Executive summary:

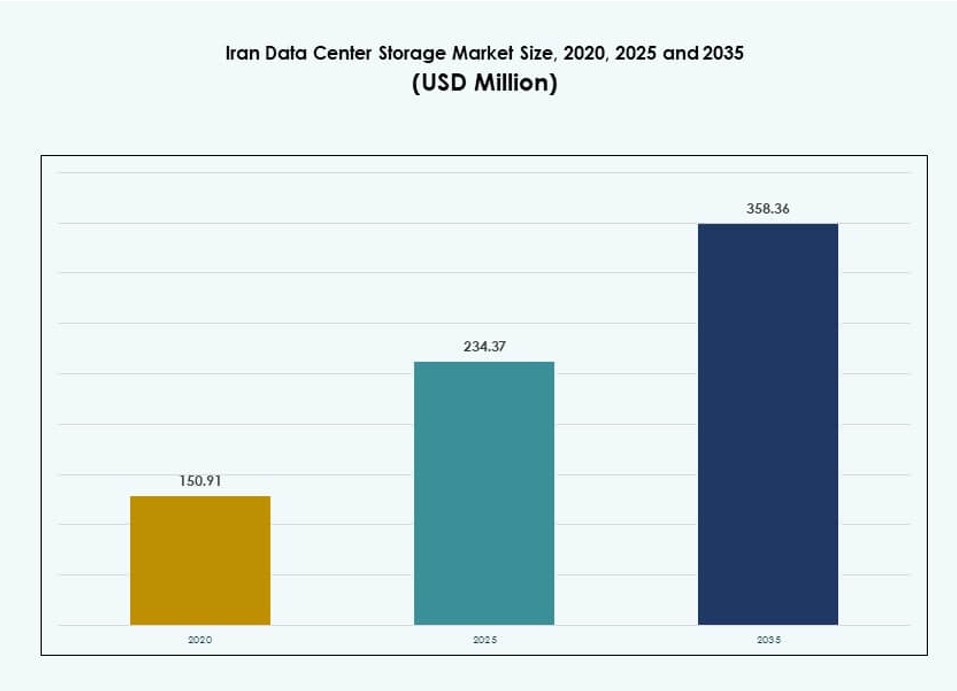

The Iran Data Center Storage Market size was valued at USD 150.91 million in 2020 to USD 234.37 million in 2025 and is anticipated to reach USD 358.36 million by 2035, at a CAGR of 4.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Iran Data Center Storage Market Size 2025 |

USD 234.37 Million |

| Iran Data Center Storage Market, CAGR |

4.19% |

| Iran Data Center Storage Market Size 2035 |

USD 358.36 Million |

The market is driven by digital transformation across public and private sectors, growing adoption of cloud platforms, and expanding AI initiatives. Edge computing is gaining traction with the nationwide rollout of 5G and smart city infrastructure. Government-backed AI megaprojects and the development of GPU-powered data centers are accelerating high-performance storage demand. Enterprises are investing in secure, scalable storage for applications spanning telecom, healthcare, and BFSI. The market is viewed as critical for national data resilience and digital self-sufficiency.

Tehran leads in storage infrastructure due to its concentration of enterprises, telcos, and government data hubs. It accounts for the majority of deployments owing to advanced connectivity and talent availability. Cities like Isfahan, Shiraz, and Mashhad are emerging with investments in smart services and edge storage to support local populations. Border regions are seeing selective growth to support surveillance and cross-border communications, creating opportunities for decentralized storage solutions.

Market Dynamics:

Market Drivers

Digital Transformation Across Public and Private Sectors Accelerates Storage Demand

Widespread digitalization across Iran’s public services, financial institutions, and telecom sectors is pushing demand for secure, high-capacity storage systems. National data localization policies are creating urgency for in-country infrastructure expansion. Government agencies require compliant storage platforms to handle sensitive databases and citizen services. Financial institutions seek encrypted, high-throughput systems to support real-time payments, fraud detection, and archiving. Telecom players aim to meet traffic surges from mobile applications, video, and social media. This transformation is reshaping enterprise IT planning. The Iran Data Center Storage Market supports this momentum by offering localized and scalable capacity. It is viewed as essential for business continuity, data control, and national sovereignty.

- For instance, Iran Telecommunication Co. (TCI) plays a central role in operating and expanding Iran’s National Information Network, which underpins domestic data routing for government platforms and public digital services. The network is designed to support data localization, service continuity, and reduced reliance on international traffic for sensitive workloads.

Growing Enterprise Cloud Adoption Drives Demand for Scalable Storage Solutions

Cloud services are gaining traction among Iranian enterprises, especially in sectors like retail, manufacturing, and IT. The shift from on-premises systems to public and hybrid cloud models is intensifying the need for elastic, secure, and fast-access storage. Companies are investing in backup systems, business continuity tools, and cloud-native applications. Multi-region replication and disaster recovery have become core planning criteria. As cloud providers expand local zones, storage demand follows suit. The Iran Data Center Storage Market supports this shift through modular, cloud-compatible infrastructure. It is now central to enterprise digital growth and data-driven operations.

Emerging Smart City Projects and Surveillance Networks Create New Storage Needs

Iran is actively expanding its smart city initiatives in urban areas like Tehran, Mashhad, and Shiraz. Smart infrastructure such as surveillance, traffic control, and public safety requires petabyte-scale storage. Video data, traffic analytics, and IoT telemetry must be stored and accessed quickly. City governments seek edge storage to reduce latency and optimize cost. These needs push investment into hybrid storage and distributed systems. Large-scale deployments depend on consistent uptime, throughput, and data redundancy. The Iran Data Center Storage Market helps municipalities deploy these capabilities while supporting policy compliance and urban resilience. It offers a digital backbone to next-generation city infrastructure.

- For example, Iran announced plans to allocate 3,600–3,700 MHz spectrum for 5G deployment and expected to activate 5G mobile services in major cities by 2025, with operators rolling out networks in urban areas such as Tehran, Shiraz, and others.

Increased Cybersecurity Awareness Fuels Adoption of Encrypted Storage Platforms

Cybersecurity has become a national and corporate priority in Iran due to increasing attacks and regulatory scrutiny. Enterprises are migrating to encrypted storage platforms that meet domestic compliance and minimize exposure to external threats. There is growing demand for immutable storage, audit trails, and AI-integrated monitoring systems. Telecom, BFSI, and health sectors are leading adoption due to their high risk profiles. Encrypted backup and object storage are preferred for long-term archival. The Iran Data Center Storage Market is aligning with this shift by offering hardened, secure platforms that safeguard critical infrastructure. It enables data assurance for sectors under regulatory pressure.

Market Trends

NVMe and Flash-Based Storage Gaining Momentum Across Performance-Critical Applications

Organizations across Iran are replacing legacy storage with NVMe and all-flash systems to boost speed and responsiveness. These technologies offer lower latency, faster data access, and higher throughput ideal for AI training, database indexing, and VDI environments. Flash systems reduce power usage and optimize floor space, addressing urban energy and real estate constraints. Telecoms are integrating NVMe arrays to support peak data loads. E-commerce and fintech platforms benefit from microsecond-level response times. NVMe-oF adoption is rising in larger deployments. The Iran Data Center Storage Market is witnessing steady upgrades as performance demands surpass what spinning disks can offer.

Software-Defined Storage Becoming a Preferred Option in Multi-Cloud Environments

The move toward software-defined storage (SDS) reflects Iran’s demand for flexibility, control, and interoperability. Enterprises want vendor-agnostic platforms that run on standard hardware and integrate across private, public, and hybrid cloud setups. SDS enables faster provisioning, easier scaling, and automated data tiering. IT teams prefer centralized management and cost transparency. Sectors with fluctuating workloads like media and education are adopting SDS to match storage dynamically with compute needs. Government and defense agencies value localized control and reduced vendor lock-in. The Iran Data Center Storage Market is adopting SDS faster as multi-cloud becomes the default model.

Rise of AI and Big Data Analytics Fueling Demand for Object-Based Storage Systems

Big data, AI, and video analytics are becoming vital tools in Iran’s tech, education, and health sectors. These workloads need object storage systems that offer massive scale, data durability, and easier metadata management. Universities require long-term archiving of research datasets. AI developers store large training datasets and inference logs. Healthcare institutions retain high-resolution medical imaging and genomic files. Enterprises prefer object storage for seamless scalability and integration with analytics platforms. The Iran Data Center Storage Market supports this demand by offering S3-compatible platforms and hybrid cloud options. It ensures fast ingestion and retrieval of unstructured data.

Edge Data Centers Expanding in Secondary Cities to Support Low-Latency Applications

To reduce latency and improve local services, Iranian service providers are building edge data centers in cities beyond Tehran. Locations like Isfahan, Tabriz, and Karaj are seeing investments from telecom, banking, and content delivery firms. Edge facilities require compact, energy-efficient storage to manage content caching, analytics, and user data locally. This trend supports IoT services, e-learning, and regional enterprise workloads. Edge deployments align with government goals for digital equity. Storage vendors are now offering modular units tailored for space-constrained environments. The Iran Data Center Storage Market supports this shift by extending infrastructure closer to end users.

Market Challenges

International Sanctions Limit Access to Advanced Storage Technologies and Global Vendors

Ongoing international sanctions against Iran present serious challenges for accessing high-end storage systems and vendor support. Major global players restrict direct sales, leaving enterprises dependent on secondary markets or domestic assemblers. This limits the use of cutting-edge platforms like NVMe-over-Fabrics, AI-integrated storage controllers, and hyperscale object storage systems. It impacts large enterprises and telcos aiming to compete regionally. Organizations struggle to find long-term warranties and certified maintenance. The Iran Data Center Storage Market must navigate this constraint using local expertise and open-source platforms. It creates uncertainty around scalability, interoperability, and technical support.

Energy Limitations and Cooling Infrastructure Constraints Impact Large-Scale Storage Expansion

Iran faces frequent power shortages, especially during peak summer months. Data centers with high-density storage workloads require continuous cooling and redundant power systems. These limitations make it difficult to scale storage capacity beyond a certain threshold. Flash arrays and dense disk systems need consistent temperature and energy inputs. In regions with weak infrastructure, high-performance deployments are delayed or downsized. Investors are cautious due to operating risks and cost of redundancy. The Iran Data Center Storage Market must balance performance and sustainability. It demands innovative solutions like low-power storage, immersion cooling, and modular design.

Market Opportunities

Development of Sovereign Cloud and National Digital Projects Create New Growth Channels

Iran’s push for sovereign cloud infrastructure and digital self-sufficiency opens new markets for domestic storage providers. Government mandates for data localization, public sector cloud migration, and digital ID projects require scalable, secure, in-country storage systems. The Iran Data Center Storage Market benefits by offering compliant platforms aligned with national priorities. It supports high-volume archival, citizen databases, and real-time processing.

SME Digitalization and Fintech Growth Present Demand for Scalable, Tiered Storage

Startups and mid-sized businesses in fintech, e-commerce, and logistics are seeking affordable and scalable storage. These players need secure options for backup, customer analytics, and app hosting. The Iran Data Center Storage Market offers growth by serving this segment with cost-effective cloud and hybrid storage solutions.

Market Segmentation

By Storage Type

Traditional storage currently dominates the Iran Data Center Storage Market due to its wide availability and lower entry cost. However, all-flash storage is gaining traction in high-speed environments, especially in telecom and banking sectors. Hybrid storage is seeing growing interest from mid-sized enterprises needing both cost efficiency and performance. Niche applications are testing advanced solutions like scale-out and object-based storage.

By Storage Deployment

Storage Area Network (SAN) systems hold the leading share in the Iran Data Center Storage Market due to their performance, reliability, and ability to support mission-critical applications. Network-Attached Storage (NAS) is commonly used in media, education, and research institutions. Direct-Attached Storage (DAS) continues to serve small and legacy environments. Hybrid deployments are emerging as organizations move toward virtualization and containerization.

By Component

Hardware holds the dominant share of the Iran Data Center Storage Market due to the capital-intensive nature of physical infrastructure. Enterprises and telcos invest in storage arrays, controllers, and backup devices. However, software is growing at a faster rate, driven by demand for SDS, backup automation, and storage orchestration tools. This shift reflects a move toward IT flexibility and centralized management.

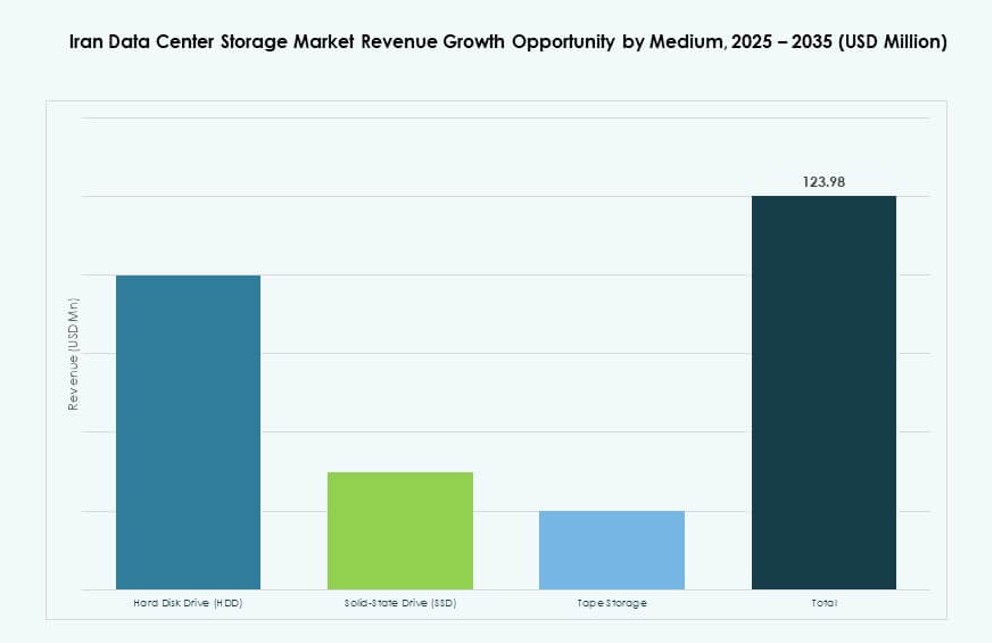

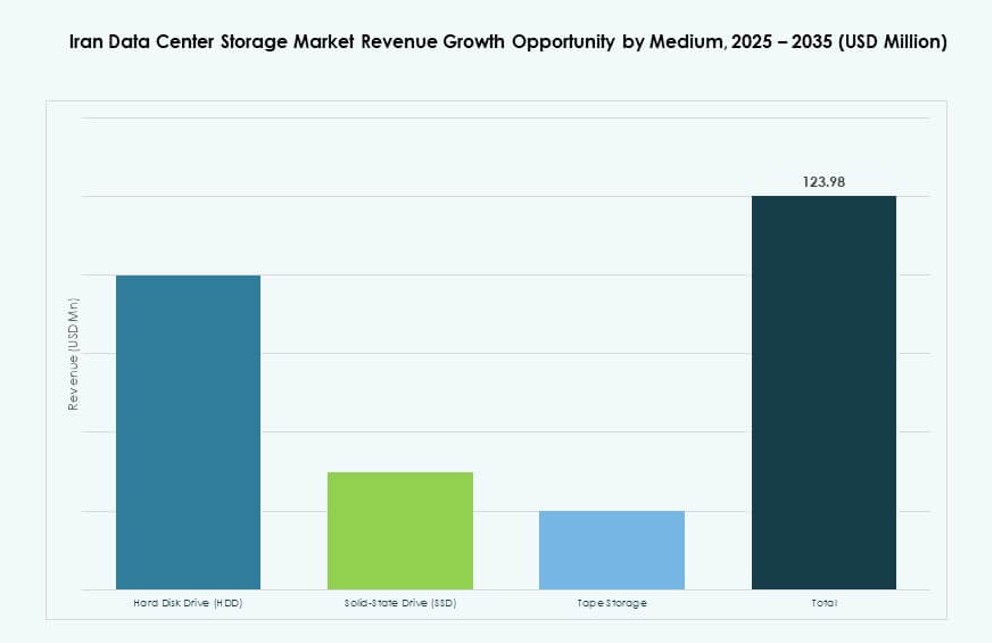

By Medium

Hard Disk Drives (HDDs) remain the preferred storage medium in the Iran Data Center Storage Market due to cost advantages and supply availability. Solid-State Drives (SSDs) are growing rapidly in critical applications requiring faster IOPS and lower latency. Tape storage holds a small but stable share, primarily for archival and compliance workloads. The market is seeing hybrid deployments mixing SSDs for active workloads and HDDs for bulk storage.

By Deployment Model

On-premises models dominate the Iran Data Center Storage Market due to security preferences, regulatory needs, and legacy infrastructure. However, cloud-based deployment is expanding fast in sectors like fintech and software services. Hybrid models are gaining adoption as organizations try to balance control with scalability. Government and public service agencies are slowly shifting toward hosted and sovereign cloud deployments.

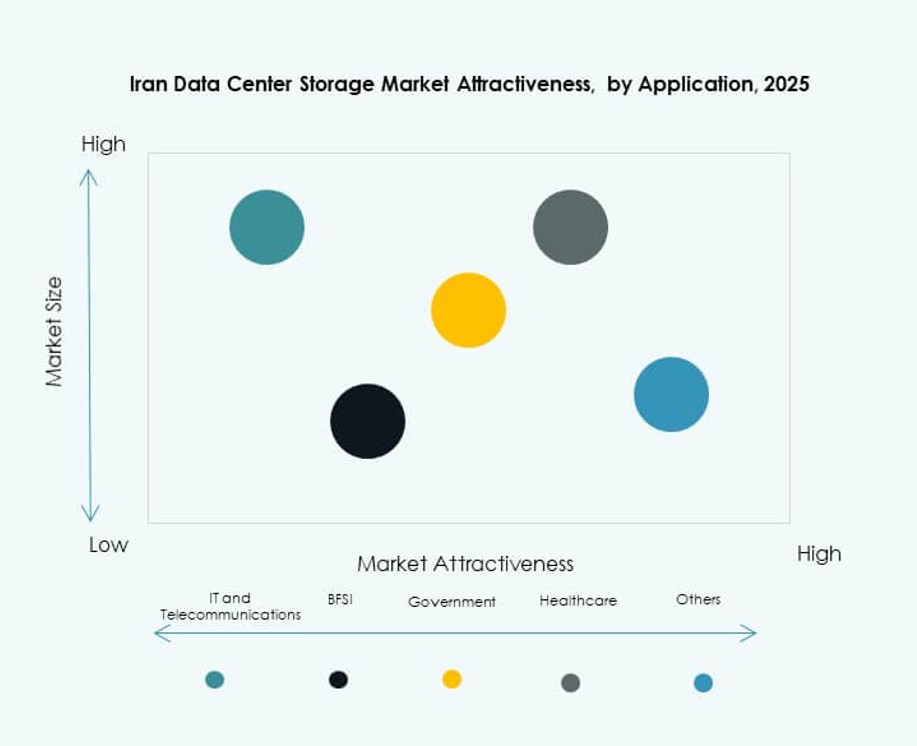

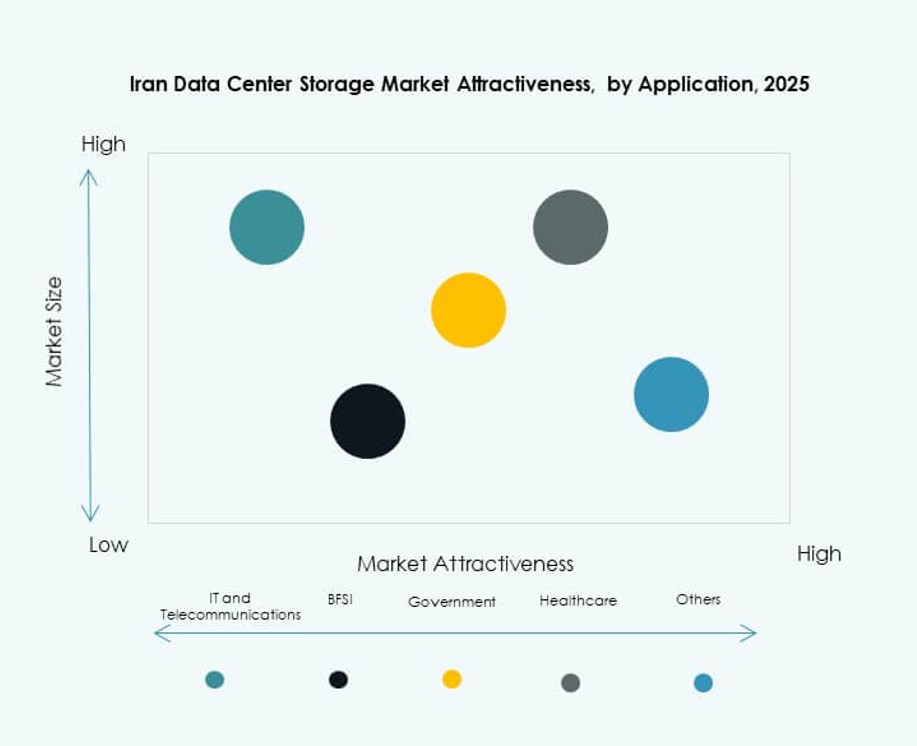

By Application

IT and Telecommunications account for the largest share of the Iran Data Center Storage Market, driven by mobile data growth, 5G planning, and CDN expansion. BFSI follows with strong demand for encrypted storage, compliance, and business continuity. Government and healthcare segments are investing in localized and secure data handling. Other sectors like retail, logistics, and education are emerging fast with rising digitization needs.

Regional Insights

Tehran Leads with Over 50% Market Share Due to Dense Enterprise and Public Sector Demand

Tehran dominates the Iran Data Center Storage Market with over 50% market share. It hosts the country’s largest data centers, government IT infrastructure, telecom hubs, and financial institutions. High demand for real-time data access, centralized cloud services, and secure storage makes Tehran the primary location for new deployments. Strong connectivity, skilled workforce, and policy support drive infrastructure maturity in this region.

Isfahan, Mashhad, and Shiraz Jointly Account for 30% Share with Expanding Edge Infrastructure

These secondary cities are emerging as key storage hubs due to growing industrial bases and regional digitization initiatives. Local governments are investing in smart city platforms and digital service delivery, pushing demand for regional data storage. Edge deployments in these cities are reducing latency for local users and services. Together, Isfahan, Mashhad, and Shiraz contribute around 30% of the Iran Data Center Storage Market’s footprint.

- For instance, Rightel commenced limited commercial 5G services in 2025 and expanded its radio network coverage to cities including Mashhad and Shiraz, enhancing mobile broadband speed and laying the groundwork for future edge and data center storage integrations.

Other Provinces Hold the Remaining 20%, Driven by Border Connectivity and Public Service Expansion

The remaining 20% market share comes from border and rural provinces including Tabriz, Kerman, and Ahvaz. Storage deployments in these areas support cross-border telecom, surveillance systems, and public health records. Infrastructure development remains a challenge, but rising demand for digital services is encouraging small-scale data center growth. These regions offer long-term opportunities for distributed storage models and edge infrastructure.

- For instance, Shatel operates nationwide colocation and enterprise hosting services from its Tehran data center facilities, providing dedicated server space and broadband connectivity for organizations requiring local network support and storage solutions.

Competitive Insights:

- Iran Telecommunication Company

- Shatel Data Center

- Asiatech Data Center

- Dell Technologies

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies Co., Ltd.

- NetApp

- Cisco Systems, Inc.

- Lenovo Group

The Iran Data Center Storage Market features a hybrid competitive environment comprising domestic telecom-led data center operators and global storage technology providers. Local firms like Iran Telecommunication Company, Shatel, and Asiatech dominate hosting, infrastructure, and sovereign cloud services. Global players such as Dell, HPE, and Huawei supply advanced hardware, flash arrays, and software-defined storage. Partnerships and indirect sales routes support market presence despite trade restrictions. It is becoming more fragmented as SMEs and fintechs demand modular, cost-effective storage platforms. The push for compliance, cloud-native systems, and AI-ready infrastructure shapes the competitive strategies of both domestic and multinational firms.

Recent Developments:

- In July 2025, countrywide 5G activation was scheduled following 3.6–3.7 GHz spectrum auctions, boosting edge-computing demands and related storage infrastructure across key population centers in Iran’s data center market.

- In December 2024, Iran’s deputy of science, technology, and knowledge-based economy, Hossein Afshin, announced the launch of the country’s first GPU-based data center by 2025 to host a national AI system, with a prototype AI operating system expected within six months to support localized algorithms and storage needs.