Executive summary:

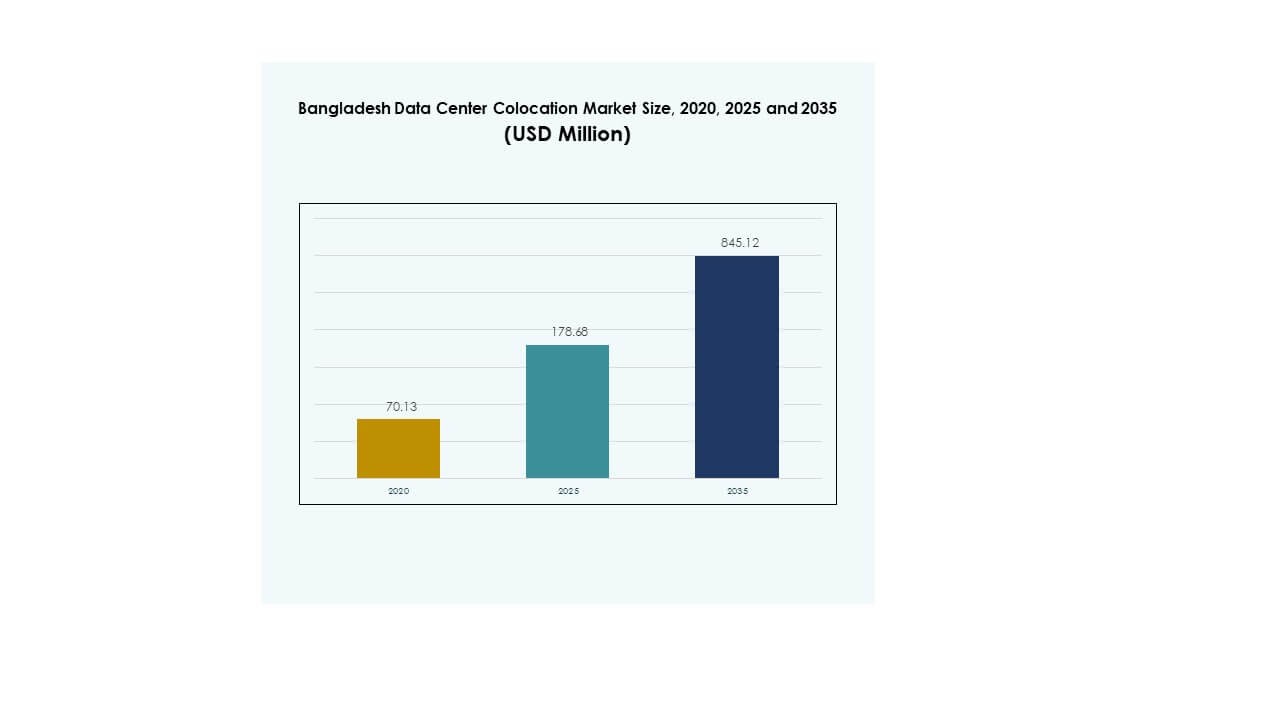

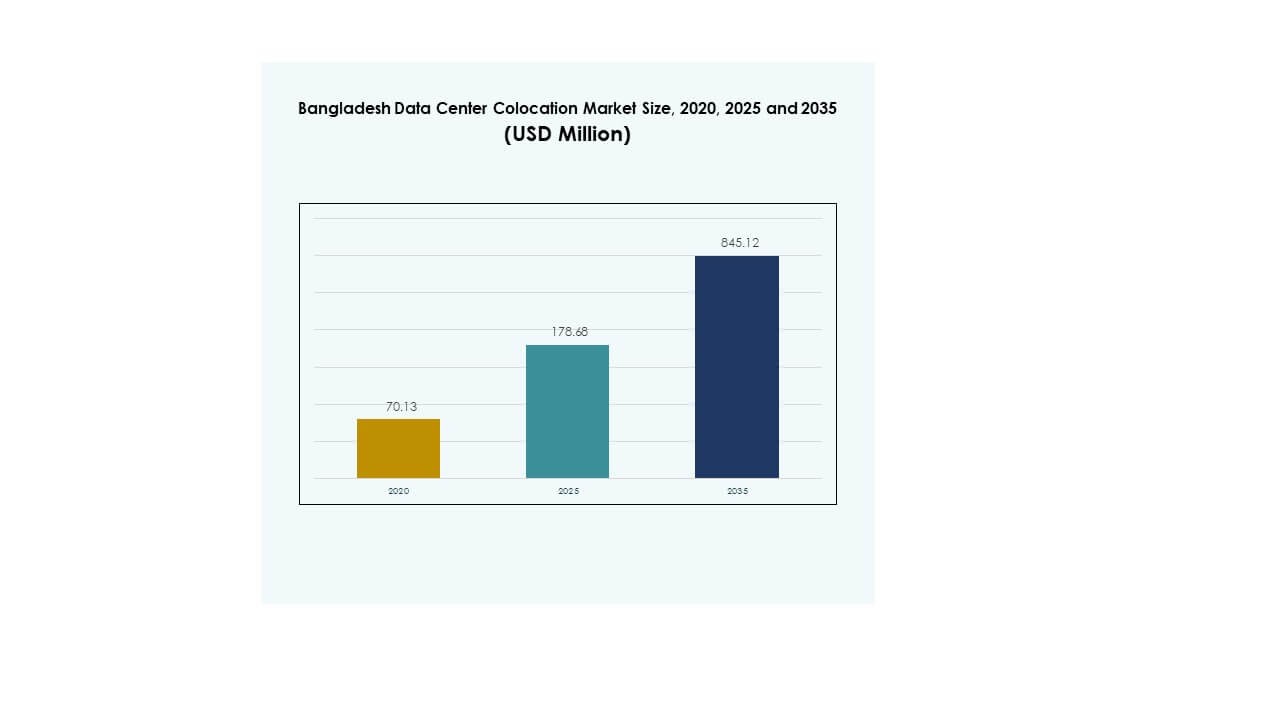

The Bangladesh Data Center Colocation Market size was valued at USD 70.13 million in 2020 to USD 178.68 million in 2025 and is anticipated to reach USD 845.12 million by 2035, at a CAGR of 16.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Bangladesh Data Center Colocation Market Size 2025 |

USD 178.68 Million |

| Bangladesh Data Center Colocation Market, CAGR |

16.72% |

| Bangladesh Data Center Colocation Market Size 2035 |

USD 845.12 Million |

The market is expanding rapidly due to growing digital transformation across industries. Enterprises are investing in advanced infrastructure to support AI, IoT, and edge computing. Power and cooling innovation, combined with modern connectivity solutions, is driving stronger data center capabilities. Strategic alliances between domestic and international players are improving service availability. It is becoming an attractive investment hub for businesses aiming to scale digital operations securely and efficiently.

Dhaka leads the market due to its advanced infrastructure and strong connectivity backbone. Secondary regions such as Chittagong are emerging as strategic colocation hubs supported by expanding fiber networks and government digital programs. This regional structure strengthens nationwide coverage and improves access for enterprises. It also enhances investment attractiveness, supporting long-term ecosystem growth.

Market Drivers

Rapid Digital Transformation and Cloud Migration Accelerating Infrastructure Demand

The Bangladesh Data Center Colocation Market is expanding with strong digital transformation across industries. Telecom, BFSI, and government sectors are driving demand for secure hosting environments. Enterprises are shifting core systems to colocation facilities to reduce operational costs and improve uptime. The adoption of cloud, AI, and IoT solutions is increasing infrastructure needs. Hyperscale and edge models are gaining attention due to growing application loads. Investors are seeing steady returns from scalable infrastructure models. Businesses prefer colocation to improve security and compliance standards. Strategic partnerships with global operators are strengthening the ecosystem.

- For instance, on January 27, 2025, the Asian Development Bank (ADB) and the Bangladesh Telecommunications Company Limited (BTCL) signed an MoU to develop the country’s first green data center in Chattogram, under a Public-Private Partnership (PPP) model. The facility will be powered by renewable energy and meet international uptime and scalability standards, offering colocation services to both government and private enterprises.

Innovation in Power and Cooling Technologies Enhancing Facility Efficiency

Advanced power and cooling technologies are improving operational performance in colocation facilities. Operators are deploying energy-efficient infrastructure to meet sustainability goals and lower costs. Liquid cooling and modular UPS systems are becoming standard in high-density environments. These innovations ensure stability and improve energy use effectiveness. Enterprises seek providers that offer both reliability and environmental responsibility. Efficiency improvements make facilities more attractive to multinational clients. This technological advancement strengthens the competitiveness of the local ecosystem. It creates opportunities for sustainable growth and modernization of legacy infrastructure.

Government Support and Regulatory Reforms Driving Market Maturity

Policy changes are playing a critical role in building a stable and secure colocation landscape. Government initiatives are focusing on data localization, cybersecurity frameworks, and foreign investment incentives. These steps are encouraging international operators to invest in advanced facilities. Regulatory clarity reduces operational risk for investors and enterprises. Local players are aligning infrastructure with global compliance standards. This supportive environment accelerates infrastructure deployment and adoption. It builds confidence among businesses planning long-term technology strategies. These shifts are making the market strategically significant in South Asia.

Strategic Location and Connectivity Enhancing Investment Appeal

Bangladesh offers a strategic location with strong regional connectivity advantages. Its position near major South Asian trade routes attracts hyperscale operators. Submarine cable upgrades and high-speed backbone networks strengthen bandwidth capacity. Enterprises benefit from low-latency connectivity to regional hubs. Investors find strong opportunities in proximity to high-growth digital economies. Urban centers are becoming hotspots for new facilities with efficient power availability. The strengthening of carrier-neutral networks improves market attractiveness. It creates a stable environment for enterprise expansion and digital growth.

- For instance, Bangladesh Submarine Cables PLC (BSCCL) approved an upgrade of the SEA-ME-WE-4 cable, adding 3,800 Gbps capacity and increasing its total capacity to 4,600 Gbps. The company is also a confirmed stakeholder in the SEA-ME-WE-6 consortium to further strengthen international connectivity.

Market Trends

Rising Hyperscale Adoption and Edge Expansion Transforming Market Landscape

The Bangladesh Data Center Colocation Market is witnessing a notable shift toward hyperscale deployments. Large operators are building facilities designed for AI and high-performance computing. Edge nodes are expanding to improve latency-sensitive applications. Telecom operators are investing in dense interconnect fabrics for 5G enablement. Enterprises are seeking scalable rack spaces for flexible IT deployment. The combination of hyperscale and edge models is reshaping network architecture. This evolution supports digital services growth. It creates opportunities for faster innovation cycles across sectors.

Integration of Renewable Energy Sources Strengthening Sustainability Goals

Operators are integrating renewable energy sources to meet sustainability targets and regulatory requirements. Solar and hybrid energy models are being adopted in both urban and semi-urban centers. These practices reduce operational expenses and improve power reliability. Clients prefer green facilities for meeting their ESG commitments. The adoption of renewable energy creates long-term cost advantages. Global players see green certification as a competitive differentiator. It strengthens brand value and investment confidence. This shift positions the market as an emerging sustainable infrastructure hub.

Increased Adoption of Software-Defined Infrastructure Improving Flexibility

The industry is embracing software-defined infrastructure to boost agility and reduce manual processes. SDN and automation tools enhance monitoring and optimize energy use. It enables rapid scaling and better load balancing across facilities. Clients gain control over workload distribution with advanced orchestration features. Real-time visibility improves network performance. Enterprises prefer flexible deployment models for AI, IoT, and hybrid workloads. These capabilities make facilities more attractive to international clients. It aligns with modern enterprise IT strategies.

Rising Demand for Carrier-Neutral Facilities Boosting Interconnectivity

Carrier-neutral colocation facilities are gaining strong traction among enterprises and cloud providers. Interconnection hubs offer greater flexibility and vendor choice. These setups reduce network costs and improve redundancy. High-speed fiber networks support robust cross-connect capabilities. Enterprises prefer vendor-agnostic models for secure and scalable deployment. This structure enables rapid integration with multiple service providers. It drives ecosystem maturity and encourages multi-cloud adoption. It also creates opportunities for advanced service delivery models.

Market Challenges

Power Constraints and Infrastructure Gaps Limiting Growth Potential

The Bangladesh Data Center Colocation Market faces operational challenges due to power constraints and infrastructure gaps. Unstable grid supply affects large-scale deployment plans. Facilities often depend on backup systems, increasing operational costs. Limited high-capacity power availability in secondary cities delays expansion. Energy efficiency initiatives require high capital investment, which slows smaller players. Power reliability remains a concern for international hyperscale operators. These issues can impact investor confidence in long-term strategies. It creates a barrier for rapid infrastructure scaling and technological advancement.

Regulatory Complexity and Skill Shortages Slowing Market Evolution

The regulatory environment involves multiple approvals and overlapping policies, which increase operational delays. Investors face uncertainty around evolving data protection and localization frameworks. These challenges discourage faster entry for global operators. The industry also lacks a skilled workforce capable of managing hyperscale facilities. Technical training and specialized certifications remain limited in local markets. This talent gap restricts operational excellence and innovation. It forces companies to depend on foreign expertise. It slows ecosystem maturity and strategic growth.

Market Opportunities

Rising Enterprise Digitalization Creating Expansion Potential in New Regions

The Bangladesh Data Center Colocation Market offers strong opportunities due to enterprise digitalization. Mid-sized businesses are shifting toward hybrid and cloud-supported infrastructure. Secondary cities are opening for new colocation builds supported by improving connectivity. This decentralization increases service availability and reduces latency. Retail, telecom, and financial sectors are expanding digital operations. It enables operators to capture underserved segments and scale rapidly. Investors view this expansion as a stable growth avenue. It drives the diversification of revenue streams.

Strategic Partnerships and Foreign Investments Accelerating Market Expansion

Strategic alliances between local operators and global hyperscale providers are growing. These collaborations bring technology transfer and capital infusion into the ecosystem. International investments help improve power stability, cooling infrastructure, and connectivity. Such partnerships also improve compliance with global standards. Stronger alliances strengthen the local value chain. It improves competitiveness against regional markets. This environment attracts more institutional investors seeking sustainable infrastructure opportunities. It builds a stronger digital economy foundation.

Market Segmentation

By Type

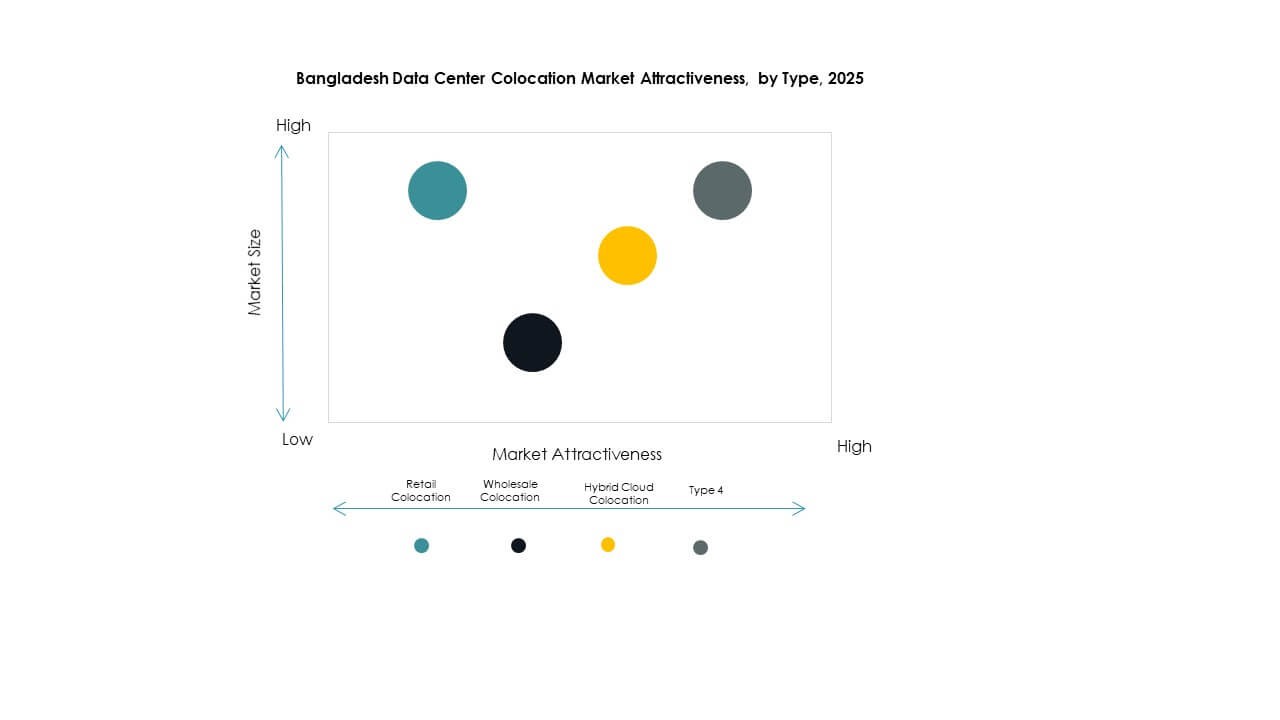

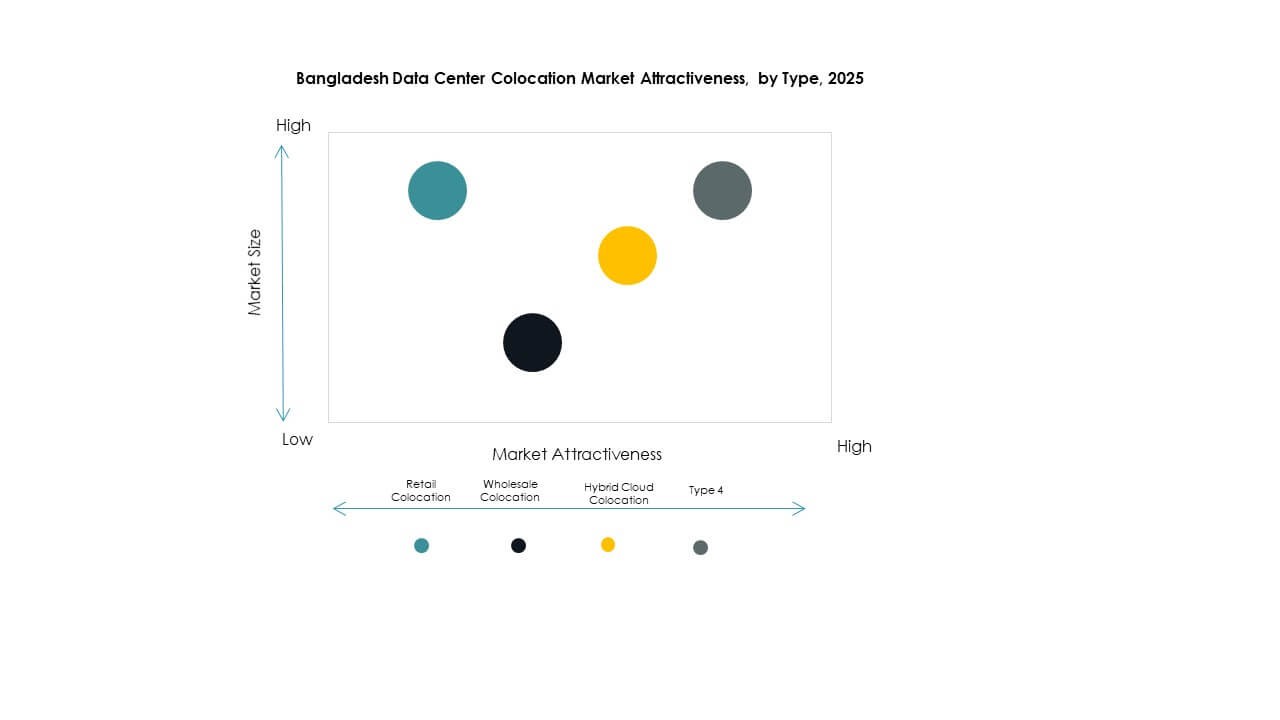

Retail colocation dominates the Bangladesh Data Center Colocation Market with a strong share due to its flexible contracts and scalability. Enterprises prefer retail models for rapid deployment and lower capital costs. Wholesale colocation is gaining traction from hyperscale operators seeking dedicated space. Hybrid cloud colocation is emerging as businesses adopt multi-cloud strategies. Growing enterprise demand for cost efficiency strengthens retail segment leadership. Strategic expansion by providers supports this growth. This segment remains a primary driver for market expansion.

By Tier Level

Tier 3 facilities hold a dominant share in the Bangladesh Data Center Colocation Market due to strong uptime standards and balanced costs. Tier 4 facilities are expanding slowly with hyperscale investment. Tier 1 and Tier 2 serve smaller enterprises requiring basic availability. Enterprises prefer Tier 3 for high reliability and efficient power usage. This tier supports strong SLA commitments, attracting BFSI and telecom clients. Market players continue upgrading facilities to meet global compliance. This dominance supports overall infrastructure maturity.

By Enterprise Size

Large enterprises lead the Bangladesh Data Center Colocation Market due to their complex IT infrastructure and need for scalability. SMEs are increasingly adopting colocation to avoid capital expenditure on in-house data centers. Large enterprises focus on high-density workloads and disaster recovery capabilities. SMEs seek flexible pricing and managed services. This dual demand drives balanced market expansion. Providers are tailoring offerings to match both segments’ requirements. Large enterprise dominance ensures stable revenue streams for operators.

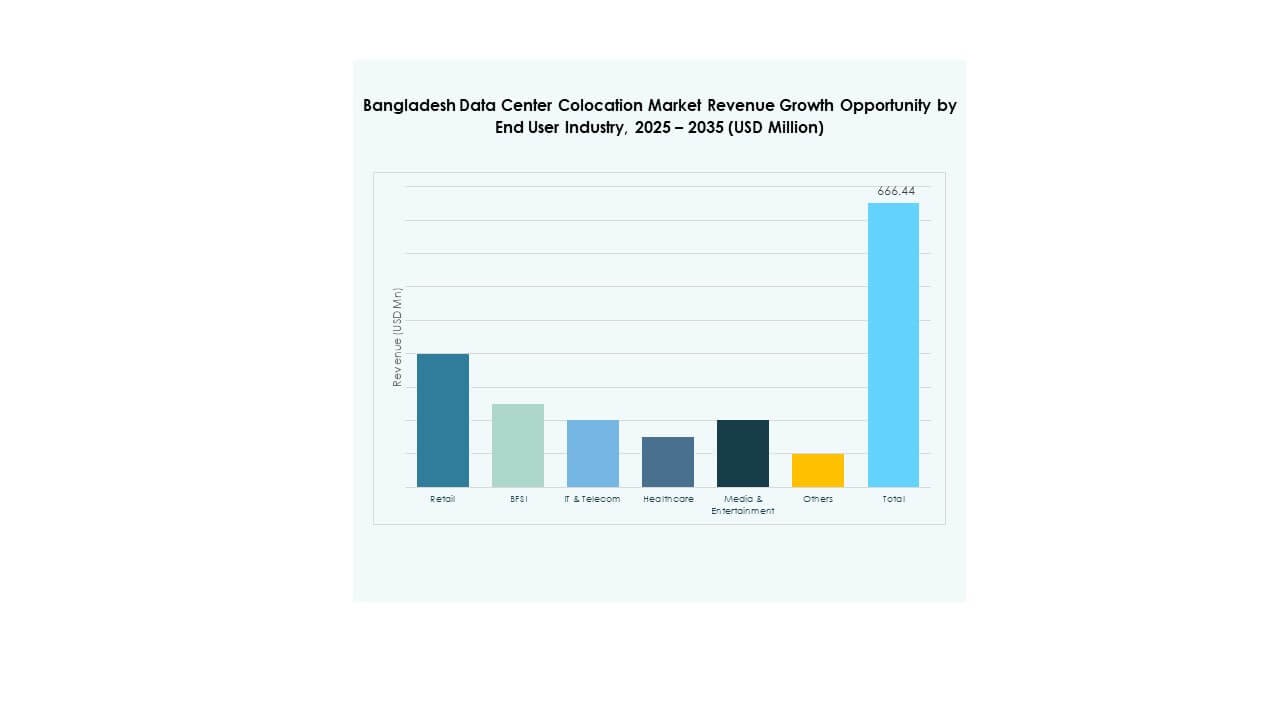

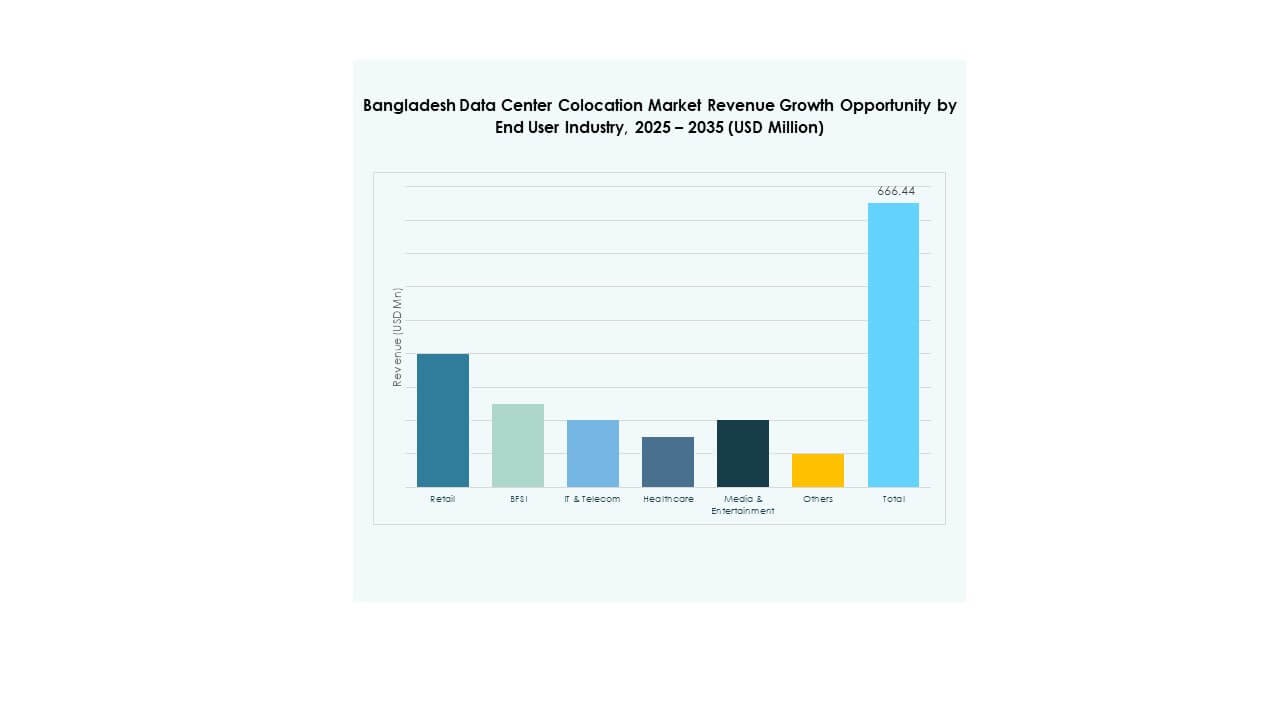

By End User Industry

IT & Telecom dominates the Bangladesh Data Center Colocation Market due to growing data traffic and cloud migration. BFSI and retail are expanding their footprints to improve uptime and security. Healthcare is adopting colocation for compliance and secure patient data hosting. Media and entertainment rely on scalable bandwidth for content delivery. Other sectors are adopting colocation for digital transformation. IT & Telecom leadership supports rapid infrastructure investment. Strong demand from these verticals ensures consistent market growth.

Regional Insights

Dhaka Region: Leading Hub with 62.3% Market Share

Dhaka leads the Bangladesh Data Center Colocation Market with 62.3% share, driven by strong telecom and BFSI activity. Its advanced infrastructure and reliable connectivity support hyperscale deployment. Dhaka hosts most Tier 3 facilities, making it a primary enterprise hub. High fiber availability enables low-latency applications. Global investors prefer Dhaka for strategic location advantages. It remains the focal point for most expansion projects. This dominance sets the pace for the market’s technological maturity.

- For instance, Yotta Infrastructure partnered with Shamsul Alamin Group to develop a hyperscale data center park at Bangabandhu Hi-Tech City, Kaliakoir, featuring two buildings with 4,800 racks and 28.8MW IT load capacity. The first facility is scheduled for completion by Q3 2024, representing an investment of Tk 2,000 crore (≈USD 190.5 million).

Chittagong Region: Emerging Growth Center with 24.5% Market Share

Chittagong holds 24.5% market share with rising investment in new colocation builds. Its port city status attracts logistics and manufacturing enterprises. Improved connectivity and power infrastructure are strengthening its appeal. Mid-sized facilities are expanding to support secondary demand. Businesses seek cost-effective alternatives to Dhaka. Government support for regional digital hubs encourages growth. It is evolving into a strategic colocation zone with increasing market relevance.

Other Regions: Developing Hubs with 13.2% Market Share

Other regions hold 13.2% market share and are witnessing steady development. Secondary cities are benefiting from nationwide fiber backbone projects. Local enterprises are demanding lower latency solutions. Smaller data center builds are increasing service availability. Operators are exploring edge models to meet localized needs. These regions are expected to attract new investments in coming years. It creates a balanced regional distribution of infrastructure capacity.

- For instance, Fiber@Home operates Felicity IDC Limited, a Tier III data center in Kaliakoir, Gazipur. The facility spans over 100,000 square feet, houses 500 racks, and supports 5 MW power capacity with ISO 9001, ISO 14001, and ISO 27001 certifications. It plays a key role in supporting Fiber@Home’s nationwide fiber network.

Competitive Insights:

- Bangladesh Data Center Company Limited (BDCCL)

- Mango Teleservices

- Grameenphone

- Robi

- Google Cloud

- Bangladesh Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Bangladesh Data Center Colocation Market features a mix of strong local operators and global hyperscale leaders. Local companies focus on domestic connectivity, government projects, and compliance-based hosting. Global providers bring scalable infrastructure, advanced cooling systems, and strong interconnection capabilities. Partnerships between foreign hyperscale players and local operators are expanding service capacity and network reach. Competition is intensifying through price optimization, high-density rack offerings, and green energy adoption. Many firms are investing in Tier 3 and Tier 4 facilities to attract enterprise clients. It reflects a competitive environment shaped by rapid digital transformation and growing regional demand. Strategic differentiation is increasingly driven by energy efficiency, connectivity quality, and integration with multi-cloud ecosystems.

Recent Developments:

- In October 2025, Grameenphoneentered into a new strategic partnership with Sumash Tech Ltd to enhance nationwide access to digital connectivity products. The initiative will make Grameenphone’s smart IoT portfolio—such as vehicle tracking systems, pocket routers, and AI-enabled home devices—available at Sumash Tech’s 15 outlets across Bangladesh.

- In May 2025, Robi Axiataalso partnered with FloSolar Solutions and GreenPower Asia (Volta Groupe subsidiary) to develop a 100MW solar project under a long-term corporate power purchase agreement. The initiative is intended to power its data center operations sustainably and reduce CO₂ emissions by over 68,000 tons annually.