Executive summary:

The Portugal Data Center Infrastructure Market size was valued at USD 458.16 million in 2020 to USD 840.01 million in 2025 and is anticipated to reach USD 2,237.33 million by 2035, at a CAGR of 10.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Portugal Data Center Infrastructure Market Size 2025 |

USD 840.01 Million |

| Portugal Data Center Infrastructure Market, CAGR |

10.22% |

| Portugal Data Center Infrastructure Market Size 2035 |

USD 2,237.33 Million |

Strong demand for cloud services, hyperscale deployments, and edge computing drives the Portugal Data Center Infrastructure Market. Rising digital transformation across telecom, banking, and manufacturing boosts infrastructure investments. The shift toward renewable energy and modular construction enhances efficiency and sustainability. Global operators and investors view Portugal as a strategic hub for low-latency connectivity and long-term data infrastructure growth across Southern Europe.

Southern Portugal leads with robust data center activity around Lisbon and Sines, supported by reliable power and submarine cable access. Northern Portugal shows rapid expansion driven by enterprise and industrial automation needs. Central and interior regions emerge with modular data center projects that strengthen national digital resilience. This regional diversification supports balanced infrastructure and wider connectivity coverage across the country.

Market Dynamics:

Market Dynamics:

Growing Digital Transformation Across Sectors

The Portugal Data Center Infrastructure Market experiences strong growth through digital transformation across finance, telecom, and manufacturing. Enterprises invest in scalable infrastructure to host cloud workloads and manage real-time analytics. Rising use of AI, IoT, and automation pushes demand for high-capacity networks. It supports faster computing and improved operational resilience. Data localization policies drive new buildouts to meet compliance standards. Cloud providers expand their regional presence to meet rising service demand. Strong ICT investments from the government improve broadband access. This shift strengthens digital readiness across industries.

- For instance, Equinix is deploying its LS2 facility in Lisbon, based on an initial investment of about €50 million. The LS2 colocation and intercontinental-connectivity hub adds substantial new capacity in Lisbon’s data center ecosystem.

Surge in Cloud and Hyperscale Deployments

The market benefits from the rapid expansion of cloud and hyperscale facilities. Major players deploy large-scale centers to serve Southern Europe’s rising data needs. It boosts the construction of high-efficiency campuses near Lisbon and Porto. Renewable energy availability supports green builds for global operators. Companies prefer Tier III and IV designs for uptime reliability. Edge deployments improve response times for local businesses. Investments focus on low-latency zones that serve both domestic and EU traffic. Strategic location attracts cross-border connectivity and foreign investment. Continuous demand drives sustained infrastructure expansion.

- For instance, Start Campus constructing Sines DC across 60 hectares with six buildings totaling 1.2GW IT capacity. It boosts the construction of high-efficiency campuses near Lisbon and Porto, for instance, Equinix planning its third data center in Lisbon by 2027 to support cloud and AI demands.

Advancement in Power and Cooling Efficiency

Energy efficiency acts as a key growth catalyst. Operators deploy liquid and free-air cooling systems to manage rising compute loads. The Portugal Data Center Infrastructure Market integrates renewable power sources to meet sustainability targets. Companies redesign layouts to reduce energy waste and optimize airflow. Smart grids and energy storage improve cost control and stability. Modular energy solutions speed up deployment across multiple sites. It encourages innovation in hybrid cooling and UPS technologies. The trend enhances long-term operational sustainability. Local firms gain competitive advantage through greener facilities.

Government Support and Investment-Friendly Policies

Supportive policies drive investor confidence in large infrastructure projects. The government promotes digital hubs to attract technology firms. Tax benefits and fast-track zoning approvals simplify new builds. The market gains traction through European recovery funds focused on digital resilience. It helps expand fiber networks and regional cloud ecosystems. Sustainable construction standards align with EU climate goals. Energy access and skilled workforce improve operational stability. It attracts global hyperscale players seeking reliable expansion bases. This policy framework sustains long-term development momentum.

Market Trends

Market Trends

Adoption of Edge and Modular Data Centers

Edge and modular centers redefine the operational landscape. Localized facilities near population centers ensure faster data delivery and network stability. The Portugal Data Center Infrastructure Market witnesses higher modular adoption for flexible scaling. Prefabricated systems shorten deployment time and reduce project risk. Edge setups support smart city frameworks and 5G networks. Telecom operators integrate small edge nodes for IoT analytics. Businesses use modular pods to extend IT capacity on demand. It enhances agility and energy efficiency in distributed environments. This modular trend accelerates infrastructure modernization across the nation.

Rise of Green and Sustainable Infrastructure Designs

Sustainability drives the next phase of innovation. Operators commit to low-carbon and renewable-powered campuses. The Portugal Data Center Infrastructure Market emphasizes green designs to meet EU carbon goals. Liquid immersion and heat-reuse technologies become industry standards. Firms integrate solar and wind inputs to stabilize power supply. Green certifications strengthen brand reputation among enterprise buyers. Data centers partner with utilities for circular energy models. It aligns profitability with environmental responsibility. Sustainable practices improve long-term resilience and operational performance.

Integration of AI and Automation in Facility Management

AI-driven monitoring tools transform data center operations. Automated systems predict failures and balance workloads in real time. The Portugal Data Center Infrastructure Market benefits from AI-based efficiency management. Predictive algorithms control temperature, humidity, and energy usage. Robotics handle repetitive maintenance, reducing downtime. Smart sensors track equipment status for proactive servicing. Automated reporting ensures transparency in power usage effectiveness. It reduces human error and improves system reliability. Intelligent management enhances productivity and asset optimization.

Expansion of Data Connectivity and Network Infrastructure

Portugal strengthens its digital backbone through new submarine and terrestrial cables. Improved connectivity enhances the market’s role in Europe’s data transit routes. The Portugal Data Center Infrastructure Market benefits from direct links to Africa and the Americas. Multi-carrier networks increase redundancy and global reach. Fiber expansions around Lisbon create robust interconnection hubs. Carriers invest in 400G and 800G optical networks to support hyperscale needs. Enterprises demand low-latency connectivity for cloud and AI services. It positions Portugal as a key digital corridor within the EU. This connectivity boom drives regional competitiveness.

Market Challenges

Market Challenges

High Energy Demand and Infrastructure Costs

Energy-intensive operations create financial strain for operators. Rising power prices and capacity shortages limit profitability. The Portugal Data Center Infrastructure Market faces challenges in maintaining sustainable cost structures. Limited grid access delays expansion projects in remote zones. Developers struggle to balance redundancy with energy efficiency. Cooling system upgrades require large capital outlay. Limited renewable storage options restrict 24/7 reliability. It pushes companies to explore hybrid or offshore sourcing strategies. Managing these pressures remains critical for long-term viability.

Skilled Workforce and Regulatory Constraints

Shortage of specialized talent affects deployment timelines. Engineering, cybersecurity, and maintenance skills remain scarce across the sector. The Portugal Data Center Infrastructure Market experiences slower project delivery due to limited expertise. Strict construction and environmental rules complicate site development. Lengthy permit approvals delay commissioning schedules. Businesses must navigate overlapping municipal and EU standards. The absence of standardized codes affects design flexibility. It challenges foreign firms aiming to replicate global infrastructure templates. Overcoming these gaps demands targeted training and policy reform.

Market Opportunities

Expansion Through Renewable Energy Integration

Portugal’s renewable capacity offers a strong base for sustainable data centers. Abundant solar and wind resources lower carbon intensity. The Portugal Data Center Infrastructure Market gains from projects linking green grids with new campuses. Operators can market low-PUE facilities to eco-conscious clients. Renewable-linked data parks attract hyperscale firms seeking net-zero alignment. Government energy reforms encourage private grid partnerships. It promotes regional competitiveness in green digital infrastructure. Continued investment creates long-term cost and sustainability advantages.

Emergence of AI, 5G, and Edge Computing Applications

AI and 5G adoption generate new workload demands. Companies need low-latency and high-capacity environments to process data near users. The Portugal Data Center Infrastructure Market benefits from smart industry expansion across logistics, health, and finance. Edge nodes link rural and urban operations for seamless connectivity. Cloud-to-edge ecosystems support real-time analytics and autonomous systems. It boosts demand for high-density rack configurations and scalable infrastructure. The convergence of these technologies opens lucrative development pathways.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates due to its crucial role in power continuity and uptime reliability. The Portugal Data Center Infrastructure Market shows high deployment of UPS, PDUs, and switchgears to manage sensitive operations. Mechanical systems follow with advanced cooling solutions for thermal stability. IT and network infrastructure grow steadily with demand for virtualization and AI workloads. Civil and architectural setups evolve with modular builds for faster project delivery and space optimization.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems lead this category, ensuring stable energy flow during grid disruptions. The Portugal Data Center Infrastructure Market emphasizes efficient PDUs and BESS integration to reduce power loss. Utility grid connections remain vital for long-term stability. Transfer switches enable fault isolation to protect sensitive hardware. BESS supports renewable adoption across high-load facilities. Switchgears provide automation for intelligent distribution. Operators invest in next-gen power systems for efficiency and reliability enhancement.

By Mechanical Infrastructure

Cooling systems form the backbone of operational reliability. The Portugal Data Center Infrastructure Market sees rapid deployment of CRAC and CRAH units optimized for energy performance. Chillers dominate among mechanical components, with preference for hybrid and water-cooled types. Containment systems support efficient airflow management. Pumps and piping designs ensure stable cooling circulation. Smart sensors monitor environmental conditions for real-time control. Operators integrate AI-driven systems for predictive cooling efficiency.

By Civil / Structural & Architectural

Structural frameworks evolve toward modular and prefabricated setups for faster construction. The Portugal Data Center Infrastructure Market emphasizes steel and reinforced concrete structures for durability. Building envelopes focus on thermal insulation and acoustic control. Raised floors and suspended ceilings support flexible cabling management. Foundations are optimized for seismic stability and load distribution. Modular units reduce on-site labor needs. These practices enhance design scalability and cost efficiency.

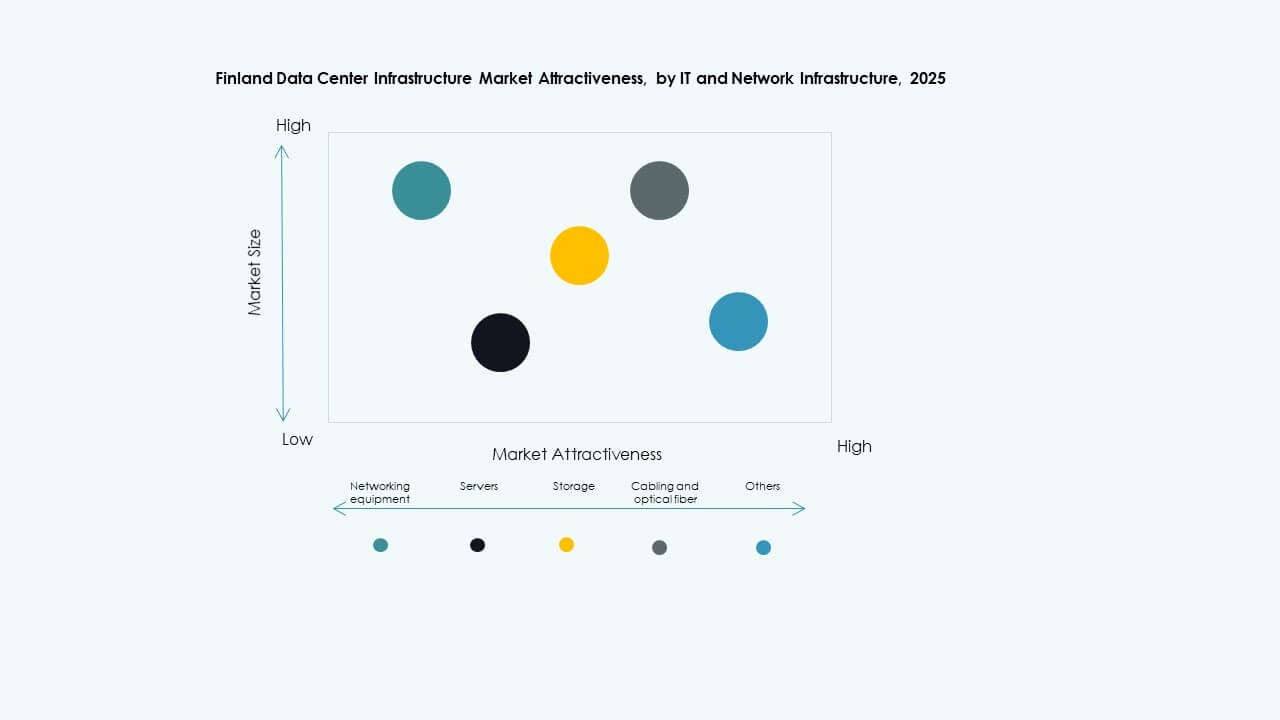

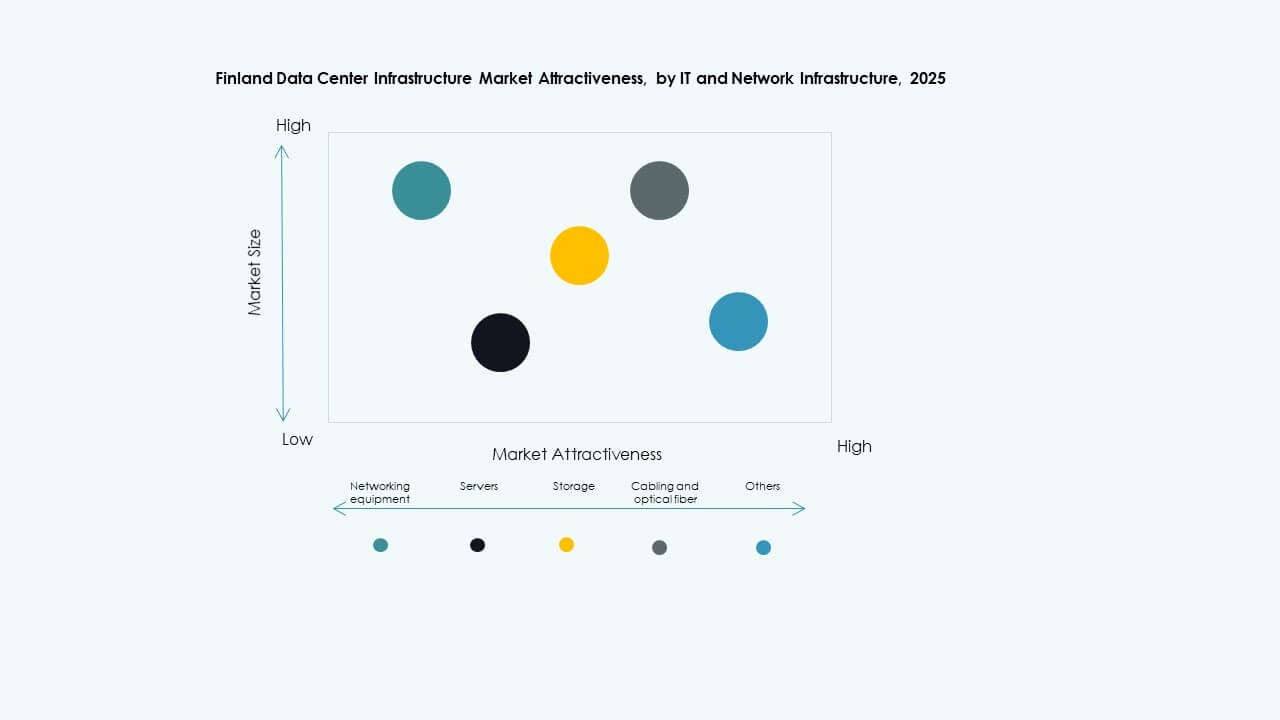

By IT & Network Infrastructure

Servers and storage units form the largest segment within IT infrastructure. The Portugal Data Center Infrastructure Market relies on high-performance computing units to manage data-heavy applications. Network switches and fiber cabling deliver improved latency and throughput. Racks and enclosures organize dense setups with efficient space utilization. Data management demands push upgrades toward hybrid storage models. Integration of optical networks expands capacity for enterprise-level workloads.

By Data Center Type

Hyperscale centers dominate due to rising global cloud traffic. The Portugal Data Center Infrastructure Market experiences strong investment from international tech firms. Colocation centers attract medium enterprises seeking cost flexibility. Edge centers grow to support local digital services. Enterprise data centers retain value for private cloud and security needs. Hybrid infrastructure models gain popularity for their balance of control and scalability.

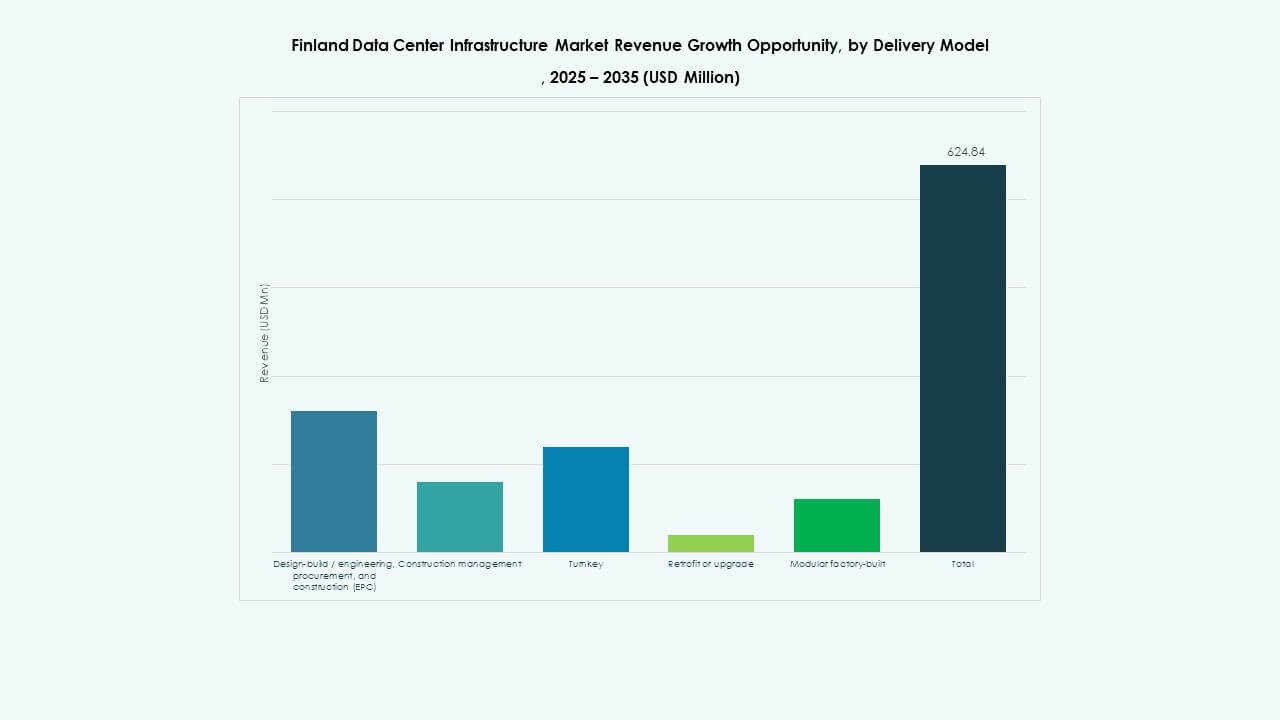

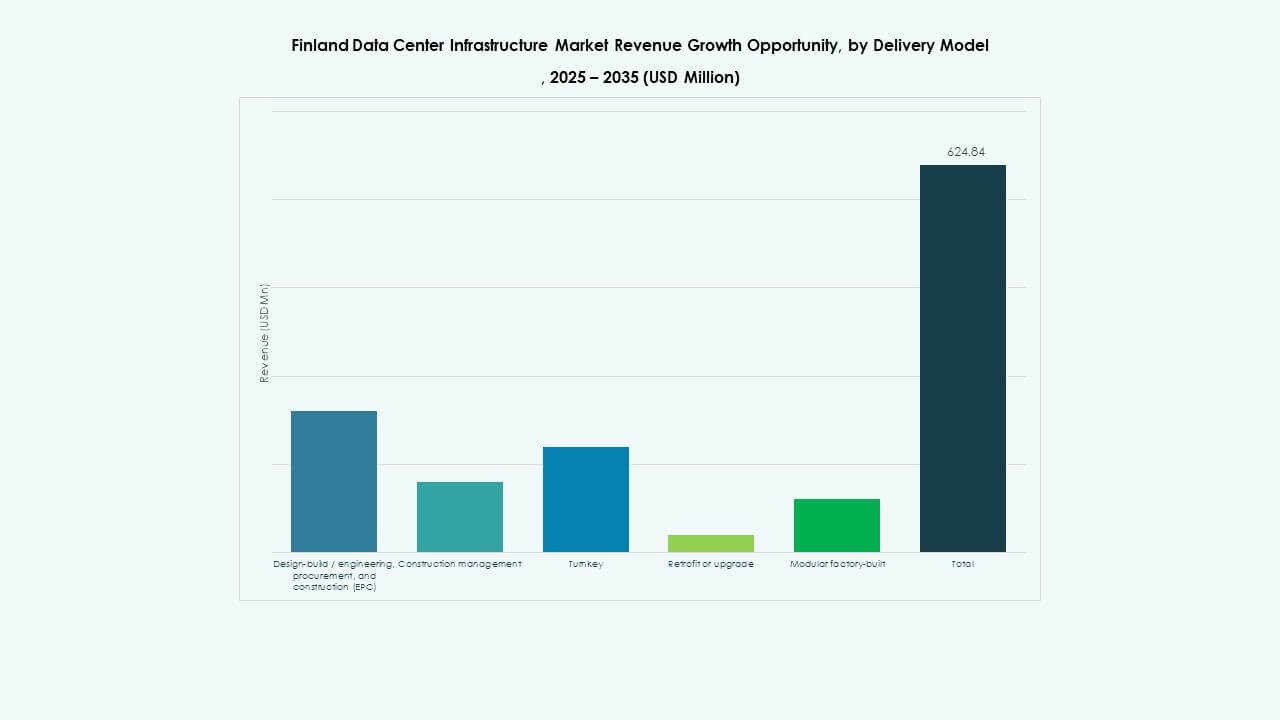

By Delivery Model

Design-Build and EPC models lead due to integrated project control. The Portugal Data Center Infrastructure Market adopts turnkey and modular factory-built formats for rapid setup. Construction management supports phased expansion for large operators. Retrofit and upgrade solutions modernize existing capacity. Modular approaches improve standardization and speed. These delivery frameworks enhance project predictability and cost efficiency.

By Tier Type

Tier III dominates due to balanced uptime and cost efficiency. The Portugal Data Center Infrastructure Market sees gradual Tier IV adoption among hyperscale operators. Tier II remains relevant for edge and local deployments. Tier I facilities decline due to limited redundancy. Businesses prefer designs certified for at least 99.982% availability. Tier diversification supports multi-level reliability across enterprise and service providers.

Regional Insights

Regional Insights

Southern Portugal – The Core Hub of Data Activity (38% Market Share)

Southern Portugal leads due to concentrated data center clusters near Lisbon and Sines. The Portugal Data Center Infrastructure Market benefits from strong fiber connectivity and proximity to submarine cables. Access to renewable power enhances energy security for hyperscale projects. The region hosts major colocation and cloud providers. High infrastructure density supports lower latency and efficient interconnection. Its coastal geography enables large-capacity builds and redundancy routes. The south remains the strategic entry point for international data flow.

- For instance, Start Campus’s SINES DC in Southern Portugal is recognized as one of Europe’s largest and most sustainable data center campuses, designed for 1.2 GW IT capacity and powered by renewable energy. Its first facility, SIN01, launched in late 2024, features advanced seawater-cooling technology to support high-density workloads efficiently.

Northern Portugal – Growing Edge and Enterprise Deployments (33% Market Share)

Northern Portugal expands through industrial automation and edge computing applications. The Portugal Data Center Infrastructure Market grows steadily around Porto and Braga due to new enterprise demand. High-tech clusters support AI and IoT workloads. Green energy availability drives eco-friendly designs across mid-sized facilities. Expansion of local fiber grids boosts digital inclusion. It offers balanced cost structures and regional network reliability. The area supports growing enterprise and academic data ecosystems.

Central and Interior Portugal – Emerging Secondary Zones (29% Market Share)

Central and interior regions show early potential for decentralized infrastructure. The Portugal Data Center Infrastructure Market witnesses growing investments in modular and containerized facilities. Lower land costs attract small and medium operators. Regional authorities promote data-driven innovation zones for agriculture and logistics. Improved renewable integration supports cost-effective builds. It helps balance national data distribution and reduce network congestion. These emerging areas will strengthen Portugal’s overall data resilience.

- For instance, Colt Data Centre Services (Colt DCS) has strengthened its presence in Portugal through a partnership with AtlasEdge, enabling sustainable and high-performance connectivity services in Lisbon. The collaboration supports regional digital infrastructure growth by linking data centers to renewable-powered networks.

Competitive Insights:

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- ABB

- Digital Realty

- Schneider Electric

- Vertiv Group Corp.

- IBM

- Oracle

- Fujitsu

The Portugal Data Center Infrastructure Market features strong competition between global technology providers and regional operators. It focuses on scalable infrastructure, energy-efficient systems, and cloud-ready architecture. Major vendors invest in modular builds and hybrid deployment solutions to enhance uptime reliability. Local colocation firms partner with telecom carriers to expand connectivity and network resilience. Leading players differentiate through AI-enabled cooling, renewable integration, and predictive maintenance tools. It experiences strategic mergers and facility expansions to capture cross-border demand. Sustainability, automation, and power optimization remain central to maintaining long-term competitive advantage in Portugal’s evolving digital infrastructure ecosystem.

Recent Developments:

- In November 2025, Vertiv announced the acquisition of HVAC services firm PurgeRite for approximately USD 1 billion. The acquisition aims to expand Vertiv’s liquid-cooling and thermal-management capabilities to meet rising demand from high-power, AI-driven data centers. This enhances Vertiv’s mechanical infrastructure offerings in cooling and HVAC services

- In November 2025, Schneider Electric secured roughly USD 2.3 billion in new U.S. data-center contracts. The deals include major supply agreements with a hyperscale operator and a leading colocation provider to supply power modules, cooling systems, UPS units and switchgear over 2025–2026.

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights