Executive summary:

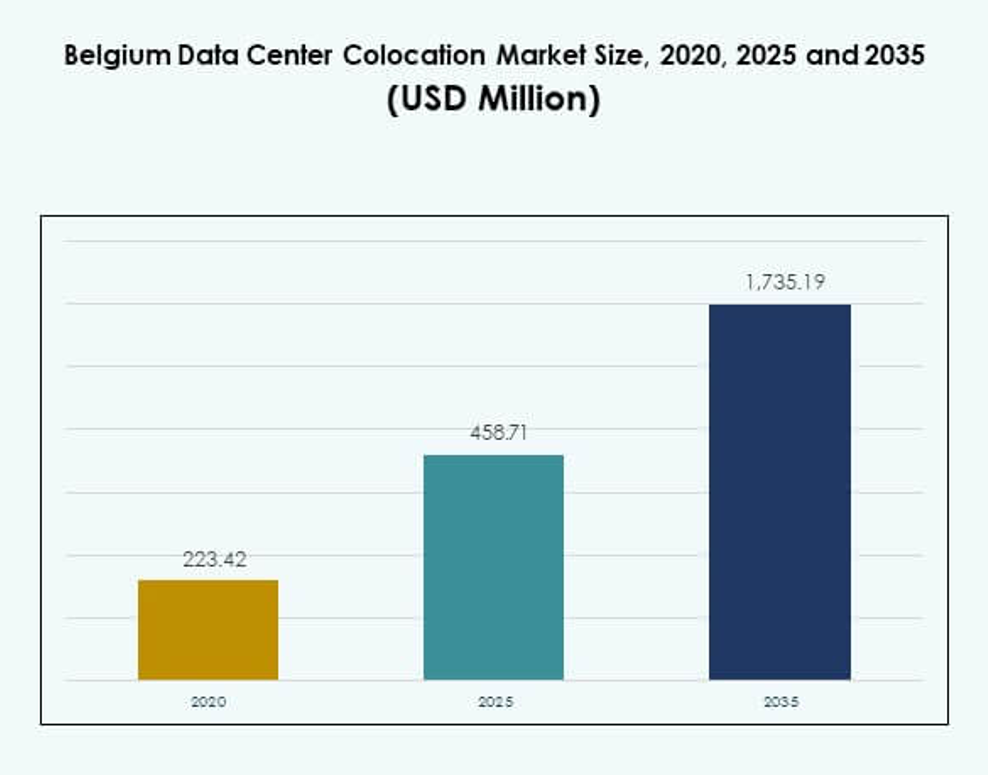

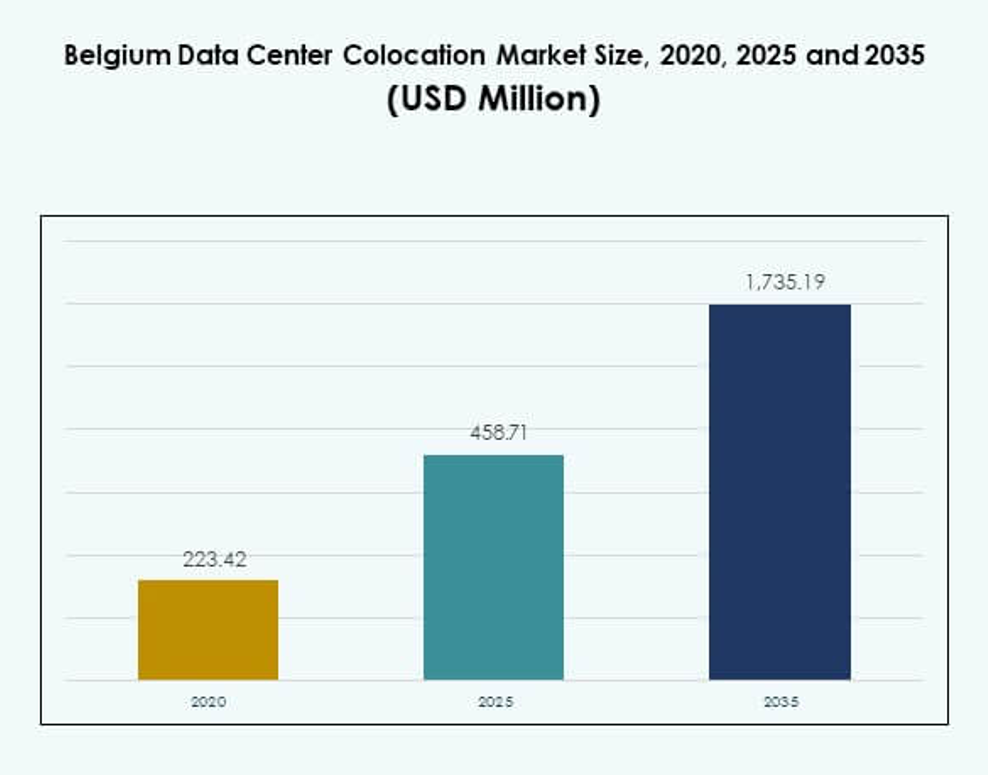

The Belgium Data Center Colocation Market size was valued at USD 223.42 million in 2020 to USD 458.71 million in 2025 and is anticipated to reach USD 1,735.19 million by 2035, at a CAGR of 14.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Belgium Data Center Colocation Market Size 2025 |

USD 458.71 Million |

| Belgium Data Center Colocation Market, CAGR |

14.17% |

| Belgium Data Center Colocation Market Size 2035 |

USD 1,735.19 Million |

Rising demand for secure, scalable infrastructure and growing digital transformation initiatives are driving market expansion. Enterprises and cloud providers are adopting colocation to improve operational flexibility and reduce infrastructure costs. Strong investment in renewable energy and edge computing further boosts infrastructure modernization. The market’s strategic importance lies in its ability to support AI, IoT, and cloud workloads for businesses and investors seeking long-term growth.

Brussels remains the primary hub due to its strong network connectivity and proximity to key European cities. Antwerp is emerging as a growth center supported by logistics, industrial activity, and infrastructure expansion. Other regions such as Ghent and Liège are gaining traction through lower land costs, improved connectivity, and rising SME colocation demand. This geographic spread enhances the country’s strategic position in Europe’s digital network.

Market Drivers

Strong Digital Transformation Initiatives and Expansion of Cloud Ecosystems

The Belgium Data Center Colocation Market is driven by rapid digital transformation across industries. Enterprises are migrating critical workloads to colocation facilities to reduce capital costs and increase flexibility. It supports advanced cloud ecosystems that integrate with hybrid IT strategies. Growing enterprise demand for AI and machine learning workloads strengthens infrastructure modernization. Businesses rely on reliable colocation services to achieve faster deployment timelines and scalable capacity. Increased use of big data analytics also drives higher compute and storage requirements. Global hyperscalers view Belgium as a strategic hub for regional operations. Strong enterprise demand positions the country as a digital infrastructure gateway for Europe.

Strategic Geographical Position Supporting High-Density Connectivity Hubs

Belgium’s central location in Western Europe creates strong demand for colocation capacity. It connects major European data corridors between Amsterdam, Frankfurt, London, and Paris. This network advantage attracts multinational enterprises seeking low-latency data exchange. Proximity to leading submarine cable landing stations also boosts connectivity speed and reliability. Telecom operators invest in expanding dark fiber routes and redundant links to meet enterprise needs. Colocation facilities in Brussels benefit from dense interconnection ecosystems and access to major cloud exchanges. This connectivity ecosystem drives sustained demand from banking, logistics, and e-commerce players. Strong network density strengthens Belgium’s position in the regional colocation landscape.

Regulatory Stability and Focus on Green Energy Adoption for Data Centers

Belgium provides a transparent regulatory environment that supports data center investments. Clear energy regulations, stable power pricing, and government incentives encourage infrastructure expansion. Colocation operators prioritize renewable energy integration to meet ESG standards. It improves operational efficiency and helps clients meet sustainability goals. Advanced power usage effectiveness systems reduce energy consumption across Tier 3 and Tier 4 facilities. Government initiatives promoting green energy supply create a competitive advantage for operators. This stable regulatory landscape attracts international colocation and cloud providers. Energy-efficient infrastructure enhances long-term investment confidence for large enterprise clients.

- For instance, in May 2025, LCL Data Centers completed the installation of a 3.4 MW rooftop solar portfolio across several facilities in East and West Flanders, actively using this renewable energy to decarbonize data center operations and supply clean energy to the Belgian grid. This project is backed by Power Purchase Agreements with local farmers, emphasizing a commitment to higher sustainability standards within the Belgian colocation sector.

Rising Demand for Edge Computing and High-Performance Infrastructure

The rise of 5G and IoT is fueling demand for edge-ready colocation infrastructure. It supports ultra-low latency workloads in healthcare, retail, and autonomous systems. Colocation providers deploy micro data centers closer to urban and industrial zones. This deployment improves application performance and reduces data transit costs. High-performance interconnectivity enables enterprises to scale faster without building private facilities. Strong fiber networks and edge architecture integration strengthen digital service delivery. Global cloud providers expand partnerships with colocation firms to improve edge coverage. This growing adoption reinforces Belgium’s role as a critical node in Europe’s edge ecosystem.

- For example, in July 2025, Orange Belgium and Proximus signed a Memorandum of Understanding to expand fiber deployment and increase access to gigabit networks in Wallonia. This collaboration aims to boost high-speed, low-latency connectivity essential for edge computing, serving both rural and urban enterprises.

Market Trends

Rapid Growth of Hyperscale Deployments and Interconnection Ecosystems

Hyperscale operators are increasingly entering the Belgian market to meet regional cloud demand. It encourages large-scale campus-style colocation developments near Brussels and Antwerp. These sites support multi-MW deployments for AI, analytics, and IoT applications. Rising enterprise interconnection requirements drive expansion of carrier-neutral facilities. Global providers integrate cross-connect services to support hybrid workloads. Strong presence of internet exchanges increases peering efficiency and data routing flexibility. This trend aligns with enterprise strategies seeking scalable and flexible IT infrastructure. Hyperscale adoption accelerates technological maturity and operational capacity across the ecosystem.

Integration of Renewable Energy and Low-Carbon Infrastructure Models

Colocation providers are adopting renewable energy sources to support carbon neutrality goals. It strengthens their market position by aligning with sustainability requirements of global clients. Operators invest in advanced cooling technologies and real-time energy monitoring systems. Integration of solar, wind, and hydropower enhances long-term energy reliability. Renewable-powered colocation attracts cloud and enterprise clients focused on ESG commitments. The shift to sustainable power improves operational efficiency and reduces long-term costs. New infrastructure developments prioritize PUE optimization and low-emission construction. This sustainability trend strengthens Belgium’s position as a green colocation hub in Europe.

Deployment of Advanced Security and Compliance-Driven Infrastructure

Security and regulatory compliance play a central role in colocation investments. Operators deploy advanced biometric access controls, AI-based threat detection, and zero-trust frameworks. It ensures strong protection for mission-critical workloads in finance, government, and healthcare. Compliance with GDPR and ISO certifications strengthens enterprise trust in colocation facilities. Rising cyber threats drive rapid investments in secure architecture and encrypted interconnection. Data sovereignty remains a key concern, supporting domestic data hosting preferences. Enhanced monitoring and automated incident response improve operational resilience. This security-driven trend reinforces market stability and trust among global and regional clients.

Increased Adoption of Modular and Scalable Facility Designs

Colocation providers are shifting toward modular designs to address dynamic enterprise demand. It allows rapid deployment of new capacity without disrupting existing workloads. Modular facilities enable cost-effective scaling for both SMEs and hyperscalers. Pre-fabricated modules support faster construction timelines and improved energy control. This approach helps operators align capacity expansion with actual demand cycles. Integration of AI-based infrastructure management enhances efficiency and uptime. Flexible design frameworks allow customization for sector-specific requirements. Modular adoption improves competitiveness and reduces capital-intensive risk across the sector.

Market Challenges

Energy Supply Limitations and High Power Dependency of Modern Facilities

Colocation operators face challenges related to energy supply stability and cost control. Modern facilities require significant power for high-density racks and cooling systems. It creates strong dependency on uninterrupted power availability from national grids. Fluctuations in energy prices impact operational budgets and client pricing structures. Securing renewable power purchase agreements can be complex for smaller operators. Power grid congestion in urban zones restricts fast capacity expansion. Maintaining energy efficiency while increasing load remains a persistent concern. This challenge limits smaller entrants from competing with established global providers.

Complex Regulatory Approvals and Limited Land Availability for Expansion

Belgium’s dense urban environment creates challenges for large-scale data center construction. Limited land availability near core connectivity zones restricts new colocation builds. It increases competition for suitable sites and raises development costs. Regulatory approval timelines for environmental and construction permits can delay project execution. Strict sustainability regulations add additional compliance layers for operators. Real estate prices around major interconnection hubs also elevate capital investment needs. Land scarcity encourages vertical designs but raises cooling and design complexity. This constraint affects market scalability and long-term site planning for hyperscale operators.

Market Opportunities

Strong Growth Prospects in Edge Computing and Sector-Specific Solutions

The Belgium Data Center Colocation Market benefits from expanding edge computing demand. It creates opportunities for specialized infrastructure supporting healthcare, retail, and smart mobility. Edge-ready colocation facilities improve data processing efficiency near end users. This development attracts enterprises seeking faster deployment cycles and lower latency. It also supports AI-driven services and connected devices. Rising interest in customized vertical solutions enhances market diversification. Strategic collaborations with telecom and cloud providers strengthen growth momentum.

Favorable Investment Environment and Green Infrastructure Expansion

Belgium’s stable economy and supportive regulatory framework attract infrastructure investors. It creates opportunities for developing sustainable, high-capacity colocation campuses. Government incentives for renewable energy integration strengthen competitive positioning. Low-carbon infrastructure appeals to enterprises with strict ESG requirements. The growing demand from hyperscalers drives investment interest in secondary cities. Green and efficient facilities enable operators to capture long-term contracts. This investment-friendly climate enhances expansion opportunities for both domestic and international players.

Market Segmentation

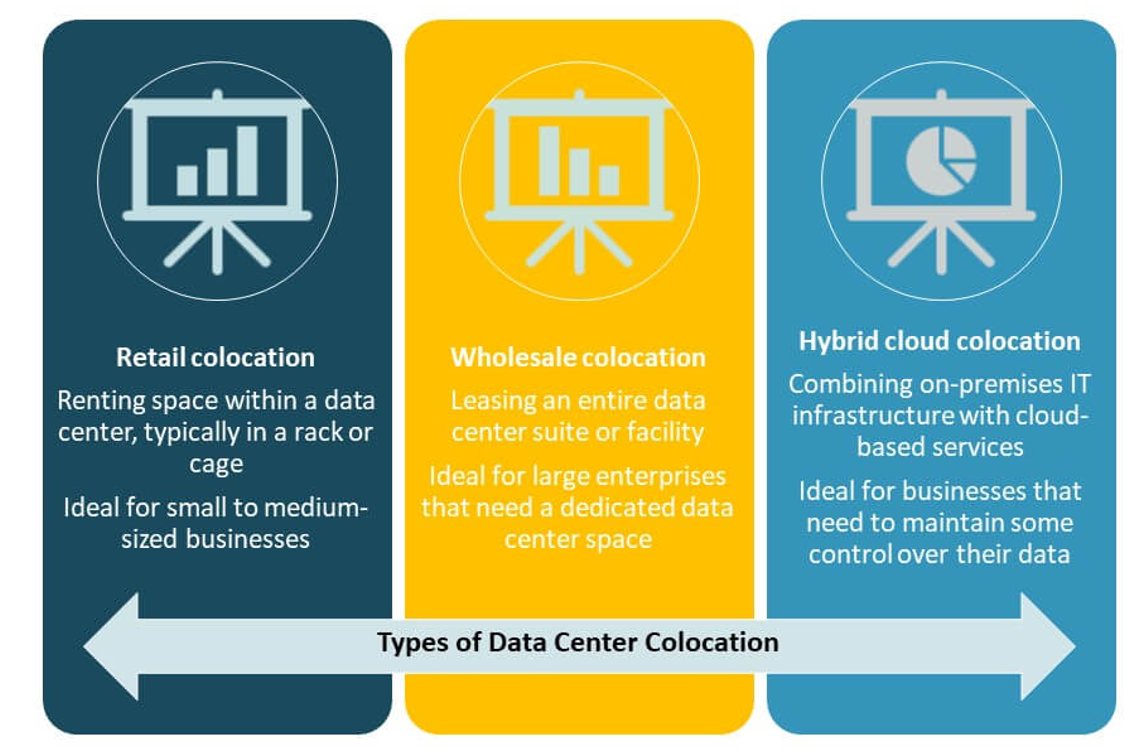

By Type

Retail colocation dominates the Belgium Data Center Colocation Market with strong demand from enterprises and SMEs. Its flexibility and cost efficiency make it suitable for various workloads. Wholesale colocation supports hyperscale deployments with large power and space requirements. Hybrid cloud colocation is gaining momentum as firms adopt mixed infrastructure models. Retail’s dominance stems from its scalability and lower capital investment needs. Enterprises prefer retail colocation for critical IT operations. Wholesale offers capacity for global cloud providers. Hybrid drives future growth with flexible workload management.

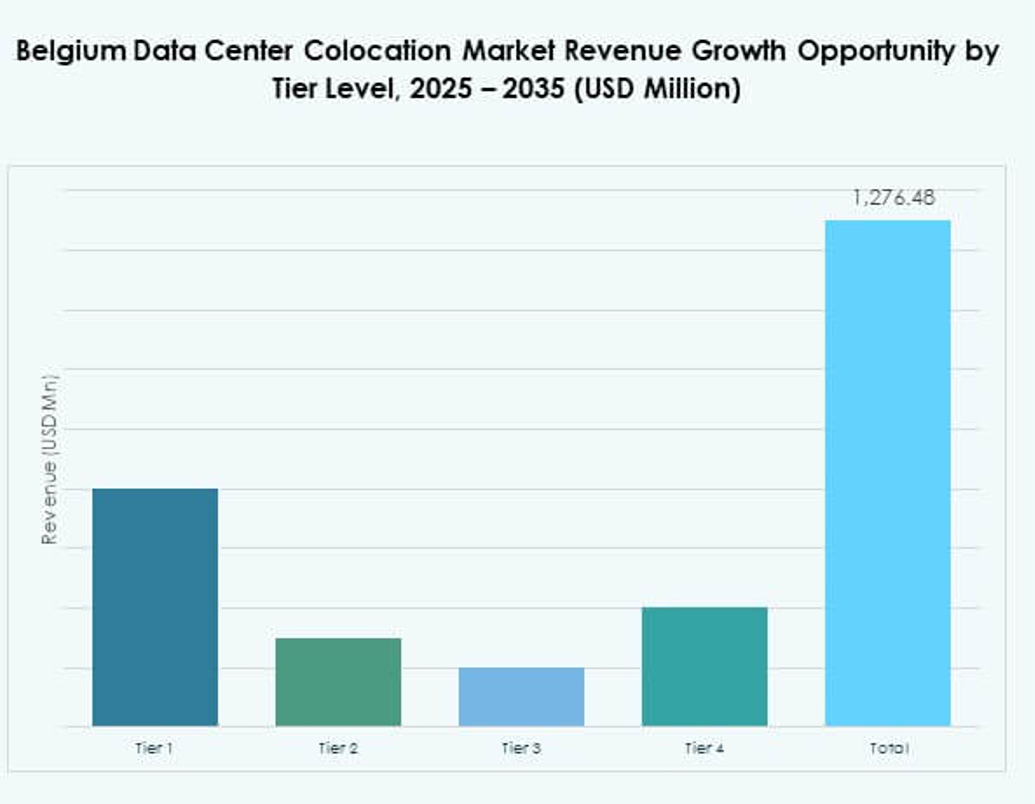

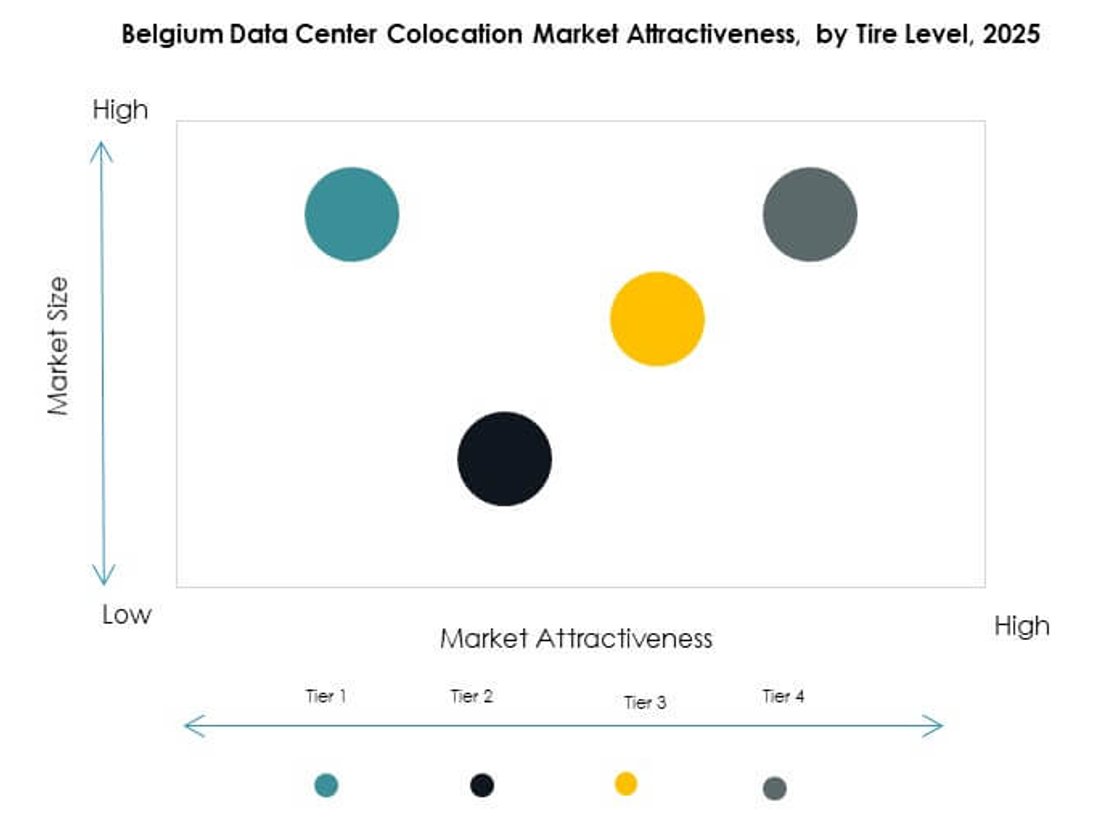

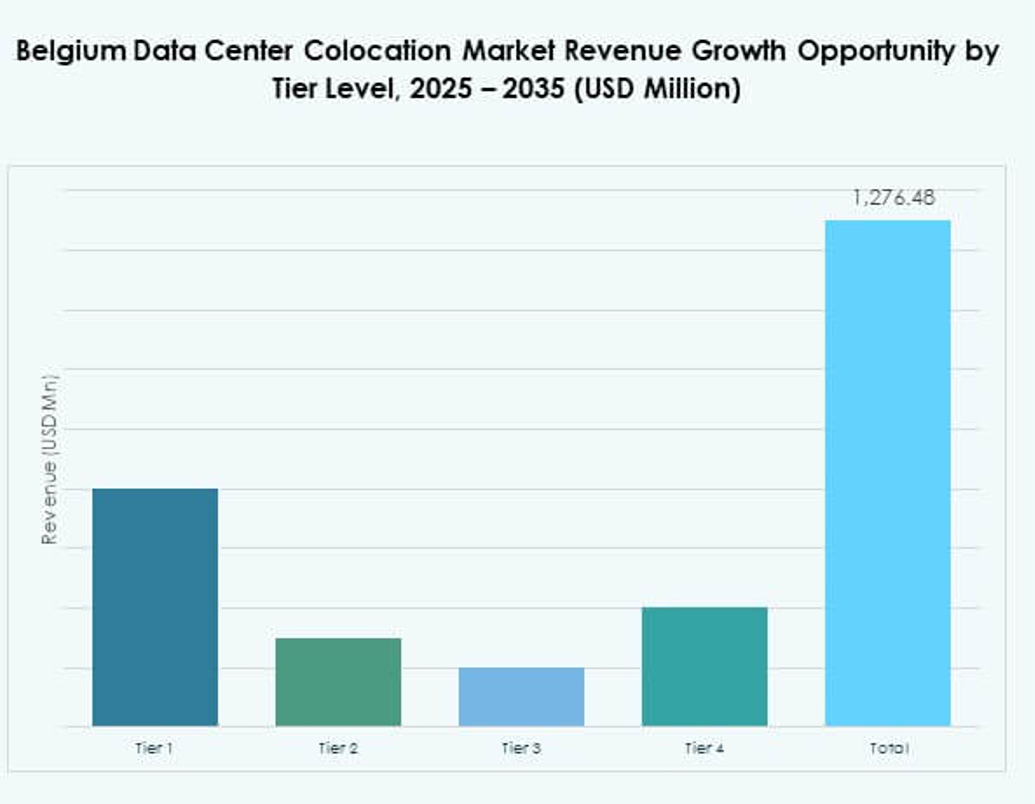

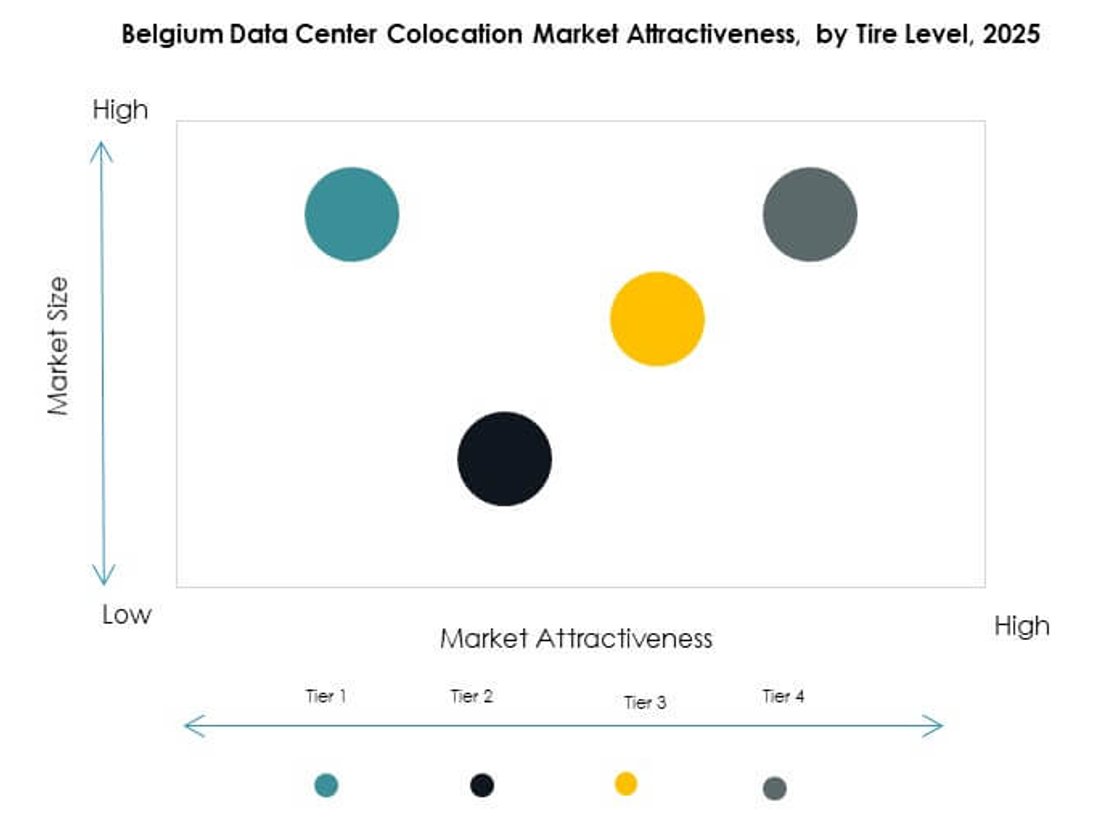

By Tier Level

Tier 3 facilities hold the largest market share, driven by their balance of performance and cost. These facilities offer strong redundancy and uptime levels, aligning with enterprise SLA needs. Tier 4 is expanding due to demand for mission-critical applications. Tier 1 and Tier 2 mainly serve smaller enterprises and edge deployments. Tier 3’s reliability supports banking, healthcare, and e-commerce sectors. It provides strong fault tolerance and operational resilience. Tier 4 suits hyperscalers with advanced redundancy needs. This tier segmentation reflects diverse enterprise infrastructure priorities.

By Enterprise Size

Large enterprises lead the market share due to their need for secure and scalable IT environments. They rely on colocation facilities for cloud integration, disaster recovery, and compliance. SMEs contribute steadily through retail colocation adoption. SMEs prefer flexible contracts and shared capacity models. Large enterprises drive bulk demand for wholesale and hybrid colocation. Their investments support infrastructure modernization and network densification. SME participation broadens the client base and drives regional expansion. This size segmentation creates a balanced growth structure.

By End User Industry

IT & Telecom dominates the market with the highest colocation adoption rates. The sector relies on data center infrastructure for network performance and service reliability. BFSI follows closely due to strict compliance and security requirements. Retail and healthcare sectors contribute through increasing digitalization. Media & entertainment demand rises with content streaming and gaming. IT & Telecom’s lead reflects Belgium’s role in regional connectivity. Strong sector diversity drives stable and sustainable market expansion.

Regional Insights

Brussels Leading with Dense Interconnection Ecosystem and 51% Market Share

Brussels leads the Belgium Data Center Colocation Market with 51% share. It hosts the country’s main carrier-neutral data hubs and international cloud on-ramps. High network density and proximity to government institutions attract global operators. The region’s advanced power and fiber infrastructure supports large-scale deployments. Financial services, telecom, and cloud firms anchor most capacity here. Brussels also benefits from direct links to Frankfurt, Amsterdam, and Paris, reinforcing its strategic relevance.

- For instance, Digital Realty’s BRU4 data center in Brussels provides direct cloud on-ramps to Microsoft Azure, AWS, and Google Cloud through its ServiceFabric® platform. The facility hosts a large ecosystem of network and cloud providers, enabling low-latency connectivity to major European hubs such as Amsterdam, Frankfurt, and Paris.

Antwerp Emerging with Strategic Industrial Base and 29% Market Share

Antwerp holds 29% of the market share, supported by its strong logistics and port ecosystem. It attracts enterprise demand for edge and industrial applications. Proximity to manufacturing and energy sectors drives specialized colocation projects. The region invests in low-carbon infrastructure to support sustainable growth. Strategic location along major transport routes strengthens connectivity. Hyperscalers explore Antwerp for expansion due to its strong infrastructure foundations.

Other Regions Including Ghent and Liege Holding 20% Market Share

Other regions, including Ghent and Liege, account for 20% of the market. These cities offer lower land costs and improving fiber connectivity. Secondary cities attract mid-sized enterprises seeking cost-effective colocation options. Investment incentives support the development of edge-ready data centers. The growing SME base in these areas creates new revenue streams. Strong regional diversification supports balanced market development and infrastructure resilience.

- For example, Cegeka deployed Adtran’s FSP 3000 open optical transport technology to upgrade its backbone and connect new data centers in Belgium. The deployment includes optical‐layer encryption (ConnectGuard™) and real-time fiber monitoring to ensure secure, resilient connectivity.

Competitive Insights:

- LCL Data Center

- NRB

- IONOS Belgium

- Byte

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The Belgium Data Center Colocation Market features a strong mix of global hyperscalers and regional operators. It is shaped by strategic investments, facility expansion, and sustainable infrastructure adoption. Equinix, Digital Realty, and NTT focus on high-capacity campuses and interconnection-rich ecosystems. AWS and Google Cloud strengthen their presence through scalable cloud integration and edge deployments. LCL Data Center and NRB play a key role in serving domestic enterprises with localized solutions and compliance-focused infrastructure. Telecom players such as Colt and China Telecom support network resilience and low-latency connectivity. Competitive intensity remains high, driven by rapid demand for edge, AI workloads, and hybrid infrastructure models. Strategic alliances, green energy integration, and modular capacity expansion are central to market differentiation.

Recent Developments:

- In October 2025, Google Cloud unveiled a €5 billion (approx. $5.8 billion) investment over the next two years to expand its AI and cloud infrastructure in Belgium, notably enhancing its data center campuses in Saint-Ghislain and launching partnerships with local energy providers Eneco, Luminus, and Renner for renewable energy development.

- In September 2025, NRB advanced Belgium’s data ecosystem by building a collaborative artificial intelligence ecosystem using local data centers and the SophIA platform, in partnership with regional universities. This fosters innovation and supports secure Belgian AI development.

- In May 2025, LCL Data Centers completed the installation of a 3.4MW rooftop solar project in partnership with Nett Energie and Elindus, supporting decarbonization and sustainability initiatives for its Belgian operations. The energy produced is underpinned by power purchase agreements with local farmers, linking renewable supply directly to LCL’s data centers across the country.