Executive summary:

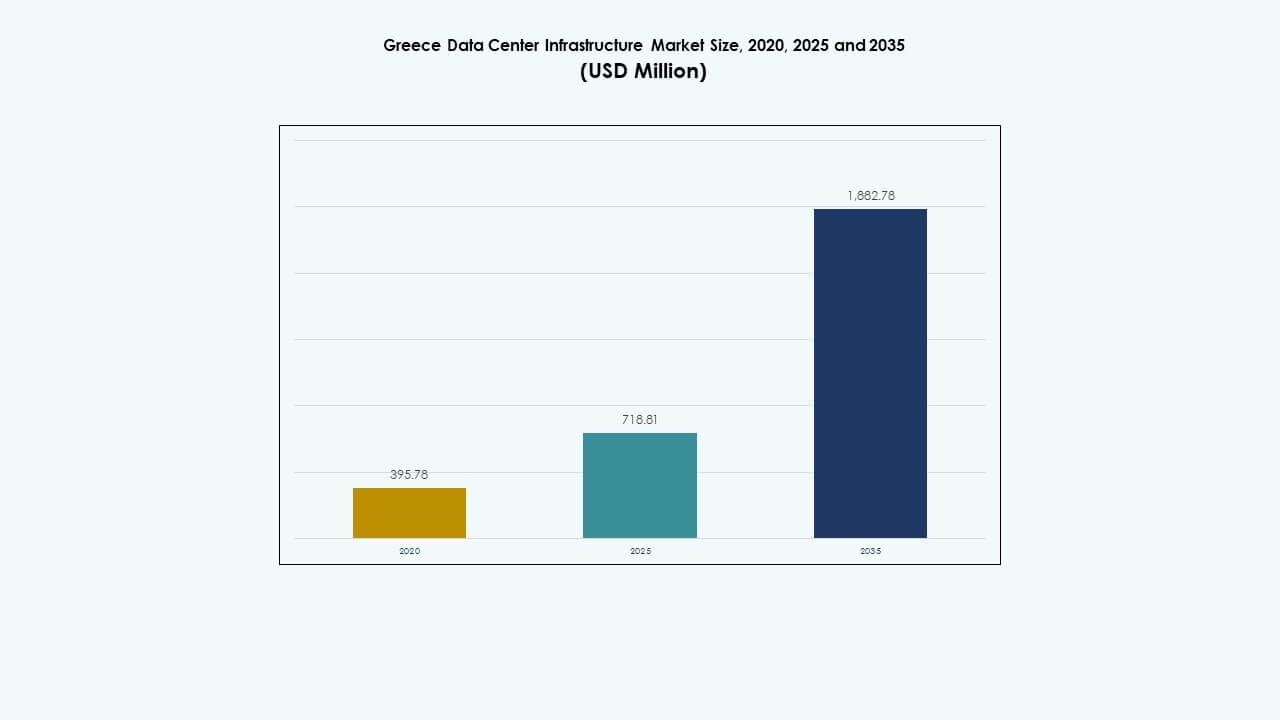

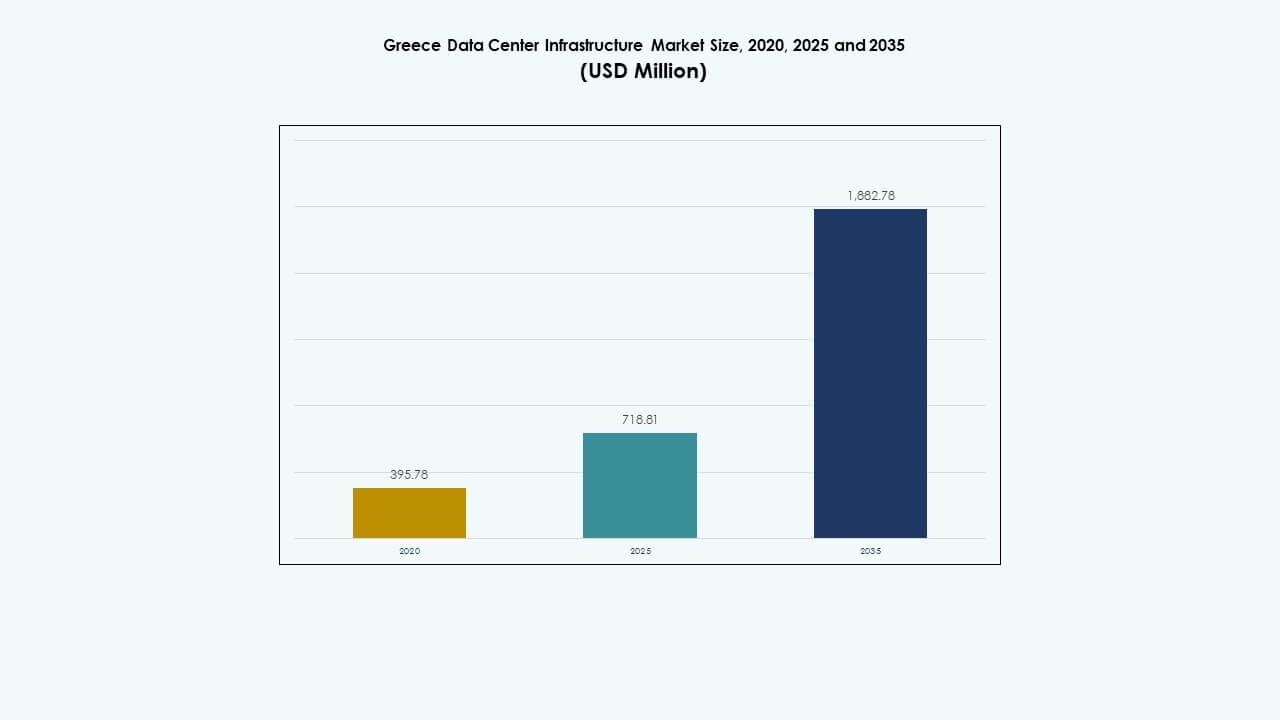

The Greece Data Center Infrastructure Market size was valued at USD 395.78 million in 2020, increased to USD 718.81 million in 2025, and is anticipated to reach USD 1,882.78 million by 2035, at a CAGR of 10.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Greece Data Center Infrastructure Market Size 2025 |

USD 718.81 Million |

| Greece Data Center Infrastructure Market, CAGR |

10.04% |

| Greece Data Center Infrastructure Market Size 2035 |

USD 1,882.78 Million |

Strong digital transformation across enterprises and the rapid adoption of cloud, AI, and IoT applications drive infrastructure upgrades nationwide. Rising investment in edge and hyperscale facilities accelerates deployment of efficient power and cooling systems. Innovation in modular and prefabricated designs enables faster scaling, while sustainability and renewable integration attract global investors. The market’s strategic position supports regional connectivity and data sovereignty across Southeast Europe.

Southern Greece dominates market growth due to high data concentration and advanced network infrastructure in Athens. Northern regions, particularly Thessaloniki, emerge as secondary hubs supported by industrial digitization and cross-border data exchange. Western and island areas show steady adoption through smaller edge facilities. Greece’s geographic advantage as a connectivity bridge between Europe, Africa, and Asia strengthens its role in regional data infrastructure development.

Market Drivers

Market Drivers

Rising Demand for Cloud and Digital Infrastructure

The Greece Data Center Infrastructure Market expands through accelerated adoption of cloud computing and enterprise digital transformation. Businesses modernize IT operations to manage rising workloads and ensure data sovereignty within EU borders. It gains traction from increased deployment of hybrid and multi-cloud models supporting remote work. Investments in next-generation networks strengthen data transfer speed and reliability. Energy-efficient technologies become a top priority among operators. Enterprises enhance infrastructure resilience to meet uptime standards. This shift drives local and international vendors to scale operations across key Greek cities.

- For instance, Edgnex Data Centers (by DAMAC) and PPC Group launched a joint venture “Data In Scale” for a 12.5MW data center in Athens’ Attica region, with €150 million investment in the first phase scaling to 25MW, construction starting Q1 2025 to support AI and cloud workloads.

Adoption of Edge and AI-Driven Data Processing

Edge computing adoption transforms how companies manage latency-sensitive applications. The Greece Data Center Infrastructure Market benefits from local data nodes supporting real-time analytics. AI workloads push demand for high-density servers and advanced cooling systems. Industrial sectors deploy intelligent monitoring tools for predictive maintenance and process automation. Telecom operators expand 5G backbone networks, boosting regional connectivity. Innovation in micro data centers improves service delivery in remote areas. Vendors invest in AI-ready infrastructure that ensures low latency and power optimization.

Government and EU Investments Strengthening Digital Foundations

Strong policy alignment with the EU’s Digital Decade goals fuels investment momentum. Greece attracts co-funded projects focusing on secure cloud and data management hubs. Public-private partnerships strengthen nationwide data capacity and support green initiatives. The Greece Data Center Infrastructure Market aligns with EU cybersecurity and sustainability frameworks. Local governments facilitate land access and permits for hyperscale expansion. Rising emphasis on energy-efficient systems enhances competitiveness. Growing institutional support builds investor confidence across key development zones.

- For instance, Greece’s Law 5069/2023 establishes clear building and zoning rules for data centers, defining permitted land uses and construction standards. The regulation simplifies licensing procedures and strengthens Greece’s position as an attractive hub for digital infrastructure investment aligned with EU sustainability and energy-efficiency goals.

Strategic Importance for Investors and Businesses

The market gains strategic weight due to Greece’s geographic position as a digital gateway between Europe, Africa, and Asia. It enables low-latency interconnections across regional markets. High fiber connectivity and submarine cable networks enhance cross-border data flow. Global investors recognize potential in Greece’s stable infrastructure ecosystem. The Greece Data Center Infrastructure Market offers cost advantages compared to Western Europe. Multinational enterprises expand presence to secure business continuity and resilience. Continuous infrastructure modernization strengthens national digital competitiveness.

Market Trends

Market Trends

Shift Toward Sustainable and Green Data Center Designs

Growing energy concerns drive investment in renewable-powered facilities. Operators integrate solar and wind energy sources to reduce grid dependence. The Greece Data Center Infrastructure Market witnesses design innovation focused on heat reuse and smart cooling. Firms adopt advanced airflow systems to maintain operational efficiency. Modular designs reduce waste and speed construction timelines. Sustainable certification programs gain traction among large developers. This transition aligns national targets for carbon neutrality.

Expansion of Hyperscale and Colocation Facilities

Rising demand for large-scale computing capacity fuels hyperscale projects. Global providers establish hubs to meet cloud service expansion. Colocation demand grows as enterprises seek scalable, managed infrastructure. The Greece Data Center Infrastructure Market sees stronger participation from telecom-backed ventures. Integration of automation tools optimizes rack utilization. Multi-tenant models provide flexibility for startups and SMEs. Rapid scalability encourages new investments near Athens and Thessaloniki.

Integration of Liquid Cooling and AI-Optimized Systems

High-performance computing workloads push operators toward liquid-cooling technology. AI and machine learning integration optimize thermal management and asset allocation. The Greece Data Center Infrastructure Market adopts immersion cooling to improve efficiency. Facilities employ digital twins for real-time monitoring and predictive maintenance. Hardware upgrades enhance density and reduce heat output. Vendors develop intelligent management systems for environmental control. The focus shifts toward balanced performance and energy use.

Rise of Modular and Prefabricated Construction Models

Developers adopt modular designs to shorten deployment cycles. Prefabricated modules allow phased expansion while maintaining quality standards. The Greece Data Center Infrastructure Market benefits from local engineering expertise supporting faster builds. Modular systems ensure consistent power and cooling distribution. Factory-built solutions lower construction costs and improve reliability. Operators leverage plug-and-play scalability to address growing demand. The trend supports resilient, adaptive infrastructure development.

Market Challenges

Market Challenges

High Energy Costs and Power Supply Constraints

Energy dependency remains a concern for long-term sustainability. High electricity tariffs challenge profitability for large data operators. The Greece Data Center Infrastructure Market faces pressure to adopt renewable energy faster. Power grid limitations in remote zones restrict expansion opportunities. Balancing efficiency with affordability becomes complex for mid-tier developers. Local utilities must enhance grid reliability to support continuous uptime. Operators explore hybrid energy systems to offset cost volatility.

Limited Skilled Workforce and Complex Regulatory Barriers

The market experiences a shortage of trained professionals in data center engineering. Limited local expertise slows adoption of emerging technologies. The Greece Data Center Infrastructure Market navigates evolving compliance rules under EU and national frameworks. Lengthy permit processes delay project execution. Operators face coordination issues with multi-agency approval systems. Skill development programs are essential to meet future capacity needs. Regulatory clarity and streamlined policies could accelerate infrastructure deployment.

Market Opportunities

Growing Focus on Renewable Energy Integration

Transition toward renewable energy sources opens significant opportunities. Solar and wind energy potential enhances sustainability for new facilities. The Greece Data Center Infrastructure Market benefits from EU funding for green transformation. Investors favor data centers designed for net-zero carbon operations. Expansion of energy storage and microgrid systems supports uninterrupted supply. These advancements improve operational resilience while lowering emissions.

Emerging Role as a Regional Digital Gateway

Greece’s location positions it as a bridge for intercontinental data traffic. Submarine cable routes connecting Europe, Africa, and Asia boost connectivity appeal. The Greece Data Center Infrastructure Market attracts hyperscale players seeking regional presence. Expansion of fiber and edge nodes strengthens cross-border data flow. Local partnerships create a competitive ecosystem for global cloud service integration. The opportunity reinforces Greece’s role as a regional technology hub.

Market Segmentation

By Infrastructure Type

Electrical infrastructure dominates due to its critical role in uptime and reliability. The Greece Data Center Infrastructure Market relies heavily on robust power systems and backup solutions. Mechanical and IT infrastructure follow closely, supported by efficient cooling and scalable server systems. Civil and architectural components add resilience to structural design. Investments in advanced systems improve performance and sustainability across facilities.

By Electrical Infrastructure

Uninterruptible power supply (UPS) and PDUs account for major investments. The Greece Data Center Infrastructure Market emphasizes grid connection stability and energy backup systems. Operators deploy battery energy storage for seamless failover. Switchgears and power transfer systems enhance reliability in multi-tenant facilities. Electrical efficiency supports sustainability goals and reduces operational expenditure.

By Mechanical Infrastructure

Cooling units, chillers, and containment systems lead the segment. The Greece Data Center Infrastructure Market integrates efficient heat management to support high-density workloads. Water-cooled chillers gain popularity for large data halls. Pumps and piping ensure stable temperature regulation. Mechanical upgrades optimize energy use and extend equipment life.

By Civil / Structural & Architectural

Strong foundations, envelope materials, and modular systems dominate project design. The Greece Data Center Infrastructure Market prioritizes durability against regional climate conditions. Raised floors and modular prefabricated structures allow flexible scaling. Building standards align with EU safety and energy regulations. Civil and architectural innovation reduces construction time and cost.

By IT & Network Infrastructure

Server and storage systems hold a leading share. The Greece Data Center Infrastructure Market grows through adoption of high-speed networking and fiber cabling. Integration of AI-ready hardware boosts computing efficiency. Rack and enclosure solutions improve airflow and accessibility. IT innovation drives operational scalability across cloud and enterprise facilities.

By Data Center Type

Colocation centers and enterprise data centers dominate due to flexibility and cost-sharing benefits. Hyperscale and edge facilities gain traction from global tech adoption. The Greece Data Center Infrastructure Market leverages hybrid expansion for optimized deployment. These categories support diverse industries including telecom, finance, and manufacturing.

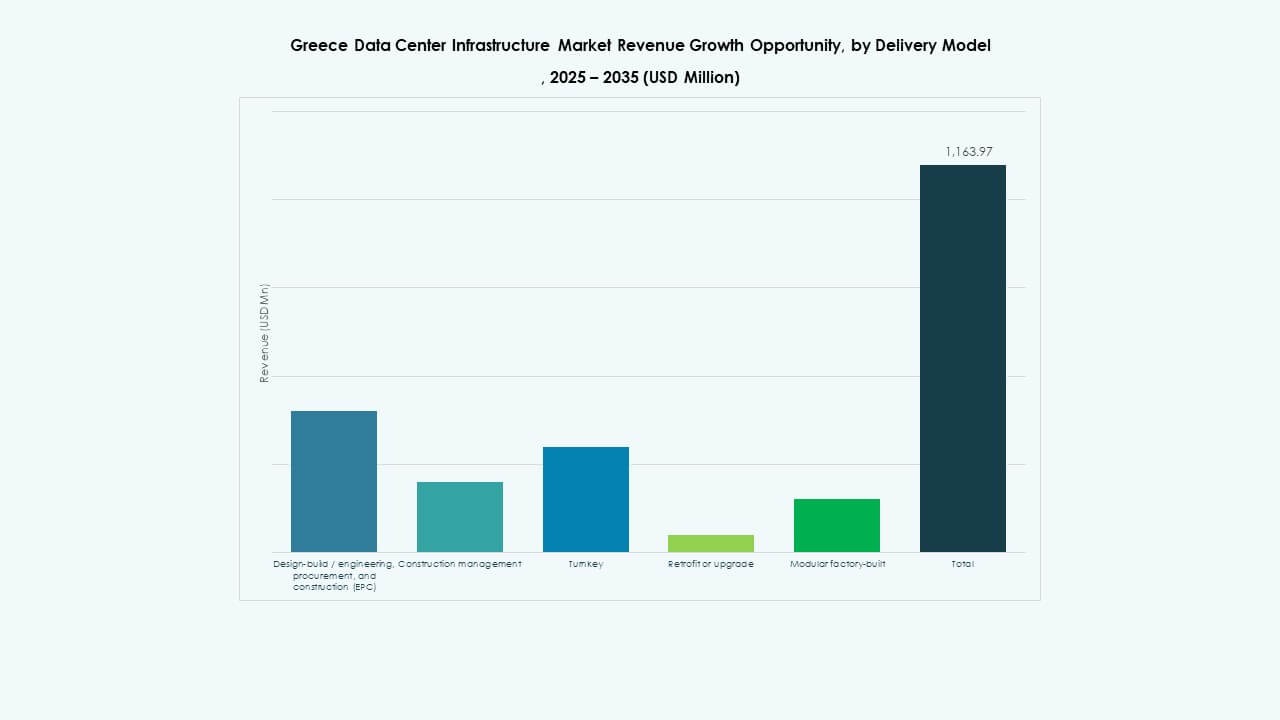

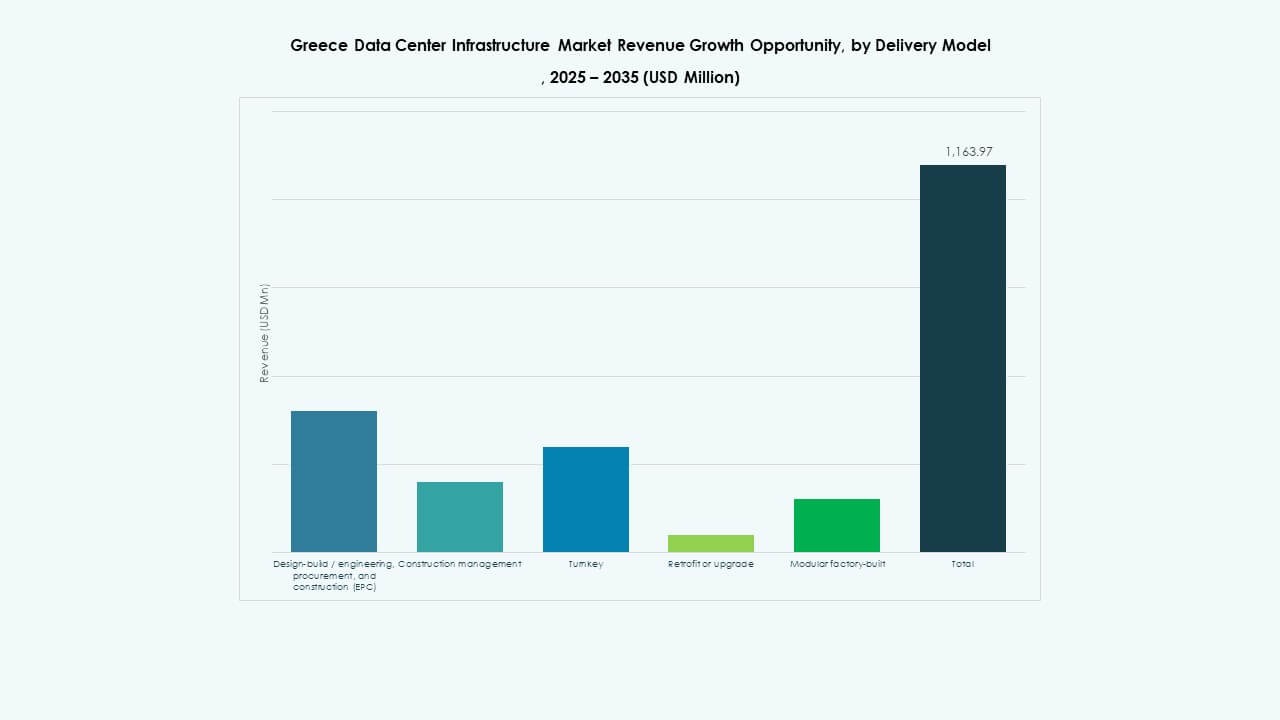

By Delivery Model

Design-build and turnkey projects lead due to speed and control. The Greece Data Center Infrastructure Market uses modular factory-built models for faster commissioning. Retrofit and upgrade approaches sustain older sites. EPC contractors deliver integrated project execution under strict performance standards.

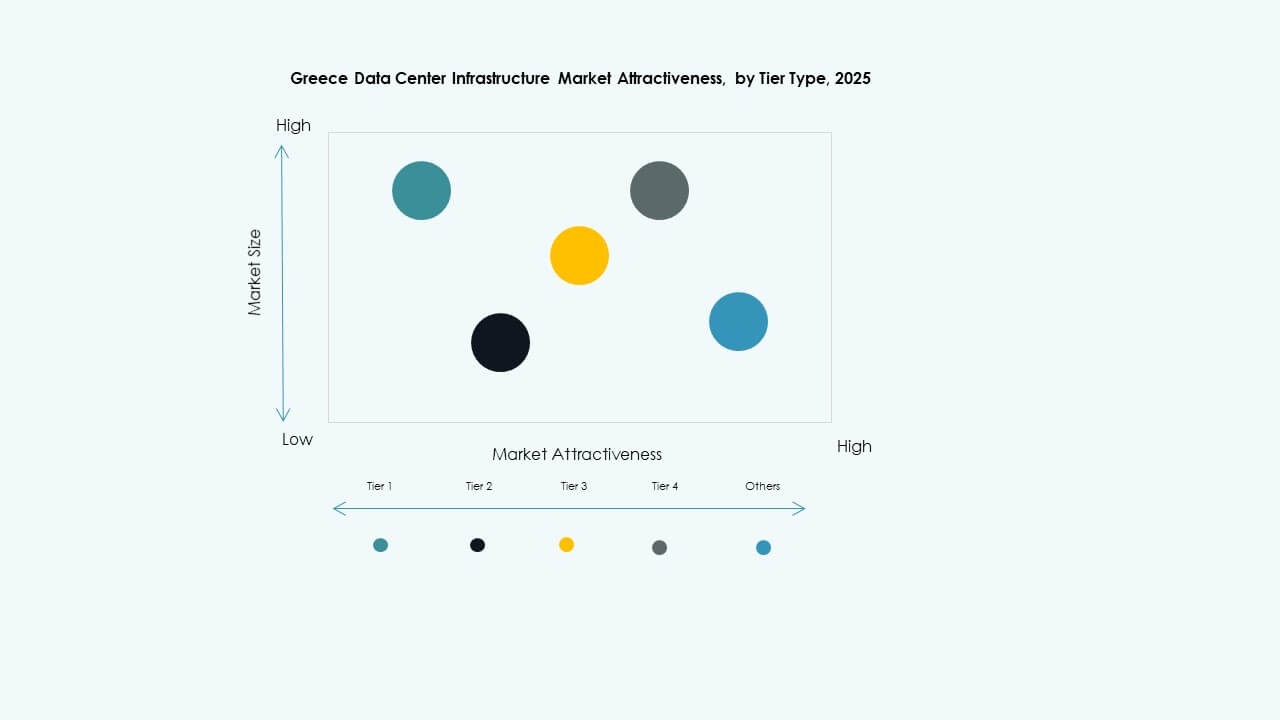

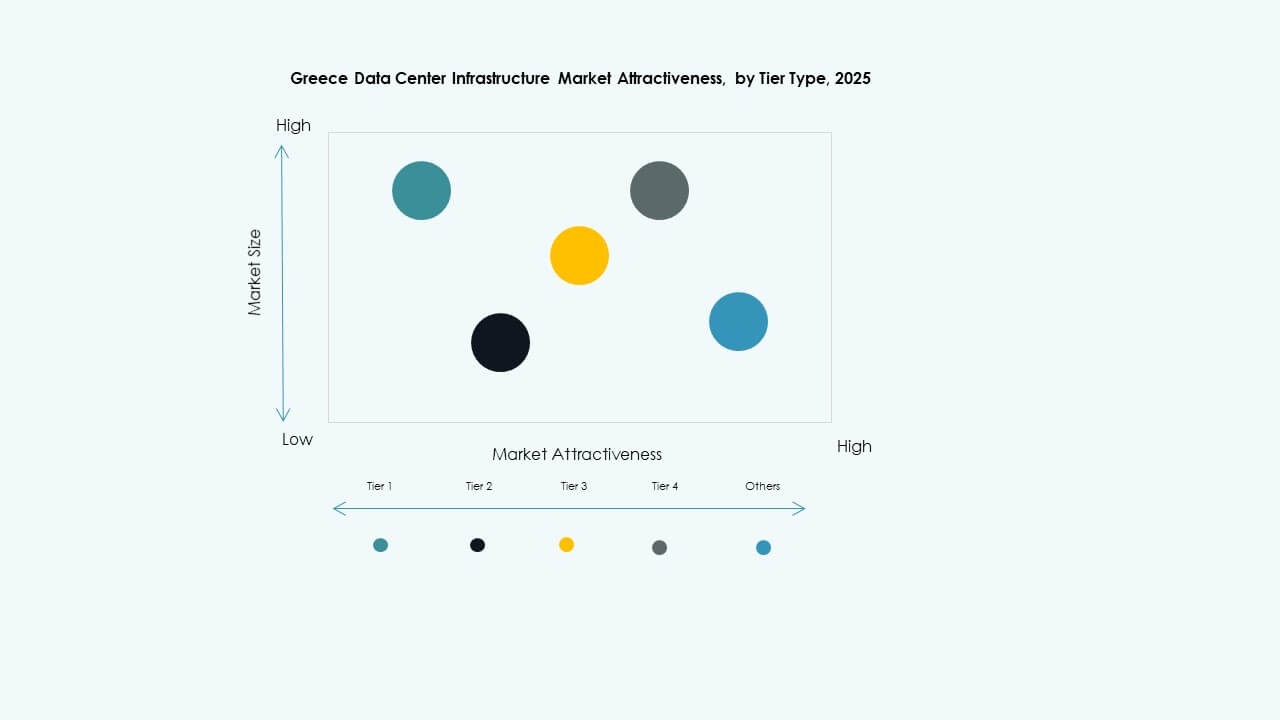

By Tier Type

Tier 3 data centers dominate for balance between cost and resilience. The Greece Data Center Infrastructure Market sees rising Tier 4 adoption among hyperscale operators. Tier 1 and 2 remain suitable for small enterprises and edge applications. Enhanced fault tolerance supports service-level reliability across all facility tiers.

Regional Insights

Regional Insights

Southern Greece Dominating Market Share

Southern Greece holds over 45% share, driven by Athens-based hyperscale and colocation hubs. The Greece Data Center Infrastructure Market benefits from proximity to fiber networks and business clusters. Energy availability and real estate support large-scale development. Strategic positioning attracts telecom and cloud service providers expanding their regional footprint.

- For instance, the DATA4 “ATH1” campus in Paiania (Athens region) sits on a 7.5-hectare plot and offers up to 90 MW of power capacity. The first phase facility (DC1) under this project will deliver 15 MW IT load capacity.

Northern Greece Emerging with Infrastructure Expansion

Northern regions contribute around 30% share with growing enterprise facilities near Thessaloniki. The Greece Data Center Infrastructure Market benefits from logistics connectivity with Balkan countries. Regional development projects and renewable installations boost investment appeal. Edge computing demand from industrial zones fosters localized infrastructure.

Western and Island Regions Showing Moderate Growth

Western and island regions hold around 25% share, supported by smaller colocation and edge centers. The Greece Data Center Infrastructure Market sees interest in renewable-powered modular builds. Geographic challenges slow large-scale expansion but open prospects for distributed computing. These areas strengthen national data resilience and connectivity coverage.

- For instance, Digital Realty launched its first data center in Crete, named HER1, serving as a carrier-neutral facility designed to enhance Eastern Mediterranean connectivity through major subsea cable links. The project marks a key step in strengthening Greece’s role as a regional data exchange and interconnection hub.

Competitive Insights:

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- ABB Ltd.

- Schneider Electric SE

- Vertiv Group Corp.

- Digital Realty

- IBM Corporation

- Fujitsu Ltd.

- Lenovo Group Ltd.

The Greece Data Center Infrastructure Market features a balanced mix of global technology leaders and regional operators. It remains highly competitive due to continuous investments in power management, IT hardware, and cooling innovations. Major vendors like Schneider Electric and Vertiv focus on energy-efficient systems to support sustainability goals. Equinix and Digital Realty expand colocation capacity to meet rising enterprise demand. Cisco, Dell, and Lenovo strengthen market presence through scalable IT and networking solutions. ABB and IBM provide smart infrastructure and automation tools that improve operational efficiency. The market continues to favor partnerships, modular construction, and green data center models to enhance resilience and performance.

Recent Developments:

- In November 2025, Schneider Electric secured roughly USD 2.3 billion in new U.S. data-center contracts. The deals include major supply agreements with a hyperscale operator and a leading colocation provider to supply power modules, cooling systems, UPS units and switchgear over 2025–2026.

- In October 2025, Hitachi signed a strategic partnership with OpenAI to expand global AI data-center infrastructure. Under this agreement, the companies will co-develop modular and prefabricated data-center designs, energy-efficient cooling and storage infrastructures, and plan supply-chain strategies for reliable deployment. The deal targets sustainable data-center operations and rapid global expansion of AI infrastructure

- In September 2025, Schneider Electric launched its AI-ready liquid-cooled EcoStruxure solutions designed for high-density servers supporting NVIDIA GPU-based workloads, marking a significant product launch in data center infrastructure.

Market Drivers

Market Drivers Market Trends

Market Trends Market Challenges

Market Challenges Regional Insights

Regional Insights