Executive summary:

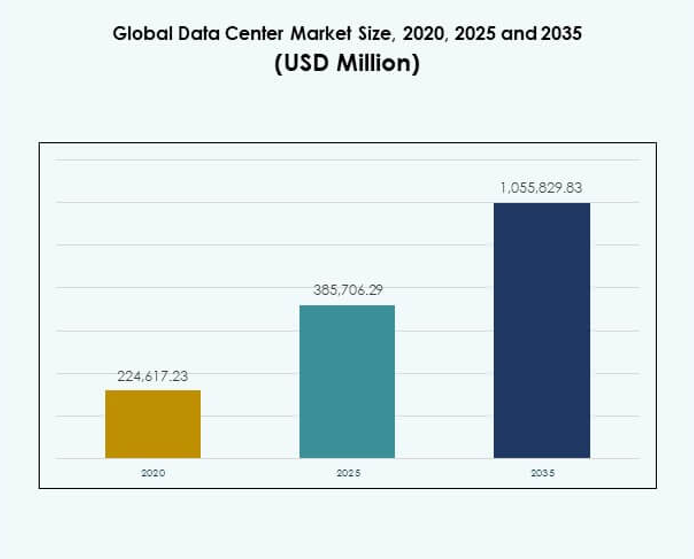

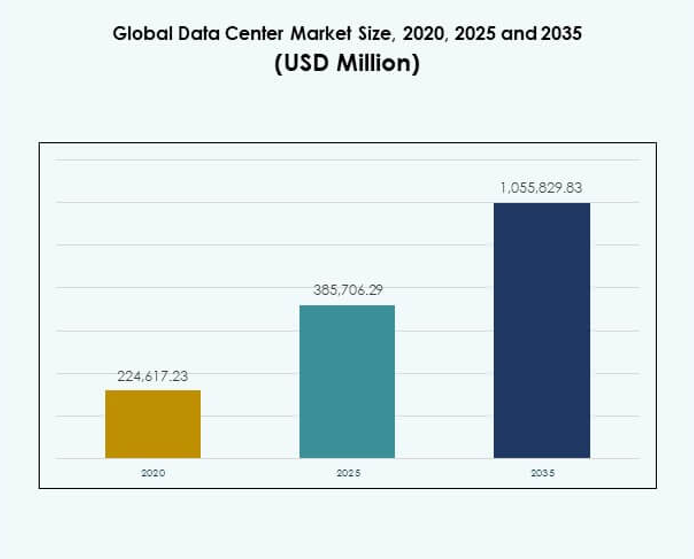

The Global Data Center Market size was valued at USD 2,24,617.23 million in 2020 to USD 3,85,706.29 million in 2025 and is anticipated to reach USD 10,55,829.83 million by 2035, at a CAGR of 10.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Data Center Market Size 2025 |

USD 3,85,706.29 Million |

| Data Center Market, CAGR |

10.54% |

| Data Center Market Size 2035 |

USD 10,55,829.83 Million |

Rising demand for cloud computing, big data analytics, and AI integration is driving market growth. Companies are focusing on energy-efficient architectures, modular data centers, and advanced cooling solutions to meet sustainability goals. Continuous innovation and adoption of edge computing make data centers strategically vital for businesses, supporting faster decision-making, operational efficiency, and scalable infrastructure investments. For investors, this market represents a cornerstone of digital transformation and global connectivity.

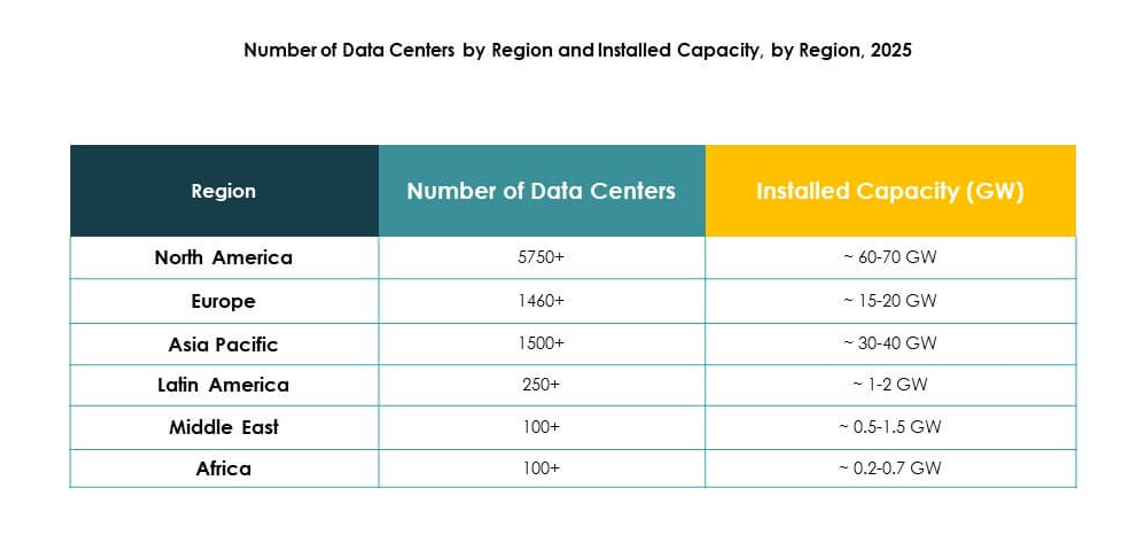

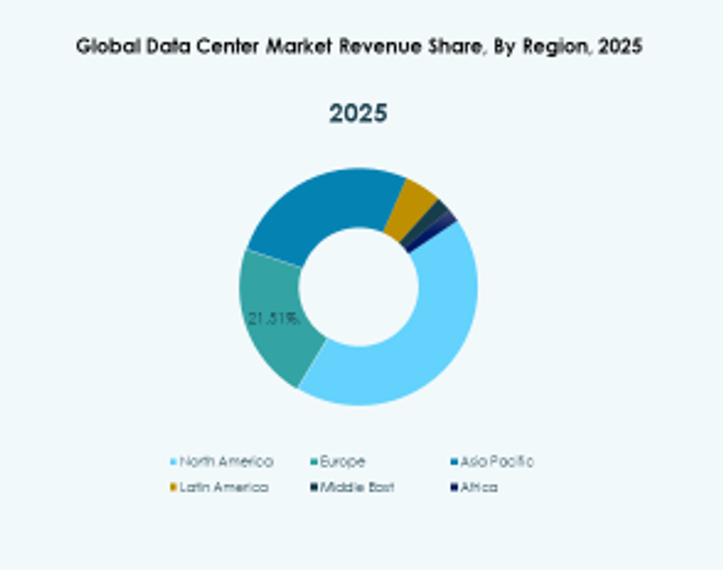

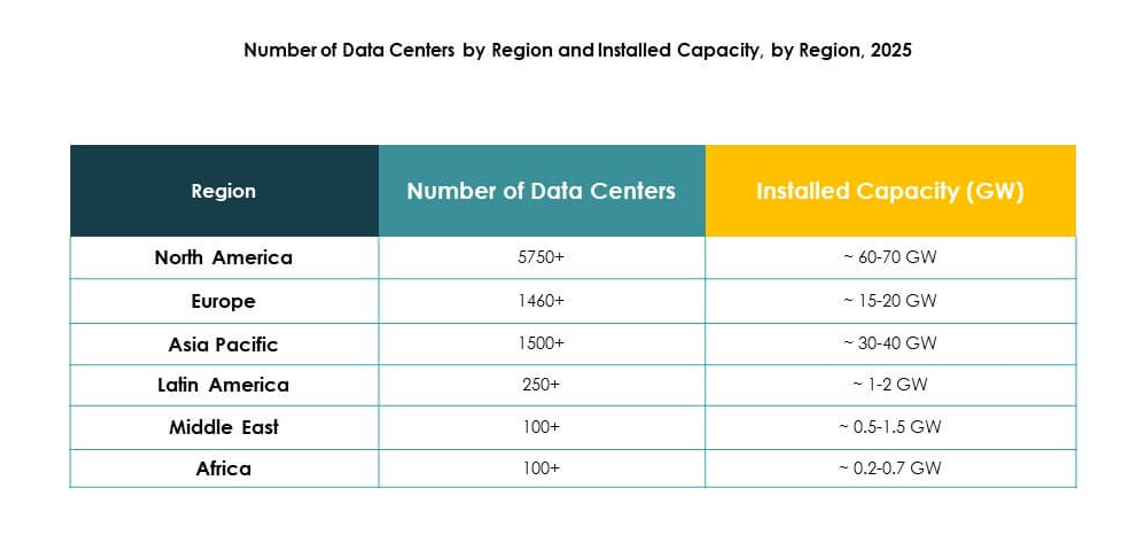

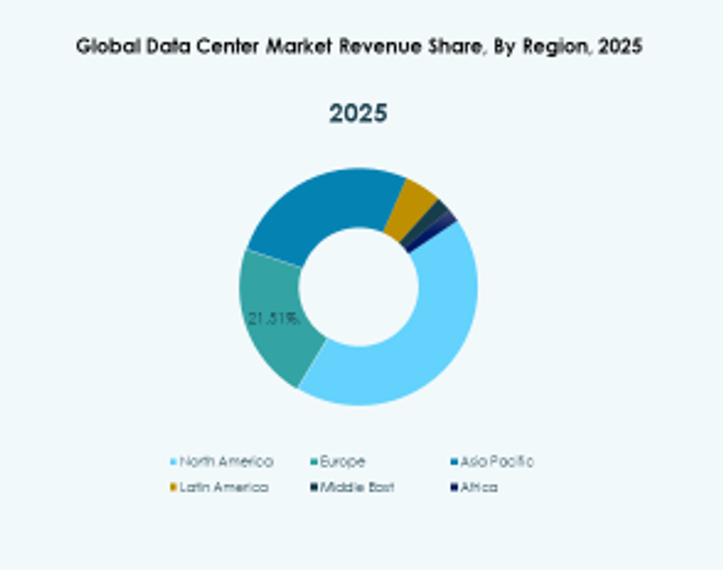

Regionally, North America dominates the market due to strong technological infrastructure and hyperscale investments. Europe follows with regulatory support and demand for green data centers. Asia-Pacific is the fastest-growing region, fueled by digitalization, rapid 5G deployment, and rising cloud adoption in countries like China and India. Emerging markets in Latin America and the Middle East are gaining momentum, driven by enterprise expansion and government-backed digital strategies.

Market Drivers:

Growing Adoption of Cloud Computing, Artificial Intelligence, and Data-Driven Solutions

The Global Data Center Market is expanding rapidly due to rising demand for cloud computing, artificial intelligence, and big data solutions. Enterprises are deploying advanced digital platforms that require scalable storage and processing power. Cloud-native applications increase the need for high-performance facilities that ensure efficiency and reliability. Artificial intelligence adoption further drives the need for powerful computing infrastructure to manage vast datasets. Businesses rely on secure and flexible environments that allow faster analytics and decision-making. Governments support digital transformation through policies that enhance connectivity and data sovereignty. Investors recognize the market’s role in enabling technology-driven industries to thrive. The growth trajectory highlights its critical importance for modern economies.

Innovation in Energy Efficiency, Cooling Technologies, and Sustainable Infrastructure

Innovation in design and infrastructure is transforming the GLOBAL DATA CENTER MARKET. Energy efficiency has become a central focus, with companies integrating liquid cooling, modular systems, and renewable energy. These innovations reduce operating costs while addressing environmental regulations. Advanced power management systems are now embedded to deliver consistent performance under high workloads. Businesses benefit from reliable uptime and reduced risks of service interruption. Sustainability initiatives attract both enterprises and regulators aiming for greener solutions. Investors view this shift as a long-term value driver supported by operational resilience. Market leaders continue to implement cutting-edge solutions that shape global best practices.

- For instance, Google’s official 2024 Environmental Report confirms its data centers reached a 84% waste diversion rateand repurposed 44% of server components during 2023, directly reducing environmental impact and boosting operational resource efficiency

Industry Shifts Toward Edge Computing, Hyperscale Deployments, and Digital Ecosystems

The GLOBAL DATA CENTER MARKET is undergoing major shifts driven by edge computing and hyperscale models. Edge facilities bring data processing closer to end users, reducing latency and enabling real-time services. Hyperscale operators continue to expand capacity to meet demand from global enterprises and digital platforms. These shifts create new opportunities for industries such as telecom, healthcare, and finance. It also strengthens ecosystems where multiple services integrate seamlessly. Strategic partnerships between providers and enterprises expand innovation potential. The acceleration of 5G further enhances edge deployments by connecting vast numbers of devices. Investors find strong growth prospects in these scalable and adaptive systems.

- For instance, in February 2025, Equinix inaugurated the PA13x data center in Paris with 28.8 MW of IT capacity, featuring energy-efficient design and a heat-recovery partnership with Engie Solutions to supply the local district heating network.

Strategic Importance for Businesses, Governments, and Global Investors

The GLOBAL DATA CENTER MARKET has become a strategic asset for enterprises, governments, and investors. Businesses view it as essential for maintaining competitiveness in a digital-first economy. Secure and reliable infrastructure supports critical functions, from financial transactions to healthcare systems. Governments invest in regional hubs to ensure data sovereignty and strengthen national security. Investors regard the sector as a resilient and high-growth opportunity tied to technological advancement. It provides a foundation for future innovations such as smart cities and connected industries. The market’s strategic role ensures consistent demand even during economic uncertainties. Its ability to enable digital ecosystems positions it as a long-term growth driver.

Market Trends:

Rising Integration of Artificial Intelligence for Operational Optimization and Predictive Maintenance

The GLOBAL DATA CENTER MARKET is experiencing a strong trend toward embedding artificial intelligence into facility management. AI-driven platforms optimize energy consumption, automate cooling systems, and reduce downtime through predictive maintenance. It supports operational stability by identifying risks before disruptions occur. Automated monitoring tools ensure efficiency across networks and workloads. Enterprises benefit from lower costs and higher service reliability. AI-enabled forecasting also allows capacity planning to align with demand cycles. Providers are building advanced ecosystems that rely heavily on machine learning for daily operations. Investors recognize these capabilities as a foundation for competitive advantage in the sector.

Expansion of Interconnection Services and Growing Importance of Data Sovereignty Regulations

The GLOBAL DATA CENTER MARKET shows a marked increase in demand for interconnection services that link enterprises, cloud providers, and digital platforms. It supports seamless data exchange and enhances network efficiency. Governments enforce stricter regulations on data sovereignty, compelling companies to localize data storage. This shift drives new investments in regional hubs. Enterprises seek facilities that guarantee compliance while ensuring scalability. Strategic alliances between operators and governments expand secure ecosystems. Interconnection growth strengthens collaboration across industries while maintaining legal and security standards. Investors find this regulatory-driven demand a key factor shaping regional expansion strategies.

Increased Adoption of Modular and Prefabricated Data Center Designs Across Regions

The GLOBAL DATA CENTER MARKET is witnessing a transition toward modular and prefabricated construction models. It enables faster deployment and reduces upfront capital requirements for operators. Prefabricated units improve scalability by allowing phased expansion aligned with demand growth. Enterprises favor modular builds due to predictable timelines and cost efficiencies. These facilities also enhance sustainability with compact designs that optimize space utilization. Providers incorporate flexible infrastructure to address varying regional requirements. Rapid deployment strategies support new entrants seeking faster market presence. Investors view modular adoption as a strong trend that accelerates global infrastructure growth.

Growing Role of Renewable Energy Integration and Long-Term Power Purchase Agreements

The GLOBAL DATA CENTER MARKET continues to expand its reliance on renewable energy sources. Operators are signing long-term power purchase agreements with solar, wind, and hydro suppliers. It ensures predictable energy pricing and supports sustainability commitments. Enterprises select providers that align with environmental goals and corporate social responsibility standards. Green certifications increasingly influence customer decisions across industries. Providers integrate battery storage systems to ensure power stability during fluctuations. The alignment with renewable energy reduces carbon footprints while enhancing brand value. Investors highlight this transition as a defining trend that secures resilience and sustainability for future growth.

Market Challenges:

Escalating Energy Consumption, Rising Costs, and Environmental Pressures

The GLOBAL DATA CENTER MARKET faces mounting challenges from energy consumption and its associated costs. Operators struggle to balance performance demands with sustainability goals. It requires constant investment in efficient cooling, renewable energy, and advanced infrastructure to manage power use. Environmental regulations place further pressure on providers to adopt greener solutions without sacrificing uptime. Rising electricity costs directly impact profitability and long-term operating models. Enterprises demand low-carbon facilities, pushing providers to rethink designs and sourcing strategies. Supply chain disruptions for critical equipment further complicate expansion plans. Investors watch these dynamics closely, as energy management becomes central to market competitiveness.

Cybersecurity Risks, Regulatory Compliance, and Skilled Workforce Shortages

The GLOBAL DATA CENTER MARKET also contends with increasing cybersecurity threats and complex compliance requirements. Growing reliance on digital ecosystems makes facilities prime targets for attacks. It forces operators to strengthen defenses with multi-layered security protocols. Data protection laws vary widely, requiring costly adaptations to meet regional rules. Enterprises expect providers to guarantee compliance, which increases operational burdens. Workforce shortages in cybersecurity, AI, and cloud architecture slow adoption of advanced solutions. Recruiting and retaining skilled talent remains a major obstacle for sustained growth. These challenges highlight the sector’s vulnerability, requiring strategic focus to secure trust and maintain resilience.

Market Opportunities:

Expanding Demand for Edge Infrastructure, Cloud Services, and Industry-Specific Solutions

The GLOBAL DATA CENTER MARKET presents significant opportunities through rising demand for edge infrastructure and industry-focused solutions. Enterprises across healthcare, finance, and retail seek localized processing to improve speed and reliability. It enables real-time applications that require low latency, such as IoT and 5G services. Cloud adoption continues to expand, driving hybrid and multi-cloud deployments that increase capacity needs. Providers who offer tailored services gain a competitive advantage with industry-specific compliance and performance standards. Investments in automation, AI-driven monitoring, and scalable systems strengthen market appeal. Governments support digitalization initiatives, opening opportunities in underserved regions. Investors identify strong growth potential in ecosystems that integrate cloud, edge, and enterprise services.

Sustainability, Renewable Integration, and Growth in Emerging Markets

The GLOBAL DATA CENTER MARKET is positioned for growth through sustainability and renewable adoption. Operators who secure long-term renewable energy agreements improve resilience and meet corporate environmental targets. It strengthens relationships with global enterprises prioritizing green infrastructure. Emerging markets in Asia, Africa, and Latin America provide untapped opportunities driven by digital transformation and expanding internet penetration. Providers entering these regions can benefit from early positioning and government-backed incentives. Modular facilities also create avenues for faster, cost-effective deployments. The combination of green innovation and geographic expansion makes the sector attractive for long-term investment. Investors view these developments as critical levers for future market leadership.

Market Segmentation:

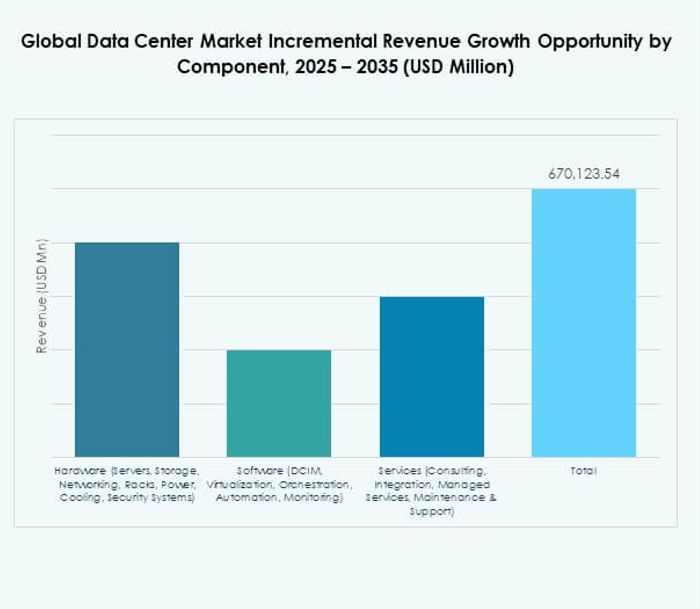

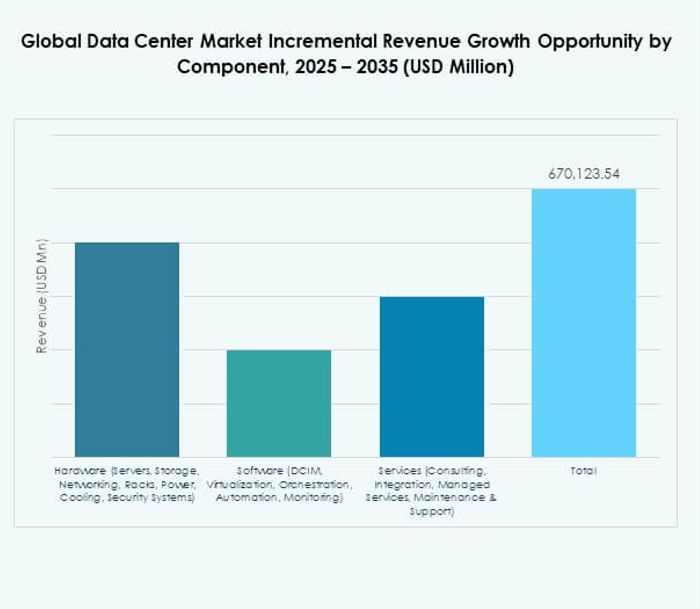

By Component

The GLOBAL DATA CENTER MARKET shows hardware as the dominant segment, supported by servers, storage, networking, racks, power, cooling, and security systems. Servers and storage drive the largest share due to rising demand for cloud services and data processing. Cooling systems also gain importance as efficiency standards tighten worldwide. Software segments such as DCIM, virtualization, and automation expand steadily with digital transformation initiatives. Services including consulting, integration, and managed offerings provide consistent growth, driven by enterprise outsourcing. Hardware leads with a substantial share, while software and services support long-term scalability and efficiency.

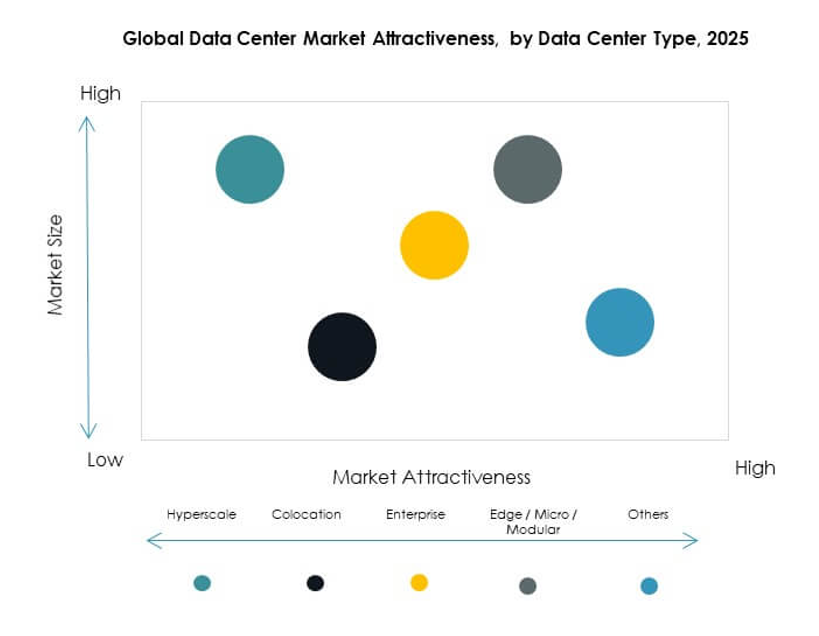

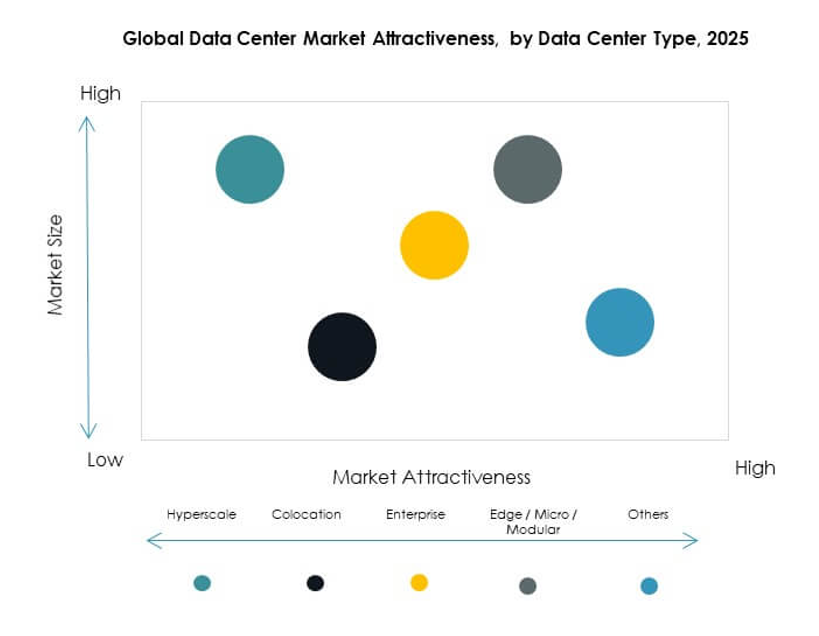

By Data Center Type

The GLOBAL DATA CENTER MARKET is dominated by hyperscale facilities, which account for the largest share due to massive capacity expansion from cloud providers. Colocation facilities follow closely, driven by enterprises seeking cost-effective infrastructure without ownership. Edge and modular centers gain momentum with 5G and IoT applications demanding low-latency operations. Enterprise data centers remain relevant for industries prioritizing security and compliance. Cloud or internet data centers further support hybrid deployments across multiple regions. Mega centers, although fewer in number, hold significant capacity. Hyperscale and colocation remain the key growth engines shaping global infrastructure expansion.

By Deployment Model

The GLOBAL DATA CENTER MARKET sees cloud-based deployments as the leading model, reflecting enterprises’ shift toward flexibility and scalability. Hybrid models also capture strong momentum, combining on-premises infrastructure with public and private cloud systems to optimize performance. On-premises centers maintain relevance in industries requiring strict regulatory compliance and sensitive data control. Cloud-based deployments dominate due to cost efficiency, agility, and support for AI and big data workloads. Hybrid models strengthen as organizations seek resilience and workload balance. Cloud-based facilities continue to grow fastest, shaping global investment strategies and technology adoption.

By Enterprise Size

The GLOBAL DATA CENTER MARKET is primarily driven by large enterprises, which command the largest share due to advanced IT infrastructure requirements and global digital strategies. Large organizations invest heavily in cloud migration, hyperscale facilities, and data sovereignty compliance. Small and medium enterprises (SMEs) increasingly adopt cloud and colocation services to reduce costs and enhance scalability. SMEs benefit from modular and hybrid options that require less capital investment. Large enterprises remain dominant, yet SMEs represent a rising growth engine. Demand from both segments ensures continuous market expansion across diverse industries.

By Application / Use Case

The GLOBAL DATA CENTER MARKET is led by the IT and telecom segment, which holds the largest share due to massive data traffic and connectivity requirements. BFSI follows with strong demand for secure, scalable infrastructure supporting financial services. Government and defense agencies rely on secure centers to safeguard critical data. Healthcare, retail, and e-commerce expand rapidly with digital platforms requiring real-time operations. Media and entertainment drive content storage and streaming growth. Manufacturing and energy add to infrastructure demand for automation and analytics. IT and telecom remain dominant, but e-commerce and healthcare show the fastest expansion.

By End User Industry

The GLOBAL DATA CENTER MARKET is dominated by cloud service providers, which account for the largest share through hyperscale expansions and global network integration. Enterprises contribute significantly, leveraging hybrid and multi-cloud strategies to optimize operations. Colocation providers see rising demand from businesses seeking cost-effective, flexible infrastructure solutions. Government agencies strengthen market growth through sovereign data initiatives and regulatory compliance. Other end users, including research institutions and utilities, also increase adoption. Cloud service providers drive growth at scale, while colocation providers expand access to emerging markets. Together, these user groups shape global digital infrastructure demand.

Regional Insights:

North America

The North America Global Data Center Market size was valued at USD 96,866.18 million in 2020 to USD 1,66,239.41 million in 2025 and is anticipated to reach USD 4,52,687.04 million by 2035, at a CAGR of 10.48% during the forecast period. North America holds the largest share of the Global Data Center Market, supported by strong investments from hyperscale operators and cloud service providers. It benefits from advanced infrastructure, robust connectivity, and high enterprise adoption of cloud and AI. The presence of leading technology firms accelerates innovation and expansion across major hubs. Governments enforce data security and privacy regulations that drive regional investments. Edge computing deployment further enhances capacity for real-time services. It also gains from rising demand in financial services, healthcare, and retail sectors.

- For instance, CBRE’s H1 2025 report shows North American primary market data center inventory reached 8,155 MW, a 43.4% year-over-year increase, fueled by hyperscale expansions from AWS, Microsoft, and Google.

Europe

The Europe Global Data Center Market size was valued at USD 48,719.48 million in 2020 to USD 82,965.42 million in 2025 and is anticipated to reach USD 2,10,004.55 million by 2035, at a CAGR of 9.68% during the forecast period. Europe maintains a strong share in the Global Data Center Market driven by regulatory focus on sustainability and data sovereignty. Regional demand is supported by cloud adoption, digital transformation programs, and stricter data localization laws. Leading markets such as Germany, the UK, and France host several advanced facilities. Green energy adoption strengthens Europe’s leadership in sustainable operations. Investments in modular and hyperscale facilities expand capacity across emerging markets in Eastern Europe. Edge deployments rise alongside 5G rollouts, fueling demand for localized infrastructure.

- For instance, Germany mandated that all new data centers starting operation from July 2026 must achieve a Power Usage Effectiveness (PUE) of 2and utilize 100% renewable energy, setting new industry standards under the German Energy Efficiency Act (EnEFG).

Asia Pacific

The Asia Pacific Global Data Center Market size was valued at USD 58,479.10 million in 2020 to USD 1,01,787.89 million in 2025 and is anticipated to reach USD 3,12,367.26 million by 2035, at a CAGR of 11.79% during the forecast period. Asia Pacific is the fastest-growing region in the Global Data Center Market due to rapid digitalization and expanding internet penetration. China, India, and Southeast Asian nations invest heavily in hyperscale facilities and cloud ecosystems. Enterprises adopt advanced services to meet the demands of e-commerce, telecom, and fintech industries. Strong government backing supports digital infrastructure projects, while international players expand regional presence. The region also benefits from strong 5G deployments that accelerate edge computing growth. Sustainability targets create opportunities for renewable-powered facilities.

Latin America

The Latin America Global Data Center Market size was valued at USD 11,567.79 million in 2020 to USD 19,671.02 million in 2025 and is anticipated to reach USD 49,096.09 million by 2035, at a CAGR of 9.53% during the forecast period. Latin America shows steady progress in the Global Data Center Market as enterprises increase adoption of cloud services and digital platforms. Brazil and Mexico lead with major investments in hyperscale facilities. Regional demand is supported by growth in banking, telecom, and government sectors. Connectivity improvements enhance infrastructure development across secondary markets. Sustainability initiatives begin shaping investments, particularly in renewable-powered operations. It also benefits from global providers expanding partnerships with local operators. Rising internet penetration fuels long-term opportunities.

Middle East

The Middle East Global Data Center Market size was valued at USD 4,761.89 million in 2020 to USD 8,003.41 million in 2025 and is anticipated to reach USD 17,632.36 million by 2035, at a CAGR of 8.17% during the forecast period. The Middle East is emerging as a strategic region within the Global Data Center Market. Strong demand comes from government-backed digital transformation and smart city initiatives. Saudi Arabia and the UAE lead with investments in hyperscale and colocation facilities. Enterprises in finance, oil and gas, and telecom drive capacity requirements. Renewable integration supports the sustainability goals of regional governments. It benefits from partnerships between global players and local providers to expand capabilities. Data sovereignty regulations encourage domestic infrastructure growth.

Africa

The Africa Global Data Center Market size was valued at USD 4,222.80 million in 2020 to USD 7,039.14 million in 2025 and is anticipated to reach USD 14,042.54 million by 2035, at a CAGR of 7.08% during the forecast period. Africa represents an early-stage but promising region in the Global Data Center Market. Rising internet penetration and mobile adoption drive demand for cloud services and colocation facilities. South Africa, Nigeria, and Kenya lead with initial investments in digital infrastructure. It benefits from government initiatives that promote connectivity and economic diversification. Limited power infrastructure remains a challenge but also an opportunity for renewable integration. Enterprises increasingly adopt cloud and digital platforms to support growth. International players partner with regional firms to expand service offerings.

Competitive Insights:

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- CyrusOne Inc.

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

The GLOBAL DATA CENTER MARKET is highly competitive, shaped by global technology leaders and specialized operators. It features Equinix and Digital Realty as dominant colocation providers with extensive global footprints. Hyperscale growth is driven by AWS, Microsoft, and Google, which expand capacity to serve enterprise cloud and AI demand. IBM and HPE strengthen positions through hybrid cloud and infrastructure solutions. Cisco supports networking advancements, while NTT Communications and CyrusOne enhance regional presence with strategic partnerships. Intense competition pushes providers to invest in hyperscale capacity, renewable energy, and edge deployments. It fosters innovation in cooling, automation, and interconnection services to meet rising enterprise and regulatory requirements. The market continues to consolidate through mergers and acquisitions, reflecting strong strategic positioning among leading players.

Recent Developments:

- In September 2025, Equinix launched its first AI-ready data center in Chennai, India, following an initial investment of $69 million. This facility is designed to accelerate AI and cloud deployments in India, supporting robust digital transformation in the Asia-Pacific data center segment.

- In August 2025, EdgeConneX partnered with Lambda to develop a “dual-city infrastructure” project, focused on deploying AI data centers in both Chicago and Atlanta. This collaboration aims to address rising demand for advanced infrastructure supporting high-performance AI and cloud workloads across North America.