Executive summary:

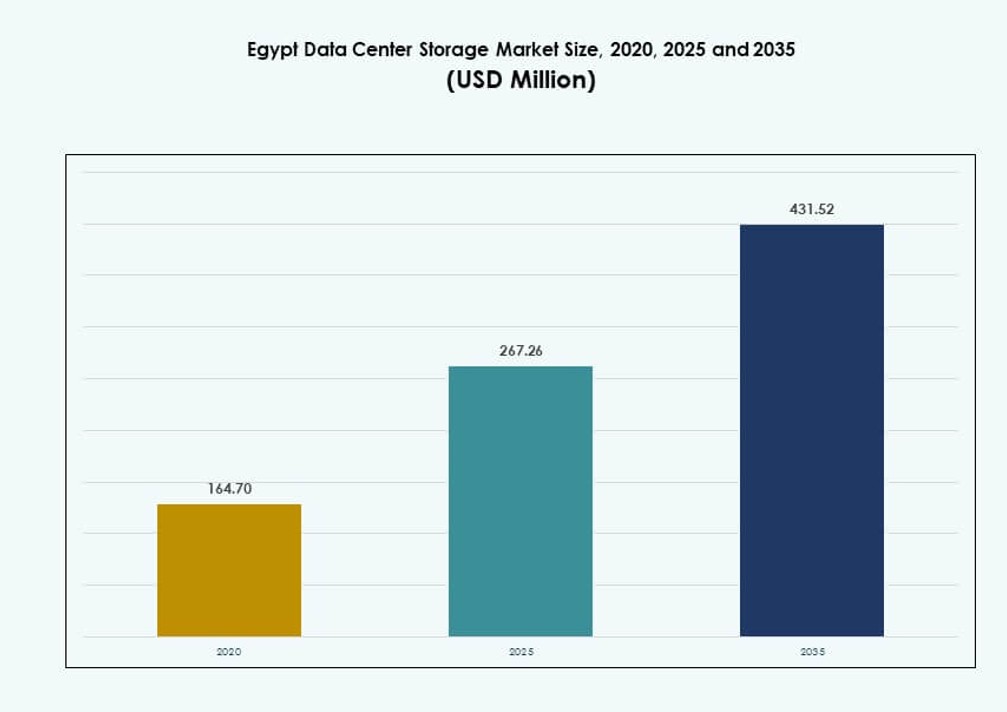

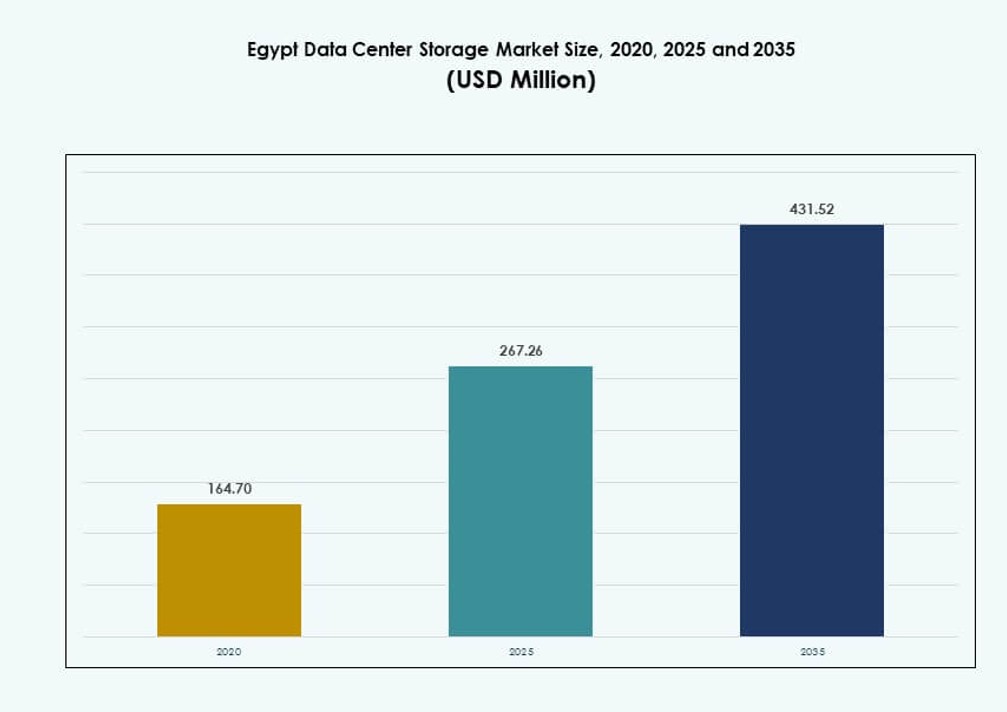

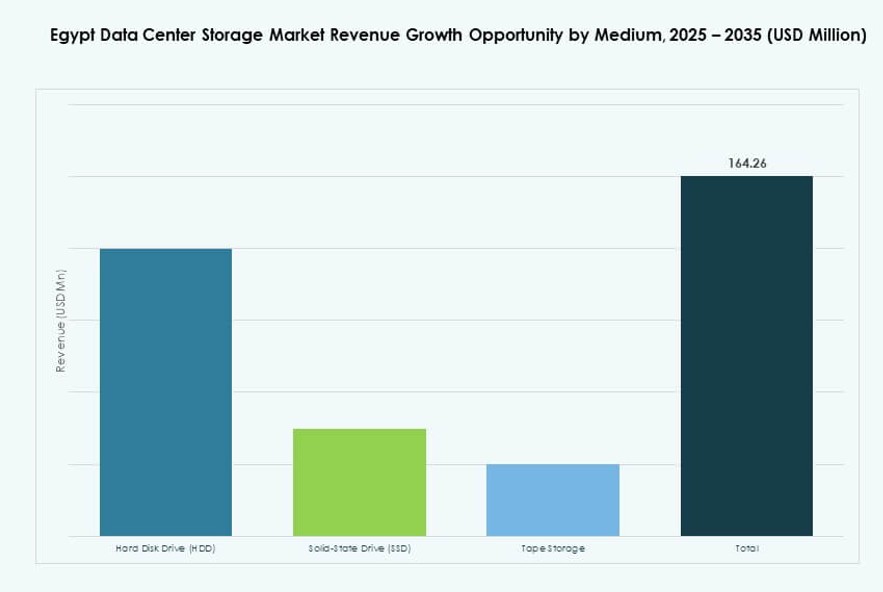

The Egypt Data Center Storage Market size was valued at USD 164.70 million in 2020 to USD 267.26 million in 2025 and is anticipated to reach USD 431.52 million by 2035, at a CAGR of 4.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Egypt Data Center Storage Market Size 2025 |

USD 267.26 Million |

| Egypt Data Center Storage Market, CAGR |

4.90% |

| Egypt Data Center Storage Market Size 2035 |

USD 431.52 Million |

The market is expanding due to rising adoption of cloud-native platforms, growing enterprise digitalization, and national strategies focused on smart infrastructure. Demand for scalable, secure, and energy-efficient storage systems is increasing across telecom, finance, and government sectors. AI, analytics, and content streaming platforms are influencing storage architecture. The market plays a vital role in supporting national data sovereignty, enterprise transformation, and regional interconnection. Businesses and investors view it as a strategic asset amid Egypt’s digital infrastructure shift.

Cairo leads in storage infrastructure due to its data concentration, government backing, and dense enterprise presence. Alexandria is emerging with support from cable landing stations and smart port initiatives. Other regions like Suez and Giza are growing steadily with edge deployments and education-led digital hubs. Strategic location and infrastructure expansion position Egypt as a regional gateway for storage and cloud services. These dynamics support decentralized growth across multiple urban zones.

Market Dynamics:

Market Drivers

Government-Backed Digital Infrastructure Programs Creating Strong Storage Demand Across Public and Private Sectors

The expansion of Egypt’s digital economy is supported by national strategies like “Digital Egypt,” which is strengthening storage demand across ministries, education, and finance. Government mandates for digital service delivery and cloud adoption are accelerating data generation volumes. With state-led smart city projects, real-time analytics and video storage needs are rising fast. This has driven procurement of scalable and resilient storage infrastructure by public agencies. The Egypt Data Center Storage Market is benefiting from budget allocations to national data hubs and sovereign cloud initiatives. It has created steady demand from state-run banks, universities, and government health networks. Enterprises now follow similar trends to align with compliance and data sovereignty laws. This policy-driven digital transformation is critical to shaping Egypt’s future data landscape. Investors see this alignment as a foundation for long-term infrastructure stability.

- For instance, Egypt inaugurated its first Government Data and Cloud Computing Center in Ain Sokhna in April 2024, spanning 23,500 sqm with 10,000 sqm of active infrastructure to centralize data for all ministries and enable AI-driven analysis.

Enterprise Shift Toward Cloud-Native Applications Driving Need for Scalable and Flexible Storage Infrastructure

Egyptian enterprises are shifting from legacy systems to cloud-native platforms that rely on high-performance storage. Data-hungry applications in fintech, telecom, and retail require fast, secure access with minimal downtime. Traditional storage models have proven inefficient for dynamic workloads, leading to growing demand for hybrid and software-defined storage. The Egypt Data Center Storage Market has responded with flexible solutions that optimize performance and cost. Vendors now offer flash arrays, NVMe systems, and hyperconverged infrastructure for private and multi-cloud setups. Businesses see IT modernization as a growth enabler and data as a competitive asset. This shift toward agility and speed has made investment in reliable storage architecture a board-level priority. The market benefits from rising digital transaction volumes and content delivery workloads. Strategic infrastructure upgrades now align with broader enterprise transformation goals.

- For instance, Huawei Cloud launched its Cairo region public cloud service in May 2024, certified for government use and supporting sovereign cloud needs across multiple sectors with Tier-3 compliant infrastructure.

Widespread AI and Analytics Adoption Across Industries Elevating Requirements for Low-Latency Data Access

AI use cases in Egypt are growing across financial fraud detection, healthcare diagnostics, video surveillance, and smart manufacturing. These applications demand low-latency, high-throughput storage systems to process real-time data effectively. Flash-based solutions and NVMe-enabled arrays are gaining traction due to speed and endurance. The Egypt Data Center Storage Market is capitalizing on this trend by deploying performance-optimized storage in edge and core setups. AI-driven operations require massive parallel data feeds, particularly for training models or inferencing. Businesses now prioritize IOPS and throughput performance over basic storage capacity. IT teams deploy tiered storage with caching for latency-sensitive workloads. This dynamic change in expectations drives innovation in how data centers architect their storage stack. High-performance infrastructure has become essential to delivering AI at scale in Egypt.

Rise of Telecom Data, Streaming, and Content Platforms Reshaping Storage Usage Patterns in Egypt

The explosion of 4G/5G networks, mobile applications, and digital platforms has generated unprecedented volumes of data. Egypt’s growing youth population consumes high amounts of video and social media content, increasing bandwidth and storage load on telcos. Storage systems must now support millions of concurrent users, large file transfers, and constant video playback. The Egypt Data Center Storage Market sees strong adoption of scalable object storage, especially in telecom and entertainment verticals. Content delivery networks and caching infrastructure require optimized storage to reduce latency and improve user experience. Telcos are modernizing their storage backends to manage customer analytics, billing data, and streaming content efficiently. Demand for high-capacity, low-cost storage configurations is rising across ISPs and data platforms. This trend is reshaping how telecom providers architect digital infrastructure in the country.

Market Trends

Increased Use of Edge Data Centers and Distributed Storage Nodes to Support Real-Time Applications

Edge computing is gaining traction in Egypt, especially in logistics, retail, and smart transportation. Organizations are deploying distributed micro data centers to process data closer to end users. This reduces latency and improves service quality across cities and remote areas. The Egypt Data Center Storage Market is adapting by integrating compact storage nodes in regional hubs. These nodes support localized caching, analytics, and real-time processing. Edge deployments often use flash storage with high endurance and fast access speeds. Smart city systems and digital payment platforms benefit from such setups. This trend strengthens Egypt’s storage infrastructure across non-centralized locations. Businesses now consider edge as critical for operational efficiency and digital services delivery.

Emergence of Green Storage Infrastructure and Energy-Efficient Storage Hardware Among Leading Operators

Sustainability is a rising priority for data center operators in Egypt, influencing storage design and procurement. Vendors now promote low-power storage systems, energy-efficient drives, and intelligent cooling for storage racks. The Egypt Data Center Storage Market reflects a growing preference for SSDs over HDDs due to lower energy use and faster performance. Hyperscale and colocation providers are embedding ESG criteria in data infrastructure planning. Government-led green building certifications also encourage adoption of sustainable storage technologies. Large enterprises increasingly assess carbon footprint before investing in storage equipment. This shift supports Egypt’s broader environmental goals and creates demand for innovation in eco-friendly storage systems. It influences design and operational strategy for new data center projects.

Adoption of Software-Defined Storage Platforms for Unified Management Across Hybrid Environments

Software-defined storage (SDS) solutions are transforming how IT teams manage diverse storage resources. Enterprises in Egypt are deploying SDS to abstract hardware, simplify operations, and cut costs. It enables unified control across SAN, NAS, and object storage platforms. The Egypt Data Center Storage Market shows growing demand for SDS in multi-cloud and hybrid cloud environments. IT departments leverage SDS to pool capacity, automate provisioning, and apply smart policies. This trend allows businesses to scale storage more flexibly and meet evolving workload needs. SDS improves performance, simplifies backups, and enables seamless data mobility. It also boosts ROI by extending asset lifecycles and reducing lock-in. Enterprises favor SDS for its agility and compatibility with modern IT stacks.

Growth of Industry-Specific Storage Solutions Tailored to Compliance, Analytics, and Data Lifecycle Needs

Sectors like BFSI, healthcare, and public services have unique data retention, privacy, and access requirements. Storage vendors now offer specialized solutions tailored to sector-specific compliance and analytics workflows. The Egypt Data Center Storage Market benefits from this trend through verticalized offerings that align with local regulatory needs. For example, banks need encrypted storage with real-time replication, while hospitals require medical imaging archives with fast retrieval. Customized architectures enhance performance, security, and long-term reliability. Industry solutions often include policy-based tiering, immutable storage, and AI-driven insights. This approach adds value beyond raw capacity by aligning with end-user goals. Providers differentiate by delivering targeted features for critical verticals.

Market Challenges

Slow Cloud Migration and Legacy Infrastructure Dependency Across Government and Traditional Enterprises

While Egypt has made progress on digital transformation, many public sector entities still rely on legacy infrastructure. Slow migration to the cloud limits agility and increases operational risk. On-premises systems lack the scalability and resilience needed for modern workloads. The Egypt Data Center Storage Market must address this fragmentation across older storage assets and outdated procurement cycles. High upfront costs, limited technical expertise, and fear of service disruption hinder adoption of next-gen storage. These barriers delay critical upgrades, especially in mid-sized government agencies and traditional enterprises. System integrators and vendors must invest in training and support to accelerate cloud readiness. Without modernization, legacy dependencies will continue to create inefficiencies and security risks.

Power Supply Constraints and Cooling Infrastructure Gaps Limiting High-Performance Storage Deployments

Egypt faces challenges in maintaining consistent power delivery across all regions. Data centers require stable electricity and specialized cooling systems for high-density storage arrays. Intermittent outages and infrastructure bottlenecks raise costs and reduce system reliability. The Egypt Data Center Storage Market must adapt to operational constraints that affect uptime and performance. Rural and second-tier cities face bigger infrastructure deficits, restricting edge expansion plans. Power-hungry workloads like AI and video processing cannot function optimally without thermal management. This limits deployment of all-flash arrays or large-scale SAN systems outside major cities. Efficient cooling and backup power systems are critical to expanding modern storage across Egypt. Operators are forced to compromise on performance due to physical limitations.

Market Opportunities

Rapid Growth of Digital Startups and E-Commerce Platforms Creating Demand for Flexible Storage Solutions

Egypt’s booming tech ecosystem includes fintechs, e-commerce players, and content platforms that require agile storage models. These businesses need cost-effective, scalable systems to support unpredictable data growth. The Egypt Data Center Storage Market can capture this demand by offering modular, API-integrated, and cloud-native storage. Startups often adopt hybrid architectures combining SSD for performance and object storage for scale. Demand from digital-native firms will help expand storage adoption across the private sector.

International Submarine Cable Projects and Regional Interconnection Enhancing Egypt’s Storage Gateway Potential

Egypt’s strategic geography and investment in subsea cable landing stations have positioned it as a regional data gateway. New cables connecting Africa, Europe, and Asia are enabling low-latency connectivity. The Egypt Data Center Storage Market benefits from this by supporting caching, peering, and content storage hubs. Cross-border data flows create opportunities for colocation and hyperscale providers to build scalable storage backbones. Egypt’s role in regional data exchange boosts demand for modern storage capacity.

Market Segmentation

By Storage Type

Traditional storage continues to lead due to large installed bases across public and legacy enterprise systems. However, all-flash storage is gaining share in Egypt Data Center Storage Market due to growing demand for speed and energy efficiency. Hybrid storage sees steady uptake, especially among mid-sized businesses seeking a balance between cost and performance. Innovation in flash pricing and density drives shift from mechanical to electronic media.

By Storage Deployment

Storage Area Network (SAN) systems dominate due to their use in mission-critical applications across telecom and BFSI sectors. NAS systems see adoption in enterprise backup and media-rich applications. DAS systems remain common in edge and on-prem setups. Egypt Data Center Storage Market is witnessing hybrid deployments integrating SAN and NAS to support mixed workload environments.

By Component

Hardware holds a larger share in Egypt Data Center Storage Market, particularly for core systems like disk arrays and controllers. Software segment is growing faster, driven by SDS adoption and intelligent storage management platforms. Integrated hardware-software packages are gaining attention, especially in high-performance computing and analytics.

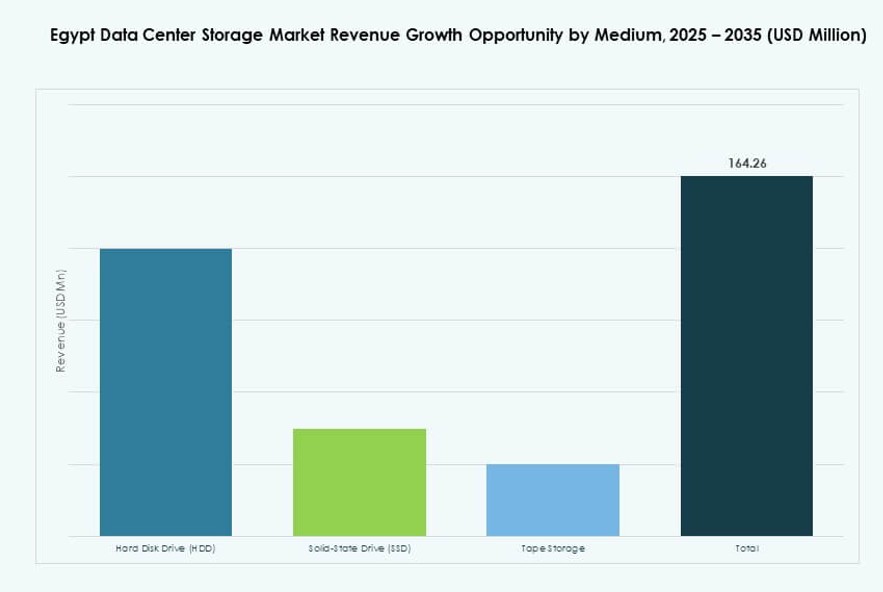

By Medium

Solid-State Drives (SSD) are rapidly gaining traction due to superior speed and reliability. HDDs still lead in terms of volume, particularly for cold data and archival use cases. Tape storage is limited but continues in compliance-heavy sectors like banking and government. Egypt Data Center Storage Market sees growing SSD use in primary workloads and caching layers.

By Deployment Model

On-premises models dominate due to security, control, and regulatory requirements. However, cloud-based storage is expanding across retail, education, and startups. Hybrid deployments are rising, allowing organizations to balance flexibility and compliance. Egypt Data Center Storage Market is evolving with a tilt toward cloud-first strategies in new builds.

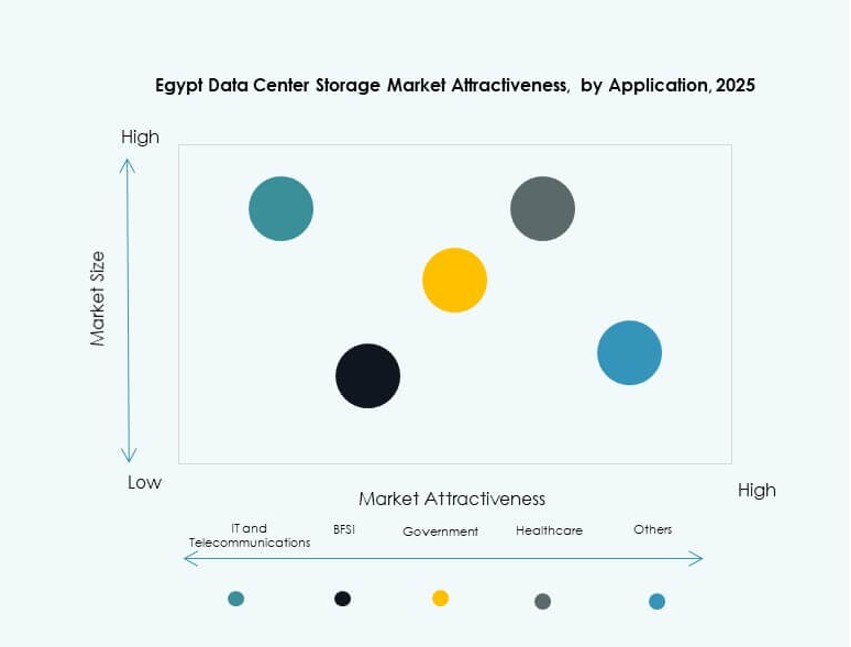

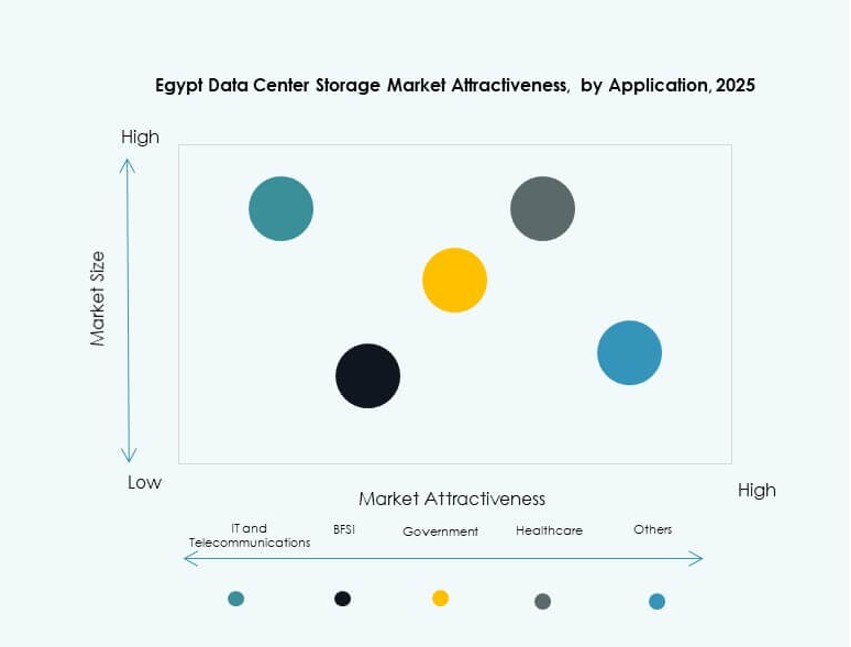

By Application

IT and telecommunications remain top contributors in Egypt Data Center Storage Market, driven by high data throughput and uptime needs. BFSI follows closely due to secure transaction storage and compliance needs. Government is another key segment due to digital transformation initiatives. Healthcare storage demand grows with medical imaging and e-health systems. Other sectors like media, logistics, and education also show moderate uptake.

Regional Insights

Cairo Leading with Over 65% Share Due to Dense Enterprise Base and Public Sector Infrastructure

Cairo holds the majority share in the Egypt Data Center Storage Market due to its role as the administrative and economic hub. It hosts major government data centers, telecom exchanges, financial institutions, and enterprise campuses. Demand for storage remains high due to centralized IT policies and high data generation rates. International operators prefer Cairo due to connectivity and infrastructure readiness. Most greenfield projects and private colocation sites are also concentrated here. The region accounts for over 65% of the total storage capacity in Egypt.

Alexandria Emerging with 20% Share Due to Cable Landing Points and Port-Centric Digitization

Alexandria ranks second, contributing nearly 20% of the Egypt Data Center Storage Market. It benefits from its proximity to submarine cable systems and international bandwidth hubs. Growing trade and port logistics digitization fuel demand for storage systems. Local ISPs, content providers, and educational institutions drive steady growth. Infrastructure upgrades in metro and industrial zones support edge and secondary data deployments. Alexandria is also attracting small colocation facilities focused on content caching and backup.

- For instance, Orange Egypt established a cloud-ready data center in Alexandria in partnership with Huawei to deliver enterprise cloud services and support digital infrastructure expansion in northern Egypt. The facility is designed to meet high-availability and disaster recovery requirements.

Other Governorates Contributing 15% with Growing Storage Demand from Edge, Education, and E-Government Initiatives

Regions such as Giza, Suez, and Upper Egypt collectively hold 15% market share, driven by edge deployments and educational data centers. Government initiatives for data decentralization and smart services fuel localized demand. These areas face infrastructure challenges but offer opportunities for modular and low-power storage systems. Schools, municipal networks, and provincial healthcare units are key customers. Investment is slowly picking up in edge data centers to serve underconnected regions. These governorates play a growing role in the spatial diversification of storage infrastructure.

- For instance, the Ministry of Communications and Information Technology expanded the Digital Egypt initiative beyond Cairo in 2024, deploying government data platforms and secure backup systems for governorates such as Giza and Upper Egypt.

Competitive Insights:

- Telecom Egypt Data Centers

- Raya Data Center

- Giza Systems

- Dell Technologies

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- Cisco Systems

- NetApp

- Lenovo Group

The Egypt Data Center Storage Market features a competitive mix of local and global players, each targeting distinct customer segments. Telecom Egypt and Raya Data Center lead the domestic market with strong ties to public sector and telecom infrastructure. Giza Systems supports large-scale enterprise deployments through systems integration. Global vendors such as Dell, HPE, Huawei, and IBM dominate the enterprise and cloud storage segments by offering advanced platforms and modular solutions. NetApp and Cisco play key roles in software-defined and hybrid environments. Competition centers around performance, scalability, energy efficiency, and compliance capabilities. It remains intense due to growing demand across BFSI, telecom, and government. Players invest in localized support, ecosystem partnerships, and region-specific solutions to gain market share.

Recent Developments:

- In October 2025, NEOIX and DAI Infrastruktur announced a strategic partnership to develop a hyperscale and green data centre ecosystem in Egypt. This collaboration advances infrastructure efforts that support large‑scale storage, energy‑efficient facilities, and next‑generation services tailored to global and regional clients.

- In September 2025, Telecom Egypt granted preliminary approval to Helios Investment Partners’ binding offer for a strategic partnership in its Regional Data Hub (RDH) data centre venture. Helios will acquire approximately 75–80% stake in the RDH subsidiary.