Executive summary:

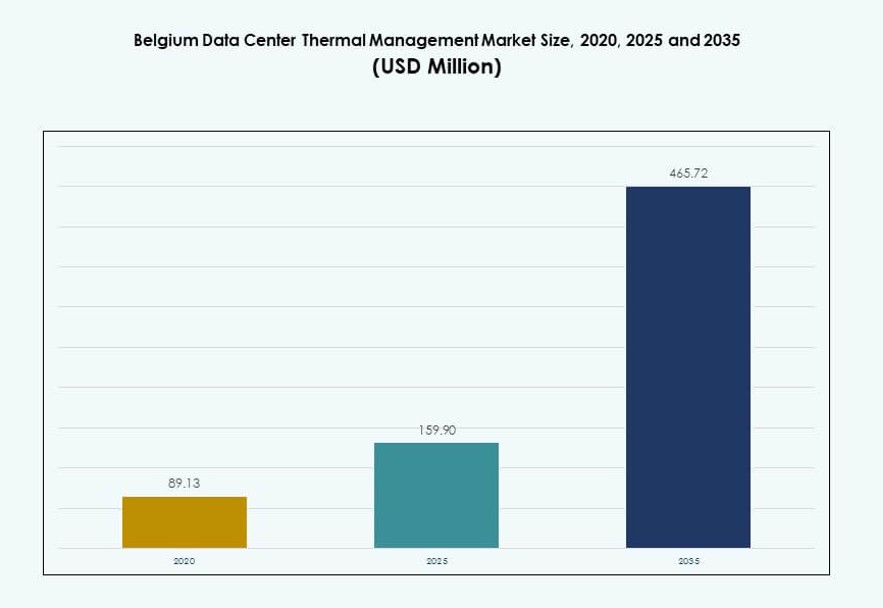

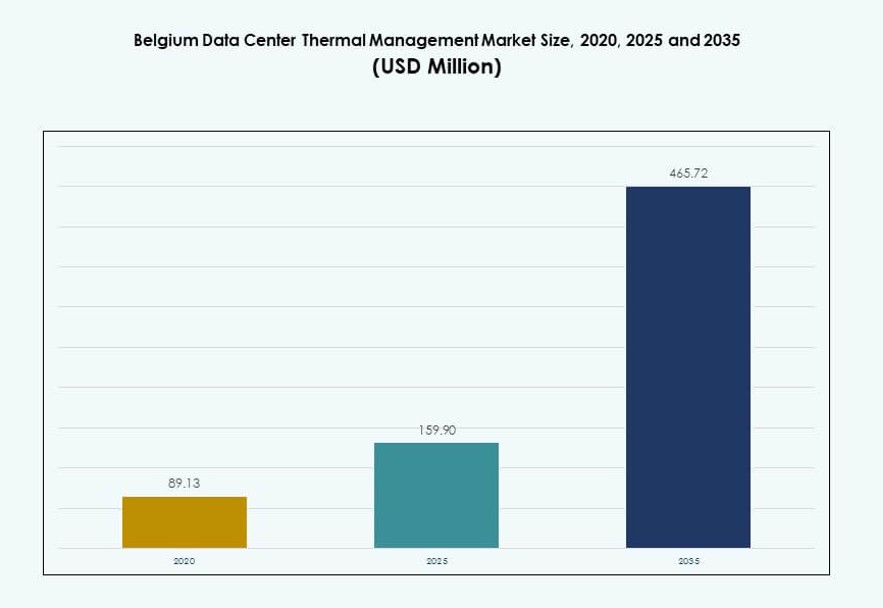

The Belgium Data Center Thermal Management Market size was valued at USD 89.13 million in 2020 to USD 159.90 million in 2025 and is anticipated to reach USD 465.72 million by 2035, at a CAGR of 11.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Belgium Data Center Thermal Management Market Size 2025 |

USD 159.90 Million |

| Belgium Data Center Thermal Management Market, CAGR |

11.22% |

| Belgium Data Center Thermal Management Market Size 2035 |

USD 465.72 Million |

Thermal efficiency has become a top priority as Belgian data centers scale high-density AI workloads. The market is propelled by adoption of liquid cooling, hybrid systems, and AI-integrated thermal controls. Industry shifts toward sustainability and energy optimization drive investment in advanced cooling infrastructure. Businesses rely on intelligent cooling to ensure uptime, reduce energy bills, and meet regulatory standards. These factors make thermal solutions central to both operational success and long-term competitiveness.

The Flemish Region leads the market due to its concentration of large-scale and colocation data centers. Brussels holds strategic weight with hyperscale facilities and public sector demand. The Walloon Region is emerging, fueled by new edge deployments in cities like Liège. Each subregion brings unique drivers, from dense interconnection hubs to low-cost land zones, shaping localized growth patterns in thermal system deployment.

Market Dynamics:

Market Drivers

Rapid Rise in Rack Density and the Push for High-Performance Cooling Solutions

Data centers in Belgium are seeing a notable rise in rack power density, with demands regularly exceeding 20 kW per rack. This has triggered greater interest in advanced thermal management systems to prevent overheating and reduce operational disruptions. The Belgium Data Center Thermal Management Market benefits from this need, especially with AI workloads and high-performance computing deployments increasing. Operators seek solutions that offer precise temperature control and energy savings. Liquid cooling, particularly direct-to-chip systems, is gaining attention. Efficient heat dissipation is now a performance metric in selecting infrastructure partners. Businesses view thermal efficiency as critical for uptime and cost control. These dynamics are pushing thermal management from a back-end utility to a strategic priority for investors and data center providers.

- For example, a data hall in Belgium was built to support rack power densities up to 60 kW and plans for future liquid‑cooled environments beyond 150 kW per rack, enabling local AI and high‑performance workloads.

Growing Integration of AI and Smart Thermal Optimization Tools in Facility Operations

Belgium’s colocation and enterprise data centers are adopting AI-based thermal management systems to optimize performance. Smart systems use real-time sensor data and algorithms to regulate airflow, fluid dynamics, and energy loads. This improves energy use and ensures localized cooling without over-provisioning capacity. The Belgium Data Center Thermal Management Market supports this shift with hardware-software ecosystems designed for intelligent infrastructure. AI-driven tools are being integrated into BMS and DCIM platforms. These tools help detect anomalies, automate cooling adjustments, and extend equipment lifespan. Their role grows as more centers move toward predictive maintenance. Facilities reduce downtime and control operational costs through these smart systems. Long-term gains in energy efficiency and cooling precision make AI integration a core growth driver.

Government Support for Energy Efficiency and Data Center Sustainability Standards

Belgium’s national and EU-level sustainability goals are directly influencing thermal system adoption in data centers. Policy frameworks support high-efficiency infrastructure, waste heat reuse, and integration with district heating. Operators are incentivized to reduce emissions and adopt green cooling solutions. The Belgium Data Center Thermal Management Market benefits from these directives, driving demand for low-PUE, energy-conscious setups. Several projects now integrate ambient air cooling and heat recovery. These methods support both regulatory compliance and ESG targets. Green building certifications further push businesses to invest in modern cooling. Long-term policy pressure secures the market’s momentum and opens access to subsidies for thermal innovation.

Accelerating Edge and Hyperscale Deployments Creating Diverse Thermal Demands

Growth in edge computing and hyperscale expansion is reshaping thermal strategies across Belgium. Hyperscale facilities require scalable liquid cooling, while edge sites need compact, efficient air-based systems. This variation fuels demand across a spectrum of technologies and architectures. The Belgium Data Center Thermal Management Market addresses both ends with modular and hybrid solutions. Vendors offer flexibility in deployment without sacrificing performance. Rapid digital growth in sectors like healthcare, finance, and manufacturing also boosts distributed computing needs. Facilities are being planned closer to end users, creating thermal challenges in urban and regional locations. Operators must balance performance, space, and energy constraints. This broadens the market scope and diversifies investment interest.

- For example, Penta Infra’s BRU01 (formerly Nexus) facility in Zellik integrates renewable energy, rainwater recuperation for cooling, and heat reuse via a thermal smart grid, showcasing how sustainability and efficient thermal management are applied in Belgian data centers.

Market Trends

Rise in Liquid Cooling Deployment for AI-Optimized and High-Density Facilities

Liquid cooling is moving from pilot phase to mainstream in Belgium’s leading data centers. Direct-to-chip and immersion methods are increasingly used for dense AI clusters and GPU-intensive racks. This trend reflects growing interest in energy-efficient cooling that supports high rack performance. The Belgium Data Center Thermal Management Market sees vendors developing integrated systems for seamless deployment. Liquid solutions reduce space requirements and eliminate reliance on raised floor designs. Facilities report measurable improvements in energy metrics and system stability. Adoption continues in hyperscale, colocation, and enterprise sectors. Sustainability targets further enhance the shift, as liquid systems support heat reuse and lower emissions. Market stakeholders focus on standardizing liquid modules to accelerate deployment.

Adoption of Waste Heat Recovery and District Heating Integration in Urban Sites

Urban data centers in Belgium are increasingly contributing to district heating networks by reusing waste heat. Operators deploy heat exchangers and recovery systems to transfer thermal energy to nearby residential or commercial buildings. This creates value while supporting carbon reduction mandates. The Belgium Data Center Thermal Management Market aligns with municipal infrastructure planning. Developers integrate cooling with community-level utilities to improve public-private alignment. It opens revenue streams and improves site approval timelines. Regulatory preference for heat reuse boosts market credibility. Operators gain recognition for ESG efforts and efficient land use. Future projects are likely to include heat-sharing from the planning phase.

Increased Use of AI and ML for Real-Time Adaptive Thermal Control in Data Centers

Artificial intelligence and machine learning play a growing role in dynamic thermal management. Belgium’s large-scale facilities deploy AI tools to manage temperature, airflow, and humidity in real time. These tools optimize cooling loads based on live data and workload patterns. The Belgium Data Center Thermal Management Market benefits from this shift toward automation. Predictive models help anticipate cooling demand, minimizing energy waste. It enables data centers to meet high-density needs without overengineering. Vendors focus on seamless integration with existing DCIM and BMS platforms. Real-time controls improve uptime and energy performance. The trend supports operational scalability and strengthens long-term infrastructure resilience.

Growth in Modular, Prefabricated Cooling Units to Support Fast Construction Cycles

Modular thermal units are gaining traction as construction timelines compress for edge and colocation sites. Vendors deliver prefabricated cooling pods that plug into existing systems. The Belgium Data Center Thermal Management Market sees this trend rising with compact rack-based units and modular chillers. These systems reduce installation time and complexity. Builders gain flexibility in configuring thermal setups to match client workloads. Prefabricated designs meet energy codes and reduce labor costs. Operators also benefit from standardized parts, easing maintenance. This model supports fast scaling during demand surges. Providers use modularity to support multiple tier levels within the same facility.

Market Challenges

Rising Energy Costs and Utility Constraints Limiting Scalability of Cooling Systems

Belgium faces some of the highest energy costs in Western Europe, making thermal efficiency a financial priority. Cooling systems draw significant power, putting pressure on operating budgets. The Belgium Data Center Thermal Management Market experiences adoption delays when ROI is unclear or energy costs spike. Grid capacity in certain regions also restricts how much power-intensive cooling can be deployed. Data centers must navigate utility regulations and often face delays in connection approvals. Infrastructure expansion slows when grid upgrades are required. These conditions challenge scalability for new thermal technologies. Investors seek proven, low-risk systems over experimental models. Balancing innovation with grid limitations becomes a major operational task.

Complexity in Retrofitting Older Data Centers with Next-Generation Cooling Technologies

Belgium hosts many legacy facilities built before modern thermal demands emerged. Retrofitting them for liquid cooling or hybrid systems poses structural and logistical hurdles. Operators must address spatial constraints, airflow redesigns, and compatibility with old IT gear. The Belgium Data Center Thermal Management Market sees high upgrade costs limiting adoption in older sites. Facility downtime during retrofits also concerns colocation providers. Planning involves careful phasing and integration with live operations. Smaller players lack budgets for full-scale upgrades. Without thermal enhancements, older centers risk falling behind on performance and energy standards. This slows market-wide progress despite technological availability.

Market Opportunities

Public-Private Collaboration on Sustainable Cooling Can Accelerate Thermal Innovation

Belgium’s climate and sustainability goals offer strong ground for partnerships in efficient cooling systems. Municipalities are open to district heat reuse and energy sharing. The Belgium Data Center Thermal Management Market can grow by aligning with public infrastructure plans. Vendors can co-develop cooling setups that also serve community heating needs. EU funding channels and smart city initiatives further support innovation pilots. This synergy opens new business models around thermal services.

Edge Infrastructure Growth in Tier-2 Cities Can Expand the Thermal Ecosystem

Rising demand for low-latency computing in regional zones like Ghent and Liège drives micro data center growth. These sites require compact, efficient thermal units that can run autonomously. The Belgium Data Center Thermal Management Market can leverage this by offering modular systems for distributed setups. The expansion creates new demand beyond traditional urban hubs. Vendors that cater to edge-specific thermal formats gain first-mover advantage.

Market Segmentation

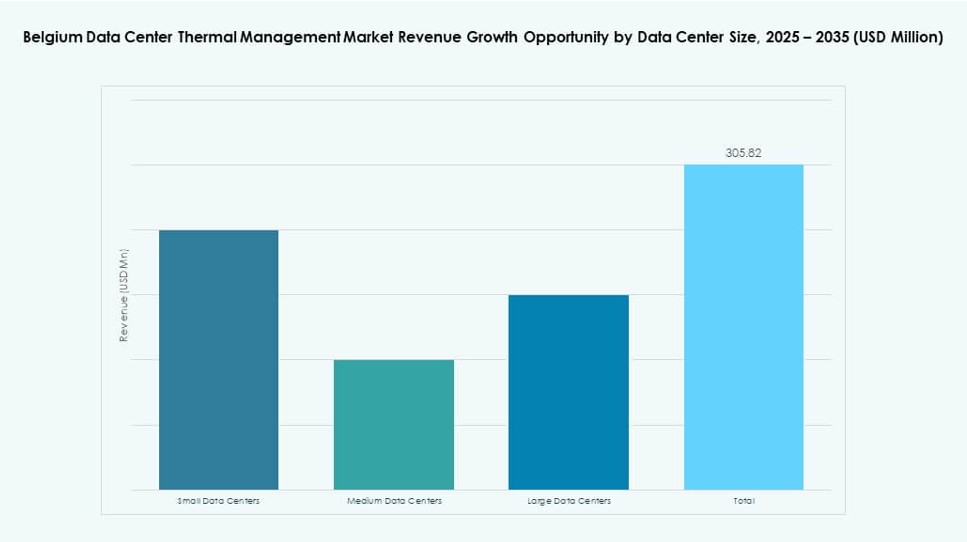

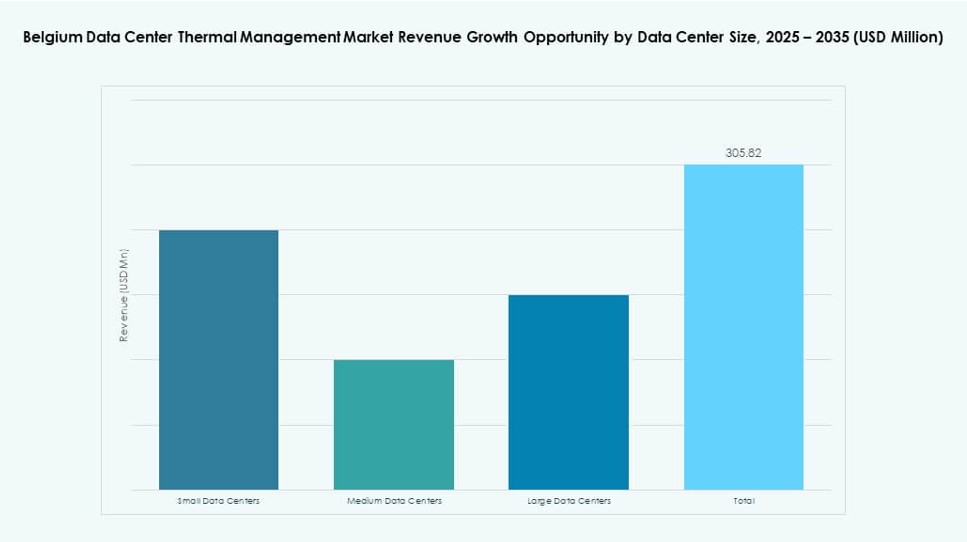

By Data Center Size

Large data centers dominate the Belgium Data Center Thermal Management Market due to hyperscale and colocation investments. They account for the highest revenue share, driven by high rack density and 24/7 operations. Medium-sized facilities follow, supporting enterprise IT needs. Small data centers serve niche, often edge-driven deployments with lower thermal intensity. Large-scale sites continue to adopt advanced liquid and hybrid cooling, driving market innovation and vendor collaboration.

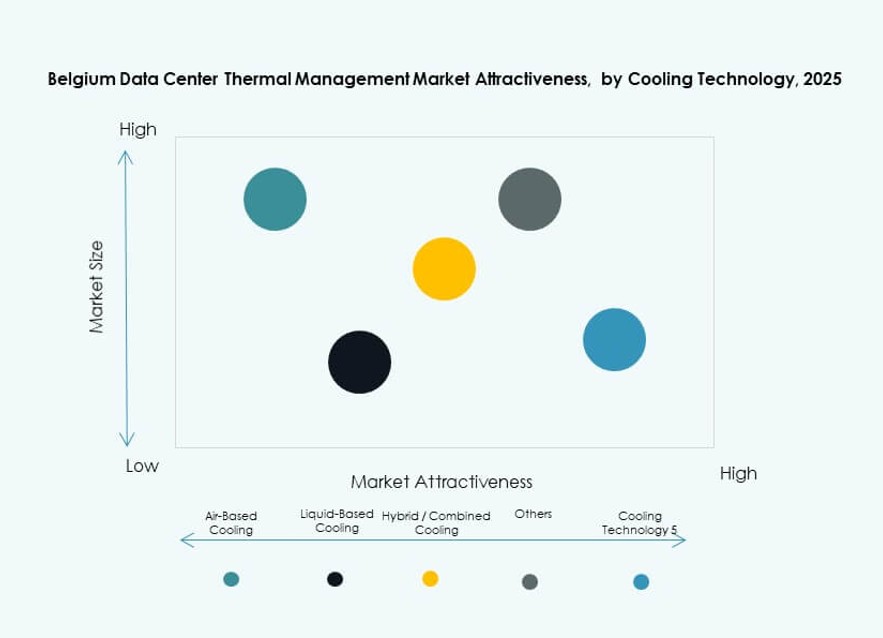

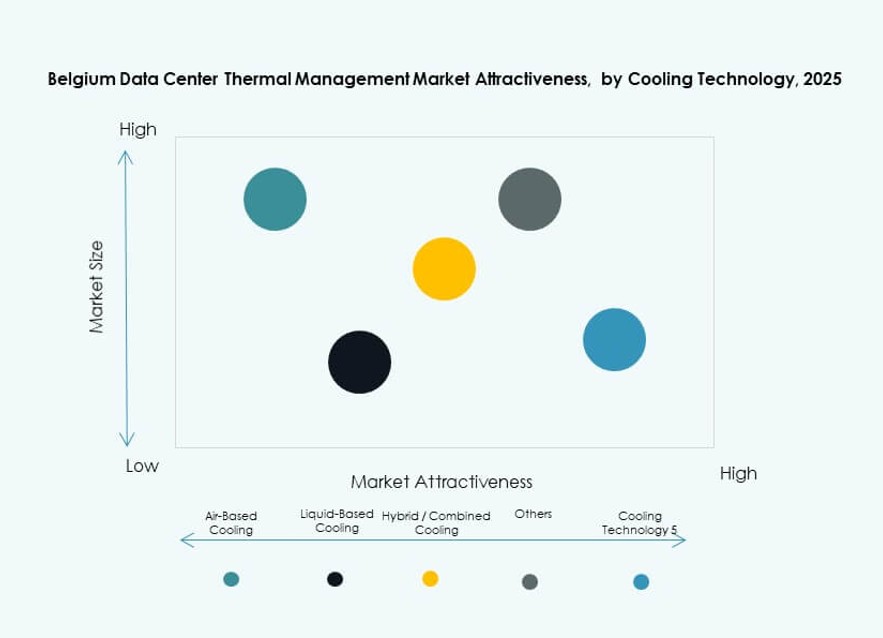

By Cooling Technology

Air-based cooling remains widely deployed, especially direct air and aisle containment systems. However, liquid-based cooling is gaining strong traction in high-density environments, particularly direct-to-chip and immersion methods. Hybrid models are growing due to flexible deployments and thermal performance needs. The Belgium Data Center Thermal Management Market supports this mix as operators seek modularity and redundancy. Thermoelectric and phase-change cooling remain niche but show potential in edge and space-constrained environments.

By Component

Hardware leads the market with the highest share, driven by demand for chillers, heat exchangers, and airflow devices. Software is growing as AI, DCIM dashboards, and simulation tools become essential for precision cooling. Services play a key role in supporting deployment, upgrades, and maintenance. The Belgium Data Center Thermal Management Market offers strong opportunity in value-added services, especially in monitoring and retrofitting.

By Hardware

Cooling units and chillers hold the largest share due to their central role in thermal systems. Piping and airflow devices follow, ensuring temperature control across facility zones. Heat exchangers gain traction in waste heat recovery. The Belgium Data Center Thermal Management Market also sees growing demand for advanced fans and thermal transfer components, particularly in liquid setups. Vendors innovate to improve efficiency and lifespan.

By Software

DCIM dashboards are most widely adopted, offering visibility and basic thermal management. AI optimization tools are expanding quickly in hyperscale setups. CFD simulation and BMS modules support high-performance cooling design. The Belgium Data Center Thermal Management Market sees growing integration of these tools for predictive control. Software boosts overall infrastructure agility and energy responsiveness.

By Services

Installation and commissioning dominate the services segment due to complex system requirements. Preventive maintenance and retrofits see rising demand in both legacy and modern setups. Monitoring as a Service is gaining popularity for remote visibility. The Belgium Data Center Thermal Management Market benefits from bundled service offerings that ensure continuous optimization. Operators prefer partners offering full lifecycle management.

By Data Center Type

Colocation/cloud data centers lead the market due to their scale and rapid growth across Belgium. Hyperscale sites follow with advanced thermal needs. Enterprise data centers retain relevance but often lag in technology upgrades. Edge/micro data centers are emerging, driving compact cooling innovations. The Belgium Data Center Thermal Management Market adapts to each type with customized thermal solutions.

By Structure

Room-based cooling remains the most common structure in legacy and large enterprise sites. Rack-based and row-based systems are gaining ground due to better scalability and energy control. The Belgium Data Center Thermal Management Market supports this structural transition, particularly in modular builds. Rack and row setups enable localized cooling, critical for AI and GPU workloads.

Regional Insights

Flemish Region Leads in Capacity and Investment Share Across Key Urban Centers

The Flemish Region holds the largest share of the Belgium Data Center Thermal Management Market at approximately 55%. It includes high-density zones like Antwerp and Ghent, which host several enterprise and colocation facilities. This region benefits from advanced infrastructure, skilled workforce, and proximity to European data hubs. Several new projects in the area are focused on energy-efficient and liquid-cooled deployments. Government policies favor technology parks and green buildings. Strong demand from logistics, retail, and healthcare sectors supports continued investment.

- For instance, Datacenter United operates facilities in the region with total capacity exceeding 11 MW across multiple sites featuring redundant cooling infrastructure.

Brussels Capital Region Maintains Strategic Relevance with Hyperscale and Government Demand

Brussels accounts for roughly 25% of the Belgium Data Center Thermal Management Market. Its location as the EU and national capital supports hyperscale, interconnect, and regulated IT infrastructure. High-security standards drive demand for precision thermal systems. Operators in Brussels prioritize sustainability, aligning with European environmental targets. The market in this area benefits from district heating integration and proximity to key customers. Innovation pilots often start here due to regulatory visibility and funding access.

- For instance, Digital Realty’s BRU4 facility in Zaventem delivers approximately 13.6 MW of IT capacity with N+1 redundant cooling systems and sustainable energy infrastructure supporting efficient operations.

Walloon Region Shows Growth Potential in Edge and Mid-Sized Deployments

The Walloon Region contributes about 20% to the Belgium Data Center Thermal Management Market and is an emerging hub for regional and edge data centers. Cities like Liège and Charleroi are attracting infrastructure investments due to land availability and lower operating costs. Smaller, distributed setups require modular cooling systems, creating fresh demand for flexible thermal products. Government incentives and industrial clusters are boosting interest. The region plays a growing role in Belgium’s digital economy and attracts long-term infrastructure planning.

Competitive Insights:

- Schneider Electric Belgium

- Equans Belgium

- Engie Belgium

- Vertiv Group Corp.

- Daikin Industries Ltd.

- Delta Electronics, Inc.

- Johnson Controls International plc

- Airedale International Air Conditioning Ltd.

- Eaton Corporation

- Mitsubishi Electric Corporation

The competitive landscape in the Belgium Data Center Thermal Management Market shows strong presence of global and local players pushing innovation in cooling hardware, software, and services. Major firms like Schneider Electric Belgium and Vertiv focus on integrated solutions that support energy efficiency and modular deployment. Equans and Engie leverage regional expertise to tailor services for Belgian data center operators. Technology leaders such as Daikin and Delta Electronics invest in next‑gen cooling technologies that improve performance and lower operational costs. Johnson Controls and Eaton support clients with energy management systems that align with green mandates. Competition drives price optimization and faster delivery cycles. Smaller specialists like Airedale serve niche needs in air‑based and hybrid cooling segments. This dynamic mix boosts choice for investors and end users alike.

Recent Developments:

- In December 2025, Engie Belgium expanded energy infrastructure relevant to data center support by partnering with NHOA Energy on a 320 MWh Battery Energy Storage System at Drogenbos near Brussels.

- In June 2025, Equans Belgium advanced data center cooling via the FRAU (FRee cooling Autonomous Unit) technology deployment at Parc Crealys in Gembloux, achieving a PUE of 1.25. This patented solution leverages over 20 years of expertise in efficient thermal management.

- In February 2025, Schneider Electric strengthened its data center thermal management capabilities through the acquisition of a controlling interest in Motivair. This move, completed in February 2025, integrates advanced liquid cooling technologies like CDUs, RDHx, and chillers for high-density AI workloads.