Executive summary:

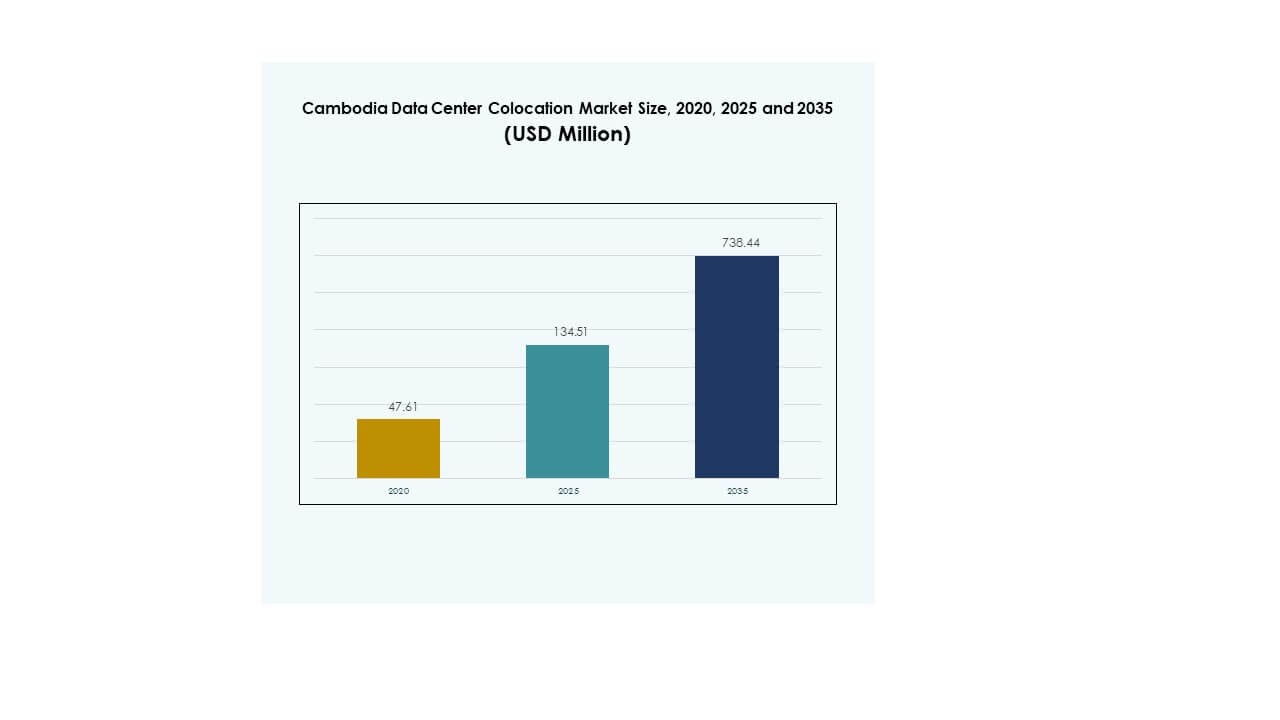

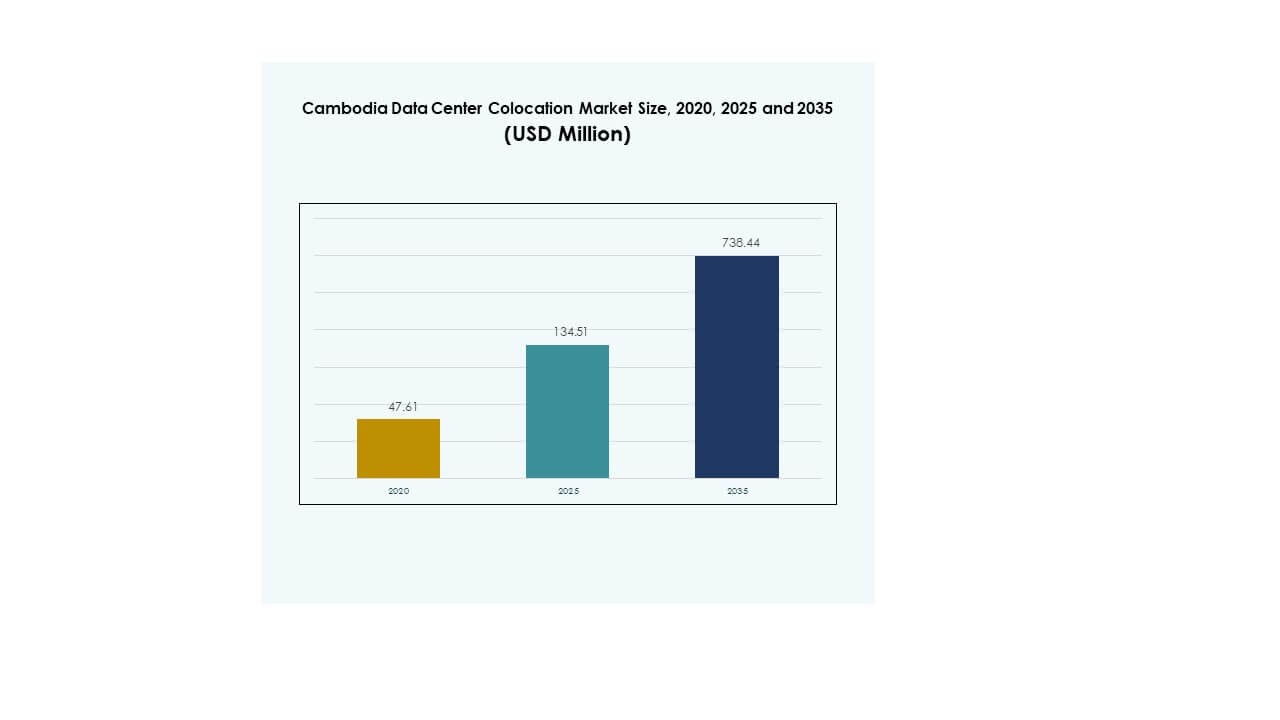

The Cambodia Data Center Colocation Market size was valued at USD 47.61 million in 2020 to USD 134.51 million in 2025 and is anticipated to reach USD 738.44 million by 2035, at a CAGR of 18.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Cambodia Data Center Colocation Market Size 2025 |

USD 134.51 Million |

| Cambodia Data Center Colocation Market, CAGR |

18.44% |

| Cambodia Data Center Colocation Market Size 2035 |

USD 738.44Million |

Strong cloud adoption, infrastructure modernization, and rising enterprise digital transformation are driving market growth. It is witnessing increased deployment of advanced colocation solutions, edge facilities, and hybrid cloud architectures. Strategic investments by telecom operators and global hyperscale players are strengthening operational capacity. The market’s growing role in regional connectivity and secure data hosting makes it attractive for businesses and investors seeking long-term returns.

Phnom Penh leads the market due to its strong connectivity, enterprise concentration, and infrastructure readiness. Sihanoukville is emerging as a strategic secondary hub, supported by port connectivity and industrial expansion. Other provinces are steadily expanding capacity through economic zones and digitalization programs, contributing to a more distributed national data center ecosystem.

Market Drivers

Rising Enterprise Cloud Adoption and Strategic Infrastructure Modernization Across Core Economic Sectors

Strong cloud adoption by enterprises is driving rapid colocation demand in the Cambodia Data Center Colocation Market. Companies are focusing on scalable IT infrastructure to support digital operations. It is enabling faster migration of workloads from on-premises to secure colocation facilities. Organizations are shifting capital expenses to operational models, improving cost efficiency. Service providers are investing in modular infrastructure that allows rapid deployment. Government digital strategies are reinforcing private sector participation. Reliable colocation services are improving network resiliency and operational performance. Strategic infrastructure upgrades are making the market attractive for foreign investors.

- For instance, on February 21, 2025, ByteDC Solutions and Huawei Cambodia signed an MoU to collaborate on developing hybrid cloud infrastructure. ByteDC’s Phnom Penh data center at the Global Tech Exchange spans 7,529 m² and supports up to 1,000 IT racks, strengthening the city’s role in advanced digital infrastructure.

Technological Transformation and Integration of Advanced Data Center Infrastructure Solutions

Modernization of data center facilities is accelerating through the use of AI-driven monitoring, automation, and energy-efficient technologies. The Cambodia Data Center Colocation Market is benefiting from this transition. It is increasing capacity utilization and improving energy optimization. Operators are deploying smart cooling systems to manage high-density workloads. Real-time monitoring solutions are supporting reliable uptime and service continuity. These changes are aligning operations with global standards. Enterprise customers are focusing on performance, scalability, and security. Innovation is reducing operational costs and improving ROI for investors.

- For instance, Huawei’s Digital Power division highlighted in its 2024 ASEAN data center white paper that advanced cooling technologies can significantly reduce PUE and improve efficiency across Southeast Asia. The report references efficiency improvements through innovative cooling strategies and smart energy management, including deployments in Cambodia and Malaysia.

Expansion of Digital Ecosystems and Growing Cross-Border Connectivity Across Southeast Asia

Strong cross-border connectivity growth is driving infrastructure investments. The Cambodia Data Center Colocation Market is gaining importance through its geographic positioning. It is supporting interconnection between enterprises, cloud providers, and telecom carriers. New fiber routes are strengthening network resilience and international data exchange. Investments are enhancing bandwidth capacity for latency-sensitive applications. This growth is boosting cloud deployments and hybrid architectures. Businesses are securing better performance through direct connections to global hubs. Rising demand for regional connectivity is fueling consistent market growth.

Supportive Policy Landscape and Strategic Investor Confidence Driving Long-Term Market Growth

Government support for digital infrastructure is accelerating investment inflows. The Cambodia Data Center Colocation Market benefits from simplified regulatory procedures and investment incentives. It is creating a favorable environment for both domestic and foreign operators. Policy reforms are enhancing data sovereignty and operational transparency. Large enterprises are strengthening their digital transformation strategies. Foreign investors are viewing Cambodia as an entry point to regional expansion. Long-term investment in energy-efficient facilities is increasing competitiveness. Strategic policy alignment is making the country a regional digital hub.

Market Trends

Growing Adoption of Hyperscale-Ready Colocation Facilities and Edge Infrastructure Development

Demand for hyperscale-ready data centers is increasing across the region. The Cambodia Data Center Colocation Market is evolving toward higher capacity and low-latency infrastructure. It is enabling enterprises to deploy advanced applications and AI workloads. Edge data centers are supporting latency-sensitive services in industrial zones. Operators are focusing on modular and scalable designs to meet future demand. Power efficiency and sustainability goals are shaping facility designs. This trend aligns with the expansion of global cloud regions. Enterprises are integrating hybrid models to ensure operational continuity.

Sustainability and Energy-Efficient Data Center Operations Gaining Strong Industry Momentum

Sustainability is becoming a core operational priority. The Cambodia Data Center Colocation Market is witnessing strong investment in green energy solutions. It is driving a shift toward low-carbon operations and advanced cooling methods. Operators are adopting renewable power sources to reduce operational costs. Energy efficiency is helping align facilities with international standards. Environmental certifications are improving investor confidence. This approach strengthens market positioning in the region. Companies are focusing on long-term operational stability and brand trust.

Accelerating Digitalization of BFSI, Healthcare, and Retail Industries Driving Sector-Specific Deployments

Industry verticals are rapidly embracing digital transformation strategies. The Cambodia Data Center Colocation Market is seeing increased demand from BFSI, healthcare, and retail sectors. It is enabling secure storage, data processing, and AI-driven analytics. Mission-critical workloads are shifting toward colocation environments for better control. Companies are integrating cloud and colocation solutions to improve performance. Demand for data security and regulatory compliance is intensifying. This trend is encouraging strategic partnerships with global technology providers. Sector-specific adoption is creating new growth pathways.

Integration of AI, Automation, and IoT Solutions Transforming Data Center Operational Efficiency

Technological convergence is redefining operational strategies. The Cambodia Data Center Colocation Market is seeing wide deployment of AI and IoT technologies. It is improving resource utilization and optimizing cooling systems. Automation is enhancing security, energy management, and predictive maintenance. Facility operators are deploying advanced analytics to monitor workloads in real time. This reduces downtime and increases reliability. The shift supports faster service delivery and agile scaling. Data-driven insights are creating operational excellence across facilities.

Market Challenges

Limited Energy Infrastructure and High Dependency on External Power Sources Impacting Operational Reliability

Energy infrastructure limitations are challenging capacity expansion. The Cambodia Data Center Colocation Market faces delays in securing reliable energy supply for new builds. It is increasing dependency on backup systems and external power sources. This affects operational cost structures and uptime guarantees. Expanding capacity requires strategic coordination with utility providers. Power fluctuations impact data center performance and service continuity. Rising energy demand from multiple sectors creates supply pressure. Operators are exploring renewable and hybrid energy solutions to mitigate risks. Infrastructure gaps remain a critical challenge for long-term growth.

Talent Shortage and Slow Skill Development Hindering Advanced Technology Deployment

Workforce skill shortages are limiting operational efficiency in several facilities. The Cambodia Data Center Colocation Market requires specialized expertise in automation, cybersecurity, and energy management. It is slowing down the deployment of advanced infrastructure solutions. Limited local training programs reduce the availability of qualified technicians. Companies rely on foreign expertise, increasing operational costs. This creates longer timelines for implementation of advanced technologies. Workforce development programs are not yet aligned with the industry’s pace. Lack of technical depth impacts innovation and resilience.

Market Opportunities

Strategic Infrastructure Development Creating Pathways for Regional Leadership in Digital Connectivity

Strategic infrastructure investments are opening new opportunities. The Cambodia Data Center Colocation Market is benefiting from its position between major digital corridors. It is becoming an attractive site for cross-border connectivity projects. Investments in fiber, power, and interconnection networks support this growth. Enterprises view the market as a scalable platform for regional operations. Global players are targeting the market to expand their footprint. This creates opportunities for joint ventures and technology transfers. Strategic positioning enhances competitiveness in Southeast Asia.

Emergence of AI, Cloud, and Edge Applications Unlocking New Commercial Revenue Streams

Technology adoption is reshaping commercial opportunities. The Cambodia Data Center Colocation Market is witnessing rapid growth in AI and edge application hosting. It is attracting enterprise clients from data-intensive industries. Demand for low-latency infrastructure encourages investments in edge nodes. Service providers are launching flexible, hybrid solutions to support diverse workloads. This shift boosts long-term contract value and client retention. AI-driven analytics are unlocking new service models. Emerging applications strengthen the market’s revenue potential.

Market Segmentation

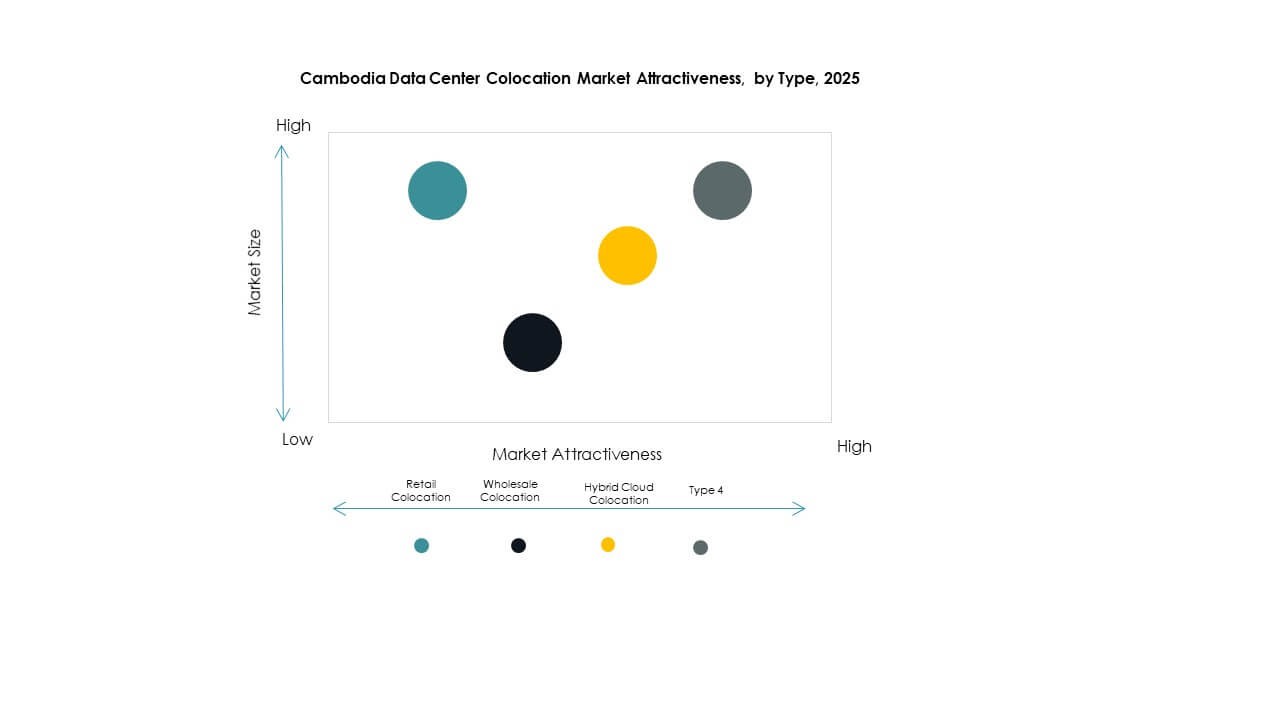

By Type

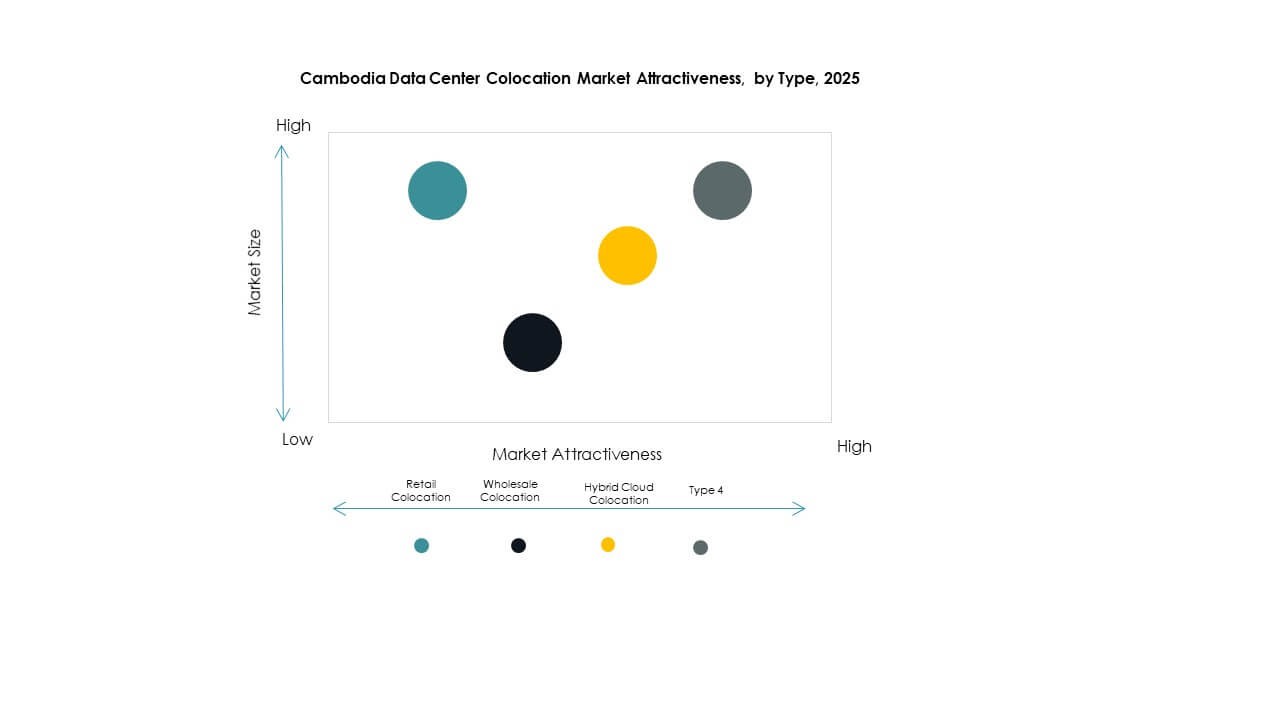

Retail colocation holds the largest share in the Cambodia Data Center Colocation Market. It is preferred by enterprises needing flexible capacity and cost control. Wholesale colocation is gaining traction from hyperscale and large enterprise customers. Hybrid cloud colocation is growing due to rising demand for scalable and secure hybrid models. Retail colocation remains dominant due to its suitability for SMEs and medium enterprises. Increasing cloud adoption is driving growth across all types. The segment’s flexibility supports strong market expansion.

By Tier Level

Tier 3 facilities dominate the Cambodia Data Center Colocation Market with the highest market share. It is valued for its fault tolerance, high uptime, and scalable architecture. Tier 1 and Tier 2 facilities cater to smaller enterprises with limited critical workloads. Tier 4 facilities are emerging for mission-critical deployments with high reliability. Operators prefer Tier 3 due to cost efficiency and performance balance. Growing enterprise demand reinforces Tier 3 investments. The tiered structure aligns infrastructure levels with operational priorities.

By Enterprise Size

Large enterprises account for the largest share in the Cambodia Data Center Colocation Market. It is driven by heavy workloads, complex IT requirements, and data compliance needs. SMEs are increasingly adopting retail colocation for scalability and reduced capital costs. Demand from smaller enterprises is expected to grow with digital transformation. Large enterprises remain the backbone of market revenue. Service providers tailor offerings to match enterprise requirements. Market diversification across enterprise sizes strengthens competitive positioning.

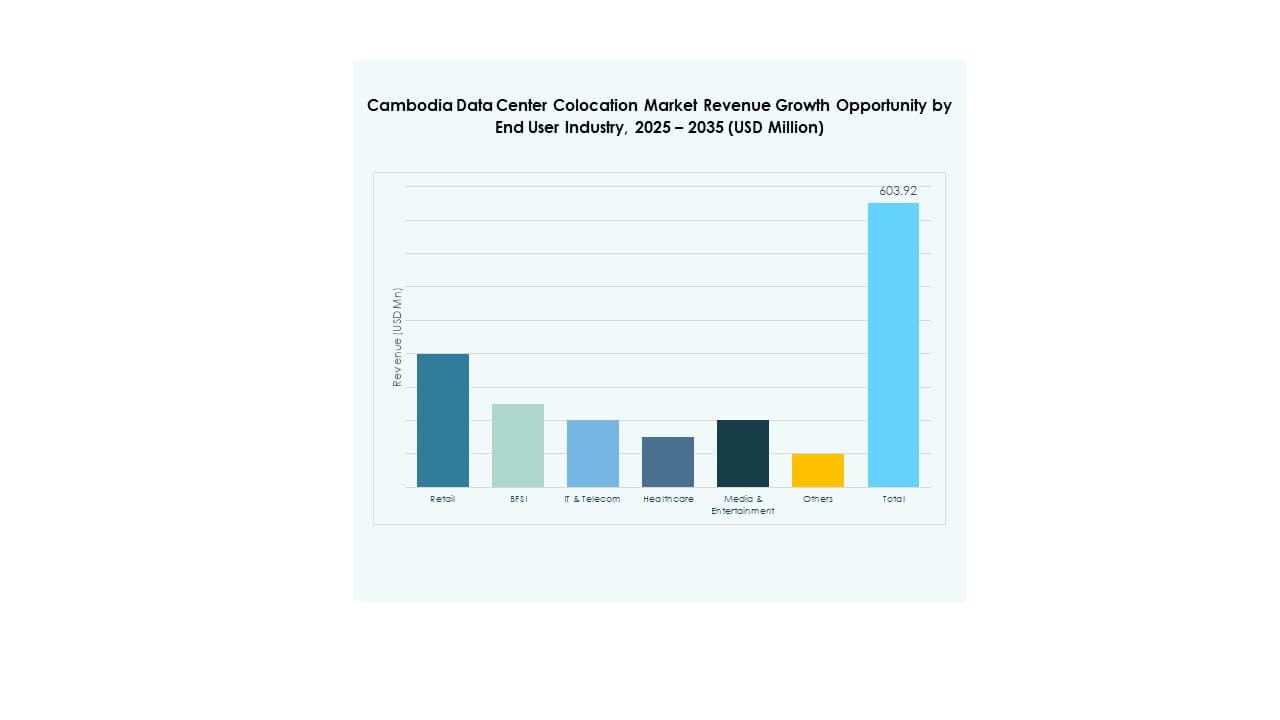

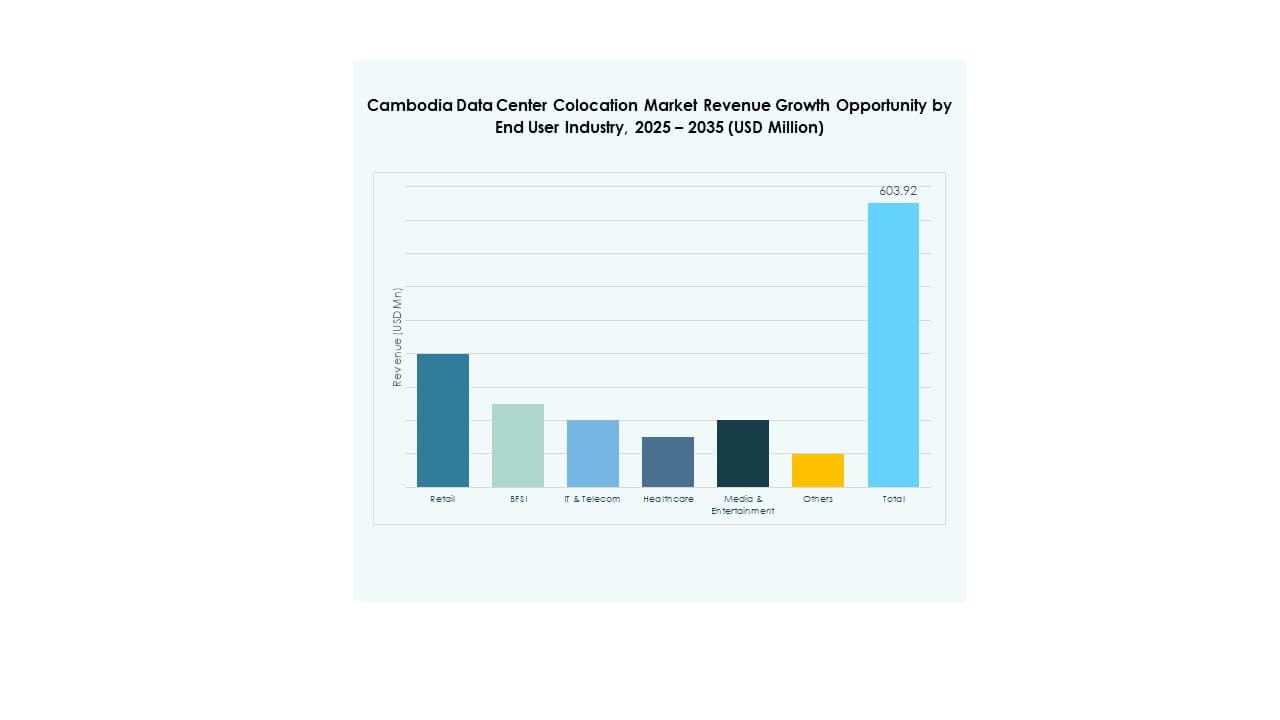

By End User Industry

IT and Telecom dominate the Cambodia Data Center Colocation Market with the largest share. It is followed by BFSI, healthcare, and media sectors, which demand high data security and availability. Retail is also adopting colocation for e-commerce operations. Healthcare relies on secure data hosting to meet compliance standards. Media and entertainment require high-capacity infrastructure for streaming and content delivery. Expanding digitalization across industries drives multi-sectoral demand. Strong end-user diversity enhances market resilience.

Regional Insights

Strong Leadership of Phnom Penh Driven by Strategic Infrastructure and Economic Concentration

Phnom Penh holds a 63.2% market share in the Cambodia Data Center Colocation Market. It is the primary hub for digital infrastructure development. Strong economic activity, business concentration, and connectivity make the capital an ideal location. Government offices and major enterprises anchor their operations here. Strong fiber network access supports data center expansion. Investors prefer Phnom Penh for stable power access and business readiness. This concentration strengthens its role as the nation’s digital core.

- For instance, in July 2023, the Cambodian Ministry of Posts and Telecommunications broke ground on a $30 million, 12-story National Data Center in Phnom Penh, targeting Tier IV certification and operational readiness by 2025. In May 2023, ByteDC also launched a 3 MW data center facility in Phnom Penh, reinforcing the capital’s position as Cambodia’s digital hub.

Emerging Growth in Sihanoukville Through Port Connectivity and Economic Zone Expansion

Sihanoukville accounts for 23.5% of the Cambodia Data Center Colocation Market. It is benefiting from its port connectivity and economic zone developments. The area is becoming a key secondary hub supporting national infrastructure. Industrial and logistics players rely on colocation to support operational systems. Strong energy development projects enhance reliability. Improved connectivity positions Sihanoukville for future capacity expansion. Its role is growing steadily in the national digital ecosystem.

- For instance, in 2024, the Sihanoukville Special Economic Zone recorded a total trade volume of USD 4.07 billion, marking a 21.3% year-on-year increase. The zone hosted 202 enterprises and created over 32,000 jobs, reinforcing its role as a key industrial and logistics hub in Cambodia.

Rising Adoption in Provincial Economic Zones Driving Balanced Regional Expansion

Other provinces hold a 13.3% share of the Cambodia Data Center Colocation Market. It is supported by expanding economic zones and government-led digitalization programs. Secondary cities are adopting colocation to support SME digital operations. Infrastructure development improves network coverage across provinces. These regions create new growth corridors for investors. Balanced expansion ensures more distributed capacity across the country. Regional diversification strengthens overall market stability and competitiveness.

Competitive Insights:

- Telcotech Data Centre

- EZECOM

- SINET Data Center

- MekongNet

- Google Cloud

- Cambodia Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Cambodia Data Center Colocation Market features a mix of domestic telecom operators and global colocation leaders. It is seeing rapid investments in scalable, hyperscale-ready facilities to support enterprise digital transformation. Local players focus on expanding connectivity infrastructure and offering competitive pricing for retail colocation. Global operators are targeting enterprise and cloud-native workloads with Tier 3 and Tier 4 facilities. Strong competition is driving innovation in energy efficiency, security, and service automation. Strategic alliances between carriers and hyperscale providers are enhancing ecosystem strength. International brands are gaining influence through advanced infrastructure and regional interconnection. Local providers are leveraging strong market relationships to retain strategic enterprise clients.

Recent Developments:

- In February 2025, ByteDC Solutions Co., Ltd., a leading Cambodian data center provider, formed a strategic partnership with Huawei Technologies (Cambodia) Co., Ltd. The Memorandum of Understanding (MoU), signed on February 21, 2025, aims to enhance Cambodia’s digital infrastructure through the deployment of hybrid cloud solutions.

- In March 2025, Hattha Bank, one of Cambodia’s major financial institutions, entered into a partnership with NTT Cambodia to modernize its data center operations and enhance digital banking resilience. The collaboration, announced on March 24, 2025, involves deploying NTT’s advanced colocation and network management systems to support Hattha Bank’s growing online banking and financial applications infrastructure.