Executive summary:

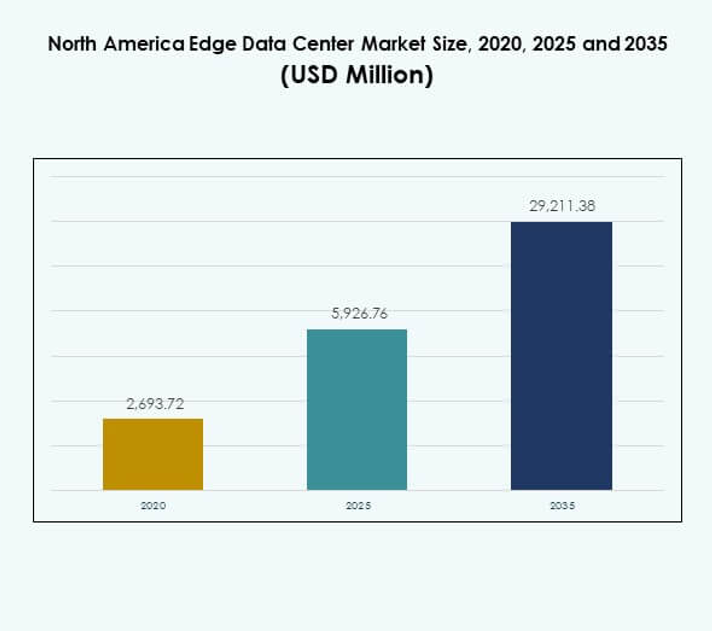

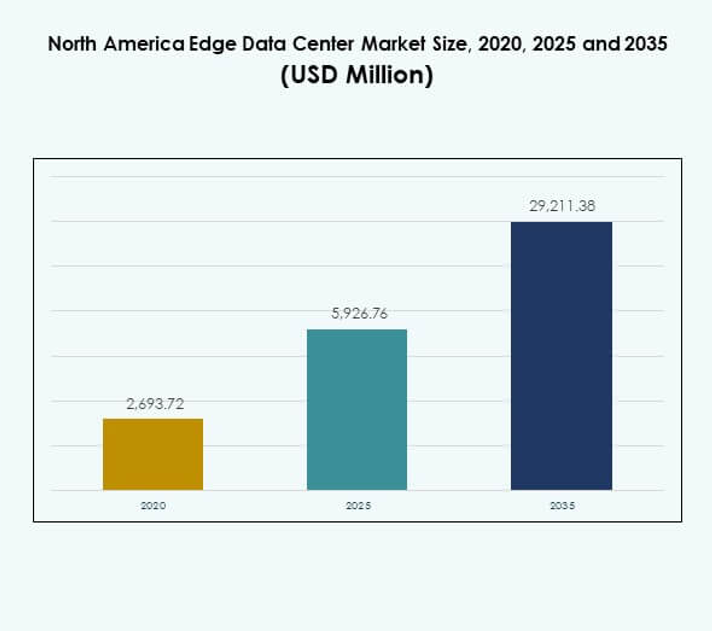

The North America Edge Data Center Market size was valued at USD 2,693.72 million in 2020, reaching USD 5,926.76 million in 2025, and is anticipated to attain USD 29,211.38 million by 2035, at a CAGR of 17.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| North America Edge Data Center Market Size 2025 |

USD 5,926.76 Million |

| North America Edge Data Center Market, CAGR |

17.15% |

| North America Edge Data Center Market Size 2035 |

USD 29,211.38 Million |

Rapid digital transformation, the expansion of 5G infrastructure, and growing adoption of AI-driven applications are fueling the market growth. Enterprises are deploying edge facilities to reduce latency, optimize bandwidth, and enhance data security. Innovation in modular designs, liquid cooling, and automation strengthens operational efficiency. The market holds strategic importance for investors and enterprises seeking faster data processing, localized computing, and competitive scalability across industries.

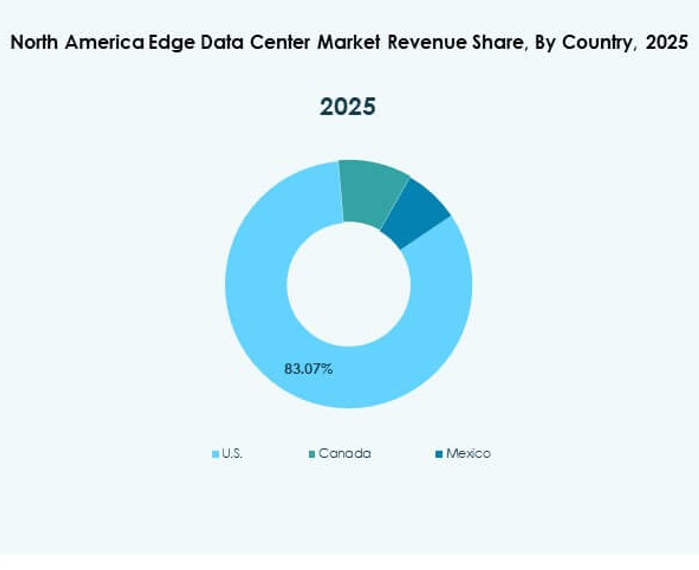

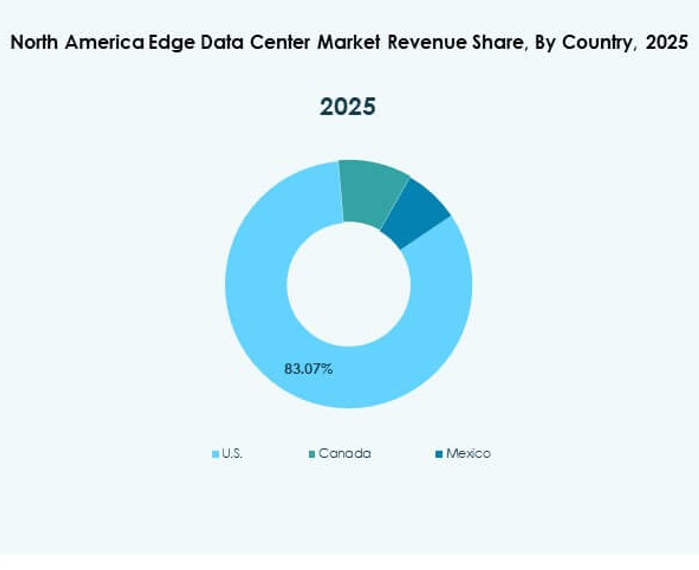

The United States dominates the regional market due to extensive cloud adoption, strong telecom infrastructure, and rapid 5G rollout. Canada is emerging through government-backed digital expansion and data localization initiatives, while Mexico experiences steady growth with rising industrial connectivity and telecom modernization. Each subregion contributes uniquely to advancing digital ecosystems and distributed data processing.

Market Drivers

Rapid Expansion of 5G Infrastructure and Low-Latency Connectivity Demand

The deployment of 5G networks across the region drives large-scale investments in localized computing infrastructure. The North America Edge Data Center Market benefits from telecom operators integrating edge facilities to process data near end users. It enables ultra-low latency for applications such as autonomous vehicles, AR/VR, and remote surgeries. The integration of Multi-access Edge Computing (MEC) strengthens mobile networks and supports massive IoT adoption. Governments and private players prioritize infrastructure upgrades to ensure seamless connectivity. This shift enhances user experience and reduces dependence on distant hyperscale centers. It strengthens network reliability and speeds digital transformation.

- For instance, AT&T and Google Cloud partnered to deliver Multi-access Edge Computing (MEC) services in the United States, combining AT&T’s 5G and fiber network with Google Distributed Cloud Edge to provide localized, low-latency processing capabilities for enterprise applications across sectors such as manufacturing and retail.

Adoption of Artificial Intelligence and Data-Intensive Workloads

AI-driven workloads demand faster data processing and distributed computing environments. The North America Edge Data Center Market gains traction as enterprises process data at the edge for real-time decision-making. It supports intelligent applications in manufacturing, healthcare, and retail sectors. Integration with AI accelerators and GPUs enhances operational efficiency. The need for high-performance computing close to data sources reduces latency and bandwidth usage. Enterprises are deploying edge nodes to optimize predictive analytics and automation processes. Cloud service providers expand hybrid architectures to manage large AI datasets effectively. This transformation supports scalable and intelligent operations.

Rising Importance of Sustainable and Energy-Efficient Infrastructure

Sustainability initiatives reshape investment strategies across the region. The North America Edge Data Center Market sees growing adoption of renewable energy integration and advanced cooling technologies. It helps operators reduce carbon footprint and comply with environmental regulations. Liquid cooling and AI-based energy optimization systems improve power utilization. Companies design modular facilities that balance performance with energy efficiency. Green data centers enhance brand reputation and attract environmentally conscious investors. The focus on net-zero emissions increases renewable procurement contracts. Sustainability thus becomes a defining factor in long-term competitiveness.

- For instance, in April 2025, EdgeConneX was recognized by Structure Research’s State of the Environmental Impact Report as one of the top-ranked sustainable data center operators, achieving 100% renewable energy usage across its 80+ global facilities and maintaining carbon neutrality for Scope 1 and Scope 2 emissions.

Strategic Collaborations and Cloud Ecosystem Integration

Collaborations among cloud providers, telecom companies, and enterprises accelerate innovation. The North America Edge Data Center Market benefits from joint ventures that combine connectivity and computing expertise. It allows businesses to deploy distributed networks with consistent performance. Strategic alliances ensure seamless integration between core and edge facilities. Partnerships between hyperscalers and local data center operators expand access to scalable resources. The focus on interoperability and open architectures improves service agility. It enhances the ecosystem’s ability to meet diverse digital workloads. Collaboration fosters resilience and supports regional economic growth.

Market Trends

Growth in Modular and Prefabricated Edge Facility Deployments

Modular and prefabricated construction models are becoming preferred for rapid deployment. The North America Edge Data Center Market witnesses demand for scalable facilities designed to meet dynamic computing requirements. It allows operators to expand capacity without lengthy construction timelines. Prefabricated modules improve cost efficiency and minimize site disruptions. Vendors offer containerized solutions to deliver flexibility across urban and rural areas. This trend enhances deployment speed while maintaining consistent quality. Prefabrication also supports disaster recovery and temporary site operations. It contributes to agile infrastructure development across sectors.

Integration of Edge with Cloud and Core Network Infrastructure

Edge facilities are increasingly integrated into broader hybrid and multi-cloud architectures. The North America Edge Data Center Market benefits from synchronized workloads between local nodes and central clouds. It ensures consistent data flow and optimized resource utilization. Businesses gain flexibility by distributing applications across network layers. Integration enhances reliability for latency-sensitive applications such as industrial automation. Service providers focus on open APIs and cross-platform compatibility. The trend drives innovation in orchestration software and intelligent workload management. It enables a seamless experience for enterprises relying on edge computing.

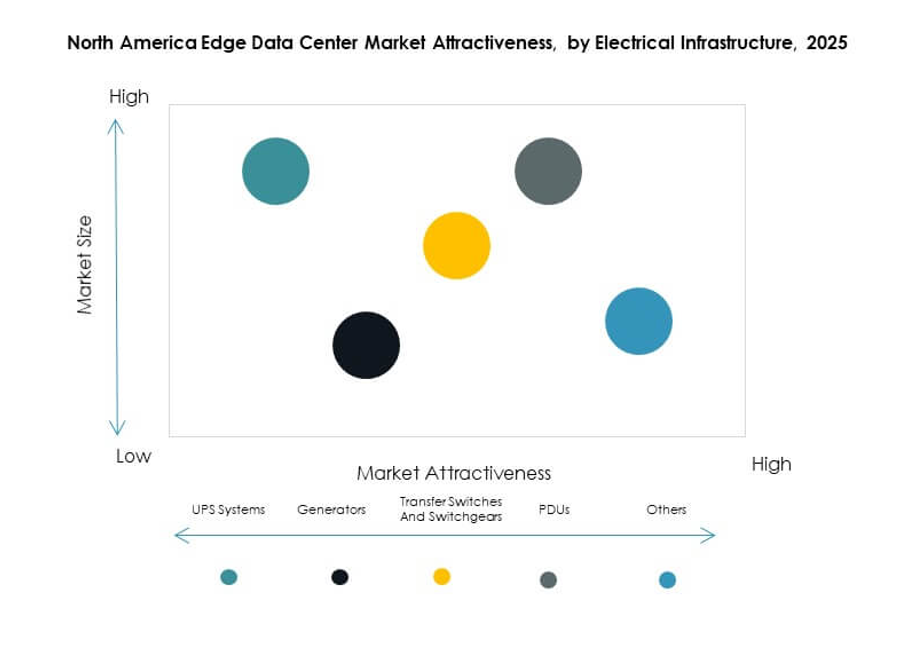

Advancements in Liquid Cooling and High-Density Power Designs

Technological innovation in cooling systems improves operational efficiency. The North America Edge Data Center Market embraces liquid cooling and immersion systems to support high-density racks. It reduces dependency on traditional air-based systems and minimizes power wastage. Data center operators implement AI-based monitoring to optimize temperature control. Adoption of advanced materials and heat exchange methods boosts equipment longevity. These solutions improve sustainability and performance metrics. Integration of energy-efficient UPS systems supports higher workloads. It ensures consistent operations even under increased data traffic pressure.

Rising Focus on Edge Security and Regulatory Compliance

Cybersecurity remains a top priority across regional deployments. The North America Edge Data Center Market emphasizes advanced encryption, zero-trust frameworks, and AI-based threat detection. It safeguards distributed assets against growing cyber threats. Regulations surrounding data residency and privacy shape investment decisions. Operators are aligning with frameworks such as NIST and ISO 27001 to ensure compliance. Secure interconnection and network segmentation mitigate risk exposure. Vendors develop integrated monitoring to detect breaches in real time. The focus on resilience strengthens investor confidence and operational trust.

Market Challenges

High Capital Expenditure and Limited Standardization in Deployment

High infrastructure costs pose a significant challenge for operators and investors. The North America Edge Data Center Market demands large upfront investments in power, cooling, and network integration. It creates barriers for small and medium enterprises entering the sector. Lack of uniform design standards complicates interoperability across vendors. Fragmented deployment models slow scalability and increase maintenance complexities. Rural areas face additional costs due to limited connectivity and logistics constraints. Operators must balance ROI timelines with growing competitive pressure. The absence of industry-wide standardization limits unified ecosystem growth.

Energy Supply Constraints and Complex Regulatory Landscape

The rising power consumption of edge data centers strains regional utilities. The North America Edge Data Center Market faces challenges due to limited renewable energy availability in some states. It requires sustainable grid partnerships and energy-efficient innovations. Complex permitting processes delay site development and expansion. Regional differences in data privacy and zoning laws increase compliance burdens. The integration of renewable sources demands infrastructure upgrades and coordination with utilities. High operational costs and evolving carbon regulations add pressure on profitability. Energy reliability and compliance remain major hurdles to consistent expansion.

Market Opportunities

Expansion in Smart Cities, IoT, and Connected Ecosystems

Smart city initiatives and industrial IoT expansion open new growth avenues. The North America Edge Data Center Market supports intelligent traffic management, connected vehicles, and public safety networks. It processes large data volumes close to sensors and endpoints. This proximity improves responsiveness and reliability. Government investments in smart infrastructure enhance regional demand. Edge facilities enable cities to adopt AI-powered solutions efficiently. It drives innovation across mobility, energy, and public utilities. The trend positions edge computing as a core element of urban transformation.

Rising Enterprise Demand for Hybrid Edge Cloud Architectures

Hybrid cloud adoption accelerates across industries seeking flexibility and control. The North America Edge Data Center Market benefits from enterprises deploying workloads across cloud and edge environments. It improves operational agility and ensures business continuity. Companies leverage distributed models to enhance performance for AI, analytics, and 5G applications. Service providers focus on interconnection platforms that simplify hybrid management. This opportunity supports customized solutions for specific use cases. The hybrid approach strengthens collaboration between hyperscalers and enterprises, boosting innovation.

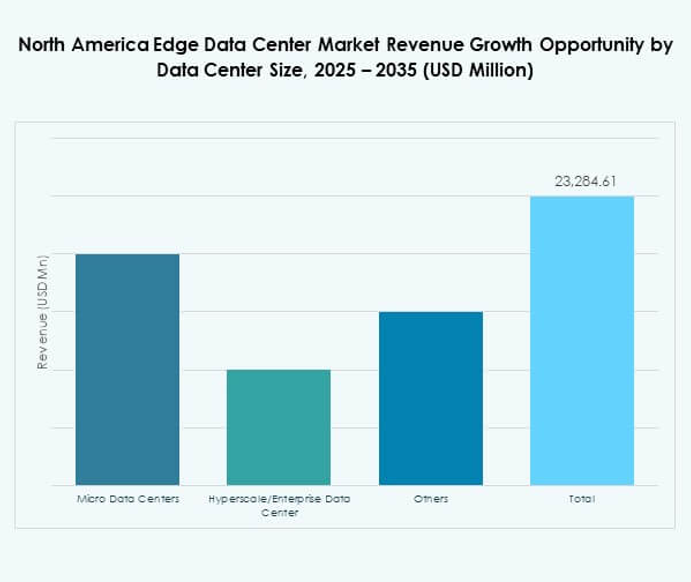

Market Segmentation

By Component

Solutions dominate the segment due to high adoption of software-defined infrastructure and automation tools. The North America Edge Data Center Market witnesses strong demand for integrated management and networking systems. Services including installation, monitoring, and maintenance complement solution growth. Vendors focus on AI-driven systems for predictive operations. Continuous innovation in hardware integration and cybersecurity boosts competitiveness. Solution providers enhance modular scalability to meet enterprise workloads. The trend strengthens overall ecosystem reliability and operational performance.

By Data Center Type

Colocation edge data centers hold the largest share due to increasing demand from enterprises and cloud providers. The North America Edge Data Center Market benefits from scalable shared infrastructure models. Managed and cloud-edge centers follow closely, driven by hybrid adoption. Enterprise data centers remain relevant for regulated industries requiring control over sensitive data. Colocation hubs reduce deployment costs and enable faster market entry. Operators expand across metro and suburban zones to improve coverage. This segment supports distributed computing expansion across the region.

By Deployment Model

Cloud-based deployments dominate due to agility and scalability advantages. The North America Edge Data Center Market experiences growth in hybrid frameworks integrating on-premises systems. It provides flexibility for diverse enterprise needs while maintaining control over critical workloads. On-premises solutions remain vital for data-sensitive operations and government sectors. The rise of edge-native applications promotes hybrid models for optimal balance. Vendors offer orchestration tools to ensure workload interoperability. The flexibility of deployment enhances resilience and long-term sustainability.

By Enterprise Size

Large enterprises lead the segment, leveraging distributed data processing to enhance digital operations. The North America Edge Data Center Market sees increasing adoption by SMEs through managed and modular models. It allows cost-efficient scaling and remote management capabilities. Large enterprises integrate AI and IoT at the edge to improve customer experience. SMEs adopt cloud-edge solutions to compete effectively in digital ecosystems. Support from managed service providers eases entry barriers. Enterprise digitization drives consistent demand across both categories.

By Application / Use Case

Power monitoring and environmental monitoring dominate as critical applications. The North America Edge Data Center Market uses these systems for operational reliability and efficiency optimization. Asset management and BI analytics also show strong growth due to automation demand. Capacity management supports dynamic workload allocation in real time. Real-time data tracking ensures predictive maintenance and uptime assurance. Vendors develop advanced dashboards integrating multiple monitoring layers. These applications enhance data-driven infrastructure management across sectors.

By End User Industry

The IT and telecommunications sector leads the market with the largest share. The North America Edge Data Center Market gains momentum from network operators upgrading 5G and cloud infrastructure. BFSI and healthcare sectors adopt edge solutions for secure data handling. Retail and e-commerce utilize it for real-time analytics and customer engagement. Aerospace, defense, and utilities rely on edge for critical operational continuity. Cross-industry adoption accelerates through innovation and policy support. This segment diversity strengthens the region’s digital competitiveness.

Regional Insights

United States: Leading Market with Advanced Digital Infrastructure (64% Share)

The United States dominates the North America Edge Data Center Market with a 64% share. It benefits from dense connectivity hubs, cloud provider investments, and widespread 5G coverage. Edge deployments are concentrated in major metros such as Dallas, Chicago, and Northern Virginia. High enterprise cloud adoption and AI initiatives fuel demand. The strong ecosystem of hyperscalers and telecom firms supports nationwide network integration. It maintains leadership through sustained innovation and regulatory alignment.

- For instance, Equinix entered a joint venture with GIC and CPP Investments in October 2024 to raise at least $15 billion for building out hyperscale xScale data centers in the United States, with plans to create multiple campuses each exceeding 100 megawatts (MW) of power capacity to meet AI and cloud provider demand.

Canada: Emerging Market Driven by Cloud and Telecom Expansion (23% Share)

Canada holds a 23% share and shows strong growth due to national digitalization programs. The North America Edge Data Center Market in Canada thrives on government-backed data infrastructure projects. Telecom firms deploy edge networks to reduce data transit time. Smart manufacturing and healthcare applications drive further demand. Urban centers such as Toronto and Montreal attract major investments. It strengthens competitiveness through cross-border cloud connectivity. Regional sustainability focus also drives clean-energy data center expansion.

- For instance, Bell Canada announced in May 2025 the launch of Bell AI Fabric—a network beginning with six AI data centers in British Columbia, providing upwards of 500 MW of hydroelectric-powered AI compute capacity, with the first facility scheduled to go online in June 2025 and Groq as a lead technology partner.

Mexico: Growing Edge Ecosystem Supported by Telecom Modernization (13% Share)

Mexico captures a 13% share supported by rising industrial digitalization and telecom modernization. The North America Edge Data Center Market in Mexico benefits from proximity to U.S. cloud routes and growing e-commerce. Government initiatives to enhance connectivity drive edge deployments. Colocation and hyperscale firms invest in Querétaro and Monterrey for latency-sensitive workloads. Increasing 5G rollouts enable real-time applications across logistics and manufacturing. It continues evolving as a strategic hub for Latin American digital networks.

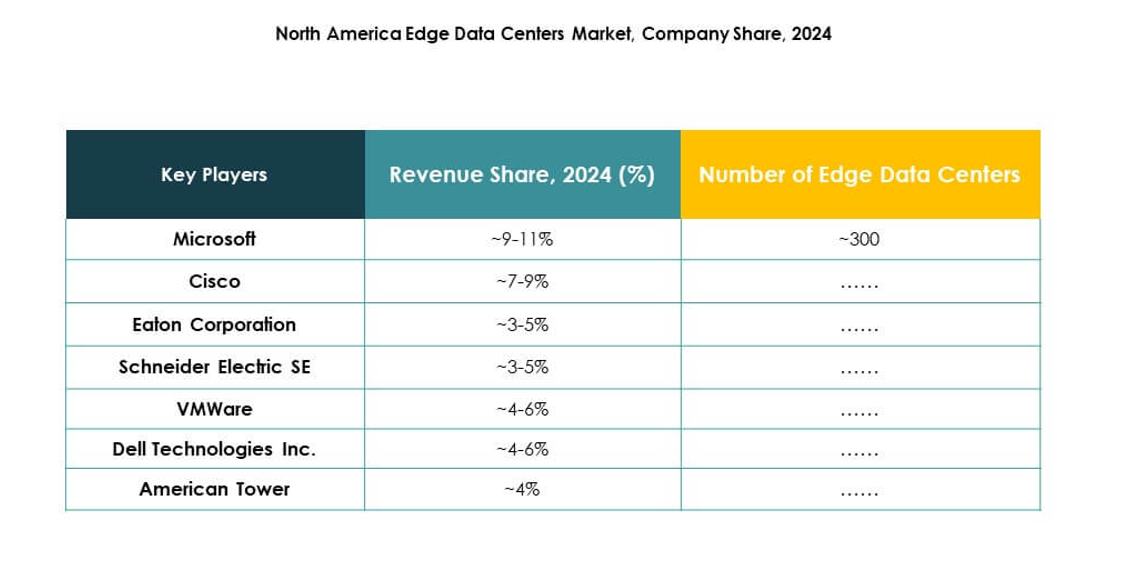

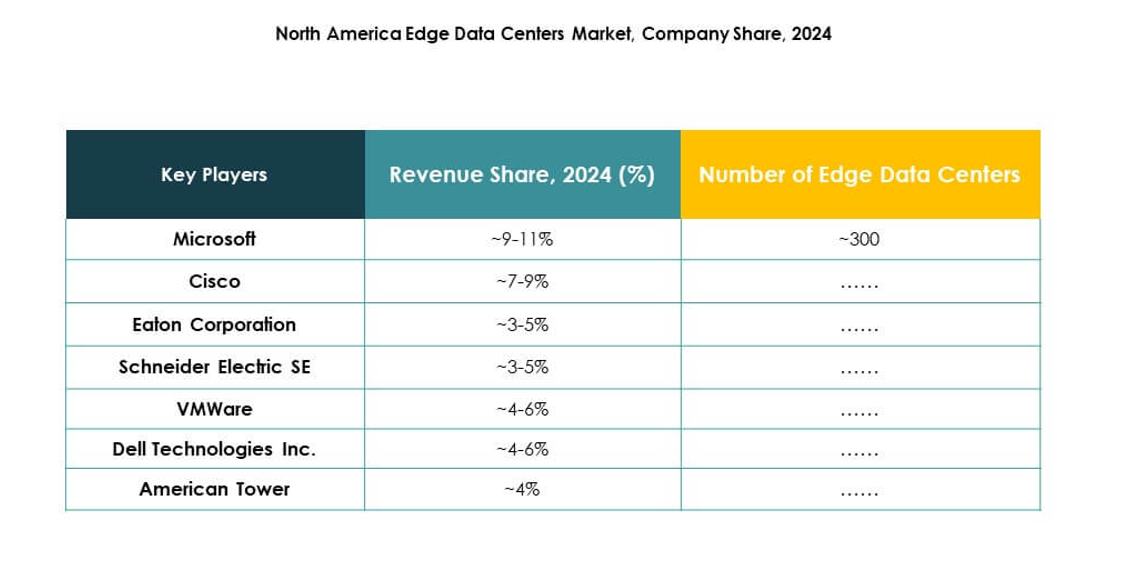

Competitive Insights:

- 365 Operating Company LLC

- EdgeConneX

- Eaton Corporation

- Dell Technologies Inc.

- Compass Datacenters

- Fujitsu

- American Tower Corporation

- Cisco Systems, Inc.

- SixSq

- Microsoft Corporation

- VMware, Inc.

- Schneider Electric SE

- Rittal GmbH & Co. KG

The North America Edge Data Center Market features a highly competitive environment led by technology innovators, infrastructure providers, and cloud service firms. It is shaped by rapid expansion strategies, modular deployments, and integration of AI-driven management platforms. Microsoft, Dell Technologies, and VMware strengthen hybrid edge-cloud ecosystems, while Schneider Electric and Eaton focus on sustainable power infrastructure. EdgeConneX and Compass Datacenters expand regional presence through scalable colocation facilities and renewable-powered campuses. Cisco and SixSq drive software-defined network efficiency for distributed edge environments. American Tower leverages tower assets to extend mobile edge coverage. Continuous innovation and alliances define market leadership and regional competitiveness.

Recent Developments:

- In August 2025, EdgeConneX partnered with Lambda to develop over 30 megawatts (MW) of high-density, AI-enabled data center infrastructure in Chicago and Atlanta, leveraging hybrid cooling technologies to support next-generation cloud and AI workloads. The Chicago facility will be ready for service in 2026, underscoring EdgeConneX’s commitment to delivering scalable AI infrastructure.

- In April 2025, Dell Technologies introduced new infrastructure innovations built for modern AI-ready data centers, including advancements across its PowerEdge servers and PowerStore storage portfolio designed to help organizations accelerate modernization for traditional and emerging workloads in edge environments.