.

- For instance, in August 2025, Vietnam’s Ministry of Public Security inaugurated National Data Center No. 1 in Hanoi’s Hoa Lac Hi-Tech Park, spanning over 20 hectares and supporting 1,300 server racks, marking one of Southeast Asia’s largest national-level facilities for consolidating government databases and powering digital transformation.

Central Region: Emerging Growth Hub with Strategic Connectivity Development

The Central region holds 27% of the market share with growing interest in infrastructure investment. Regional connectivity projects and smart city programs are creating favorable conditions for expansion. Enterprises are targeting tier-2 cities to extend service coverage. Government incentives encourage private sector involvement in digital infrastructure. It is gradually becoming an important secondary hub for new deployments. Vietnam Edge Data Center Market benefits from rising activity in this region.

- For example, in August 2025, IPTP Networks announced the AIDC DeCenter project in Da Nang Hi-Tech Park with an investment of USD 200 million. The facility is designed to support 1,000 server racks and offer carrier-neutral, multi-operator connectivity. It will be strategically linked to major submarine cable landing points to enhance Vietnam’s international digital infrastructure.

South Region: Strong Investment in Urban Digital Infrastructure

The South region accounts for 31% of the market share, driven by rapid digital adoption. Ho Chi Minh City hosts several large-scale edge deployments supporting financial and retail sectors. High population density and industrial activities make it a prime target for investors. The region attracts multinational firms aiming to establish regional data nodes. It strengthens the overall ecosystem through technology transfer and capacity building. Vietnam Edge Data Center Market gains long-term advantages from this southern expansion.

Competitive Insights:

- Viettel Group

- VNPT (Vietnam Posts & Telecom)

- MobiFone

- FPT Telecom

- EdgeConneX

- Fujitsu

- Cisco

- Eaton Corporation

- Dell Technologies Inc.

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

The competitive landscape of the Vietnam Edge Data Center Market is shaped by telecom operators, cloud service providers, and global technology firms. It is driven by infrastructure expansion, strategic partnerships, and investments in modular and hybrid edge facilities. Local players like Viettel Group and VNPT leverage strong connectivity networks and government support. Global firms including Cisco, Dell Technologies, and Microsoft bring advanced technologies to enhance performance and security. EdgeConneX and Schneider Electric strengthen the market with colocation and power management solutions. This mix of domestic and international capabilities creates intense competition and rapid technological progress. Companies focus on reliability, scalability, and sustainable operations to secure long-term contracts.

Recent Developments:

- In August 2025, Viettel Group commenced work on two landmark projects: the An Khanh Data Center in Hanoi and the Viettel Research & Development Center at Hoa Lac Hi-Tech Park, together representing an investment exceeding $1 billion. The An Khanh Data Center is positioned to become northern Vietnam’s largest, designed for 60MW capacity, and is set to be upgraded to hyperscale status by 2030, providing robust support for national digital transformation and AI initiatives.

- In August 2025, VNPT announced a partnership with South Korea’s LG CNS and Korea Investment Real Asset Management to develop Vietnam’s first 40MW hyperscale AI data center, signaling a leap in the country’s AI capabilities and infrastructure competitiveness.

- In May 2025, Korea Telecom and Viettel entered into a partnership valued at $94.6 million. The collaboration aims to develop AI-centric technologies and GPU farm infrastructure for Vietnamese-language virtual assistants and anti-fraud analytics within Vietnam’s edge data center ecosystem.

- In April 2025, Viettel, Vietnam’s largest telecommunications provider, broke ground on the Tan Phu Trung Data Center in Ho Chi Minh City, marking the launch of the country’s first hyperscale facility to exceed 100 MW in capacity. This edge data center, spanning nearly four hectares and designed for approximately 10,000 racks, specifically targets AI workloads with advanced cooling technologies capable of supporting up to 60 kW per rack.