Executive summary:

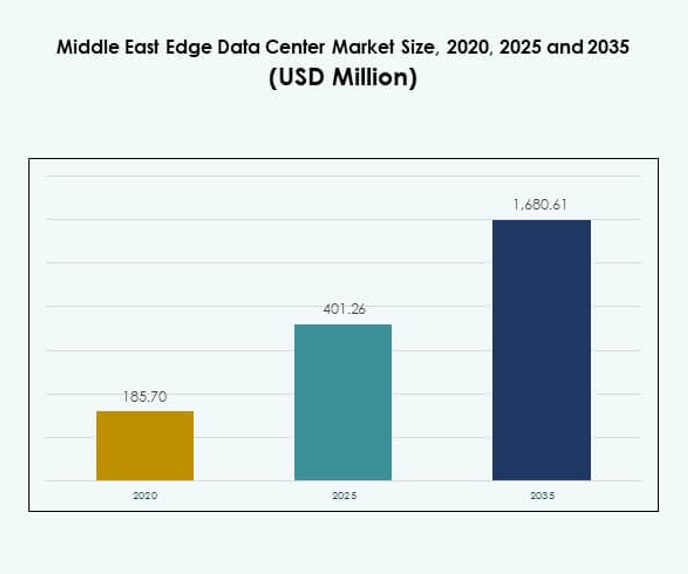

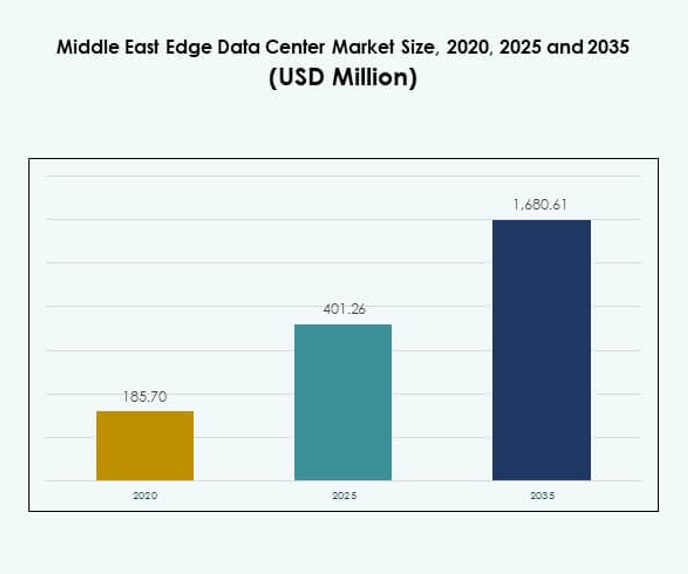

The Middle East Edge Data Center Market size was valued at USD 185.70 million in 2020, reached USD 401.26 million in 2025, and is anticipated to reach USD 1,680.61 million by 2035, at a CAGR of 15.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Middle East Edge Data Center Market Size 2025 |

USD 401.26 Million |

| Middle East Edge Data Center Market, CAGR |

15.26% |

| Middle East Edge Data Center Market Size 2035 |

USD 1,680.61 Million |

Strong adoption of digital technologies, rapid 5G network deployment, and growing reliance on real-time data processing are driving the market forward. Enterprises are investing in scalable and efficient edge infrastructure to enhance operational speed and support AI, IoT, and automation. The market holds strategic importance for investors and businesses seeking to leverage low-latency networks, improved energy efficiency, and next-generation applications.

The UAE and Saudi Arabia lead the market with large-scale infrastructure investments and national digital strategies. Qatar, Oman, and Bahrain are emerging as regional hubs due to regulatory support and rising enterprise adoption. These countries are building strong digital ecosystems that position the region as a critical center for edge infrastructure growth.

Market Drivers

Rising Government-Led Digital Transformation Initiatives and Smart City Programs Driving Infrastructure Expansion

Middle Eastern governments are actively investing in digital transformation to modernize economies and build smart cities. National programs in the UAE and Saudi Arabia focus on high-speed connectivity and edge deployment to reduce latency and improve service reliability. It drives large-scale adoption of IoT, AI, and automation in public services. Key smart city initiatives push infrastructure providers to develop localized computing hubs. Investors view this momentum as a catalyst for steady market expansion. Edge facilities positioned near urban zones enable faster data processing. Growing reliance on digital platforms fuels demand for real-time processing. The Middle East Edge Data Center Market is strategically important for enabling national innovation goals.

- For instance, in October 2024, Huawei, together with Freedo Technology and Isoftstone, launched its National Smart City Solution at GITEX GLOBAL 2024 in Dubai, integrating edge, cloud, and AI technologies to support urban governance and smart city operations across the UAE.

Rapid Growth in 5G Infrastructure Creating Strong Demand for Low-Latency Data Processing

Telecom operators across the region are expanding 5G networks, creating strong demand for distributed computing power. Low-latency requirements of 5G technology make edge deployments essential for efficient data flow. It improves user experiences in areas like autonomous mobility, AR/VR, and real-time analytics. Major operators are partnering with cloud providers to build modular and scalable facilities. Governments support 5G rollouts through funding and infrastructure regulations. Telecom edge deployments enhance industrial productivity and smart service delivery. This infrastructure improves responsiveness for critical applications. The Middle East Edge Data Center Market benefits from strong 5G momentum.

- For instance, in March 2024, stc Group launched a sovereign cloud platform powered by Oracle Alloy, hosted in Center3 data centers in Saudi Arabia. The platform offers over 100 Oracle Cloud Infrastructure services, ensuring compliance with national data residency requirements.

Growing Enterprise Digitalization Across Sectors Boosting Edge Data Demand

Large enterprises in banking, retail, healthcare, and energy are increasing investments in edge computing. Data-heavy workloads require localized processing for security, compliance, and operational efficiency. It helps enterprises reduce cloud dependency and enhance operational continuity. Many organizations are deploying hybrid models to balance central and distributed networks. This transition aligns with enterprise cost optimization strategies. New vertical use cases in real-time analytics and automated control are gaining traction. Technology adoption across industries continues to expand steadily. The Middle East Edge Data Center Market plays a key role in supporting this digital shift.

Expanding Hyperscaler and Cloud Provider Presence Accelerating Ecosystem Maturity

Global cloud providers are accelerating regional expansion through data center investments and partnerships. Hyperscaler entry creates favorable conditions for edge integration across multiple sectors. It enhances capacity, improves data resilience, and strengthens connectivity infrastructure. Edge zones connected to hyperscaler regions provide strong performance for latency-sensitive services. Enterprises benefit from localized data processing and regulatory compliance. Governments encourage these investments with favorable tax structures and data sovereignty frameworks. Strategic partnerships enhance network scalability and deployment efficiency. The Middle East Edge Data Center Market gains strength from rapid ecosystem maturity.

Market Trends

Rising Deployment of Modular and Prefabricated Edge Facilities for Faster Rollout

Enterprises and service providers are shifting toward modular edge infrastructure to meet rapid deployment needs. Modular facilities enable flexible scaling and support site-specific customization. It reduces construction time and upfront capital requirements. Telecom operators and hyperscalers use prefabricated modules for network edge expansion. This approach aligns well with growing 5G deployment strategies. It supports energy-efficient designs and advanced cooling technologies. Modular deployments are transforming project timelines across key markets. The Middle East Edge Data Center Market reflects this accelerated rollout pattern.

Integration of AI and Automation Enhancing Edge Infrastructure Operations

AI-driven monitoring and automation solutions are gaining strong adoption in edge environments. Intelligent systems manage workloads, optimize cooling, and predict maintenance needs with precision. It increases operational efficiency and minimizes downtime risks. Automation improves network coordination and resource allocation in real time. Energy management systems reduce operating costs across facilities. AI integration enhances security through anomaly detection and response systems. Enterprises rely on this technology for uninterrupted service delivery. The Middle East Edge Data Center Market demonstrates a clear shift toward smarter infrastructure.

Shift Toward Sustainable and Energy-Efficient Infrastructure Designs

Operators are prioritizing energy efficiency and environmental compliance in infrastructure strategies. New facilities integrate renewable energy sources, advanced cooling, and low-PUE architectures. It helps reduce operating costs and meet sustainability goals. Governments encourage these practices through regulatory support and green incentives. Green certifications and efficient power utilization are becoming industry norms. Sustainable infrastructure strengthens brand value and attracts responsible investors. This shift aligns with global carbon reduction commitments. The Middle East Edge Data Center Market mirrors this broader industry sustainability trend.

Rising Investment in Edge Connectivity Hubs and Carrier-Neutral Platforms

Telecom carriers, hyperscalers, and enterprises are co-investing in carrier-neutral edge hubs. These hubs improve regional interconnection and reduce dependence on distant data centers. It strengthens enterprise agility and enhances traffic distribution efficiency. The neutral model attracts multiple tenants and encourages service innovation. Interconnection platforms support 5G, IoT, and cloud integration strategies. Enterprises benefit from flexible scaling and cost control. Interconnectivity is becoming a strategic factor in regional deployments. The Middle East Edge Data Center Market shows strong growth in neutral hub models.

Market Challenges

High Infrastructure Costs and Limited Access to Advanced Edge Technology

Edge deployments require significant capital investment in land, energy, connectivity, and equipment. Smaller operators face difficulty matching the financial capabilities of large hyperscalers. It slows down expansion in developing areas of the region. Access to advanced cooling systems, automation, and AI integration remains uneven. Many local providers still rely on conventional infrastructure with limited scalability. Regulatory frameworks sometimes delay infrastructure permitting and deployment. Financing large-scale edge projects requires complex partnership structures. The Middle East Edge Data Center Market faces cost and access constraints.

Data Sovereignty Rules and Integration Complexity Across Distributed Networks

Complex regulations on data localization increase the operational burden for multinational operators. Each country imposes different compliance rules that affect network planning. It creates integration challenges for enterprises with cross-border operations. Distributed infrastructure also faces coordination and latency management issues. Multi-layered security and governance frameworks are required to maintain reliability. These factors increase operational complexity and deployment timelines. Interoperability between cloud and on-premises models remains a concern. The Middle East Edge Data Center Market must adapt to strict compliance and integration demands.

Market Opportunities

Strategic Investments in AI-Driven Edge Platforms Creating New Business Models

Rising enterprise demand for AI and automation solutions creates strong investment opportunities. AI-driven edge platforms enhance predictive analytics, real-time processing, and intelligent service delivery. It allows faster response times and secure localized decision-making. Governments support AI integration with national digital programs. Investors see strong potential in scalable and intelligent infrastructure deployments. AI-enabled edge sites offer cost-efficient operations with optimized resource use. Early adopters gain a competitive advantage in emerging applications. The Middle East Edge Data Center Market holds potential for AI-led business innovation.

Emergence of New Industrial and Telecom Partnerships Supporting Ecosystem Growth

Telecom operators, hyperscalers, and industrial players are forming alliances to accelerate edge deployment. These collaborations create integrated service platforms for IoT, smart manufacturing, and critical infrastructure. It enhances operational capacity and market reach for participants. Governments offer strategic incentives for these partnerships to strengthen local capabilities. This ecosystem encourages standardization and long-term investment planning. Investors find opportunities in joint infrastructure models. Strong partnerships enable cost-effective deployment and innovation. The Middle East Edge Data Center Market benefits from this collaborative expansion.

Market Segmentation

By Component

Solution holds the largest share driven by demand for modular edge infrastructure and high-performance systems. Service adoption is rising as enterprises rely on managed solutions for operations and maintenance. It reflects growing complexity in network management. Rapid 5G expansion and increasing enterprise digitalization push solution-led deployments. Service models support organizations with limited internal expertise. Integration of intelligent monitoring tools also boosts service relevance. Energy-efficient and scalable solutions dominate infrastructure choices. The Middle East Edge Data Center Market sees solutions as a core segment.

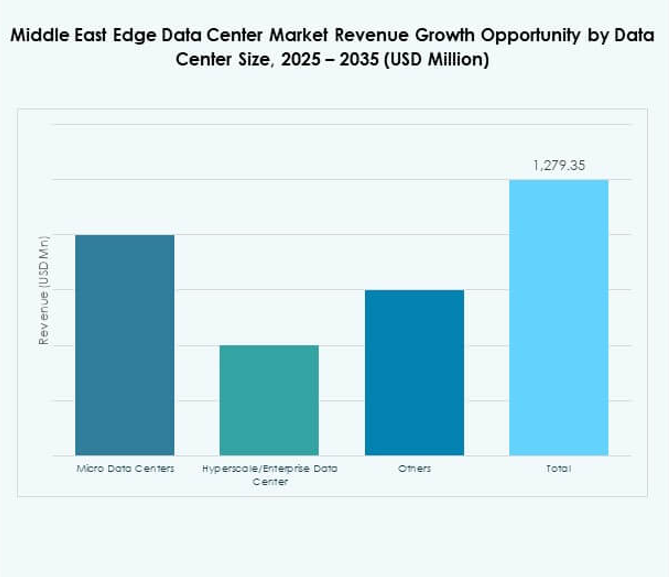

By Data Center Type

Colocation edge data centers lead the segment with high adoption from telecom operators and cloud providers. Enterprise data centers follow closely, supporting hybrid strategies across industries. It offers flexibility in capacity planning and compliance. Managed facilities are gaining traction among SMEs seeking reliable infrastructure. Cloud and edge data centers strengthen service delivery across distributed networks. Multi-tenant facilities help lower costs and improve scalability. The dominance of colocation is driven by strategic investments from hyperscalers. The Middle East Edge Data Center Market builds strength around colocation models.

By Deployment Model

Cloud-based models dominate deployments due to easy scalability and low infrastructure burden. Hybrid solutions are gaining popularity among large enterprises needing security and control. It ensures better workload distribution and compliance flexibility. On-premises models remain relevant for industries with strict data residency rules. Enterprises prefer flexible deployments that reduce capital intensity. Strong cloud integration supports IoT and real-time analytics. Service providers offer hybrid models to balance performance and cost. The Middle East Edge Data Center Market shows strong momentum in cloud-led deployments.

By Enterprise Size

Large enterprises account for the majority of deployments due to high capital capacity and advanced requirements. SMEs adopt managed services to lower operational risks. It enables smaller firms to access modern infrastructure without heavy investment. Large enterprises deploy edge systems to enhance operational control. Their demand drives innovation in scalable architecture. SMEs are focusing on cost-effective, plug-and-play solutions. This mix of adoption drives diverse infrastructure strategies. The Middle East Edge Data Center Market reflects strong large enterprise leadership.

By Application / Use Case

Power monitoring leads the application segment, driven by the need for operational efficiency. Capacity management and environmental monitoring follow due to rising automation in data centers. It ensures energy efficiency and reduced downtime risks. Asset management applications grow with increasing infrastructure complexity. BI and analytics tools enhance decision-making at the network edge. Edge-specific applications allow better operational control for enterprises. Growing AI adoption also strengthens application performance. The Middle East Edge Data Center Market sees strong growth in power monitoring use cases.

By End User Industry

IT and telecommunications dominate due to large-scale edge deployments supporting 5G and IoT applications. BFSI and healthcare show rising adoption for compliance and secure data processing. It strengthens real-time service delivery in critical sectors. Retail and e-commerce rely on edge infrastructure for latency-sensitive customer experiences. Aerospace and defense benefit from secure localized networks. Energy and utilities integrate edge systems for grid optimization. Multiple industries drive infrastructure diversification. The Middle East Edge Data Center Market positions IT and telecom as key growth pillars.

Regional Insights

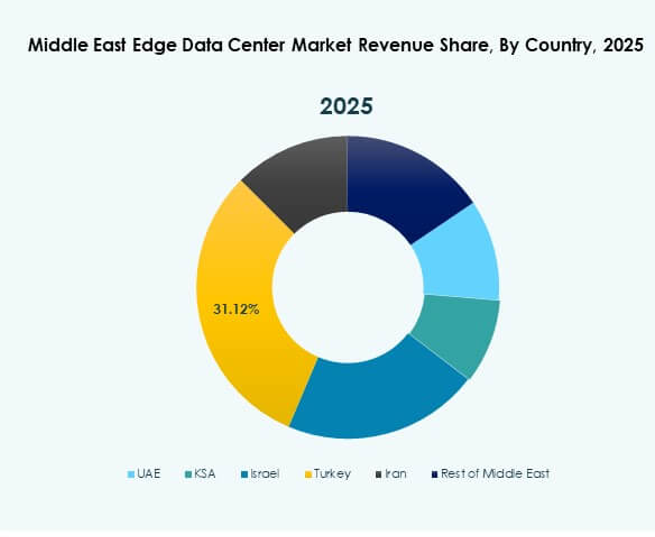

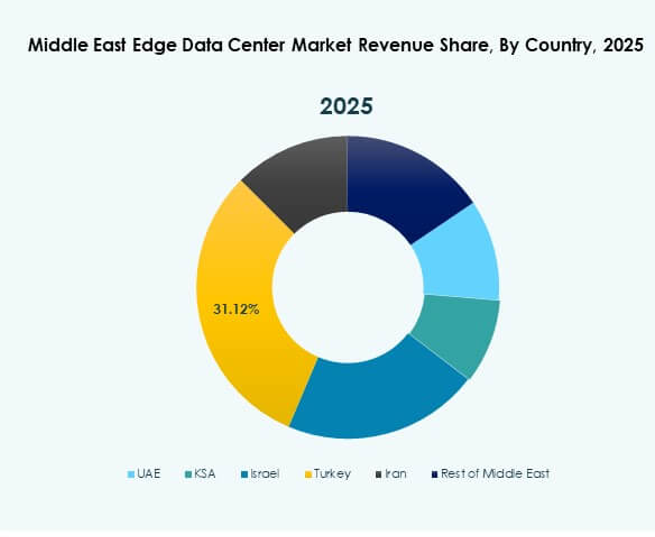

GCC Countries – 67% Market Share

GCC countries lead the market due to strong digital transformation programs and 5G deployments. It reflects major investments from hyperscalers, telecom operators, and governments. Saudi Arabia and the UAE are at the forefront with large-scale smart city projects. Qatar and Bahrain are building strong connectivity hubs to attract investors. Data sovereignty frameworks encourage local deployments. High infrastructure spending and strategic partnerships accelerate edge expansion. The Middle East Edge Data Center Market sees GCC countries as the dominant subregion.

- For example, in September 2025, e& enterprise (formerly Etisalat) announced OneCloud, a UAE-sovereign cloud platform powered by Oracle Alloy, which will deliver over 200 Oracle Cloud Infrastructure services hosted entirely within the UAE to meet data residency and regulatory needs.

Levant Region – 19% Market Share

The Levant region shows steady growth with increasing enterprise digitalization and cloud adoption. Israel is emerging as a strong hub due to advanced innovation ecosystems. It focuses on secure, high-performance edge infrastructure to support critical applications. Jordan and Lebanon are developing early-stage edge deployments through public-private partnerships. Local telecom operators expand capacity to serve industrial users. The presence of skilled technology talent accelerates market maturity. The Middle East Edge Data Center Market gains resilience through Levant expansion.

- For instance, in February 2025, Orange Jordan and Nokia completed a strategic upgrade of Orange’s Broadband Network Gateway across 76 sites nationwide, improving broadband service and operational efficiency for both enterprise and residential users.

Rest of Middle East – 14% Market Share

The rest of the region is in the early phase of infrastructure development. Iraq and Iran are gradually adopting edge solutions to improve connectivity and digital access. It faces slower progress due to regulatory barriers and capital limitations. Emerging telecom and enterprise networks provide initial demand signals. Governments are introducing supportive policies to encourage foreign investment. Infrastructure modernization programs are gaining visibility across these markets. The Middle East Edge Data Center Market gains future growth potential from these emerging economies.

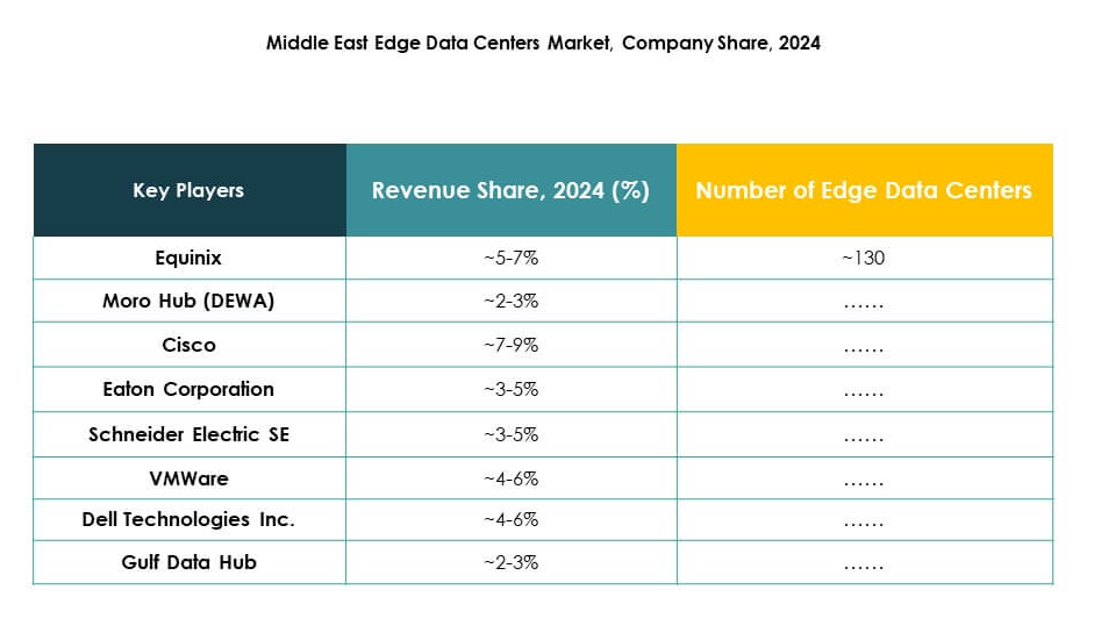

Competitive Insights:

- Moro Hub (DEWA)

- Zain KSA

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Compass Datacenters

- Fujitsu

- American Tower

- Cisco

- Microsoft

- Schneider Electric SE

- Rittal GmbH & Co. Kg

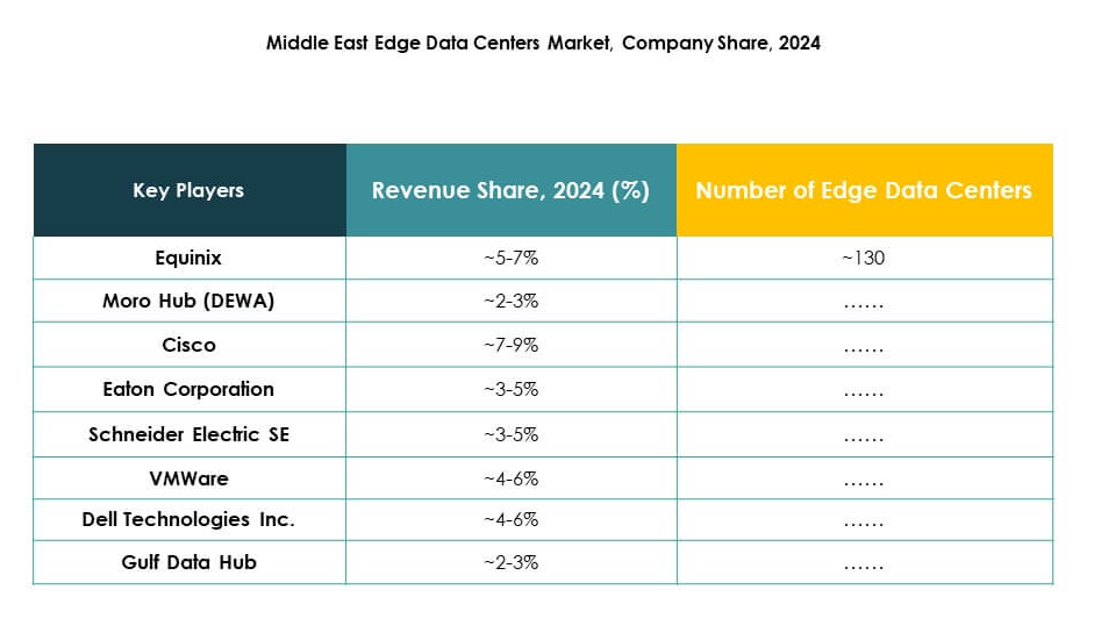

The competitive landscape in the Middle East Edge Data Center Market is shaped by global technology leaders and regional telecom operators. It reflects strong investment in modular infrastructure, cloud integration, and localized computing capabilities. Leading companies are expanding strategic partnerships with hyperscalers and government entities to secure long-term contracts. Innovation in power systems, cooling solutions, and software-defined architectures drives competitive positioning. Global firms focus on scalable platforms and advanced automation to address high-capacity demands. Regional operators strengthen their role through edge network expansions and smart city initiatives. Strategic collaborations support faster rollout and market reach. Product differentiation, sustainability strategies, and operational efficiency define leadership in this growing market.

Recent Developments:

- In October 2025, Moro Hub, a subsidiary of Digital DEWA, signed a strategic partnership with Univers, a global leader in AI and IoT solutions for energy, to develop advanced AI-driven technologies focused on renewable energy, energy storage, and commercial and industrial energy management. This collaboration aims to accelerate the UAE’s clean energy agenda through innovations in AI analytics for solar and wind, predictive maintenance, and carbon footprint reduction, with applications expected to extend across the wider Middle East.

- In August 2025, Center3 announced plans to develop one gigawatt of data center capacity in Saudi Arabia by 2030 as part of a significant move to build extensive edge and hyperscale facilities in the Middle East region. This is positioned to make Center3 a major player in both national and regional digital infrastructure due to its sheer scale and ambition.

- In March 2025, Alfanar revealed a substantial investment totaling $1.4 billion for new data centers in Saudi Arabia. This investment will enhance the country’s edge data center footprint, supporting growing demand for low-latency infrastructure and regional cloud services in the Middle East.