Executive summary:

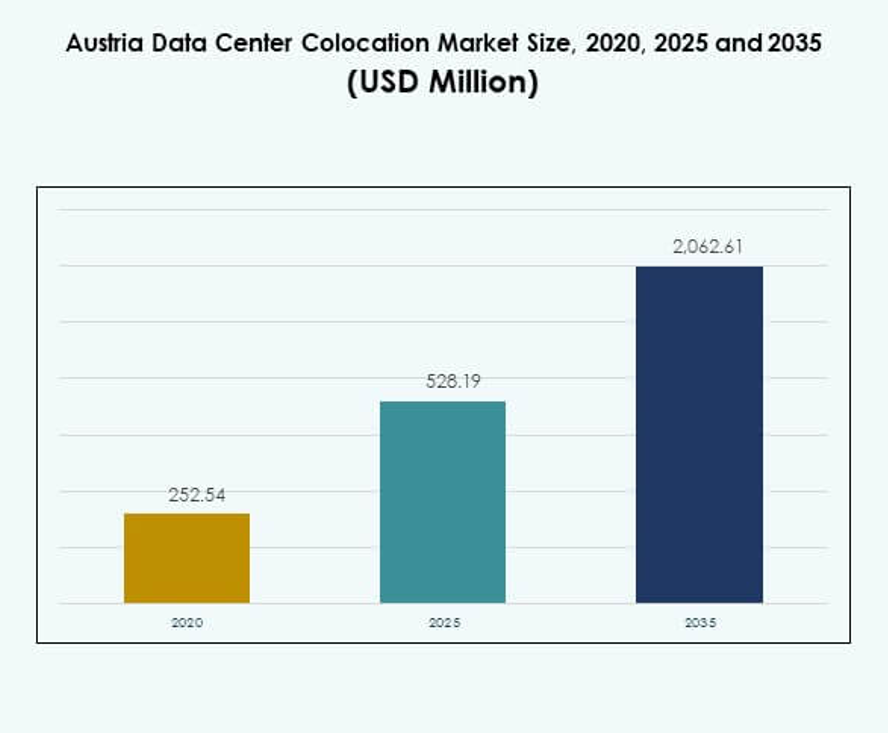

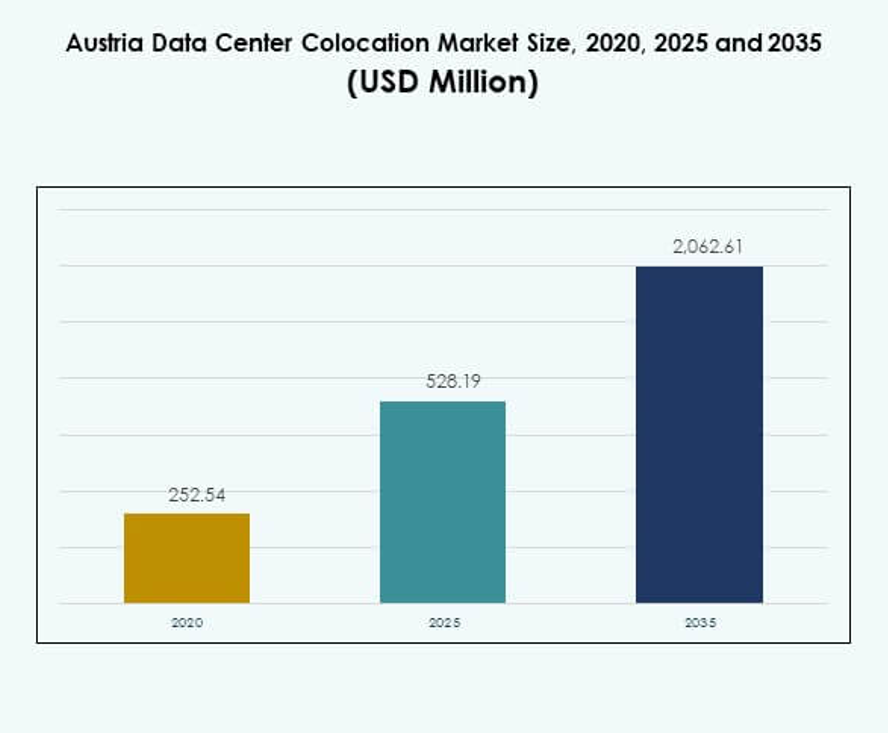

The Austria Data Center Colocation Market size was valued at USD 252.54 million in 2020, growing to USD 528.19 million in 2025, and is anticipated to reach USD 2,062.61 million by 2035, at a CAGR of 14.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Austria Data Center Colocation Market Size 2025 |

USD 528.19 Million |

| Austria Data Center Colocation Market, CAGR |

14.53% |

| Austria Data Center Colocation Market Size 2035 |

USD 2,062.61 Million |

Strong demand for cloud computing, AI, and edge technologies drives the Austria Data Center Colocation Market. Businesses seek scalable, secure, and energy-efficient colocation facilities to handle increasing digital workloads. Innovation in high-density infrastructure and renewable-powered facilities enhances operational efficiency. It plays a strategic role for enterprises aiming to strengthen data resilience and reduce capital costs. Investors view the market as a stable and high-growth environment for long-term expansion.

Western Austria leads the market due to strong connectivity, advanced energy infrastructure, and proximity to key European economies. Eastern Austria is emerging as a fast-growing region supported by cloud adoption and edge deployments. Central and Southern regions show growing potential, driven by new investments and expanding digital infrastructure. Strategic positioning and cross-border network access make Austria an attractive hub for regional data center expansion.

Market Drivers

Strong Digital Transformation Across Core Industry Verticals

The Austria Data Center Colocation Market benefits from rapid digital transformation across banking, retail, healthcare, and telecommunications. Enterprises prioritize secure and scalable infrastructure to support real-time applications and cloud workloads. Companies focus on advanced connectivity to reduce latency and support mission-critical operations. Cloud-native platforms and edge deployment models boost operational resilience. It helps businesses handle high volumes of data securely and efficiently. Data-driven models also increase demand for reliable colocation facilities. This shift improves resource utilization, enabling enterprises to optimize IT infrastructure spending. Strong digital adoption supports sustainable market expansion.

Rising Enterprise Cloud Migration and Strategic Technology Shifts

Growing enterprise migration to hybrid and multi-cloud environments drives colocation demand. Businesses invest in flexible infrastructure to balance performance and cost efficiency. It enables faster application deployment and simplified workload management. Colocation offers a secure alternative to building in-house facilities, reducing capital expenditures. Companies leverage data centers to support AI, analytics, and automation tools. These tools enhance operational visibility and productivity. Strategic technology adoption helps enterprises scale faster without major infrastructure delays. The shift positions colocation as a core enabler of enterprise digital transformation.

- For instance, Interxion Austria, part of Digital Realty, expanded its Vienna facility by about 1,300 m², boosting capacity and strengthening its position among ecosystem providers. Their Vienna site now offers 338,000 ft² of colocation area and connects to over 135 service providers, backed by certifications including SOC2, PCI-DSS, ISO 9001, ISO 27001, and ISO 22301.

Growing Investment In AI, Edge Computing, And Low-Latency Infrastructure

Expanding AI and edge computing applications create strong demand for high-performance data centers. Low-latency infrastructure improves service quality and enhances decision-making speed. It supports industries requiring real-time data processing, including fintech, media, and manufacturing. Investors prioritize facilities equipped with AI-ready networks, energy-efficient power systems, and advanced cooling solutions. This infrastructure allows data centers to handle heavier computational workloads effectively. Companies seek colocation facilities with strong network redundancy and modular scalability. Strategic investments drive innovation and help enterprises stay competitive. Rising AI adoption accelerates infrastructure modernization efforts.

Strategic Geographic Positioning Strengthening Investment Appeal

Austria’s central location in Europe enhances its attractiveness as a regional data hub. Strong connectivity to major European economies supports strategic investments in colocation infrastructure. It enables efficient data routing and faster content delivery to surrounding regions. Enterprises view Austria as a gateway to both Western and Eastern Europe. The favorable regulatory climate improves investor confidence and market stability. Reliable energy supply and renewable integration increase operational efficiency. This positioning encourages hyperscale and enterprise customers to establish long-term partnerships. Strong investment inflows strengthen Austria’s competitive standing.

- For example, in January 2025, A1 Telekom Austria and Sunrise Communications AG announced a joint plan to develop the shortest and fastest dark fiber route connecting Vienna and Zürich. This infrastructure will deliver minimal latency for cross-border data traffic and support AI, cloud, and media services between major European nodes.

Market Trends

Integration Of Modular And Sustainable Data Center Designs

The Austria Data Center Colocation Market is witnessing a clear shift toward modular and sustainable facility designs. Companies prioritize energy-efficient systems to reduce operational costs and align with environmental regulations. Prefabricated modular units offer faster deployment and flexibility for future expansions. It enables operators to meet evolving customer requirements efficiently. Green building certifications gain importance in investment decisions. Enterprises prefer facilities powered by renewable energy sources. Cooling optimization technologies improve power usage effectiveness. This trend aligns infrastructure growth with environmental responsibility and cost efficiency.

Expanding Role Of Interconnection Ecosystems In Business Strategies

Interconnection ecosystems play a key role in shaping colocation strategies. Enterprises prefer data centers with strong peering networks, cloud on-ramps, and carrier neutrality. It enables direct connections to cloud providers and content delivery networks. Businesses reduce network complexity and enhance application performance. Strong interconnection strategies also improve disaster recovery capabilities. Data centers with multi-tenant ecosystems offer better operational flexibility. These ecosystems create value for enterprises seeking secure and agile connectivity. The trend strengthens Austria’s role as a regional digital connectivity hub.

Increased Deployment Of High-Density Racks And Advanced Cooling Systems

Data centers are adopting high-density racks to support modern workloads and processing demands. It helps enterprises run advanced computing applications without compromising performance. Facilities upgrade power and cooling systems to manage increased thermal loads effectively. Liquid and immersion cooling technologies gain popularity among operators. This shift ensures consistent performance and reduced energy waste. High-density solutions also optimize physical space utilization. Operators enhance data center layouts to support scalable power distribution. The trend reflects a strategic move toward performance-driven infrastructure design.

Rising Focus On Regulatory Compliance And Data Sovereignty

Regulatory compliance remains a significant trend shaping market growth. Enterprises prioritize colocation facilities that meet strict EU data protection and privacy standards. It strengthens customer trust and ensures secure handling of sensitive information. Operators invest in advanced cybersecurity and audit-ready frameworks. Data sovereignty considerations drive enterprises to select local facilities for critical workloads. Businesses benefit from legal clarity and operational transparency. Regulatory alignment improves long-term operational reliability. The trend boosts Austria’s credibility as a trusted digital infrastructure destination.

Market Challenges

Rising Energy Demand And Infrastructure Sustainability Pressures

The Austria Data Center Colocation Market faces increasing energy consumption pressures due to high compute density and 24/7 operations. Facilities must balance power efficiency with growing processing demands. It requires advanced energy management systems to control costs and meet sustainability goals. High energy use can affect profit margins and long-term investment appeal. Renewable energy integration remains complex in certain regions. Strict energy regulations add operational complexity for facility operators. Companies must adopt innovative cooling technologies and energy optimization strategies. Sustainability expectations continue to tighten, demanding faster adaptation.

Heightened Competition And Strategic Capacity Planning Constraints

Growing competition among colocation providers creates pressure to differentiate service offerings. It requires continuous innovation in network capabilities, security frameworks, and pricing strategies. Overcapacity in key urban clusters can impact profitability. Rapid technological advancements increase the need for frequent infrastructure upgrades. High capital costs and planning restrictions slow expansion in some regions. Regulatory delays affect project timelines. Enterprises also face difficulties predicting future capacity needs accurately. These constraints demand agile planning, strategic partnerships, and operational resilience.

Market Opportunities

Rising Cross-Border Connectivity And Digital Ecosystem Expansion

The Austria Data Center Colocation Market offers strong opportunities through expanding cross-border digital connectivity. Central geographic positioning supports international data traffic and interconnection growth. It attracts cloud providers, financial institutions, and content delivery companies. Enterprises benefit from improved access to regional markets and faster network performance. Strong digital ecosystems enable operators to build competitive service portfolios. It enhances Austria’s role as a strategic digital hub.

Surge In Hyperscale Investments And Renewable Integration

Rising hyperscale deployments create attractive opportunities for long-term growth. Large cloud providers and technology companies expand colocation partnerships to scale faster. It drives infrastructure upgrades and capacity expansions across multiple sites. Renewable energy integration strengthens the country’s green infrastructure positioning. Investors view the market as stable, secure, and innovation-ready. These conditions support strong revenue potential and strategic collaboration.

Market Segmentation

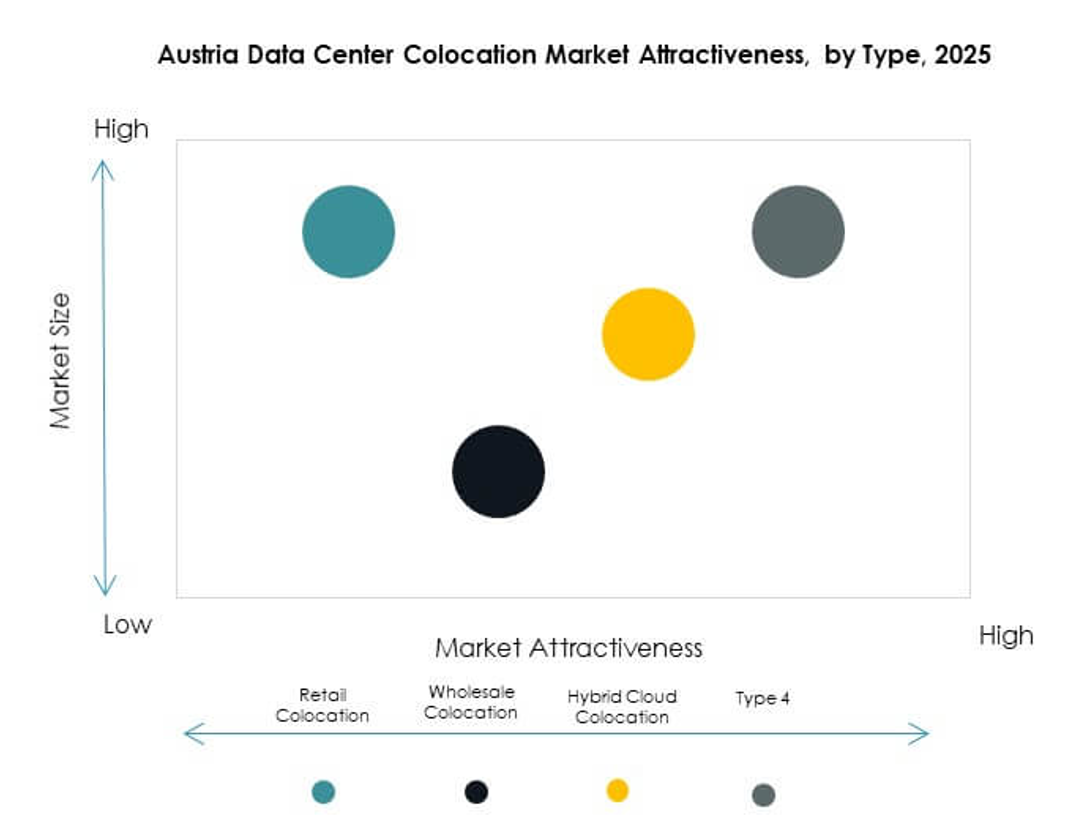

By Type

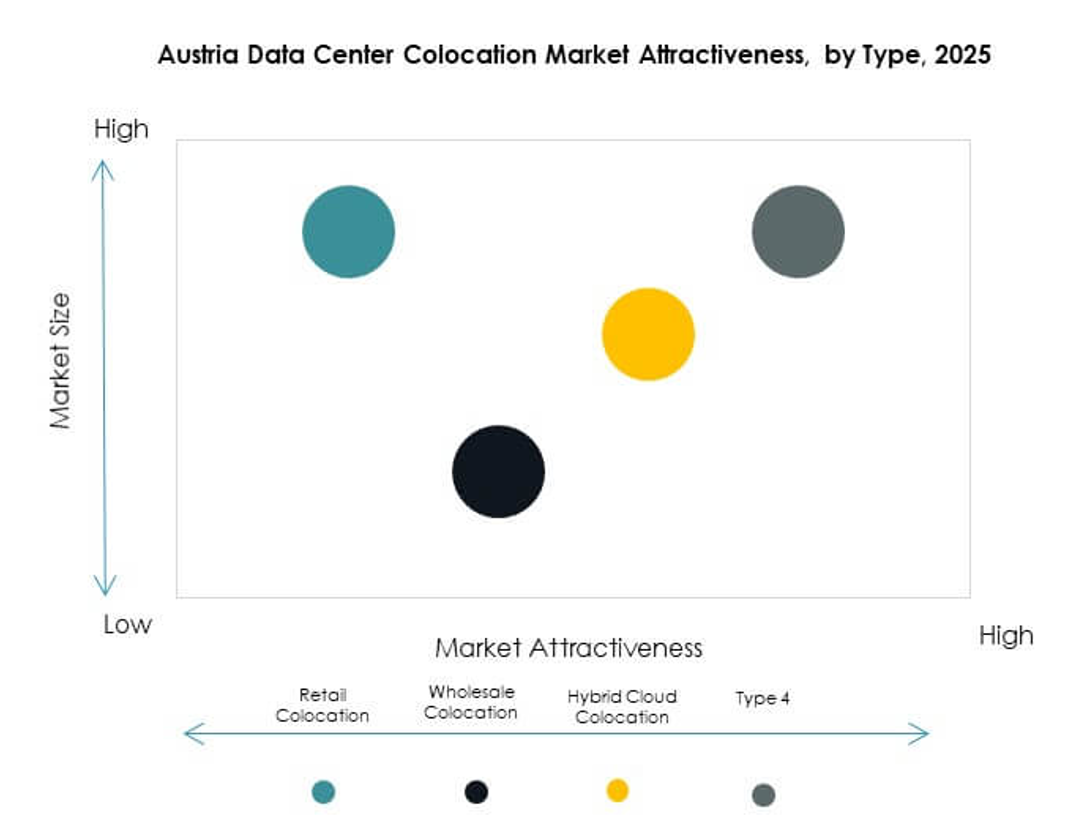

Retail colocation holds a dominant share in the Austria Data Center Colocation Market due to strong demand from mid-sized enterprises seeking scalable capacity without high capital investments. Wholesale colocation supports larger deployments for hyperscale providers and global corporations. Hybrid cloud colocation is growing fast as businesses adopt flexible multi-cloud models. Retail facilities enable quick deployment and strong network interconnections. Wholesale sites attract long-term contracts from major enterprises. Hybrid models offer agility and cost control, driving sustained adoption.

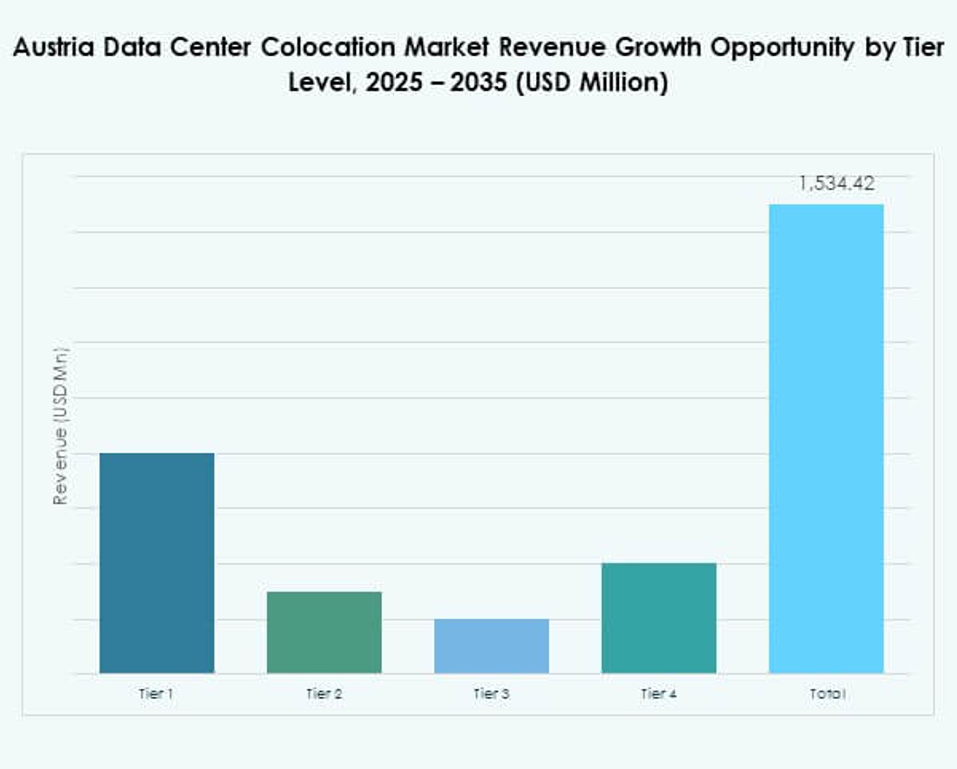

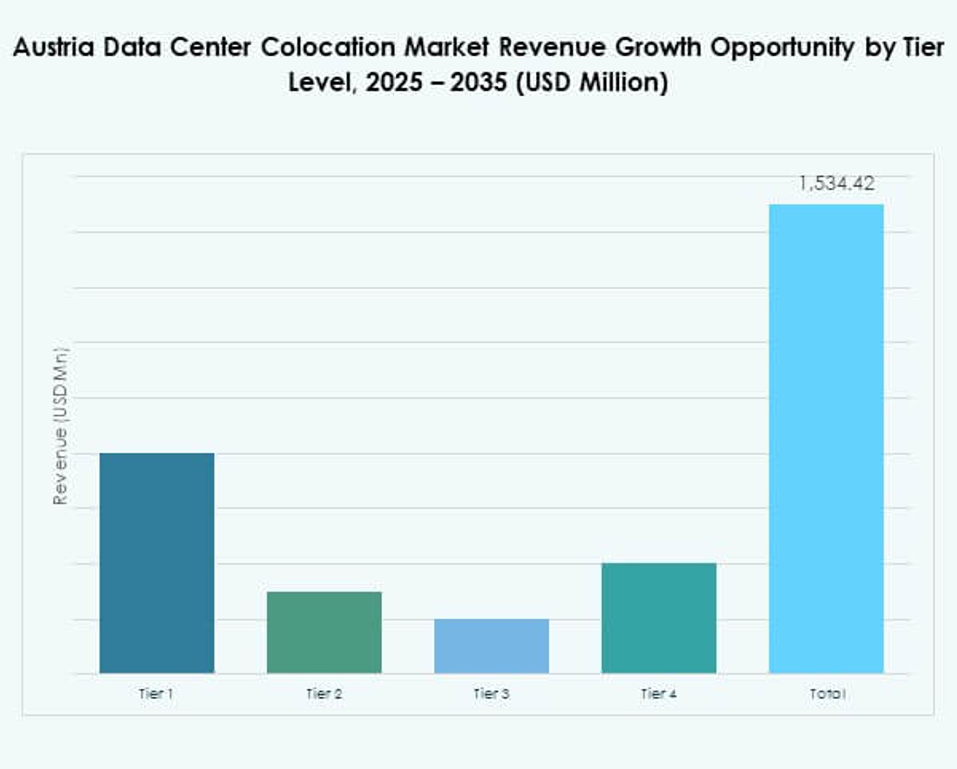

By Tier Level

Tier 3 data centers dominate the Austria Data Center Colocation Market with their strong balance between performance, redundancy, and cost. Tier 4 facilities are gaining traction in financial and critical service sectors that require maximum uptime. Tier 2 remains common among small enterprises with moderate IT needs. Tier 1 accounts for limited deployments. Tier 3 ensures reliable service delivery with concurrent maintainability, making it the preferred choice for most commercial clients.

By Enterprise Size

Large enterprises lead the Austria Data Center Colocation Market due to higher IT infrastructure requirements and strong focus on security, scalability, and regulatory compliance. SMEs contribute to steady growth by adopting cost-efficient retail colocation services. Large firms seek high-density, interconnected facilities to support global operations. SMEs value flexible contracts and managed services. This segmentation highlights the role of scale in shaping investment patterns across industries.

By End User Industry

IT and telecom hold the largest share of the Austria Data Center Colocation Market, driven by rising data traffic, cloud applications, and AI adoption. BFSI follows closely with strong security and compliance needs. Healthcare is growing due to increased digitalization of patient records and telemedicine expansion. Retail and media industries rely on colocation for content delivery and e-commerce services. Other sectors are adopting digital infrastructure gradually.

Regional Insights

Western Austria: High Market Concentration And Strategic Infrastructure Development

Western Austria holds a 46% share of the Austria Data Center Colocation Market, supported by dense fiber networks and proximity to major European economic hubs. Strong connectivity to Germany and Switzerland drives steady enterprise demand. It benefits from regulatory stability, mature energy infrastructure, and access to renewable resources. High investment levels strengthen capacity expansion. Companies prioritize this subregion for its robust interconnection and service reliability. Western Austria remains a key location for hyperscale and enterprise-grade deployments.

- For example, Google submitted plans in August 2025 to move ahead on a data center campus in Kronstorf, Austria, nearly 17 years after acquiring land and securing planning permits.

Eastern Austria: Expanding Demand Driven By Cloud And Edge Growth

Eastern Austria accounts for a 33% share of the Austria Data Center Colocation Market, with rapid adoption of cloud computing and edge infrastructure. Enterprises expand capacity to support digital workloads closer to end users. Strong government focus on digitalization drives new investments. It benefits from improving power grid reliability and growing carrier-neutral data centers. Urban clusters in this subregion create favorable conditions for network expansion and low-latency services.

Central and Southern Austria: Emerging Growth Potential Through Strategic Connectivity

Central and Southern Austria represent a 21% share of the Austria Data Center Colocation Market, showing strong growth potential. These subregions attract investments due to cost advantages and untapped capacity. Enterprises establish secondary and disaster recovery sites to strengthen business continuity. It benefits from increasing connectivity to cross-border digital corridors. These regions are expected to gain more strategic importance as infrastructure matures and edge deployments expand.

- For instance, Digital Realty’s Vienna data centers provide over 338,000 ft² of colocation space and offer direct ecosystem access to 135+ service providers, supported by certifications including SOC2, PCI-DSS, ISO 9001, ISO 27001, and ISO 22301.

Competitive Insights:

- Interxion (Digital Realty)

- EvoSwitch

- Nxtra Data

- Greenhouse Data

- Amazon Web Services (AWS)

- Google Cloud

- China Telecom Corporation Limited

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- NTT Ltd. (NTT DATA)

The competitive landscape of the Austria Data Center Colocation Market is shaped by global hyperscalers, cloud service providers, and specialized colocation operators. It is defined by strong investment in high-capacity facilities, advanced interconnection ecosystems, and energy-efficient infrastructure. Leading firms expand footprints through acquisitions, partnerships, and modular deployments. Hyperscalers such as AWS and Google Cloud focus on low-latency connectivity to strengthen enterprise workloads. Established players like Digital Realty and Equinix build large multi-tenant facilities to secure long-term contracts. Telecom-linked operators emphasize carrier-neutral solutions to support cross-border traffic. Continuous technology upgrades and strategic alliances drive market consolidation and service differentiation.

Recent Developments:

- In October 2025, new developments in the Austria data center colocation arena were highlighted with major investments and expansion activity. The report noted that hyperscale companies such as Microsoft and Google have announced ongoing expansion plans in Austria, while local colocation investors including AtlasEdge, A1 Telekom Austria Group, Digital Realty, and NTT DATA are further strengthening their presence to meet growing regional demand.

- In August 2025, Nxtra Data announced it is entering a major phase of growth, with its CEO highlighting unprecedented demand driven by artificial intelligence, cloud services, and digital connectivity. Nxtra reports that 49% of its core data center energy now comes from renewable sources.

- In August 2025, Google submitted plans for its long-awaited data center in Kronstorf, Austria, finally moving ahead after purchasing the land 17 years ago. Google expects building permits to be in place before the end of the year and aims to establish a hyperscale facility serving the entire region.

- In July 2025, Microsoft announced the launch of its Azure cloud region in Austria, which will provide three availability zones and operate entirely on renewable energy sources. The official press event was held with local government representatives, and the company confirmed that the new cloud region would begin processing customer workloads starting August 2025.