Executive summary:

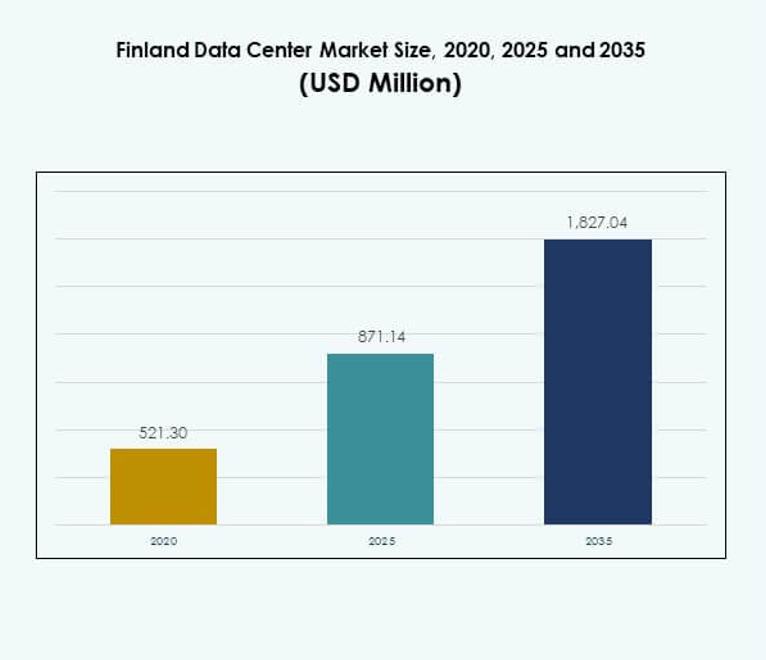

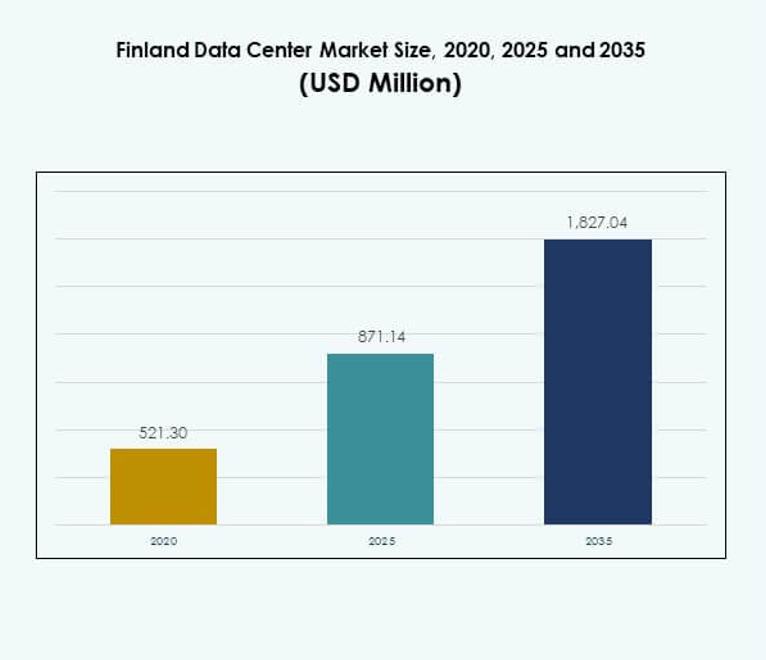

The Finland Data Center Market size was valued at USD 521.30 million in 2020 to USD 871.14 million in 2025 and is anticipated to reach USD 1,827.04 million by 2035, at a CAGR of 7.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2025 |

| Forecast Period |

2025-2035 |

| Finland Data Center Market Size 2025 |

USD 871.14 Million |

| Finland Data Center Market, CAGR |

7.65% |

| Finland Data Center Market Size 2035 |

USD 1,827.04 Million |

The Finland data center market is driven by rising demand for cloud adoption, digital transformation, and the integration of AI and IoT technologies. Companies are investing in scalable and sustainable infrastructure to support increasing data workloads and connectivity requirements. The adoption of green energy and advanced cooling systems further enhances operational efficiency. The market holds strategic importance for global investors seeking secure, innovative, and environmentally responsible digital infrastructure in Europe.

Regionally, Finland benefits from its strong position within the Nordic region, offering reliable connectivity to European and international markets. Southern Finland leads with high concentration of hyperscale and colocation facilities, while Central Finland is emerging with demand from industrial sectors. Northern Finland is gaining importance through edge deployments supported by renewable resources, creating balanced growth across different subregions.

Market Drivers

Rising Demand For Digital Transformation And Cloud Infrastructure

The Finland Data Center Market benefits from the rapid adoption of cloud platforms across industries. Enterprises are migrating workloads to hybrid and multi-cloud ecosystems to gain flexibility and scalability. This shift has created strong demand for advanced colocation and hyperscale facilities. IT leaders view Finland’s infrastructure as reliable, energy-efficient, and secure. Businesses are prioritizing digitization of operations, which fuels investments in high-performance data centers. The market is also supported by the government’s digital-first strategies. It positions Finland as a hub for innovation and cross-border digital trade.

Integration Of Emerging Technologies Such As Artificial Intelligence And Internet Of Things

Artificial intelligence and IoT applications demand high computing power and low-latency networks. The Finland Data Center Market adapts by expanding modular and edge facilities to support real-time processing. Organizations in healthcare, manufacturing, and telecom adopt AI-driven solutions, creating stronger reliance on efficient infrastructure. It supports predictive analytics, machine learning, and automation across industries. Companies are deploying next-generation servers and advanced storage systems to handle growing data volumes. The combination of AI, IoT, and 5G accelerates infrastructure upgrades. Investors consider Finland a stable environment for scaling digital ecosystems.

Focus On Sustainability And Adoption Of Renewable-Powered Infrastructure

Data center operators in Finland emphasize renewable energy and green cooling technologies. The Finland Data Center Market is shaped by the country’s access to abundant clean power sources. Operators adopt free-air cooling and advanced power management systems to cut carbon emissions. Enterprises value sustainability, driving demand for eco-friendly facilities. It ensures long-term cost efficiency while supporting corporate environmental goals. Green certifications also strengthen competitiveness against regional peers. Businesses view Finland as a leader in sustainable infrastructure, attracting global partnerships. The strategic importance aligns with Europe’s broader energy transition policies.

- For instance, in May 2024, Google’s data center in Hamina, Finland, launched a district heat recovery project in partnership with Haminan Energia, providing carbon-free heating to approximately 2,000 local residents and covering up to 80% of the district’s annual heating demand by reusing excess data center heat.

Shift Toward Hyperscale Expansion And Global Connectivity Solutions

Global cloud providers are investing heavily in large-scale hyperscale campuses. The Finland Data Center Market benefits from geographic proximity to Europe, Russia, and the Nordics. Operators expand fiber connectivity and submarine cables, boosting cross-border data flows. It creates opportunities for multinationals to strengthen their European presence. Enterprise reliance on hyperscale partners increases demand for modular and scalable architectures. Finland’s reliable grid and advanced connectivity position it as an attractive hub. Businesses and investors gain access to a stable ecosystem with growth potential. The trend ensures the market remains competitive on the global stage.

- For instance, in January 2025, GlobalConnect completed a new land-based fiber optic connection between Sweden and Finland, deploying three cables as part of a 2,600-kilometer Nordic digital infrastructure project, increasing capacity and resilience for data center and enterprise connectivity in the region.

Market Trends

Growth Of Edge Data Centers To Support Low-Latency Applications

Edge facilities are gaining prominence due to increasing reliance on real-time applications. The Finland Data Center Market experiences strong momentum in deploying micro and modular sites. It supports applications in autonomous transport, smart manufacturing, and digital healthcare. Enterprises seek low-latency infrastructure for mission-critical workloads. Demand for distributed architecture rises as 5G networks expand across the country. Operators invest in compact designs that reduce operational overhead. Finland’s advanced telecom infrastructure strengthens adoption of edge facilities. The trend supports stronger coverage in underserved or remote areas.

Expansion Of Cloud-Based Service Ecosystems By Global And Regional Players

The market observes a growing ecosystem of cloud-native platforms. The Finland Data Center Market attracts investment from hyperscale players and regional providers. It accelerates enterprise migration from legacy IT systems to cloud-first solutions. Industries leverage SaaS, PaaS, and IaaS models for agility. Operators expand colocation and managed services to meet diverse enterprise requirements. Cloud adoption enhances resilience and reduces dependency on physical assets. Businesses prioritize hybrid models that integrate on-premises with cloud workloads. The ecosystem strengthens Finland’s digital competitiveness across European markets.

Adoption Of Advanced Automation And AI-Powered Data Center Management Tools

Data center operators integrate automation and AI-driven monitoring platforms. The Finland Data Center Market adopts DCIM, orchestration, and predictive tools for optimization. It improves uptime, reduces human error, and enhances energy efficiency. Enterprises demand real-time monitoring and proactive issue detection to protect assets. AI supports predictive maintenance, reducing operational costs for operators. Advanced automation ensures scalability in fast-growing digital environments. Vendors provide intelligent orchestration to manage hybrid and multi-cloud deployments. The trend improves reliability while enabling strategic cost reduction for investors.

Rise Of Industry-Specific Infrastructure For Critical Sectors

Operators design specialized data center solutions for healthcare, defense, and finance. The Finland Data Center Market aligns with strict regulatory requirements in these verticals. It supports secure environments for sensitive workloads, including patient data and financial transactions. Enterprises require compliance-ready infrastructure to ensure risk mitigation. Facilities integrate advanced encryption, biometric security, and redundant power systems. Industry-specific customization drives new opportunities for operators. The trend highlights Finland’s ability to deliver sector-focused digital services. It strengthens confidence among enterprises with high compliance obligations.

Market Challenges

High Energy Costs And Complex Sustainability Compliance Requirements

The Finland Data Center Market faces challenges from fluctuating electricity costs and compliance with EU sustainability regulations. Operators must balance rising operational expenses with the need for green certifications. It requires significant investment in renewable sourcing, advanced cooling, and efficient hardware. Smaller players struggle to meet regulatory standards due to capital intensity. Enterprises demand sustainable facilities, but cost barriers limit accessibility. The challenge creates pressure on operators to innovate energy efficiency. It also pushes competition toward larger players with stronger capital resources.

Intensifying Competition And Need For Continuous Technological Upgrades

Market competitiveness creates challenges for both local and global players. The Finland Data Center Market requires frequent upgrades in infrastructure, networking, and automation tools. It places constant financial strain on operators. Rapid adoption of AI and 5G accelerates the pace of obsolescence. Companies unable to invest in innovation risk losing market relevance. It intensifies rivalry between hyperscale, colocation, and enterprise operators. Customers demand superior connectivity and reliability, which raises service expectations. The challenge makes scalability and long-term profitability harder to sustain.

Market Opportunities

Expansion Of Hyperscale Campuses And Regional Data Connectivity Infrastructure

The Finland Data Center Market offers opportunities for large-scale hyperscale investments. It benefits from geographic positioning that connects Europe with Asia and the Nordics. Operators are expanding submarine cable routes to strengthen cross-border data flows. Enterprises seek partnerships that secure long-term access to scalable infrastructure. Finland’s renewable power resources enhance the attractiveness for global investors. The growth of AI, IoT, and digital services accelerates opportunities for hyperscale operators. It positions the country as a digital gateway in the region.

Emergence Of Managed Services And Industry-Specific Colocation Solutions

Demand for managed services is increasing as enterprises focus on cost control. The Finland Data Center Market benefits from rising adoption of colocation models for SMEs. It enables organizations to access enterprise-grade infrastructure without heavy capital investments. Industry-specific colocation services create value for healthcare, BFSI, and manufacturing. Operators deliver tailored compliance-ready solutions to meet sectoral regulations. It expands service offerings beyond traditional colocation and hosting. The opportunity strengthens Finland’s role as a strategic service provider hub.

Market Segmentation

By Component

Hardware dominates the Finland Data Center Market, led by servers, networking, and cooling solutions that ensure operational resilience. Operators prioritize energy-efficient hardware to lower costs and support sustainability targets. Software segments such as DCIM and automation grow as enterprises demand intelligent management tools. Services remain essential, with managed services and consulting driving value for SMEs. The balanced ecosystem of hardware, software, and services strengthens market competitiveness.

By Data Center Type

Hyperscale facilities lead the Finland Data Center Market due to investments from global providers. Colocation centers are gaining traction among SMEs and regional enterprises. Enterprise facilities remain relevant for mission-critical workloads but face slower growth. Edge and modular data centers rise with 5G adoption and IoT expansion. Cloud and IDC infrastructures are vital for SaaS providers. Mega data centers hold importance for global scalability and long-term planning. The diversity of types enhances resilience across Finland’s ecosystem.

By Deployment Model

Cloud-based deployment leads the Finland Data Center Market as enterprises migrate workloads to scalable platforms. Hybrid models also expand rapidly, offering flexibility between on-premises and cloud. On-premises remains important in sectors requiring high security and compliance. It addresses sensitive government, defense, and healthcare workloads. Cloud deployment drives agility, while hybrid ensures risk management. Enterprises benefit from optimized cost models and improved scalability. This balance supports diverse industry adoption.

By Enterprise Size

Large enterprises dominate the Finland Data Center Market with greater capital capacity and global-scale requirements. SMEs increase adoption through colocation and cloud-based services. It provides access to enterprise-grade infrastructure without significant upfront cost. Large corporations drive hyperscale demand, while SMEs create traction for managed services. The dual growth ensures a balanced customer base across the industry. It expands opportunities for both global and regional operators.

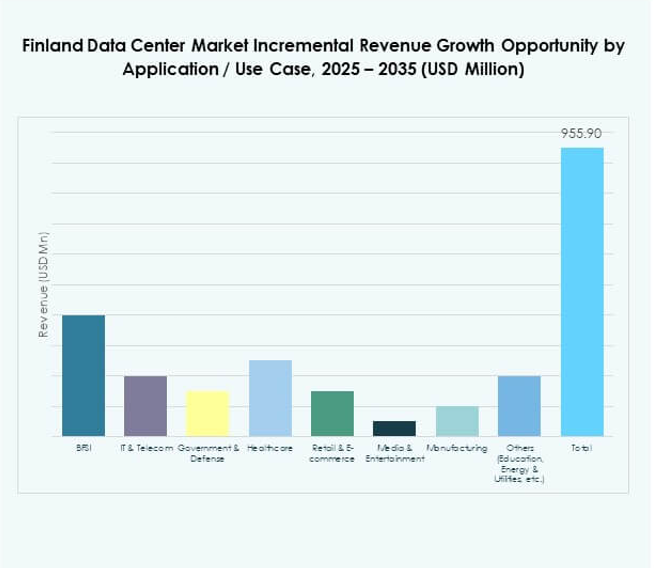

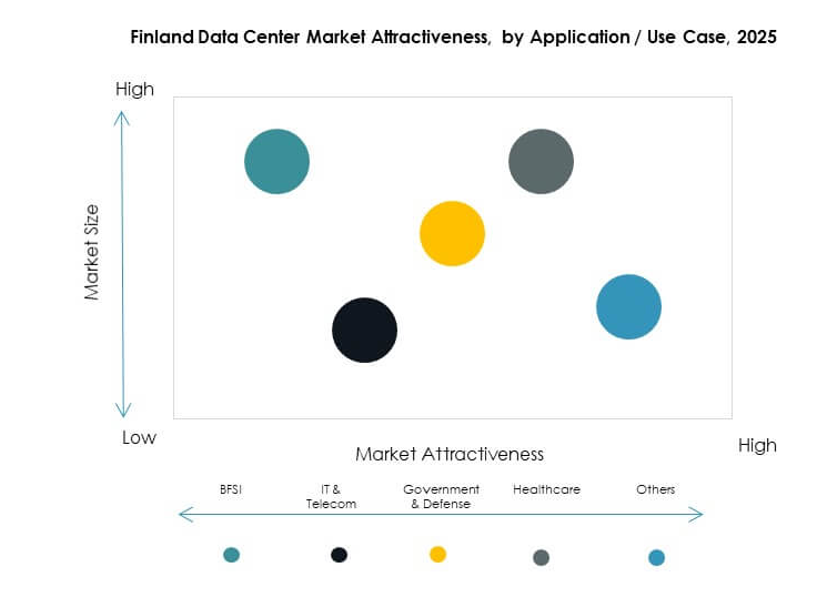

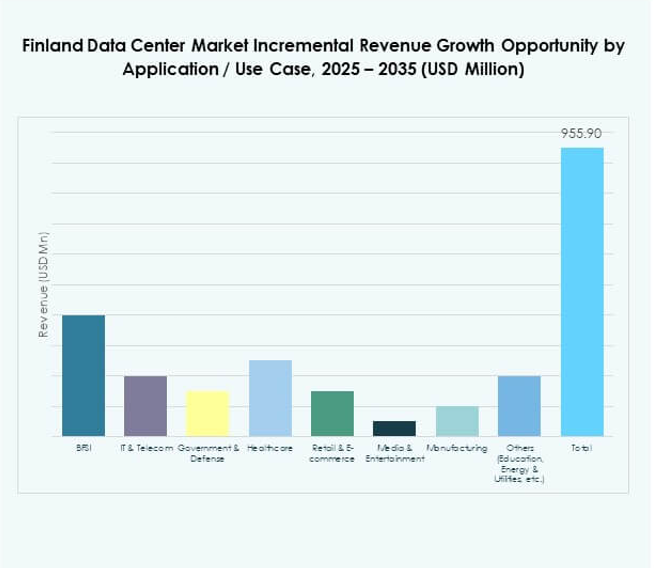

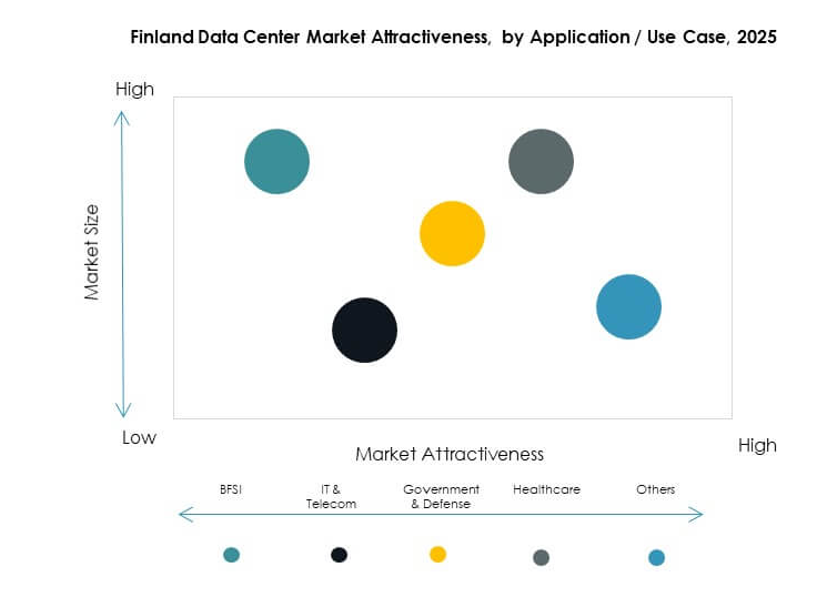

By Application / Use Case

IT and telecom lead the Finland Data Center Market, driving demand for high-performance networks. BFSI follows with strong requirements for secure and compliant infrastructure. Healthcare, government, and retail also contribute to expanding workloads. Media and entertainment gain traction with rising digital content consumption. Manufacturing and education adopt AI-driven solutions. Energy and utilities utilize infrastructure for predictive operations. Each sector adds unique demand, diversifying growth prospects.

By End User Industry

Cloud service providers dominate the Finland Data Center Market with hyperscale investments. Enterprises invest in hybrid models, while colocation providers cater to SMEs. Government agencies adopt compliant and secure infrastructure for mission-critical functions. Other users include education and energy sectors that seek sectoral specialization. The ecosystem ensures balanced adoption across industries. It builds resilience and diversification in market demand.

Regional Insights

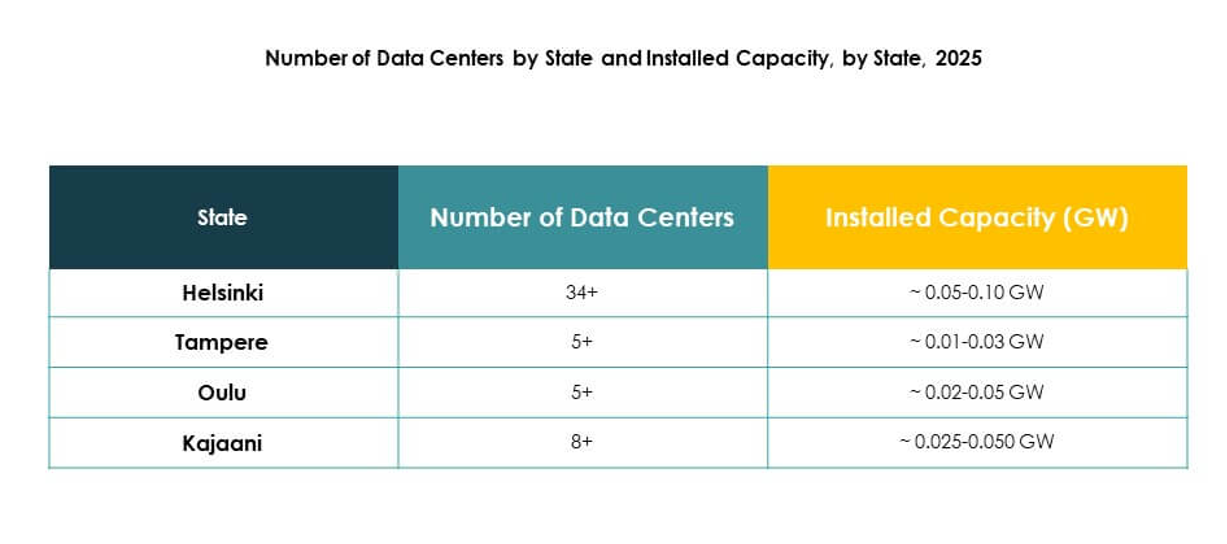

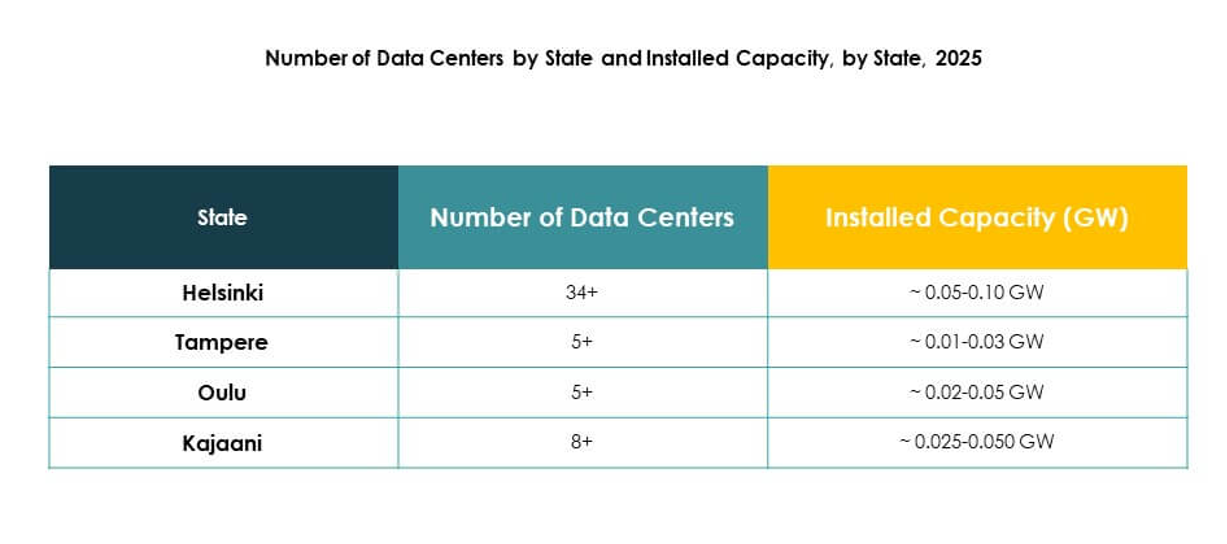

Strong Leadership Of Southern Finland In Market Share

Southern Finland leads the Finland Data Center Market with 46% share, driven by major investments in Helsinki. The region benefits from superior connectivity, reliable power supply, and proximity to enterprise hubs. It houses hyperscale campuses and multiple colocation facilities. Operators leverage strong digital infrastructure to attract global players. Enterprises in telecom and BFSI rely heavily on Southern Finland’s established ecosystem. The region maintains dominance due to favorable business policies and growing digital trade.

- For instance, in July 2025, Groq opened its first European data center in Helsinki, hosted by Equinix, bringing ultra-low-latency AI inference and delivering infrastructure supporting over 20 million tokens per second to customers across the continent.

Rising Importance Of Central Finland With Growing Industrial Base

Central Finland contributes 32% of the Finland Data Center Market, supported by manufacturing and industrial demand. Enterprises require secure and scalable infrastructure for digital transformation. The region is expanding modular and edge data centers to serve local industries. It benefits from renewable power resources that support sustainable operations. Telecom operators are strengthening fiber connectivity across Central Finland. It is emerging as a vital hub for sector-specific deployments.

- For instance, Icelandic Borealis Data Center expanded operations to Kajaani in Central Finland in 2024, increasing its capacity to serve high-performance computing needs for European research and industrial clients.

Emerging Growth Of Northern Finland Through Edge Deployments

Northern Finland holds 22% share of the Finland Data Center Market, with momentum in edge and modular sites. Operators deploy infrastructure to serve remote industries and regional populations. The region benefits from strong renewable resources, including hydro and wind power. Enterprises expand digital applications in mining, energy, and utilities. It strengthens cross-border trade with Nordic and Arctic regions. The growth potential positions Northern Finland as a rising contributor to overall industry expansion.

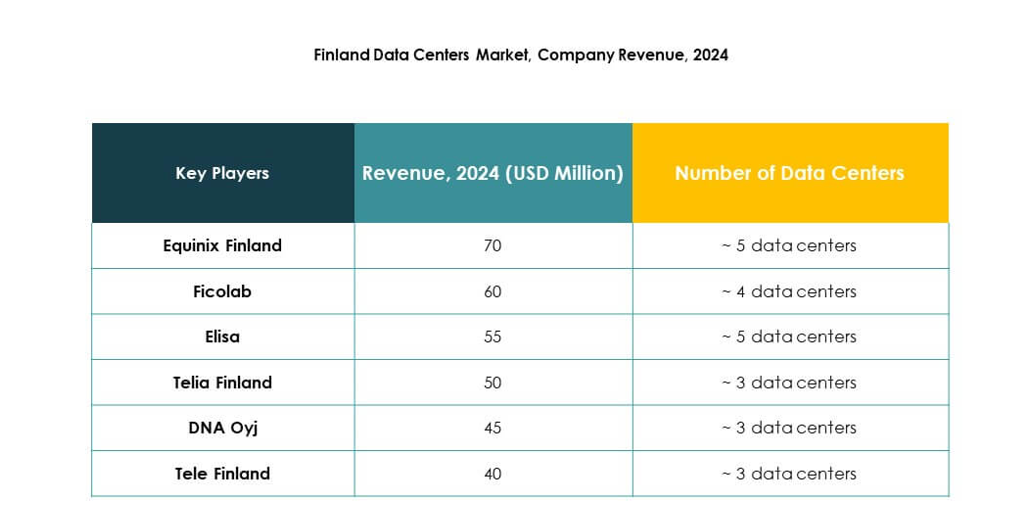

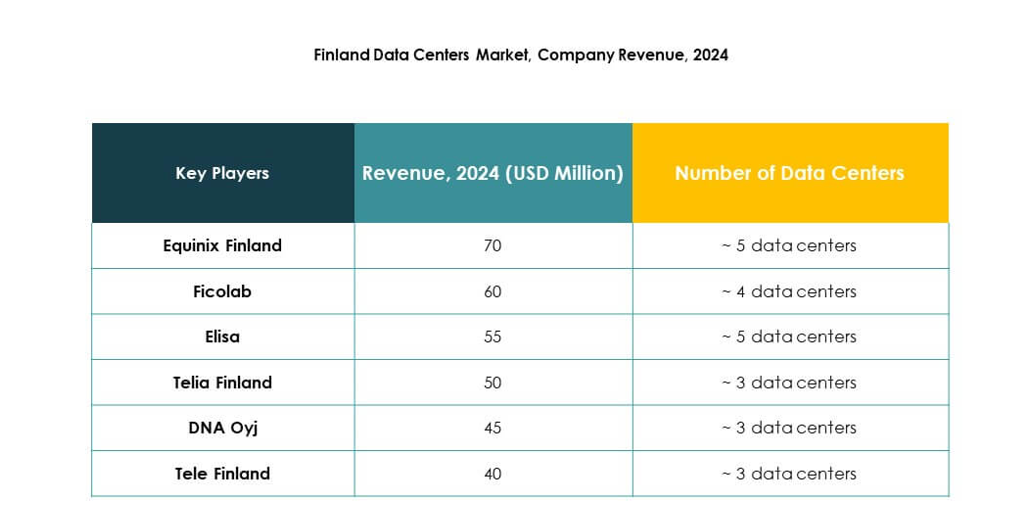

Competitive Insights:

- Equinix Finland

- Ficolab

- Elisa

- Telia Finland

- DNA Oyj

- Tele Finland

- Digital Realty Trust, Inc.

- NTT Communications Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Google LLC (Alphabet Inc.)

- Others

The Finland Data Center Market features strong competition between global hyperscale operators and established local providers. Equinix and Digital Realty expand capacity to meet rising colocation demand, while Telia, Elisa, and DNA strengthen regional networks through advanced connectivity solutions. Microsoft, AWS, and Google drive hyperscale growth with investments in cloud and AI infrastructure. Ficolab and Tele Finland focus on tailored services for enterprise clients, ensuring flexibility and reliability. NTT enhances its Nordic footprint through innovation and service integration. The market is shaped by rapid infrastructure scaling, green energy adoption, and advanced automation, making it highly competitive and strategically attractive for global investors.

Recent Developments:

- In August 2025, DayOne announced a new data center campus project in Finland, targeting a total IT load of 128MW. The initial phase will commence with site demolition in Q3 2025, and the project aims to enhance the country’s colocation ecosystem through increased capacity and next-generation infrastructure deployment.

- In June 2025, Elisa announced an expanded collaboration with Google Cloud to implement AI-enabled autonomous network operations, enabling zero-touch management, predictive analytics, and rapid deployment of new features and services across Elisa’s network infrastructure throughout Finland.

- In April 2025, DAMAC’s digital infrastructure arm EDGNEX Data Centers acquired Finland-based data centre company Hyperco, strengthening its footprint in the Nordics and accelerating plans to deliver sustainable, large-scale data center infrastructure tailored for hyperscalers and AI-driven workloads.