Executive summary:

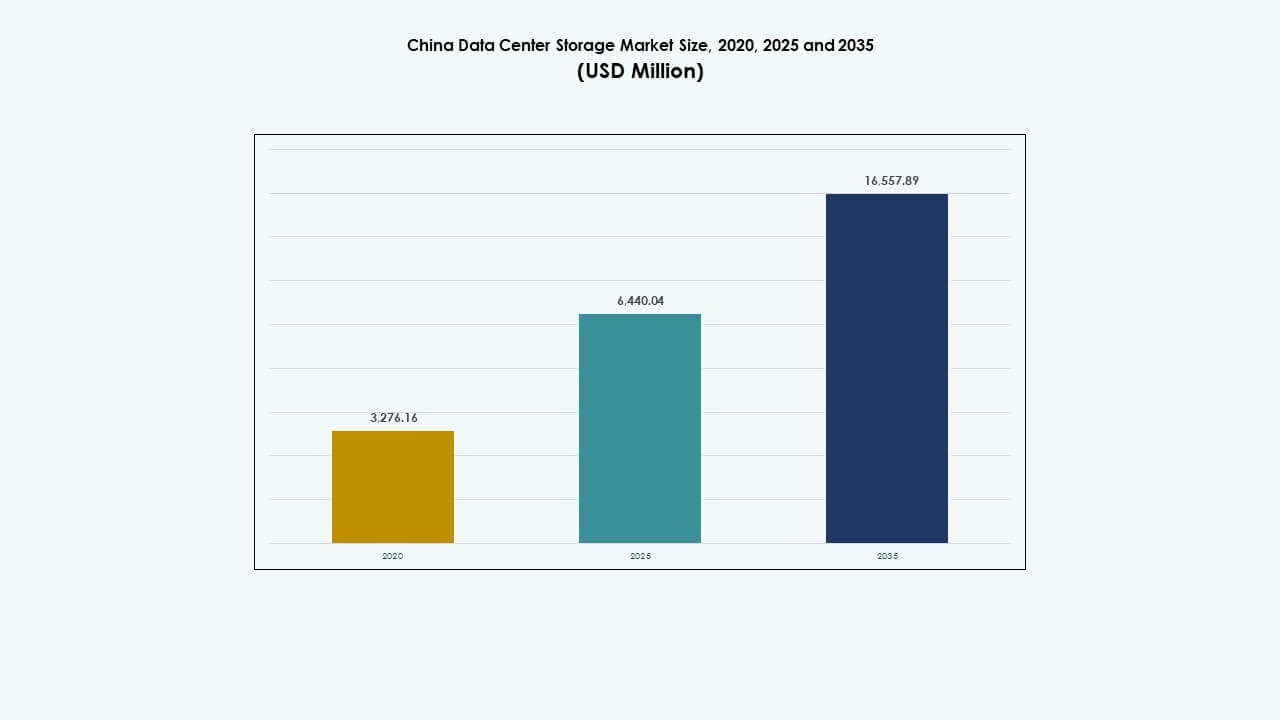

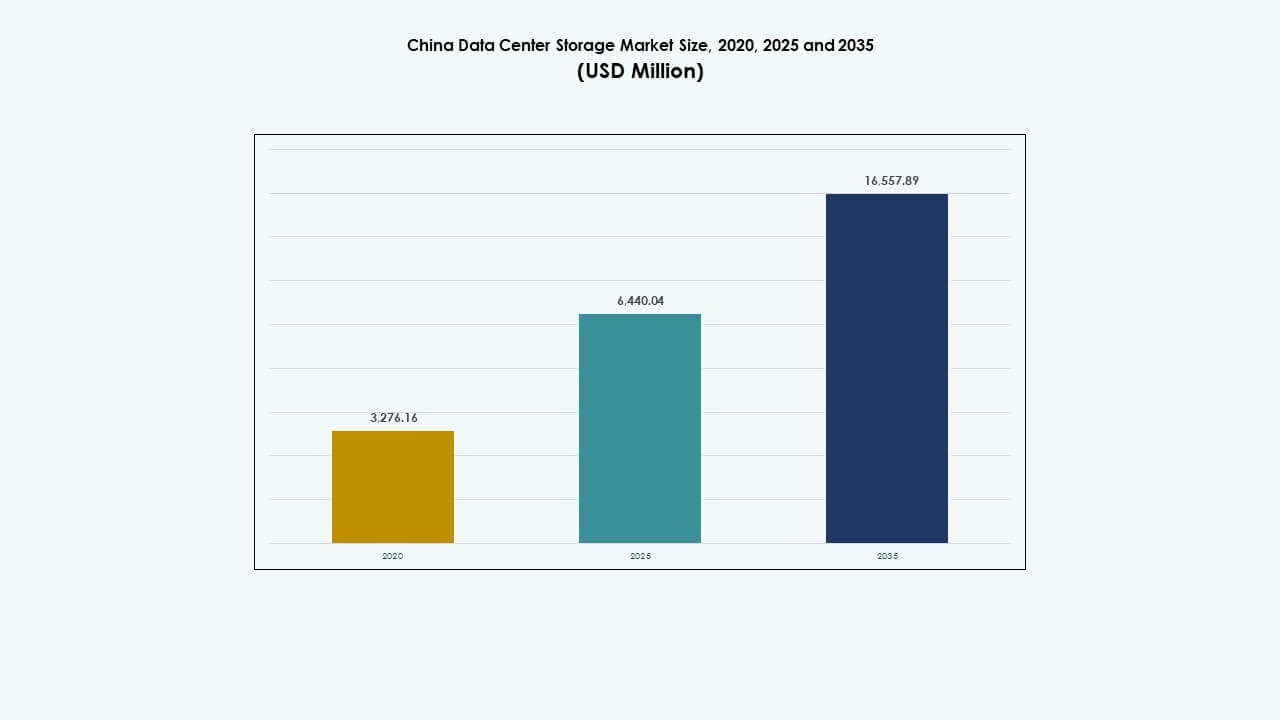

The China Data Center Storage Market size was valued at USD 3,276.16 million in 2020 to USD 6,440.04 million in 2025 and is anticipated to reach USD 16,557.89 million by 2035, at a CAGR of 9.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| China Data Center Storage Market Size 2025 |

USD 6,440.04 Million |

| China Data Center Storage Market, CAGR |

9.74% |

| China Data Center Storage Market Size 2035 |

USD 16,557.89 Million |

The market is expanding due to rapid cloud adoption, AI workloads, and strong demand for edge storage. Enterprises are modernizing IT infrastructure, driven by software-defined storage and NVMe solutions. Data localization policies and digital economy programs are pushing hyperscalers and enterprises to build resilient, scalable storage systems. Innovation in AI-driven storage management and hybrid deployment models is shaping next-gen infrastructure. For investors, the market offers long-term potential backed by policy, performance demand, and rising unstructured data volume.

Eastern China leads due to strong enterprise density and major tech hubs in Shanghai, Hangzhou, and Nanjing. Northern China, with Beijing as a policy and AI epicenter, continues to expand hyperscale and sovereign cloud deployments. Western and Central regions, including Chengdu and Wuhan, are emerging with greenfield data center investments and favorable land-power economics, gradually balancing regional storage capacity.

Market Dynamics:

Market Drivers

Digital Transformation and Government Push Fuel Rapid Storage Infrastructure Expansion

The China Data Center Storage Market is expanding due to digital transformation across finance, healthcare, manufacturing, and e-commerce. National programs like “New Infrastructure” and “Made in China 2025” increase investment in data infrastructure. Enterprises are upgrading legacy storage systems to scalable, high-speed platforms. Cloud service providers are expanding storage to meet growing SaaS, PaaS, and IaaS demand. Data localization policies further drive demand for regional data storage hubs. Real-time analytics and AI workloads require low-latency, high-throughput storage. The rise in connected devices and 5G boosts unstructured data volumes. The market benefits from strong domestic players and policy incentives. The China Data Center Storage Market enables digital-first strategies and strengthens national competitiveness.

- For instance, Alibaba Cloud’s Elastic Block Storage delivers up to 1,000,000 IOPS and 4,000 MB/s throughput per disk with 99.9999999% data durability.

AI, IoT, and Edge Computing Trigger Demand for High-Speed, Scalable Storage Solutions

AI adoption is reshaping storage architecture needs, increasing demand for high-performance computing (HPC) and NVMe-based flash arrays. Chinese tech firms deploying large-scale AI models require real-time access to massive datasets. Edge computing adoption in manufacturing, smart cities, and transportation demands distributed storage with low-latency performance. IoT deployments across utilities, logistics, and infrastructure amplify real-time data flow into edge and core storage systems. Flash and hybrid storage meet the speed and volume needs of edge-AI convergence. Public and private investments in AI-focused infrastructure further drive innovation. China’s 6G roadmap is projected to intensify storage needs. Local firms actively patent AI+storage integration tools. The market aligns storage strategy with future intelligent systems.

- For instance, Huawei OceanStor A800 delivered 698 GiB/s stable bandwidth in the 2025 MLPerf Storage v2.0 3D U-Net test, supporting 255 H100 GPUs with over 90% utilization.

Enterprise Cloud Migration and Industry Verticalization Accelerate Software-Defined Storage Uptake

Enterprises are accelerating migration to cloud-native architectures, pushing demand for software-defined storage (SDS). SDS enables centralized management, automation, and horizontal scalability across multicloud environments. BFSI, healthcare, and government sectors demand strong data sovereignty and control, making SDS vital. Telecom operators are deploying SDS for 5G core networks and distributed cloud functions. The growth in containerized workloads and DevOps practices supports flexible, programmable storage. Open-source SDS platforms are gaining traction among tech-savvy firms. Enterprises seek reduced TCO and agile provisioning through storage virtualization. The China Data Center Storage Market supports deep vertical storage customization. It enables service providers to meet application-specific performance and compliance needs.

Rising Investments in Green and Resilient Storage Facilities Support Long-Term Infrastructure Goals

Energy-efficient and resilient storage systems are key focus areas for large operators and hyperscalers. China is promoting green data centers aligned with national carbon neutrality targets. Enterprises are replacing aging HDD-based systems with SSD and hybrid solutions for power efficiency. Data centers are optimizing storage tiers to balance cost, speed, and energy use. Liquid cooling and renewable energy integration influence next-gen storage design. Regional tier-2 cities see localized storage growth driven by sustainability-linked financing. Operators design backup and disaster recovery storage to meet evolving resilience standards. Energy policy incentives and digital economy mandates shape investment patterns. The China Data Center Storage Market aligns with national sustainability and infrastructure resilience goals.

Market Trends

Growth in Cold Storage Solutions for Archival, Compliance, and Unstructured Data Handling

China’s digital growth produces massive unstructured data that requires cost-effective long-term retention. Organizations invest in cold storage for surveillance, compliance logs, and historical data. Tape libraries and object-based storage dominate archival deployments in government and healthcare. Regulatory bodies mandate longer data retention windows, boosting archival infrastructure. Media and video surveillance firms drive demand for petabyte-scale cold storage. Hyperscalers develop regional cold storage zones to reduce operational expenses. Cloud providers offer tiered storage pricing to incentivize archival usage. This trend supports sustainable storage economics. The China Data Center Storage Market responds to long-term data lifecycle needs.

High-Speed Interconnects and NVMe Adoption Enhance Storage Performance in Latency-Sensitive Workloads

Adoption of NVMe and NVMe-over-Fabrics (NVMe-oF) grows across cloud and enterprise deployments. Enterprises deploying real-time analytics, high-frequency trading, and AI/ML need sub-millisecond latency. NVMe boosts throughput in critical applications like autonomous driving and fintech. Operators upgrade backend infrastructure with PCIe Gen4/Gen5 for faster interconnects. Storage fabrics evolve toward Ethernet and InfiniBand to support high IOPS workloads. NVMe adoption improves rack density and lowers server response time. Multitenant cloud environments gain flexibility from composable NVMe storage. The China Data Center Storage Market sees faster ROI with performance-focused upgrades. NVMe infrastructure raises performance ceiling across critical verticals.

Rise of Domestic Storage Vendors Reshapes Procurement and Technology Independence Strategy

Geopolitical uncertainty accelerates preference for domestic storage brands. Local vendors expand R&D, offer customized solutions, and meet regulatory compliance. Enterprises shift procurement toward China-developed controllers, firmware, and OS-level software. Partnerships between local ODMs and hyperscalers strengthen innovation pipelines. Certification mandates from regulators push for homegrown storage in sensitive sectors. Domestic SSD and controller production scales to replace imported components. Government-owned data centers adopt domestic-first storage procurement policies. Startups receive funding to build exascale-compatible storage platforms. The China Data Center Storage Market shifts toward national tech independence. Domestic players build end-to-end vertical capabilities.

Integration of AI and ML in Storage Management Boosts Automation and Predictive Operations

Storage vendors embed AI/ML into management platforms for auto-tiering, fault prediction, and usage analytics. Enterprises reduce downtime using predictive maintenance tools. AI-enabled orchestration platforms optimize data movement based on usage patterns. Dynamic provisioning improves storage cost efficiency. Data lakes and warehouses gain from intelligent workload balancing. ML-driven insights help forecast capacity needs and prevent overprovisioning. Cloud providers launch AI-enhanced storage monitoring dashboards. Security and compliance auditing becomes AI-assisted. The China Data Center Storage Market embraces autonomous infrastructure at scale. Intelligent storage operations support higher service uptime and SLA commitments.

Market Challenges

Rising Data Sovereignty, Cybersecurity, and Regulatory Pressures Increase Storage Complexity

The China Data Center Storage Market faces regulatory complexity due to evolving data governance laws. National security regulations require data localization, which increases storage deployment redundancy across provinces. Stricter data classification guidelines complicate cross-border storage and backup operations. Enterprises must navigate multi-tier compliance standards across sectors. Cyberattacks on critical infrastructure demand higher investments in secure storage protocols. Hardware encryption and zero-trust architecture adoption raise capital costs. Storage audits and logging requirements strain system performance. It must meet both security and agility without compromising service availability. Companies struggle to balance compliance and innovation speed.

Cost Inflation, Skills Shortages, and Fragmented Procurement Challenge Market Scalability

Storage infrastructure costs rise due to chip shortages, rising labor expenses, and logistics constraints. Talent shortages in SDS, NVMe, and storage architecture design limit project scalability. Smaller enterprises lack in-house teams to manage complex hybrid environments. Fragmented procurement and compatibility issues affect multi-vendor storage integrations. Delayed government approvals stall hyperscale buildouts in key regions. It faces budget constraints in SMEs despite growing demand. Import restrictions on components also disrupt delivery timelines. OEMs must balance product pricing with performance and compliance. Market fragmentation delays consolidation of standardized storage ecosystems.

Market Opportunities

Expansion in Edge Data Centers Creates Demand for Localized, Low-Latency Storage Solutions

Smart city projects, connected industries, and autonomous systems drive mi cro and edge data center deployments. These deployments need compact, energy-efficient storage with real-time access. Companies invest in edge SSD and hybrid solutions to power IoT workloads. Regions underserved by hyperscalers offer new opportunities. The China Data Center Storage Market supports distributed storage strategies in high-growth zones.

cro and edge data center deployments. These deployments need compact, energy-efficient storage with real-time access. Companies invest in edge SSD and hybrid solutions to power IoT workloads. Regions underserved by hyperscalers offer new opportunities. The China Data Center Storage Market supports distributed storage strategies in high-growth zones.

Growth in Multicloud Storage Services and DRaaS Offers New Revenue Streams for Providers

Enterprises increasingly prefer hybrid and multicloud setups for flexibility and resilience. Cloud-based backup, DRaaS, and storage-as-a-service gain traction across sectors. Managed service providers develop offerings tailored to SMBs. Regulatory shifts also create opportunities for secure, compliant cloud storage. It enables vendors to diversify solutions and scale recurring revenues.

Market Segmentation

By Storage Type

Hybrid storage dominates the China Data Center Storage Market due to its balance of speed and cost-efficiency. Enterprises combine SSD and HDD systems to optimize workloads based on performance needs. All-flash storage is rising in Tier I data centers where latency-sensitive operations demand faster throughput. Traditional storage systems still support legacy workloads in government and public sector environments.

By Storage Deployment

Storage Area Network (SAN) systems hold the largest market share in China due to their high-speed, block-level performance. SAN remains critical for transactional databases and virtualization platforms. NAS systems grow steadily, supported by enterprise file-sharing and collaboration platforms. DAS continues in edge environments where simplicity and cost are priorities.

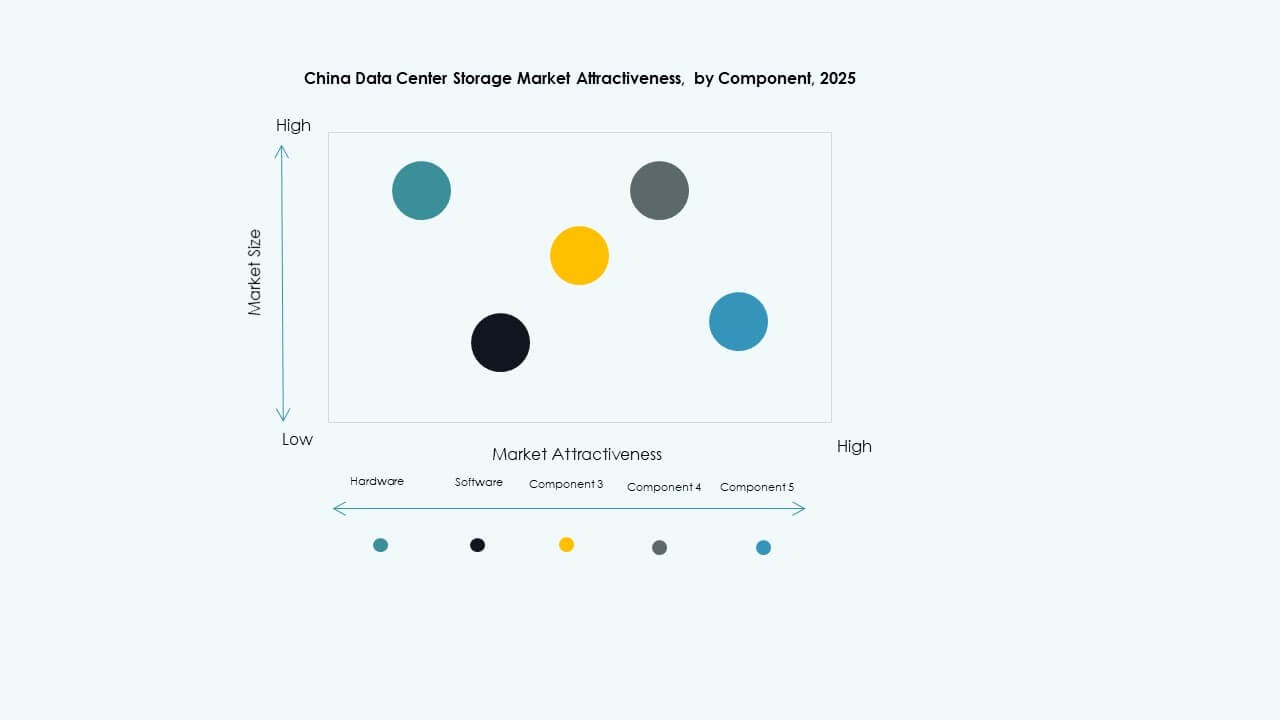

By Component

Hardware leads the China Data Center Storage Market in terms of revenue share, as physical devices form the foundation for data storage capacity. SSDs, enclosures, and controllers drive hardware investments. Software components such as storage management platforms, virtualization, and SDS solutions are gaining traction for operational efficiency.

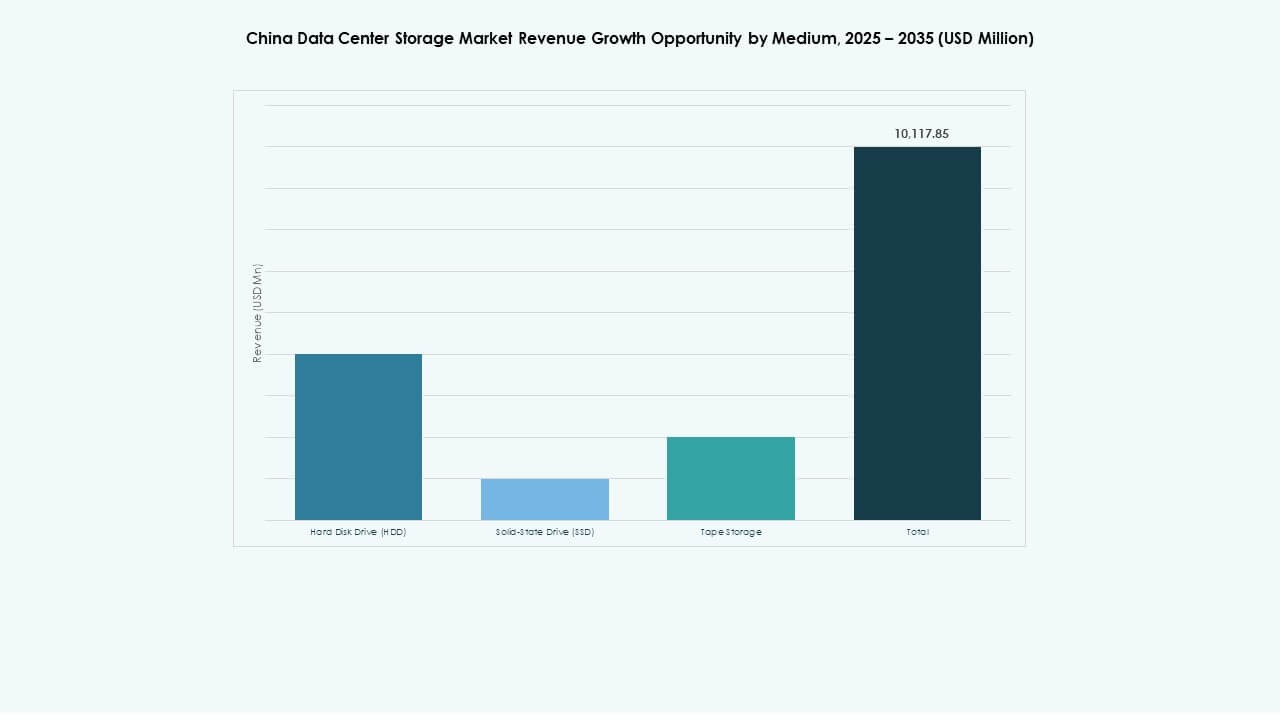

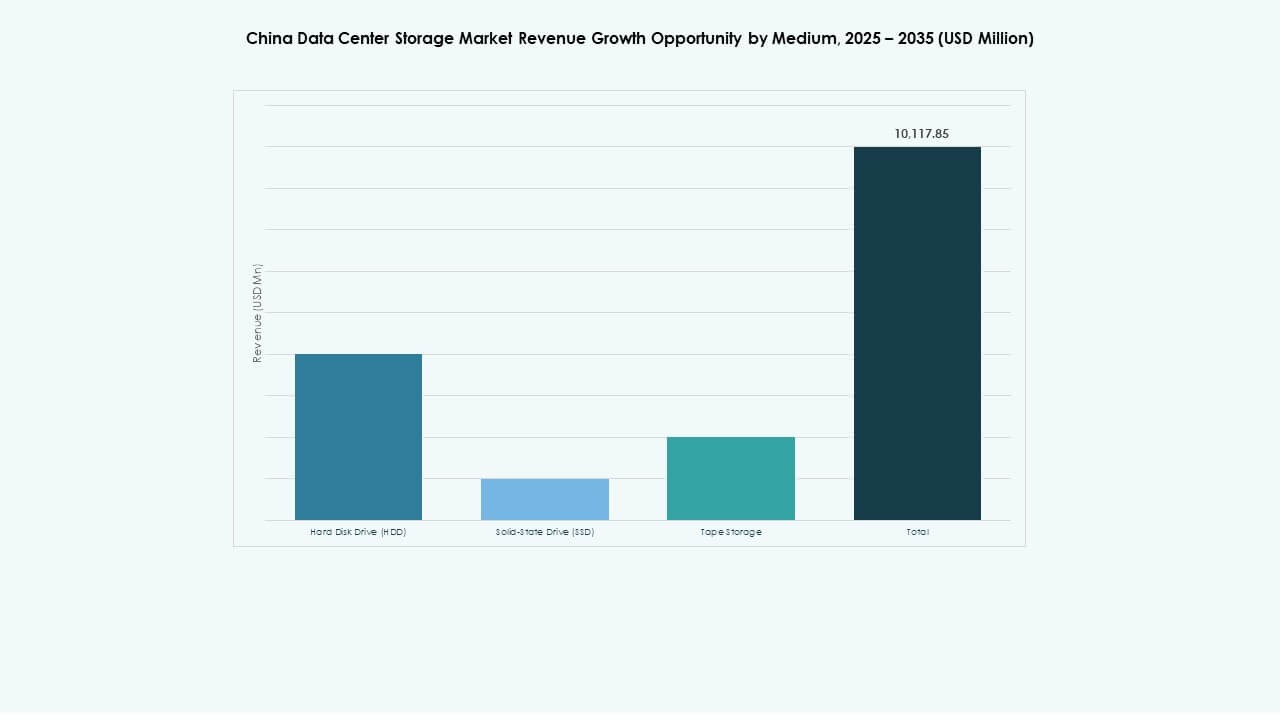

By Medium

Solid-State Drives (SSD) outpace HDDs in adoption rate due to performance advantages and falling price per gigabyte. SSDs dominate in Tier I and Tier II cities, especially in AI and cloud computing centers. HDDs remain in use for archival and cold storage purposes. Tape storage finds limited use in legacy government systems.

By Deployment Model

Cloud-based deployment is growing fastest in the China Data Center Storage Market, driven by SaaS models and digital transformation. Hybrid models are widely adopted in finance and telecom sectors that require both control and scalability. On-premises storage retains demand in high-security and compliance-heavy sectors such as defense and public administration.

By Application

IT and Telecommunications lead market share due to demand from hyperscalers, ISPs, and mobile operators. BFSI follows with large-scale storage needs for customer data, compliance, and digital transactions. Government and healthcare segments prioritize secure, localized storage. The market sees growing demand from e-commerce and education sectors under “internet plus” initiatives.

Regional Insights

Eastern China leads the China Data Center Storage Market with over 46% share, anchored by Shanghai, Hangzhou, and Nanjing.

This subregion benefits from dense enterprise clusters, cloud providers, and fintech ecosystems. It also houses major digital infrastructure zones with high-speed fiber and advanced power grids. Global and domestic hyperscalers prioritize Eastern China for premium colocation and storage rollout. Continuous investments in submarine cable access and metro edge sites further solidify its leadership.

Northern China holds around 28% market share, supported by Beijing’s role as a regulatory and AI hub.

Government investments in smart city projects and sovereign cloud services strengthen regional demand. The area benefits from public sector digitalization and large-scale cloud platforms deployed by Chinese hyperscalers. Northern China also hosts strategic disaster recovery zones and policy-driven innovation clusters. It remains key for AI training centers and national-level storage compliance infrastructure.

- For instance, Tencent Cloud’s sovereign cloud platform, Tencent Cloud Enterprise (TCE), supports high-throughput AI infrastructure using its Xingmai Network and scalable storage architecture. Its AI clusters leverage petabyte-scale storage and 200 Gbps interconnects to power large-scale model training.

Western and Central China account for 26% combined, led by Chengdu, Chongqing, and Wuhan.

These regions gain from national incentives to decentralize digital infrastructure. Power availability, land incentives, and proximity to emerging industrial hubs support storage capacity growth. Local governments promote data center parks bundled with tax and energy subsidies. The region is evolving into a secondary core for large-scale cold and archival storage.

- For instance, under China’s “East-Data-West-Compute” strategy, Huawei is supporting large-scale data hubs in Guizhou using its OceanStor Pacific storage system. This platform delivers high-density, scalable storage designed for cold and archival workloads in national computing infrastructure.

Competitive Insights:

- Huawei Technologies Co., Ltd.

- Inspur Group

- Sugon

- Lenovo Group

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- NetApp

- IBM Corporation

- Hitachi Vantara

The China Data Center Storage Market features a highly competitive landscape led by domestic giants and global technology providers. Huawei, Inspur, Sugon, and Lenovo drive local dominance through integrated offerings, vertical stack capabilities, and strong ties with government-led projects. Global vendors like Dell Technologies, HPE, and Cisco maintain share in multinational enterprise segments and hybrid cloud deployments. NetApp and IBM focus on software-defined storage and hybrid solutions. It supports a wide range of use cases, from hyperscale cloud to edge and enterprise backup. Product differentiation, regulatory compliance, and localized support shape vendor strategies. Collaborations, M&A, and green innovation remain core levers in this evolving ecosystem.

Recent Developments:

- In April 2025, Huawei launched its AI Data Lake Solution, integrating OceanStor A-series high-performance flash, OceanStor Pacific object storage, and OceanProtect backup systems tailored for data center storage needs.

- In January 2025, YMTC (Yangtze Memory Technologies Corp) began shipping its 5th-generation 3D TLC NAND with 294 layers, achieving 20 Gb/mm² density to enhance domestic flash storage competitiveness in China’s data center market.

- In November 2024, Inspur Cloud Services signed a memorandum of understanding with Hong Kong’s Cyberport to develop an artificial intelligence compute cluster in Hong Kong, marking Inspur Cloud’s formal entry into the Hong Kong market and expanding its role in supplying AI and high-performance infrastructure that complements storage capacity in regional data centers.

cro and edge data center deployments. These deployments need compact, energy-efficient storage with real-time access. Companies invest in edge SSD and hybrid solutions to power IoT workloads. Regions underserved by hyperscalers offer new opportunities. The China Data Center Storage Market supports distributed storage strategies in high-growth zones.

cro and edge data center deployments. These deployments need compact, energy-efficient storage with real-time access. Companies invest in edge SSD and hybrid solutions to power IoT workloads. Regions underserved by hyperscalers offer new opportunities. The China Data Center Storage Market supports distributed storage strategies in high-growth zones.