Executive summary:

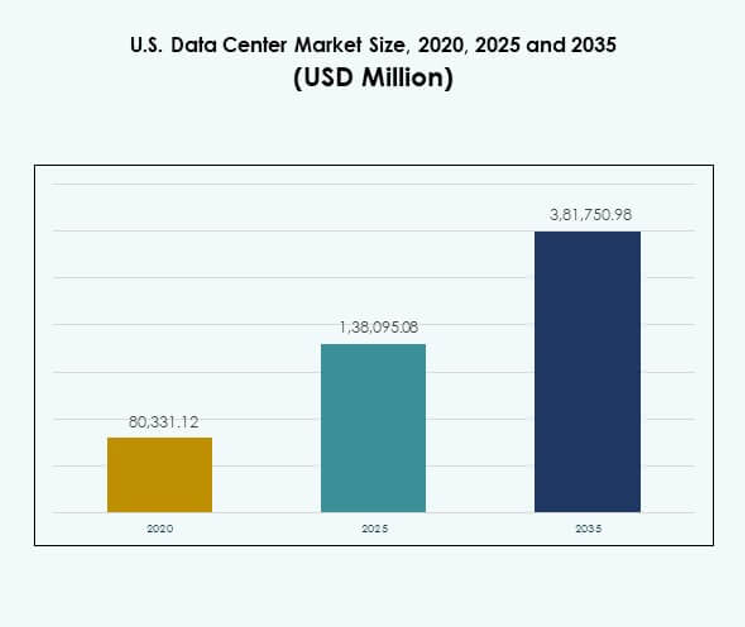

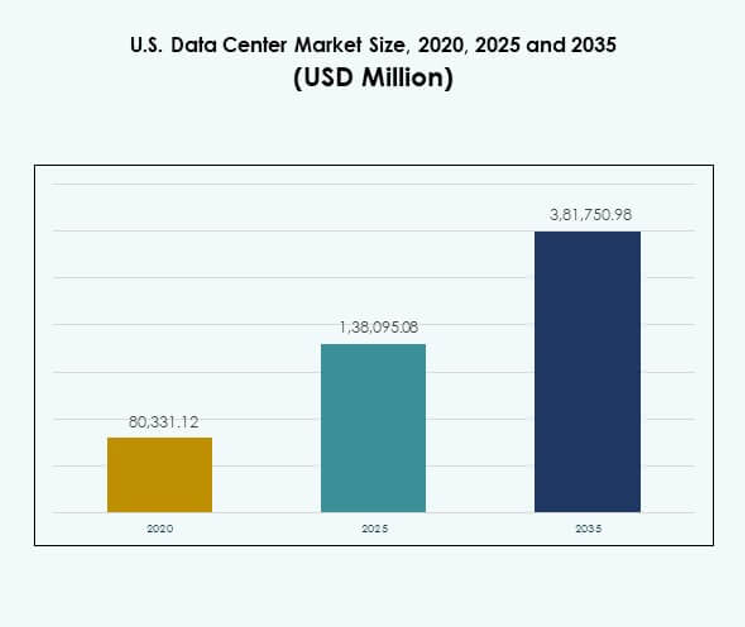

The U.S. Data Center Market size was valued at USD 80,331.12 million in 2020 to USD 1,38,095.08 million in 2025 and is anticipated to reach USD 3,81,750.98 million by 2035, at a CAGR of 10.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| U.S. Data Center Market Size 2025 |

USD 1,38,095.08 Million |

| U.S. Data Center Market, CAGR |

10.65% |

| U.S. Data Center Market Size 2035 |

USD 3,81,750.98 Million |

The market is driven by rapid digital transformation, rising demand for cloud computing, and integration of artificial intelligence and big data. Enterprises seek scalable, secure, and efficient infrastructure to manage increasing workloads. Colocation, edge deployments, and hybrid models provide flexibility and operational resilience. It plays a strategic role in enabling business continuity, innovation, and competitiveness, making the sector attractive for both enterprises and long-term investors.

The Southern region dominates the landscape with hyperscale clusters supported by strong power availability and connectivity. Western states lead in innovation and renewable adoption, driven by large technology companies. The Midwest and Northeast are emerging hubs, fueled by enterprise demand, financial sector compliance needs, and edge deployments. It reflects a balanced geographic spread, where mature hubs coexist with growing regions across the U.S.

Market Drivers

Adoption Of Advanced Digital Technologies Driving Infrastructure Expansion

The U.S. Data Center Market is expanding due to rapid adoption of cloud computing, artificial intelligence, and big data. Enterprises seek high-performance systems that support real-time processing and secure workloads. Demand for edge computing is also rising, driven by IoT and 5G networks. Hyperscale providers continue investing heavily in scalable facilities. Businesses rely on modernized centers to handle surging data traffic. Investors view it as a critical asset class supporting digital transformation. Sustainability goals push operators toward energy-efficient solutions. Together, these forces strengthen the market’s long-term momentum.

Strategic Role Of Data Centers In Enterprise Growth And Competitiveness

Companies view advanced data centers as the backbone of their digital strategies. Enterprises enhance service delivery and customer engagement through reliable data infrastructure. Technology adoption enables them to streamline operations and increase agility. Colocation and hybrid models provide flexibility while reducing capital expenditure. High-speed interconnectivity supports business continuity and disaster recovery. It offers investors predictable returns through recurring revenue streams. The market is becoming central to innovation, particularly in regulated industries. Organizations increasingly treat data centers as strategic enablers of global competitiveness.

- For instance, Equinix reported in July 2025 that its global interconnection franchise reached more than 492,000 total cross-connects, enabling secure, high-speed links for thousands of enterprises and accelerating digital transformation in regulated industries.

Innovation In Energy Efficiency And Cooling Boosting Market Attractiveness

Growing focus on energy-efficient operations is reshaping investment patterns in the sector. Operators deploy liquid cooling and advanced airflow management to lower costs. These technologies enhance performance while addressing environmental concerns. Green certifications raise the profile of sustainable facilities among enterprises. Renewable integration supports national commitments to reducing carbon footprints. It enables providers to attract clients with strong ESG requirements. Innovation in energy optimization directly impacts long-term profitability. The market continues to evolve with solutions that balance capacity, cost, and sustainability.

- For instance, Digital Realty’s 2024 Impact Report confirmed that eight of its global data centers, totaling 1.9 million square feet, were newly certified to internationally recognized sustainable building standards, such as LEED Gold, delivering enhanced resource efficiency and attracting clients with strong ESG requirements.

Shift Toward Hybrid And Cloud Models Supporting Scalability And Security

Hybrid cloud adoption is a dominant trend shaping data infrastructure. Enterprises prefer hybrid environments to balance control and flexibility. Critical workloads remain on-premises while non-sensitive applications move to the cloud. This shift creates demand for multi-tenant colocation and edge data centers. Operators gain from rising demand for secure, scalable, and high-speed connections. It strengthens the ecosystem by combining security with agility. Investors recognize hybrid adoption as a driver of long-term expansion. Businesses see hybrid deployment as essential for resilience and growth.

Market Trends

Rising Importance Of Edge Deployments For Latency-Sensitive Applications

Edge computing has emerged as a major trend shaping future deployments. Businesses require localized data processing to support IoT, 5G, and autonomous systems. This demand leads to increased adoption of micro and modular centers. Companies are shifting resources closer to end-users to ensure faster response times. It enables efficient handling of workloads such as AR, VR, and telemedicine. Operators invest in distributed models to meet enterprise expectations. Edge facilities are transforming the way services are delivered. The U.S. Data Center Market reflects this growing decentralization.

Expansion Of Hyperscale Facilities Driven By Cloud Service Demand

Hyperscale centers dominate new investments due to their ability to handle massive workloads. Cloud service providers continue to expand footprints across multiple states. Enterprises choose hyperscale operators for efficiency, cost optimization, and scalability. Investments in multi-gigawatt campuses strengthen the ecosystem’s resilience. It demonstrates the industry’s response to the surge in digital transformation. Hyperscale players partner with renewable energy suppliers to ensure sustainability. Their global interconnection capabilities attract multinational corporations. The U.S. Data Center Market benefits from these large-scale commitments.

Integration Of Artificial Intelligence And HPC In Data Infrastructure

AI workloads require advanced computing capacity and optimized environments. High-performance computing integration drives design changes in new facilities. Operators introduce GPUs and accelerators to support AI and machine learning applications. These technologies enhance automation, predictive maintenance, and analytics. It positions centers as enablers of cutting-edge digital ecosystems. Research and healthcare industries rely on AI-ready infrastructure for innovation. The adoption of HPC further strengthens the market’s growth trajectory. The U.S. Data Center Market is becoming a foundation for AI expansion.

Adoption Of Modular And Prefabricated Data Center Designs

Prefabricated and modular designs are gaining momentum among operators and enterprises. These solutions reduce deployment time while enhancing scalability. Modular approaches enable cost-effective expansion aligned with demand growth. It ensures greater flexibility compared to traditional brick-and-mortar construction. Enterprises prefer modular options for remote and emerging locations. Operators also use them to support quick edge rollouts. Prefabrication lowers construction risk while improving energy efficiency. The U.S. Data Center Market is witnessing accelerated demand for modularized designs.

Market Challenges

Rising Energy Consumption And Sustainability Pressure On Operators

The U.S. Data Center Market faces growing scrutiny due to high energy consumption. Operators must balance capacity expansion with environmental compliance. Pressure from regulators and communities is increasing for renewable adoption. Energy-intensive workloads such as AI and HPC amplify the challenge. It raises operational costs while forcing efficiency investments. Companies risk reputational damage if they fail to meet sustainability standards. Securing renewable sources at competitive costs becomes a strategic hurdle. Addressing this challenge requires long-term planning and significant capital allocation.

Cybersecurity Threats And Growing Complexity In Multi-Cloud Environments

Security remains a significant challenge for enterprises adopting hybrid and multi-cloud models. Rising cyberattacks target sensitive enterprise and government workloads. Operators must constantly upgrade defenses to ensure resilience. Compliance requirements across industries increase complexity in deployment. It creates demand for stronger encryption, monitoring, and response strategies. Breaches can impact trust and revenue streams for providers. Managing distributed environments also raises integration difficulties. The U.S. Data Center Market continues to navigate these challenges to maintain reliability.

Market Opportunities

Accelerating Digital Transformation Creating Demand For New Capacity

The U.S. Data Center Market benefits from enterprises pursuing large-scale digital initiatives. Expansion of e-commerce, fintech, and telehealth generates strong infrastructure demand. Operators can capture growth by offering scalable colocation and edge services. It positions providers to serve evolving workloads efficiently. Rapid 5G rollout further expands opportunities for localized centers. Partnerships with enterprises support industry-specific solutions. Investors see consistent returns in this expanding environment. Growing digital consumption drives new development pipelines across multiple states.

Green Data Centers And Renewable Integration Offering Competitive Advantage

Operators are seizing opportunities by building facilities powered by renewable energy. Sustainability commitments from clients amplify demand for green-certified centers. It enables providers to differentiate and secure long-term contracts. Investment in solar and wind-backed power purchase agreements supports expansion. Enterprises with ESG goals prioritize eco-friendly infrastructure. Operators focusing on low-carbon designs gain a strategic edge. The U.S. Data Center Market reflects this trend toward greener investments. Sustainable innovation creates pathways for future profitability and growth.

Market Segmentation

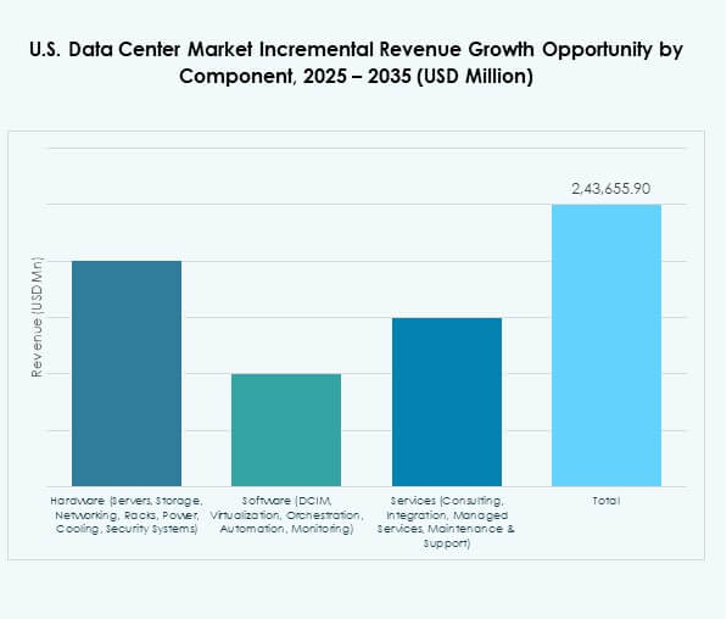

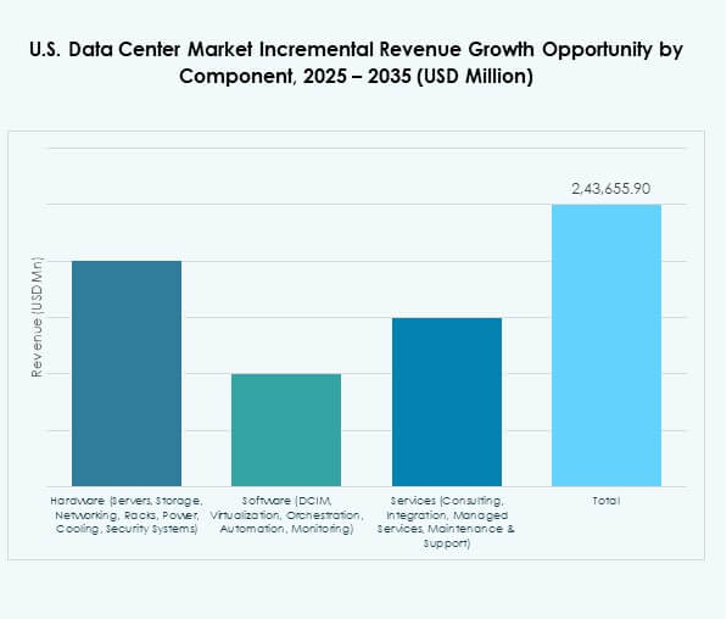

By Component

Hardware holds the largest share, driven by servers, networking equipment, and cooling systems. Rising demand for AI, HPC, and cloud workloads requires advanced infrastructure. Storage and rack density improvements further strengthen the hardware segment. Software adoption, including DCIM and automation, supports monitoring and control. Services gain traction with enterprises outsourcing integration and managed support. It highlights the growing need for flexible operations. The U.S. Data Center Market benefits from combined investments in all three categories.

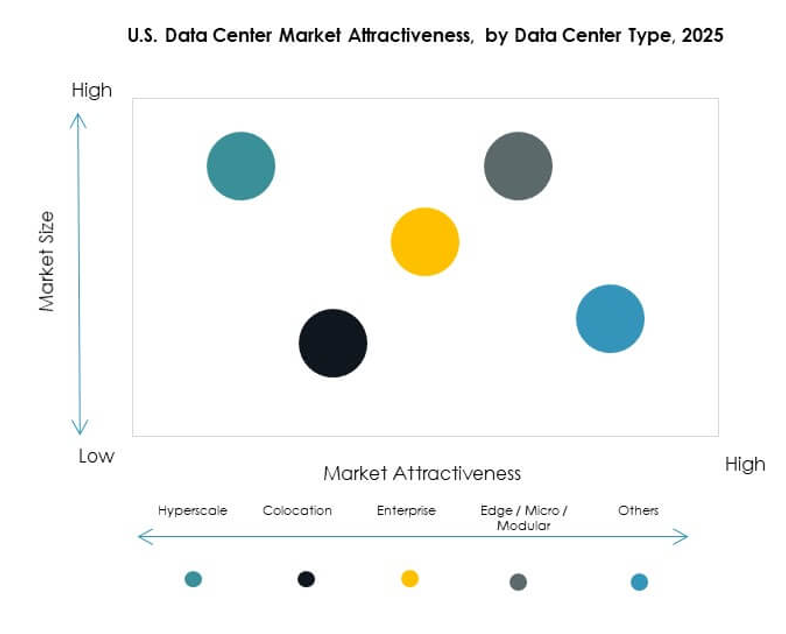

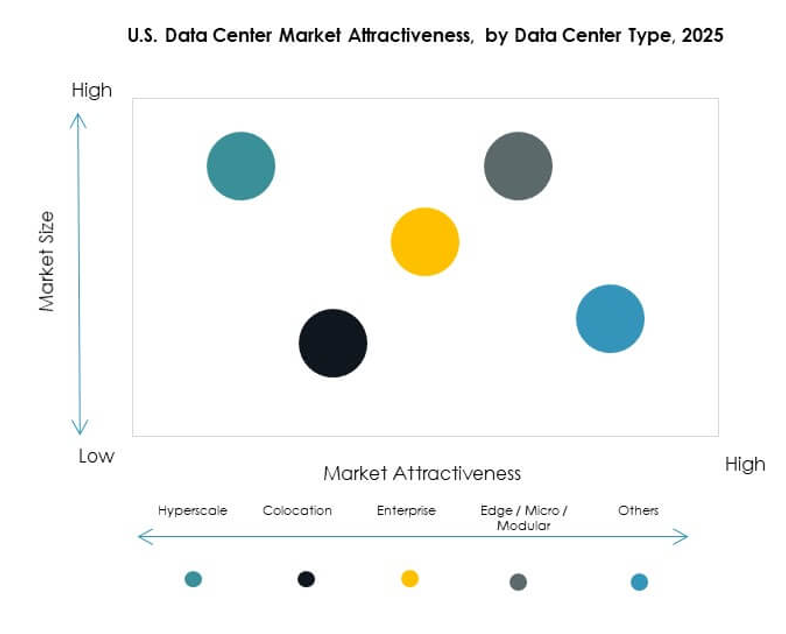

By Data Center Type

Hyperscale centers dominate due to massive investments from AWS, Microsoft, and Google. Their ability to handle multi-petabyte workloads ensures strong demand. Colocation providers attract enterprises seeking flexible and cost-effective options. Edge and modular centers are gaining share with 5G expansion. Enterprise-owned facilities continue supporting critical workloads. Mega centers and internet data centers expand rapidly in key hubs. It reflects the variety of models supporting national digital growth. The U.S. Data Center Market shows balanced expansion across types.

By Deployment Model

Cloud-based deployment leads due to strong adoption by enterprises and SMEs. On-premises models remain important for sensitive data workloads. Hybrid deployments grow quickly as firms blend control with scalability. It aligns with enterprises needing flexible, secure environments. Cloud service providers expand through hyperscale projects and regional hubs. Hybrid adoption strengthens the multi-cloud ecosystem. The U.S. Data Center Market continues evolving around these models. Flexibility and reliability drive deployment choices for diverse industries.

By Enterprise Size

Large enterprises dominate with higher budgets and advanced infrastructure needs. Their reliance on data-intensive applications sustains demand for hyperscale and colocation centers. SMEs adopt cloud and hybrid models for cost efficiency. It encourages growth of scalable colocation and managed services. SMEs seek agility and reduced capital investment through cloud solutions. Large enterprises drive innovation by deploying AI-ready infrastructure. The U.S. Data Center Market reflects balanced growth across both segments. Enterprises of all sizes play critical roles in demand expansion.

By Application / Use Case

IT and telecom lead due to rapid digitization and network expansion. BFSI requires secure, high-capacity infrastructure for transactions and analytics. Healthcare adoption grows with telemedicine and digital patient records. Retail and e-commerce rely on real-time processing and analytics. Media and entertainment see strong demand from streaming platforms. Manufacturing integrates IoT-driven data models. It reflects widespread sector adoption across industries. The U.S. Data Center Market demonstrates diverse applications with strong vertical penetration.

By End User Industry

Cloud service providers hold the largest share due to demand for global interconnectivity. Enterprises remain significant users with hybrid adoption. Colocation providers attract firms seeking cost-efficient infrastructure. Government agencies rely on secure and compliant environments. Others include energy, utilities, and education. It highlights broad demand across both private and public sectors. The U.S. Data Center Market benefits from multi-sector adoption. This diversity ensures steady and resilient market growth.

Regional Insights

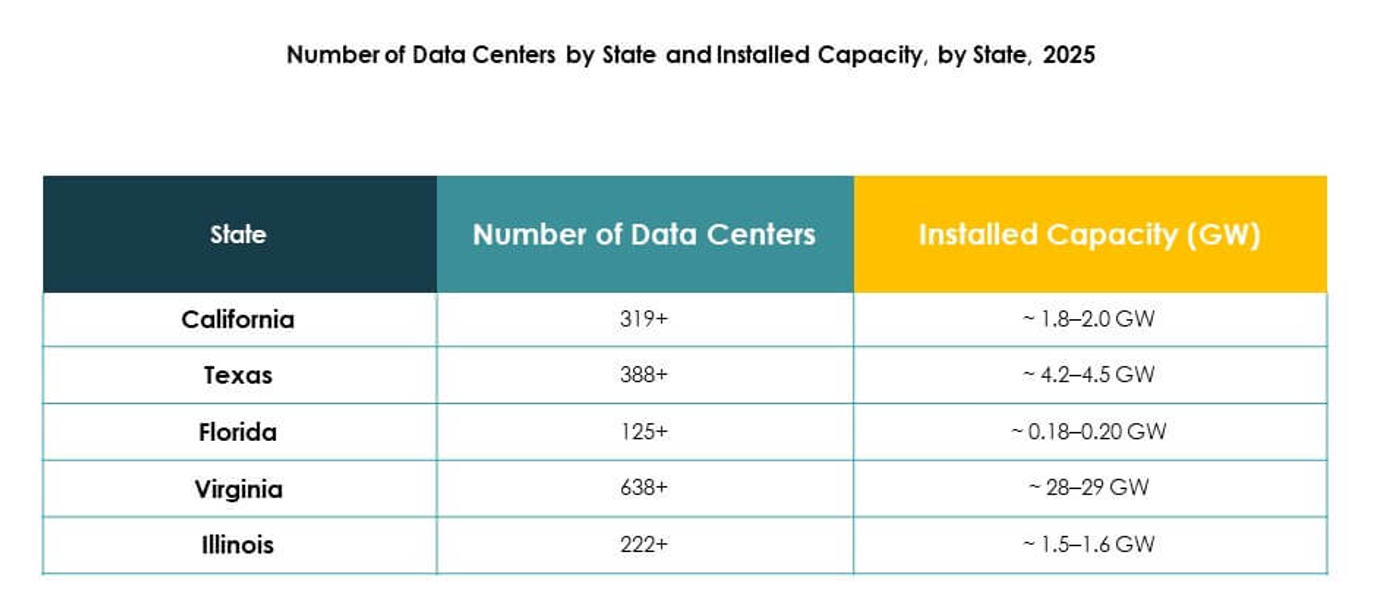

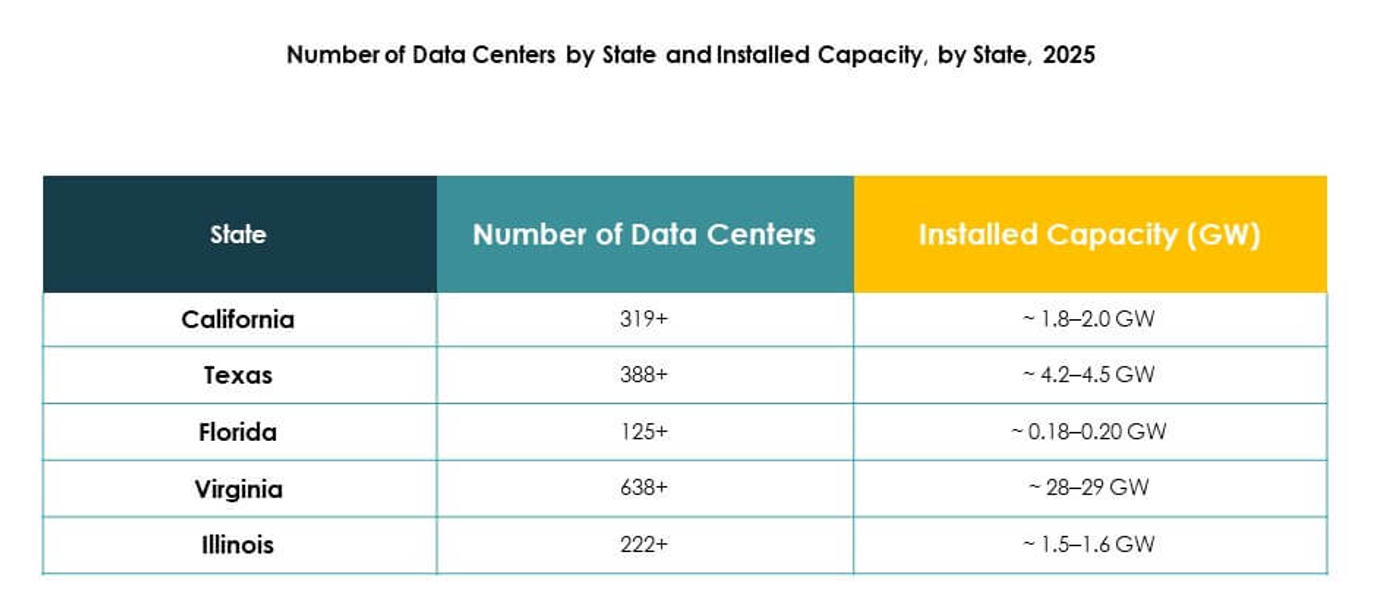

Dominance Of Southern U.S. Driven By Hyperscale Clusters And Connectivity

The Southern region leads the U.S. Data Center Market with a 37% share. Virginia, Texas, and Georgia host major hyperscale campuses supporting global cloud players. Strong power availability and interconnection networks reinforce growth in this region. It benefits from favorable policies and low operational costs. Enterprises view the South as a reliable hub for capacity expansion. The region continues attracting foreign investments through large-scale projects. It maintains strategic importance in national infrastructure.

Western U.S. Growth Driven By Innovation And Renewable Adoption

The Western region holds a 33% share, with California leading innovation. Operators in this area invest heavily in renewable energy integration. Strong presence of technology companies creates demand for edge and hyperscale centers. It benefits from advanced connectivity and established digital ecosystems. States such as Arizona and Nevada gain importance with new projects. The region’s role in supporting cloud and AI adoption is expanding. The U.S. Data Center Market thrives on these innovation-driven dynamics.

- For instance, in August 2025, Equinix announced agreements with advanced nuclear and fuel cell providers (Oklo, Radiant, ULC-Energy, Stellaria, and Bloom Energy) to secure more than 500 MW of next-generation clean electricity and over 100 MW of solid-oxide fuel cells at 19 data centers spanning six U.S. markets, maximizing ultra-reliable low-carbon power for hyperscale and AI demand.

Emerging Opportunities In Midwest And Northeastern U.S. Regions

The Midwest and Northeast collectively account for 30% of the market. Chicago serves as a central hub for enterprise colocation demand. Northeastern states like New York and New Jersey provide strong connectivity. These regions attract enterprises requiring compliance and proximity to financial centers. It strengthens distributed infrastructure across the country. Investment in edge deployments enhances regional coverage. The U.S. Data Center Market benefits from this balanced regional spread. Growth opportunities continue emerging across these subregions.

- For example, in 2025, Chicago remained a leading Midwest data center hub, with major operators including Digital Realty, Equinix, Google, and Meta expanding facilities, reinforcing the city’s role as a critical hub for enterprise aggregation and low-latency interconnection.

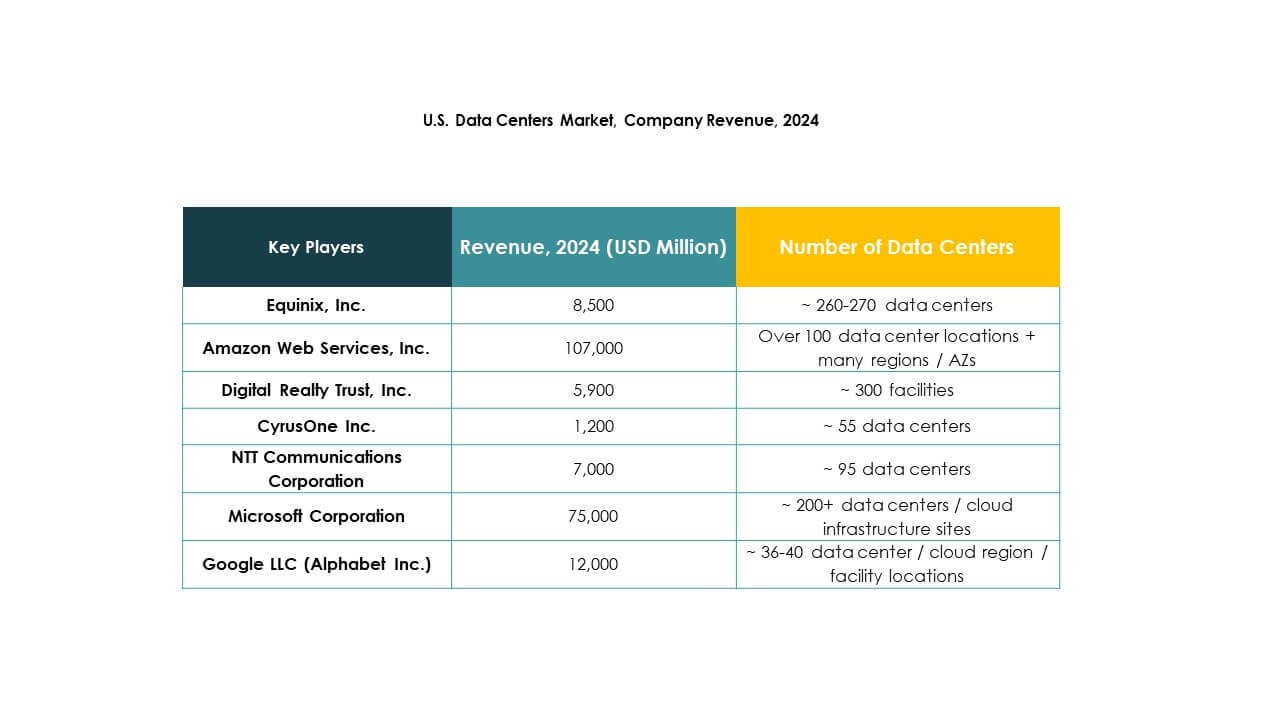

Competitive Insights:

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- CyrusOne Inc.

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise (HPE)

- Iron Mountain Data Centers

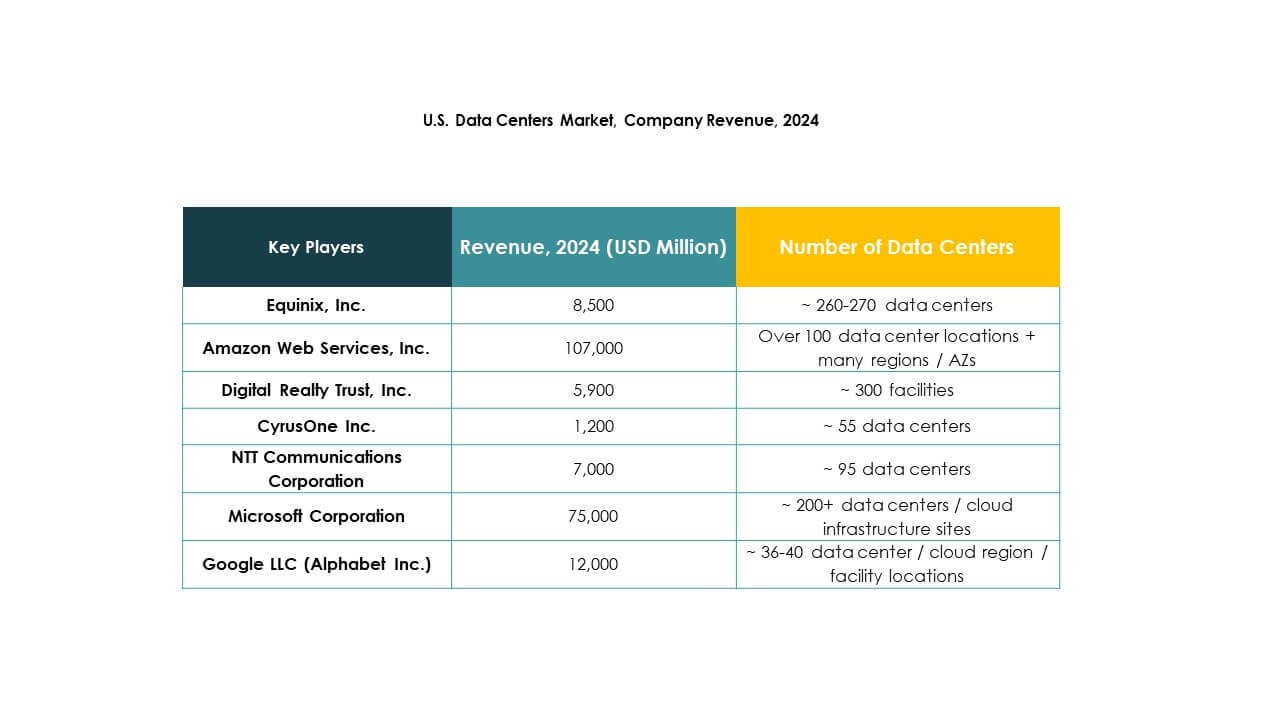

The U.S. Data Center Market is highly competitive, with global leaders and specialized providers shaping the ecosystem. Equinix and Digital Realty dominate colocation and interconnection services, while hyperscale giants AWS, Microsoft, and Google strengthen cloud-driven infrastructure. NTT Communications and CyrusOne expand capacity through strategic investments and partnerships. Iron Mountain differentiates through secure and compliant facilities, while HPE focuses on hybrid IT and edge solutions. It continues to evolve with mergers, acquisitions, and sustainable innovation shaping long-term strategies. Competitive intensity remains high, as providers invest in green data centers, AI-ready infrastructure, and calable capacity to meet enterprise and public sector demand.

Recent Developments:

- In September 2025, Equinix, Inc. introduced its Distributed AI Infrastructure, unifying over 270 data centers across 77 global markets to enhance AI connectivity and services for U.S. enterprises. This initiative aims to accelerate the next wave of AI-driven business solutions, featuring a fully programmable AI-optimized network designed to support demanding enterprise workloads.

- In September 2025, Microsoft unveiled its Fairwater AI data center in Wisconsin, part of a broader push to expand AI infrastructure across the U.S. The facility will use interconnected NVIDIA GB200 GPUs and offer liquid cooling and advanced network design for high-throughput AI workloads.

- In May 2025, NTT Communications Corporation announced the accelerated expansion of its Global Data Centers division, securing land across North America and other strategic markets as part of a $10 billion investment plan to add nearly a gigawatt of future data center capacity. This move positions NTT to proactively support AI-powered workloads and cloud adoption in the U.S. and globally.

- In April 2025, Digital Realty Trust, Inc. completed land acquisitions totaling $156 million in Atlanta, Georgia, and Charlotte, North Carolina, for new data center developments in the United States. The Atlanta site alone is projected to deliver 200 megawatts of capacity, reflecting vigorous expansion in response to robust market demand for hyperscale facilities.