Executive summary:

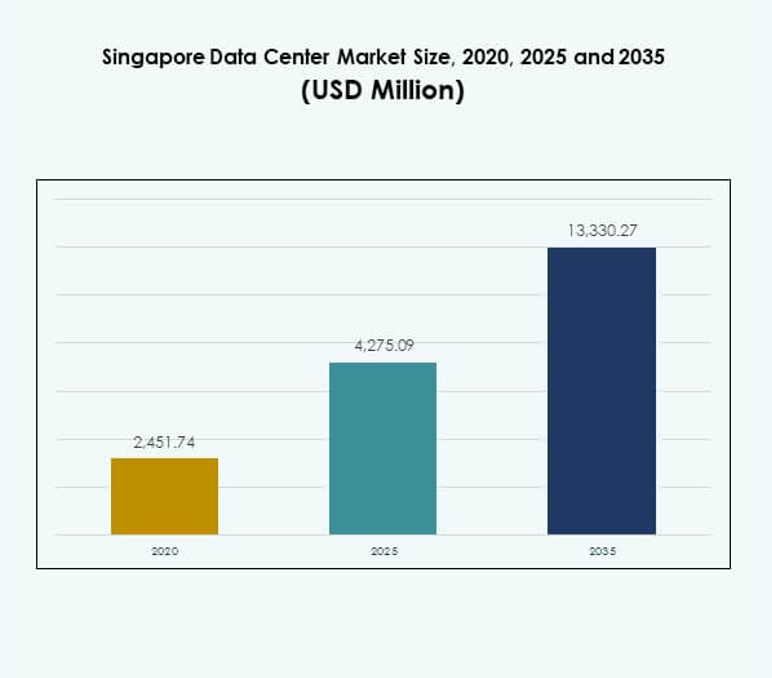

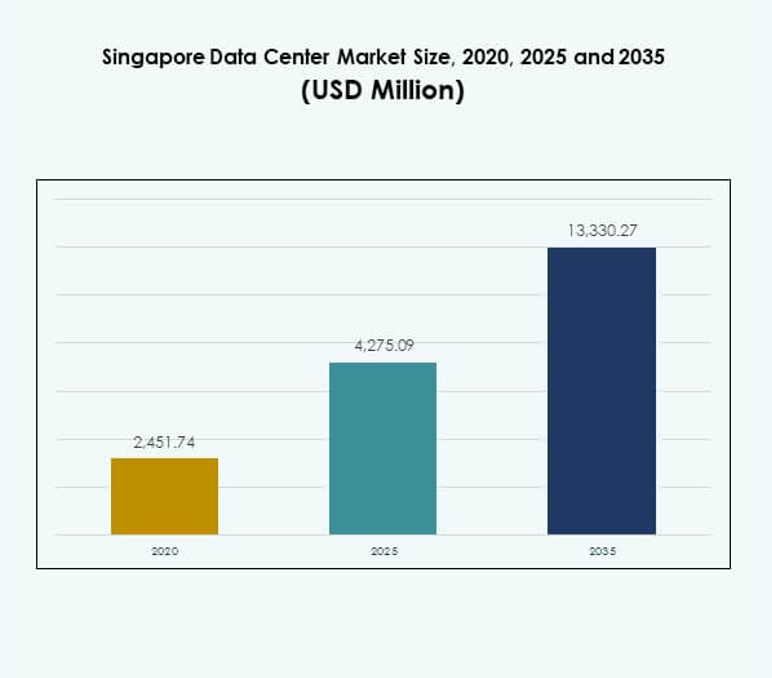

The Singapore Data Center Market size was valued at USD 2,451.74 million in 2020 to USD 4,275.09 million in 2025 and is anticipated to reach USD 13,330.27 million by 2035, at a CAGR of 11.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Singapore Data Center Market Size 2025 |

USD 4,275.09 Million |

| Singapore Data Center Market, CAGR |

11.96% |

| Singapore Data Center Market Size 2035 |

USD 13,330.27 Million |

The market is driven by strong adoption of cloud computing, rapid digital transformation, and continuous innovation in infrastructure. Enterprises are embracing AI, automation, and energy-efficient technologies to meet growing data demands. It plays a strategic role for investors and global firms, offering stability, advanced connectivity, and a gateway to Southeast Asia’s expanding digital economy.

Regionally, Singapore leads Southeast Asia as a hub due to its advanced infrastructure, stable policies, and robust connectivity. Neighboring countries such as Indonesia and Malaysia are emerging markets, fueled by rising internet penetration and enterprise demand. While Singapore dominates with cutting-edge facilities, emerging economies focus on affordability, energy resources, and land availability to capture future growth.

Market Drivers

Rising Cloud Computing Adoption and Strategic Positioning in Digital Infrastructure

The Singapore Data Center Market benefits from strong cloud computing adoption driven by enterprise digitalization. Multinational corporations rely on Singapore’s robust connectivity to manage regional operations. It stands as a hub for mission-critical data and scalable services across Asia-Pacific. Investors prioritize the market for its legal stability, tax benefits, and government-backed digital economy roadmap. Enterprises see it as a gateway to tap into Southeast Asian consumer growth. High cloud adoption accelerates demand for hyperscale and colocation centers. Strong submarine cable networks further strengthen its regional relevance. This ecosystem positions Singapore as a vital player for businesses.

- For example, in July 2024, Amazon Web Services (AWS) announced a US$9 billion investment in Singapore’s cloud infrastructure through 2028, strengthening the Singapore Data Center Market and reinforcing its position as a strategic Asia-Pacific hub.

Integration of Innovative Technologies and Advanced Operational Models

Technology integration remains a central driver of the Singapore Data Center Market. Enterprises adopt virtualization, AI-powered monitoring, and automation to improve operational efficiency. Cloud providers and hyperscale operators invest heavily in smart cooling and modular power systems. Innovation aligns with global trends toward high-density workloads and edge computing. Singapore’s operators focus on reducing latency and enhancing connectivity through cross-border digital platforms. It offers businesses streamlined operations and cost predictability. Investors recognize long-term returns through integration of sustainable energy use and intelligent management. The combination of advanced models and stable governance ensures market resilience.

- For example, in December 2024, Microsoft confirmed it would launch zero-water cooling systems in new Singapore data centers, eliminating fresh water use for thermal management of high-density AI workloads and targeting up to 125 million liters of annual water savings per facility.

Accelerating Digital Transformation Across Key Industry Verticals

The Singapore Data Center Market grows as BFSI, healthcare, and retail demand reliable digital infrastructure. Banks need secure environments for fintech solutions and real-time transactions. Healthcare providers invest in data-driven systems for medical records and telehealth. Retailers leverage e-commerce platforms requiring robust backend processing power. The telecom industry drives demand for faster connectivity with increasing 5G adoption. This industry-wide push supports a strong pipeline of new projects. Government agencies also contribute by adopting e-governance systems that require resilient data infrastructure. The broad industry application scope creates stable demand across multiple sectors.

Strategic Importance of the Market for Global Enterprises and Investors

Singapore holds a central role in Asia-Pacific’s digital ecosystem. The Singapore Data Center Market acts as a reliable entry point for enterprises expanding into emerging Southeast Asian economies. Investors value the country’s transparent policies, advanced energy infrastructure, and reliable security frameworks. It delivers a favorable climate for innovation-led data strategies. Enterprises leverage Singapore to support cross-border commerce, finance, and digital services. Its proximity to growing economies strengthens its appeal for regional investments. High demand for scalable colocation services supports consistent market growth. The combination of location, stability, and innovation drives unmatched strategic significance.

Market Trends

Emergence of Green Data Centers and Sustainable Infrastructure Commitments

Sustainability shapes investment strategies in the Singapore Data Center Market. Operators implement renewable energy integration, liquid cooling, and energy reuse technologies. Green certifications drive competitiveness and attract eco-conscious clients. Demand for lower carbon footprints leads to government partnerships promoting sustainable builds. Enterprises select operators aligned with corporate sustainability goals. Growing renewable adoption enhances long-term operational efficiency. It positions Singapore as a leader in sustainable data infrastructure in Asia. Environmental goals are now integral to data center growth plans.

Growth of Edge Data Centers and Distributed Architectures

The Singapore Data Center Market experiences rising adoption of edge and micro facilities. These centers bring computation closer to users, improving latency for 5G and IoT services. Enterprises need faster responses for gaming, autonomous systems, and AR/VR platforms. Telecom operators deploy modular edge centers to support high-density networks. Businesses value localized storage for improved compliance and control. It accelerates new business models dependent on real-time analytics. Integration with hyperscale environments ensures seamless data management. This shift signals diversification beyond traditional colocation hubs.

Increased Role of AI and Automation in Data Center Operations

AI-driven optimization plays a critical role in the Singapore Data Center Market. Operators adopt machine learning tools for predictive maintenance and energy control. Automation reduces downtime risk while optimizing workload distribution. Enterprises use orchestration platforms to improve scalability and cut costs. Robotics and remote monitoring strengthen operational resilience. The integration of AI enhances overall facility performance. It also supports operators in maintaining service level agreements with greater precision. Automation becomes essential to sustain competitiveness in high-demand environments.

Rising Investment in Interconnection and Regional Network Expansion

Interconnection services witness strong growth in the Singapore Data Center Market. Businesses seek seamless access to global cloud providers and network carriers. Operators expand partnerships with submarine cable providers to enhance cross-border connectivity. Enterprises rely on direct interconnects for secure, low-latency operations. Carrier-neutral data centers expand rapidly to meet enterprise demand. It creates a thriving ecosystem for multi-cloud strategies. Regional businesses view Singapore as a gateway for global expansion. This interconnection focus strengthens Singapore’s regional digital economy influence.

Market Challenges

Rising Energy Consumption and Infrastructure Sustainability Constraints

The Singapore Data Center Market faces challenges from rising energy consumption levels. Operators must balance demand growth with sustainability targets. Energy-intensive cooling systems strain infrastructure capacity. Government regulations push firms to adopt green solutions that require significant capital. Limited land availability complicates expansion plans, driving competition for space. Enterprises face higher costs for premium green-certified facilities. It creates pressure on operators to maintain both efficiency and profitability. Balancing growth with energy responsibility remains a critical market challenge.

Intense Competition and Limited Geographic Expansion Scope

Competitive pressures shape the Singapore Data Center Market as global players intensify presence. International providers expand aggressively, increasing pricing pressure for local firms. Limited land supply restricts the ability to scale large hyperscale campuses. Operators need to differentiate through service quality, sustainability, and innovation. High real estate costs further restrict growth margins. It creates an environment where strategic partnerships become essential. Investors assess market entry carefully given these structural limitations. Competitive dynamics and space constraints create long-term operational challenges.

Market Opportunities

Expansion of Cloud Ecosystems and Hybrid Deployments in Asia-Pacific

The Singapore Data Center Market provides strong opportunities through cloud ecosystem growth. Enterprises seek hybrid deployment models for scalability and resilience. Cloud service providers expand operations to meet increasing enterprise adoption. It strengthens Singapore’s role as a trusted hub for cloud infrastructure. Hybrid models appeal to industries balancing regulatory control with scalability. Businesses leverage cloud-based platforms to accelerate digital growth. The expansion of these ecosystems opens pathways for long-term investments.

Rising Demand for AI, IoT, and High-Performance Computing Integration

Integration of AI and IoT creates major opportunities for the Singapore Data Center Market. High-performance computing supports industries like finance, research, and healthcare. Operators invest in GPU-optimized servers for AI workloads. It positions Singapore as a hub for advanced data-driven applications. Enterprises adopt IoT platforms that require low-latency infrastructure. Demand for AR/VR and big data analytics accelerates adoption of high-capacity solutions. The growth of these segments drives a strong opportunity pipeline for investors.

Market Segmentation

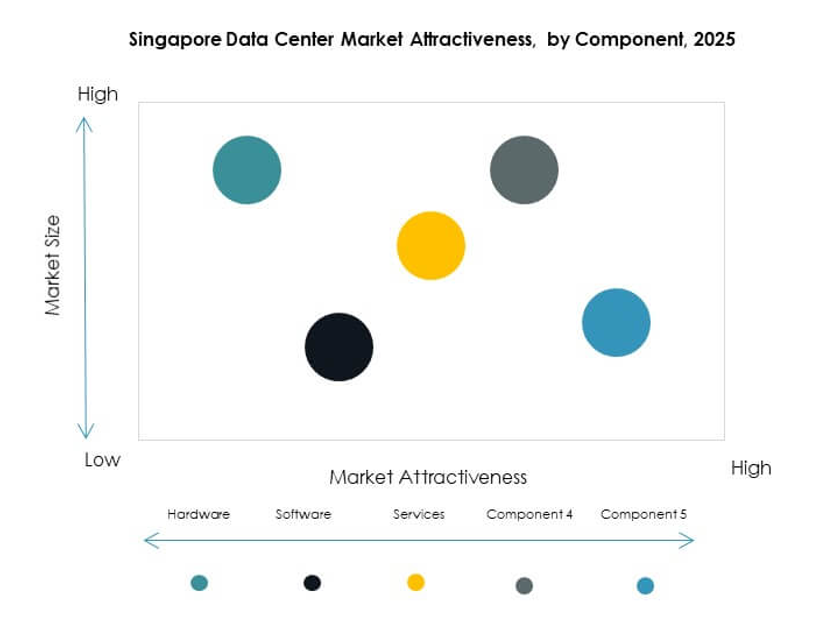

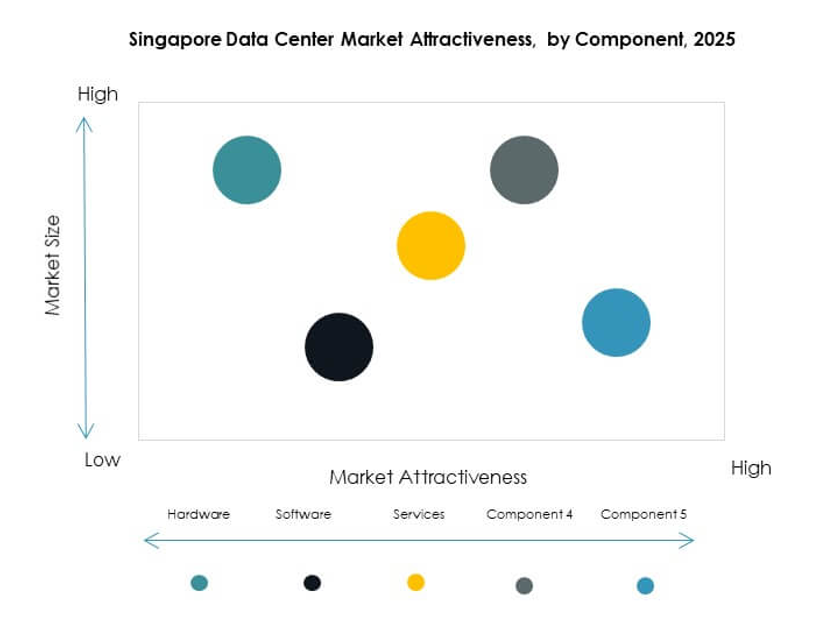

By Component

Hardware dominates the Singapore Data Center Market with servers, cooling, and power systems driving demand. Enterprises prioritize high-performance computing and energy efficiency, fueling investments in advanced racks and storage. Software adoption grows with DCIM and orchestration platforms for optimization. Services expand through managed offerings, supporting scalability. Hardware holds the largest share due to critical infrastructure needs. Software and services complement hardware growth by ensuring smooth operations and scalability across facilities.

By Data Center Type

Hyperscale data centers lead the Singapore Data Center Market, driven by global cloud providers. Colocation centers maintain strong growth through enterprise demand for flexible leasing models. Enterprise facilities play a role in industry-specific workloads. Edge and modular centers gain traction with telecom and IoT applications. Mega data centers remain rare due to land constraints, while IDCs continue expanding. Hyperscale remains dominant due to global demand for scalable computing power. Colocation follows closely with strong enterprise adoption trends.

By Deployment Model

Cloud-based deployment dominates the Singapore Data Center Market due to enterprise migration strategies. On-premises deployment sustains relevance in regulated industries like BFSI and healthcare. Hybrid models grow quickly as firms balance control with flexibility. Cloud models gain the largest share through scalability and cost savings. Hybrid adoption rises as firms need integration across cloud and on-premises environments. Enterprises continue shifting toward multi-cloud strategies, strengthening demand for flexible deployment models.

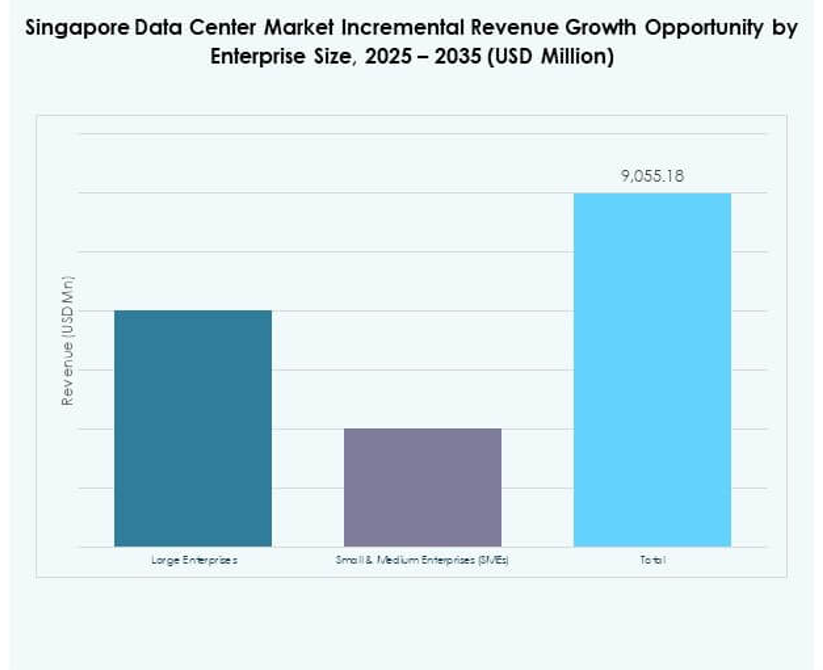

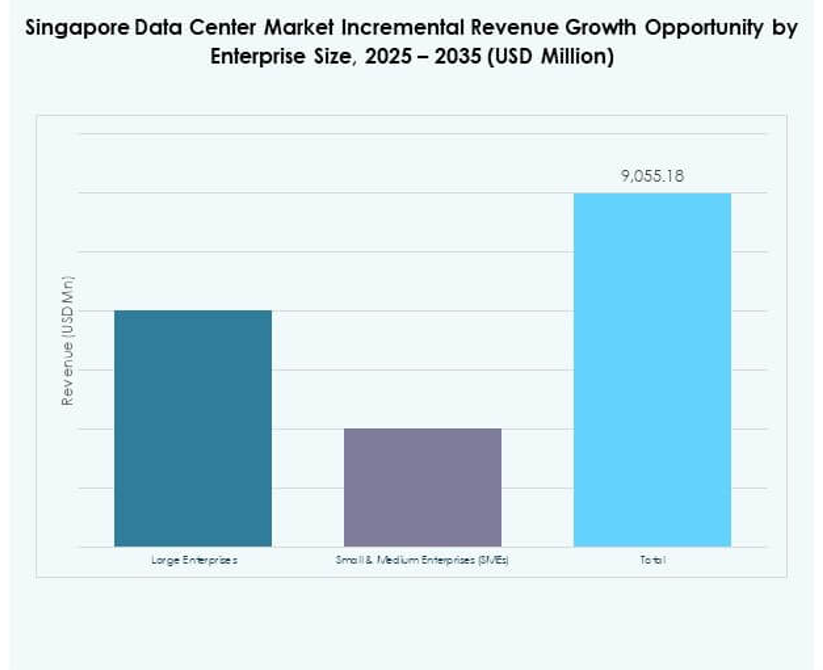

By Enterprise Size

Large enterprises lead the Singapore Data Center Market with high-capacity requirements for digital operations. SMEs expand adoption as cloud and colocation services lower entry barriers. Large firms prioritize hyperscale and hybrid solutions for global scalability. SMEs rely on managed services to minimize operational costs. Both segments contribute, but large enterprises dominate overall market share. SMEs show strong growth potential through digital adoption programs supported by regional policies.

By Application / Use Case

The BFSI sector dominates the Singapore Data Center Market due to high security and compliance needs. IT and telecom follow with strong connectivity requirements. Healthcare gains traction through digital records and telehealth adoption. Retail and e-commerce depend on backend capacity for customer platforms. Media and entertainment expand through streaming demand. Manufacturing adopts solutions for Industry 4.0 applications. Other sectors such as education and energy explore digital transformation. BFSI remains the leading application, supported by financial hub positioning.

By End User Industry

Cloud service providers dominate the Singapore Data Center Market due to hyperscale operations. Enterprises expand their share through colocation and hybrid deployments. Government agencies invest steadily in secure infrastructure for e-governance. Colocation providers strengthen offerings to meet diverse enterprise demand. Cloud service providers retain the largest share due to global expansions. Enterprises and governments continue to reinforce demand for secure, scalable infrastructure.

Regional Insights

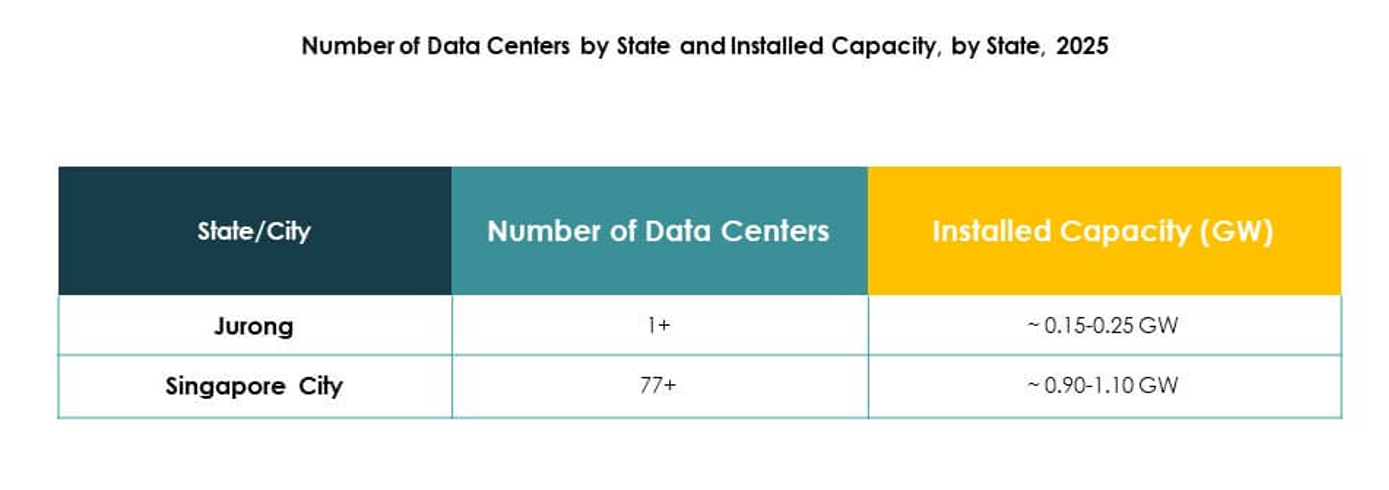

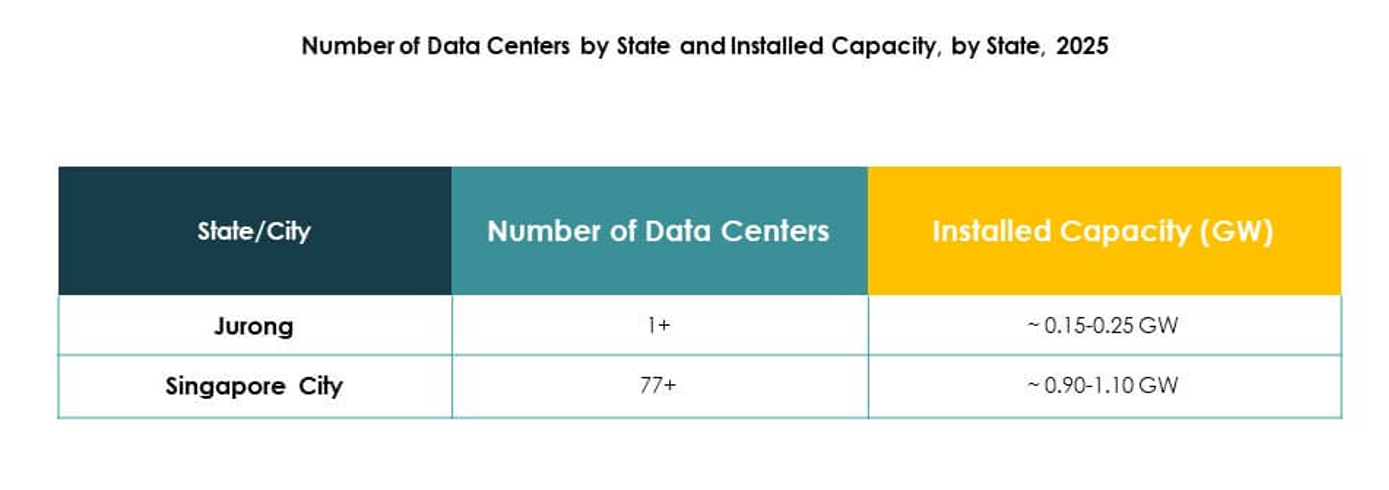

Singapore as the Core of Southeast Asia’s Digital Ecosystem

The Singapore Data Center Market accounts for 58% of Southeast Asia’s regional data center share. It dominates due to connectivity, regulatory stability, and investor-friendly policies. Strong submarine cable networks make it a key hub for regional operations. Global hyperscale providers prioritize Singapore for cloud deployments. It remains the most advanced market within Southeast Asia. Businesses view it as an essential entry point for cross-border digital commerce.

- For instance, Equinix announced in November 2024 that its new SG6 data center in Singapore will deliver up to 20 MW of IT capacity across nine stories, integrating advanced sustainability features and supporting compute-intensive workloads such as AI.

Emerging Growth in Neighboring Southeast Asian Economies

Indonesia contributes 22% of the regional market, supported by large-scale internet adoption. Malaysia holds 12% share, driven by new data center projects and government incentives. Vietnam and Thailand together represent 8%, with growing investments in digital infrastructure. The Singapore Data Center Market influences these nations through connectivity and expertise. It acts as a hub linking emerging economies with global networks. Regional cooperation strengthens resilience across the digital landscape.

- For instance, Princeton Digital Group launched its 22 MW JC2 hyperscale data center facility in Greater Jakarta in September 2023, marking the sixth operational site in Indonesia and achieving BCA Green Mark Platinum certification for energy efficiency.

Global Influence and Strategic Cross-Border Relevance

The Singapore Data Center Market maintains strong international relevance through interconnection with global networks. North American and European cloud providers establish facilities in Singapore for Asia-Pacific access. It secures long-term importance with 58% share of regional capacity. Neighboring countries gain spillover benefits while Singapore retains leadership. Its global influence stems from both infrastructure strength and regional integration. This cross-border role ensures its continued dominance in Southeast Asia’s digital economy.

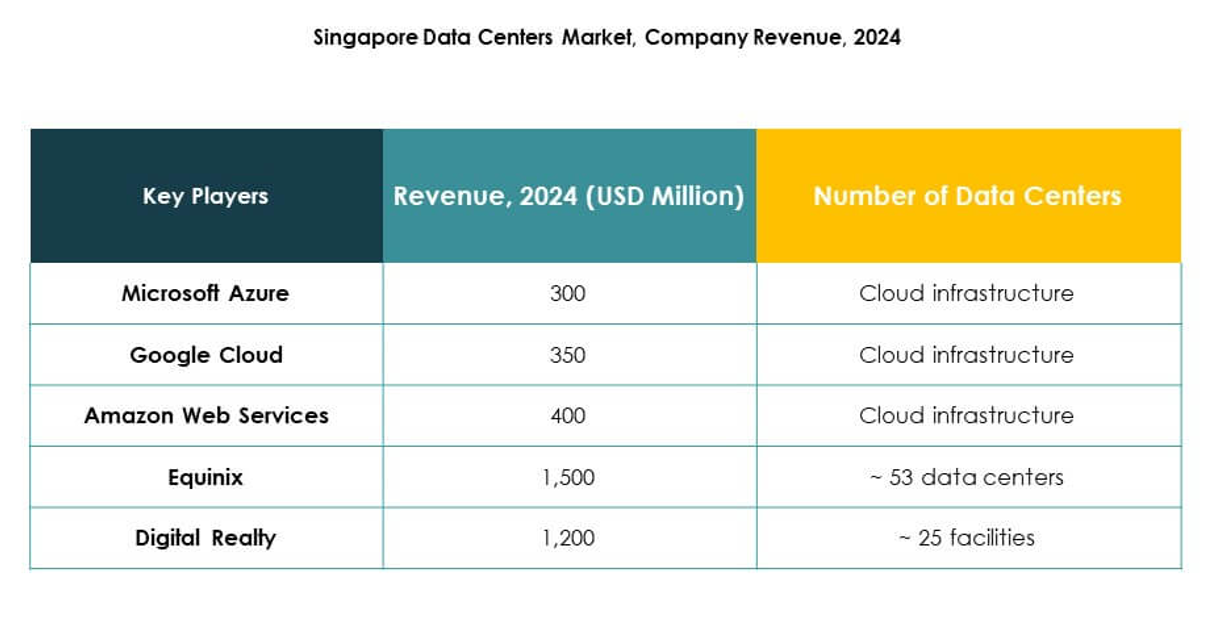

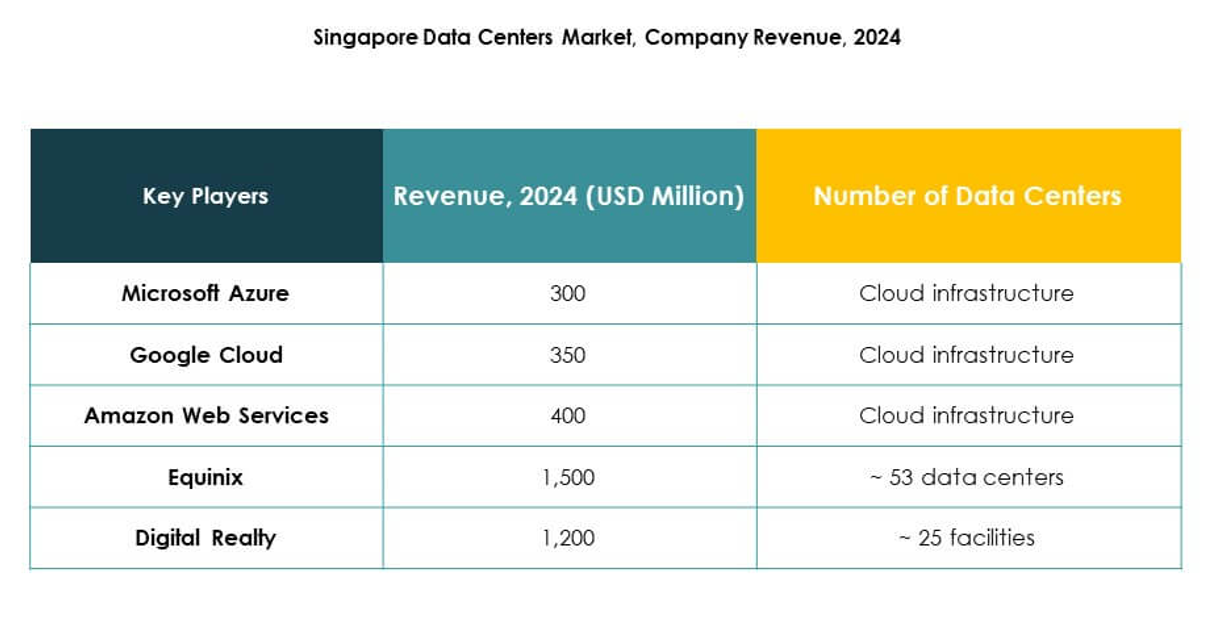

Competitive Insights:

- Equinix

- Digital Realty

- Keppel DC REIT

- STT GDC

- YTL Data Center

- NTT Communications Corporation

- Microsoft Azure

- Amazon Web Services (AWS)

- Google Cloud

The competitive landscape of the Singapore Data Center Market reflects a balance between established colocation leaders and global cloud providers. Equinix and Digital Realty dominate with extensive facilities and interconnection ecosystems, while Keppel DC REIT and STT GDC expand aggressively through strategic investments in sustainability and capacity. YTL Data Center and NTT Communications Corporation strengthen regional integration with advanced infrastructure. On the hyperscale side, Microsoft Azure, AWS, and Google Cloud enhance competition by driving large-scale cloud deployments and hybrid models. It pushes providers to focus on efficiency, innovation, and green certifications to secure enterprise trust. Competitive dynamics remain shaped by land constraints, power availability, and continuous demand for low-latency services across industries.

Recent Developments:

- In September 2025, BDx Data Centers announced a strategic partnership with HEXA Renewables to pioneer a cross-border renewable energy model contributing at least 50MW of clean power to the Singapore–Malaysia energy grid. This collaboration sets a new regional standard, aligning hyperscale data center growth with sustainability initiatives and supporting Singapore’s Green Plan 2030, while directly enabling and funding green energy projects in Malaysia through BDx’s support.

- In September 2025, Telin selected Nokia to interconnect multiple data centers across Singapore, enhancing service capabilities for hyperscalers and major tech firms. This partnership leverages Nokia’s advanced coherent optical technology and AI-driven infrastructure, supporting rapid growth in edge computing and positioning Telin and Nokia at the forefront of Singapore’s evolving digital infrastructure landscape.

- In September 2025, Keppel DC REIT acquired the remaining 51% interest in two AI-ready hyperscale data centers in Singapore. Post-acquisition, Keppel DC REIT’s portfolio expanded to 25 data centers across 10 markets, with its assets under management reaching S$5.7 billion, solidifying their leadership in high-performance and AI-driven data center services.