Executive summary:

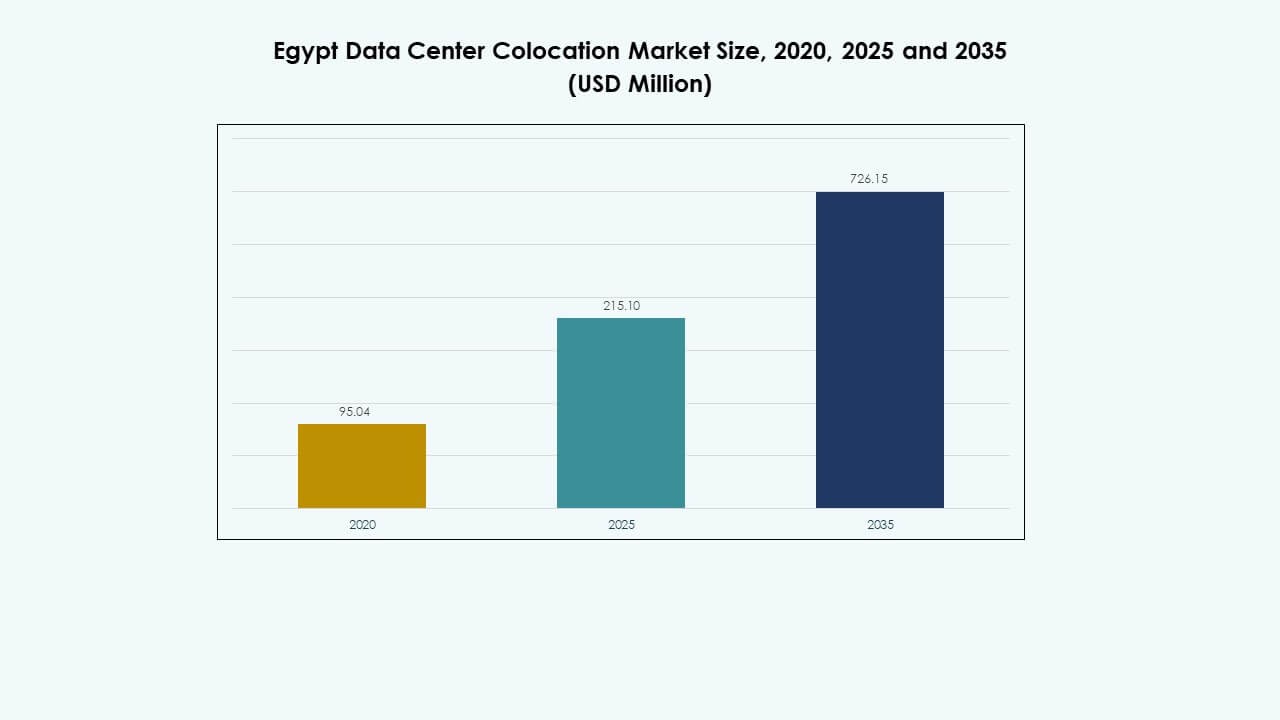

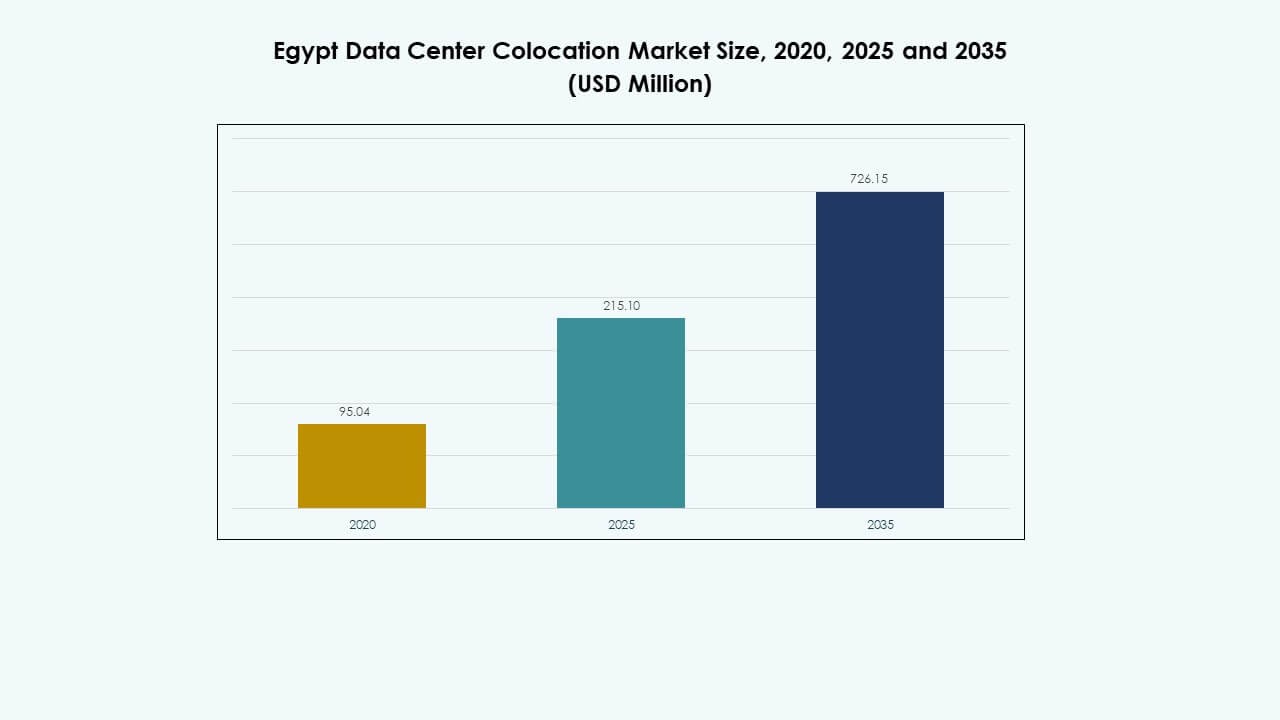

The Egypt Data Center Colocation Market size was valued at USD 95.04 million in 2020 to USD 215.10 million in 2025 and is anticipated to reach USD 726.15 million by 2035, at a CAGR of 12.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Egypt Data Center Colocation Market Size 2025 |

USD 215.10 Million |

| Egypt Data Center Colocation Market, CAGR |

12.83% |

| Egypt Data Center Colocation Market Size 2035 |

USD 726.15 Million |

Strong cloud adoption, expanding edge computing, and rising demand for scalable IT infrastructure are driving market growth. Enterprises are focusing on secure and efficient hosting environments to support digital transformation. Increased investments in AI, IoT, and automation are pushing operators to modernize infrastructure. Telecom partnerships and green technology adoption strengthen operational efficiency. This strategic positioning enhances business continuity and attracts global investors seeking stable and high-growth infrastructure markets.

Cairo leads the market due to its strong connectivity, infrastructure readiness, and enterprise presence. Coastal regions are emerging growth hubs, supported by subsea cable routes and renewable energy integration. Egypt’s position as a gateway linking Africa, Europe, and the Middle East drives international interest. This geographic advantage boosts expansion of hyperscale and edge deployments, making the country a regional colocation hub.

Market Drivers

Rising Digital Transformation and Expanding Cloud Infrastructure

Rapid digital transformation is creating strong demand for secure and scalable data center services. The Egypt Data Center Colocation Market benefits from the fast adoption of cloud platforms across public and private sectors. It supports advanced workloads and enables enterprises to modernize IT infrastructure. Widespread migration to hybrid cloud architectures improves agility and operational efficiency. Strong investments from telecom and cloud providers are accelerating infrastructure expansion. Global players are entering the market through joint ventures and long-term contracts. Government-backed digital programs are encouraging private investments. These shifts are driving stronger enterprise reliance on colocation services.

- For instance, Telecom Egypt partnered with Huawei Cloud in May 2024 to launch Huawei’s first locally hosted public cloud platform in Egypt and Northern Africa, hosted in Telecom Egypt’s Tier III data centers. According to Telecom Egypt’s official press release, the platform ensures connectivity to over 60 countries via 14 submarine systems, expanding to 18 systems by 2025, reinforcing Egypt’s position as a regional digital hub.

Growing Edge Computing Deployment and Advanced Connectivity Expansion

Rising adoption of edge computing solutions is reshaping network topologies and service delivery models. It creates demand for distributed, low-latency colocation sites across key urban centers. Telecom operators are enhancing international bandwidth through subsea cables and terrestrial fiber routes. High-speed connectivity improves service quality and supports data-heavy workloads. Global hyperscalers view the region as a strategic edge hub for Africa and Europe. New cross-border interconnections strengthen Egypt’s role in international data exchange. Companies are investing in scalable power and cooling infrastructure to support these deployments. It enhances service reliability and reduces latency for end users.

- For instance, in July 2025, Telecom Egypt and SubCom completed two landings of the SEA-ME-WE-6 subsea cable at Port Said and Ras Ghareb, connecting the Mediterranean and Red Sea through multiple terrestrial fiber crossings. The 21,700 km system, featuring 17 landing points and 10 fiber pairs with 12.6 Tbps per pair, strengthens Egypt’s global connectivity backbone and enhances its role as a regional interconnection hub.

Adoption of Emerging Technologies and Integration of AI-Driven Operations

Enterprises are integrating AI and automation in data center operations to optimize performance. The Egypt Data Center Colocation Market gains traction from smarter energy management, predictive maintenance, and resource orchestration. Automation helps reduce operational costs while improving uptime and service delivery. Advanced power monitoring systems support sustainable operations and high energy efficiency. AI-driven tools enable dynamic workload allocation and better capacity utilization. Service providers are expanding modular facilities to meet this growing demand. Strategic partnerships with technology vendors are boosting innovation. These developments strengthen operational resilience and scalability.

Strengthening Strategic Importance for Enterprises and Investors

The colocation ecosystem is becoming a critical enabler for enterprise digital strategy. Businesses prefer colocation to avoid heavy capital investment in building facilities. It supports faster deployment of services and improves network performance. Investors are drawn to Egypt due to its geographic location and strong connectivity. Long-term government programs ensure policy stability and encourage foreign direct investment. Colocation hubs support AI, IoT, and content delivery networks at scale. Global operators are securing strategic partnerships to expand capacity. These factors enhance Egypt’s role as a regional data infrastructure leader.

Market Trends

Increasing Investments in Hyperscale and Modular Data Center Facilities

Rising demand for scalable infrastructure is driving a shift toward hyperscale and modular facilities. The Egypt Data Center Colocation Market is witnessing significant capacity expansion by global and local operators. Modular facilities allow faster deployment and flexible scaling to match customer needs. Energy-efficient designs are becoming a key differentiator among colocation providers. Demand from AI, cloud, and fintech sectors is fueling growth. Investors are targeting large campuses near key fiber routes to optimize latency. Renewable energy integration is gaining importance in design strategies. These investments reflect confidence in Egypt’s long-term digital growth potential.

Accelerating Shift Toward Sustainable and Green Data Center Operations

Sustainability is becoming a defining trend in the colocation ecosystem. Operators are adopting advanced cooling systems and renewable energy sources to lower their carbon footprint. It aligns with national energy transition strategies and global corporate sustainability goals. Companies are investing in solar and wind-powered infrastructure to meet operational needs. Water-efficient technologies are gaining traction to reduce consumption. Energy management systems enable better monitoring and lower emissions. Green certifications are improving investor confidence and tenant attraction. The shift supports long-term operational resilience and regulatory compliance.

Expanding Role of Subsea Cable Systems and Carrier-Neutral Hubs

Subsea cables and carrier-neutral hubs are strengthening Egypt’s position as a global data exchange gateway. New cable routes are boosting bandwidth capacity and international connectivity. It enables faster data transfer between Africa, Europe, and Asia. Neutral interconnection points enhance network flexibility and cost efficiency. Global carriers are partnering with local operators to expand peering ecosystems. High-capacity hubs reduce latency for global traffic flows. Colocation providers are leveraging these networks to attract enterprise clients. The trend supports the development of a robust digital infrastructure backbone.

Rapid Integration of AI and Automation in Data Center Ecosystems

AI and automation are transforming data center management and operational strategies. Predictive analytics enable early fault detection and performance optimization. It helps improve energy utilization and reduce downtime risks. Automation streamlines capacity planning and infrastructure scaling. Intelligent cooling and power systems support efficiency improvements. Enterprises prefer colocation partners that provide AI-driven service assurance. Automation tools also help in cybersecurity and threat detection. This trend positions Egypt as an emerging center for intelligent infrastructure solutions.

Market Challenges

High Capital Expenditure and Infrastructure Modernization Constraints

High upfront investment remains a critical challenge for operators and investors. The Egypt Data Center Colocation Market faces rising costs for land, power, and equipment. Many legacy facilities require extensive upgrades to match global standards. Infrastructure modernization involves integrating new power systems and advanced cooling technologies. Complex regulatory procedures can slow down large-scale development projects. Limited availability of skilled technicians adds pressure on operational efficiency. High costs make entry difficult for smaller operators. These factors can slow capacity expansion and reduce competitiveness in international markets.

Power Supply Dependence and Regulatory Barriers Impacting Scalability

Stable and cost-effective power supply is essential for reliable data center operations. Fluctuations in grid stability can disrupt service levels and increase operational risks. Regulatory approval processes often take longer, delaying project timelines. It can affect investor confidence and slow new market entries. Limited renewable energy integration creates sustainability challenges. Land-use restrictions can limit site development in prime areas. Coordination between utility providers and regulators is often complex. Addressing these barriers is critical for sustaining long-term market growth and infrastructure reliability.

Market Opportunities

Strategic Geographic Advantage and Emerging Edge Deployment Potential

Egypt’s location offers a unique advantage for serving multiple international markets. The Egypt Data Center Colocation Market can leverage its position as a transit hub for global traffic. Proximity to major subsea cables supports low-latency services and regional edge deployments. Enterprises can expand operations faster through strategic interconnection points. Investors can benefit from strong demand for AI, IoT, and content delivery. New campuses can serve African, Middle Eastern, and European customers efficiently. This geographic edge enhances its role in global network infrastructure.

Policy Support and Rising Private Sector Participation Driving Growth

Supportive government policies are encouraging both domestic and foreign investments. Tax incentives and clear digital transformation goals create a stable investment climate. Private telecom and cloud operators are expanding service portfolios aggressively. Infrastructure development aligns with national connectivity strategies. Local and global players are forming partnerships to accelerate capacity building. These initiatives help attract hyperscalers and enterprise customers. Growing market confidence ensures steady expansion opportunities.

Market Segmentation

By Type

Retail colocation holds the largest share in the Egypt Data Center Colocation Market due to its flexibility and cost efficiency. It allows businesses to scale infrastructure without heavy capital expenditure. Wholesale colocation is expanding, driven by demand from hyperscalers and telecom operators. Hybrid cloud colocation is gaining traction as enterprises adopt multi-cloud strategies. Retail providers offer strong interconnection options and managed services. This segment’s growth is supported by rising digital transformation and startup activity.

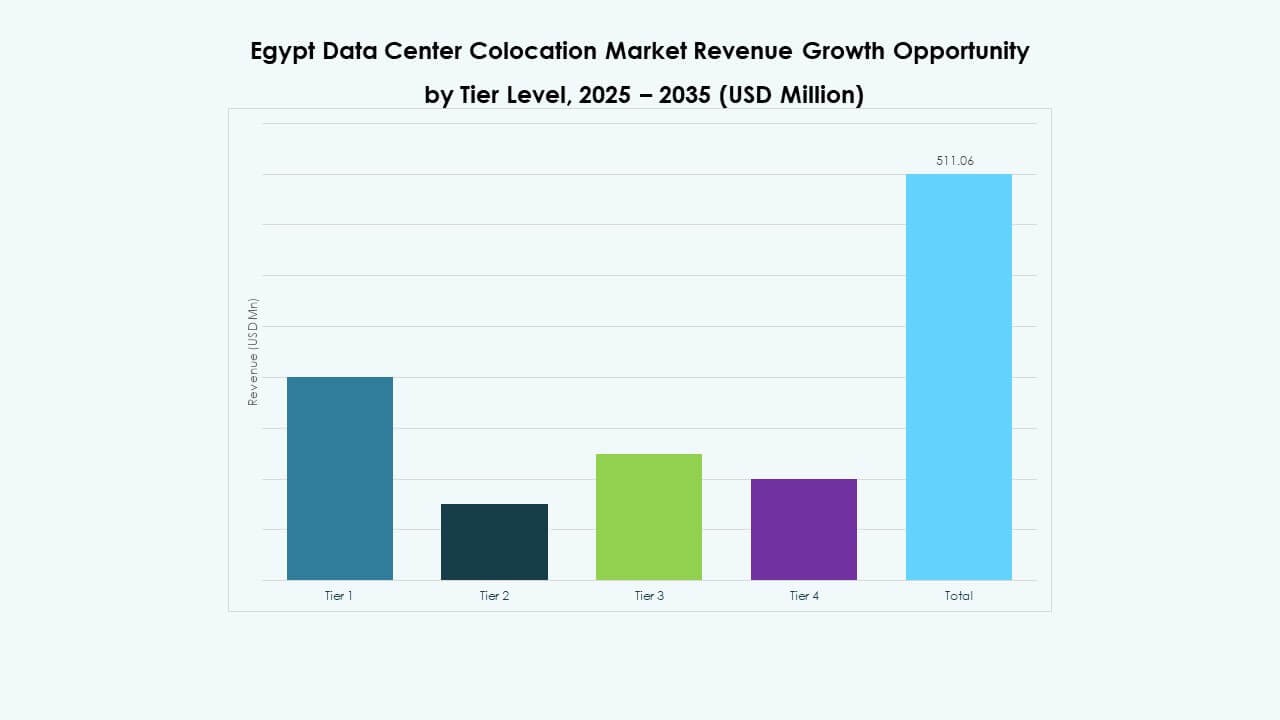

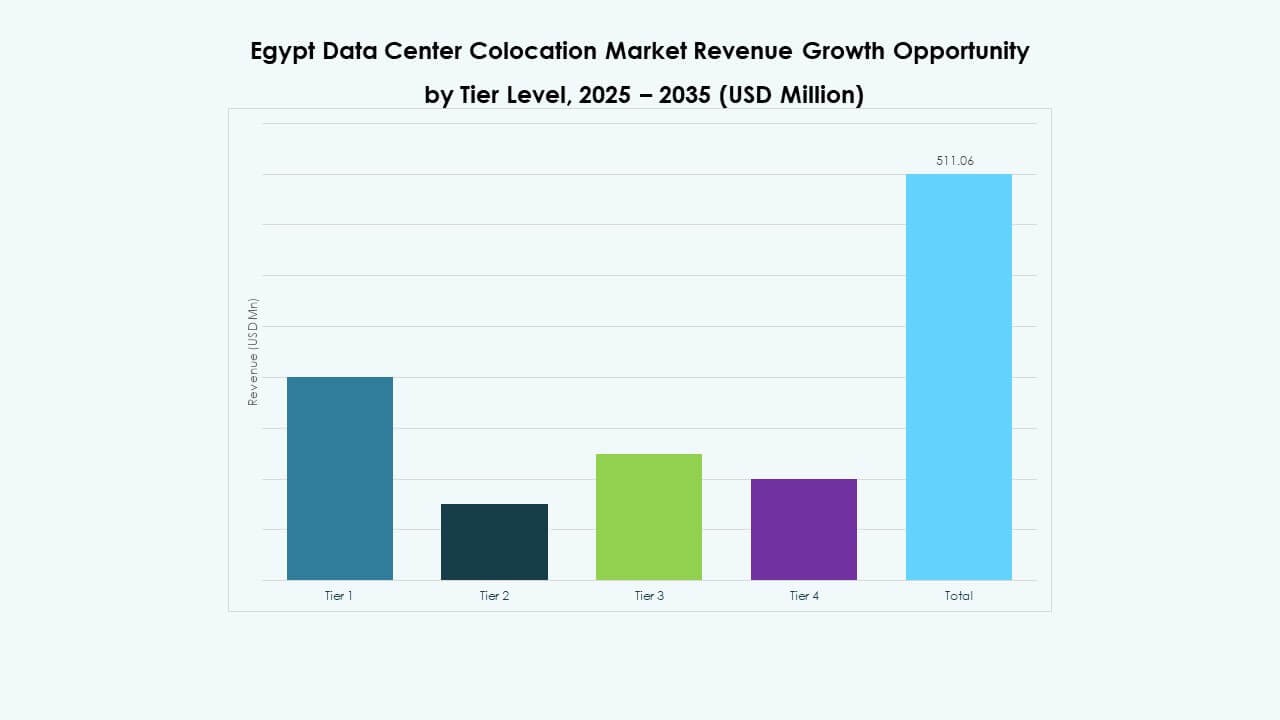

By Tier Level

Tier 3 facilities dominate the Egypt Data Center Colocation Market, offering a balance of reliability and cost efficiency. They support advanced workloads and meet international uptime standards. Tier 4 facilities are expanding with hyperscale investments focusing on maximum redundancy. Tier 2 and Tier 1 cater to smaller workloads but face competition from higher-tier data centers. Strong investment in Tier 3 and Tier 4 reflects demand for mission-critical hosting. This trend aligns with growing AI and cloud workloads.

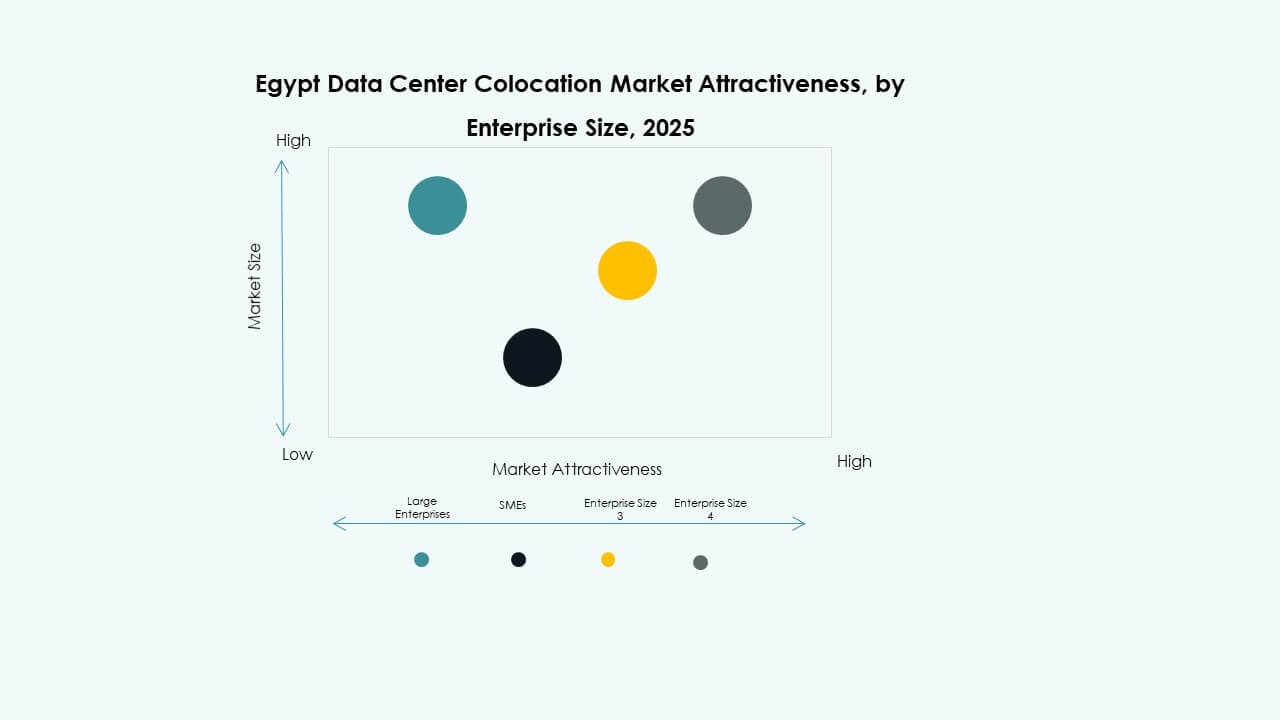

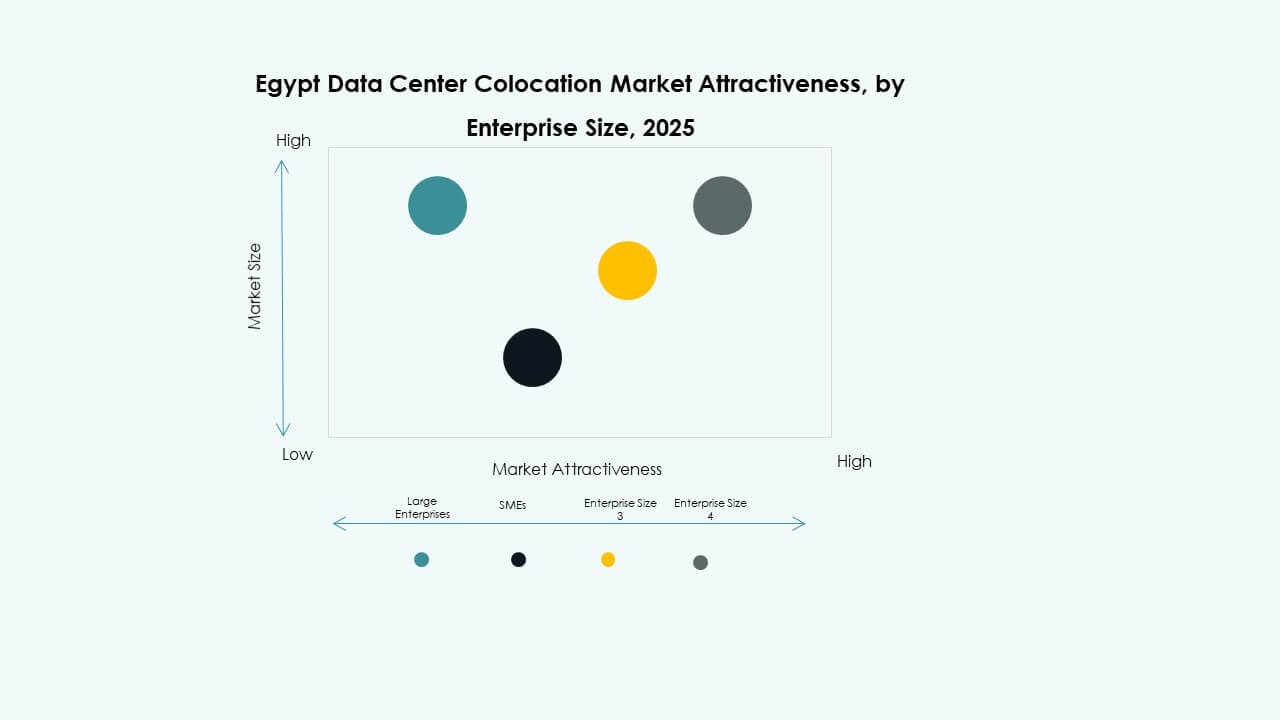

By Enterprise Size

Large enterprises hold the dominant share of the Egypt Data Center Colocation Market due to their extensive infrastructure requirements. These organizations demand high-capacity racks, strong connectivity, and strict security. SMEs are increasing their adoption to reduce IT costs and improve service delivery. Cloud-first strategies are driving hybrid deployments among growing businesses. Service providers are offering flexible pricing and bundled services. This shift supports stronger market diversification and customer base expansion.

By End User Industry

The IT & Telecom sector leads the Egypt Data Center Colocation Market, driven by rising connectivity demands and data consumption. BFSI and healthcare industries are expanding their reliance on secure and compliant colocation facilities. Media and entertainment players use these facilities for content distribution and streaming. Retail and other sectors are adopting hybrid infrastructure to enhance digital presence. Diverse demand across industries ensures stable market growth and infrastructure utilization.

Regional Insights

Cairo and Greater Cairo Region – Leading Hub with 57.6% Market Share

Cairo dominates the Egypt Data Center Colocation Market due to its advanced infrastructure, fiber connectivity, and large enterprise base. The region hosts major telecom and hyperscale deployments. Strong availability of skilled workforce supports rapid service scaling. Proximity to international subsea cables enhances its role as a regional hub. High enterprise demand and robust policy support drive expansion. Data center operators are investing in Tier 3 and Tier 4 facilities to meet global standards. Cairo remains the core focus for newest developments.

- For instance, in September 2025, Helios Investment Partners received preliminary approval from Telecom Egypt’s board to acquire a 75–80% stake in the company’s Regional Data Hub (RDH) subsidiary. The multi-phase Cairo data center campus includes a 2.5 MW Tier III-certified Phase 1, which reached full utilization within its first year, and a 4.6 MW Tier III Design Certified Phase 2 registered under LEED green standards.

Alexandria and Northern Coastal Corridor – Emerging Growth Zone with 24.1% Market Share

The Northern Coastal Corridor is becoming a critical zone for new edge deployments and subsea cable landings. Alexandria benefits from strong fiber interconnections and access to renewable energy resources. It is attracting hyperscale operators seeking low-latency services. Strong port connectivity enhances logistics and infrastructure scalability. Investors are focusing on modular data center projects in this region. The strategic coastal location strengthens Egypt’s global network positioning. Growth is driven by demand for international interconnection capacity.

- For instance, on December 18, 2023, Egypt’s Ministry of Communications and Information Technology (MCIT) and the UAE Ministry of Investment signed an MoU to jointly develop 1 GW of data center capacity in Egypt. The agreement focuses on accelerating digital infrastructure growth and supporting national digital economy goals.

Suez Canal Economic Zone and Other Regions – Expanding Edge Potential with 18.3% Market Share

The Suez Canal Economic Zone is gaining traction for new data center investments. The Egypt Data Center Colocation Market is supported by large-scale infrastructure projects near logistics and trade routes. Power availability and land access make it attractive for large deployments. Edge data center development supports regional traffic optimization. Companies are exploring partnerships to expand into underserved areas. These regions are expected to play a larger role in the long-term digital strategy. Strategic investments will accelerate their maturity in coming years.

Competitive Insights:

- Raya Data Center

- Telecom Egypt

- Link DSL

- Vodafone Egypt

- Digital Realty Trust

- Amazon Web Services (AWS)

- Google Cloud

- CoreSite

- CyrusOne

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

The competitive landscape in the Egypt Data Center Colocation Market is shaped by a mix of local operators and global hyperscalers. It is experiencing rapid infrastructure expansion, strategic partnerships, and strong investment inflows. Telecom Egypt and Raya Data Center hold a strong domestic presence, supported by strategic capital commitments. Global leaders such as AWS, Google Cloud, and Equinix are increasing their regional footprint to capture growing enterprise demand. Partnerships with telecom operators strengthen network interconnectivity and edge deployment. Competitive differentiation focuses on energy-efficient design, scalability, and security standards. Global firms bring advanced operational capabilities, while local players provide market access and regulatory alignment. This combination creates a dynamic and competitive environment that attracts new entrants and fuels sustained infrastructure growth.

Recent Developments:

- In September 2025, Telecom Egypt granted preliminary board approval for Helios Investment Partners’ binding offer to acquire a 75-80% stake in the company’s Regional Data Hub (RDH). The deal values RDH at approximately $230 million, potentially rising to $260 million if certain performance targets are met. The final transaction is subject to regulatory approvals and restructuring, positioning the data center for significant expansion and further development of Egypt’s digital infrastructure.

- In December 2024, Raya Holding for Financial Investments, through its subsidiary Raya Data Center, secured a strategic USD 15 million investment from Africa50, a Pan-African infrastructure fund, to construct a new Tier III data center in Egypt. Supported by an additional USD 10 million from Raya Information Technology, this USD 25 million initiative aims to strengthen Egypt’s digital ecosystem and promote green infrastructure adoption.