Executive summary:

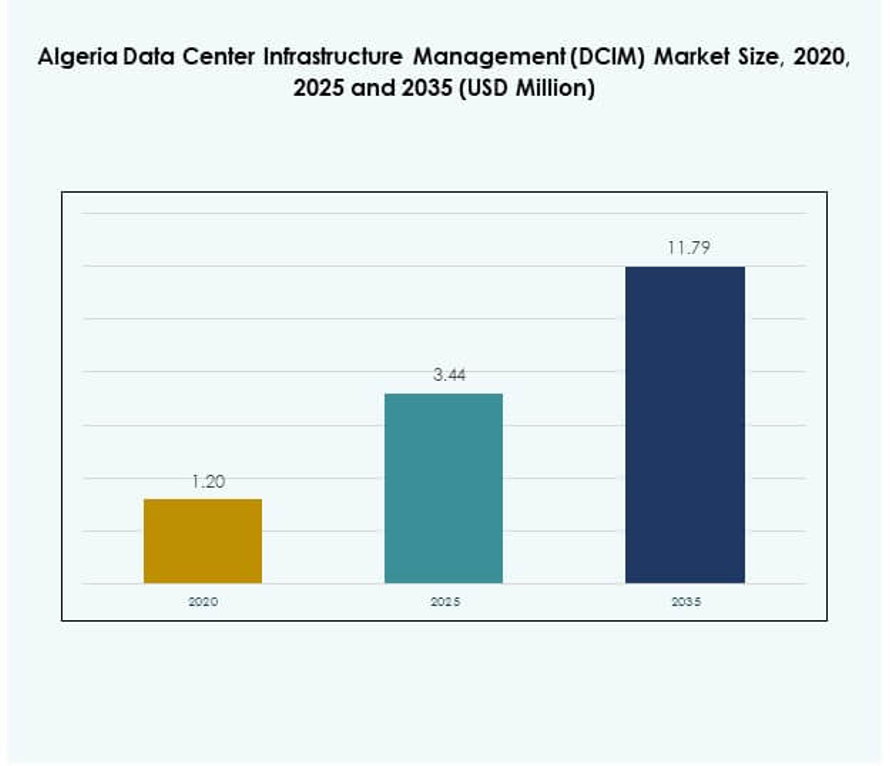

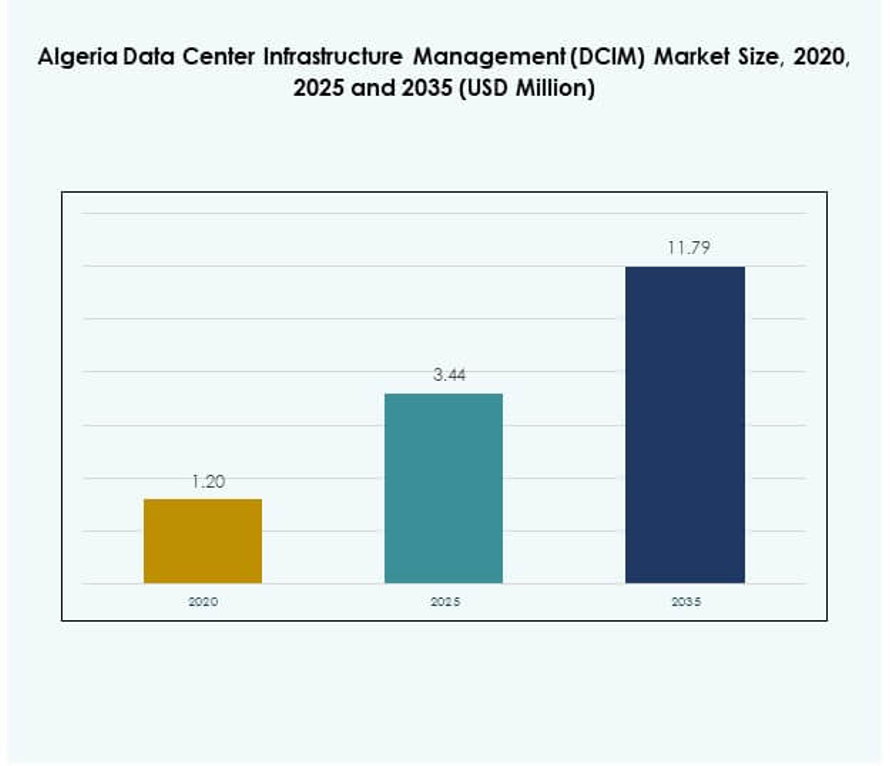

The Algeria Data Center Infrastructure Management (DCIM) Market size was valued at USD 1.20 million in 2020, increased to USD 3.44 million in 2025, and is anticipated to reach USD 11.79 million by 2035, at a CAGR of 14.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Algeria Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 3.44 Million |

| Algeria Data Center Infrastructure Management (DCIM) Market, CAGR |

14.87% |

| Algeria Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 11.79 Million |

The market is driven by rapid digital transformation, increased cloud integration, and adoption of AI-powered infrastructure management solutions. Companies are focusing on automation, predictive analytics, and real-time energy monitoring to improve efficiency and reduce downtime. Rising investments in smart infrastructure and renewable-powered data centers enhance operational reliability. The Algeria DCIM market holds strategic importance for investors seeking scalable, intelligent, and sustainable data management opportunities.

Regionally, North Africa leads with Algeria emerging as a regional digital hub due to strong ICT investments and connectivity projects. Countries like Morocco and Egypt are developing hybrid infrastructure to support growing digital ecosystems. Algeria’s geographic position and modernization efforts enable it to attract international partnerships and expand its role in Africa’s data center and DCIM landscape.

Market Drivers

Rising Digital Transformation and Demand for Intelligent Infrastructure

The Algeria Data Center Infrastructure Management (DCIM) Market is driven by rapid digital transformation across enterprises. Businesses seek to modernize operations and enhance uptime through intelligent infrastructure. The adoption of cloud computing, AI, and automation supports efficient data management. Organizations are integrating DCIM solutions to achieve real-time monitoring and energy optimization. IT infrastructure upgrades strengthen Algeria’s competitiveness in the regional digital economy. Companies prioritize predictive maintenance and operational transparency. This growing dependence on data-driven systems expands the adoption rate of DCIM platforms. It enhances overall reliability and performance of mission-critical systems.

Increased Focus on Energy Efficiency and Sustainability Goals

Energy efficiency is becoming a central driver of DCIM adoption in Algeria. Enterprises aim to reduce operational costs and carbon emissions while maintaining high performance. DCIM tools provide visibility into energy consumption, enabling better resource allocation. Integration of renewable energy systems with DCIM platforms improves sustainability tracking. Data centers increasingly deploy smart power distribution and cooling systems. Governments and regulators encourage green IT infrastructure initiatives to meet sustainability goals. The transition toward eco-efficient facilities supports market expansion. It positions Algeria as a competitive player in environmentally responsible digital operations.

Growing Cloud Adoption and Expansion of Hybrid Architectures

Cloud adoption has accelerated DCIM solution demand in Algeria’s technology landscape. Companies rely on hybrid data centers that combine on-premises and cloud infrastructure. DCIM platforms enable seamless management across these distributed environments. Businesses leverage unified dashboards for asset, capacity, and network monitoring. Integration with edge computing further improves responsiveness and reduces latency. The flexibility of hybrid deployments enhances business continuity. Growing demand for scalable data centers attracts international investors. It strengthens Algeria’s role in regional digital connectivity and cloud integration.

- For instance, ICOSNET, a leading Algerian ISP and digital solutions provider established in 1999, operates data management and web hosting facilities in Algiers and Oran, delivering national cloud and unified communications services that enable local companies to deploy hybrid and cloud-based business infrastructures with reliable domestic support and compliance with Algerian data regulations.

Increased Investments by Enterprises and Strategic Global Partnerships

Investments in new data centers and IT modernization are fueling DCIM growth. Local enterprises collaborate with global technology providers for advanced infrastructure. Partnerships with cloud and colocation firms drive knowledge transfer and innovation. Businesses are implementing DCIM systems to optimize facility utilization and reduce downtime. The integration of AI and IoT enables predictive analytics and automation. Investors view Algeria as a strategic gateway for North African digital infrastructure. The market offers high potential for long-term returns. It reflects Algeria’s steady transition toward data-driven enterprise ecosystems.

- For instance, in February 2025, Algeria Telecom and Huawei jointly launched a national 400G Wavelength Division Multiplexing (WDM) backbone network infrastructure project, deploying ultra-high-speed, low-latency optical transmission technology across Algeria to accelerate digital transformation and support e-commerce, cloud computing, and emerging digital industries.

Market Trends

Integration of Artificial Intelligence and Predictive Analytics in DCIM Platforms

The Algeria Data Center Infrastructure Management (DCIM) Market is witnessing a shift toward AI-driven operations. Predictive analytics helps detect equipment failures before downtime occurs. Machine learning algorithms optimize cooling, power, and resource allocation. Real-time insights enable faster decision-making and efficient maintenance planning. Businesses benefit from intelligent automation that improves overall system efficiency. AI-based DCIM platforms are enhancing visibility across multi-site facilities. Vendors are integrating cognitive capabilities to support future-ready data centers. It marks a major step toward fully automated and self-regulating infrastructure management.

Emergence of Edge Data Centers and Distributed Infrastructure Models

Edge computing is transforming the Algerian DCIM landscape through localized data processing. The rise of IoT and latency-sensitive applications drives micro and modular data centers. These facilities require specialized DCIM tools for distributed asset control. Edge data centers improve performance and reduce network congestion. Telecom operators and enterprises are investing in scalable DCIM solutions. This trend aligns with the rapid adoption of 5G and AI workloads. Increased demand for localized cloud access fosters infrastructure diversification. It strengthens Algeria’s position as a regional edge data hub.

Growing Importance of Cybersecurity and Compliance Integration

Cybersecurity integration within DCIM platforms is becoming a top industry trend. Businesses in Algeria face growing risks from digital threats and data breaches. Modern DCIM solutions embed security analytics and access control modules. Compliance with data protection frameworks is becoming a core requirement. The convergence of physical and digital security supports holistic infrastructure protection. Vendors are offering encryption, multi-factor authentication, and anomaly detection tools. Enterprises gain confidence in maintaining operational integrity across facilities. It ensures Algeria’s data centers meet global security and reliability standards.

Shift Toward Modular, Scalable, and Automation-Enabled Designs

Modular infrastructure design is gaining preference among Algerian data center operators. It enables flexible capacity expansion based on operational demand. DCIM platforms support automated configuration and rapid deployment. The trend allows smaller businesses to enter the digital infrastructure space efficiently. Prefabricated modular components reduce setup time and complexity. Automation tools minimize manual intervention while improving uptime. Market players focus on integrating plug-and-play systems for scalability. It supports a sustainable pathway for Algeria’s growing IT infrastructure ecosystem.

Market Challenges

Limited Technical Expertise and Integration Complexity

The Algeria Data Center Infrastructure Management (DCIM) Market faces challenges due to limited local expertise. Integrating DCIM solutions with existing legacy systems requires specialized skills. Many enterprises struggle with aligning DCIM software across diverse hardware. Lack of trained professionals slows adoption and increases operational errors. Vendors must invest in training programs and local support networks. Implementation complexity remains a barrier for small enterprises. Data synchronization between IT and facility management systems can create delays. It highlights the need for skill development and structured technical collaboration.

High Implementation Costs and Data Localization Constraints

The high cost of deploying advanced DCIM solutions restricts smaller players. Many businesses face financial limitations in adopting automation-driven platforms. Hardware upgrades, software licenses, and training contribute to higher capital expenditure. Government-mandated data localization policies add compliance challenges. Delays in network modernization also limit system integration. Enterprises must justify ROI before large-scale implementation. The lack of standardized DCIM frameworks complicates scalability. It underscores the importance of cost optimization and regulatory clarity in Algeria’s market evolution.

Market Opportunities

Growing Investments in Digital Infrastructure and Smart Energy Systems

The Algeria Data Center Infrastructure Management (DCIM) Market presents significant growth prospects through digital infrastructure expansion. Public and private sectors are investing in new data facilities and connectivity projects. The increasing use of renewable energy supports sustainable DCIM deployments. Smart energy monitoring systems improve efficiency and reduce costs. Cloud providers and telecom firms see Algeria as a regional hub for infrastructure growth. Improved power stability enhances investor confidence. The market benefits from favorable regulatory momentum and enterprise digitalization. It sets the foundation for long-term infrastructure transformation.

Emergence of Local Technology Vendors and Service Providers

The rise of domestic DCIM vendors opens new business avenues. Local firms provide tailored services aligned with Algeria’s market needs. They enable cost-effective deployments and faster support response. Partnerships between international and regional players encourage innovation. Expanding digital literacy improves DCIM awareness among enterprises. Government focus on ICT skill development strengthens technical readiness. It drives greater adoption across SMEs and large corporations. Algeria’s evolving ecosystem positions it as a future-ready DCIM destination.

Market Segmentation

By Component

Solutions dominate the Algeria Data Center Infrastructure Management (DCIM) Market due to growing automation and monitoring demand. They provide advanced tools for asset management, power control, and environmental tracking. Services, including consulting and maintenance, are expanding with hybrid and multi-cloud deployments. Vendors offering end-to-end solutions gain strong market traction. Continuous innovation in integrated DCIM platforms supports sustained growth. The rise of subscription-based models attracts both SMEs and enterprises. It strengthens customer retention and long-term scalability.

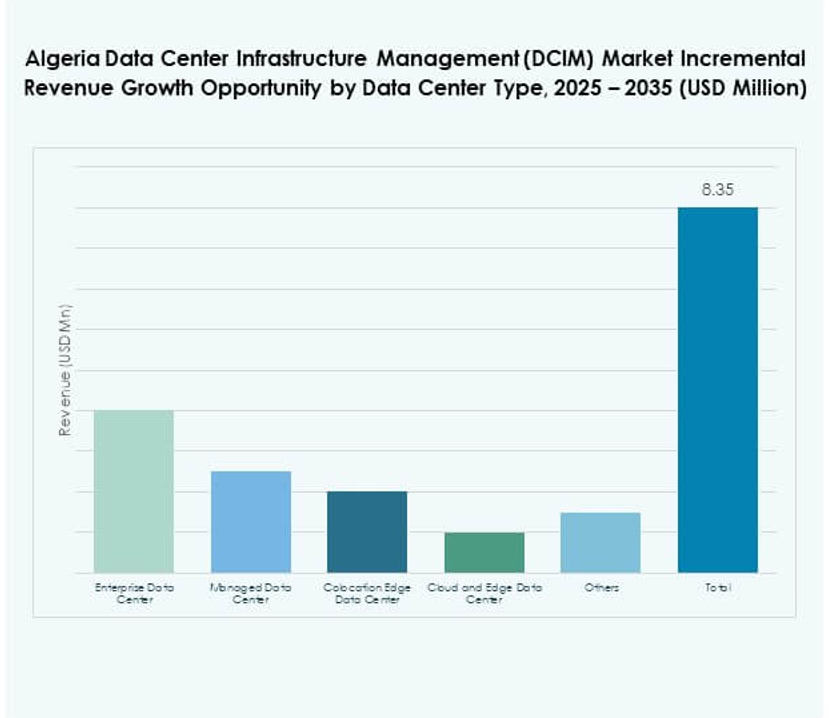

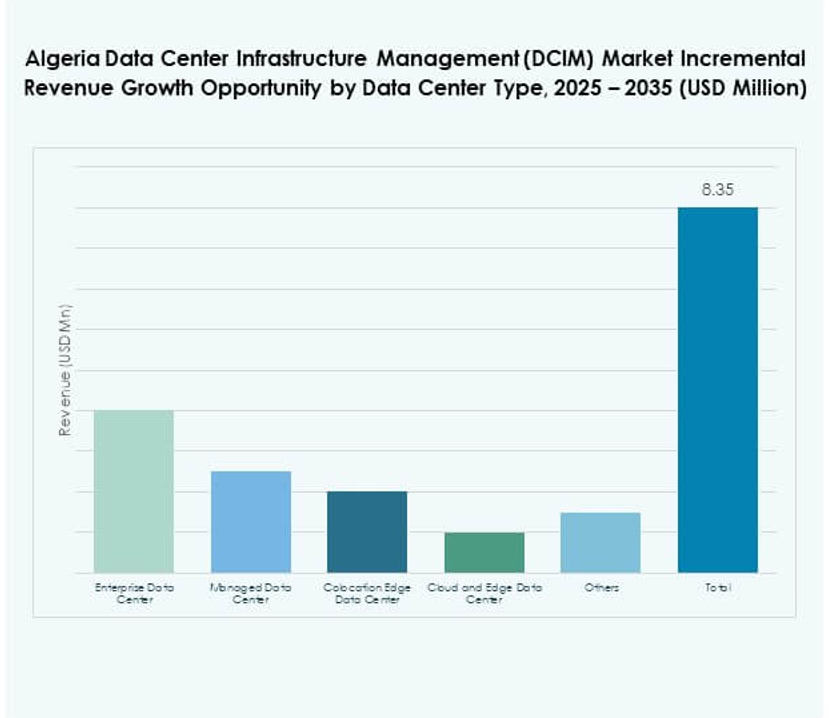

By Data Center Type

Enterprise data centers lead the Algeria Data Center Infrastructure Management (DCIM) Market with high adoption of intelligent management tools. Managed and colocation edge centers are witnessing growth due to outsourcing trends. Cloud and edge facilities gain popularity for flexibility and low-latency services. Hybrid infrastructures enhance resilience and support digital applications. Regional data investments improve operational performance and network reach. Modular centers allow cost-efficient scaling for new entrants. It supports Algeria’s digital transformation and enterprise modernization goals.

By Deployment Model

Cloud-based deployment dominates the Algeria Data Center Infrastructure Management (DCIM) Market due to its scalability and remote accessibility. Enterprises leverage cloud models for real-time insights and centralized monitoring. Hybrid deployment follows closely, supporting distributed and edge infrastructure integration. On-premises deployment retains traction in security-sensitive industries like BFSI and defense. Cloud-native DCIM tools facilitate predictive analytics and process automation. Improved data availability enhances system reliability. It drives growing adoption across public and private sector facilities.

By Enterprise Size

Large enterprises lead the Algeria Data Center Infrastructure Management (DCIM) Market due to extensive infrastructure needs and advanced digital operations. SMEs are rapidly adopting cloud-based and modular DCIM tools. Affordable subscription models make technology accessible to smaller firms. Large organizations focus on predictive monitoring and energy optimization. Scalable platforms enable easy asset tracking and power management. SMEs benefit from simplified integration and minimal maintenance requirements. It promotes inclusive digital growth across Algeria’s business ecosystem.

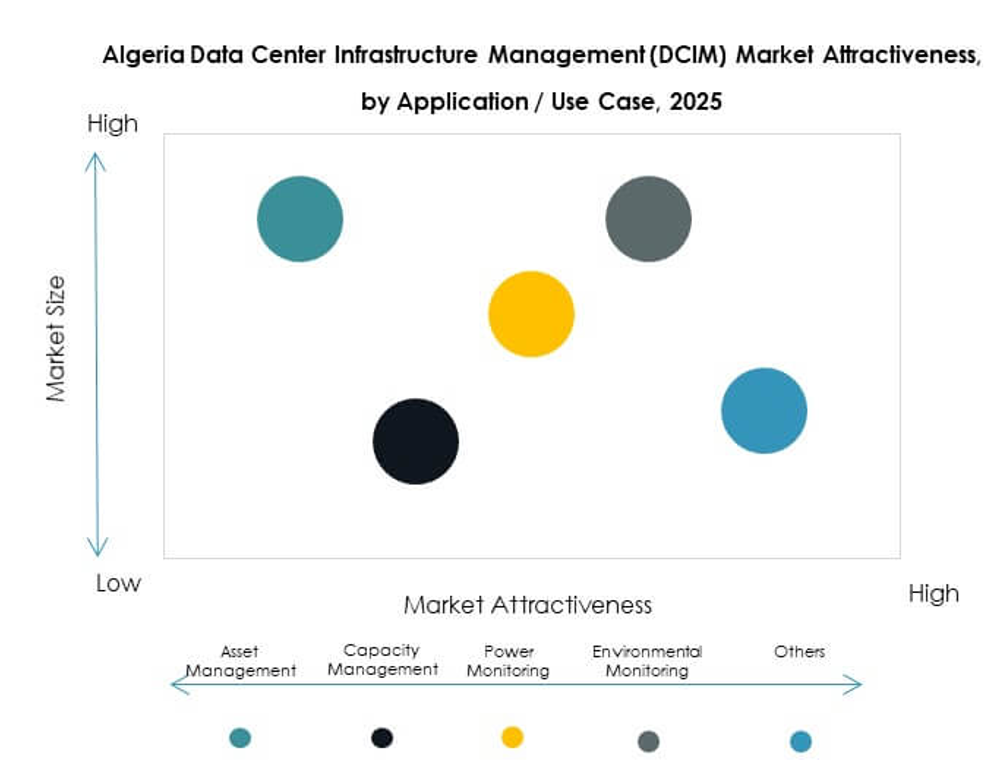

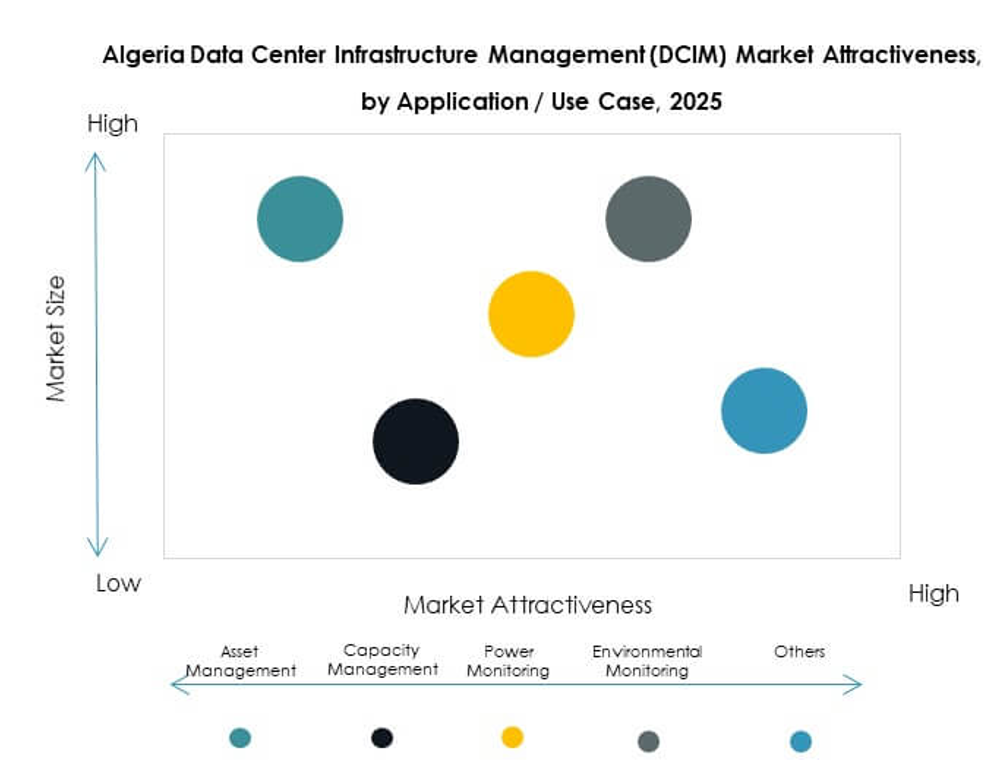

By Application / Use Case

Power monitoring and environmental management dominate the Algeria Data Center Infrastructure Management (DCIM) Market. Real-time energy control and temperature tracking improve operational efficiency. Asset management and capacity planning tools enhance utilization. Business intelligence and analysis applications support strategic decision-making. Integrated dashboards provide holistic visibility into data center operations. Automation features minimize manual oversight and system downtime. It strengthens overall infrastructure resilience and reliability.

By End User Industry

The IT and telecommunications sector leads the Algeria Data Center Infrastructure Management (DCIM) Market due to high digital data dependency. BFSI and healthcare follow, driven by strict compliance and uptime needs. Retail and e-commerce sectors use DCIM to manage seasonal workloads and inventory systems. Energy and utilities apply DCIM for predictive maintenance and grid monitoring. Aerospace and defense focus on secure data facility management. Growing digital operations across these sectors sustain long-term market growth. It supports Algeria’s broader technology modernization goals.

Regional Insights

North Africa – Algeria’s Expanding Digital Core

North Africa holds the largest share of 41% in the Algeria Data Center Infrastructure Management (DCIM) Market. Algeria leads the subregion with government-backed ICT initiatives and new data center projects. The country’s telecom and enterprise sectors are driving the need for reliable infrastructure management. Strong connectivity networks support cloud expansion and colocation growth. North Africa’s energy capabilities further enhance green data operations. It reinforces Algeria’s position as a digital powerhouse within the African continent.

- For instance, in March 2025, the Algerian government broke ground on a new AI-focused data center facility in Oran, aiming to support technological resources for researchers and startups. This initiative aligns with Algeria’s vision to establish itself as a digital technology leader in Africa. Additionally, local companies such as HostArts and Ayrade provide hosting services primarily out of Algiers and Oran, indicating a growing domestic data center ecosystem.

Sub-Saharan Africa – Emerging Connectivity and Infrastructure Growth

Sub-Saharan Africa accounts for 34% of the Algeria Data Center Infrastructure Management (DCIM) Market. Emerging economies like Nigeria and Kenya show increasing interest in DCIM integration. Cross-border digital projects strengthen regional partnerships. Expanding internet penetration creates demand for localized infrastructure monitoring. Telecom players collaborate with global vendors for scalable deployments. The subregion benefits from Algeria’s expertise in data resilience and energy management. It fosters broader market development and regional technology cooperation.

- For instance, in July 2025, MTN Nigeria officially launched the Dabengwa Data and Cloud Centre in Lagos, the largest data center in West Africa. This tier-3 facility has an initial power capacity of 4.5 megawatts with plans to expand to 14 megawatts within 24 months. The data center supports diverse clients including government agencies and large enterprises, significantly bolstering Nigeria’s digital infrastructure and reducing reliance on foreign platforms.

Middle East – Strategic Technological Collaboration and Investment Synergy

The Middle East represents 25% share of the Algeria Data Center Infrastructure Management (DCIM) Market. Collaborative ventures between Gulf countries and North African enterprises are driving innovation. UAE and Saudi Arabia contribute through advanced DCIM solutions and smart city projects. Regional cloud partnerships improve cross-border connectivity and business efficiency. Investments in cybersecurity and hybrid data frameworks enhance integration standards. The partnership ecosystem creates a balanced digital infrastructure landscape. It ensures Algeria’s continued participation in regional technological growth.

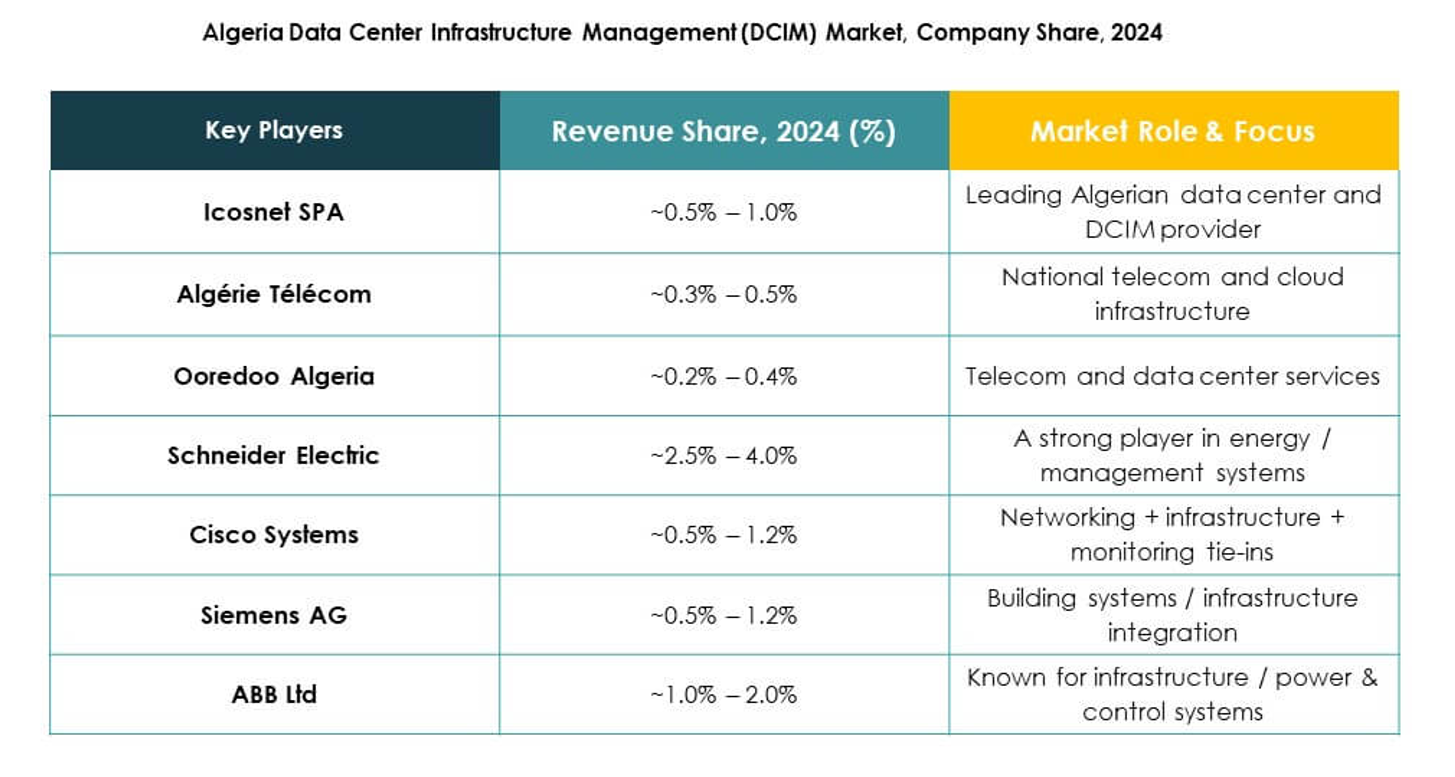

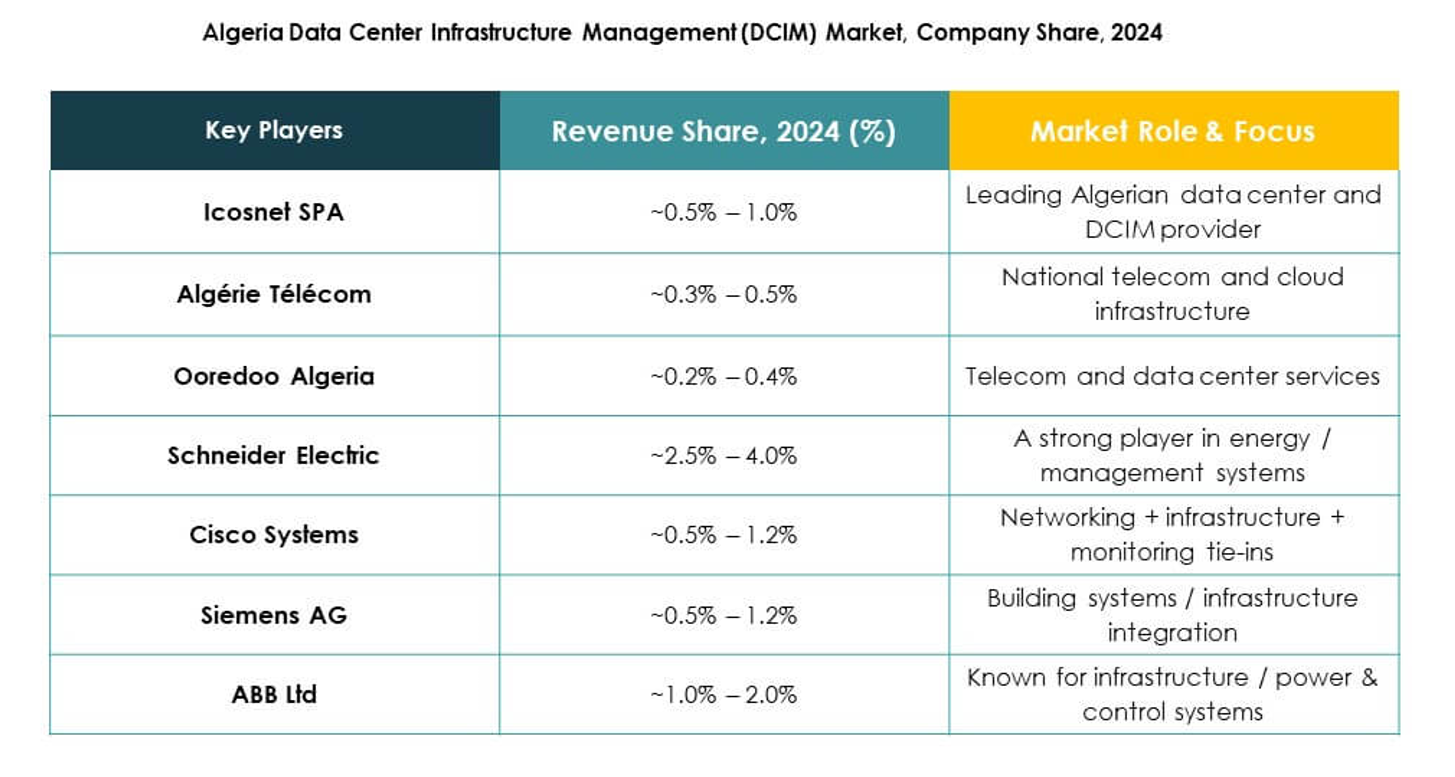

Competitive Insights:

- Icosnet SPA

- Algérie Télécom

- Ooredoo Algeria

- Eurl Host Arts

- Cisco Systems, Inc.

- Equinix, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

The Algeria Data Center Infrastructure Management (DCIM) Market features a competitive mix of domestic telecom operators and global technology leaders. Icosnet SPA and Algérie Télécom drive local infrastructure investments and digital connectivity projects. Global players such as Huawei, Schneider Electric, and Eaton focus on advanced DCIM platforms supporting automation and energy efficiency. Cisco and Siemens strengthen integration through smart monitoring and AI-based analytics. Equinix expands its data presence with global standards in reliability and interconnection. Regional providers like Ooredoo Algeria and Eurl Host Arts enhance colocation and cloud readiness. It remains characterized by strategic alliances, technology transfer, and rising competition in intelligent infrastructure solutions.

Recent Developments:

- In July 2025, Algérie Télécom entered a strategic partnership with Telecom Italia Sparkle to build a new submarine cable between Algeria and Italy, open a European Point of Presence, and develop an international-standard data center, marking a major step in Algeria’s digital transformation.

- In February 2025, Algeria Telecom partnered with Huawei to launch the national 400G WDM project, which establishes an all-optical premium transmission foundation and sets the stage for major improvements in the country’s data center connectivity and infrastructure management capabilities.