Executive summary:

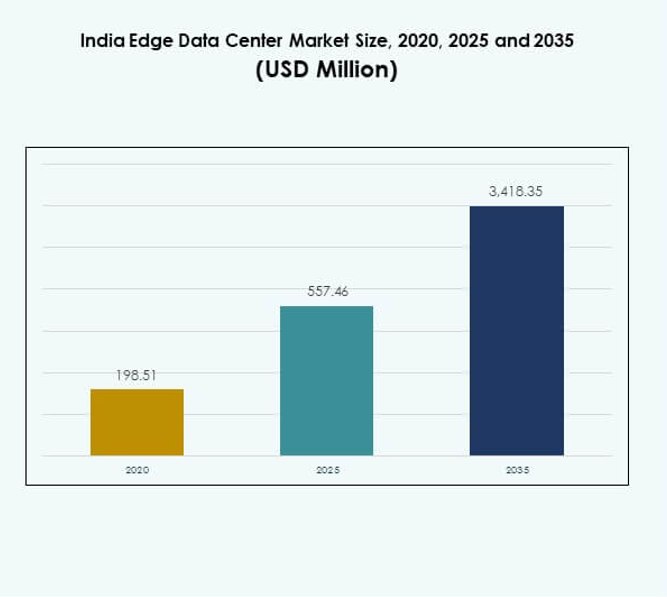

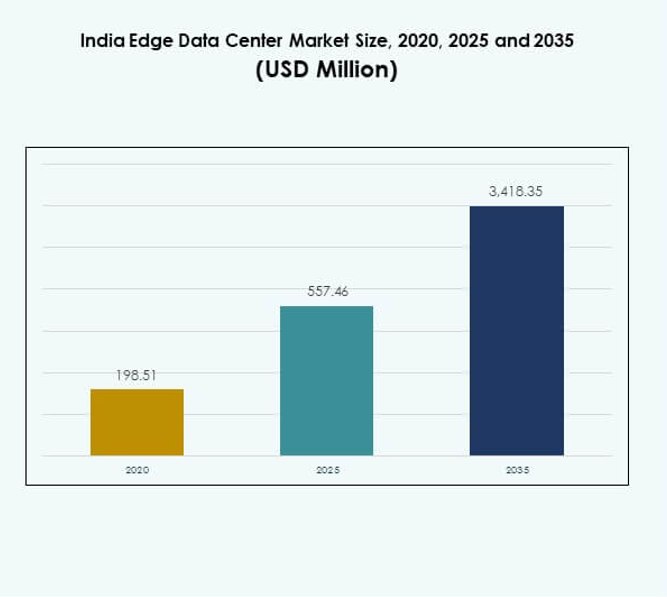

The India Edge Data Center Market size was valued at USD 198.51 million in 2020, increased to USD 557.46 million in 2025, and is anticipated to reach USD 3,418.35 million by 2035, at a CAGR of 19.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| India Data Center Market Size 2025 |

USD 557.46 Million |

| India Data Center Market, CAGR |

19.75% |

| India Data Center Market Size 2035 |

USD 3,418.35 Million |

The market is driven by the rapid expansion of digital infrastructure, accelerated 5G deployment, and growing adoption of AI, IoT, and cloud services. Rising data traffic from connected devices and smart applications creates strong demand for low-latency, secure processing near end users. It holds strategic importance for businesses and investors aiming to strengthen data sovereignty, enable real-time analytics, and support India’s digital economy transformation.

Geographically, western and southern India dominate the landscape, led by major data center hubs in Maharashtra, Karnataka, and Tamil Nadu due to superior power availability and network connectivity. Northern India, particularly Delhi-NCR, is emerging rapidly with strong enterprise concentration and government support. Eastern and central regions are developing steadily, driven by improved digital infrastructure and growing private investments.

Market Drivers

Rapid Digitalization and Cloud Expansion Across Key Sectors

The India Edge Data Center Market is witnessing strong growth driven by digital transformation across industries such as BFSI, retail, and telecommunications. The expansion of cloud computing, AI, and IoT technologies demands localized processing to reduce latency. Businesses are investing in distributed IT frameworks to improve data efficiency and customer experience. It supports the growing volume of real-time data generated by mobile and connected devices. The adoption of hybrid and multi-cloud models strengthens data sovereignty and compliance. Rising enterprise adoption of digital payment systems and automation fuels the need for edge facilities. Enterprises view localized data hosting as a strategic investment to improve operational agility. This transition positions India as a major hub for future-ready digital infrastructure.

5G Rollout Accelerating Edge Infrastructure Development

The rollout of 5G networks is a crucial driver transforming connectivity and data processing patterns. The technology enables ultra-low-latency communication, supporting high-performance applications like autonomous vehicles and industrial automation. Telecom operators and data center developers collaborate to deploy micro data hubs near user locations. It enhances speed, reliability, and network efficiency for digital services. The integration of 5G with IoT increases demand for scalable edge nodes in both urban and semi-urban regions. Smart city and Industry 4.0 initiatives also strengthen this infrastructure expansion. Leading companies such as Reliance Jio and Bharti Airtel invest in edge ecosystems to optimize network utilization. These efforts accelerate innovation and reinforce India’s position in next-generation connectivity.

Government Policies Promoting Data Localization and Digital Infrastructure Growth

Supportive government initiatives and data protection regulations encourage domestic data storage. The Digital India program and draft Data Protection Bill emphasize localized processing to improve privacy and cybersecurity. It drives foreign cloud providers to build regional data hubs within the country. Infrastructure status recognition for data centers allows easier financing and tax incentives. State governments in Maharashtra, Telangana, and Tamil Nadu promote data parks and power subsidies. Collaboration between public and private entities accelerates edge deployments. Enhanced renewable energy policies also align with the sustainability goals of modern facilities. This policy support creates a stable foundation for long-term market expansion.

- For instance, NES Data, based in Pune, develops modular and containerized edge data centers aimed at Tier II and remote towns, planning to expand its total Indian capacity to over 100MW within three years from its existing 5MW Pune site. In North India, ESDS is constructing a 30MW solar-powered facility in Ghaziabad, operated entirely on renewable energy supplied by Central Electronics Limited, showcasing the region’s focus on sustainable data infrastructure.

Growing Enterprise Demand for Low-Latency Data and AI Analytics

The surge in AI-driven applications and real-time analytics is boosting demand for edge data centers. Enterprises rely on faster insights to enhance decision-making, supply chain visibility, and consumer engagement. It enables efficient processing of data closer to its source, reducing reliance on centralized facilities. The growth of video streaming, online gaming, and digital services further amplifies capacity needs. Advanced workloads such as machine learning inference and predictive analytics thrive in edge environments. Startups and global tech firms are focusing on modular edge architectures for flexibility. Strategic partnerships between hyperscalers and telecom operators support scalable deployments. The market’s technological maturity signals India’s rise as a data-driven economy.

- For instance, Bharti Airtel’s “Xtelify” subsidiary launched a sovereign, telco-grade cloud platform in August 2025, hosted on next-generation sustainable data centers, supporting 140 crore (1.4 billion) transactions per minute and managed by 300 certified experts showcasing significant scalable, AI-enabled digital capabilities for enterprise clients.

Market Trends

Rising Adoption of Modular and Prefabricated Data Center Designs

The India Edge Data Center Market is moving toward modular architectures that enable faster and cost-effective deployments. Prefabricated modules offer scalability and reduced construction time for emerging digital hubs. Enterprises prefer modular setups for flexibility in managing power, cooling, and capacity. It supports the distributed computing model essential for edge ecosystems. Demand for containerized edge units is increasing across remote industrial and telecom locations. Vendors integrate automation to monitor these compact facilities efficiently. Companies leverage modularity to achieve energy efficiency and operational resilience. This trend enhances agility in expanding digital infrastructure nationwide.

Integration of AI and Automation in Data Center Operations

AI-based monitoring tools and automation technologies are reshaping operational efficiency and uptime management. Automated systems optimize cooling, energy utilization, and predictive maintenance in data centers. It helps operators reduce human errors while improving sustainability metrics. Machine learning algorithms analyze workload patterns to balance power usage dynamically. The adoption of digital twins and robotics improves maintenance accuracy. Firms deploy AI-based monitoring to achieve faster incident detection and response times. Sustainability-focused automation enhances power usage effectiveness across multiple edge nodes. This technological evolution strengthens operational transparency and resource efficiency.

Increased Collaboration Between Telecom Providers and Cloud Operators

Partnerships between telecom companies and hyperscale cloud providers are transforming the edge computing landscape. Joint ventures enable seamless integration of connectivity and compute capabilities at the network edge. It supports latency-sensitive applications such as AR/VR, telemedicine, and autonomous systems. Telecoms leverage their fiber networks to host distributed edge nodes efficiently. Global providers collaborate with local ISPs for shared infrastructure use. These alliances reduce operational costs and accelerate regional network expansion. Hybrid deployment frameworks also enable enterprises to manage workloads across multiple clouds. This cooperation fosters ecosystem synergy across the digital value chain.

Sustainability and Renewable Energy Integration in Edge Facilities

Sustainability is becoming a central theme in edge infrastructure development. Operators are shifting toward renewable energy sources to lower operational costs and emissions. It aligns with India’s carbon reduction targets and green data policy initiatives. Deployment of solar and wind-backed power solutions increases energy independence. Advanced cooling systems and waste heat recovery improve environmental performance. Data centers adopt circular design principles to minimize resource consumption. Companies focus on achieving low PUE levels across distributed nodes. This eco-centric transition strengthens India’s image as a sustainable data hub.

Market Challenges

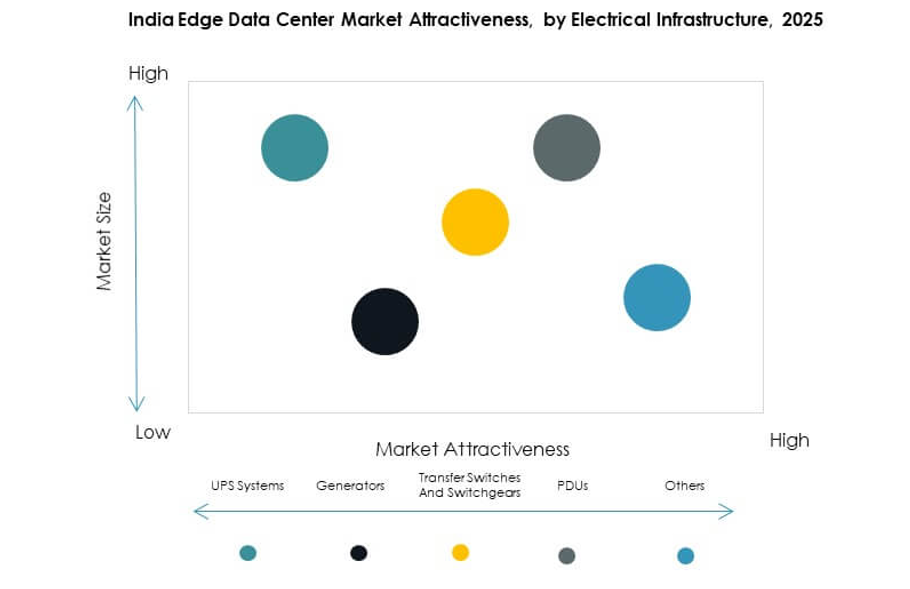

High Energy Consumption and Infrastructure Reliability Concerns

The India Edge Data Center Market faces challenges linked to high energy usage and infrastructure dependability. Power availability remains inconsistent across several states, impacting uptime performance. It forces operators to invest in backup generation and advanced cooling to maintain resilience. Energy costs account for a major share of operational expenses, reducing profitability margins. Integrating renewable power is limited by grid instability and land constraints. Smaller enterprises struggle to fund energy-efficient upgrades or micro-grid setups. Regional disparities in infrastructure readiness hinder uniform expansion. Addressing these challenges is vital for improving sustainability and reliability metrics.

Regulatory Uncertainty and Skilled Workforce Shortage

Evolving data protection regulations and compliance frameworks create uncertainty for investors. The India Edge Data Center Market must adapt to frequent policy changes impacting foreign participation. It also faces a shortage of specialized engineers skilled in edge architecture, cooling systems, and cybersecurity. Training programs for technical staff remain limited, slowing deployment cycles. Complex land acquisition processes add to project delays in certain regions. Licensing and interconnection procedures differ among states, complicating scalability. Local operators must balance compliance with efficiency to retain competitiveness. Strengthening policy clarity and workforce training will support steady growth.

Market Opportunities

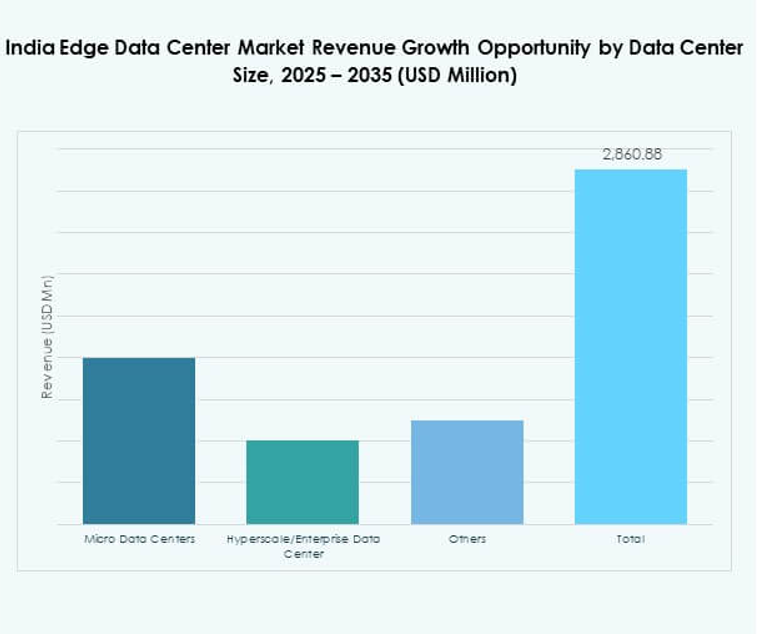

Rising Investments from Global Hyperscalers and Telecom Players

Growing collaboration between hyperscale providers and telecom companies presents major opportunities. The India Edge Data Center Market benefits from foreign capital inflows aimed at expanding local presence. It offers vast potential for cloud giants establishing distributed nodes near population centers. Telecom firms partner with tech enterprises to monetize network capacity through edge integration. Strategic investments in tier-2 cities open new markets for localized data processing. Partnerships foster innovation in edge hardware and AI deployment. Expanding 5G rollout further increases the value of scalable edge infrastructure. This investment wave enhances India’s global competitiveness in digital infrastructure.

Adoption of Smart Cities and Industry 4.0 Applications

The government’s push for smart cities and automation-based industries is opening new frontiers for edge computing. The India Edge Data Center Market is crucial for supporting IoT-driven urban management and manufacturing operations. It enables real-time control systems for utilities, transport, and logistics networks. Industrial zones adopt edge solutions for predictive maintenance and process optimization. Localized data handling improves security and response time for urban infrastructure. The integration of edge computing within national innovation projects boosts digital self-reliance. Continuous demand for connected automation systems expands future deployment opportunities.

Market Segmentation

By Component

Solutions dominate the India Edge Data Center Market, holding a major share due to rising demand for power management, cooling, and network optimization systems. It ensures efficiency and uptime for critical workloads across distributed facilities. The service segment grows steadily, supported by maintenance and managed offerings catering to SMEs. Solution providers invest in scalable architectures integrating automation and analytics.

By Data Center Type

Colocation edge data centers lead the market due to their scalability, cost efficiency, and shared infrastructure models. Enterprises and startups prefer these facilities for flexibility and reduced capital expenditure. Managed and cloud edge centers follow closely, benefiting from 5G integration and hybrid cloud strategies. It creates a competitive ecosystem driving innovation in localized computing solutions.

By Deployment Model

Cloud-based models dominate due to their scalability and reduced hardware dependency. Hybrid setups are gaining traction among enterprises seeking both control and flexibility. It supports data compliance while optimizing cost and operational efficiency. On-premises models remain relevant for critical and regulated sectors requiring higher data security.

By Enterprise Size

Large enterprises account for the majority share due to extensive data traffic and multi-site operations. It drives demand for advanced monitoring, automation, and AI-enabled processing. SMEs are emerging adopters, driven by digital transformation and cost-effective managed services. Cloud migration strategies are enabling smaller firms to leverage edge infrastructure efficiently.

By Application / Use Case

Power monitoring holds a significant share, driven by the need for efficient energy utilization and uptime management. Capacity and environmental monitoring follow, supporting sustainability and system reliability. BI and analytics applications gain momentum through AI integration and predictive tools. The market supports diverse industrial workloads across all use cases.

By End User Industry

The IT and telecommunications segment leads the India Edge Data Center Market, supported by rapid data growth and 5G networks. BFSI and retail sectors follow due to real-time data needs and digital transaction expansion. Healthcare and energy industries adopt edge computing for faster diagnostics and monitoring. This cross-industry uptake reflects India’s evolving digital economy.

Regional Insights

Western and Southern India – Major Data Center Hubs (38% Market Share)

Western and southern India dominate the India Edge Data Center Market with Maharashtra, Karnataka, and Tamil Nadu leading. These states benefit from robust power infrastructure, coastal connectivity, and tech ecosystems. It attracts global investments in hyperscale and edge facilities. Availability of renewable energy and submarine cables enhances sustainability and redundancy. Government incentives and skilled workforce further strengthen these regional clusters. Strategic cities like Mumbai, Bengaluru, and Chennai serve as gateways for digital expansion across Asia-Pacific.

Northern India – Emerging Growth Region (34% Market Share)

Northern India, particularly Delhi-NCR, is rapidly evolving as a secondary data center hub. High enterprise concentration, expanding e-commerce, and government initiatives accelerate infrastructure development. It offers proximity to major user bases and supports data localization policies. Industrial corridors and logistics networks enhance connectivity with neighboring states. Tier-2 cities in Uttar Pradesh and Haryana attract private sector investments. Increasing fiber penetration and renewable energy adoption strengthen this region’s competitiveness.

- For instance, Yotta Infrastructure inaugurated North India’s first hyper-scale data center (Yotta D1) in Greater Noida, Uttar Pradesh, in October 2022, with a capacity for 5,000 racks and 28.8MW IT load in the first phase, sited within a 20-acre park planned for 30,000 racks and 160MW total power; it was built in 20 months and formally certified as Tier III in January 2024. ST Telemedia Global Data Centres (STT GDC) operates 28 data centers across 10 Indian cities, with a combined 318MW IT load as of 2024, and is investing $3.2 billion to nearly triple national capacity by adding 550MW over five years.

Eastern and Central India – Developing Digital Corridors (28% Market Share)

Eastern and central regions are witnessing gradual adoption with new edge facilities in Kolkata, Odisha, and Madhya Pradesh. The India Edge Data Center Market benefits from government-led digital projects and submarine cable connectivity on the east coast. It improves redundancy and balances national data flow. Infrastructure expansion in industrial belts drives local demand for edge nodes. Enhanced policy support and public-private partnerships accelerate deployment. The ongoing diversification of infrastructure ensures balanced national growth across all regions.

- For instance, Sify Technologies’ edge data center in Kolkata features a 2.2MW IT power capacity and functions as a key network hub for OTT providers, telecom operators, and enterprises. The carrier-neutral facility, equipped with dual meet-me rooms, was delivered in 2025. CtrlS Datacenters is investing $18.1 million to develop a greenfield edge facility in Odisha, incorporating liquid cooling and carbon reduction measures to advance India’s sustainable edge infrastructure.

Competitive Insights:

- Reliance Jio Infocomm Ltd

- Bharti Airtel

- Vodafone Idea Ltd

- Tata Communications

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Fujitsu

- Cisco

- SixSq

- Microsoft

- VMware

- Schneider Electric SE

- Rittal GmbH & Co. KG

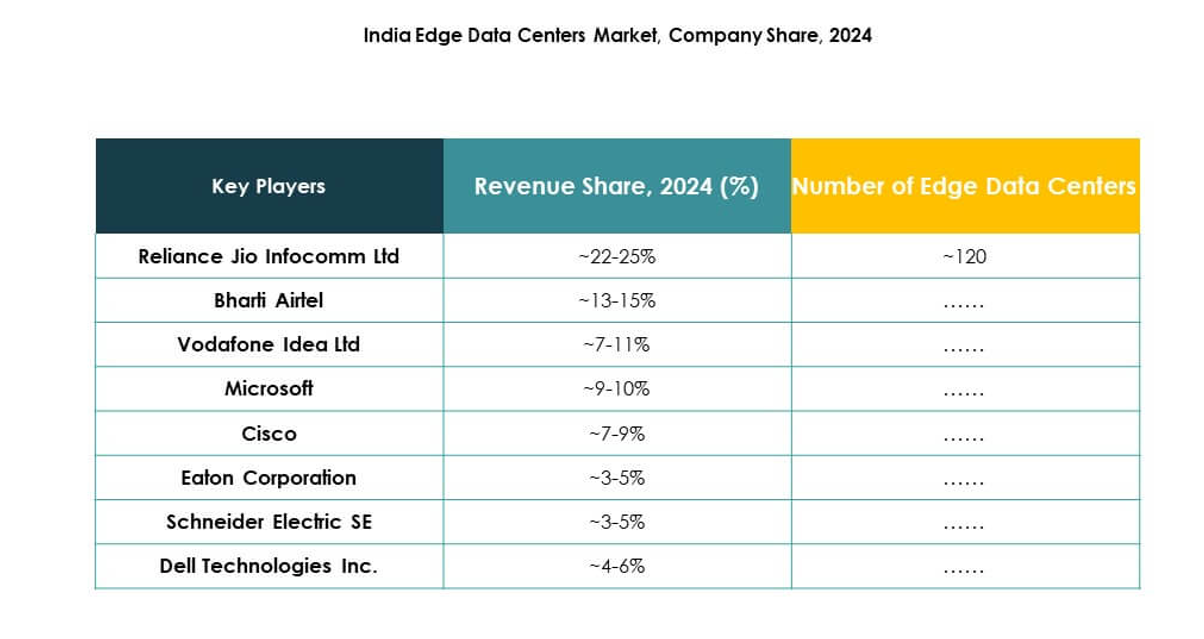

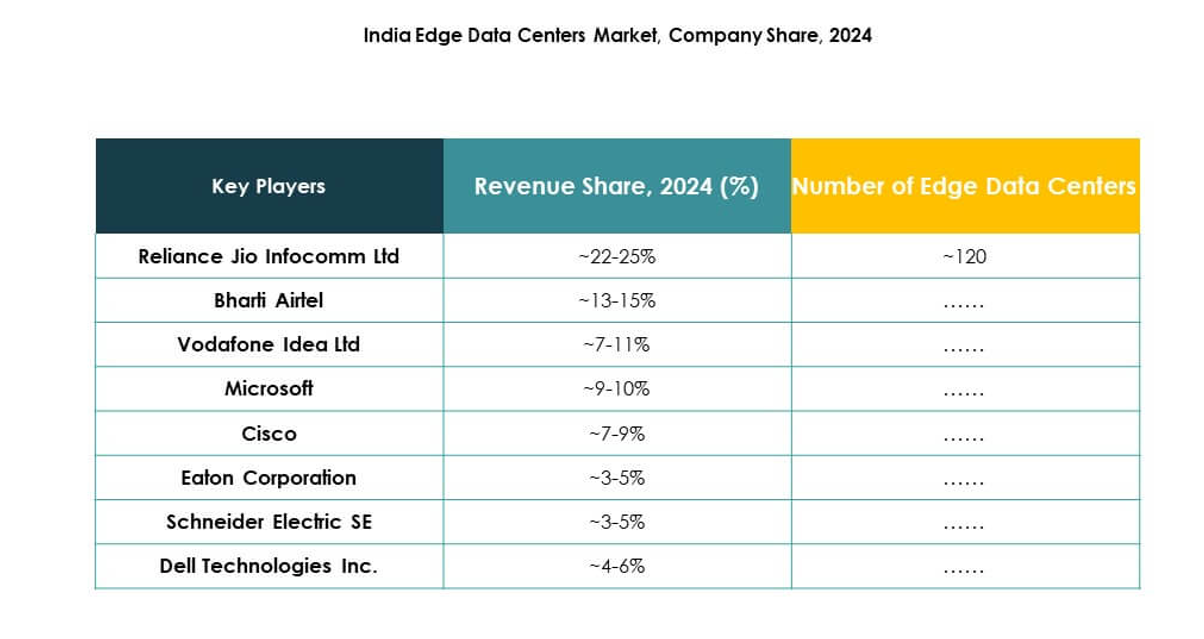

The India Edge Data Center Market features a dynamic competitive landscape driven by telecom leaders, cloud providers, and infrastructure specialists. Major telecom firms such as Reliance Jio, Bharti Airtel, and Vodafone Idea are expanding nationwide edge networks to support 5G and IoT. Global technology players including Dell Technologies, Cisco, and Microsoft integrate AI, automation, and cloud-native architectures to enhance scalability and security. Infrastructure providers like Schneider Electric, Eaton, and Rittal deliver advanced power and cooling solutions. It continues to attract partnerships between telecom and hyperscale operators, fostering innovation and efficient data processing closer to end users.

Recent Developments:

- In August 2025, Bharti Airtel’s subsidiary, Xtelify, launched Airtel Cloud—a sovereign, telco-grade cloud platform hosted across next-generation Indian data centers. Capable of managing up to 1.4 billion transactions per minute, Airtel Cloud offers scalable, cost-effective, and regulation-compliant solutions tailored for Indian enterprises.

- In July 2025, Reliance Jio, in partnership with Cisco, initiated the development of India’s AI-ready network infrastructure by collaborating on hyperscale data center and connectivity solutions. This strategic alliance leverages Cisco’s Silicon One-based 800G technology to provide low latency, high throughput, and efficient AI-centric performance across Jio’s data centers.

- In July 2025, Tata Communications formed a strategic partnership with Amazon Web Services (AWS) to launch a high-capacity, AI-ready long-distance network in India. This backbone network interconnects major AWS data center regions—Mumbai, Hyderabad, and Chennai—to support advanced AI, cloud, and high-performance computing workloads, representing Tata’s largest network project to date in India.