Executive summary:

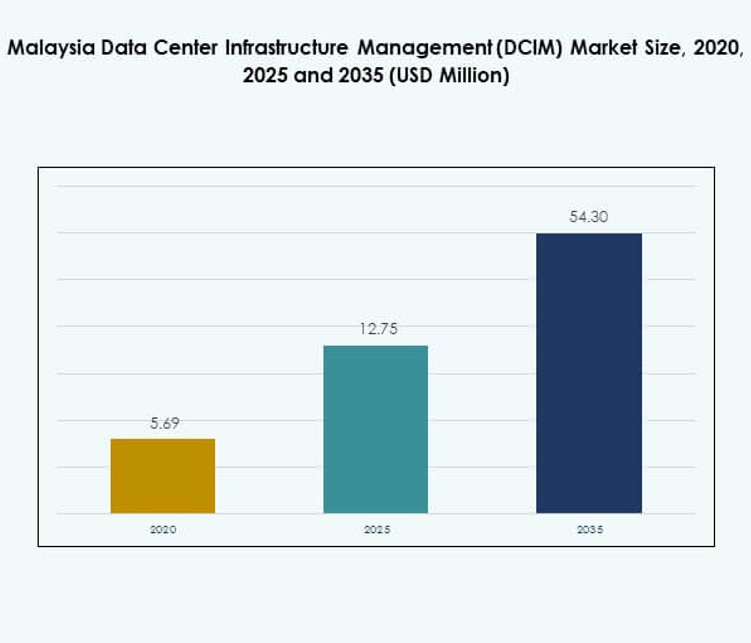

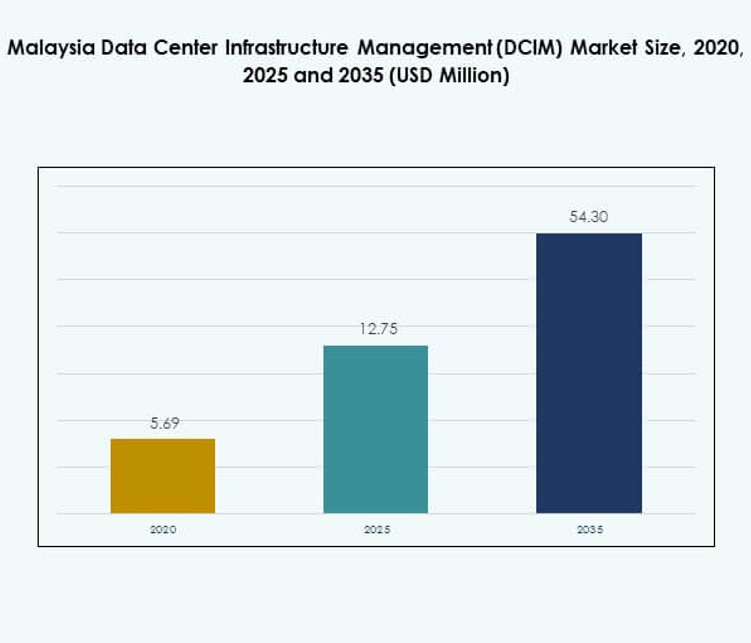

The Malaysia Data Center Infrastructure Management (DCIM) Market size was valued at USD 5.69 million in 2020, increased to USD 12.75 million in 2025, and is anticipated to reach USD 54.30 million by 2035, registering a CAGR of 17.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Malaysia Data Center Infrastructure Management (DCIM) Market Size 2025 |

USD 12.75 Million |

| Malaysia Data Center Infrastructure Management (DCIM) Market, CAGR |

17.37% |

| Malaysia Data Center Infrastructure Management (DCIM) Market Size 2035 |

USD 54.30 Million |

The Malaysia Data Center Infrastructure Management (DCIM) Market is advancing due to widespread digital transformation, cloud migration, and the integration of AI, IoT, and automation technologies. Businesses are adopting DCIM systems to enhance energy efficiency, optimize resource utilization, and improve operational resilience. Growing data volumes and the expansion of hyperscale facilities strengthen the market’s relevance. It serves as a strategic enabler for investors and enterprises seeking scalability, transparency, and improved decision-making in infrastructure management.

Regionally, Southeast Asia leads the data center infrastructure expansion, with Malaysia emerging as a dynamic hub supported by strong connectivity, government-backed digitalization, and foreign investment. Singapore dominates with advanced hyperscale capacity, while Indonesia and Thailand are fast-growing due to rising enterprise demand. Malaysia’s competitive advantage lies in its favorable regulatory environment, sustainable initiatives, and strategic positioning as a bridge between established and emerging digital economies in the region.

Market Drivers

Rapid Digitalization and Growing Cloud Infrastructure Investments

The Malaysia Data Center Infrastructure Management (DCIM) Market is expanding with rising digital transformation and cloud adoption across enterprises. Increasing investments in hyperscale and colocation data centers drive the need for DCIM solutions that optimize operational performance. Businesses are focusing on automation, predictive maintenance, and energy efficiency to reduce downtime. Government initiatives like MyDIGITAL and Industry4WRD encourage digital acceleration and infrastructure expansion. Cloud providers such as AWS and Microsoft Azure continue strengthening local presence. Growing data generation across sectors fuels demand for scalable infrastructure. The shift toward remote monitoring supports operational agility and resilience.

- For instance, in August 2024, Amazon Web Services (AWS) launched the AWS Asia Pacific (Malaysia) Region, supported by a US$6.2 billion investment through 2038. The new region introduces three Availability Zones to enhance cloud resilience and aligns with Malaysia’s MyDIGITAL blueprint to advance the nation’s digital economy.

Integration of Artificial Intelligence and Machine Learning in DCIM Systems

Artificial Intelligence (AI) and Machine Learning (ML) technologies enhance data-driven decision-making within DCIM systems. These tools support real-time power usage, temperature control, and capacity forecasting. The market is witnessing increased adoption of AI-based predictive analytics that improve asset management accuracy. AI-enabled DCIM tools reduce human error and enhance system uptime. Intelligent automation helps operators identify performance issues early. It enables optimization of energy use across facilities. The use of smart sensors and IoT devices strengthens visibility across distributed networks. Companies leverage AI for dynamic resource allocation and improved data center sustainability.

Sustainability and Energy Efficiency Driving Operational Excellence

Rising focus on energy efficiency and carbon neutrality fuels DCIM deployment in Malaysia. Operators adopt green energy and smart cooling technologies to meet environmental targets. DCIM software enables real-time monitoring of energy consumption and carbon emissions. The system helps identify inefficiencies and supports compliance with sustainability standards. Enterprises prefer solutions that lower operational costs and enhance environmental performance. It ensures transparency in energy use, promoting accountability and regulatory compliance. Growing adoption of renewable energy further accelerates sustainable data center development. The push for green DCs positions Malaysia as a regional leader in sustainable IT operations.

- For instance, YTL Power International Berhad is developing a 500 MW Green Data Center Park in Johor, spanning 275 acres and powered by renewable solar energy. The project’s first 72 MW phase began construction and is expected to be operational in 2024, marking Malaysia’s first integrated solar-powered data center park.

Expansion of Edge Computing and 5G-Enabled Infrastructure

The growing demand for low-latency connectivity strengthens the relevance of DCIM solutions in edge data centers. Edge computing deployment across Malaysia drives decentralized infrastructure management. 5G technology expands bandwidth, enabling faster real-time data processing. The market benefits from telecommunication upgrades and digital service expansion. Businesses rely on DCIM tools to manage dispersed infrastructure and support network resilience. Edge sites require automation and predictive management for reliability. It offers scalability and consistent service delivery across multiple locations. Rising digital service consumption from enterprises and consumers further boosts infrastructure optimization needs.

Market Trends

Adoption of Modular and Scalable Data Center Architectures

The Malaysia Data Center Infrastructure Management (DCIM) Market is moving toward modular infrastructure supporting flexibility and quick scalability. Modular designs help data centers expand capacity without disrupting operations. Prefabricated systems lower setup time and enable faster deployment. Enterprises prefer modular facilities to align with fluctuating data processing demands. It ensures agility for organizations managing hybrid workloads. This shift aligns with Malaysia’s goal of building cost-efficient and energy-optimized data ecosystems. The adoption of prefabricated DC modules simplifies maintenance and expansion. It helps enterprises achieve better space utilization and operational continuity.

Increasing Use of Automation and Predictive Analytics in Operations

Automation is transforming how data centers monitor assets and ensure reliability. Predictive analytics improves resource allocation and anticipates maintenance requirements. The market is observing rapid integration of autonomous systems for workflow optimization. Automated control reduces dependence on manual intervention and enhances precision. Predictive insights minimize unplanned downtime and operational inefficiencies. It strengthens the proactive management of cooling, power, and security systems. The trend toward intelligent automation supports consistent service delivery. Businesses use automated reporting for compliance and efficiency tracking across multi-site operations.

Integration of IoT and Digital Twin Technologies for Real-Time Monitoring

IoT and digital twin technology integration reshapes infrastructure visibility and decision-making. The Malaysia Data Center Infrastructure Management (DCIM) Market benefits from IoT sensors enabling continuous equipment monitoring. Digital twins replicate real-world assets to simulate system performance. It allows data centers to test configurations before implementation. Real-time analytics improve risk detection and response time. Operators gain actionable insights that guide infrastructure improvements. This technology combination enhances uptime and predictive maintenance. The shift toward interconnected DCIM ecosystems fosters reliability and efficiency in large-scale facilities.

Rising Focus on Cybersecurity and Data Protection Measures

Cybersecurity remains a major trend as operators enhance DCIM system resilience. Growing digital integration creates new attack surfaces requiring continuous security upgrades. The market emphasizes advanced encryption, multi-factor authentication, and threat detection. It prioritizes secure API communication between platforms. Companies adopt integrated cybersecurity frameworks to meet regulatory standards. Cloud-based DCIM tools are being reinforced with AI-driven anomaly detection. Strengthening cyber resilience ensures data integrity across hybrid systems. The rising threat of cyber incidents drives constant innovation in security-focused DCIM solutions.

Market Challenges

Complex Integration of DCIM Solutions with Legacy Infrastructure

The Malaysia Data Center Infrastructure Management (DCIM) Market faces integration challenges due to legacy systems. Many operators struggle to merge modern DCIM platforms with outdated equipment. Compatibility issues hinder unified monitoring and analytics. It increases the cost and complexity of system deployment. Lack of standardized protocols complicates interoperability among vendors. Integration delays can slow modernization and affect performance visibility. Operators must balance innovation with operational continuity during migration. Technical expertise shortages further limit efficient implementation and long-term optimization.

High Implementation Costs and Limited Technical Expertise

High capital investment remains a key barrier for small and medium-sized enterprises. The Malaysia Data Center Infrastructure Management (DCIM) Market requires substantial funding for software licensing, training, and system upgrades. Skilled workforce scarcity affects configuration and maintenance quality. It increases dependence on foreign service providers, raising operational expenses. Cost-sensitive organizations hesitate to adopt advanced solutions due to limited ROI clarity. Training programs and technical partnerships are required to bridge knowledge gaps. Local talent development and public-private collaboration can improve accessibility. Addressing cost and expertise barriers is vital to scale DCIM adoption sustainably.

Market Opportunities

Government Support for Digital Infrastructure and Smart Nation Vision

Malaysia’s Smart Nation agenda and MyDIGITAL blueprint create strong opportunities for DCIM adoption. The Malaysia Data Center Infrastructure Management (DCIM) Market benefits from incentives supporting digital infrastructure expansion. Public sector investments strengthen cloud computing, cybersecurity, and edge technology capabilities. It encourages multinational data center operators to establish local facilities. The rising focus on sustainability drives energy-efficient data center designs. Growing demand for digital services increases DCIM solution deployment across industries. These programs attract global technology investors and boost Malaysia’s competitiveness in Southeast Asia.

Growth Potential in Edge Computing and AI-Powered DCIM Platforms

Edge computing and AI-based management platforms are unlocking new opportunities. Businesses demand real-time monitoring and predictive analytics to optimize distributed networks. The Malaysia Data Center Infrastructure Management (DCIM) Market evolves with AI-driven insights improving operational agility. It enables automation of energy optimization and workload balancing. Growing IoT connectivity supports localized data processing and decentralized control. Demand for intelligent DCIM tools enhances system efficiency. Partnerships among cloud providers and telecom operators fuel expansion into advanced DCIM ecosystems.

Market Segmentation

By Component

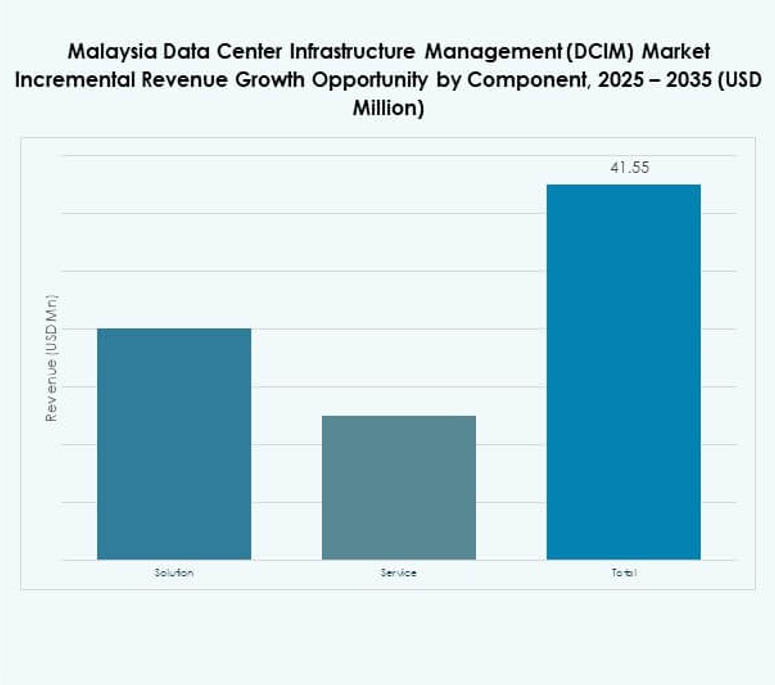

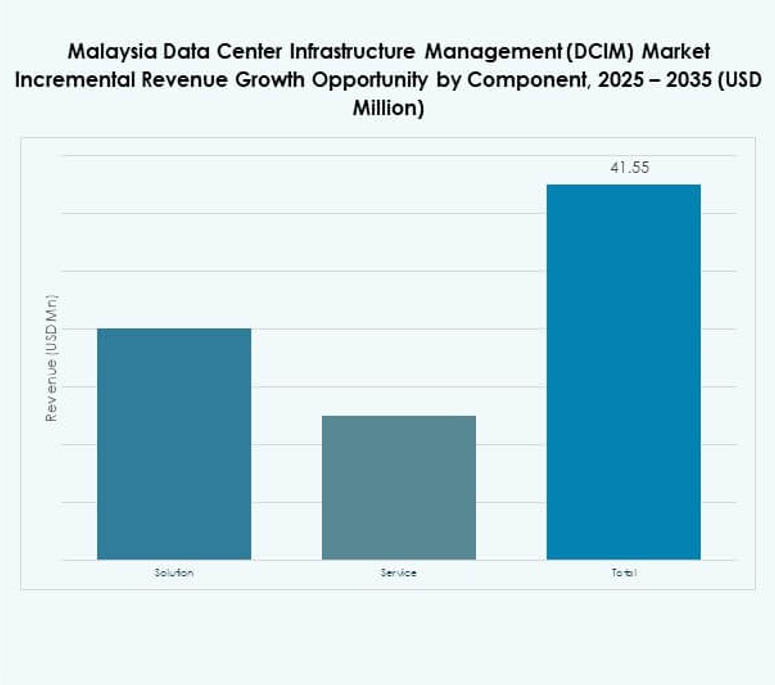

Solutions dominate the Malaysia Data Center Infrastructure Management (DCIM) Market with over 62% share due to widespread demand for integrated monitoring, capacity planning, and automation software. These systems enable centralized control, power tracking, and predictive analysis. Services such as consulting and managed operations complement solution deployment. Growing complexity in data center operations drives enterprises toward software-defined tools. Continuous upgrades in DCIM platforms ensure efficiency and compliance with operational benchmarks.

By Data Center Type

Colocation and cloud-edge data centers hold the largest share, driven by digital expansion and hyperscale investments. Enterprises and managed facilities contribute to scalable infrastructure management. The Malaysia Data Center Infrastructure Management (DCIM) Market benefits from partnerships between local operators and global cloud providers. Increasing data traffic from AI, IoT, and 5G services pushes capacity demand. Modular architecture enhances scalability, while edge deployments improve latency-sensitive application performance.

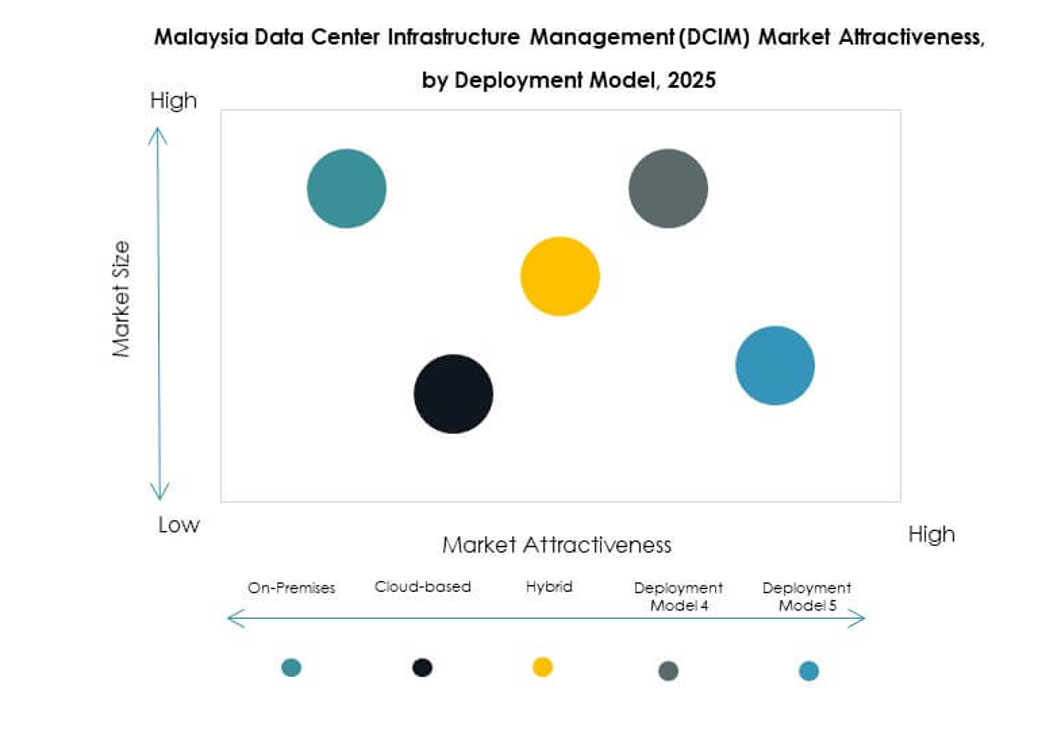

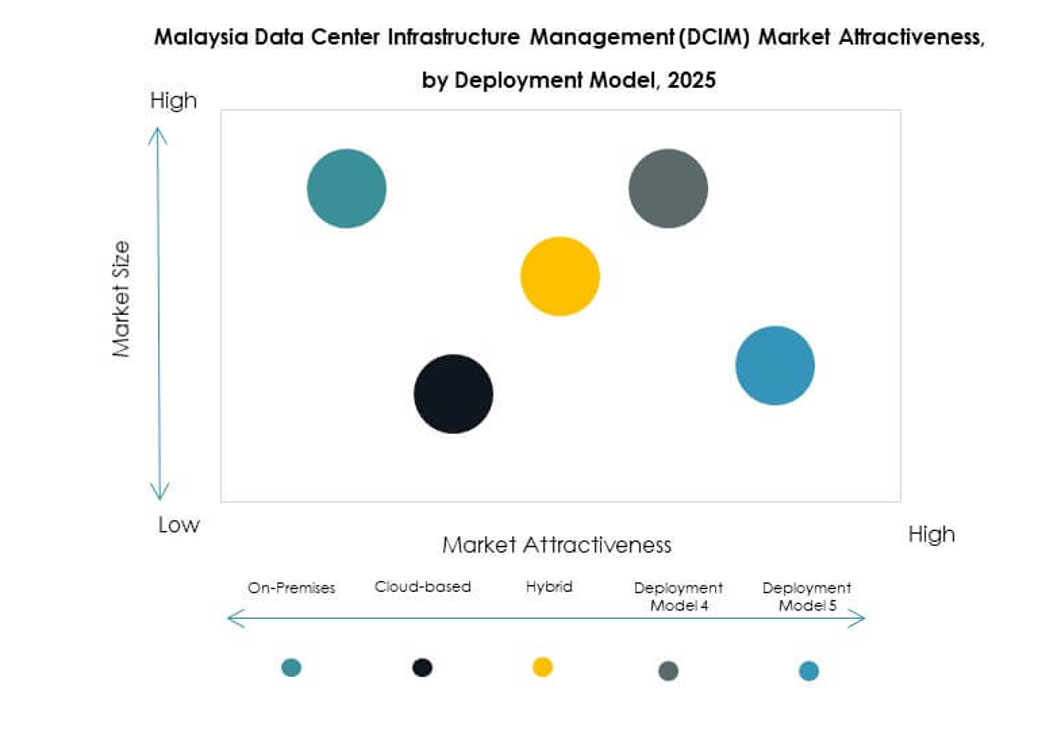

By Deployment Model

Cloud-based DCIM solutions dominate due to flexibility, lower maintenance, and scalability benefits. On-premises systems retain relevance among regulated industries requiring full data control. Hybrid deployment gains traction for balancing control and scalability. The Malaysia Data Center Infrastructure Management (DCIM) Market experiences growing preference for SaaS-based offerings supporting remote monitoring. Enterprises use cloud models to streamline updates, reduce costs, and achieve better integration.

By Enterprise Size

Large enterprises lead adoption due to higher IT budgets and complex infrastructure demands. SMEs gradually adopt DCIM to enhance resource efficiency and data visibility. The Malaysia Data Center Infrastructure Management (DCIM) Market supports both through modular pricing and customizable platforms. Cloud accessibility helps SMEs deploy advanced systems affordably. The scalability and automation features attract businesses seeking improved performance and compliance.

By Application / Use Case

Power monitoring and asset management hold major shares owing to increasing energy efficiency goals. Capacity and environmental monitoring gain traction with AI-enabled analytics. The Malaysia Data Center Infrastructure Management (DCIM) Market benefits from real-time BI and reporting solutions. These applications improve decision-making, operational reliability, and cost management. The trend toward automated power optimization enhances sustainability and transparency in operations.

By End User Industry

IT and Telecommunications dominate due to strong digital transformation, followed by BFSI and healthcare sectors. Retail, e-commerce, and energy utilities rapidly adopt DCIM to ensure uptime and service reliability. The Malaysia Data Center Infrastructure Management (DCIM) Market grows as businesses demand improved asset visibility. Regulatory compliance in financial and healthcare segments drives secure infrastructure management. Industry diversification strengthens the long-term adoption outlook.

Regional Insights

Central and Southern Malaysia Leading with Major Market Share (43%)

Central and Southern regions, including Selangor and Johor, lead the Malaysia Data Center Infrastructure Management (DCIM) Market with 43% share. These regions host key hyperscale and colocation data centers. Strong connectivity, stable power supply, and infrastructure readiness attract global investors. It supports significant deployments by cloud and telecom operators. Kuala Lumpur’s digital hub status enhances enterprise adoption. The area’s favorable business climate sustains continuous expansion and modernization.

Northern Malaysia Emerging as a Secondary Growth Cluster (31%)

Northern Malaysia, especially Penang and Kedah, records steady growth through industrial and technology park expansions. The Malaysia Data Center Infrastructure Management (DCIM) Market in this region benefits from rising manufacturing and IoT-based initiatives. Availability of skilled labor and proximity to logistics corridors support new facility investments. It also provides lower land and energy costs for data center operators. Continuous regional development positions Northern Malaysia as a competitive alternative for infrastructure projects.

- For example, YTL Power International commenced operations of its Johor Data Centre (JDC1) in May 2024, with Sea Ltd as its anchor tenant. The facility delivers 8 MW in its initial phase and is part of a larger plan to develop up to 500 MW of green data center capacity. The data center, located in Johor, was built with a focus on high energy efficiency.

Eastern Malaysia Expanding with Government-Backed Infrastructure Projects (26%)

Eastern Malaysia is evolving into a new frontier driven by government-backed digital infrastructure projects. Sabah and Sarawak invest in connectivity upgrades, renewable energy, and smart grid initiatives. The Malaysia Data Center Infrastructure Management (DCIM) Market gains momentum with public-private collaborations promoting regional inclusivity. It benefits from submarine cable projects improving international connectivity. The region’s focus on sustainability and digital readiness supports future expansion and balanced market growth.

- For instance, in September 2025, Founder Group Limited announced a RM1.16 billion investment to develop Sarawak’s first large-scale solar-plus-storage project in Baram, featuring a 310 MWp solar plant and 620 MWh battery system. The project includes plans for a 200 MW green data centre park, positioning Sarawak as a growing hub for renewable-powered digital infrastructure.

Competitive Insights:

- TM One

- Vertiv Holdings

- Device42

- FNT GmbH

- ABB Ltd.

- Cisco Systems, Inc.

- Eaton Corporation

- Huawei Technologies Co., Ltd.

- Schneider Electric SE

- Siemens AG

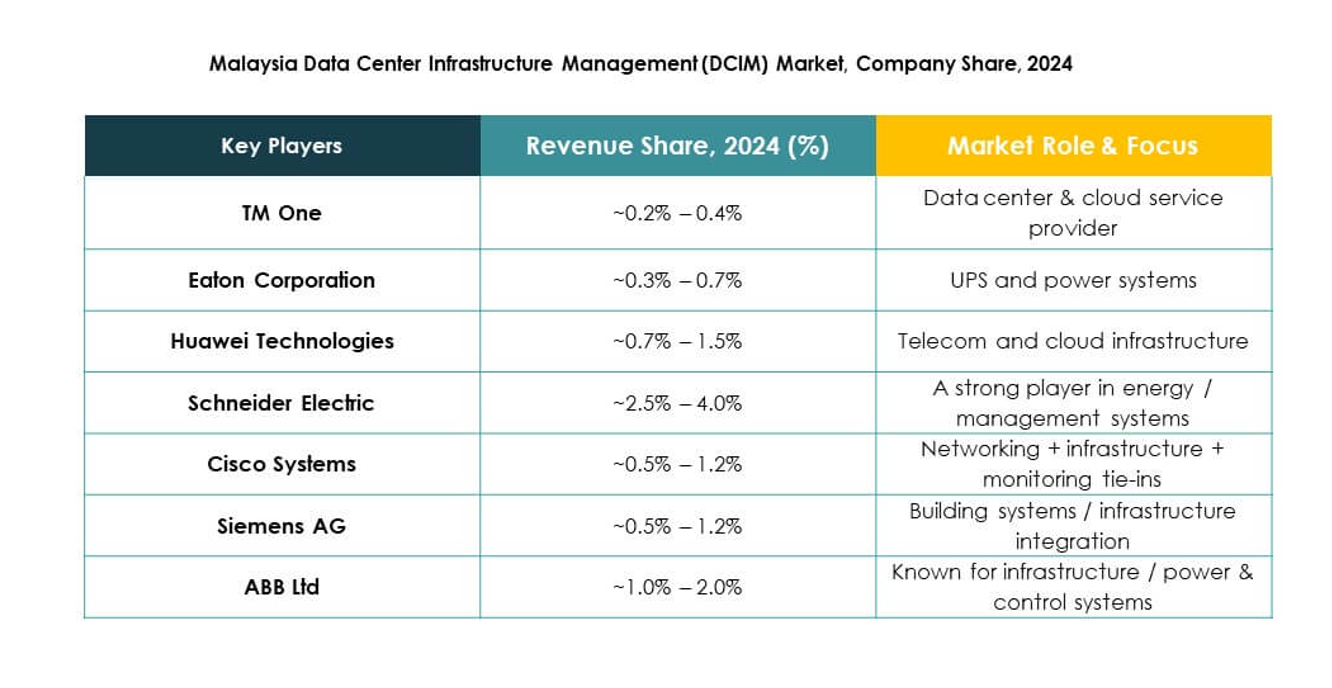

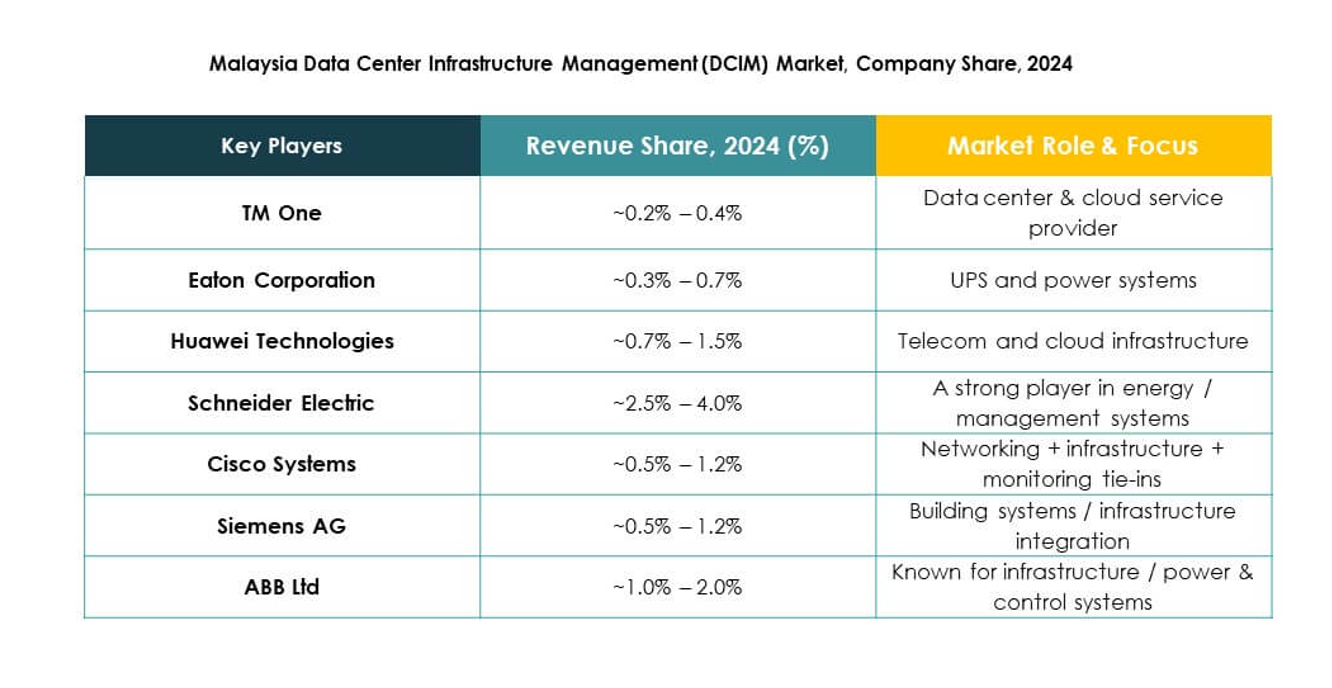

The competitive landscape in the Malaysia Data Center Infrastructure Management (DCIM) Market features both global giants and regional specialists, each striving for technological leadership and market share. Players like Schneider Electric, Cisco, and Vertiv emphasize holistic platform integration and cross-vendor interoperability. Device42 and FNT GmbH differentiate through software agility and modular offerings. ABB, Eaton, Huawei, and Siemens offer strong hardware-software bundles that cater to power, cooling, and control layers. TM One leverages local presence and government partnerships to gain strategic advantage within Malaysia. Companies compete on solution depth, service breadth, and deployment flexibility. It demands continual innovation, cost optimization, and regional customization to stay ahead.

Recent Developments:

- In September 2025, Vantage Data Centers completed the acquisition of Yondr’s data center assets in Malaysia as part of a $1.6 billion deal, strengthening its footprint and capacity in the Malaysian market while accelerating plans for APAC expansion.

- In July 2025, Google’s Pearl Computing Malaysia entered into a major construction and infrastructure agreement with Gamuda, awarding the company a contract worth $236 million for building a hyperscale data center in Port Dickson, along with a water treatment facility to support cooling and operational efficiency of the site.

- In June 2024, Device42 marked a significant development with its acquisition by Freshworks. This move was designed to combine Device42’s leading IT asset management and infrastructure mapping capabilities with Freshworks’ IT service management platform, delivering integrated discovery, application dependency mapping, and automation tools for IT teams operating in high-growth digital environments, including those in Malaysia.

- In October 2024, Bridge Data Centres formed a joint venture partnership with Mah Sing to develop new data center facilities beyond Kuala Lumpur, marking a significant strategic expansion in the Malaysian DCIM ecosystem.