Executive summary:

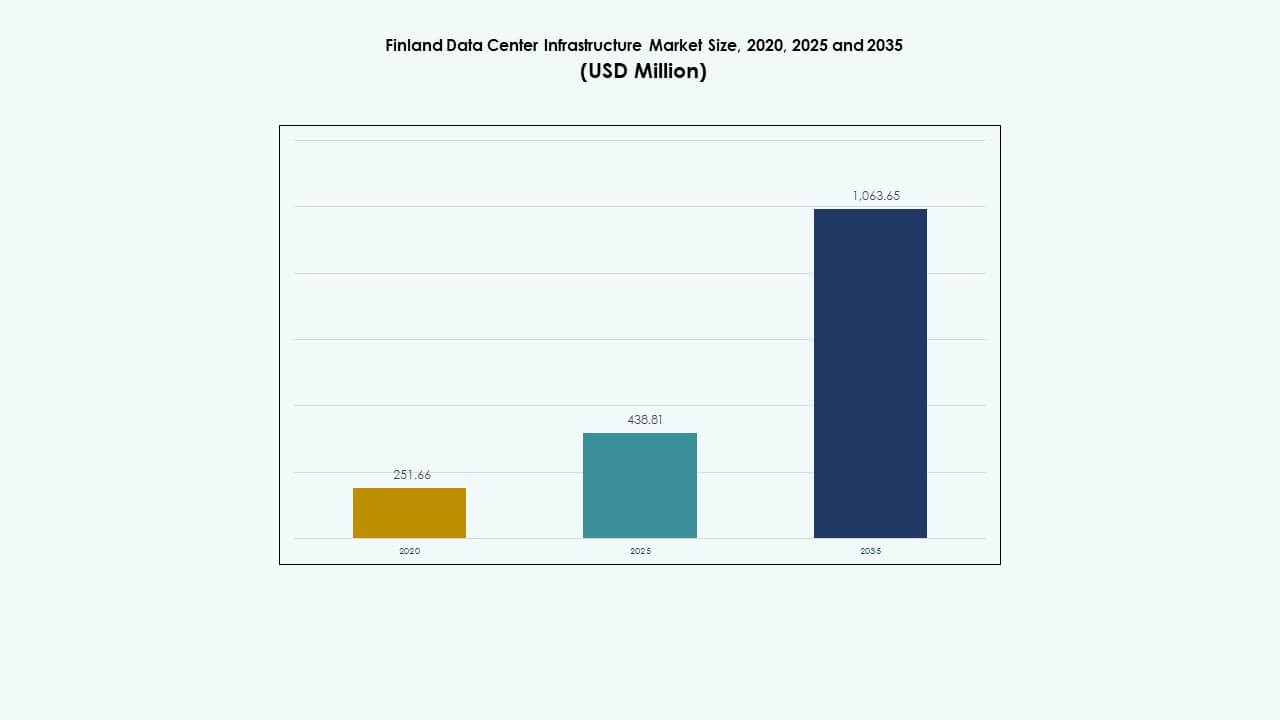

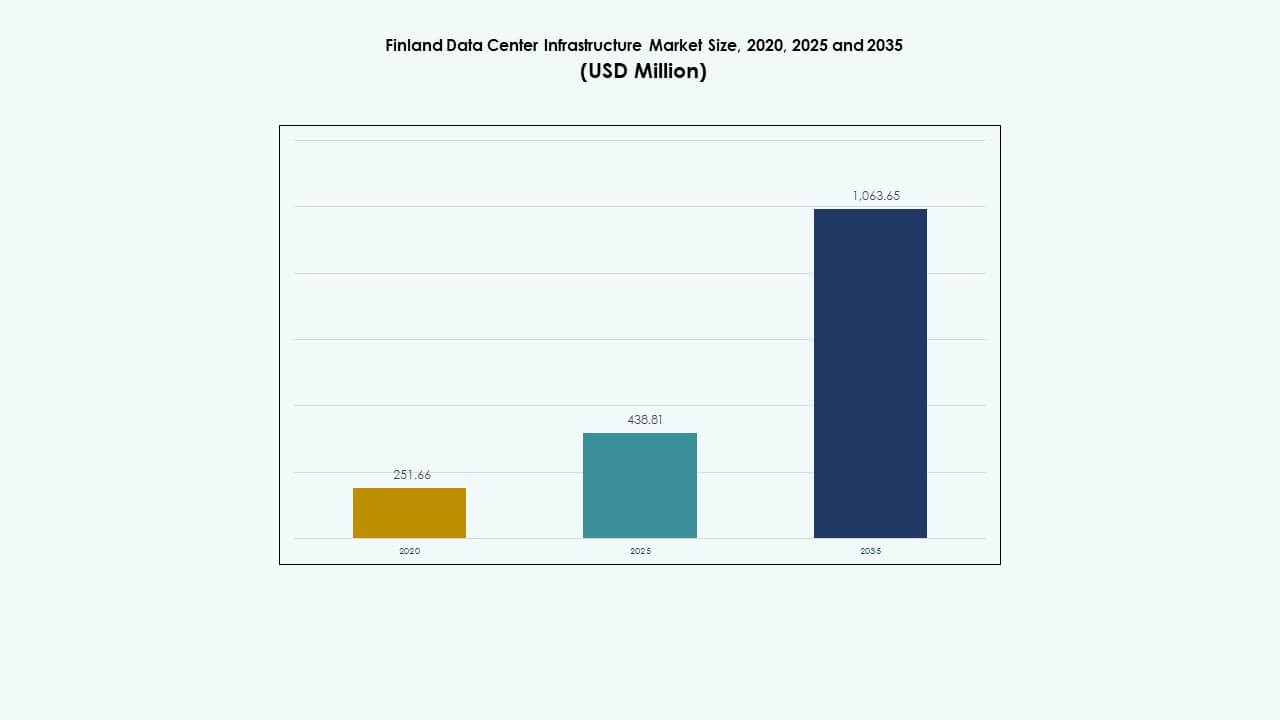

The Finland Data Center Infrastructure Market size was valued at USD 251.66 million in 2020, grew to USD 438.81 million in 2025, and is anticipated to reach USD 1,063.65 million by 2035, at a CAGR of 9.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Finland Data Center Infrastructure Market Size 2025 |

USD 438.81 Million |

| Finland Data Center Infrastructure Market, CAGR |

9.19% |

| Finland Data Center Infrastructure Market Size 2035 |

USD 1,063.65 Million |

Growing digital transformation, strong cloud adoption, and rapid integration of AI-driven systems propel Finland’s infrastructure expansion. Innovation in energy-efficient cooling, modular builds, and renewable integration boosts operational sustainability. The market holds strategic importance for investors due to stable regulations, high network reliability, and government focus on sustainable digital infrastructure.

Southern and Northern Finland lead market growth due to established fiber networks, reliable power supply, and proximity to major urban and hyperscale clusters. Western Finland shows strong potential with expanding industrial data workloads. Eastern Finland is emerging as a resilient hub for modular and edge data centers supporting regional connectivity and redundancy.

Market Dynamics:

Market Dynamics:

Growing Demand for Cloud and Digital Infrastructure Expansion

The Finland Data Center Infrastructure Market gains strong momentum from rapid cloud service adoption. Enterprises migrate workloads to the cloud to support digital transformation and remote operations. It drives large-scale deployments of data storage, compute, and network assets across Finland. Rising use of SaaS platforms accelerates infrastructure needs in both private and public sectors. Investments from global hyperscalers strengthen market competition. Domestic operators expand regional availability zones for latency-sensitive applications. Strategic partnerships between telecom providers and data center firms enhance connectivity. The trend highlights Finland’s growing role as a regional data hub.

- For instance, Microsoft is constructing three data centers in Espoo, Vihti, and Kirkkonummi, with groundbreaking ceremonies held on May 21, 2025, across all sites. It drives large-scale deployments of data storage, compute, and network assets across Finland.

Integration of Energy-Efficient and Sustainable Technologies

The market benefits from major shifts toward renewable-powered data centers. Operators adopt advanced liquid cooling, waste-heat recovery, and AI-based energy optimization systems. It reflects Finland’s strong national focus on sustainability and green technology. Local climate advantages reduce power consumption across large facilities. Investors prioritize low-carbon assets to meet environmental, social, and governance goals. Technology vendors promote smart grid integration to stabilize energy supply. Policy incentives encourage operators to adopt circular energy practices. This trend positions Finland as a leading model for eco-efficient digital infrastructure.

Acceleration of 5G, IoT, and Edge Computing Deployments

Rapid rollout of 5G and IoT networks drives expansion in localized compute infrastructure. Edge data centers grow to handle low-latency workloads in cities and industrial zones. The Finland Data Center Infrastructure Market benefits from high network reliability and strong fiber backbone. Operators develop modular edge systems that complement larger colocation and hyperscale sites. Industrial IoT applications in manufacturing and logistics drive distributed processing demand. Telecom firms upgrade backhaul systems to align with next-gen traffic growth. Government support for smart infrastructure strengthens long-term capacity expansion. Edge computing creates fresh opportunities for innovation-driven enterprises.

Strategic Investments by Global and Local Operators

Rising capital flow from global investors shapes the evolving data ecosystem. It includes investments from hyperscale firms, private equity groups, and infrastructure funds. Finnish operators leverage strong geopolitical stability and advanced connectivity for expansion. Local data center alliances enhance energy procurement and operational resilience. The market’s transparent regulatory structure attracts international players seeking predictable returns. Co-location providers scale facilities to host multinational clients. It strengthens Finland’s standing within the Nordic digital corridor. Growing cross-border collaboration with Sweden and Estonia enhances data exchange and service reliability.

- For instance, Microsoft acquired 21 hectares in Espoo for €30.9 million to advance its southern Finland data center region.

Market Trends

Market Trends

Shift Toward Modular and Prefabricated Construction Models

Developers increasingly prefer modular data center builds for faster delivery. Prefabricated units reduce construction timelines and enable flexible scaling. The Finland Data Center Infrastructure Market adopts these methods to meet growing digital demand. Modular systems enhance energy control and operational agility for operators. Prefabrication reduces on-site risk and ensures uniform performance standards. EPC firms and equipment suppliers integrate factory-assembled modules into regional projects. Demand for scalable, portable setups grows among colocation and edge players. This trend redefines deployment efficiency across Finland’s evolving data ecosystem.

Rise of AI-Driven Infrastructure Monitoring and Automation

AI and analytics tools play a growing role in optimizing data center operations. Machine learning algorithms predict failures, manage workloads, and fine-tune energy usage. Finnish facilities implement automation for temperature, power, and capacity management. It boosts uptime and lowers operational costs across facilities. Vendors integrate digital twins to simulate infrastructure performance under various loads. Predictive analytics enables proactive maintenance for critical systems. AI enhances workforce efficiency and enables smarter decision-making. Automation reshapes operational strategy across major Finnish data centers.

Increased Adoption of Renewable and Carbon-Neutral Energy Sources

The transition to renewable energy remains central to long-term growth. Data centers source electricity from hydro, wind, and biomass to cut emissions. The Finland Data Center Infrastructure Market advances toward full carbon neutrality. Partnerships with utility firms enable long-term green power contracts. Operators invest in energy storage systems for reliability during peak loads. Demand for renewable energy certificates grows across colocation and enterprise users. Heat reuse programs convert excess energy into district heating networks. These initiatives strengthen Finland’s image as a sustainable data center hub.

Growing Importance of Security and Compliance Frameworks

Tightening cybersecurity and data protection rules drive infrastructure reinforcement. Finnish operators adopt advanced monitoring and threat detection systems. It ensures full compliance with EU’s GDPR and national privacy frameworks. Data sovereignty becomes a core design factor in hyperscale and enterprise facilities. Firms deploy segmented network layers to isolate sensitive data flows. Strong audit and encryption mechanisms protect mission-critical assets. Industry collaboration with regulatory agencies builds long-term trust. Strengthened security frameworks make Finland a preferred data hosting environment for global clients.

Market Challenges

Market Challenges

High Energy Costs and Dependence on Renewable Integration

The Finland Data Center Infrastructure Market faces cost pressures from fluctuating power prices. Operators rely heavily on renewable integration, which requires advanced energy management. Balancing reliability with sustainability adds complexity to operations. High investment in cooling systems and grid upgrades increases initial capital outlay. Seasonal power variations affect load balancing in remote regions. Energy-intensive workloads create stress on national supply networks. Firms must coordinate closely with utilities for consistent performance. These challenges influence operational planning and profitability across market participants.

Complex Regulatory Requirements and Infrastructure Scaling Limits

Stringent environmental, construction, and zoning laws slow new data center projects. Permitting delays impact project timelines and investor confidence. It pushes companies to adopt phased construction strategies to manage compliance risk. Skilled labor shortages hinder rapid expansion of advanced facilities. Infrastructure scaling faces constraints in certain urban zones due to space scarcity. The need for specialized design expertise raises costs for smaller players. Operators navigate diverse standards in energy use, safety, and data protection. Effective collaboration with policymakers remains critical for sustained market growth.

Market Opportunities

Expansion of Hyperscale and Edge Infrastructure Investments

Strong investor interest drives Finland’s next wave of hyperscale expansion. Global firms seek stable environments for AI, analytics, and cloud workloads. The Finland Data Center Infrastructure Market benefits from available land and renewable resources. Edge facilities open new possibilities for telecom and industrial sectors. Local technology startups gain access to scalable infrastructure. Regional data corridors enable faster content delivery across Europe. Government incentives promote foreign participation in digital infrastructure projects. This synergy fuels diversified market growth across data ecosystems.

Integration of Smart Power and Cooling Solutions for Next-Gen Efficiency

Operators explore AI-driven energy management and advanced cooling designs. Smart systems adapt to real-time workloads to cut power use. It enhances operational sustainability and improves uptime. Liquid immersion and direct-to-chip cooling reduce resource consumption. Automation supports predictive efficiency and maintenance planning. Vendors co-develop solutions tailored for Nordic climate conditions. The shift toward smart infrastructure strengthens competitive differentiation for Finnish data centers. Innovation-driven efficiency opens new investment frontiers for long-term stakeholders.

Market Segmentation

By Infrastructure Type

Electrical infrastructure leads the Finland Data Center Infrastructure Market due to strong power system investment. Operators prioritize redundancy and energy efficiency across UPS, PDUs, and BESS systems. Mechanical infrastructure follows, supported by demand for advanced cooling and containment systems. IT and network infrastructure remain vital for connectivity and performance optimization. Civil and architectural components evolve with modular construction practices enhancing scalability. Each segment contributes to reliable, efficient, and sustainable operations across new and existing facilities.

By Electrical Infrastructure

Uninterruptible Power Supply (UPS) systems dominate as reliability becomes a top priority. Battery Energy Storage Systems (BESS) gain traction to stabilize renewable power use. PDUs and transfer switchgear ensure seamless power distribution. Utility grid connections expand to support growing hyperscale footprints. The Finland Data Center Infrastructure Market shows increasing investment in smart power technologies. Firms enhance energy efficiency while ensuring continuity during power disruptions. Demand for sustainable and resilient energy architecture continues to strengthen sector growth.

By Mechanical Infrastructure

Cooling solutions form the backbone of thermal management strategy across Finnish facilities. Chillers, containment systems, and pumps improve operational stability and reduce energy waste. The Finland Data Center Infrastructure Market adopts innovative designs like liquid and immersion cooling. Low ambient temperatures support natural cooling efficiency. Modular cooling units gain acceptance for scalability in mixed workloads. Operators align with green goals through heat reuse programs. Mechanical innovations ensure balance between energy efficiency and system reliability.

By Civil / Structural & Architectural

Construction design emphasizes robust foundations and modular frameworks for scalability. Site preparation aligns with Nordic standards for safety and climate durability. The Finland Data Center Infrastructure Market integrates raised floors and prefabricated enclosures for flexibility. Superstructure and building envelope design enhance airflow and temperature control. Use of steel and concrete frames ensures long-term strength. Architectural innovations contribute to cost efficiency and sustainability. Operators invest in flexible structural systems to enable future retrofits and expansions.

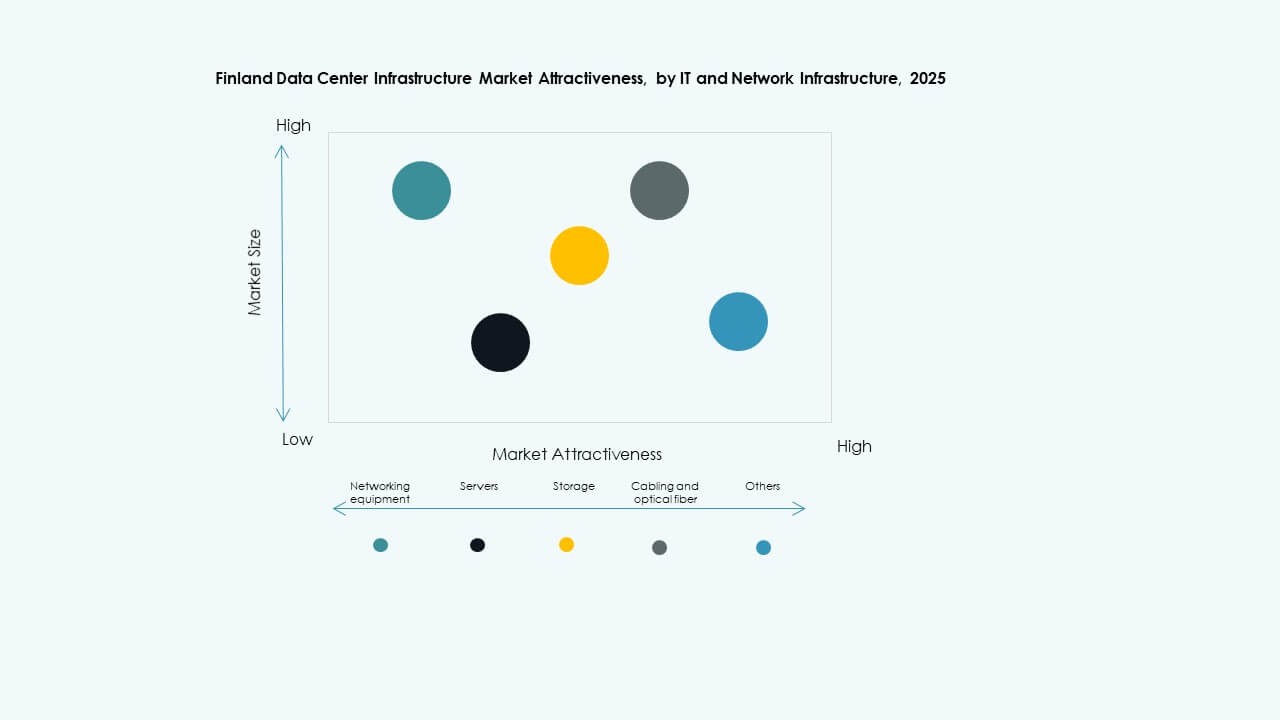

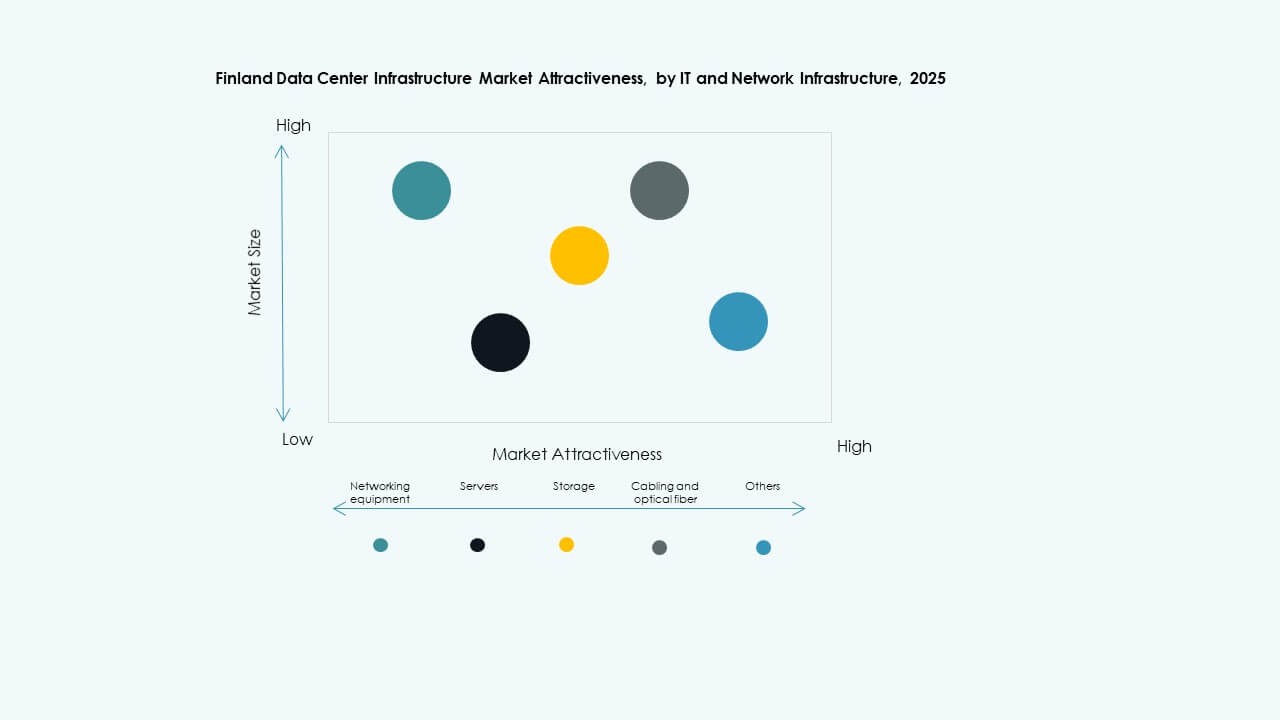

By IT & Network Infrastructure

Networking equipment and servers dominate investment priorities within Finland’s facilities. Storage and cabling infrastructure evolve with faster data transmission standards. The Finland Data Center Infrastructure Market grows through rising edge and cloud adoption. Racks, enclosures, and optical fiber systems strengthen connectivity layers. Operators deploy hybrid network setups to support AI and analytics. Modern IT infrastructure improves system resilience and scalability. Growth in digital workloads pushes continuous upgrades across hardware and network segments.

By Data Center Type

Hyperscale data centers dominate the market with extensive capacity and automation. Colocation sites grow rapidly to serve enterprise and SME clients. The Finland Data Center Infrastructure Market gains traction in edge and enterprise deployments. Edge centers emerge for 5G, IoT, and smart manufacturing workloads. Retrofits of older enterprise sites maintain hybrid operational continuity. Hyperscale operators lead investments in AI and cloud data processing. Each data center type plays a distinct role in supporting Finland’s digital expansion.

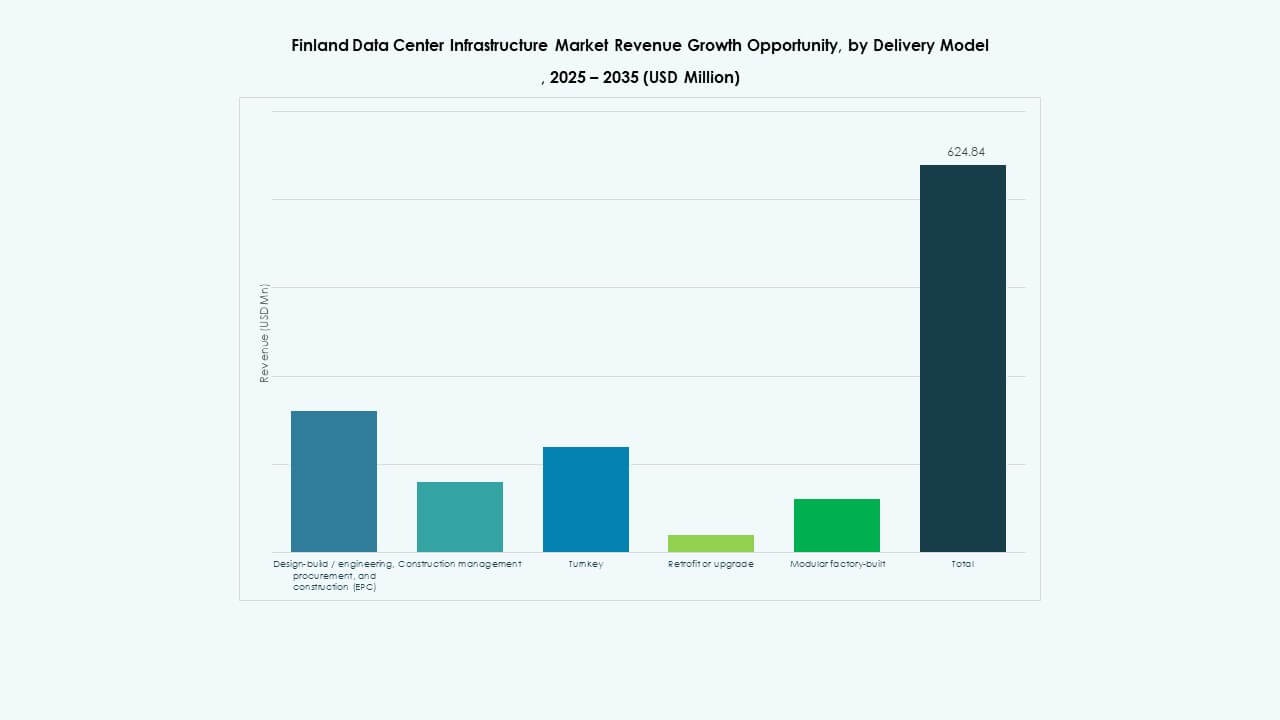

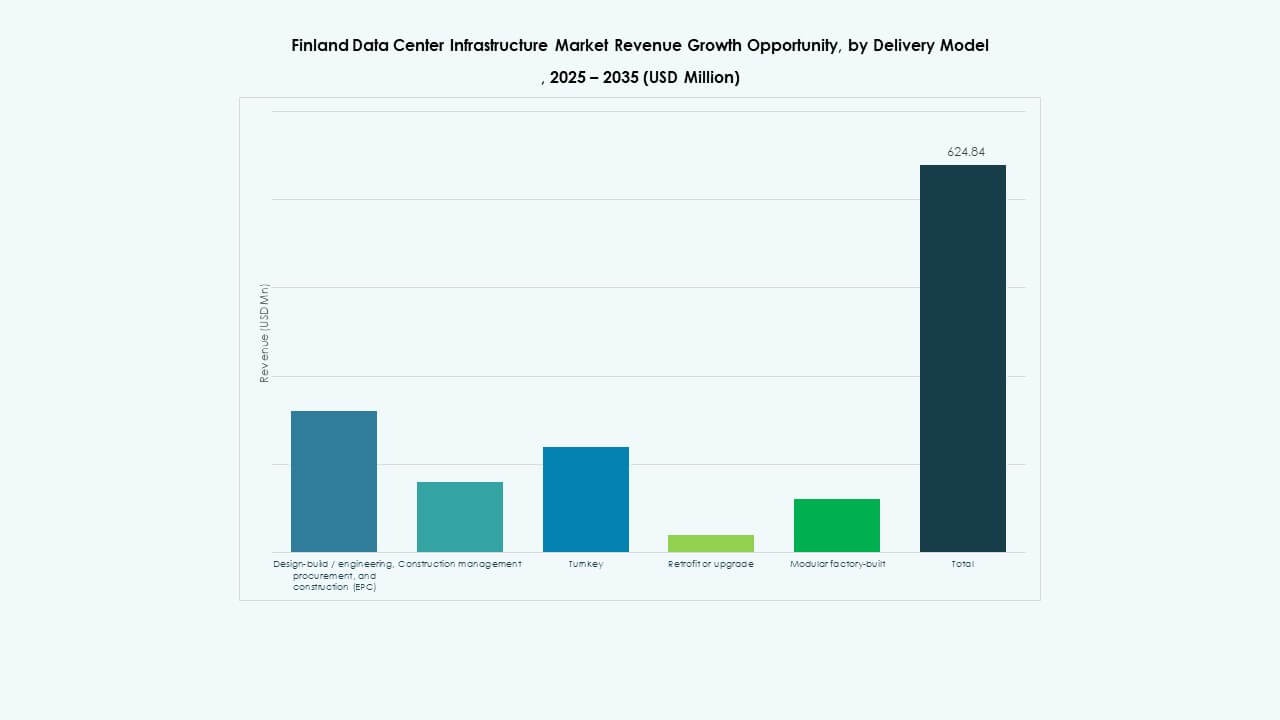

By Delivery Model

Design-build and turnkey delivery models remain dominant across new Finnish data centers. Modular factory-built solutions grow due to faster setup and reduced risk. The Finland Data Center Infrastructure Market favors EPC and retrofit upgrades for large sites. Construction management models cater to complex multi-phase projects. Standardized prefabrication improves consistency and time-to-market. Integrated delivery frameworks enhance cost control and operational predictability. Collaboration between builders and OEMs drives end-to-end project efficiency.

By Tier Type

Tier 3 facilities hold the largest share due to their balance of reliability and cost. Tier 4 sites expand for mission-critical cloud and banking operations. The Finland Data Center Infrastructure Market witnesses growing Tier 2 upgrades across regional setups. Tier 1 centers remain relevant for smaller enterprise workloads. Tier segmentation defines resilience levels and redundancy strategies. Operators invest heavily in achieving uptime certifications and global compliance standards. Tier diversification supports service continuity across Finland’s digital economy.

Regional Insights

Regional Insights

Northern and Southern Finland – Core Growth Centers

Northern and Southern Finland account for nearly 60% of the Finland Data Center Infrastructure Market. Regions like Helsinki and Oulu lead due to dense digital infrastructure and fiber availability. Energy-efficient operations thrive through access to renewable power and cool climates. Proximity to submarine cables strengthens international connectivity. Southern Finland hosts hyperscale and colocation hubs serving cross-border clients. Local authorities encourage green construction through favorable tax incentives.

Western Finland – Expanding Investment Corridor

Western Finland holds around 25% market share, driven by industrial and enterprise demand. Cities such as Tampere and Vaasa emerge as strategic expansion zones. The region benefits from abundant renewable energy and skilled technical talent. Data-intensive industries leverage local centers for real-time processing. The Finland Data Center Infrastructure Market in this region benefits from industrial IoT adoption. Public-private collaborations fund smart manufacturing ecosystems powered by edge data centers.

- For example, the Wasa Zero Emission Data Centre (WSTAR) in Vaasa is a research facility focused on developing low-power, carbon-neutral data center solutions. It integrates renewable electricity, advanced cooling, and heat recovery systems to test sustainable energy use in real operational settings.

Eastern Finland and Emerging Regional Hubs

Eastern Finland captures nearly 15% share, showing steady development in smaller-scale facilities. Local investments target backup, recovery, and regional data hosting services. It grows as part of broader national efforts to decentralize infrastructure. Proximity to Russia and Baltic regions boosts cross-border connectivity. Smaller operators focus on modular deployments for agility and cost control. These expanding hubs strengthen resilience and national data coverage within Finland’s network ecosystem.

- For instance: LUMI runs on 100% hydroelectricity, and it reuses its waste heat to supply roughly 20 % of the district heating for the city of Kajaani.

Competitive Insights:

- ABB

- Schneider Electric

- Vertiv Group Corp.

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- Digital Realty

- IBM

- Fujitsu

- Lenovo

The Finland Data Center Infrastructure Market features strong competition among global technology providers and local operators. It is shaped by companies that focus on energy efficiency, modular design, and digital automation. ABB, Schneider Electric, and Vertiv dominate power and cooling infrastructure through integrated solutions that meet green standards. Equinix and Digital Realty lead in colocation and hyperscale services with large-capacity campuses. Cisco, Dell, and Lenovo support IT hardware and networking performance across growing workloads. Partnerships between local utilities and global data center firms strengthen energy reliability. Vendors compete through innovation in renewable integration, automation software, and AI-driven infrastructure management.

Recent Developments:

- In November 2025, GI Partners acquired Finland’s Digita, a telecom tower and data center operator, along with Icelandic firm IslandsTurnar, marking a major investment in regional digital infrastructure.

- In August 2025, DayOne announced a flagship hyperscale data center project in Lahti, Finland, entering a growth partnership agreement with the City of Lahti, Lahti Region Development LADEC, Lahti Energy, and local stakeholders to invest €1.2 billion in the facility.

Market Dynamics:

Market Dynamics: Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights