Executive summary:

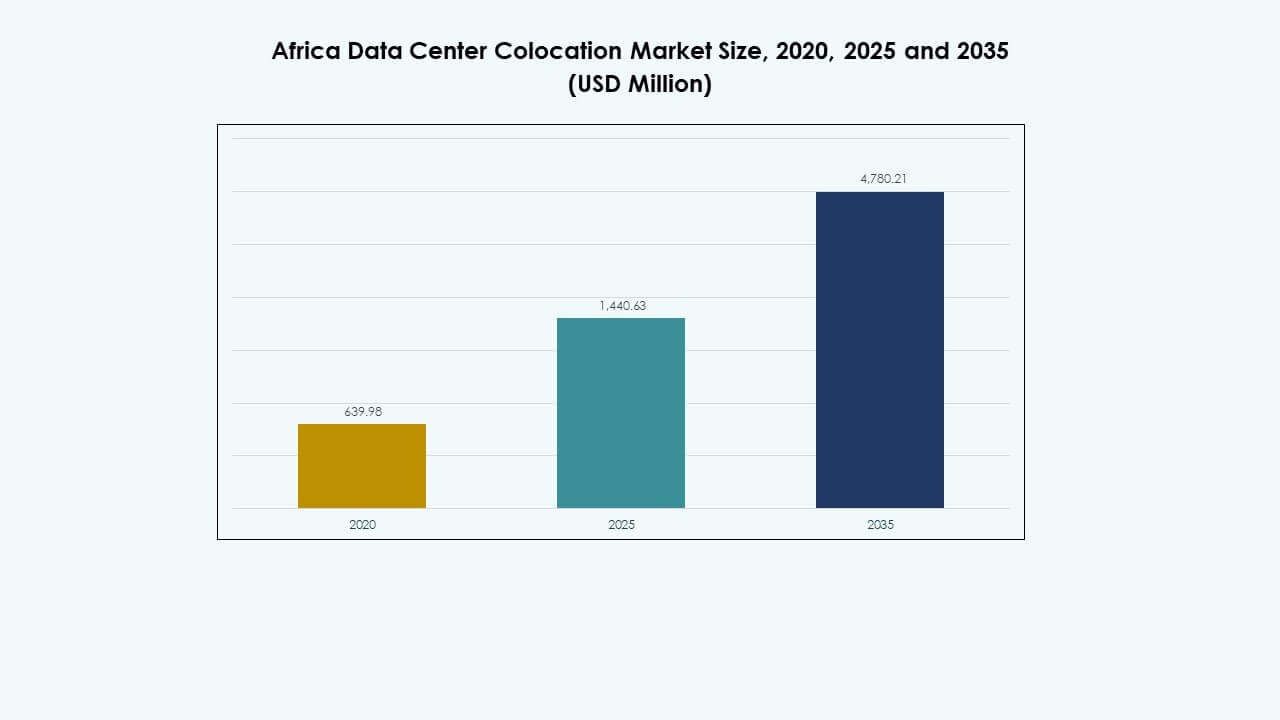

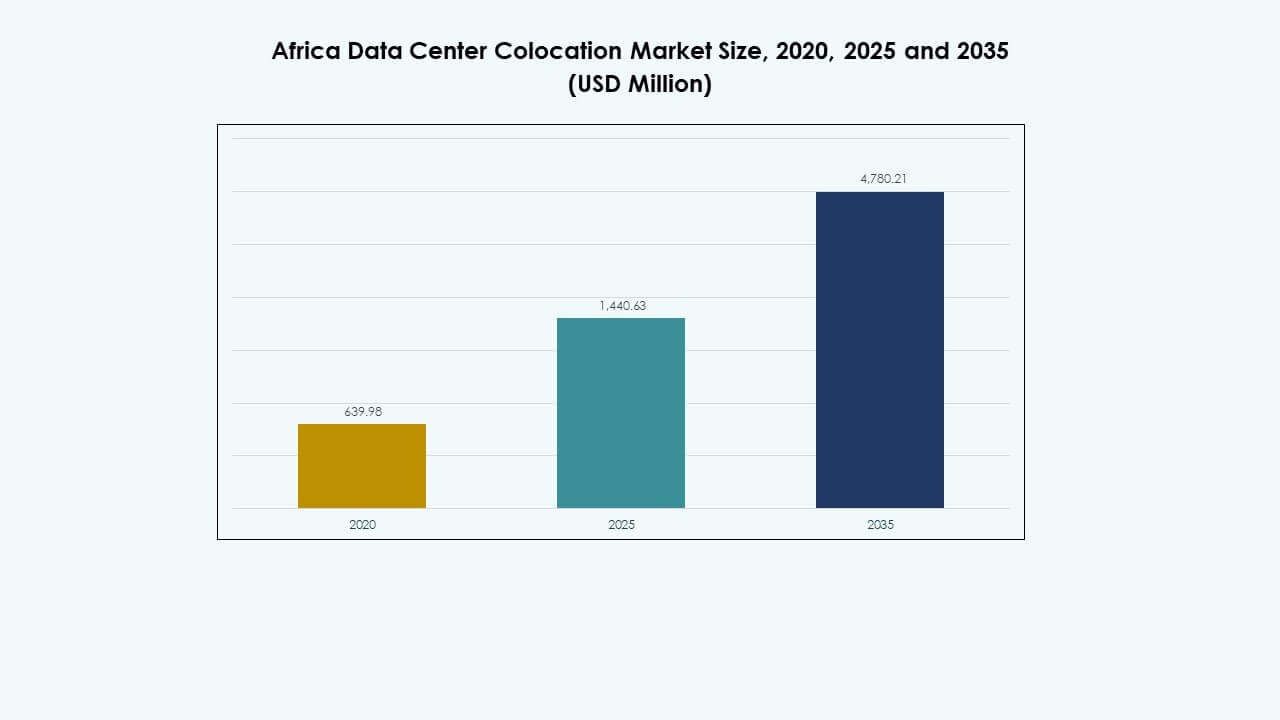

The Africa Data Center Colocation Market size was valued at USD 639.98 million in 2020 to USD 1,440.63 million in 2025 and is anticipated to reach USD 4,780.21 million by 2035, at a CAGR of 12.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Africa Data Center Colocation Market Size 2025 |

USD 1,440.63 Million |

| Africa Data Center Colocation Market, CAGR |

12.66% |

| Africa Data Center Colocation Market Size 2035 |

USD 4,780.21 Million |

Rising cloud adoption, AI-driven innovation, and enterprise digitalization are fueling market growth. Businesses are shifting critical workloads to colocation facilities to enhance scalability, security, and operational reliability. Edge computing, regulatory support, and sustainable infrastructure investments are strengthening the ecosystem. The market plays a strategic role in improving connectivity, enabling faster service delivery, and attracting strong investor interest across industries.

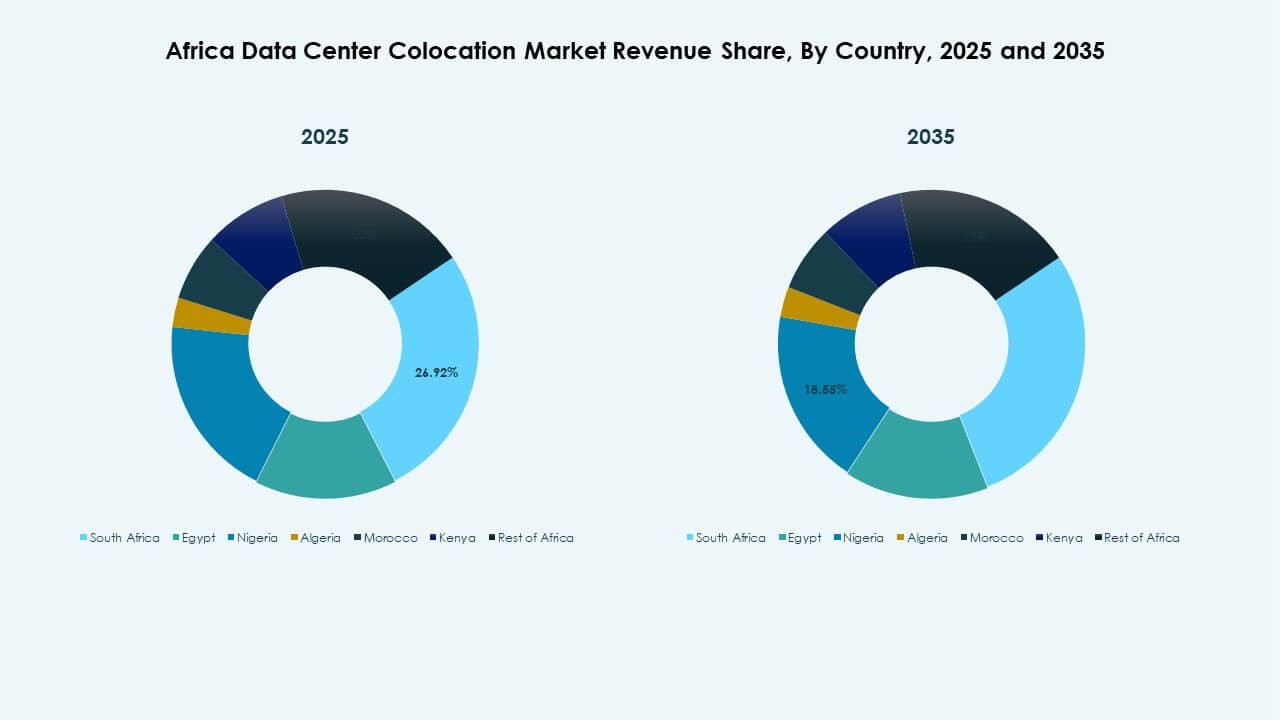

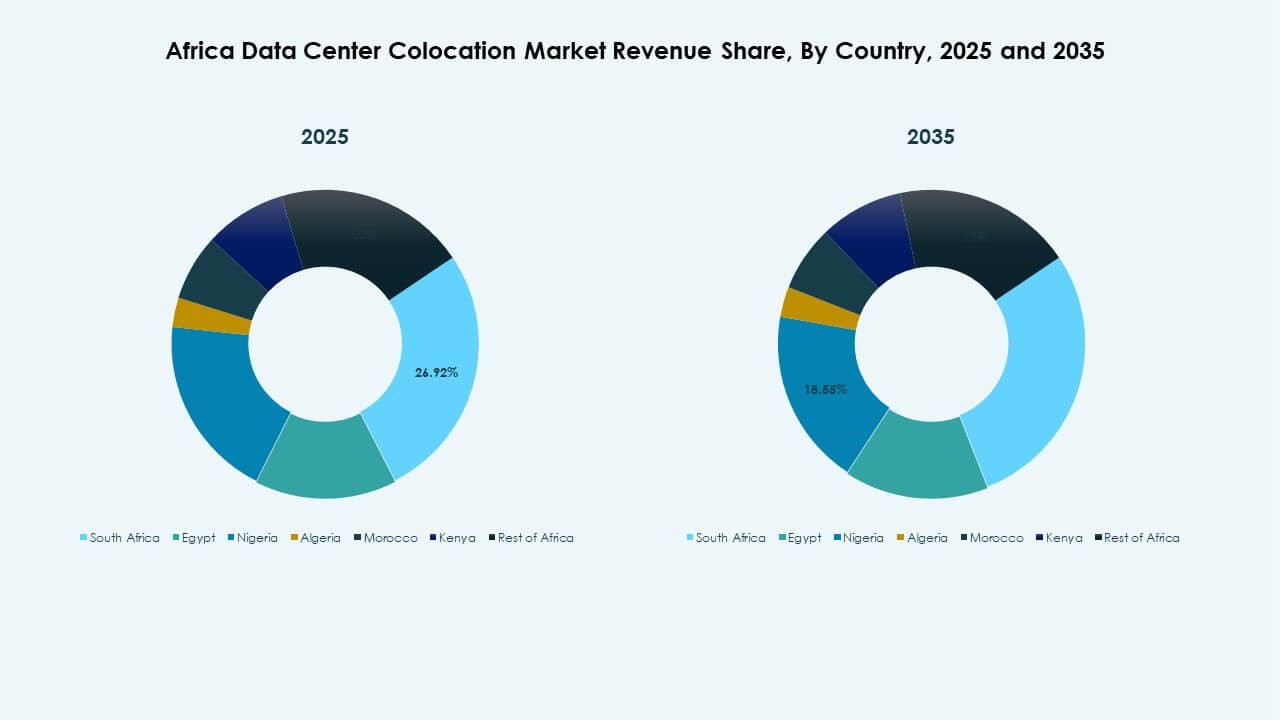

South Africa leads the market with advanced infrastructure, reliable connectivity, and strong enterprise demand. Nigeria and Kenya are emerging hubs due to subsea cable landings, digital infrastructure upgrades, and government initiatives. North and West African countries are witnessing infrastructure expansion supported by strategic partnerships and data localization efforts.

Market Drivers

Accelerating Digital Transformation and Strategic Enterprise Modernization

The Africa Data Center Colocation Market is benefiting from rapid digitalization across multiple sectors. Enterprises are migrating critical workloads to colocation facilities to achieve operational resilience and reduce infrastructure costs. Cloud integration, AI-driven platforms, and IoT deployments are fueling this shift. Local businesses are prioritizing colocation to meet latency, compliance, and data residency requirements. International players are investing in infrastructure to support cross-border connectivity. It enables faster service delivery and agile scaling strategies. Strategic modernization improves efficiency and creates strong incentives for investors to expand their presence.

- For instance, on July 23, 2025, Visa Inc. inaugurated its first African data center in Johannesburg, South Africa, backed by a ZAR 1 billion (USD 57 million) investment. The facility connects directly to VisaNet, which processes over 100 billion transactions annually, and reduces transaction latency by enabling regional payment processing.

Rising Cloud Service Adoption and Integration of Advanced Technologies

Rising adoption of cloud computing is driving the demand for modern colocation facilities. Enterprises are shifting from legacy systems to hybrid and multi-cloud frameworks. This transition requires flexible infrastructure capable of supporting high-performance applications and real-time data processing. AI and edge computing integration is expanding the operational capabilities of colocation facilities. It supports low-latency service delivery for businesses across industries. Government digital strategies are encouraging private investments in advanced technologies. The combination of scalable infrastructure and technology integration positions the region for accelerated growth.

Increasing Infrastructure Investments and Network Interconnectivity

Private and public entities are investing in large-scale data center development. Subsea cable landings, terrestrial fiber expansion, and renewable energy integration are strengthening network resilience. It enables global carriers and cloud providers to establish long-term partnerships with local operators. High interconnection capacity improves data flow efficiency and service availability. Investors are targeting regions with stable power and regulatory clarity. These investments create economic value and build digital capacity for future demand. Strategic infrastructure development boosts competitiveness and attracts enterprise clients seeking reliable operations.

- For instance, Teraco Data Environments, a Digital Realty company, announced a new 40 MW hyperscale data center (JB7) in Johannesburg in November 2024, backed by an R8 billion syndicated loan. The 71,000-square-meter facility increases total campus power capacity to 110 MW at Isando and features energy-efficient liquid-cooling systems to support AI and hyperscale cloud workloads. The project is scheduled for completion in 2026.

Regulatory Reforms and Favorable Business Environment Enhancing Confidence

Governments are implementing policies that support data localization, energy stability, and private sector participation. These reforms strengthen investor confidence and support long-term planning. Colocation operators benefit from improved licensing frameworks and tax incentives. Regulatory clarity encourages foreign players to expand in the region. It enables a structured approach to infrastructure planning and capacity expansion. Streamlined processes reduce operational risks for enterprises adopting colocation. These policy measures position the market as a key investment destination for technology-led growth. Regulatory support ensures a stable environment for sustained development.

Market Trends

Emergence of Edge Data Centers to Support Decentralized Architectures

The Africa Data Center Colocation Market is experiencing a steady increase in edge data center deployments. Enterprises are adopting decentralized models to meet low-latency demands for digital services. Edge facilities reduce network congestion and optimize bandwidth usage. It enables faster content delivery for streaming, gaming, fintech, and enterprise applications. Rural and semi-urban areas are becoming focal points for edge expansion. New investments are targeting regions closer to end-users. This trend enhances service quality and broadens connectivity access across the continent.

Growing Adoption of Renewable Energy to Strengthen Sustainability Goals

Operators are increasingly shifting toward renewable energy sources to power their facilities. Solar and wind energy are becoming integral to new infrastructure projects. It reduces carbon emissions and enhances operational efficiency. Global investors favor sustainable facilities that align with ESG commitments. Energy partnerships are reshaping procurement strategies in major data center hubs. Rising power demand drives innovation in energy storage and smart grid integration. This trend reflects the sector’s shift toward environmentally responsible operations and improved resilience.

Rising Focus on AI and Automation to Optimize Operational Efficiency

Operators are integrating AI-driven monitoring and automation systems to enhance efficiency. Predictive maintenance tools are reducing downtime and improving service reliability. It strengthens network performance and enhances power utilization effectiveness. Automation supports real-time management of workloads and energy usage. These advancements enable operators to meet enterprise expectations for uptime and security. Investments in AI tools are expanding across new and existing facilities. This trend is reinforcing Africa’s positioning as an emerging hub for intelligent infrastructure operations.

Strategic Partnerships Between Global and Regional Players

The market is witnessing strong collaborations between international operators and local firms. These partnerships focus on expanding capacity, enhancing connectivity, and accelerating innovation. It strengthens the ecosystem by merging global expertise with local market knowledge. Subsea cable operators, hyperscalers, and cloud providers are entering long-term agreements with regional players. These alliances increase network resilience and improve service reach. This trend promotes technological advancement and strengthens Africa’s role in the global digital infrastructure landscape.

Market Challenges

Power Reliability, Infrastructure Gaps, and High Operational Costs

The Africa Data Center Colocation Market faces significant power supply and infrastructure constraints. Frequent outages disrupt operations and increase dependency on backup systems. High energy costs create operational inefficiencies that affect profit margins. Limited grid capacity slows down facility expansion in underserved regions. It forces operators to invest heavily in self-generation and renewable solutions. Infrastructure gaps restrict the development of Tier 3 and Tier 4 facilities in some markets. These limitations raise entry barriers and challenge consistent service delivery across the continent.

Regulatory Fragmentation and Security Concerns Affecting Scalability

Regulatory fragmentation across countries creates uncertainty for long-term investors. Differing compliance standards complicate cross-border service delivery. It slows down deployment timelines and increases operational risks. Security concerns related to data protection and cyber threats add pressure on operators to enhance defenses. Inconsistent regulatory enforcement limits trust between enterprises and service providers. These factors discourage some investors from pursuing aggressive expansion strategies. Addressing these challenges is critical to achieving large-scale digital infrastructure integration.

Market Opportunities

Expanding Role of Hyperscale Players and Global Partnerships

The Africa Data Center Colocation Market is positioned for strong collaboration between hyperscalers and regional operators. Expanding subsea cable networks and terrestrial fiber routes create opportunities for strategic alliances. It enhances connectivity and brings advanced digital services closer to end-users. Investment from global operators enables accelerated infrastructure modernization. These partnerships strengthen competitiveness and increase regional digital capacity. Rising demand from enterprises supports sustained market growth in key hubs.

Rising Demand for Data Localization and Industry-Specific Solutions

Data sovereignty regulations are encouraging local infrastructure development. Enterprises in sectors such as banking, healthcare, and telecom require localized data storage. It drives demand for secure, compliant, and scalable colocation facilities. Operators can leverage this demand to introduce tailored services for regulated industries. Industry-specific colocation solutions enhance customer retention and attract foreign investments. This opportunity creates a clear path for market differentiation and expansion across emerging regions.

Market Segmentation

By Type

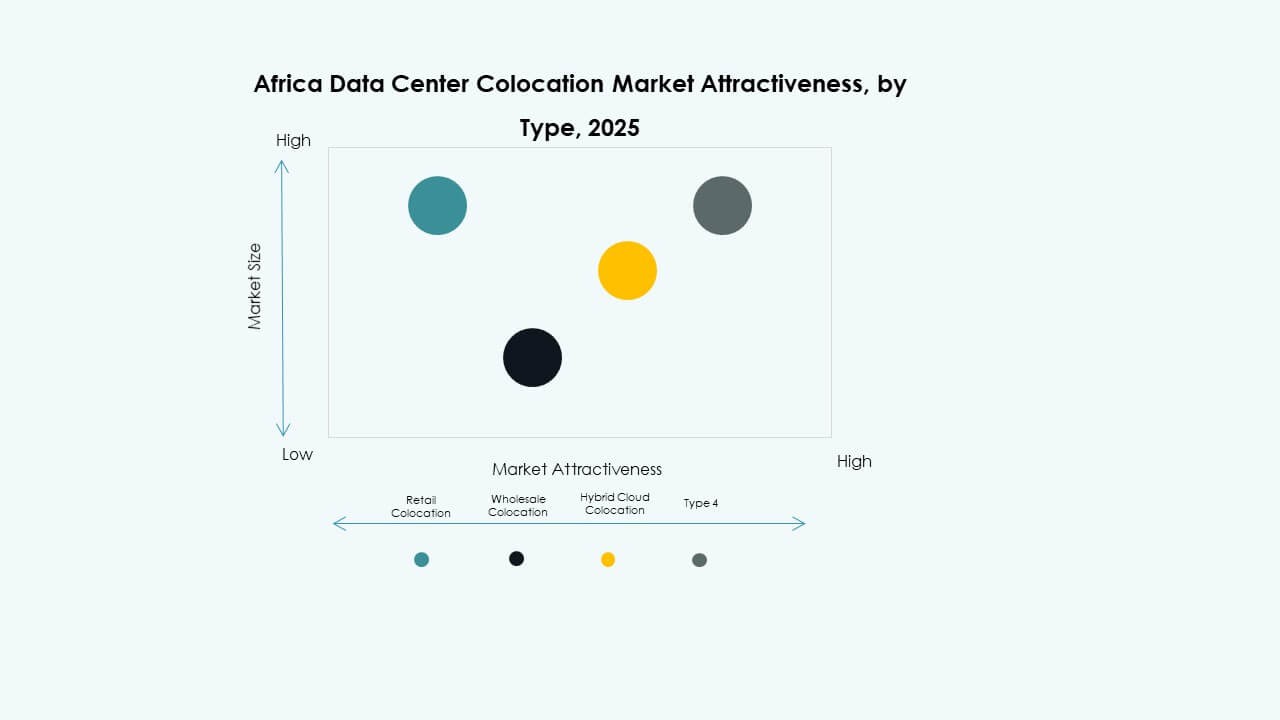

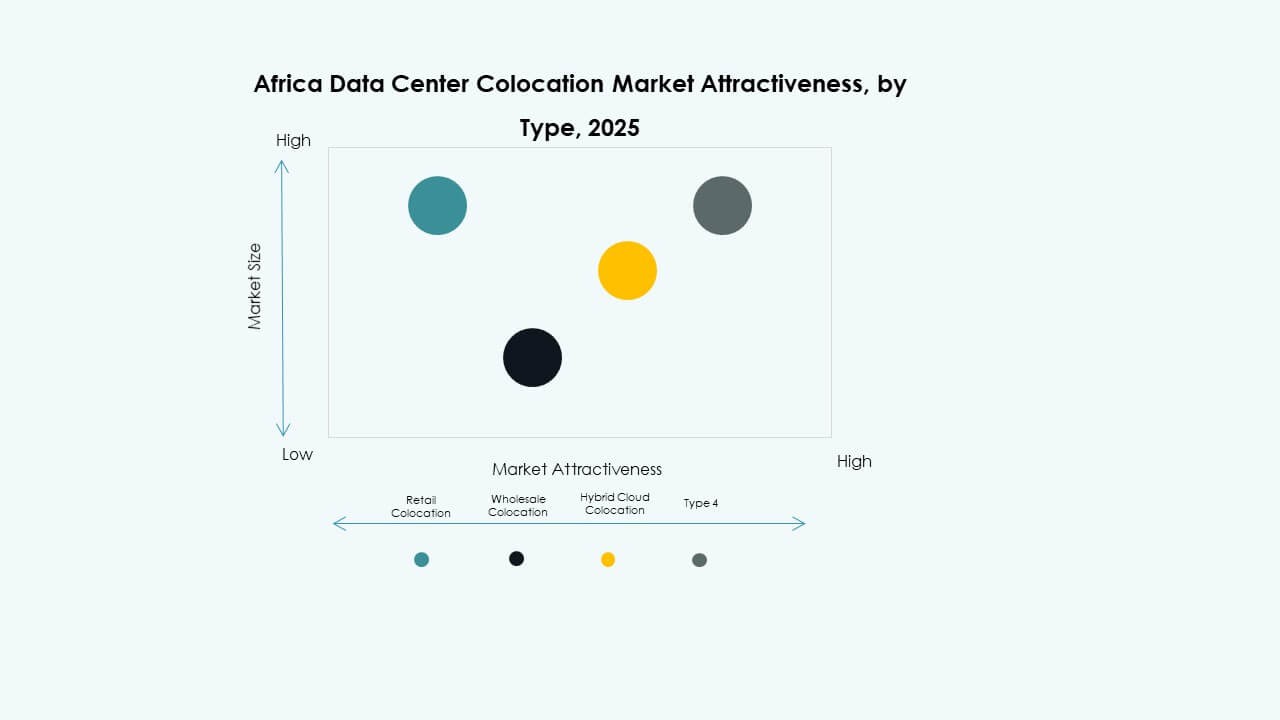

Retail colocation holds the largest share in the Africa Data Center Colocation Market due to its flexibility and lower entry barriers. Enterprises prefer this model to scale infrastructure quickly without heavy capital spending. Wholesale colocation is growing steadily, supported by hyperscalers and global carriers. Hybrid cloud colocation is emerging as a strategic solution for enterprises seeking better workload management. The combination of flexibility and cost efficiency makes retail colocation the most dominant segment.

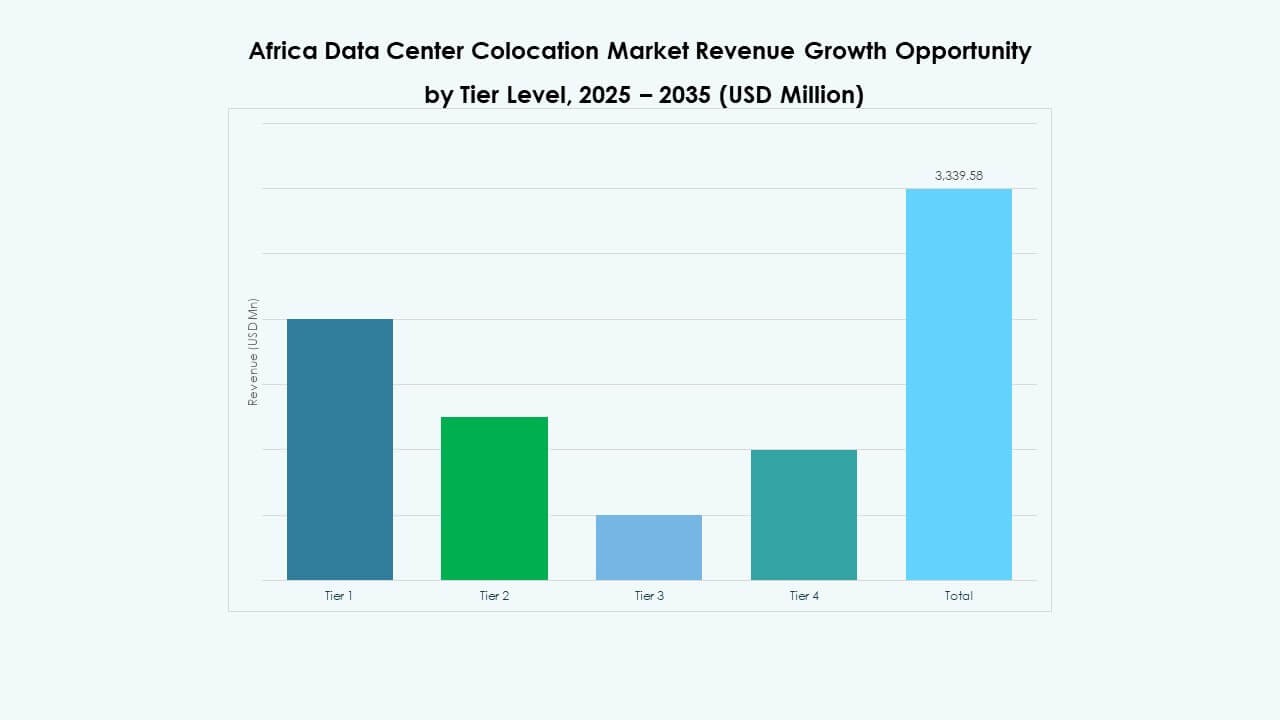

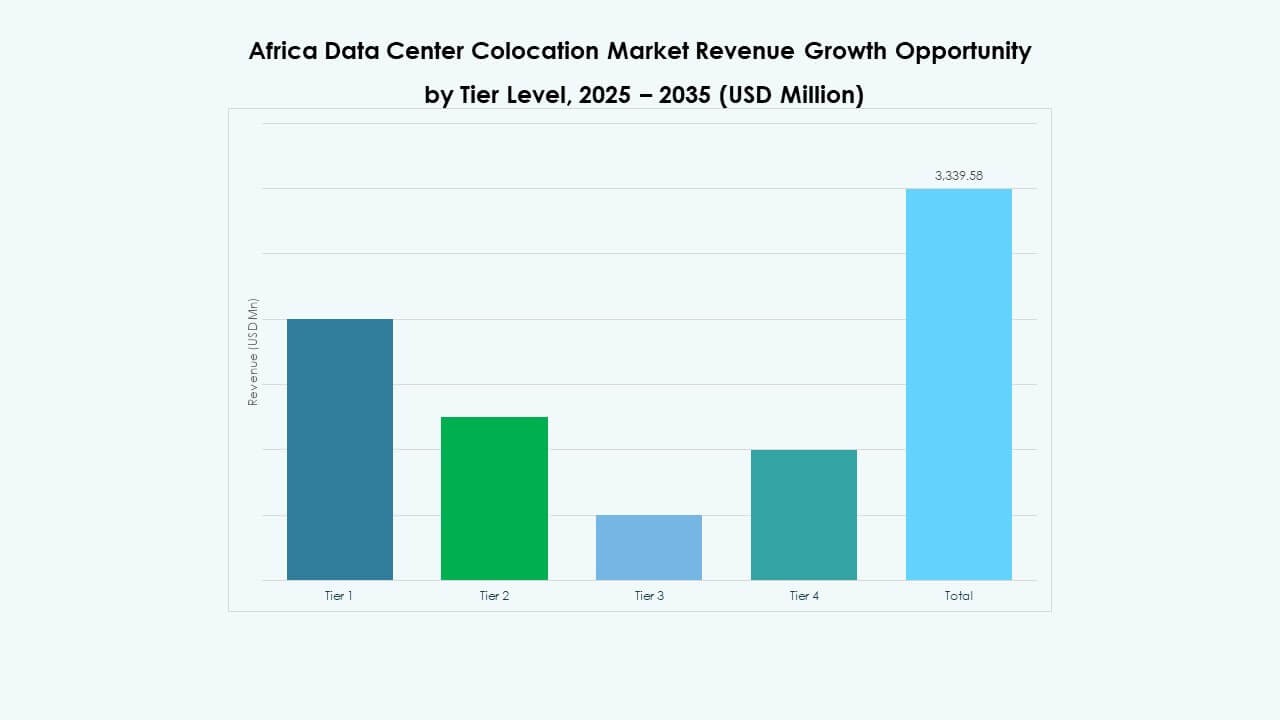

By Tier Level

Tier 3 facilities dominate the Africa Data Center Colocation Market with their balanced reliability and cost structure. Enterprises prioritize Tier 3 due to its availability guarantees and lower operational complexity compared to Tier 4. Tier 1 and Tier 2 facilities remain relevant for smaller workloads and edge deployments. Tier 4 is growing gradually in high-demand regions with stable power supply. The expansion of Tier 3 infrastructure underpins strong regional growth momentum.

By Enterprise Size

Large enterprises account for the major share of the Africa Data Center Colocation Market. They require secure and scalable environments to support complex IT operations. SMEs are increasingly adopting colocation to reduce infrastructure costs and improve performance. It allows them to compete with larger players using advanced digital capabilities. Rising SME adoption is expanding the addressable market and driving infrastructure diversification. Large enterprises continue to set growth trends through sustained demand.

By End User Industry

IT & Telecom leads the Africa Data Center Colocation Market, driven by rising connectivity demands and cloud service expansion. BFSI follows closely due to strong regulatory compliance requirements and data security needs. Healthcare is adopting colocation for telemedicine and secure patient data handling. Media and entertainment benefit from low-latency content delivery. Retail and other industries are exploring colocation to improve operational agility. IT & Telecom remains the strongest growth pillar across the region.

Regional Insights

Southern Africa Leading with Strong Infrastructure and Connectivity – 41.5% Share

Southern Africa dominates the Africa Data Center Colocation Market with a well-established digital ecosystem. South Africa leads the subregion with multiple Tier 3 and Tier 4 facilities, advanced subsea connectivity, and strong enterprise demand. It benefits from reliable power supply, regulatory clarity, and active participation from global players. The region supports hyperscaler expansion and strategic infrastructure investment. Strong interconnection density strengthens its leadership position in regional and international digital networks.

Eastern and Western Africa Emerging as Strategic Growth Hubs – 32.4% Share

Eastern and Western Africa are experiencing rapid growth in colocation infrastructure. Kenya and Nigeria lead their respective subregions, supported by government initiatives, cloud service adoption, and expanding fiber networks. It benefits from growing investor interest and rising enterprise demand. Subsea cable landings enhance connectivity and support service expansion. Emerging tech ecosystems in key cities are accelerating demand for scalable digital infrastructure. These developments strengthen their role as secondary hubs complementing Southern Africa.

- For instance, in September 2025, Nxtra by Airtel began construction of a 44 MW data center in Tatu City, Kenya. The facility is positioned as East Africa’s largest data center project, designed to run on 95% renewable energy and supported by over 120 km of secure underground fiber to ensure 99.999% uptime.

Northern and Central Africa Expanding Infrastructure Capacity – 26.1% Share

Northern and Central Africa are evolving with strategic infrastructure projects and regulatory reforms. Egypt is a key player in Northern Africa, leveraging its strategic geographic position and strong subsea cable routes. It serves as a gateway connecting Africa, Europe, and the Middle East. Central Africa is progressing gradually with smaller facilities and edge deployments. It benefits from increasing interest in underserved regions. Expanding infrastructure and improving power reliability support future regional growth.

- For instance, Egypt landed the Coral Bridge submarine cable in August 2025, its first direct link with Jordan in over 25 years, providing a new high-capacity route through Taba and boosting international data throughput.

Competitive Insights:

- Dimension Data

- Internet Solutions

- Vox Telecom

- Teraco

- Cologix

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

- NTT Ltd. (NTT DATA)

- Rackspace Technology

- Zayo Group, LLC

The Africa Data Center Colocation Market is shaped by strong competition among global hyperscalers and regional providers. Teraco and Dimension Data hold significant positions through their local infrastructure and interconnection capabilities. Equinix, Digital Realty Trust, and NTT Ltd. are expanding their presence through strategic partnerships and capacity investments. It focuses on sustainable designs and carrier-neutral services to attract large enterprises. Regional firms like Vox Telecom and Internet Solutions strengthen domestic reach, while global players leverage capital strength and technology leadership. The market’s competitive structure favors operators with scalable capacity, robust connectivity ecosystems, and strong compliance frameworks. Strategic acquisitions and alliances are common to accelerate coverage across key African hubs.

Recent Developments:

- In October 2025, Airtel Africa announced a major partnership with U.S.-based infrastructure solutions provider Vertiv to expand its data center footprint across Africa. The collaboration, revealed on October 14, 2025, begins in Nigeria and will extend across multiple African countries over a three-year period.

- In June 2025, Africa Data Centres entered into a strategic partnership with Blue Turtle Technologies aimed at accelerating digital transformation in South Africa. This collaboration facilitates enterprise‑grade colocation, cloud, and edge computing services designed to strengthen regulatory compliance and sustainability in mission‑critical sectors.

- In March 2025, Open Access Data Centres (OADC) unveiled its plan to construct a state-of-the-art, 24 MW colocation data center in Lagos, Nigeria. The project will be executed in two phases, with the first 12 MW expected to go live by 2026. This development underscores Nigeria’s emerging role as a key data hub in West Africa, fueled by rapid enterprise digitalization and growing cloud service demands.